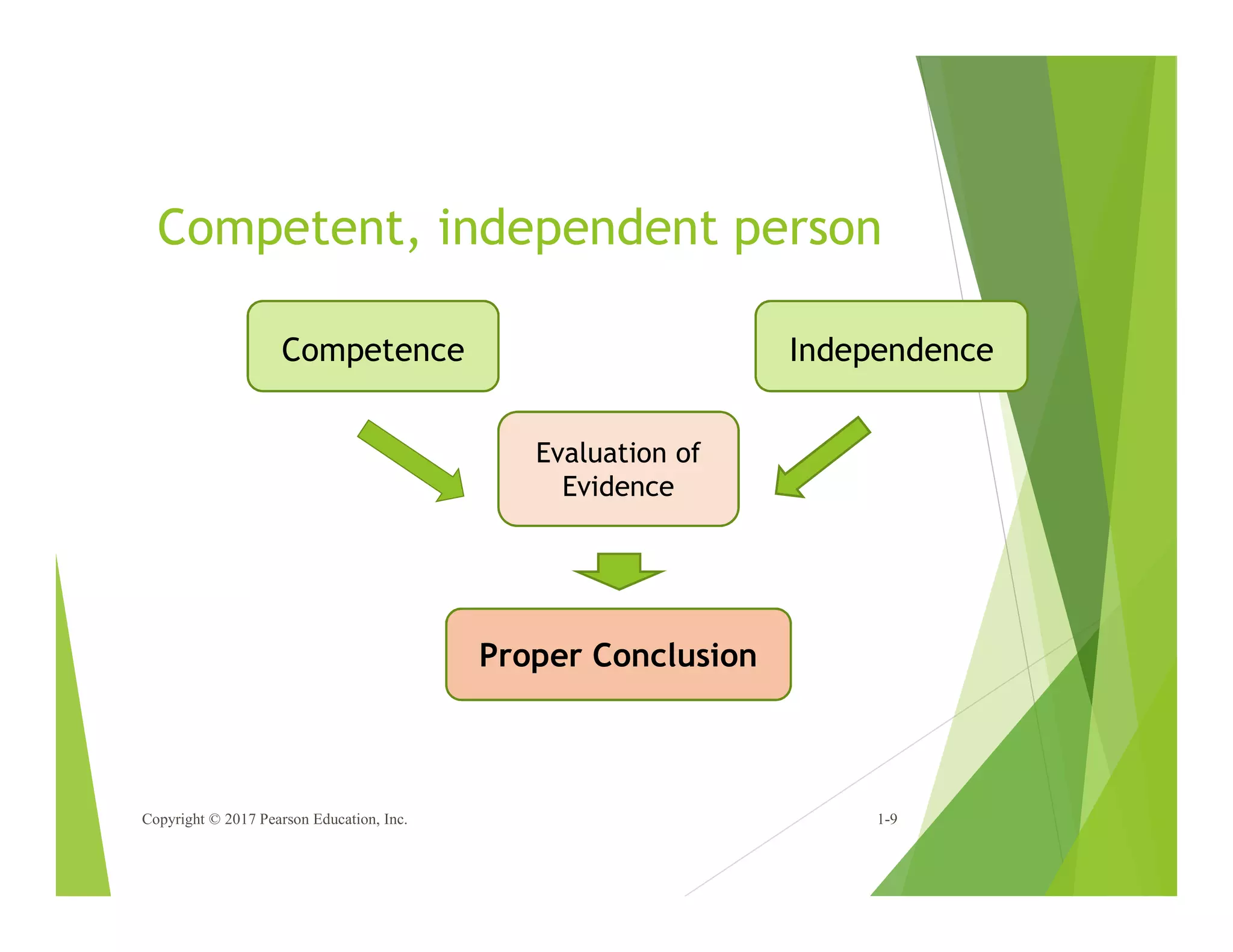

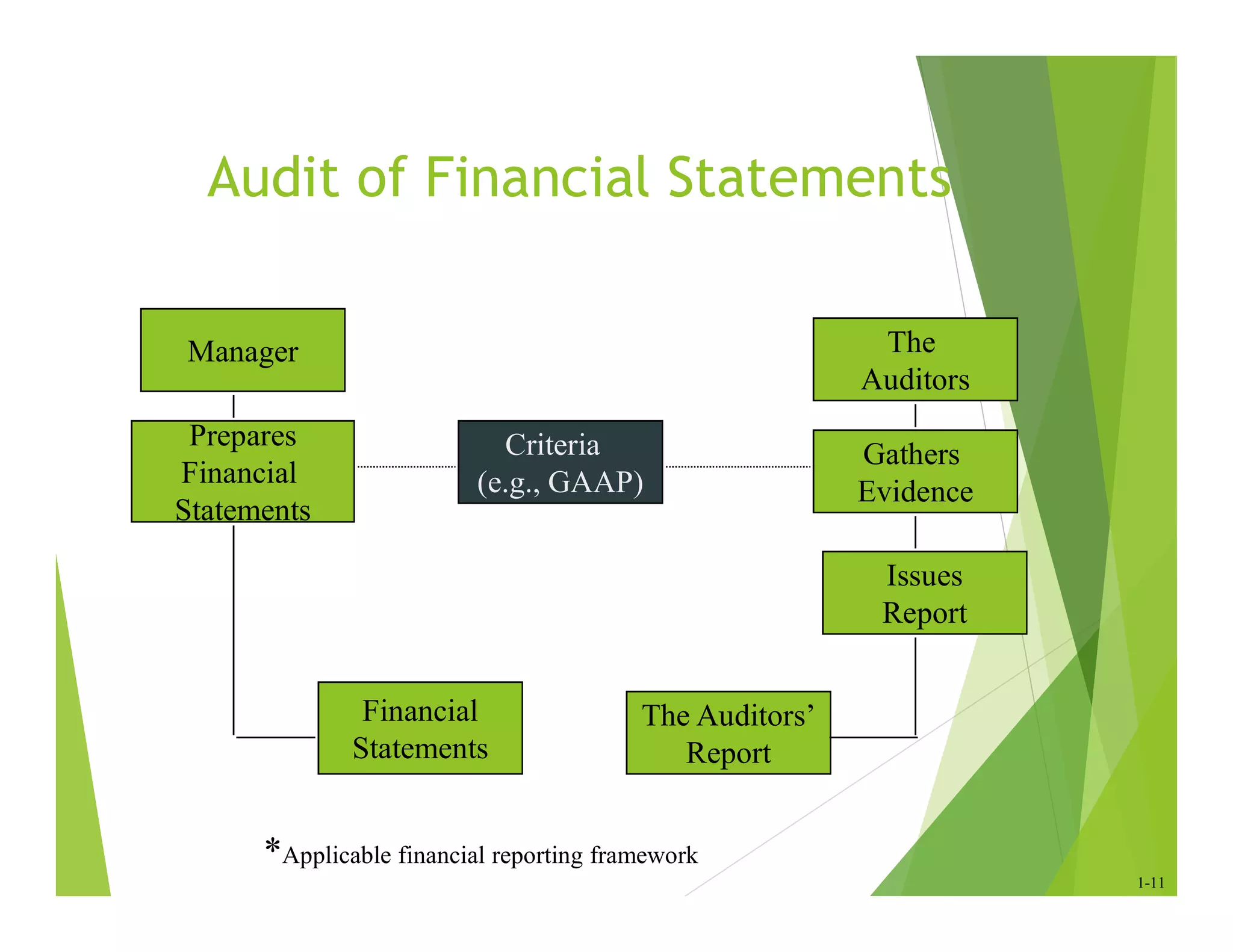

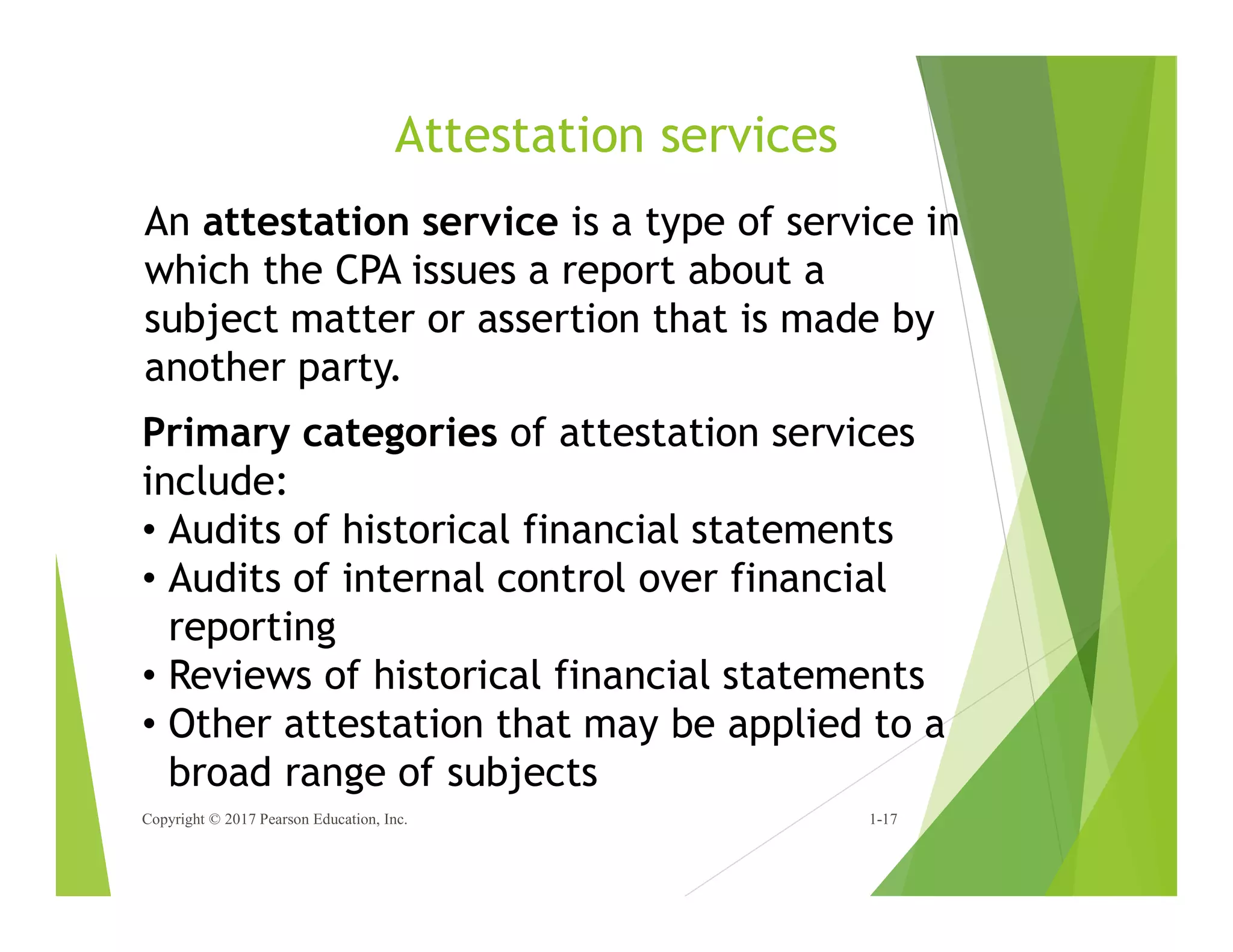

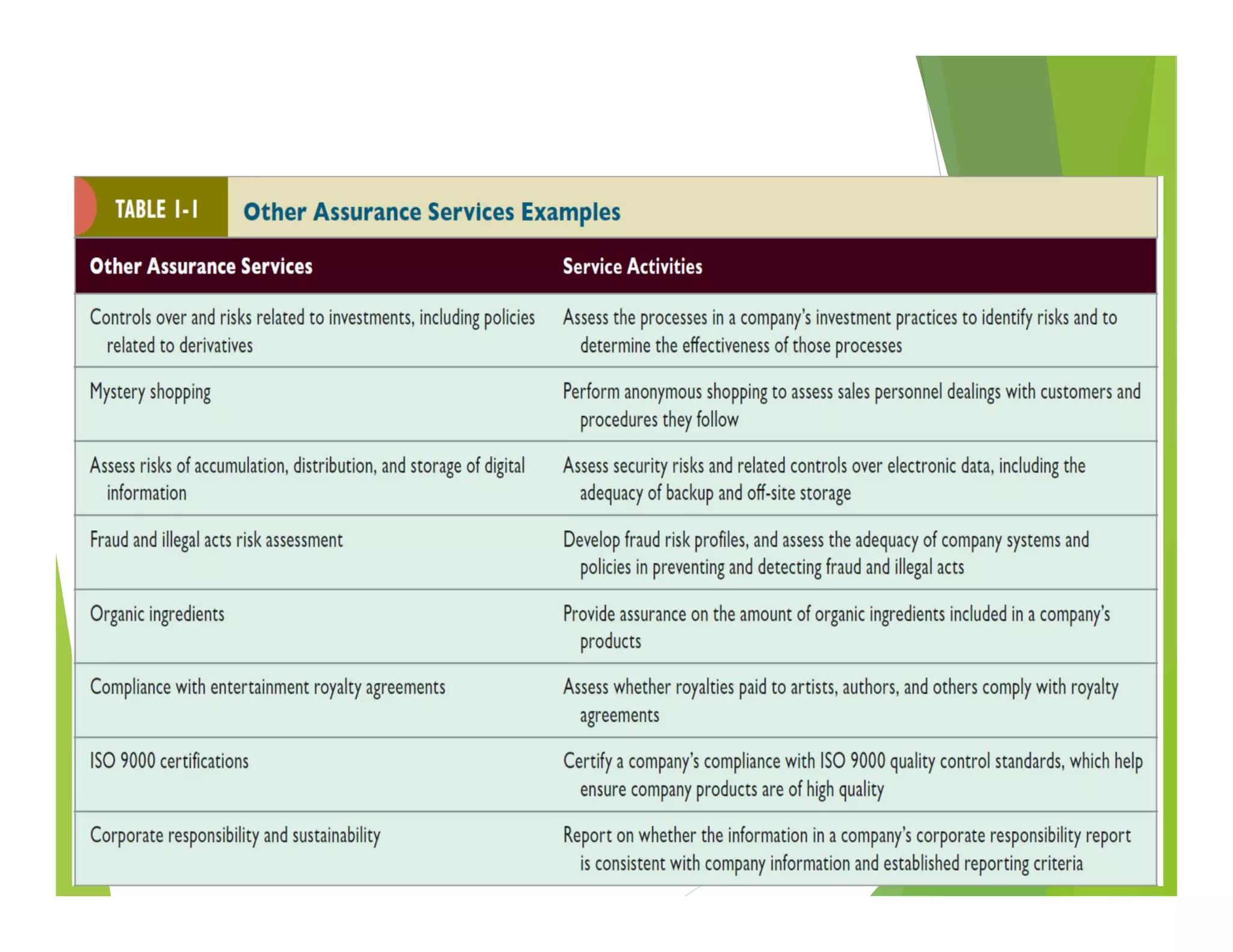

