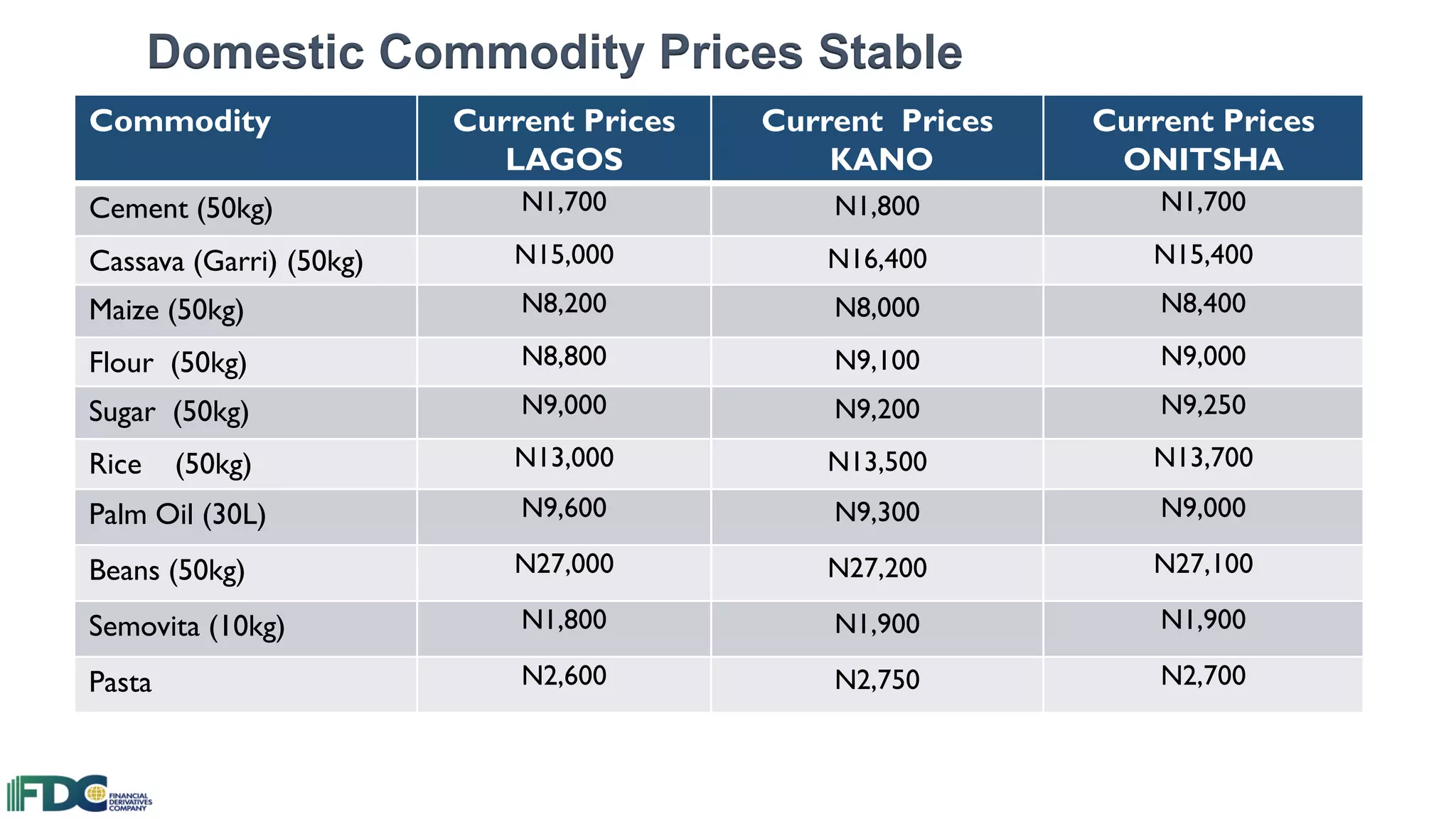

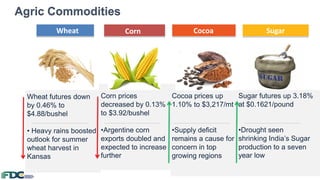

The document lists current commodity prices in three Nigerian cities - Lagos, Kano, and Onitsha. It shows the prices of items like cement, cassava, maize, flour, sugar, rice, palm oil, beans, semovita, and pasta. Domestic commodity prices have remained stable. The document also discusses rice imports, the quality of local rice, herdsmen threatening food security, and stock market performance.