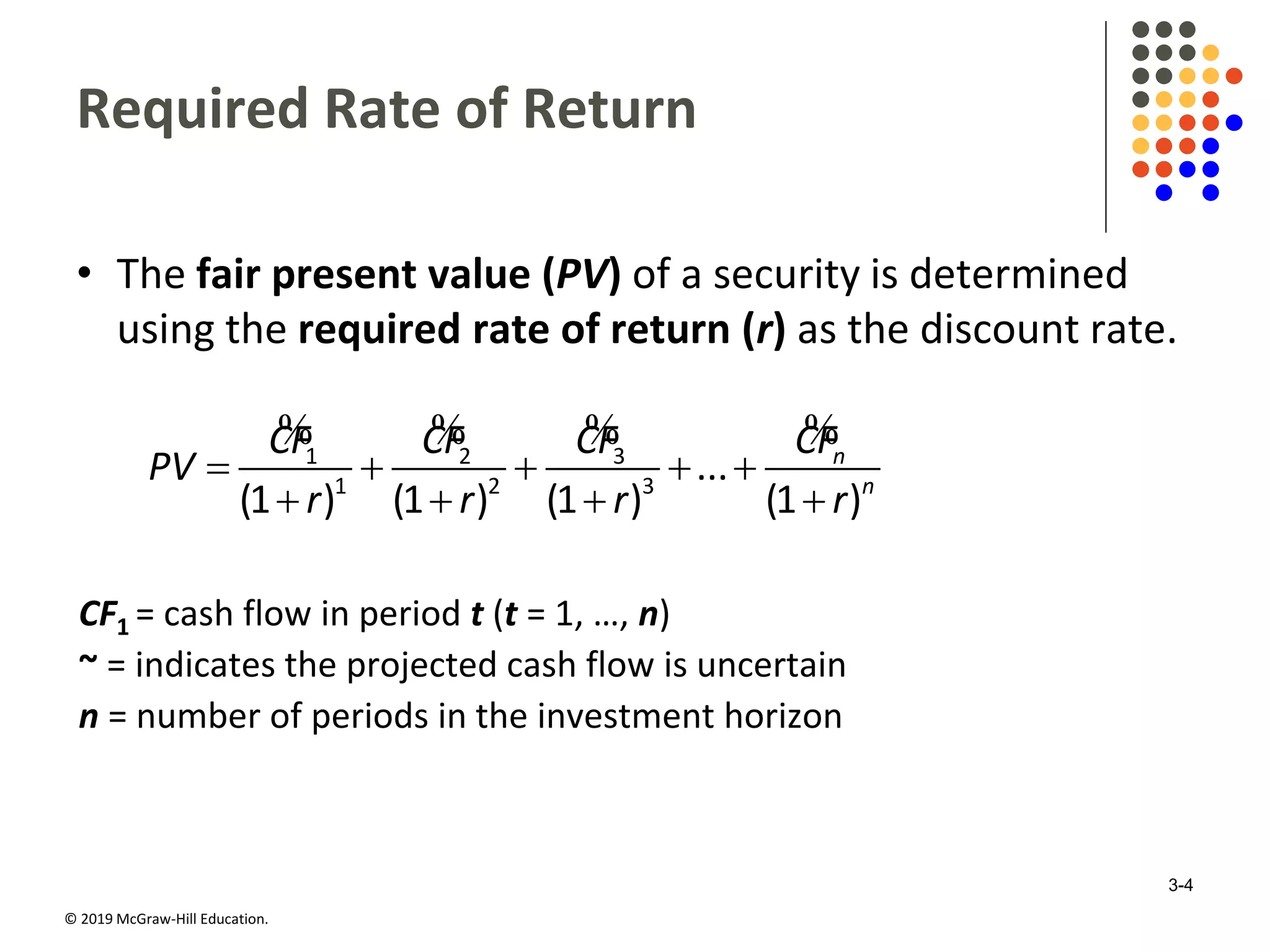

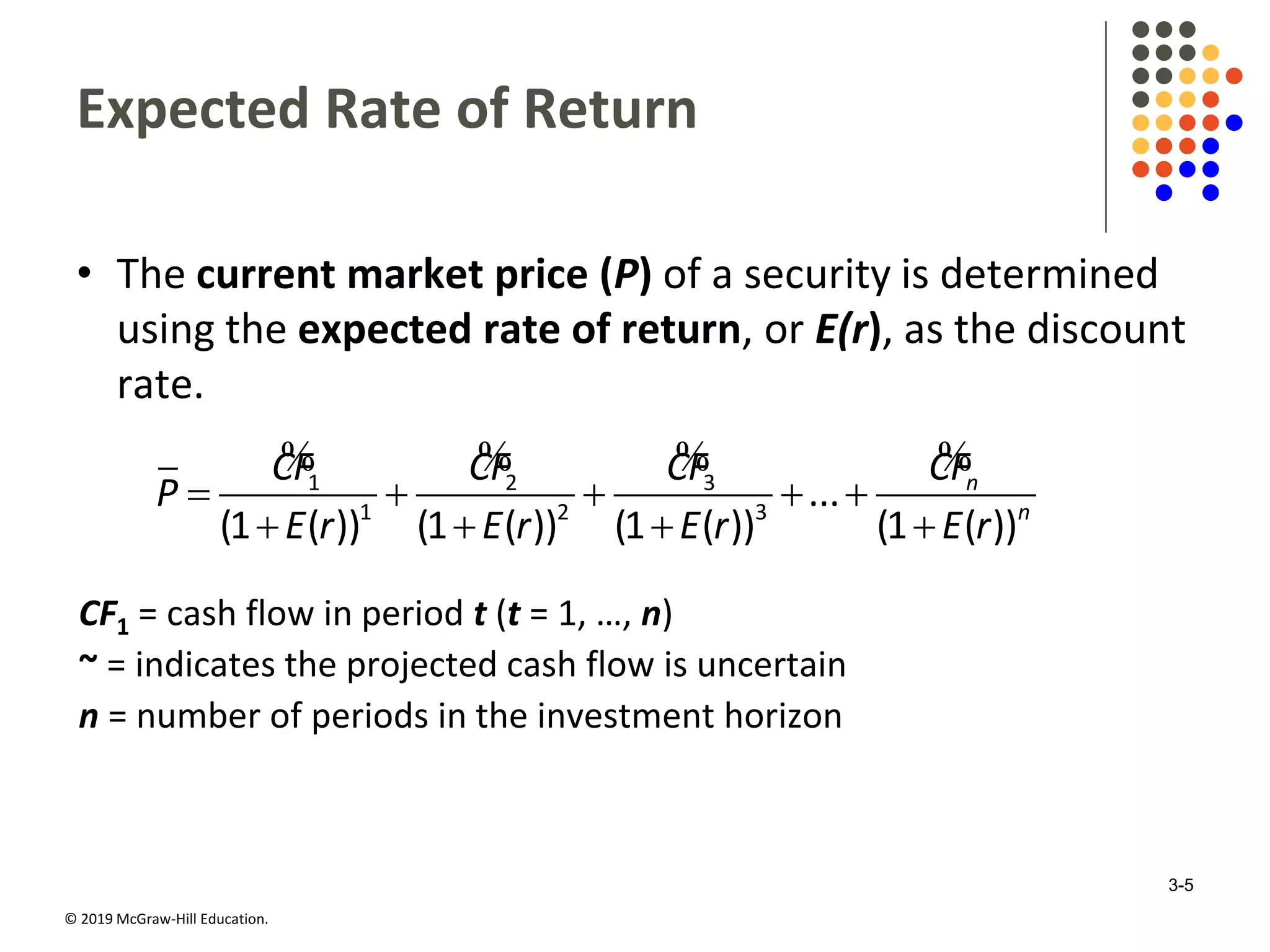

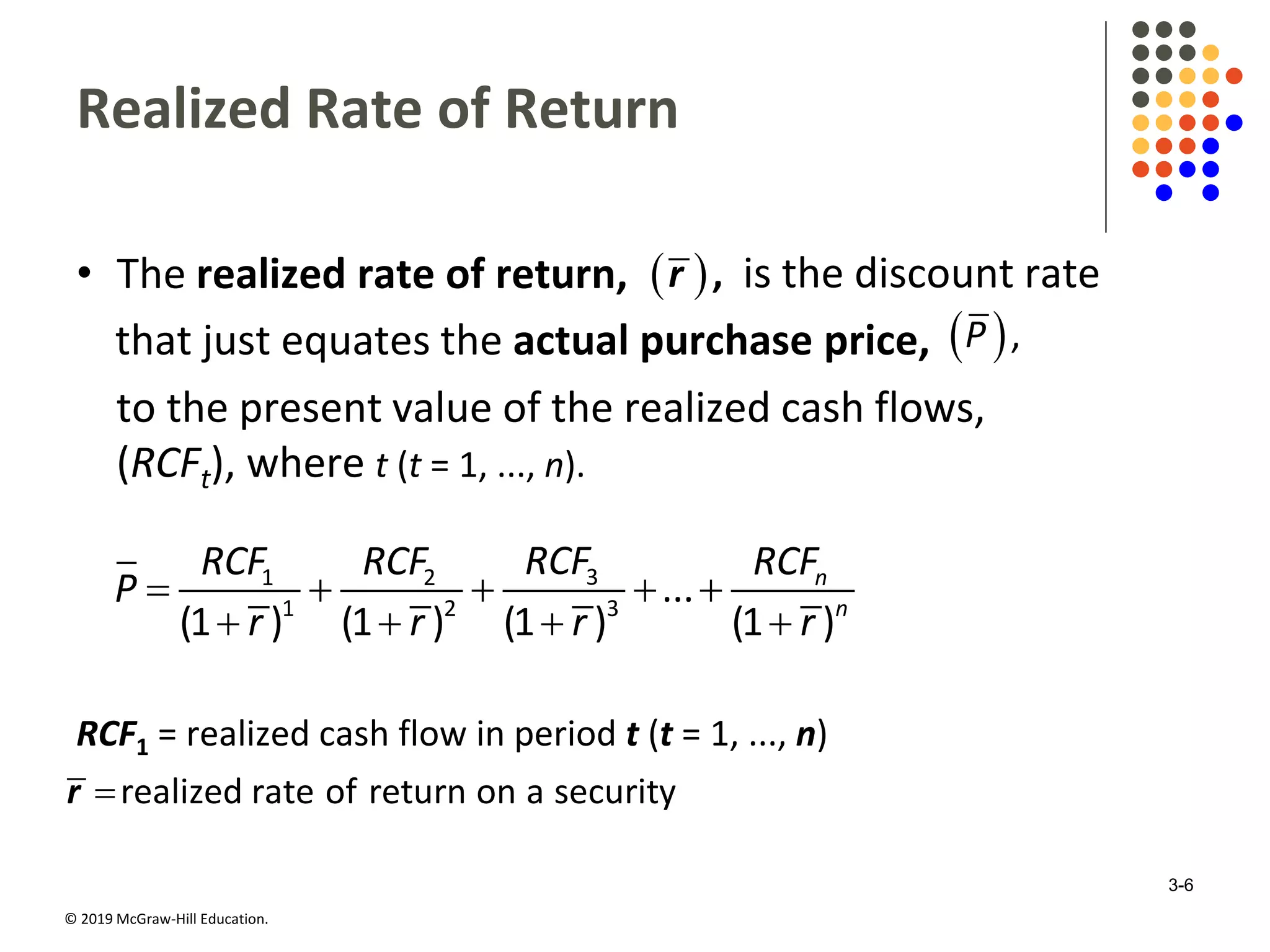

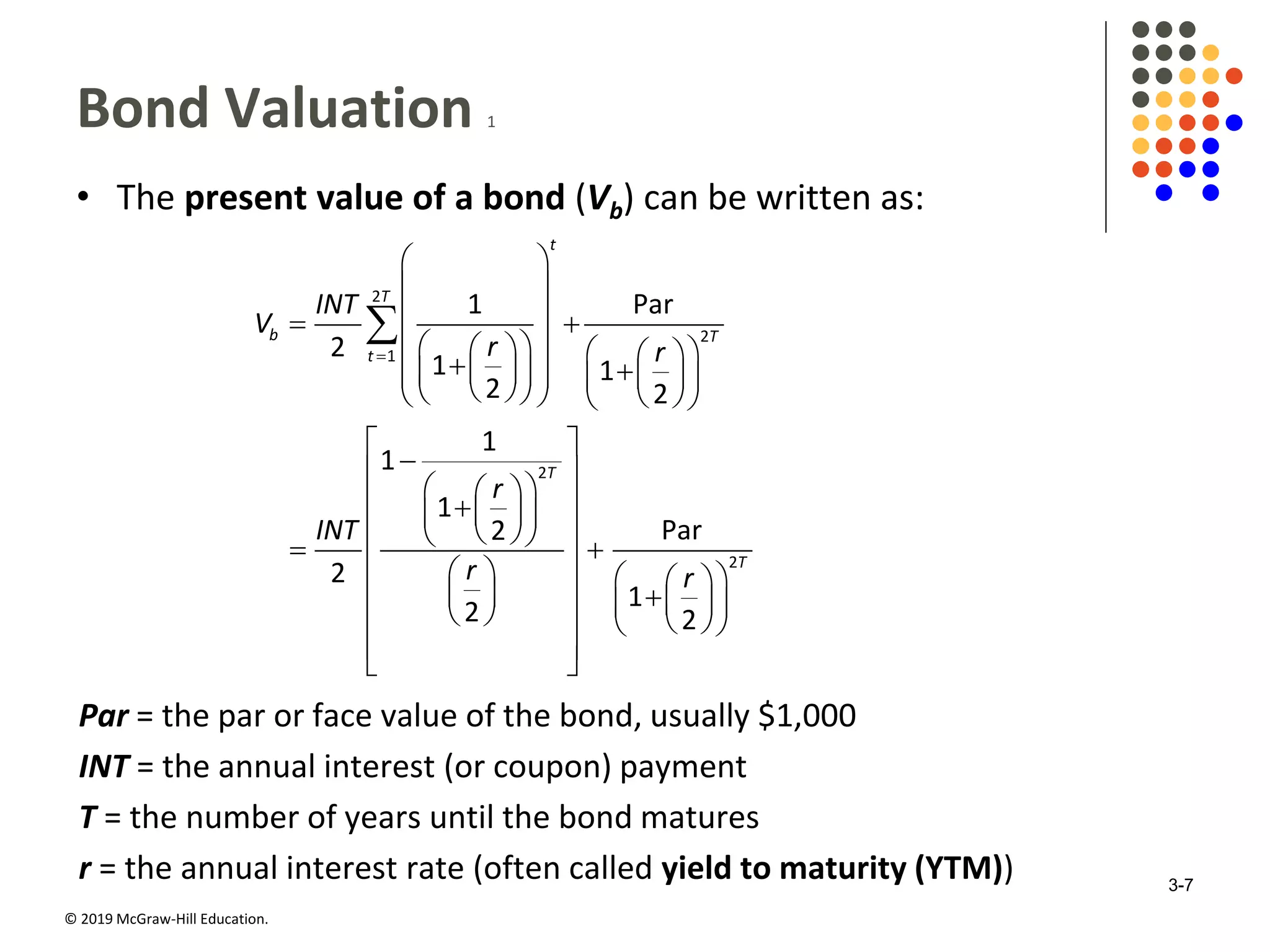

