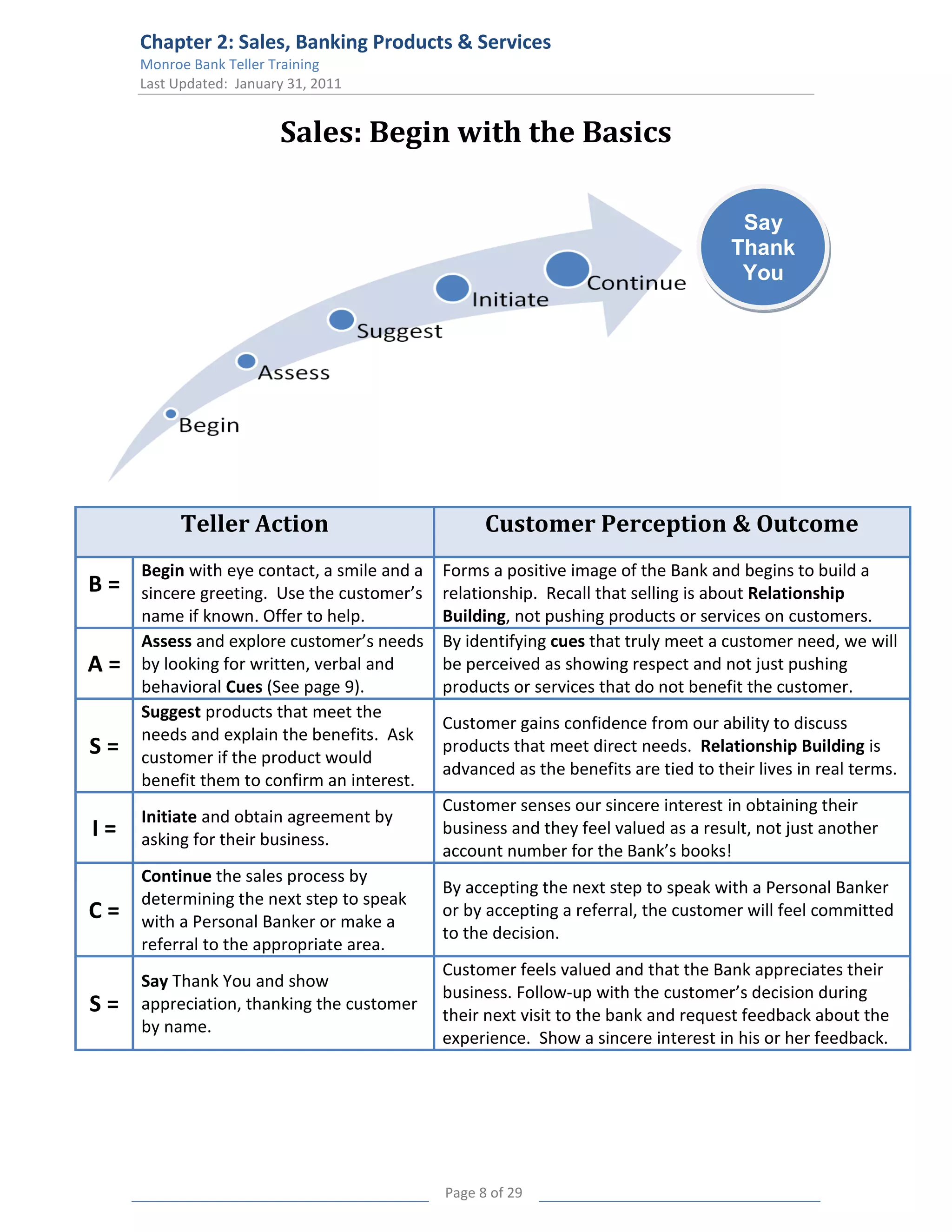

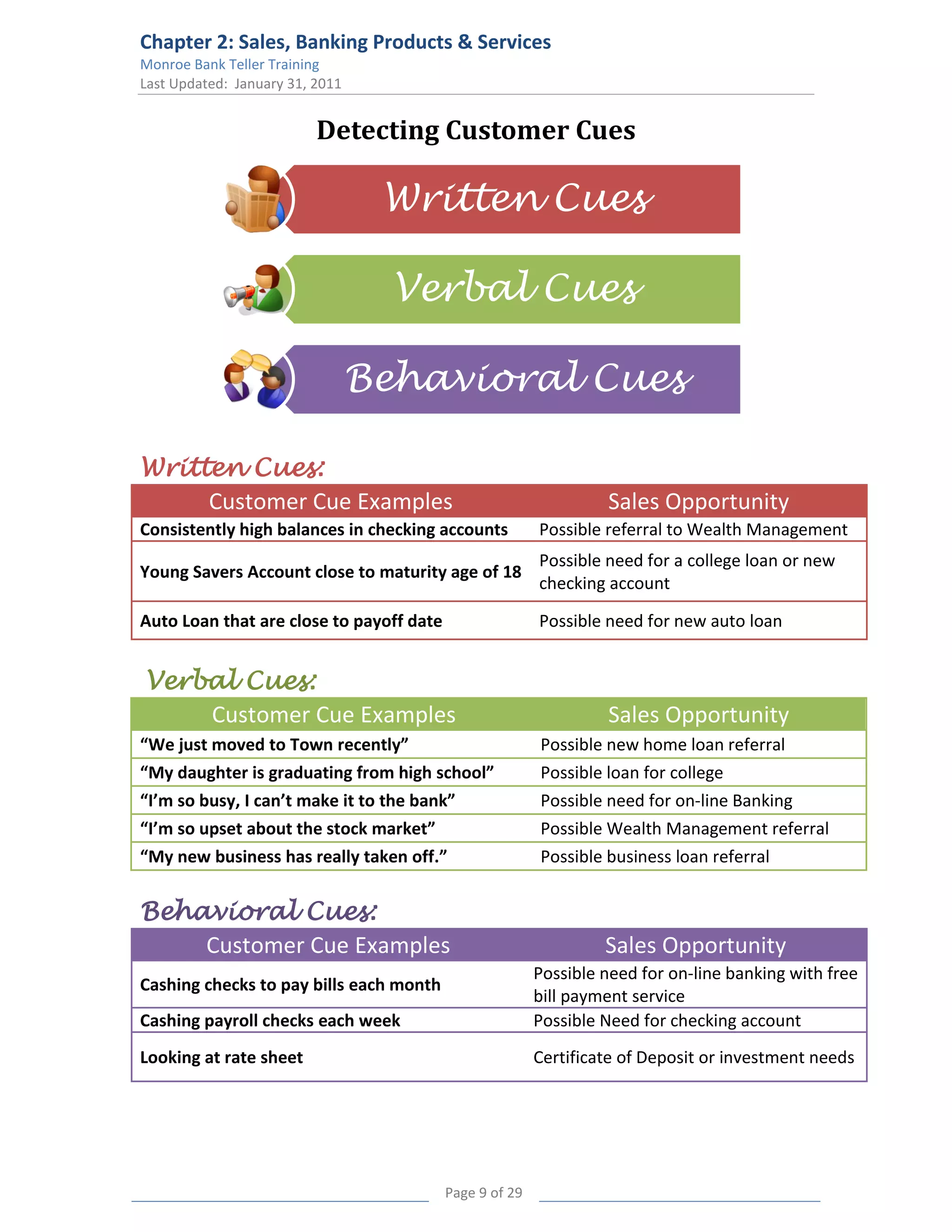

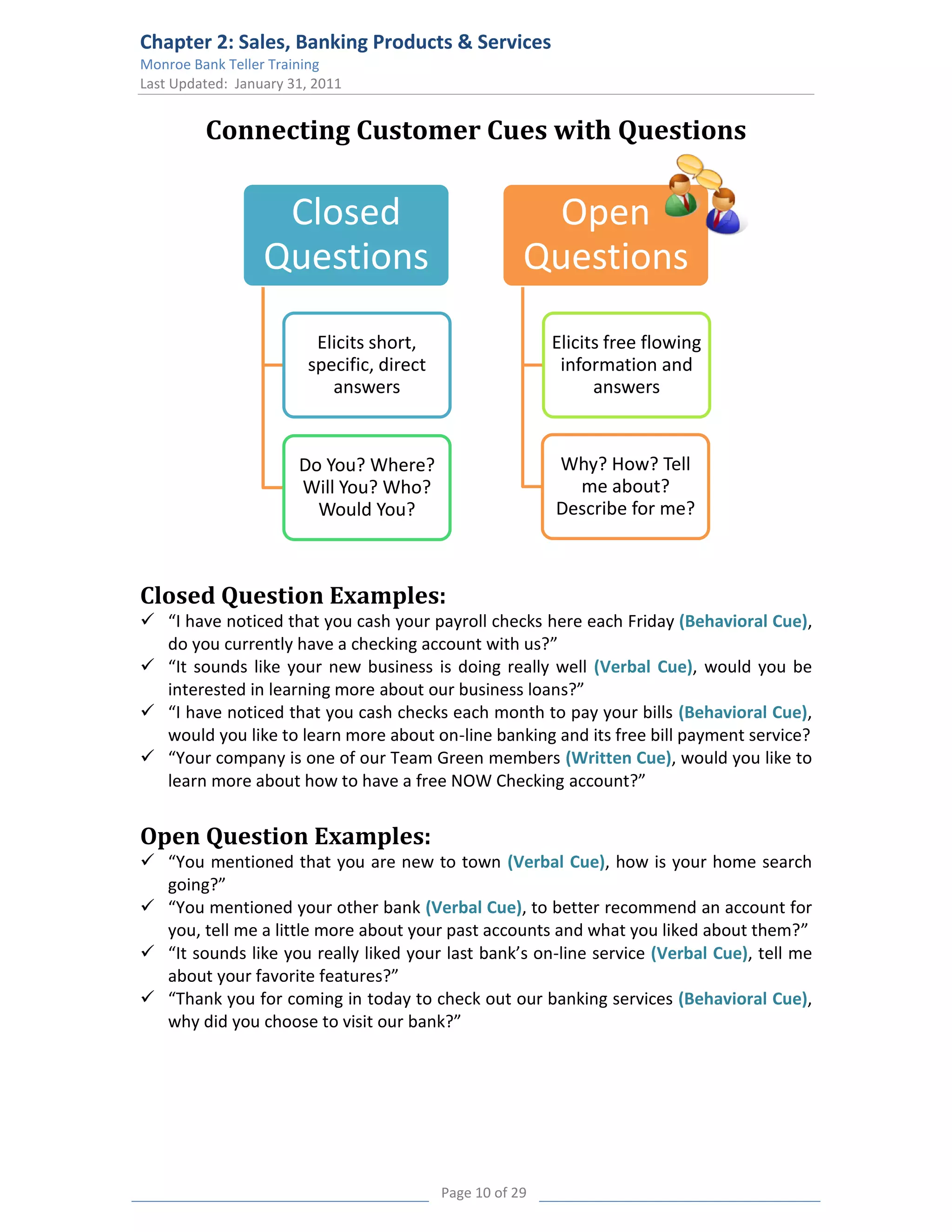

