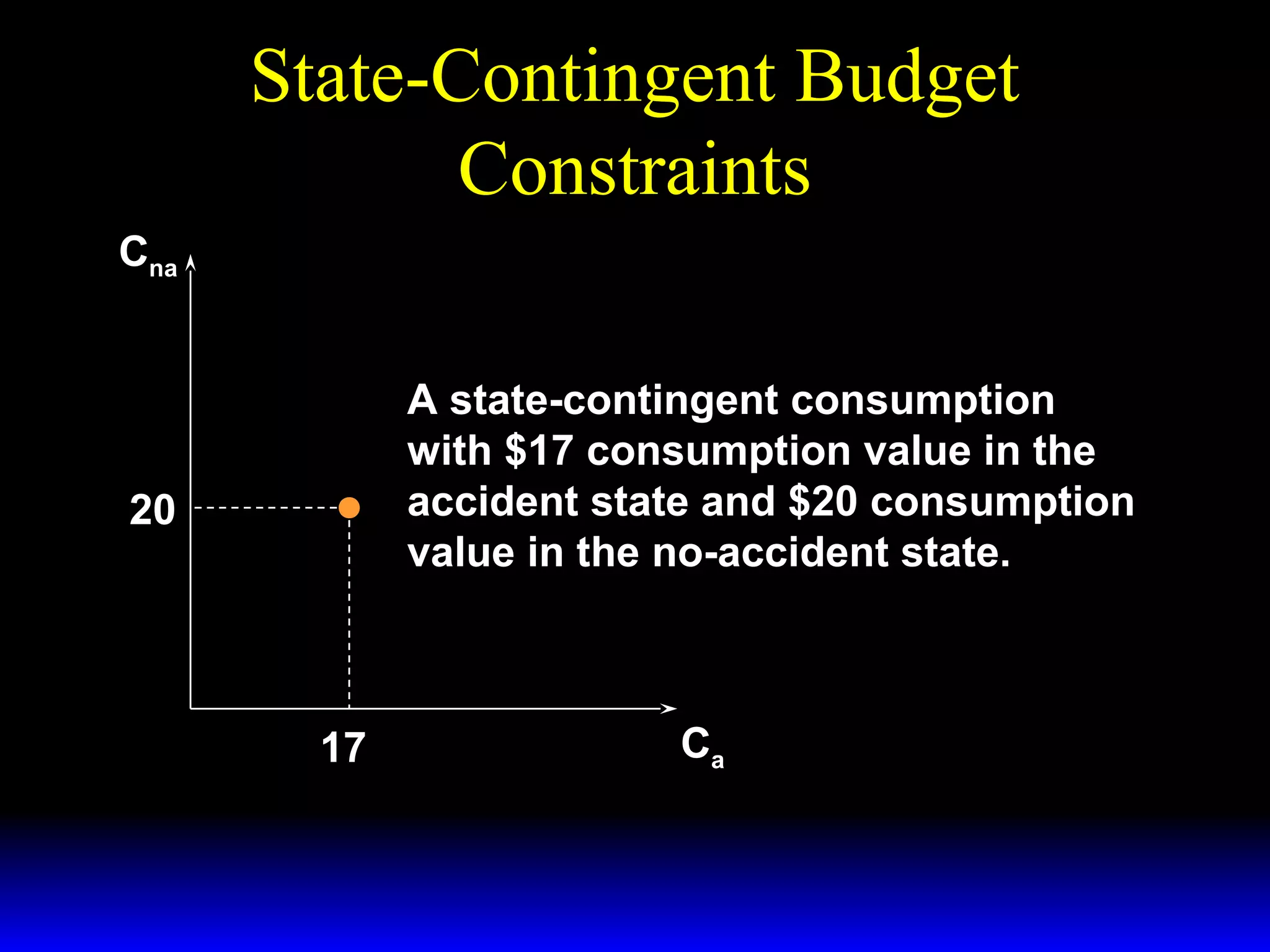

