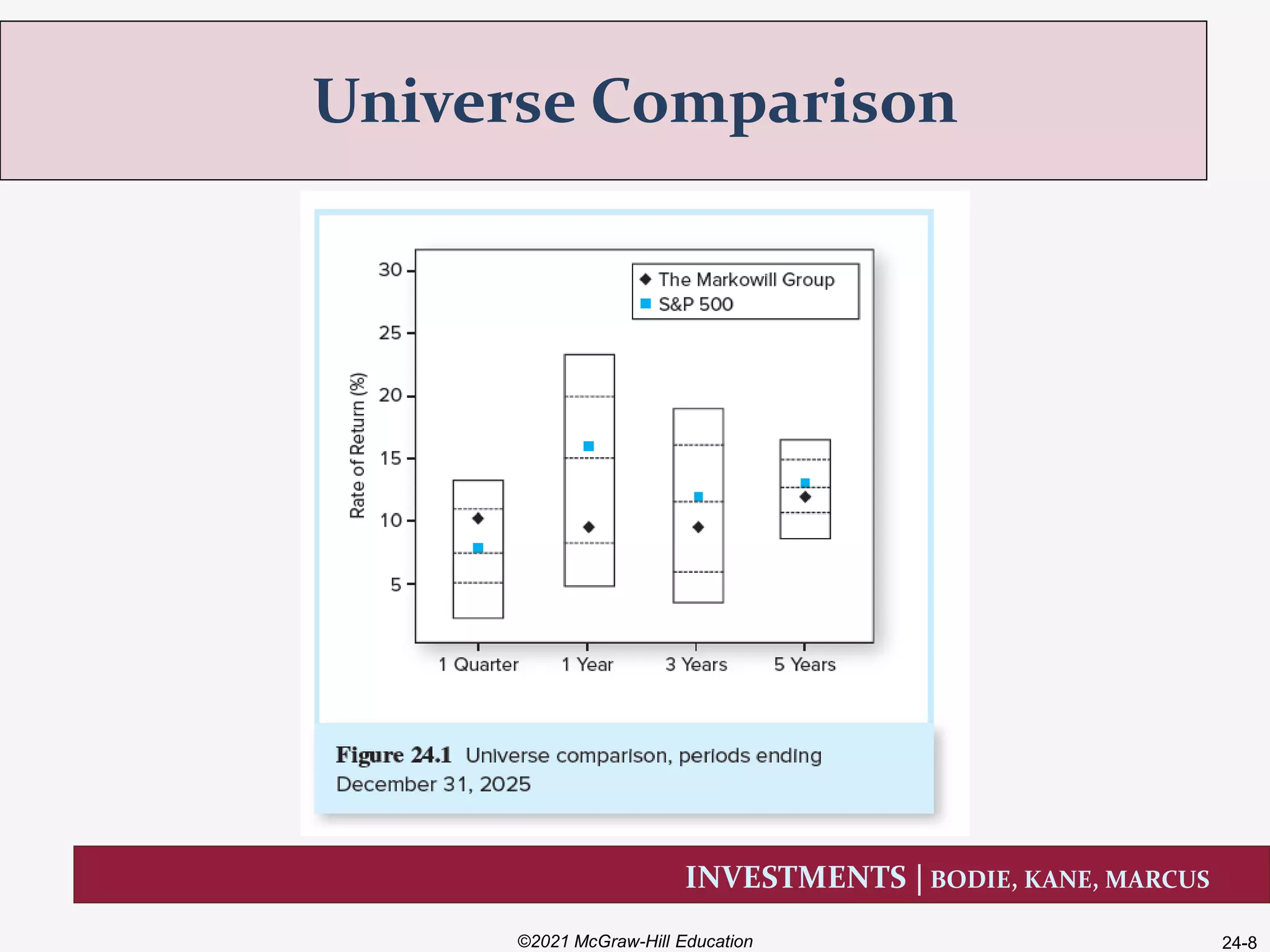

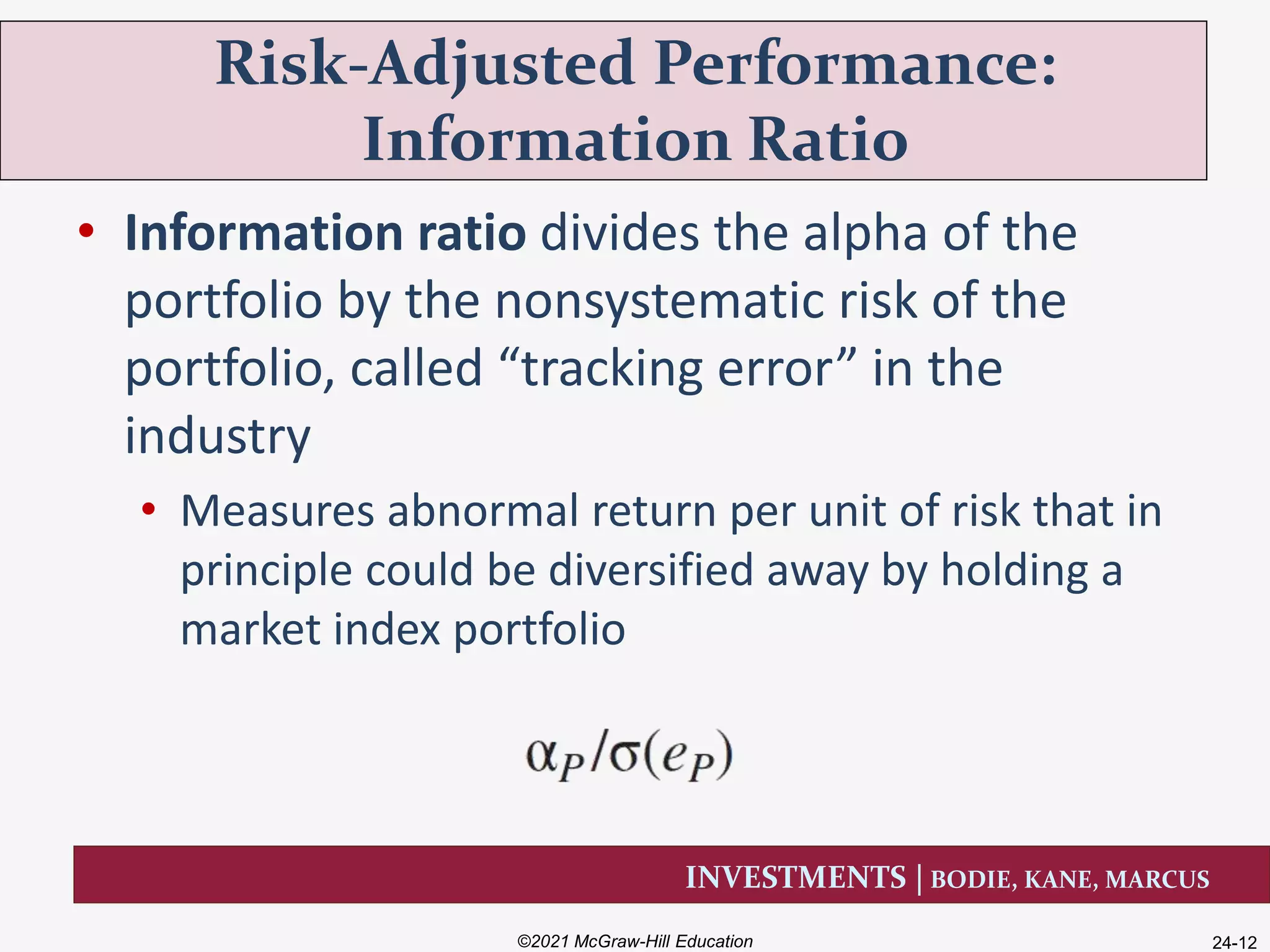