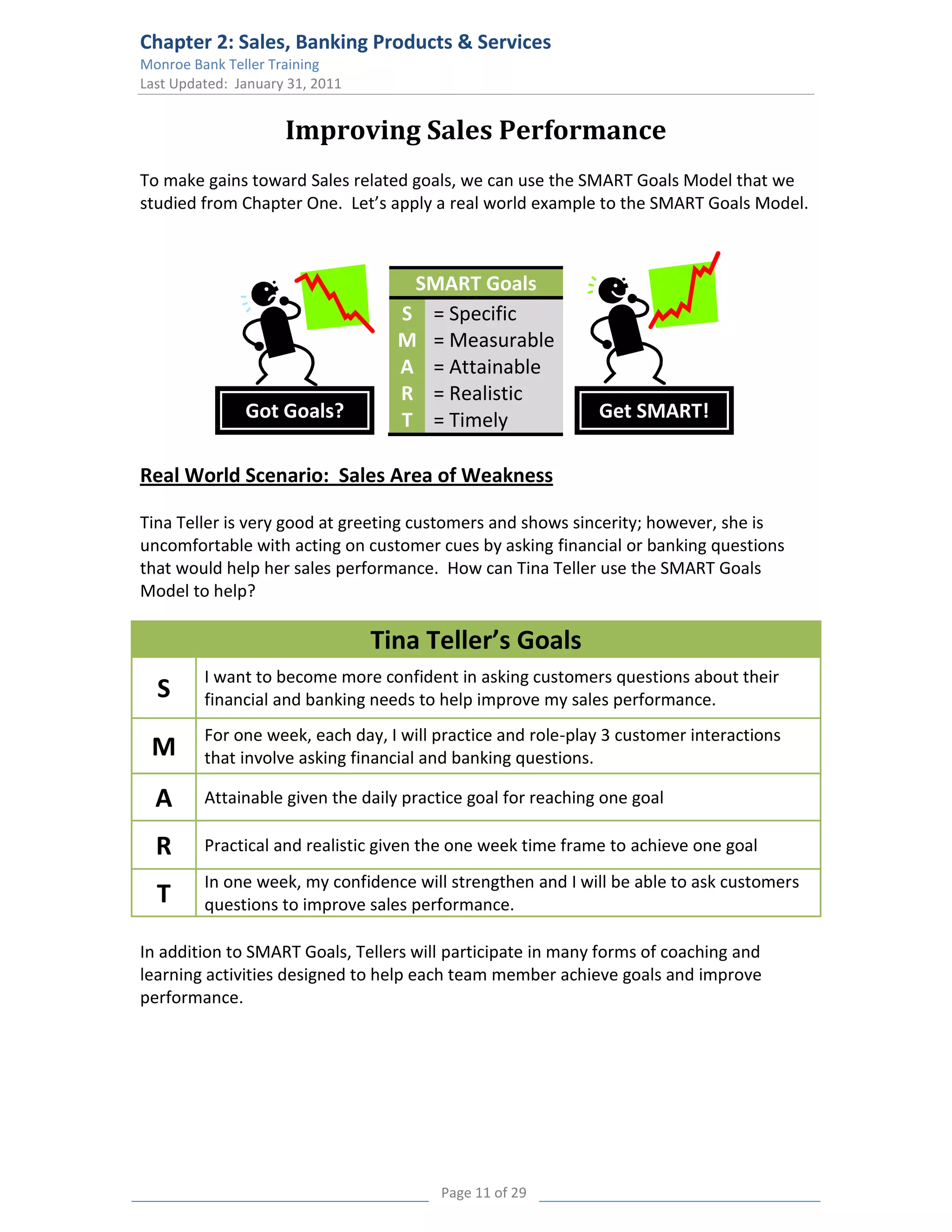

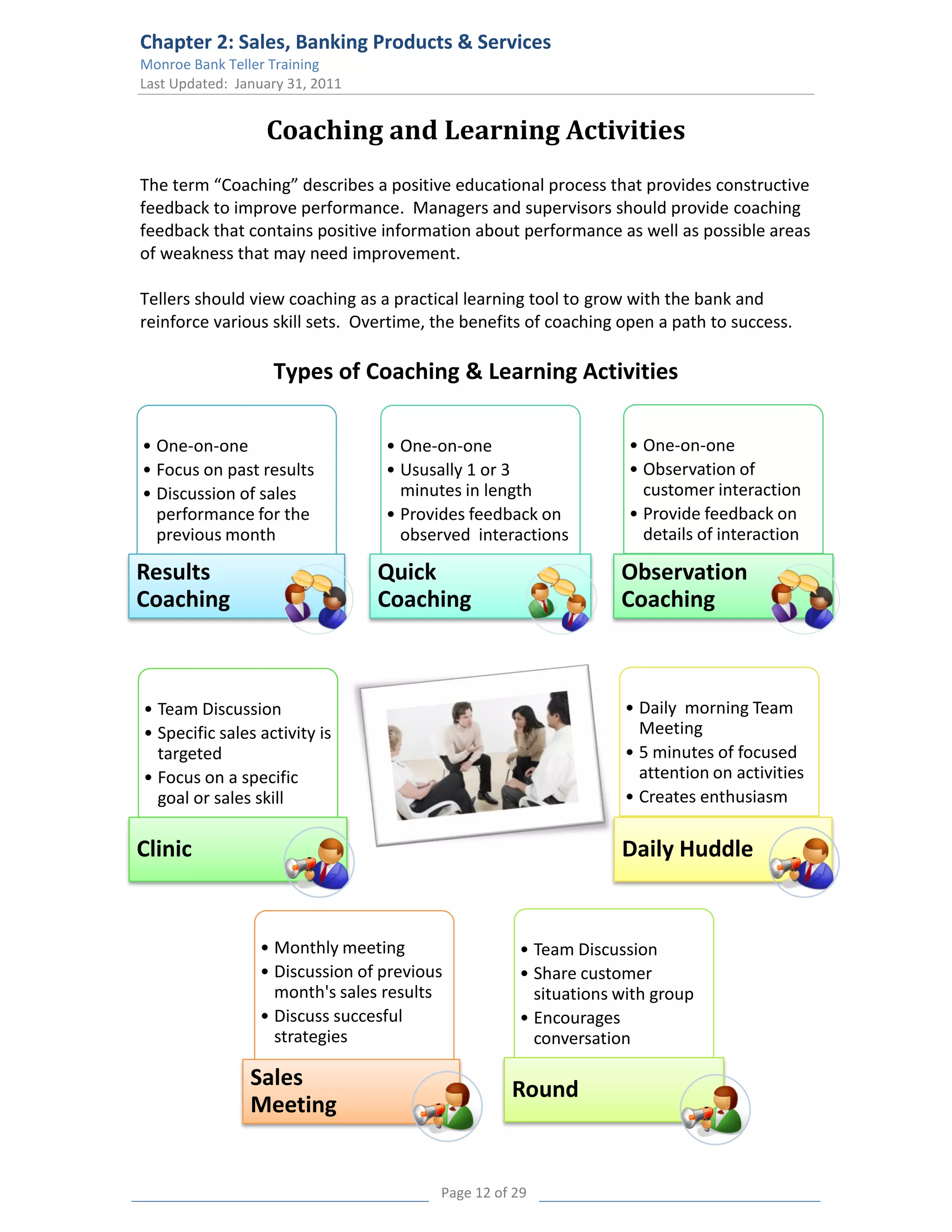

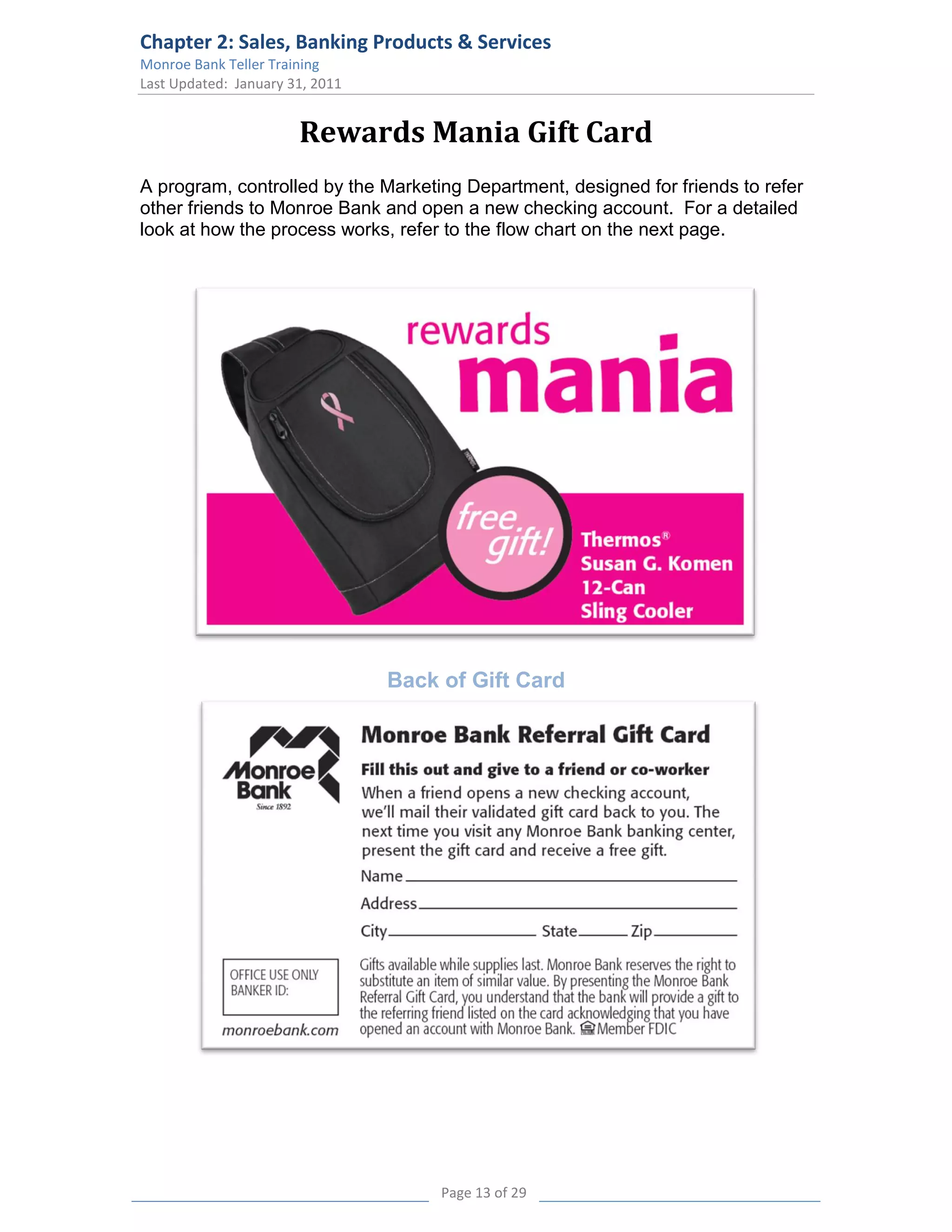

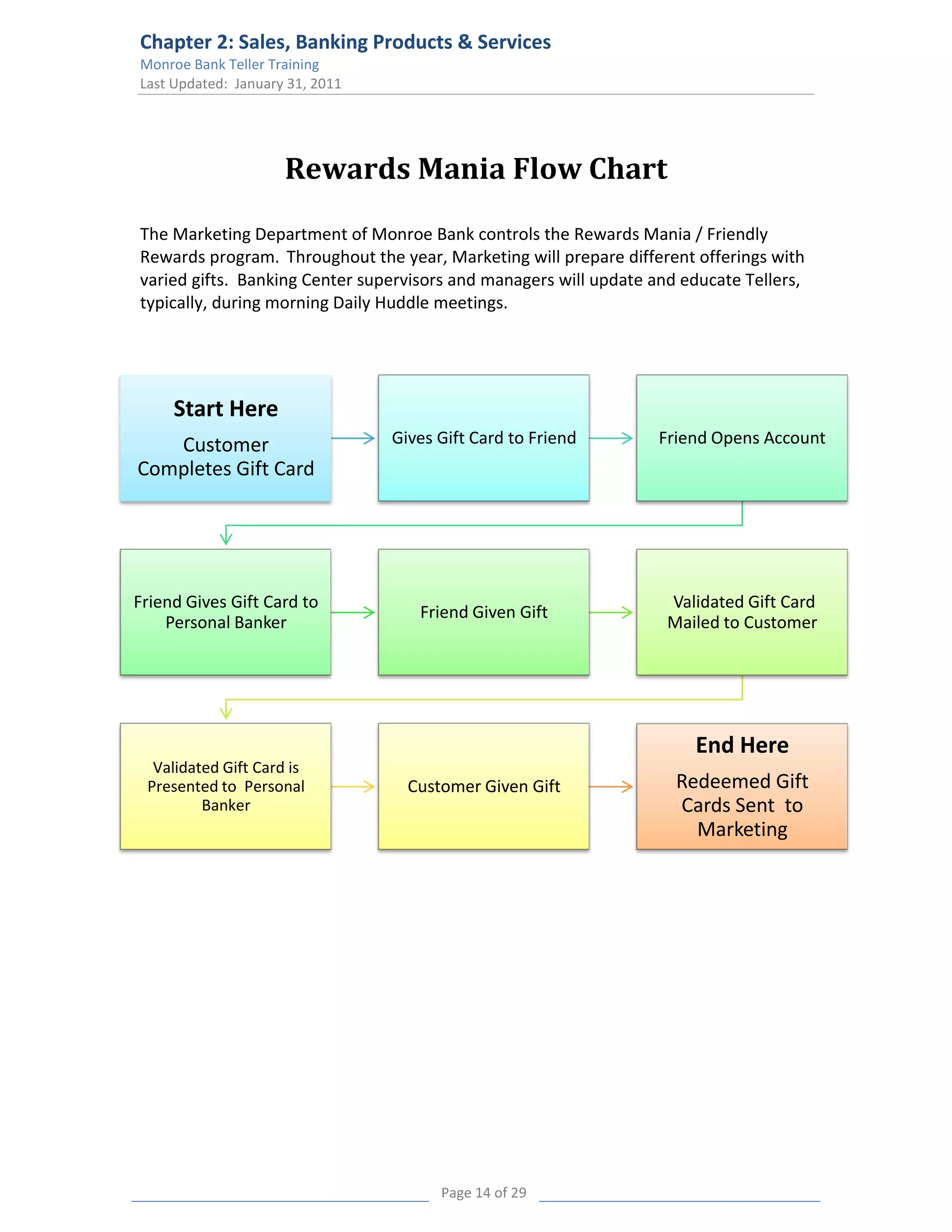