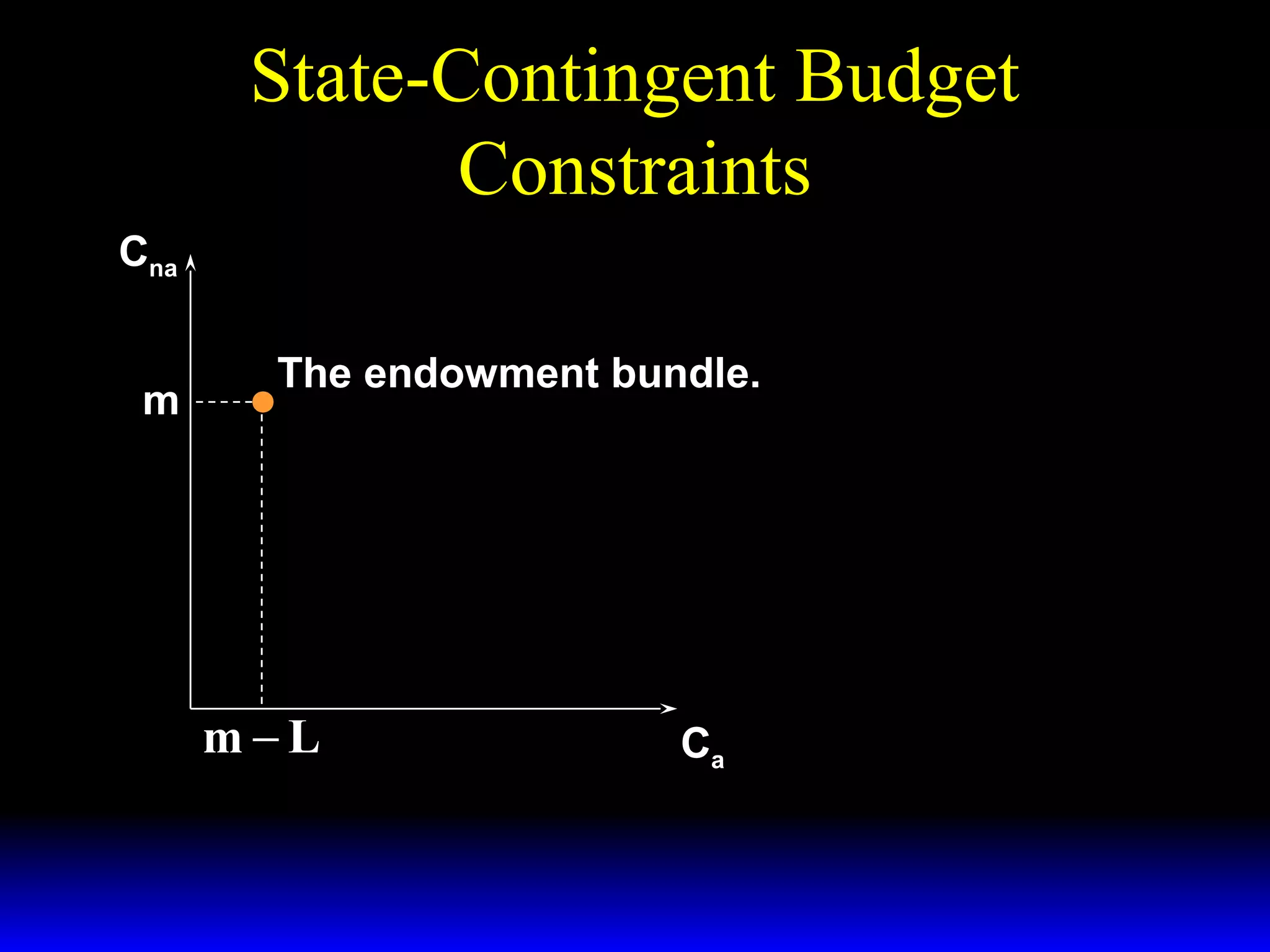