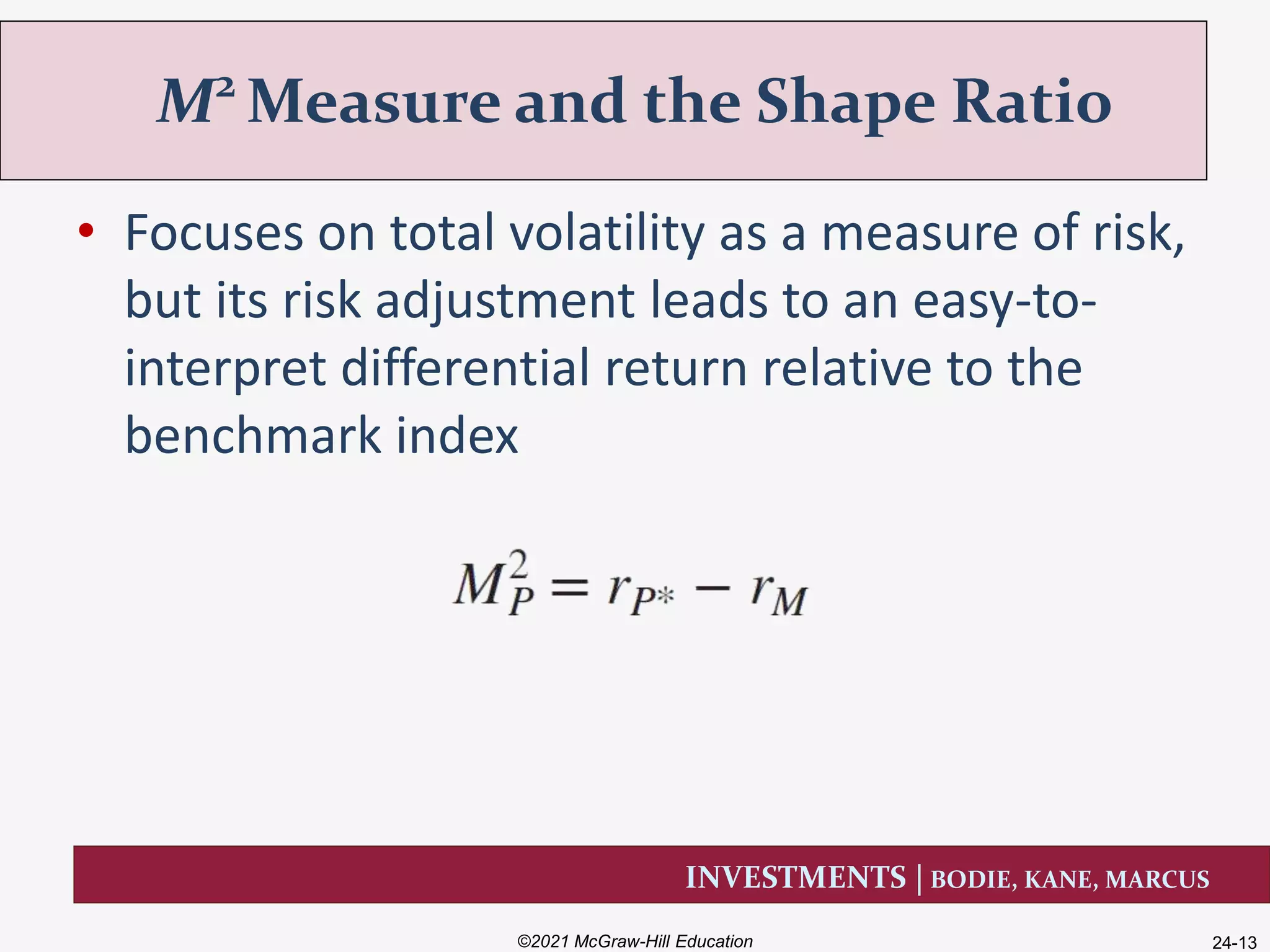

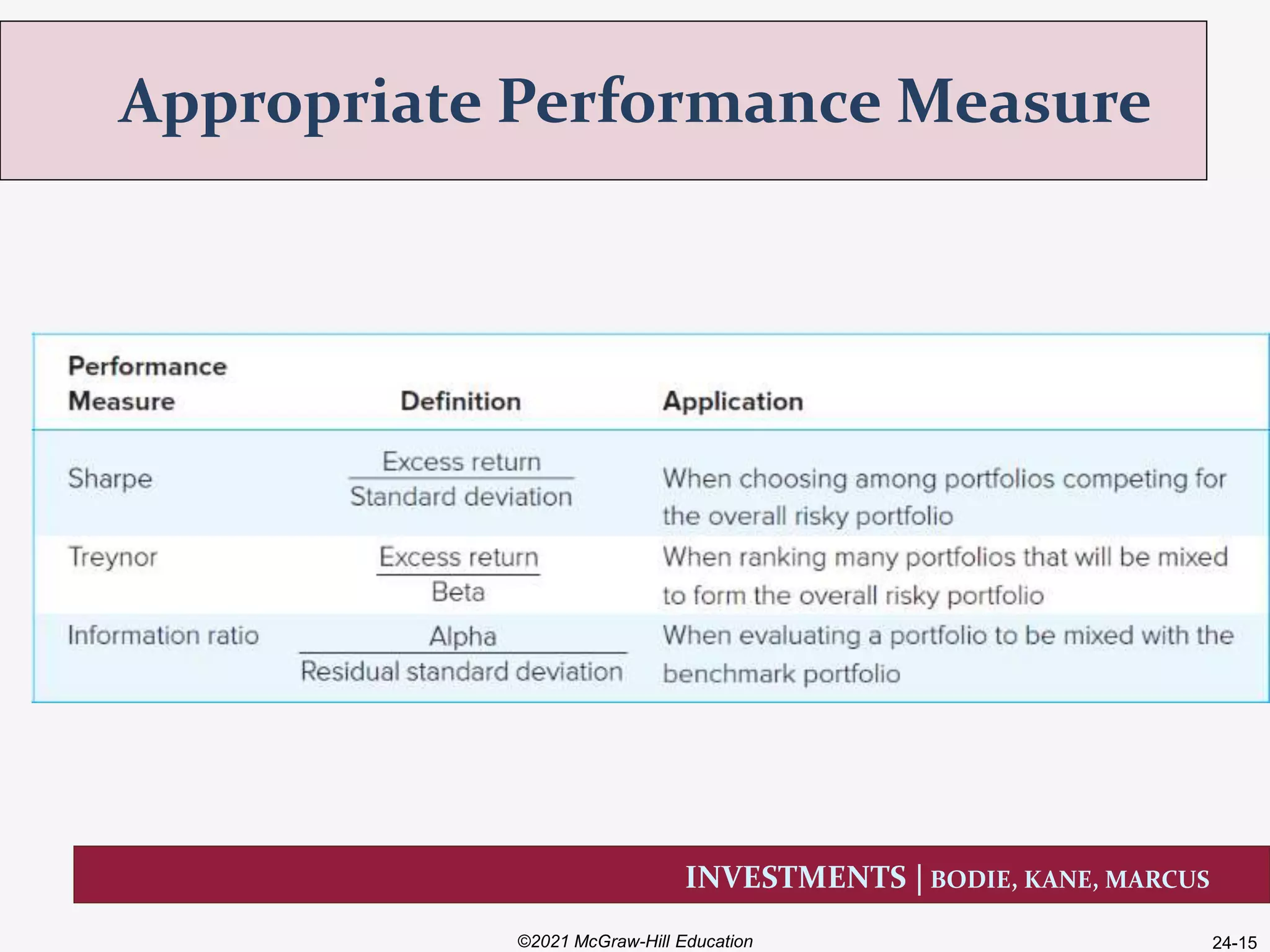

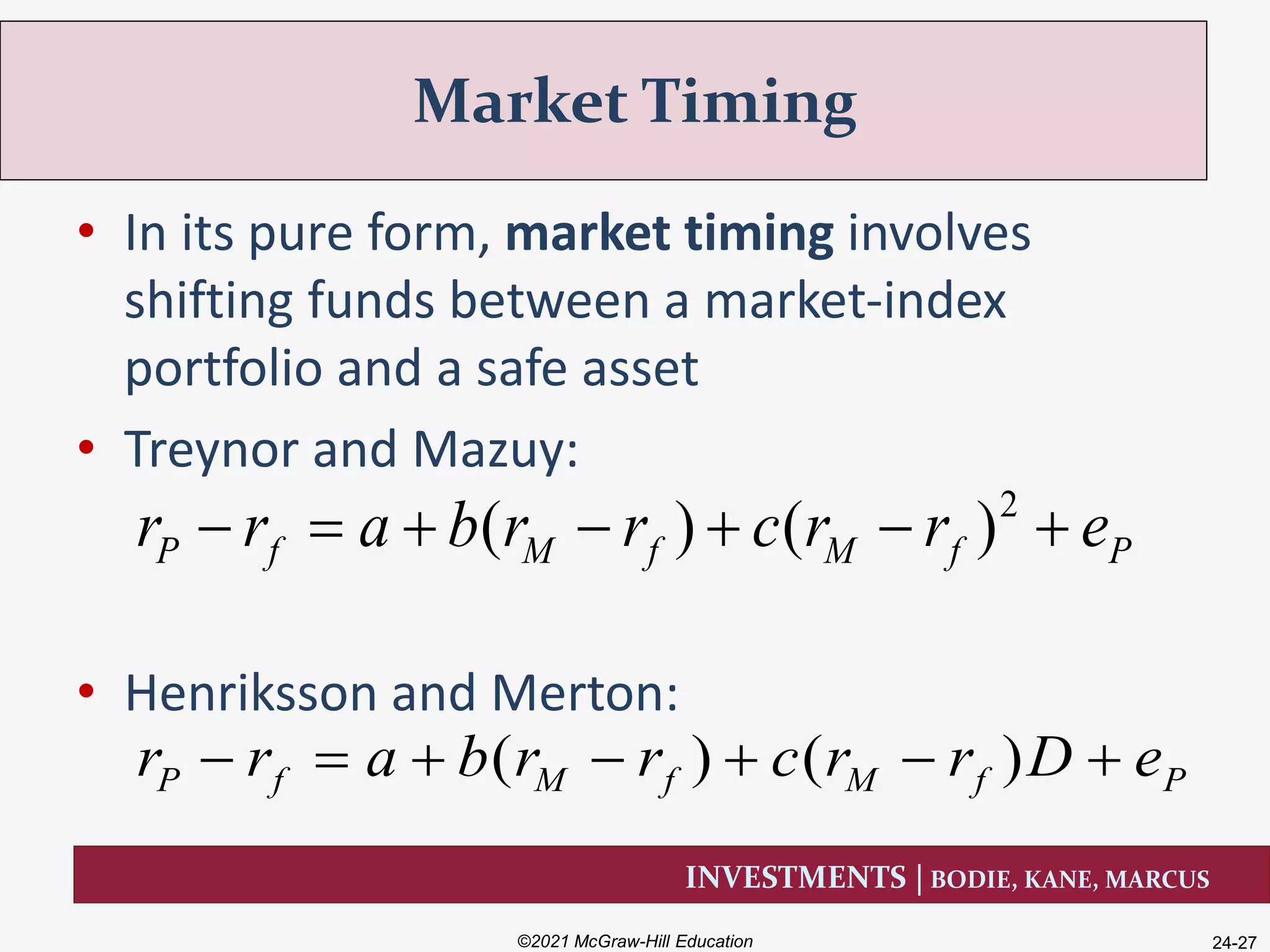

