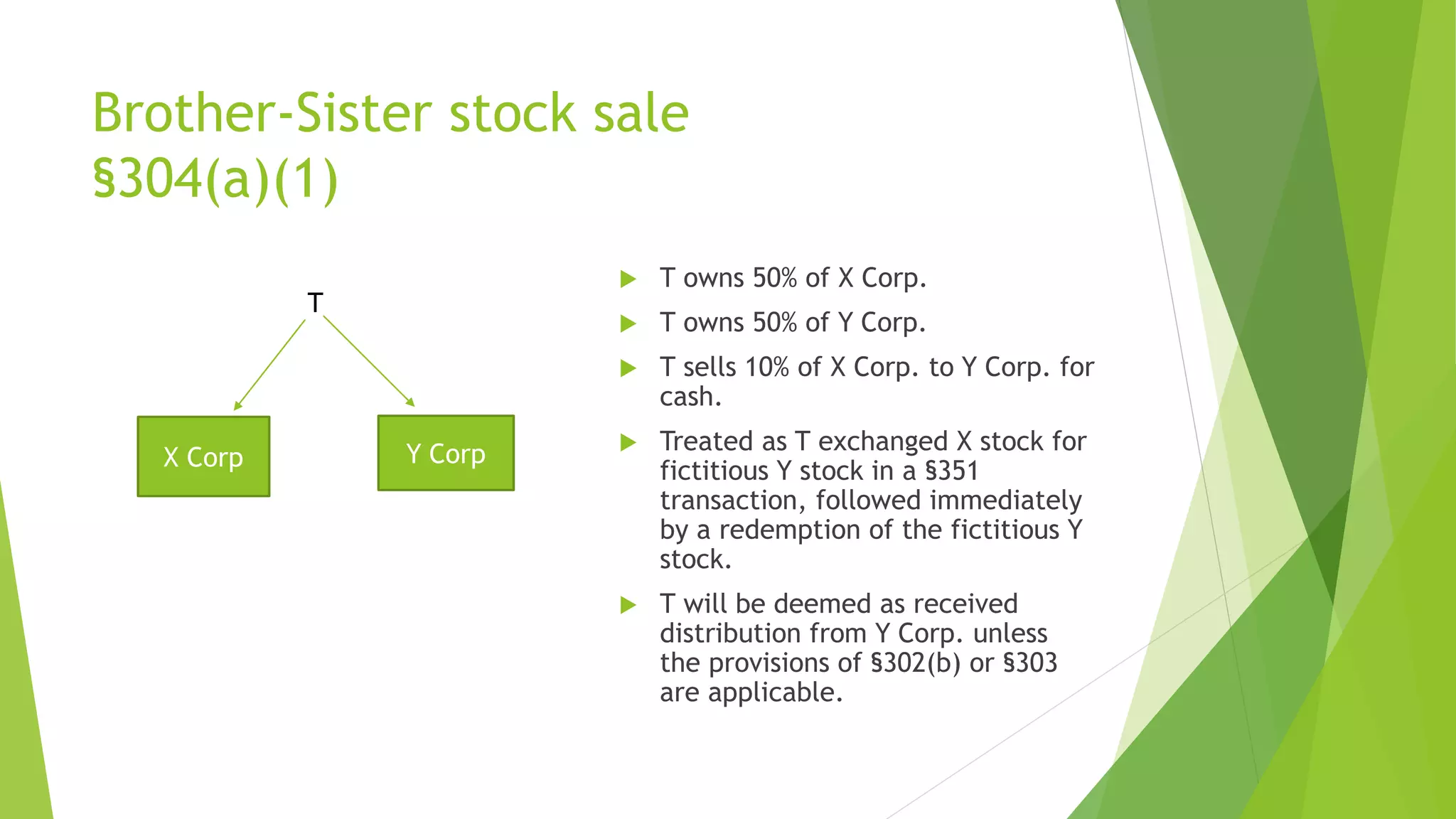

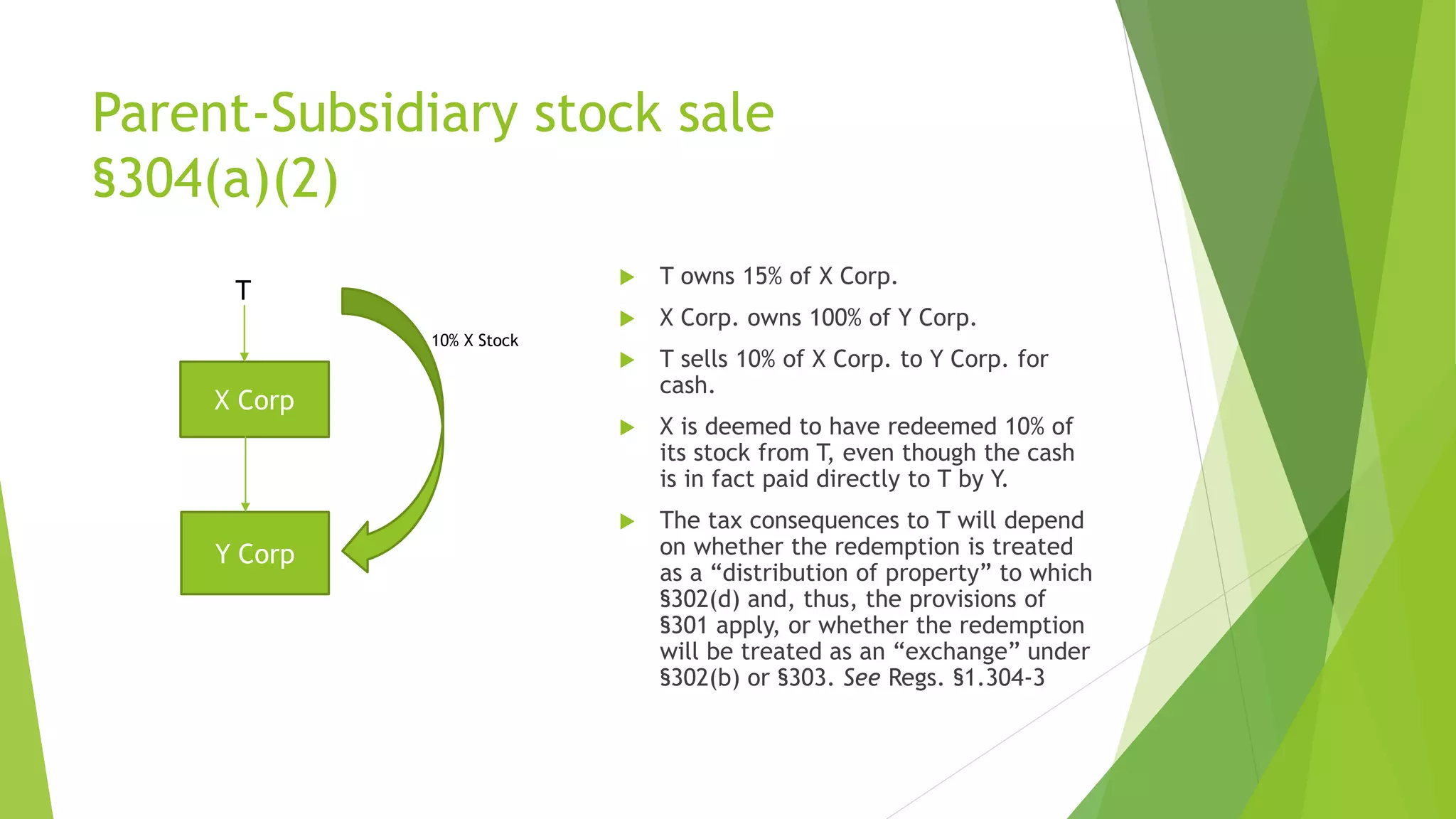

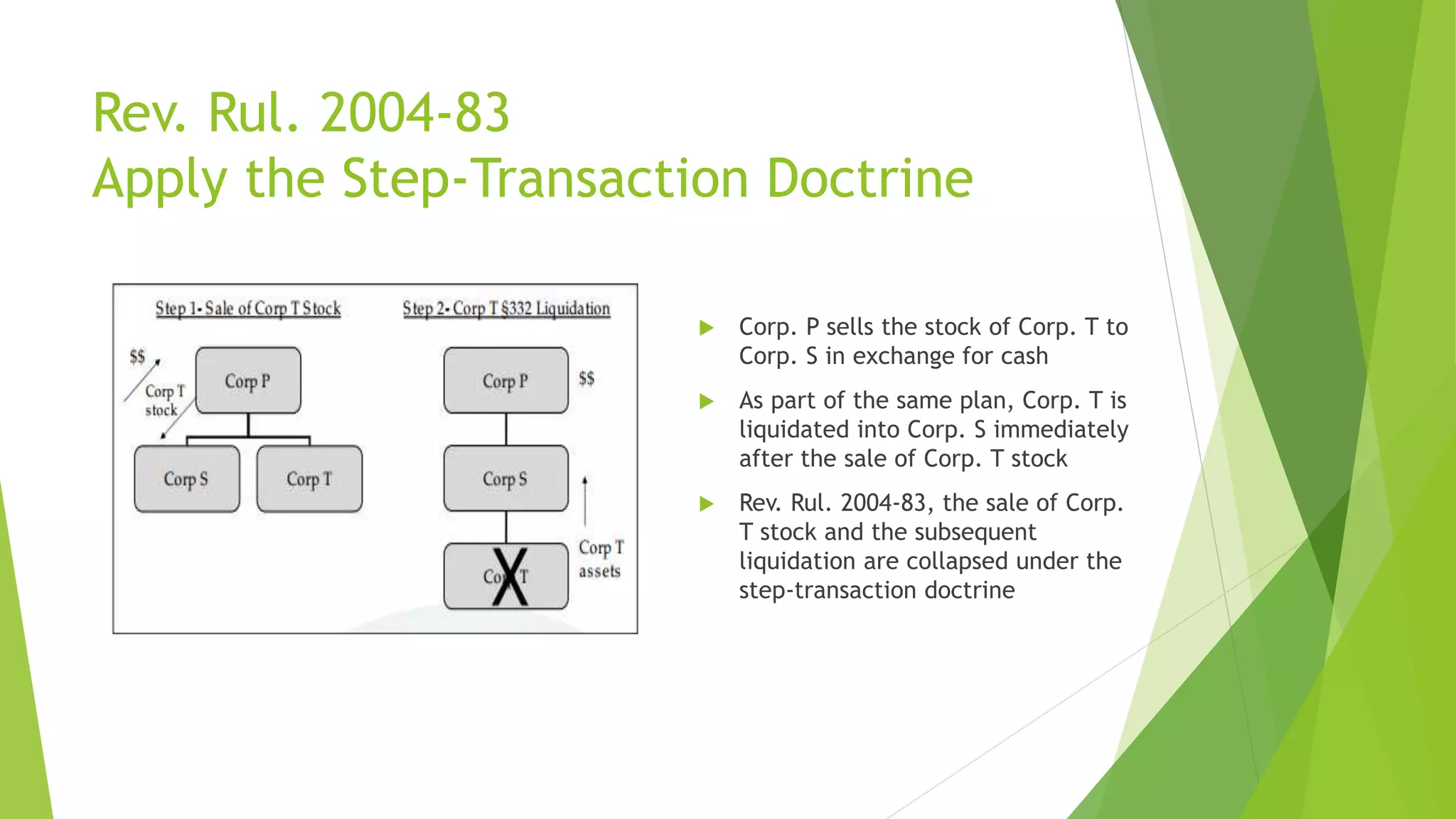

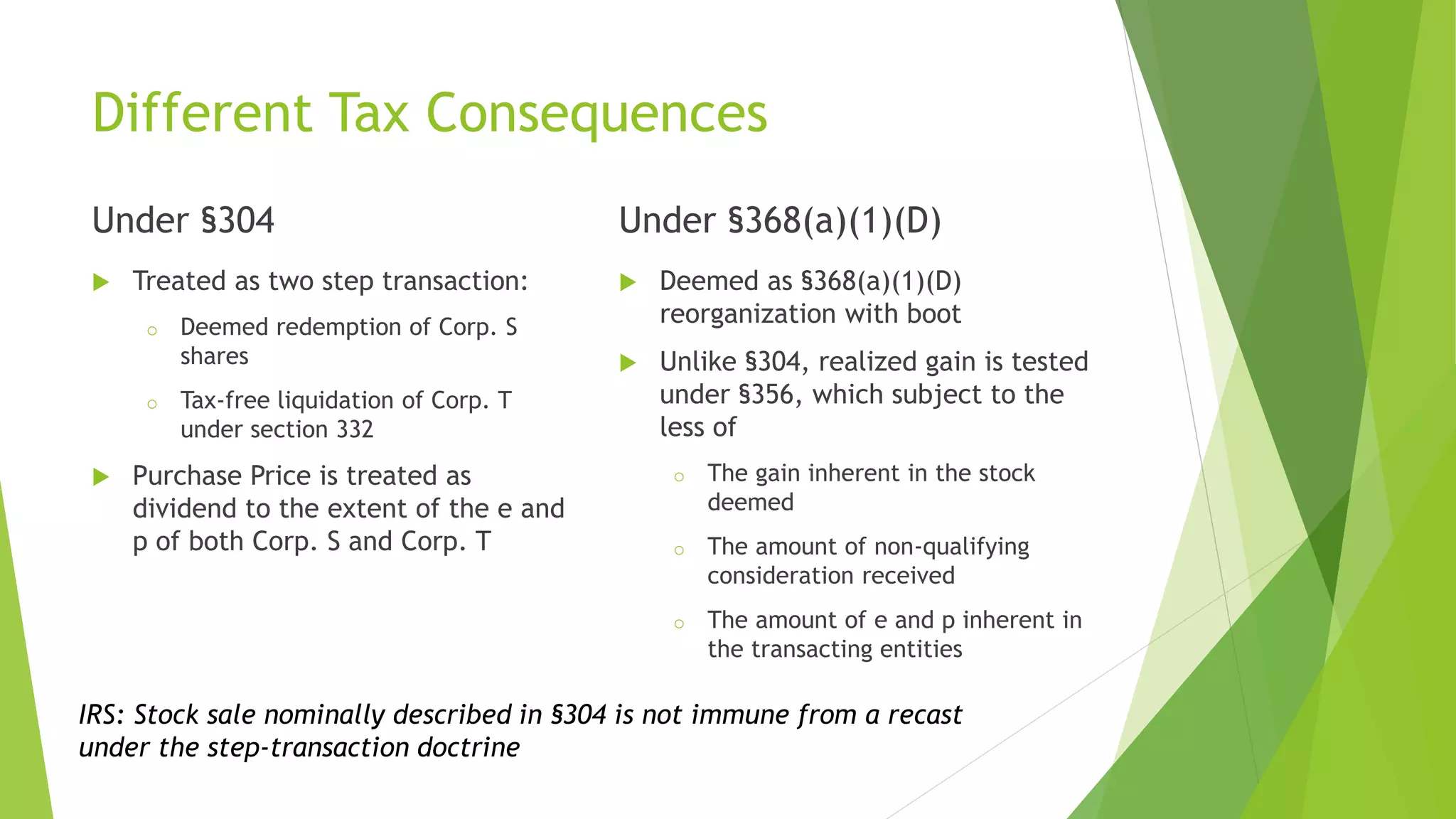

This document discusses constructive redemptions under Internal Revenue Code Section 304 for related party stock sales. Section 304 can recharacterize a stock sale between related parties as a stock redemption if there is control. It covers brother-sister stock sales where the seller controls both companies, and parent-subsidiary sales where the parent controls the subsidiary. The tax consequences will depend on if it is treated as a dividend under Section 301 or an exchange under Section 302. The document provides examples and notes that stock sales may be collapsed and recharacterized under the step-transaction doctrine.