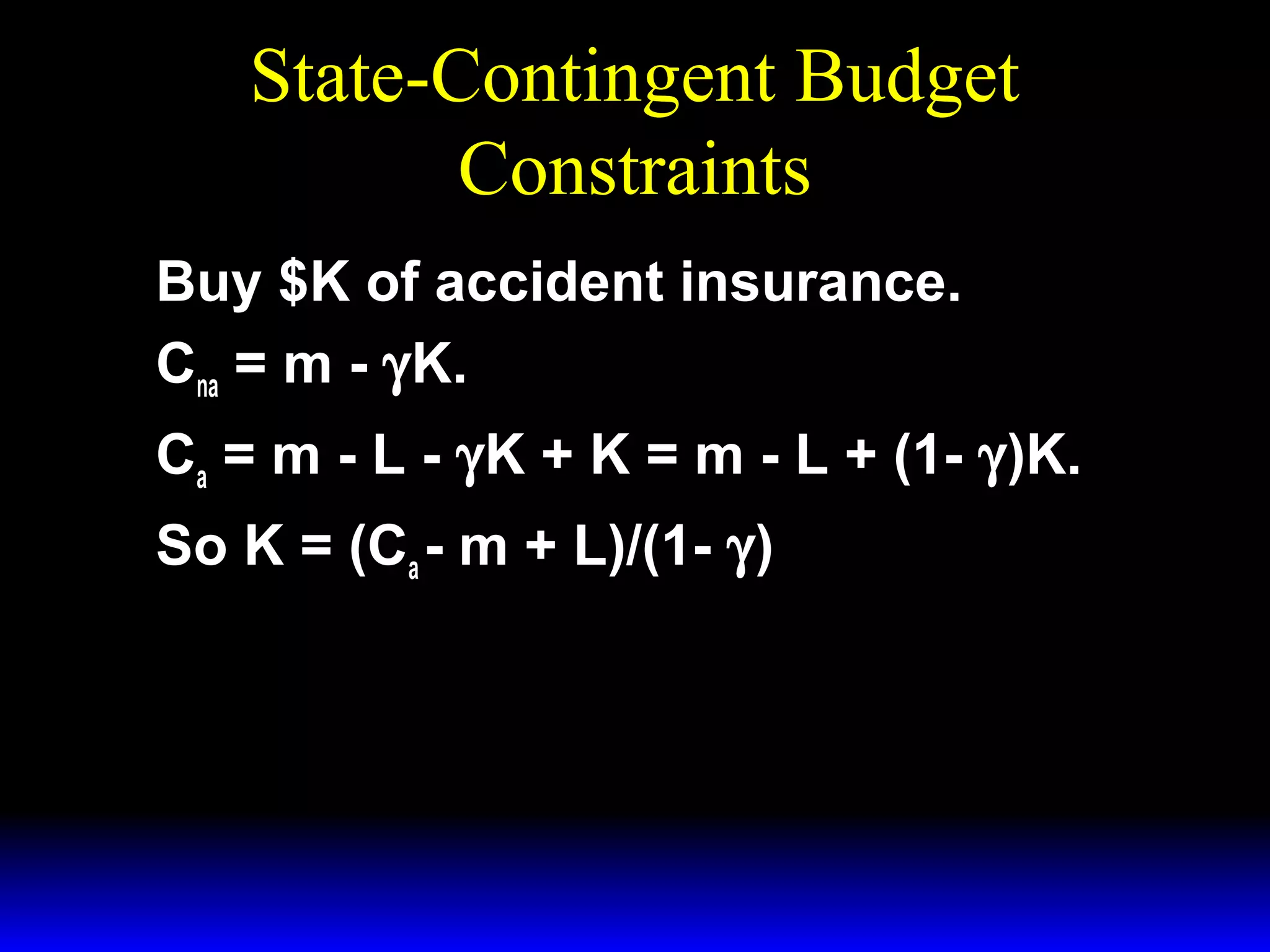