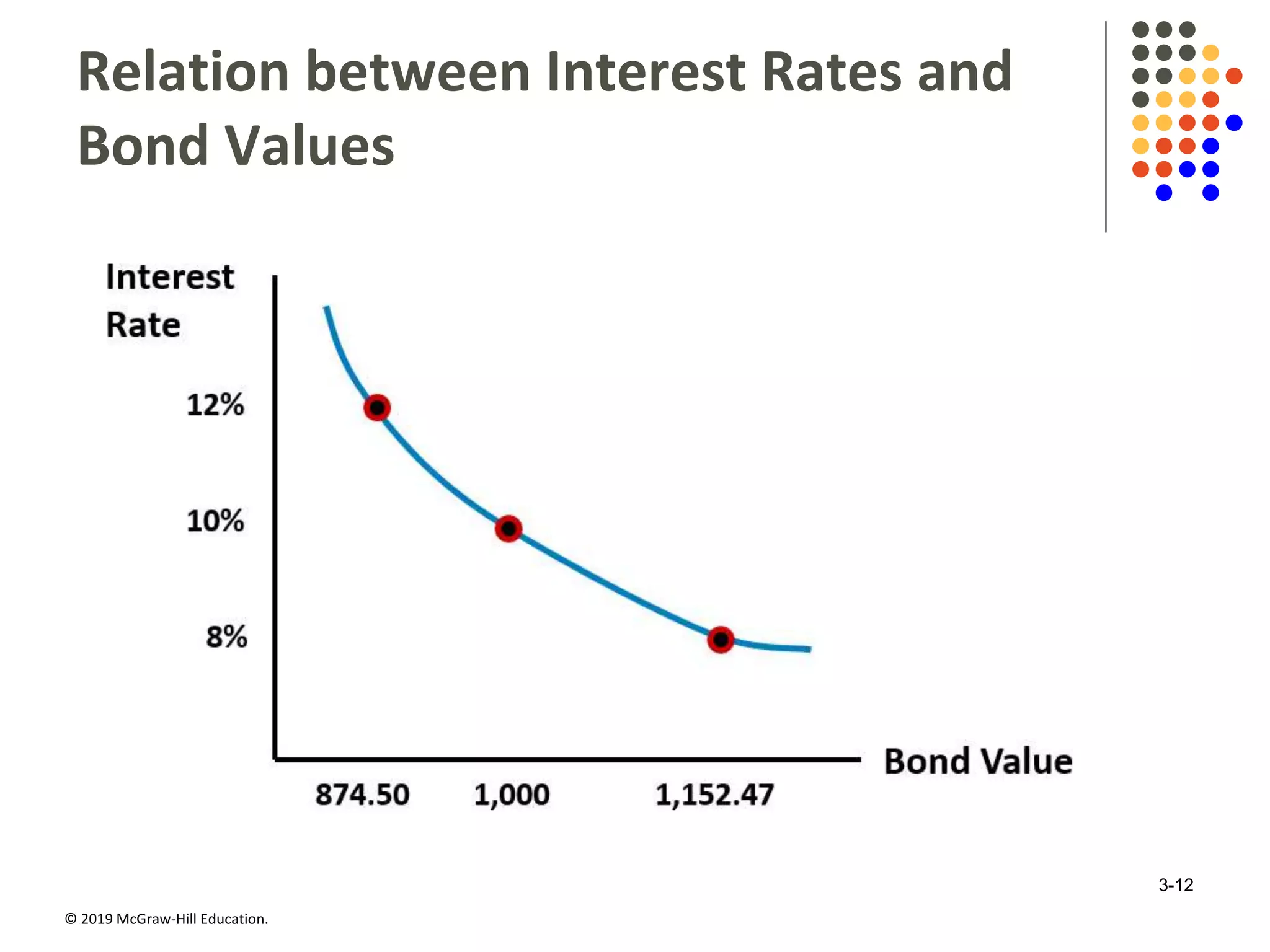

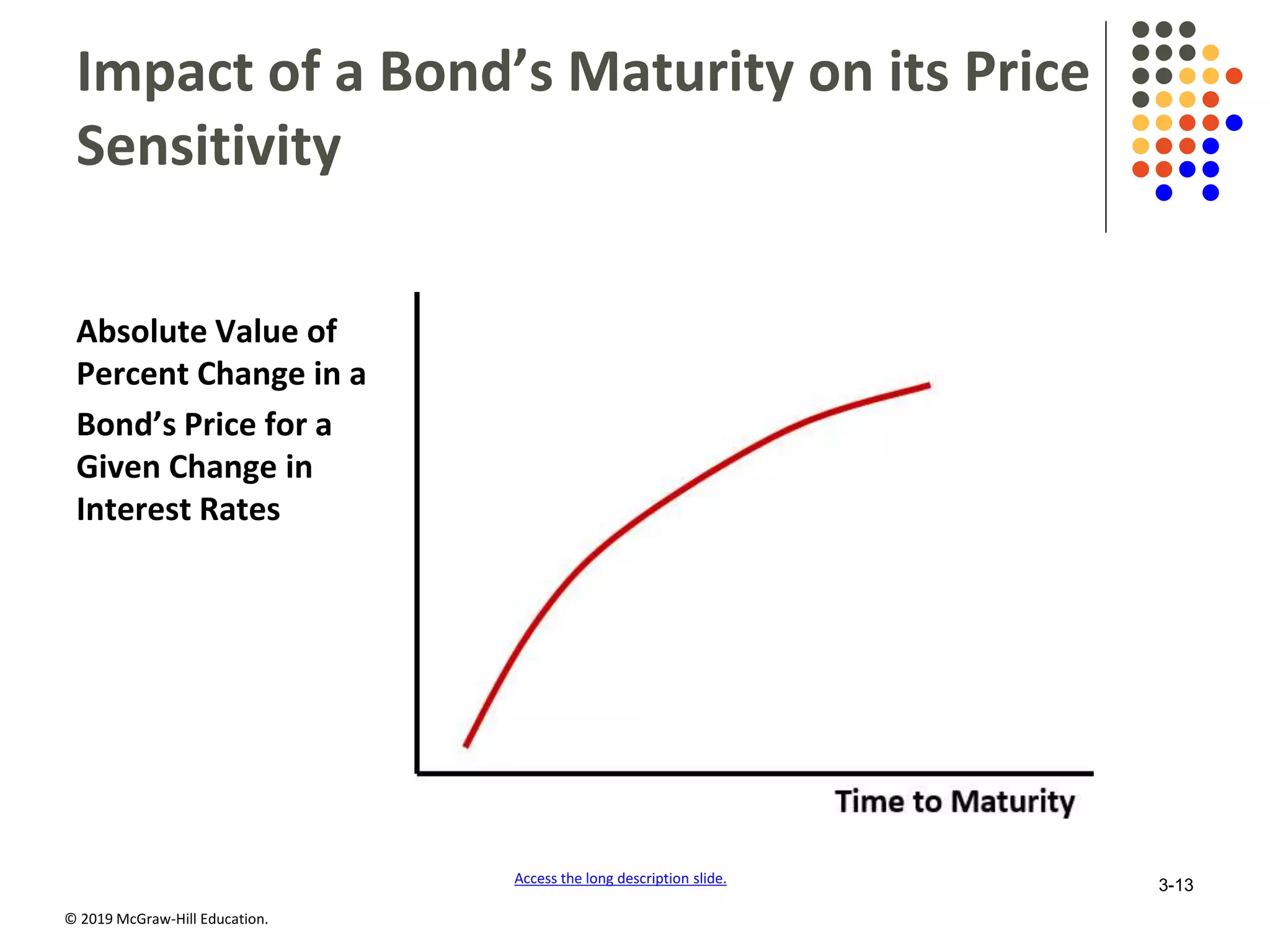

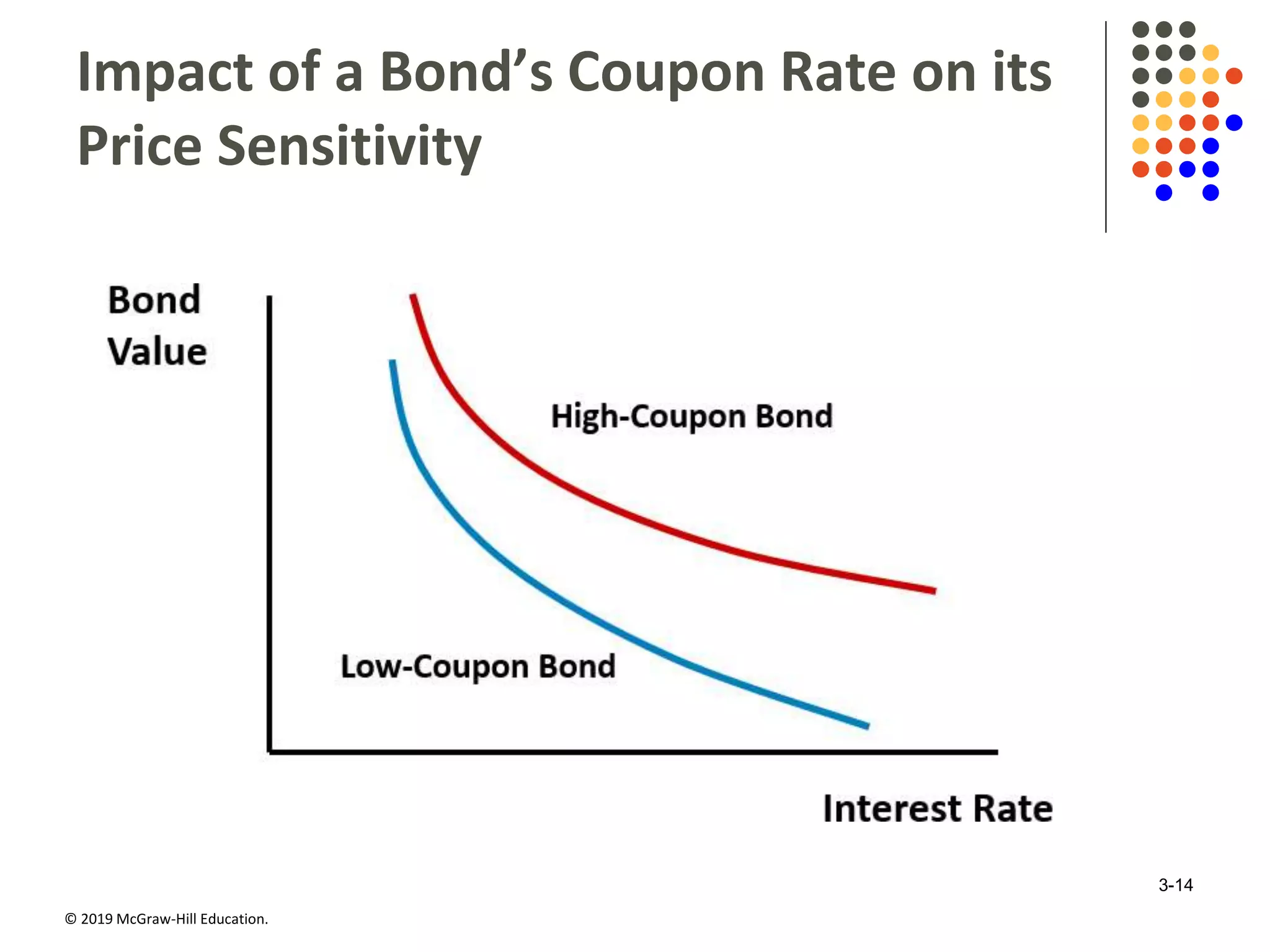

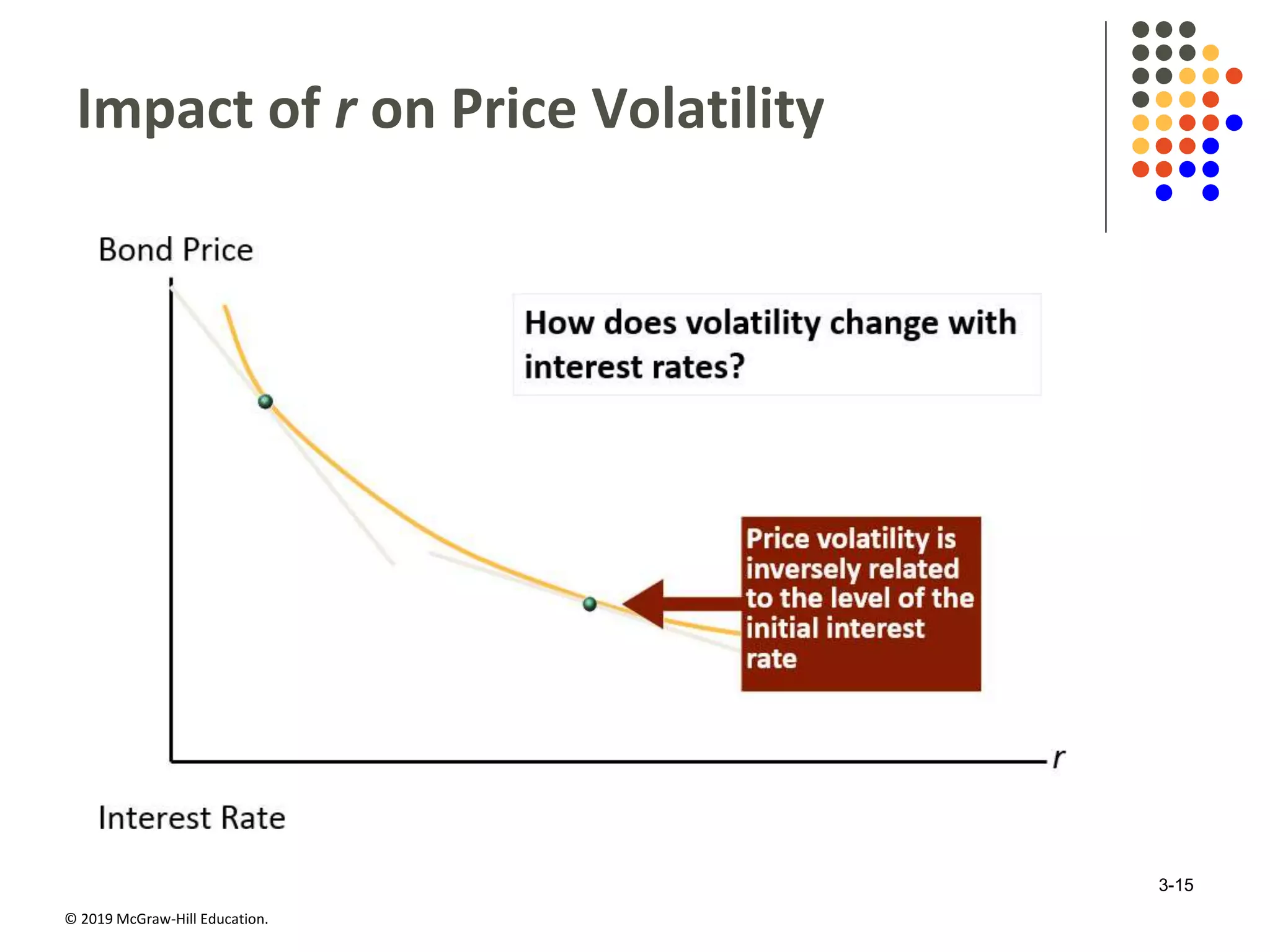