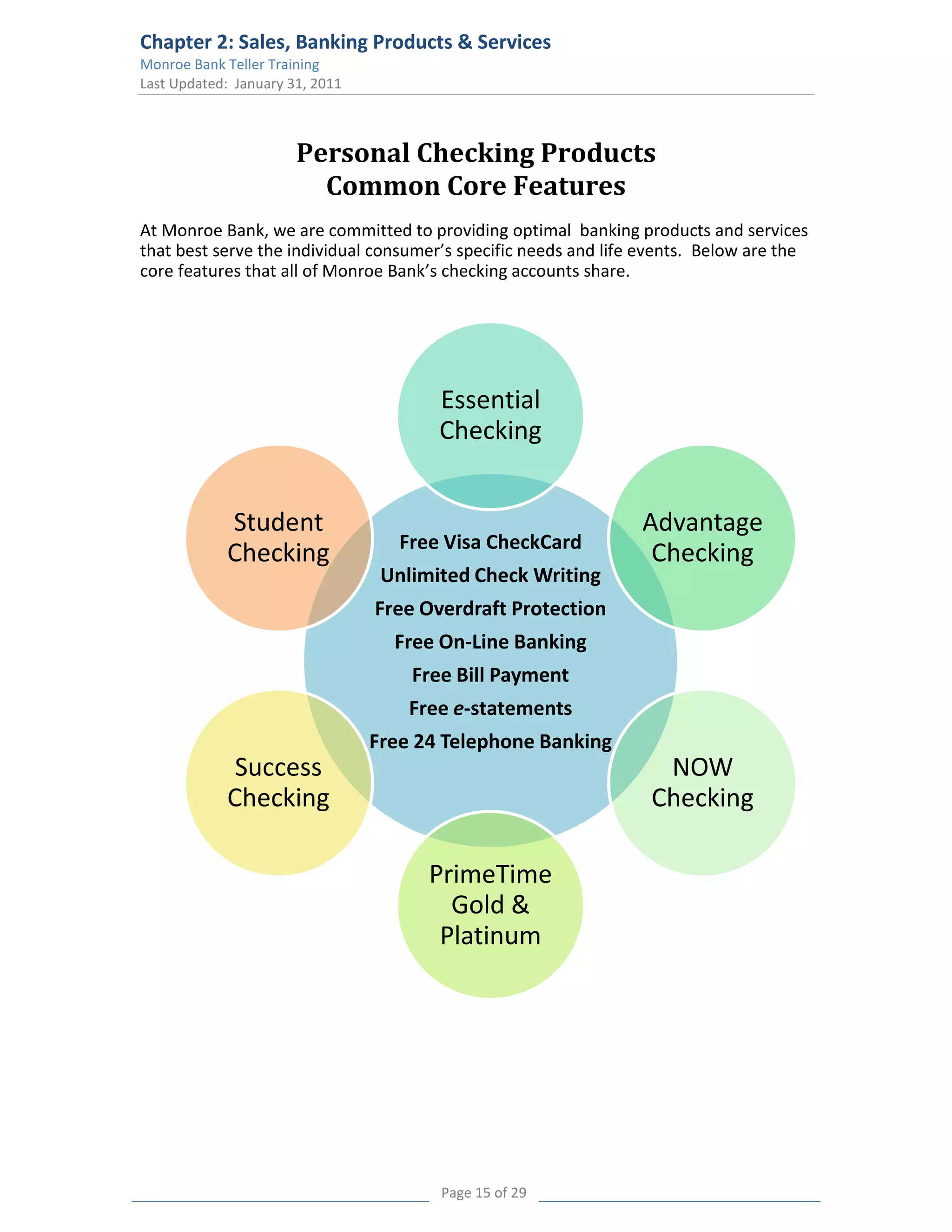

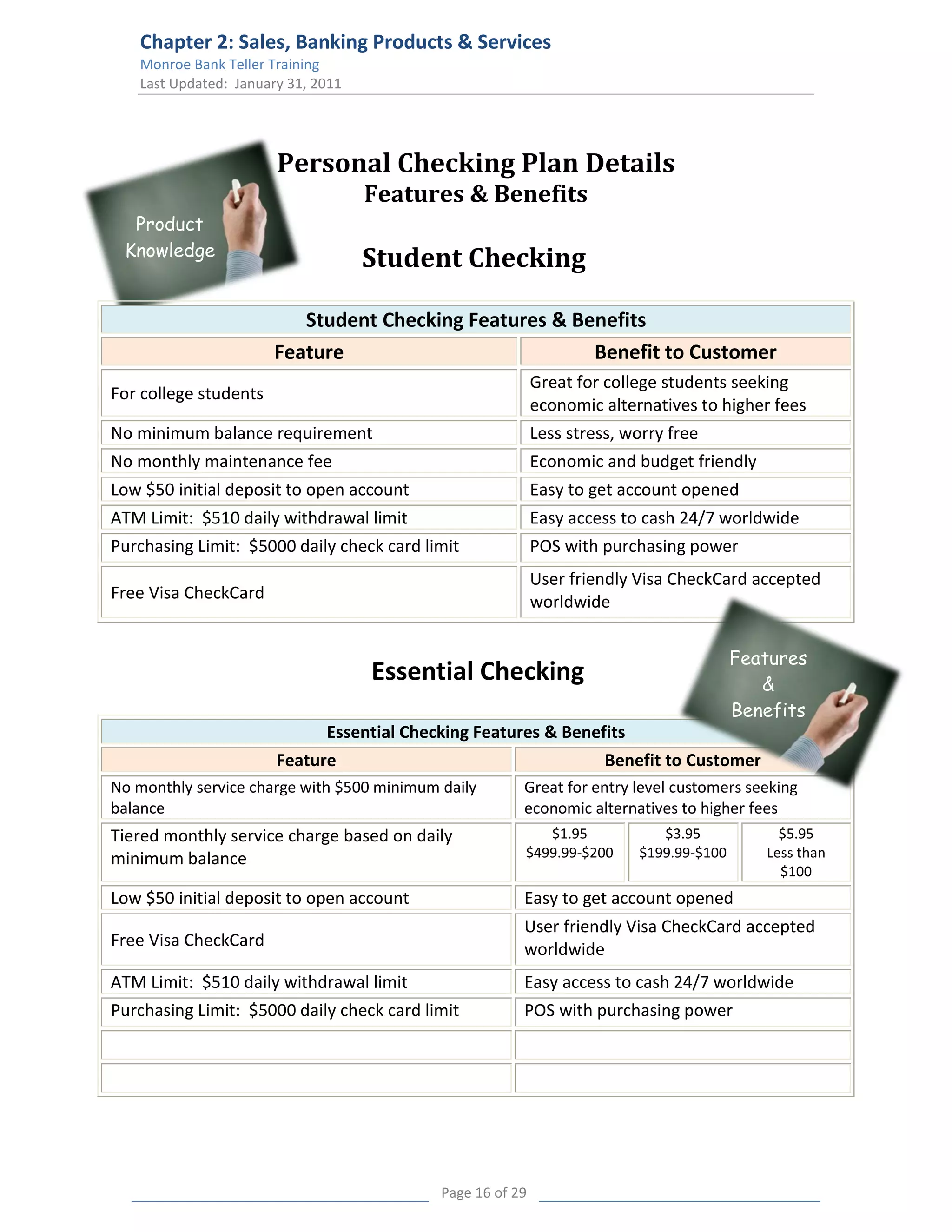

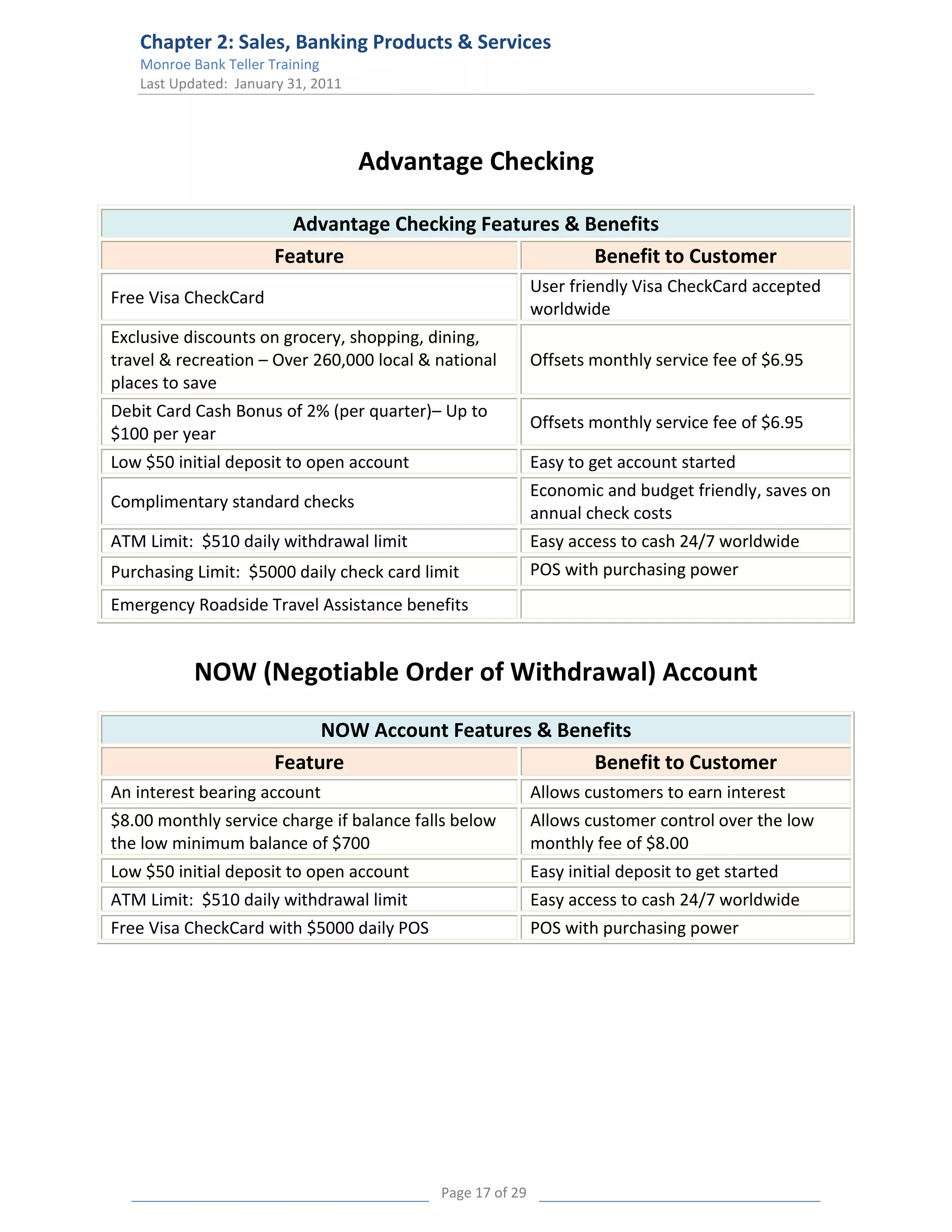