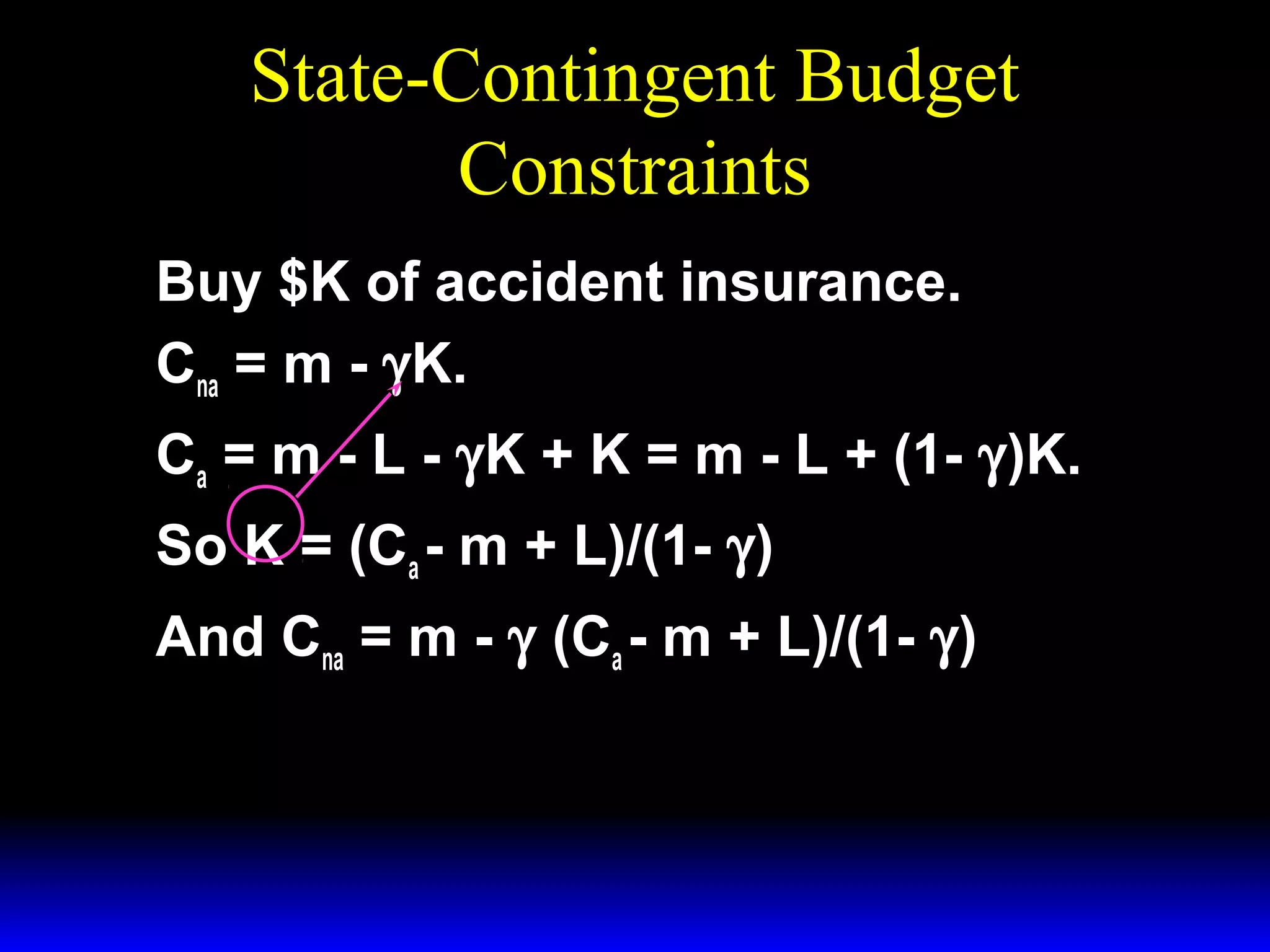

