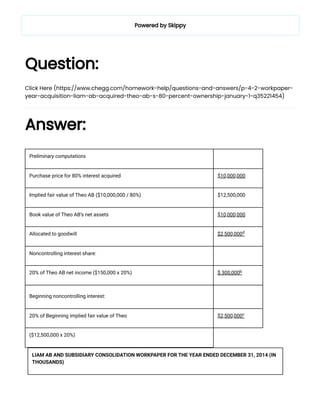

Liam AB acquired 80% ownership of Theo AB on January 1 for $10 million. This implied the total fair value of Theo AB was $12.5 million. The book value of Theo's net assets was $10 million, so $2.5 million was allocated to goodwill. In 2014, Theo had net income of $1.5 million, with 20% or $300,000 belonging to the noncontrolling interest. After consolidating the financial statements, the combined entity had sales of $97.5 million and net income of $4.3 million for the year.