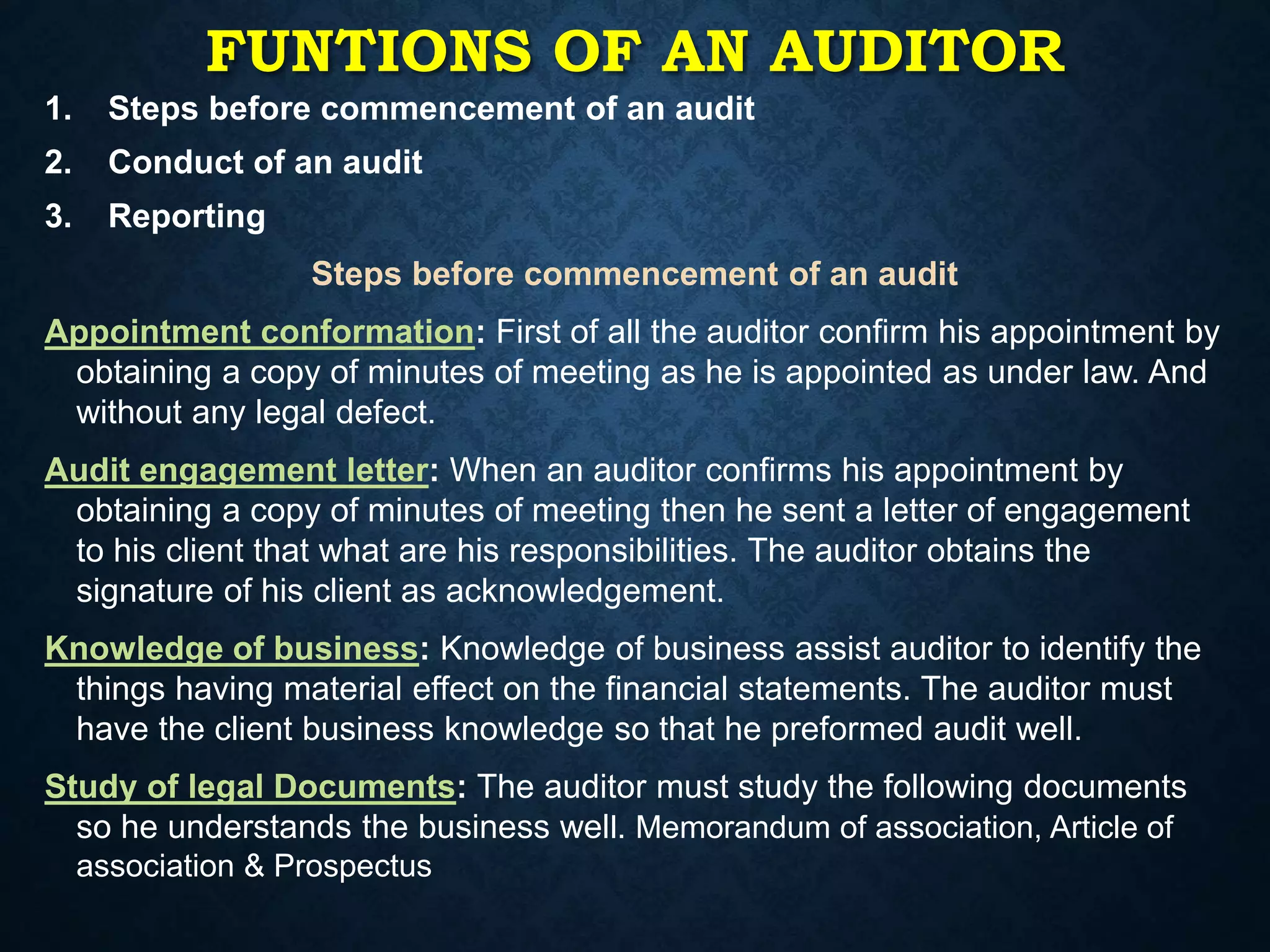

The document discusses the history, meaning, purpose, need and process of auditing. It begins with the history of auditing originating from merchants assigning transactions to be heard to detect fraud. The main purposes of auditing are to check the true and fair view of accounting records and detect errors and frauds. An audit is needed when ownership is separate from management and transactions are numerous. The auditor's role is to examine transactions, verify assets/liabilities, and prepare a report. Key steps in an audit include appointment confirmation, engagement letters, understanding the business, risk assessment, determining materiality, and developing an audit plan.