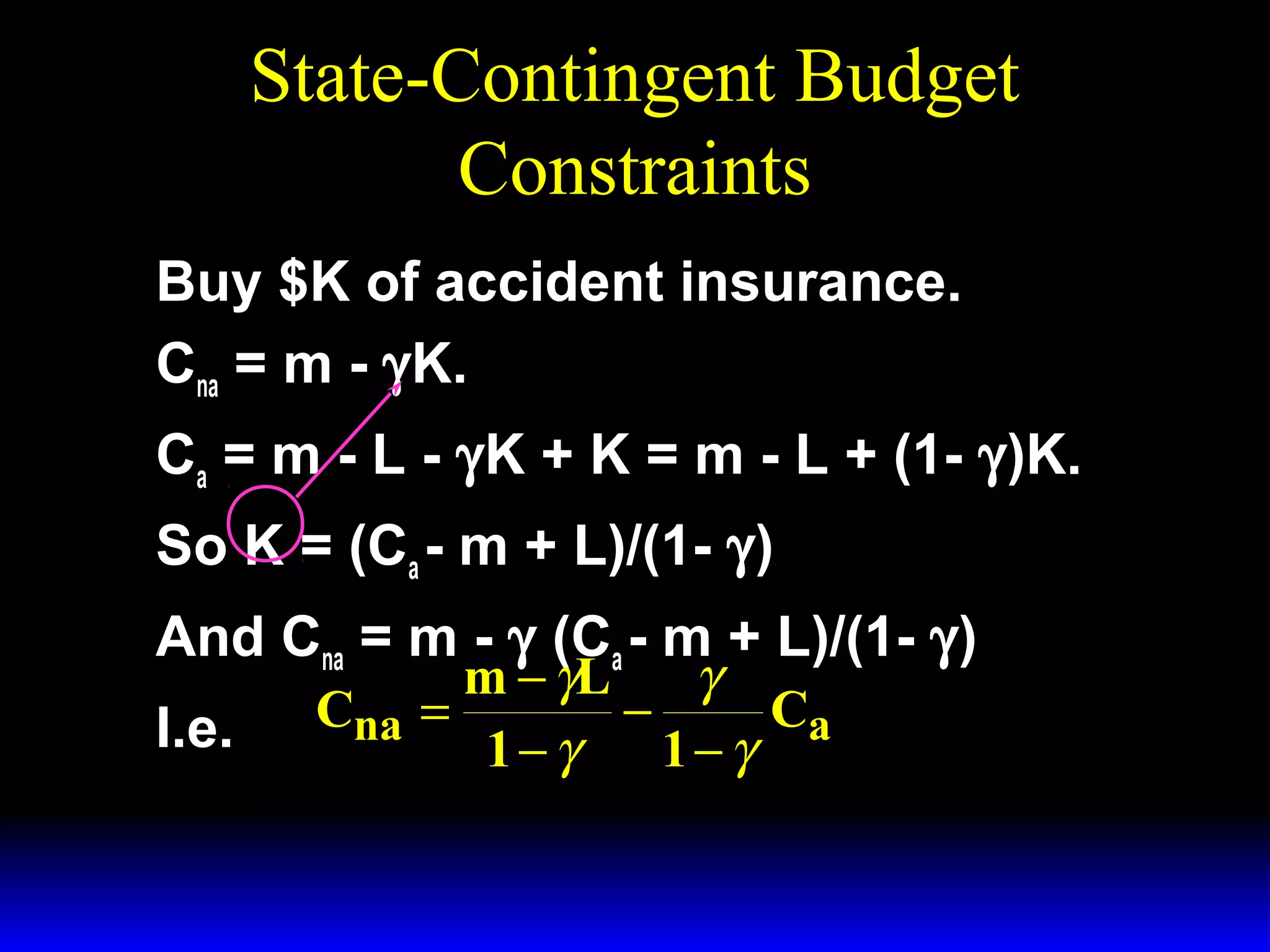

