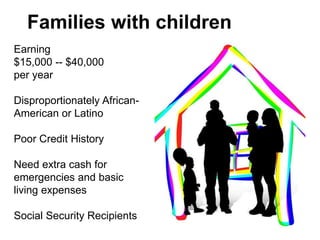

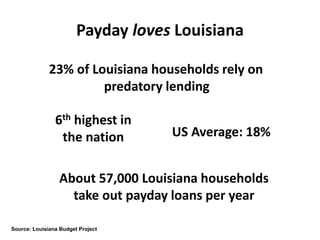

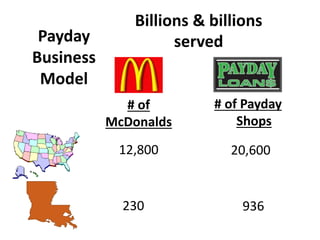

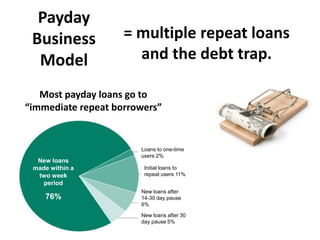

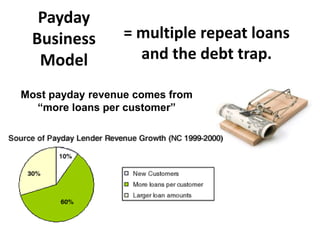

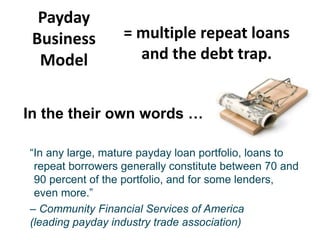

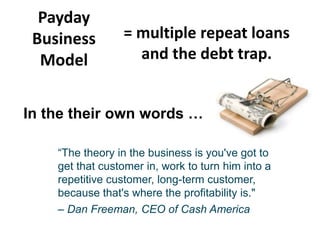

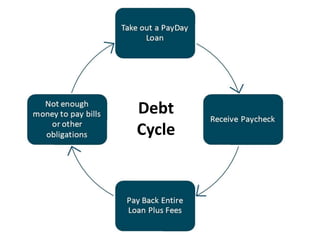

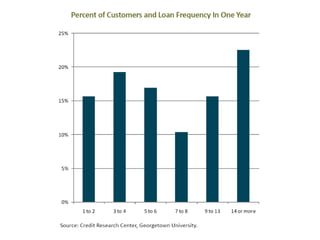

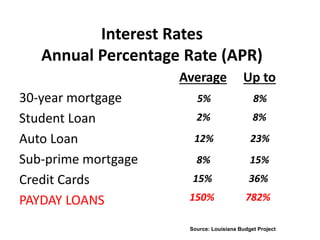

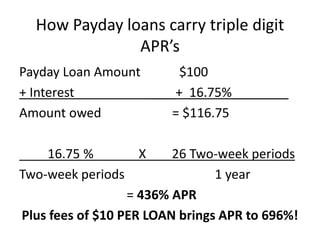

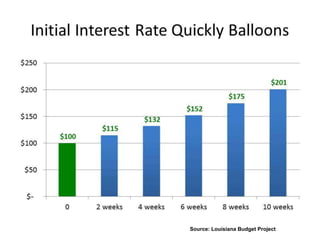

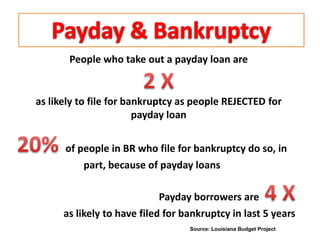

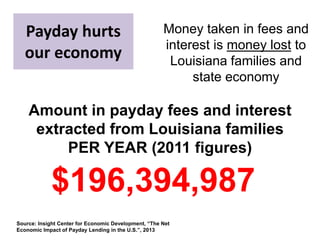

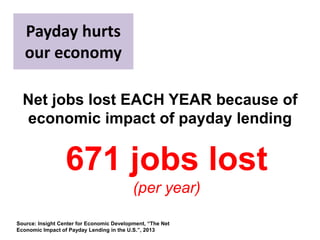

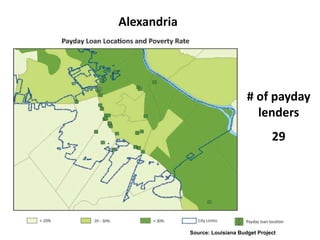

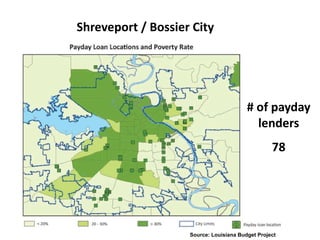

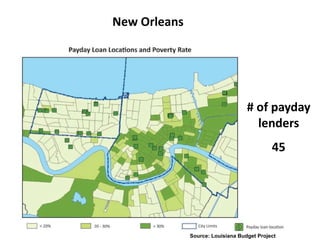

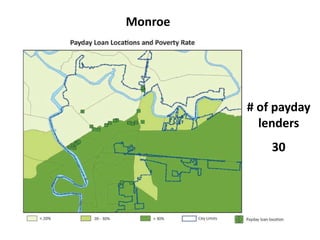

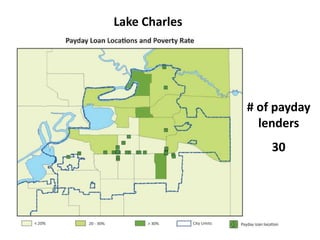