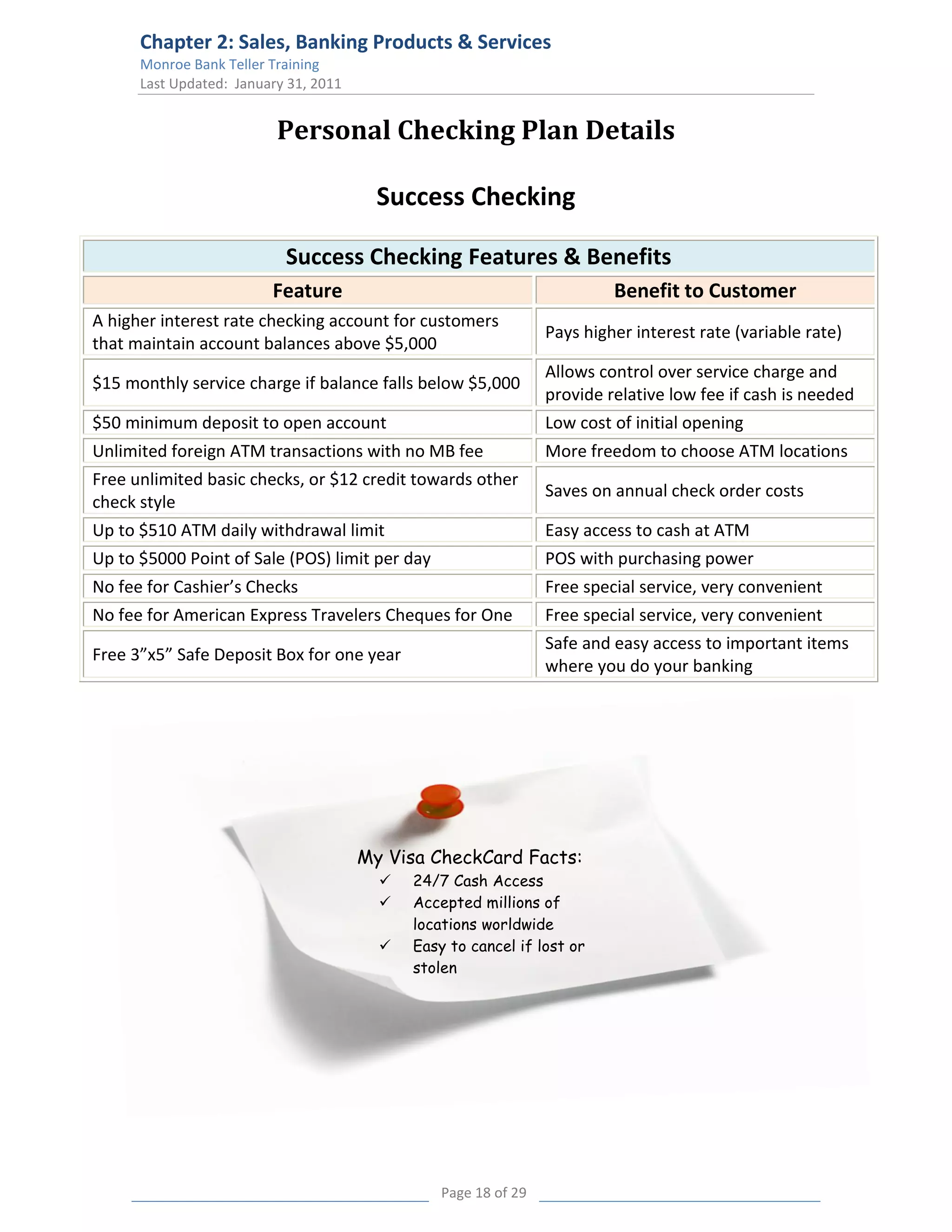

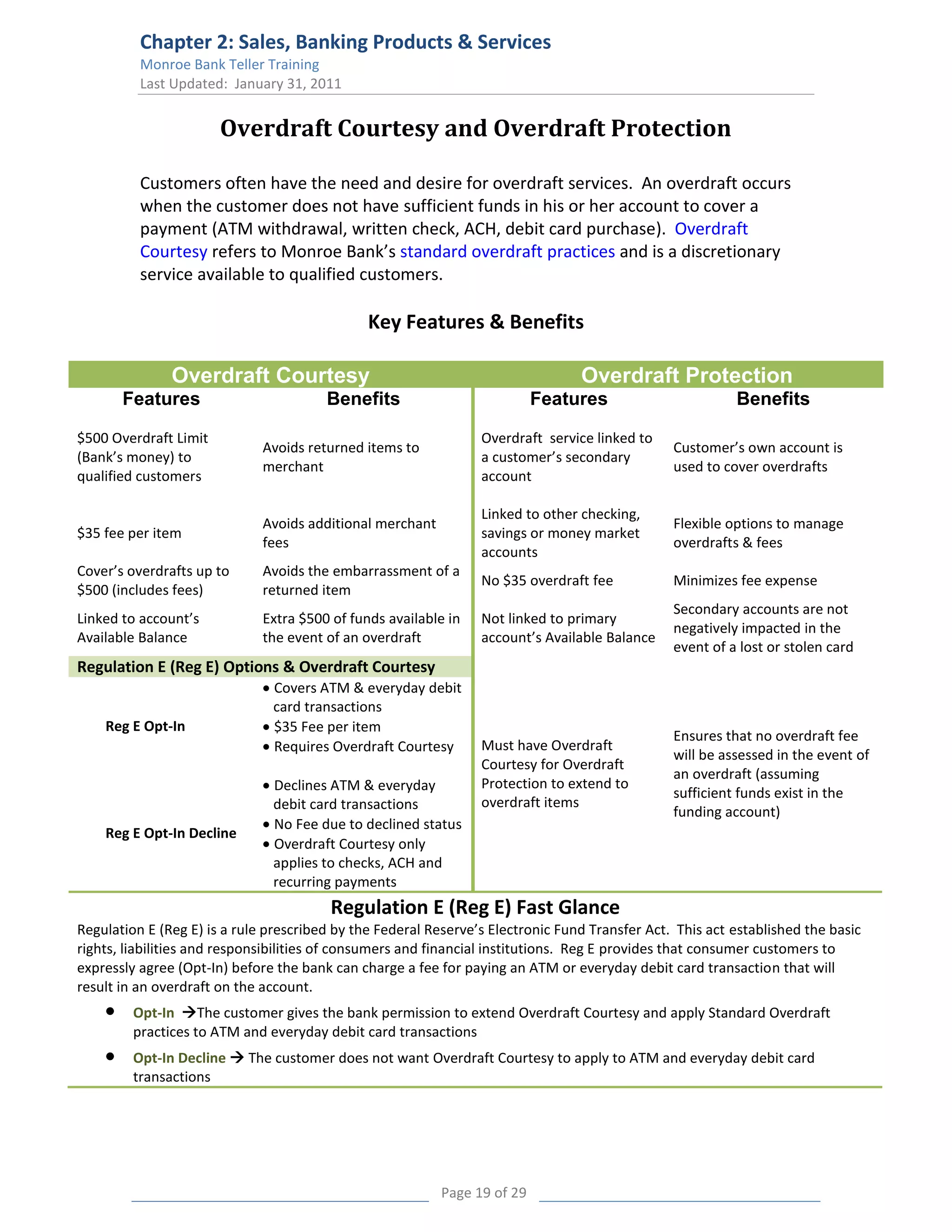

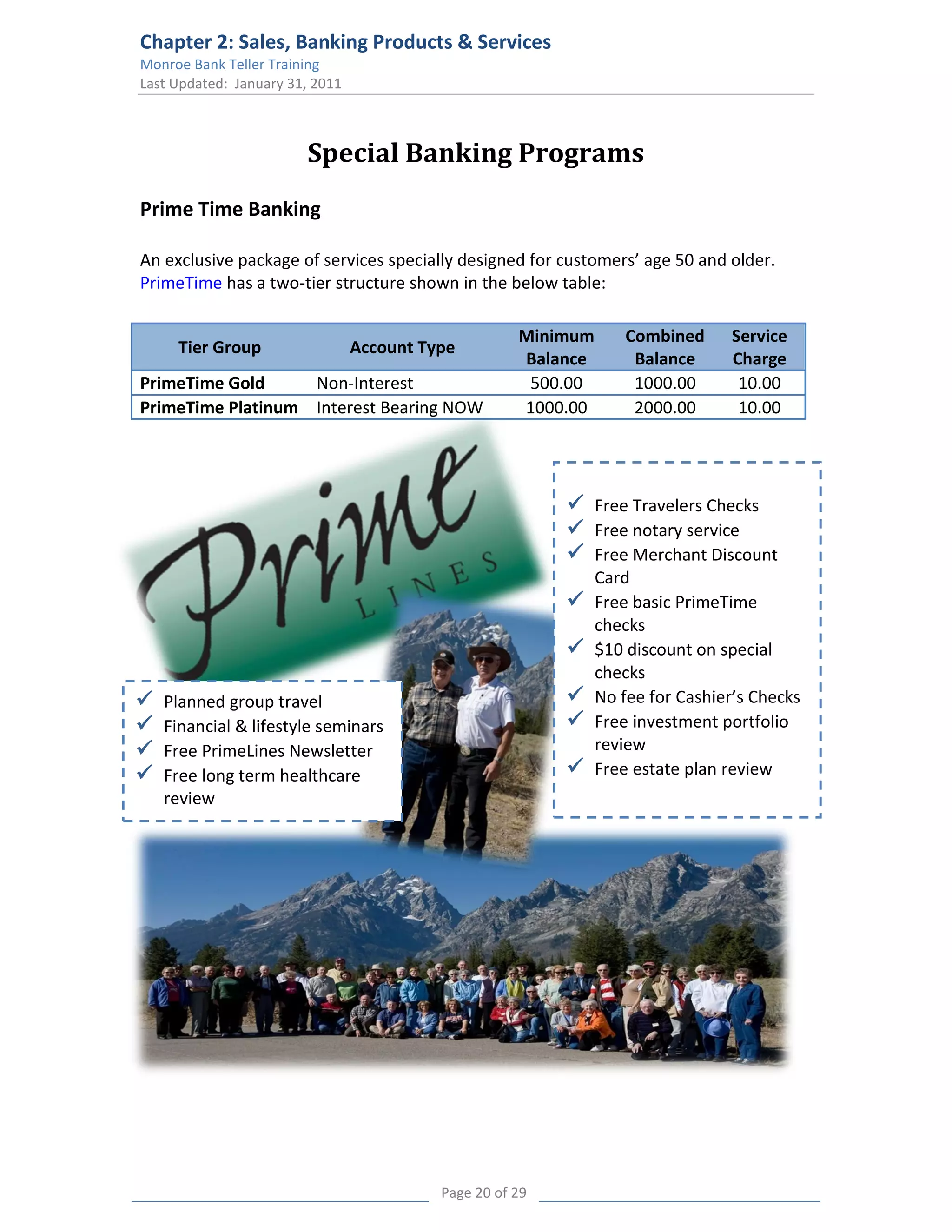