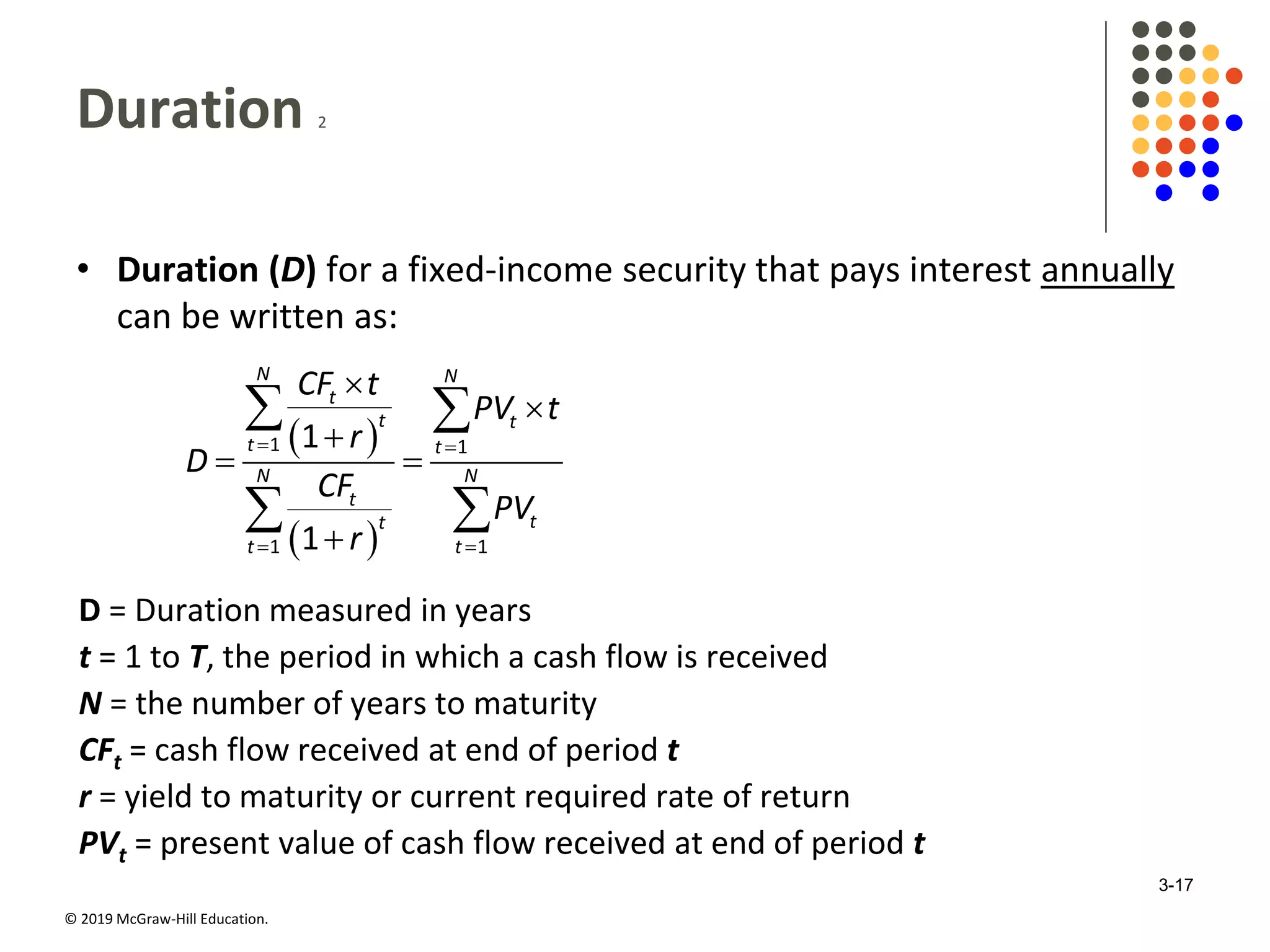

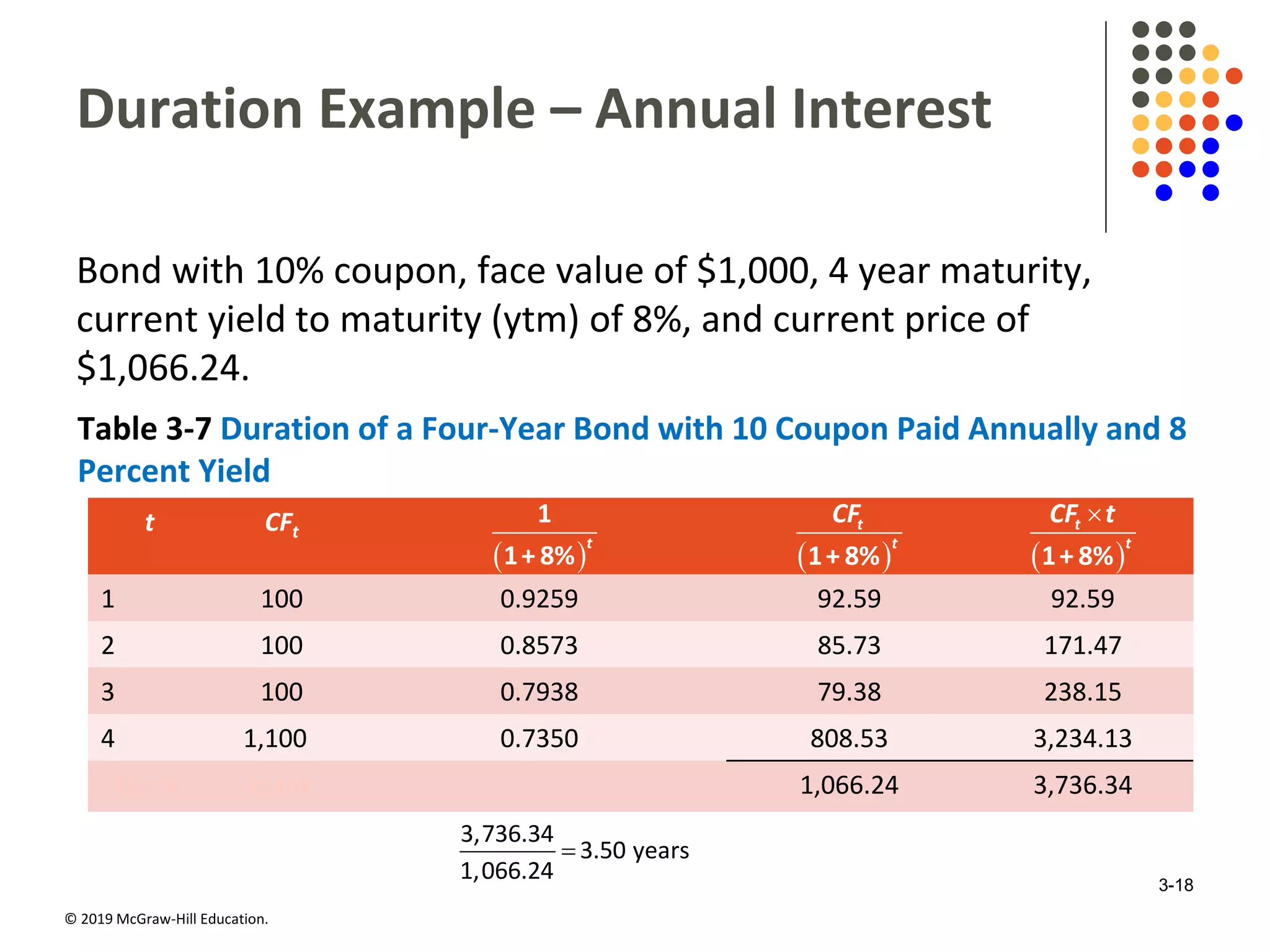

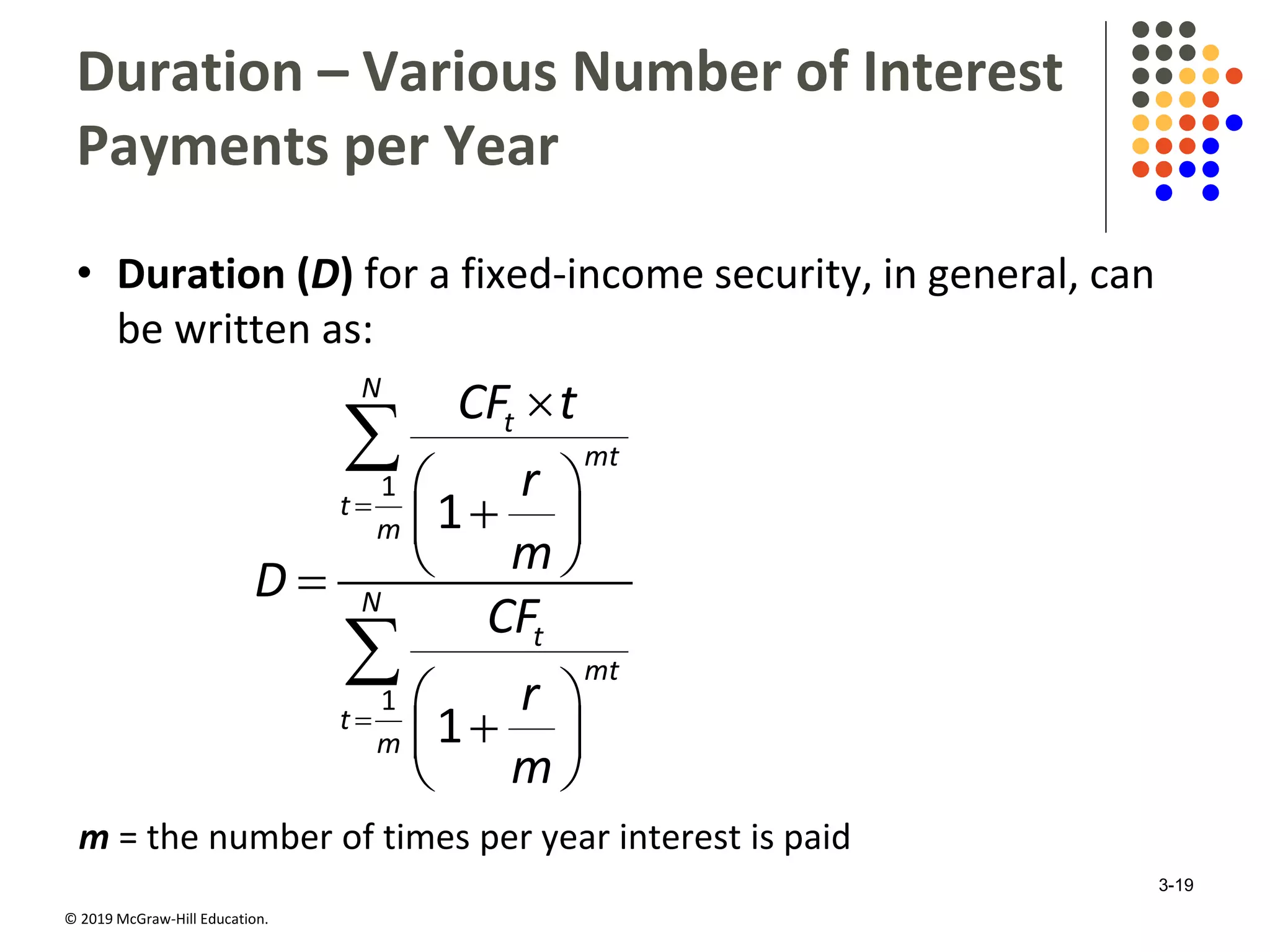

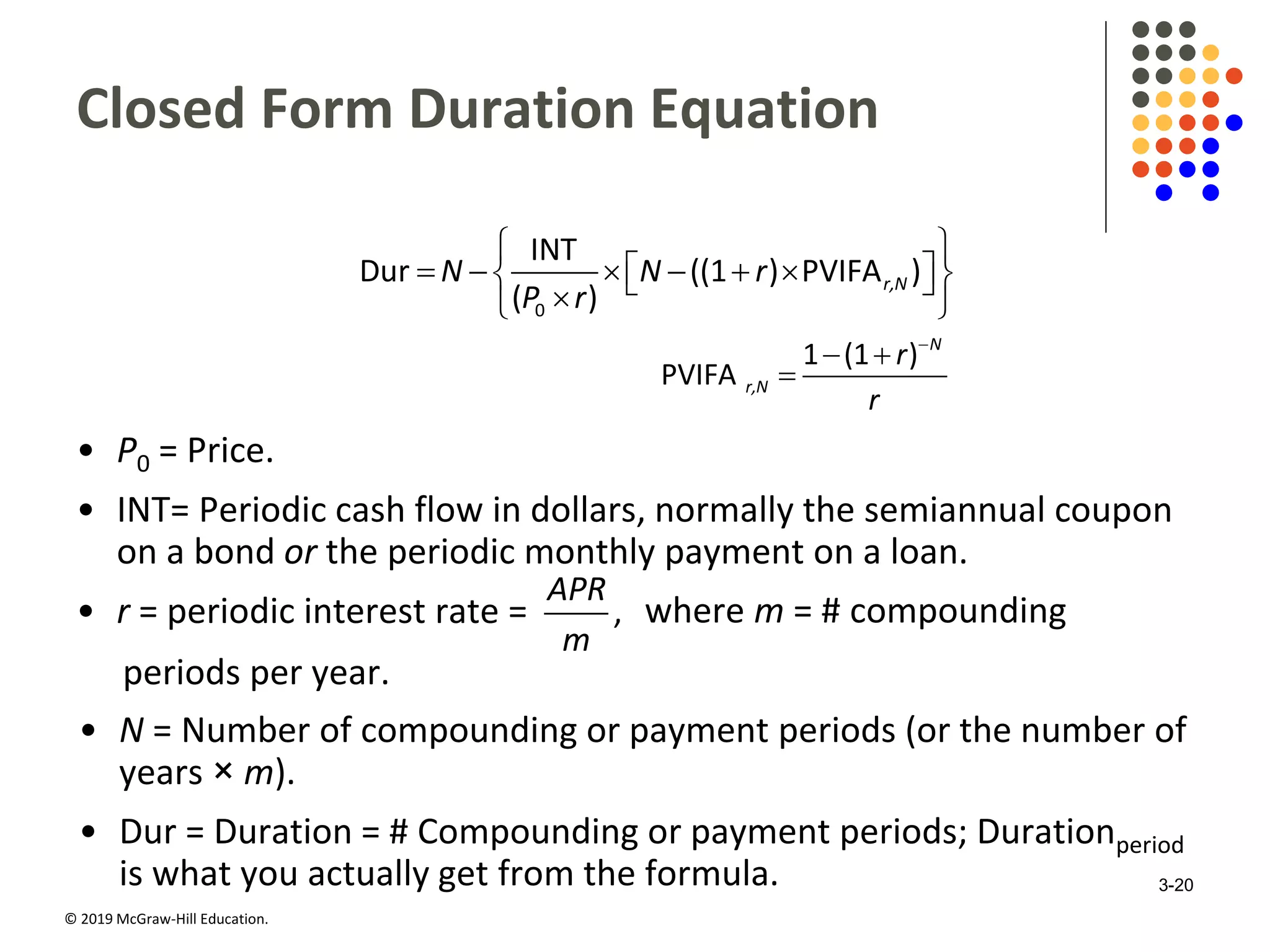