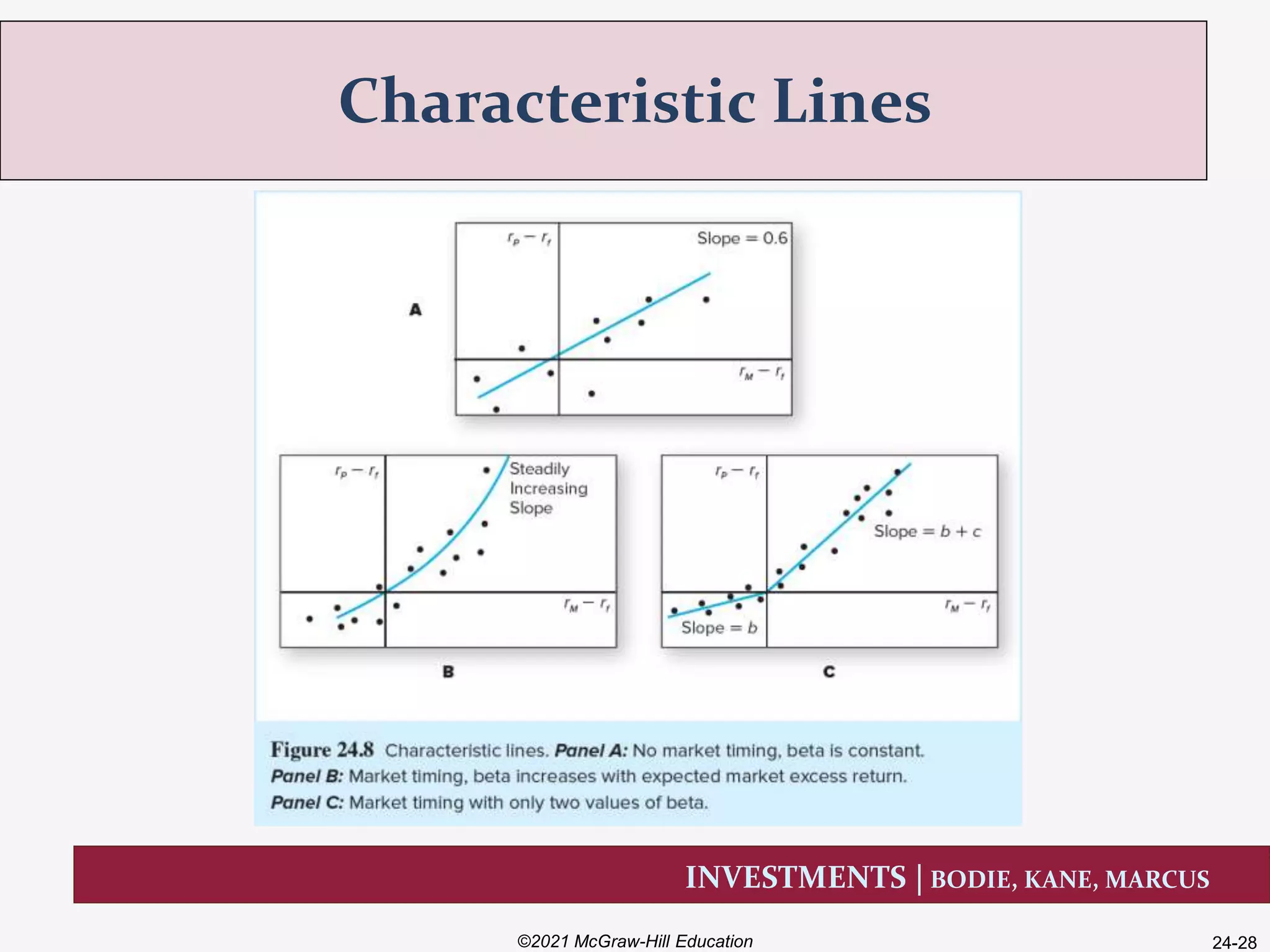

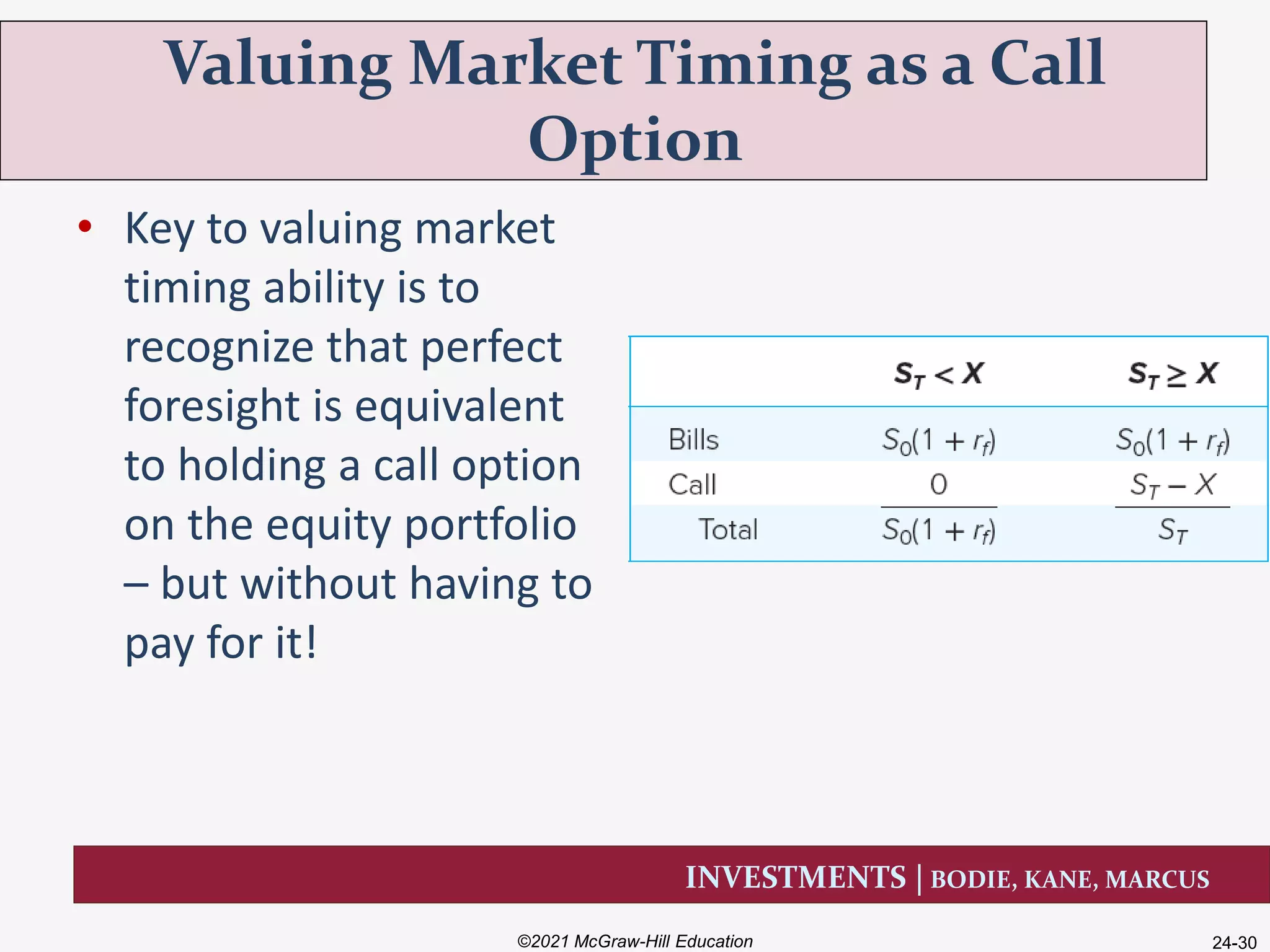

