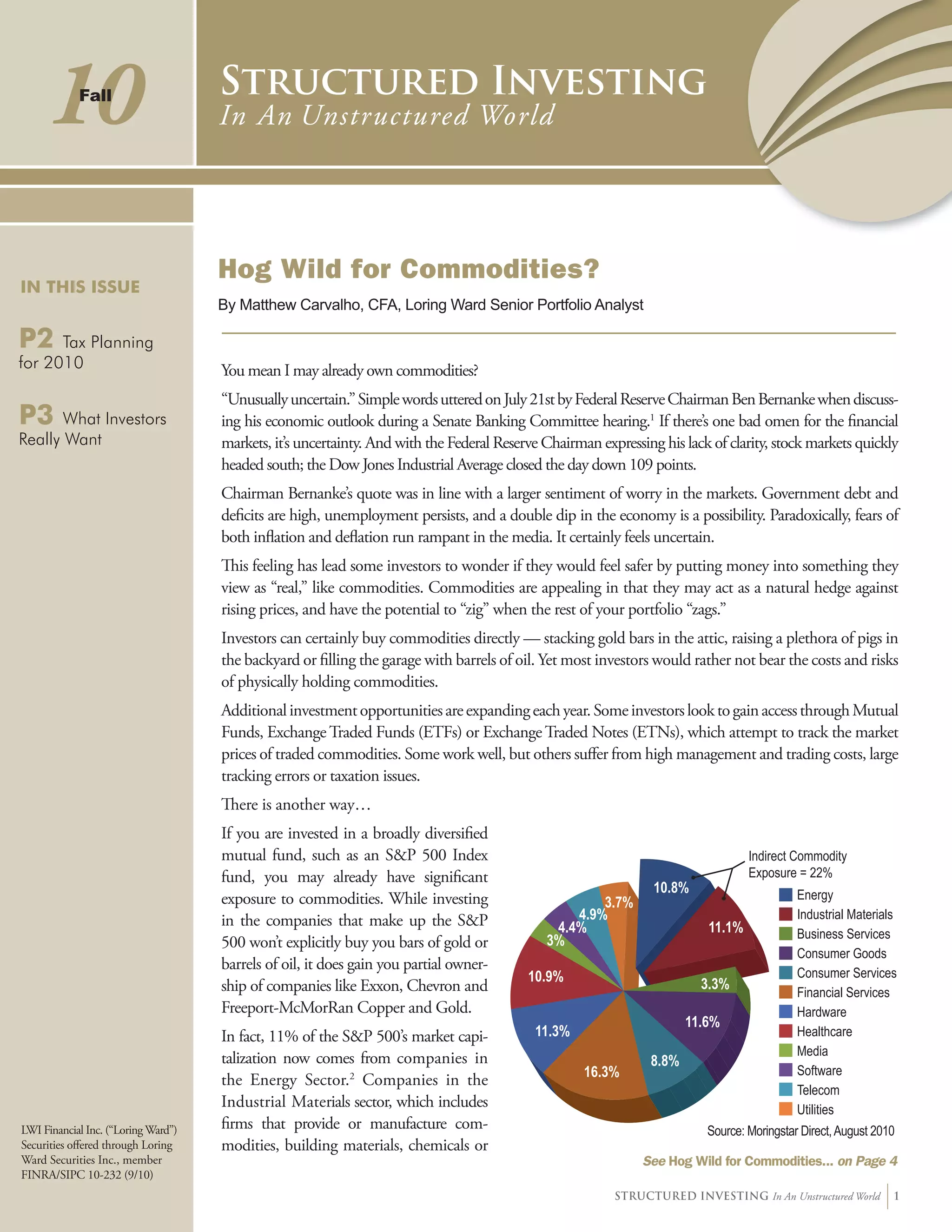

Ben Bernanke expressed economic uncertainty which contributed to stock market declines. Some investors sought commodities as a hedge against inflation. While commodities can be purchased directly, most investors access commodities through funds or ETFs. However, many of these funds have high costs or other issues. An S&P 500 index fund provides significant indirect exposure to commodities through companies in the energy and materials sectors, avoiding the additional costs of direct commodity investments or commodity funds. Approximately 22% of an S&P 500 fund's market capitalization comes from commodity-related companies.