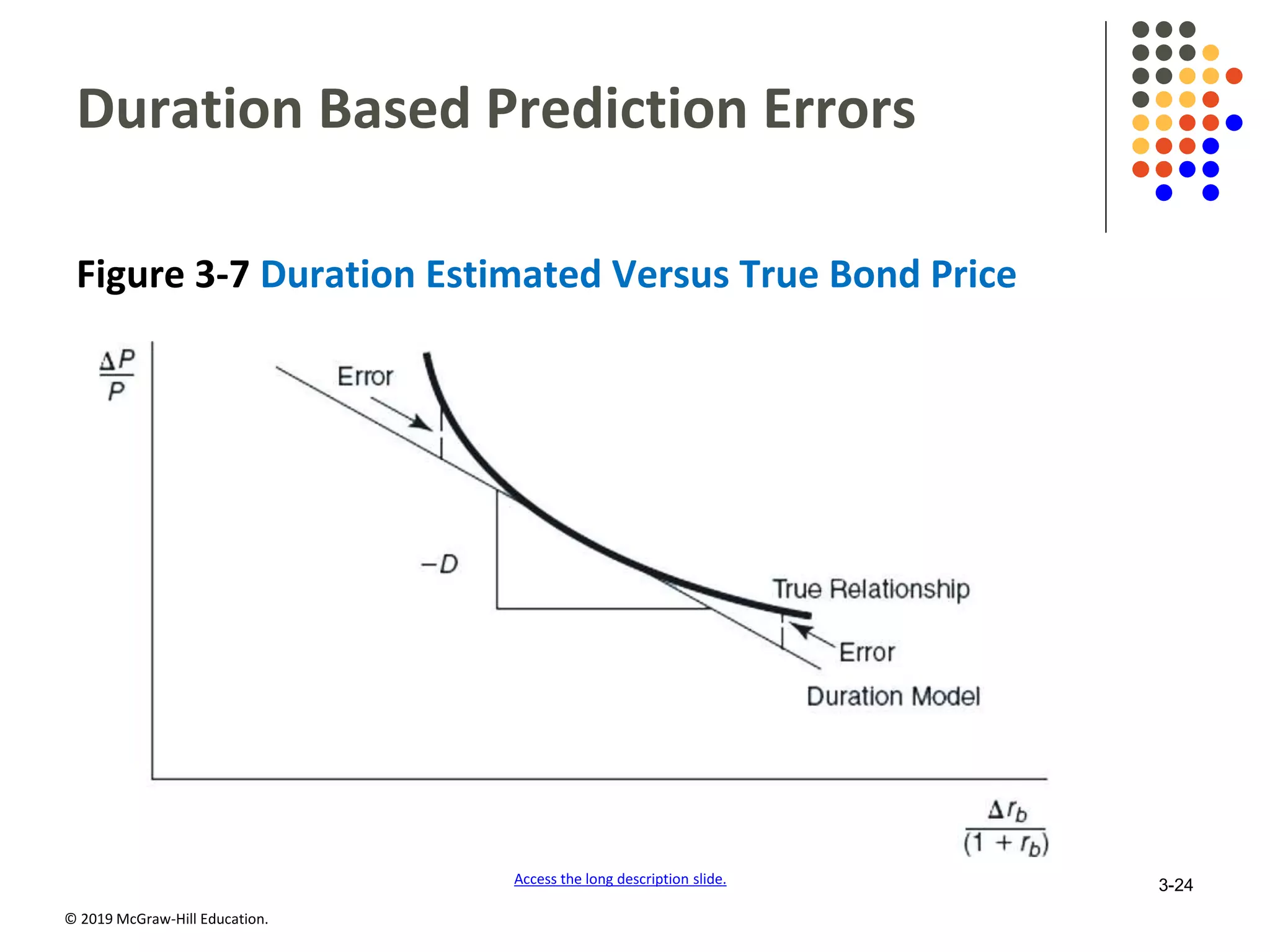

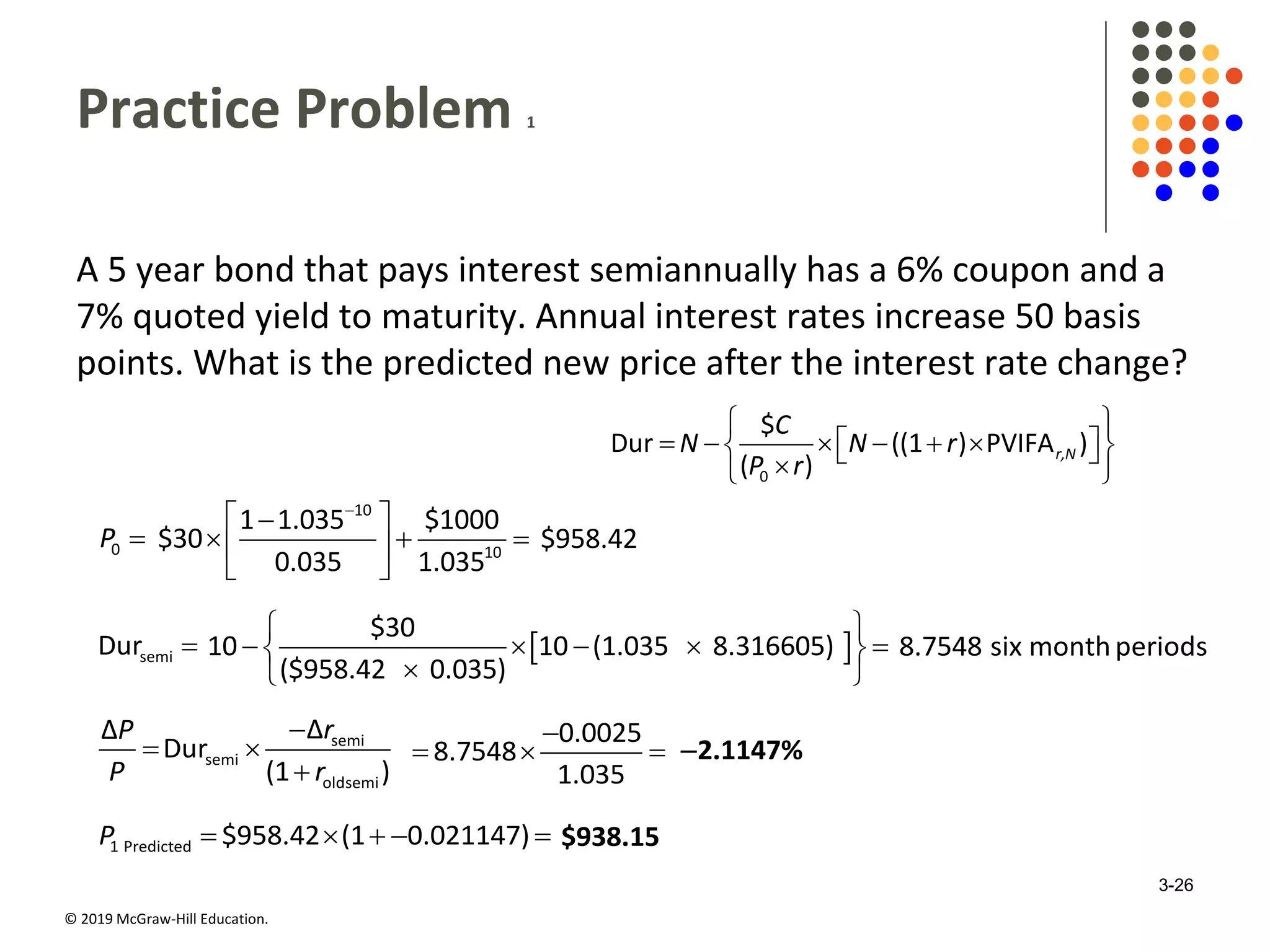

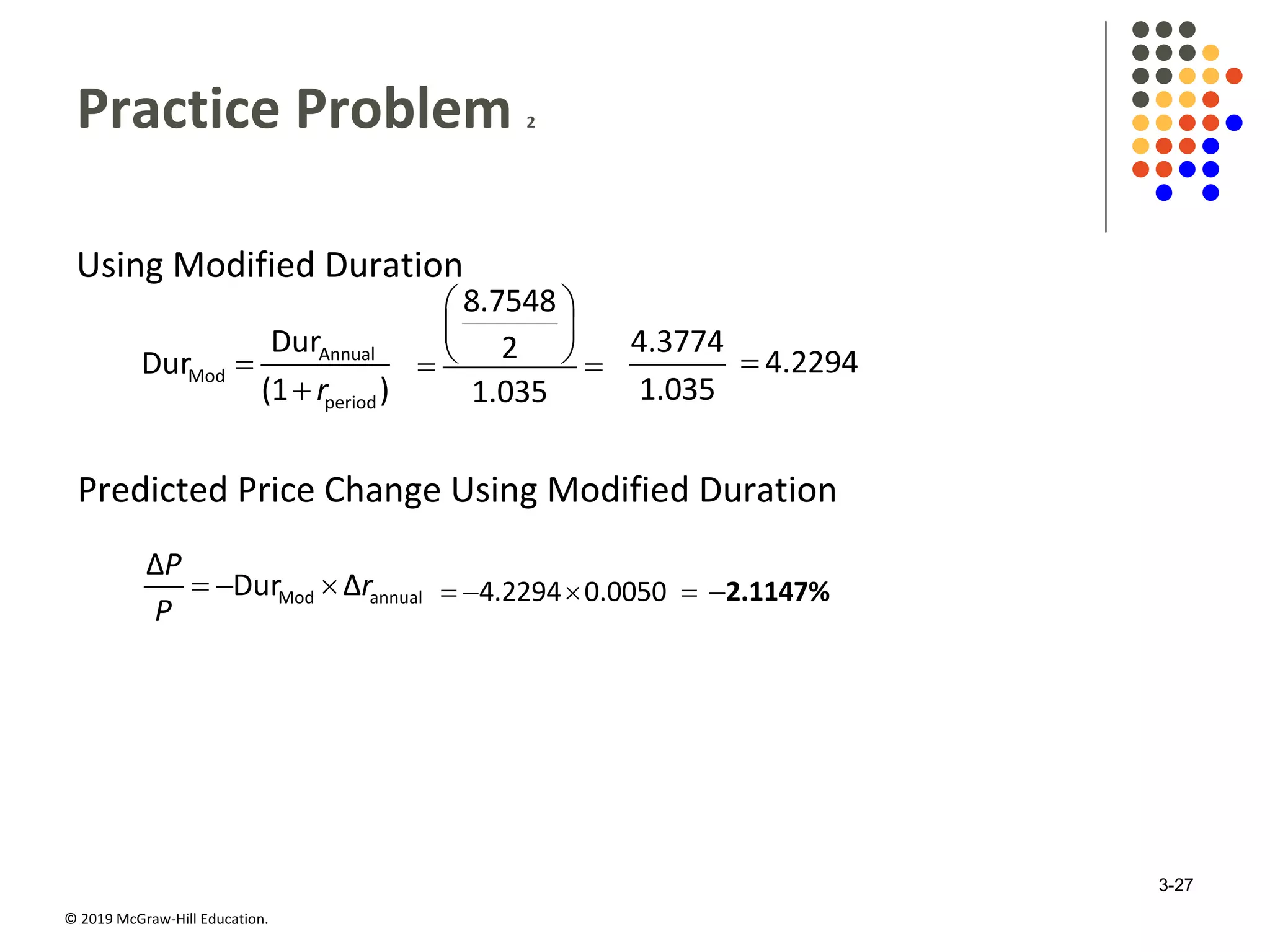

This document discusses interest rates and security valuation. It defines various interest rate measures like coupon rate, required rate of return, expected rate of return, and realized rate of return. It explains how the required rate of return is used to determine the fair present value of a security. The expected rate of return is used to determine the current market price. The realized rate of return equates the purchase price to the present value of cash flows. Bond and stock valuation models are presented. The relationship between interest rates and bond values is examined. Duration and modified duration are introduced as measures of a bond's price sensitivity to interest rate changes. Convexity is also discussed.