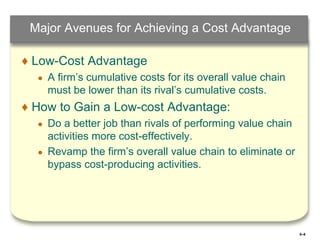

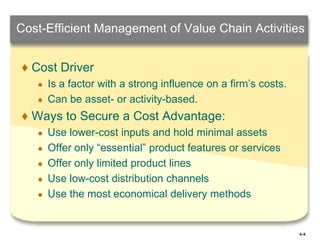

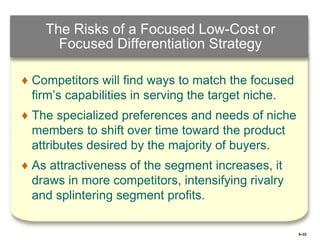

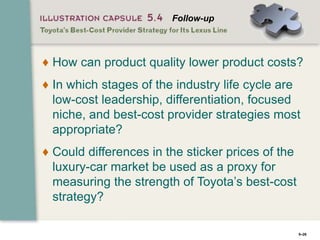

This document discusses the five generic competitive strategies: low-cost provider, differentiation, focused low-cost, focused differentiation, and best-cost provider. It explains the key factors that distinguish each strategy and how they position firms differently in the market. The strategies aim to achieve either a cost advantage or differentiation. Circumstances that make each strategy more attractive are outlined. Potential pitfalls of each approach are also noted. Finally, it is emphasized that a competitive strategy is more likely to succeed if it leverages a firm's unique resources and capabilities.