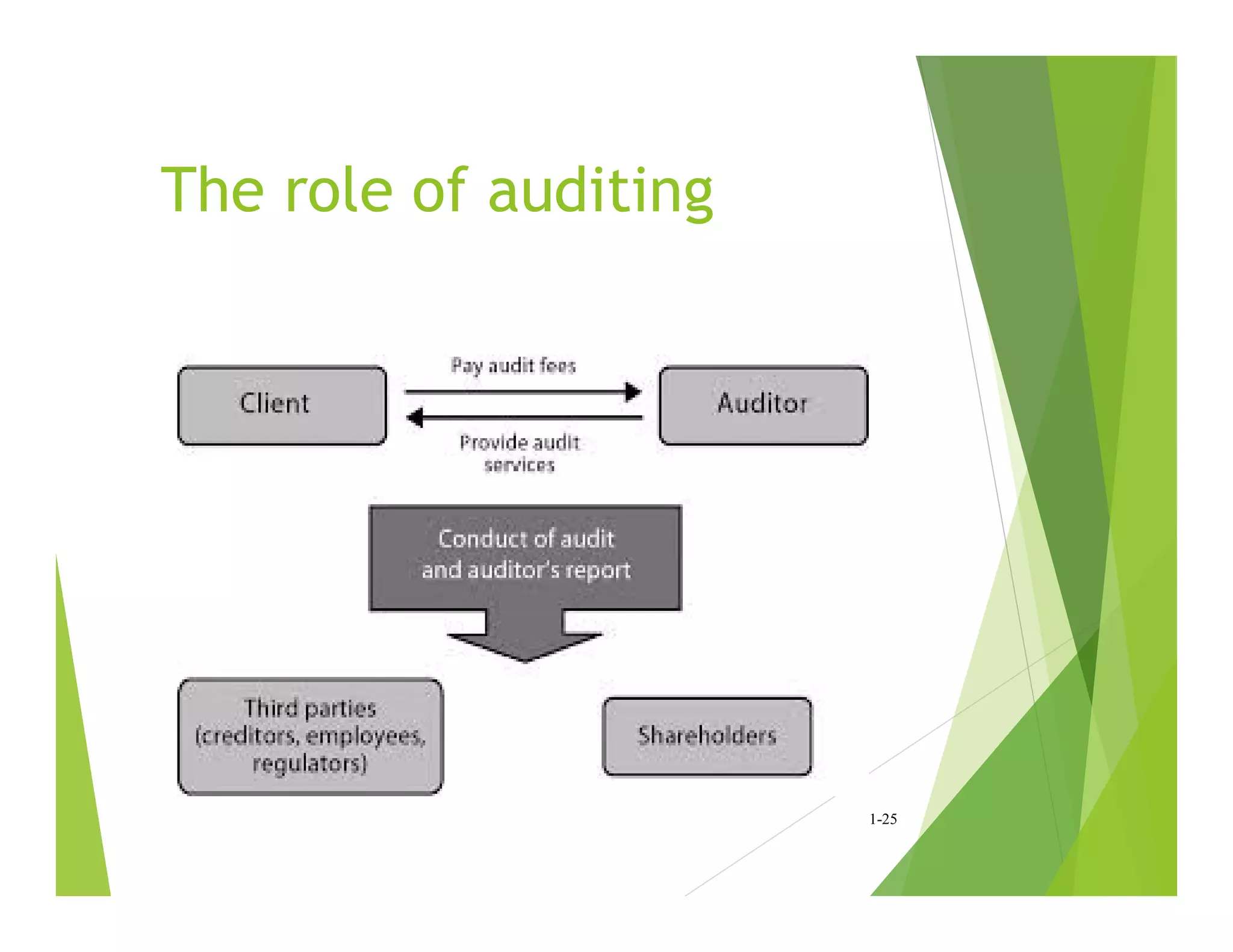

This document discusses the nature and history of auditing. It provides definitions of auditing and outlines the key components: information, criteria, evidence gathering, a competent independent auditor, and reporting. It distinguishes auditing from accounting and describes the demand factors that drive the need for auditing like remoteness of information and complex transactions. The document then reviews the historical development of auditing from ancient times through the industrial revolution and modern era, noting key developments like the establishment of standards and regulations.