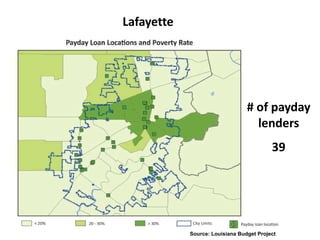

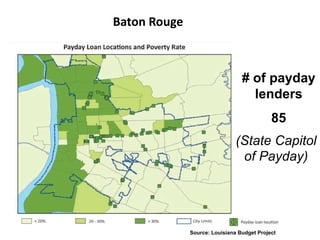

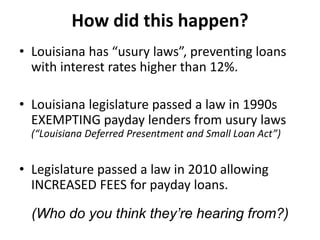

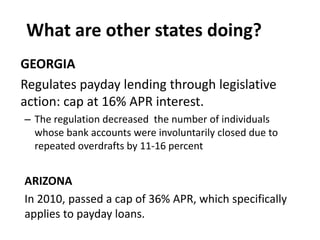

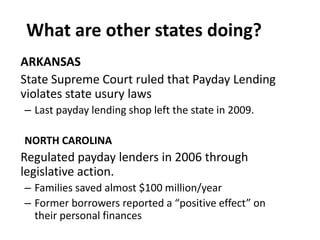

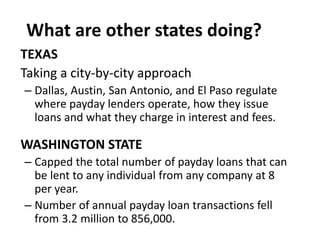

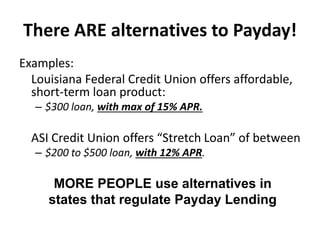

Payday lending is a significant issue in Louisiana, with 23% of households relying on it, particularly among low-income and marginalized communities. The industry operates on a business model that promotes repeat borrowing, often trapping customers in a cycle of debt with high interest rates that can exceed 700% APR. Regulatory comparisons show that states with stricter laws on payday lending experience better financial outcomes for borrowers, highlighting the need for reform in Louisiana's lending practices.