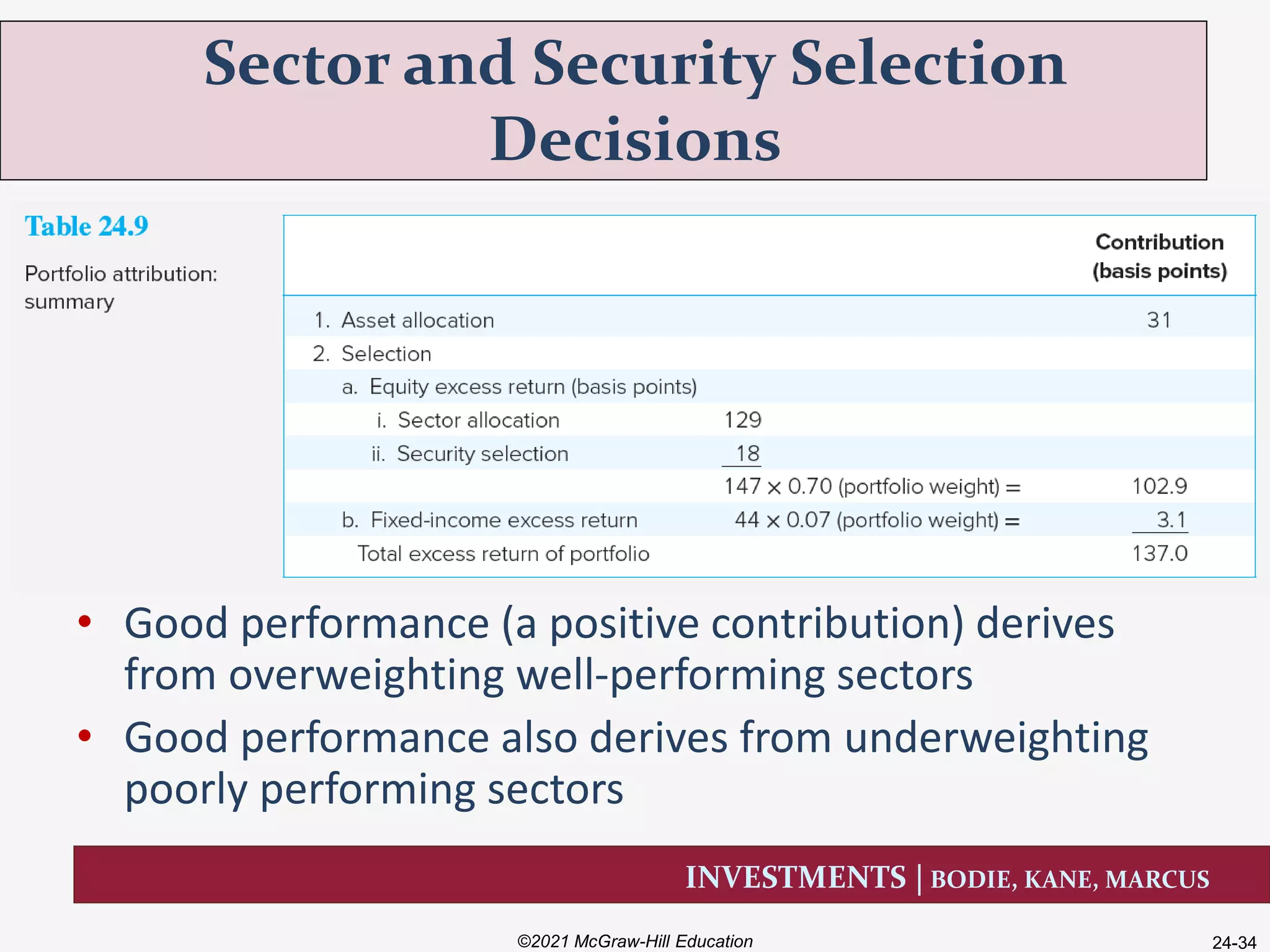

This document discusses various methods for evaluating investment performance and adjusting returns for risk. It covers time-weighted and dollar-weighted returns, comparing returns to a relevant universe, and risk-adjusted metrics like the Sharpe ratio, Treynor ratio, Jensen's alpha, and information ratio. The document also discusses issues like survivorship bias, style analysis, market timing, and performance attribution.