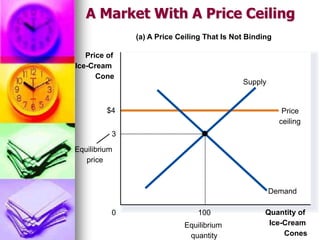

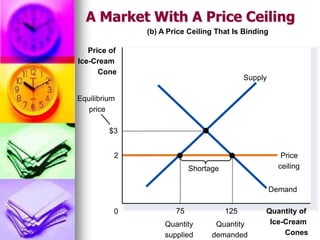

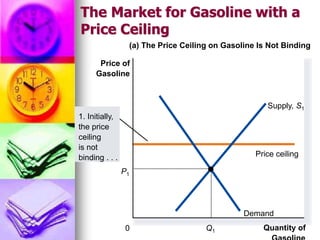

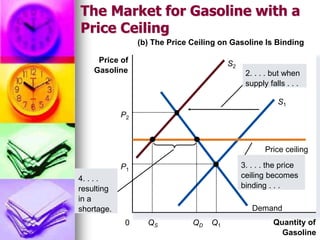

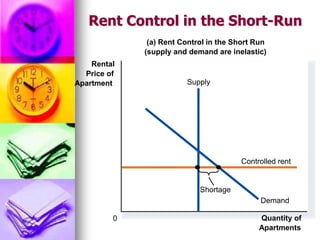

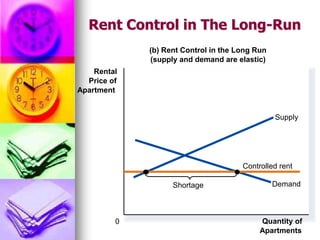

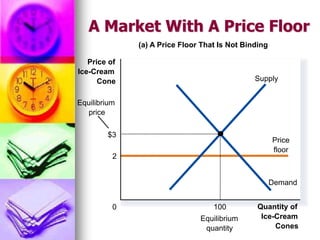

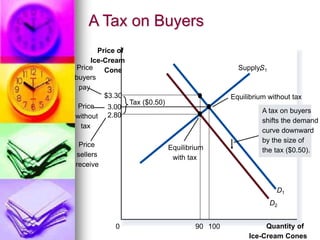

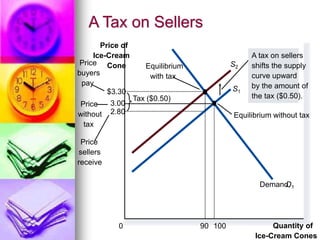

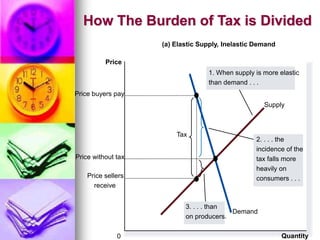

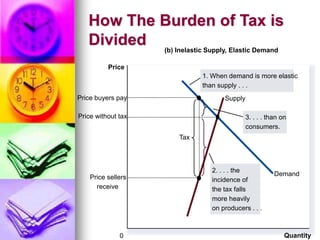

This document summarizes how government policies like price controls and taxes can affect market outcomes in microeconomics. It discusses how price ceilings create shortages by fixing prices below equilibrium, while price floors create surpluses by setting prices above equilibrium. Taxes on buyers or sellers shift demand or supply curves, lowering quantity sold. The tax burden is shared between buyers and sellers depending on elasticity, with the less elastic side bearing more of the cost.