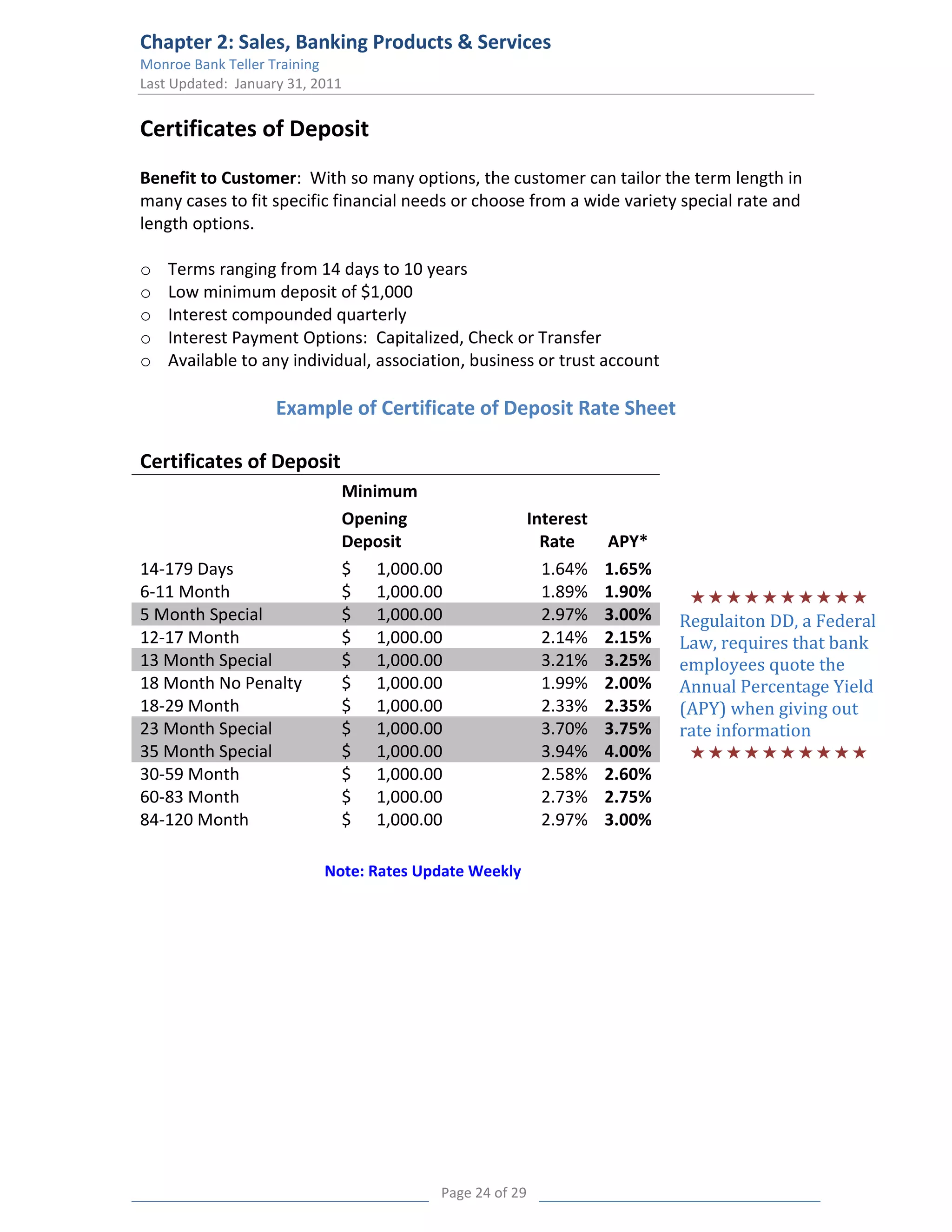

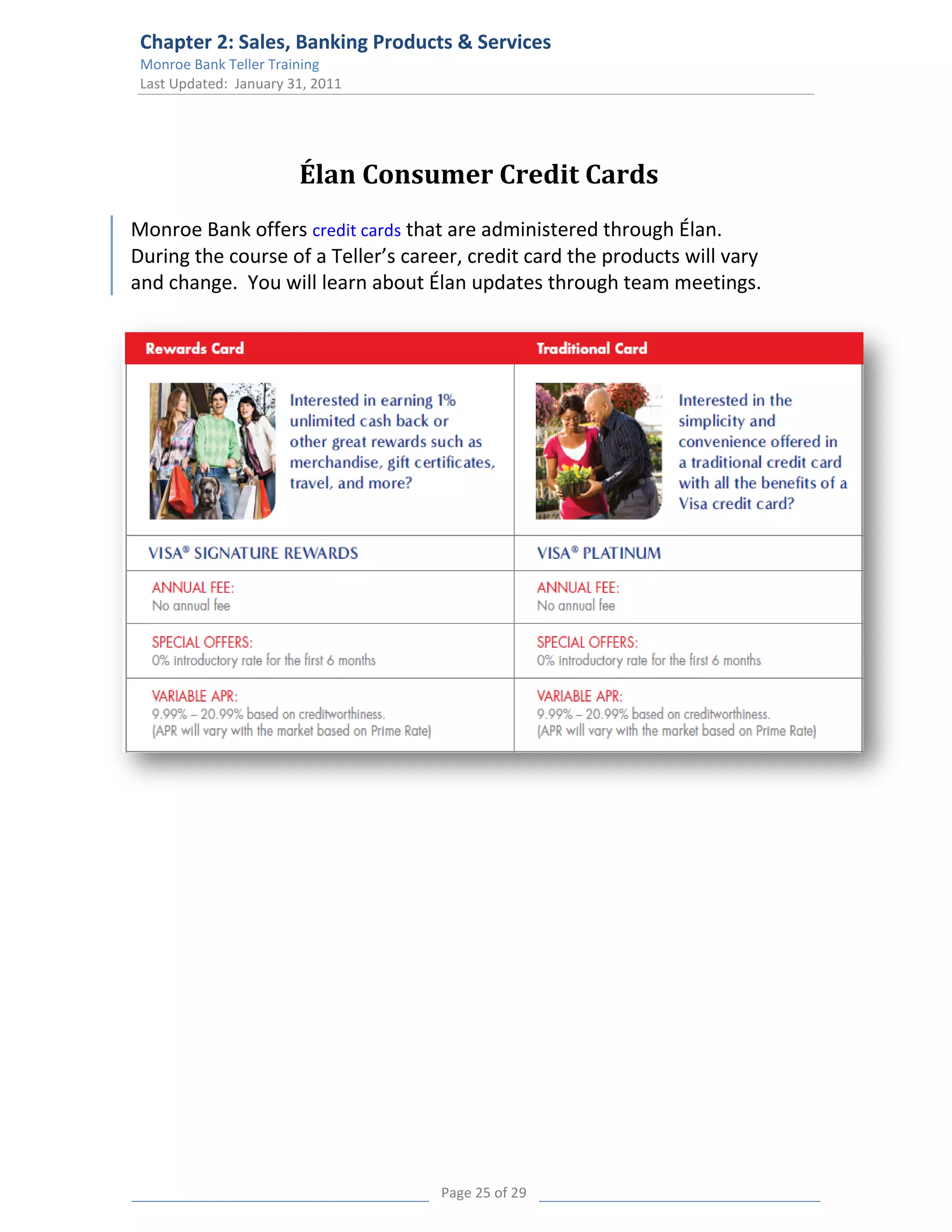

This document provides an overview of sales skills and Monroe Bank's products and services for teller education. It outlines learning objectives focused on identifying customer needs and applying sales skills to suggest appropriate products. It also describes Monroe Bank's checking, savings, credit card, and other banking services. The key terminology section defines important sales concepts like coaching, goals, and customer cues that tellers need to understand.