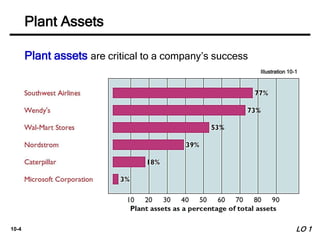

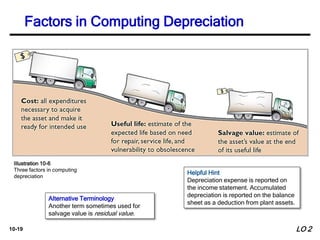

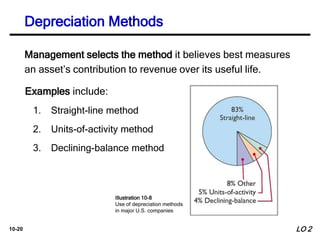

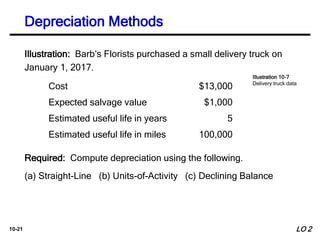

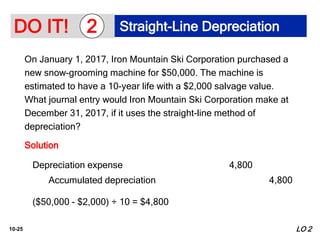

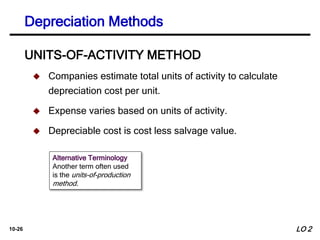

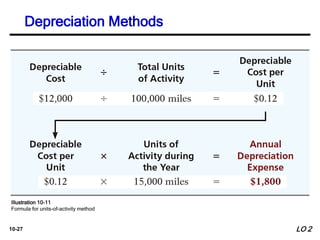

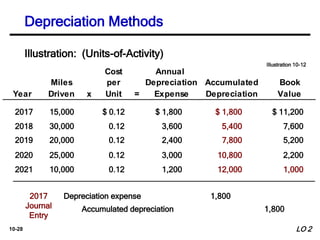

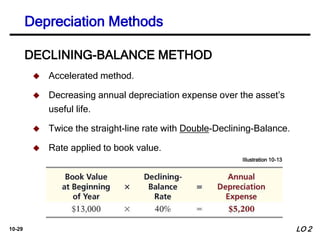

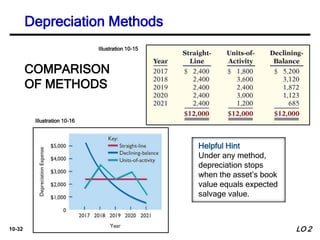

The document provides an overview of financial accounting related to plant assets, natural resources, and intangible assets, detailing accounting for expenditures and depreciation methods. It covers how to determine costs associated with plant assets, including land, buildings, and equipment, and discusses various depreciation methods such as straight-line, units-of-activity, and declining-balance. Additionally, it touches on the importance of accurate asset management and the consequences of improper accounting practices in financial reporting.

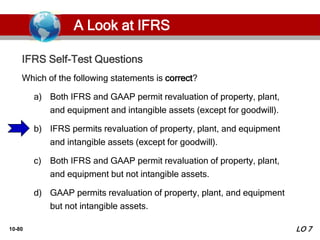

![10-46

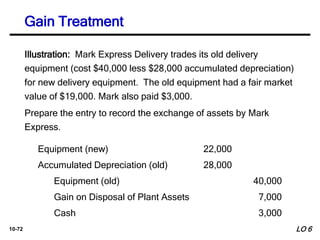

Overland Trucking has an old truck that cost $30,000, and it has

accumulated depreciation of $16,000 on this truck. Overland has

decided to sell the truck. (a) What entry would Overland Trucking

make to record the sale of the truck for $17,000 cash?

Solution

LO 3

Cash 17,000

Accumulated Depreciation—Equipment 16,000

Equipment 30,000

Gain on Disposal of Plant Assets 3,000

[$17,000 - ($30,000 - $16,000)]

DO IT! Plant Asset Disposal

3](https://image.slidesharecdn.com/chapter10fixedassetsandintangibleassets-240725115354-a3c8a962/85/Chapter-10-Fixed-Assets-and-Intangible-Assets-pptx-46-320.jpg)

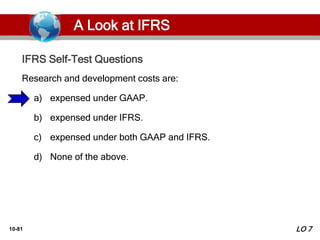

![10-47

Overland Trucking has an old truck that cost $30,000, and it has

accumulated depreciation of $16,000 on this truck. Overland has

decided to sell the truck. (b) What entry would Overland Trucking

make to record the sale of the truck for $10,000 cash?

Solution

LO 3

Cash 10,000

Accumulated Depreciation—Equipment 16,000

Loss on Disposal of Plant Assets 4,000

Equipment 30,000

[$10,000 - ($30,000 - $16,000)]

DO IT! Plant Asset Disposal

3](https://image.slidesharecdn.com/chapter10fixedassetsandintangibleassets-240725115354-a3c8a962/85/Chapter-10-Fixed-Assets-and-Intangible-Assets-pptx-47-320.jpg)