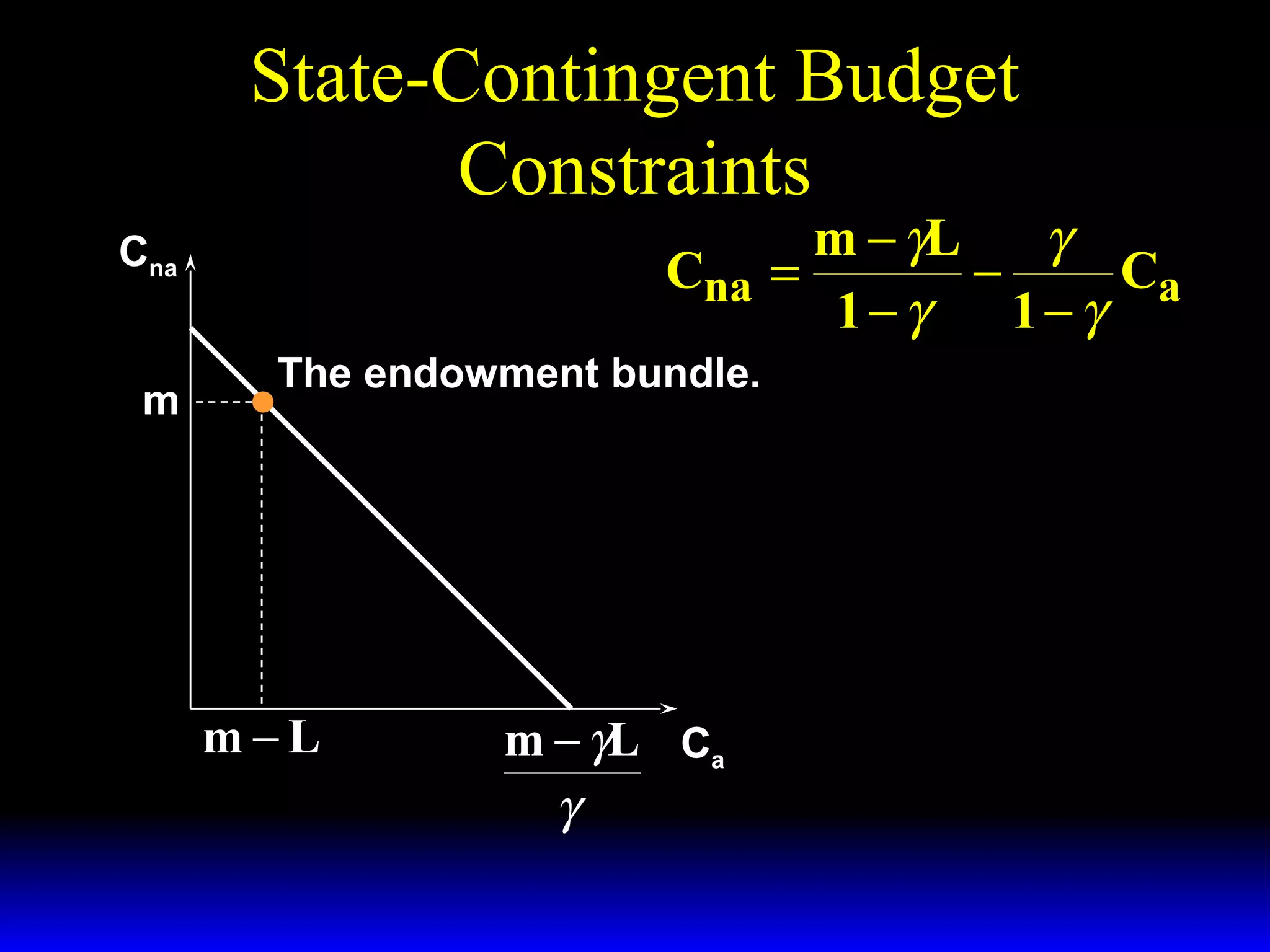

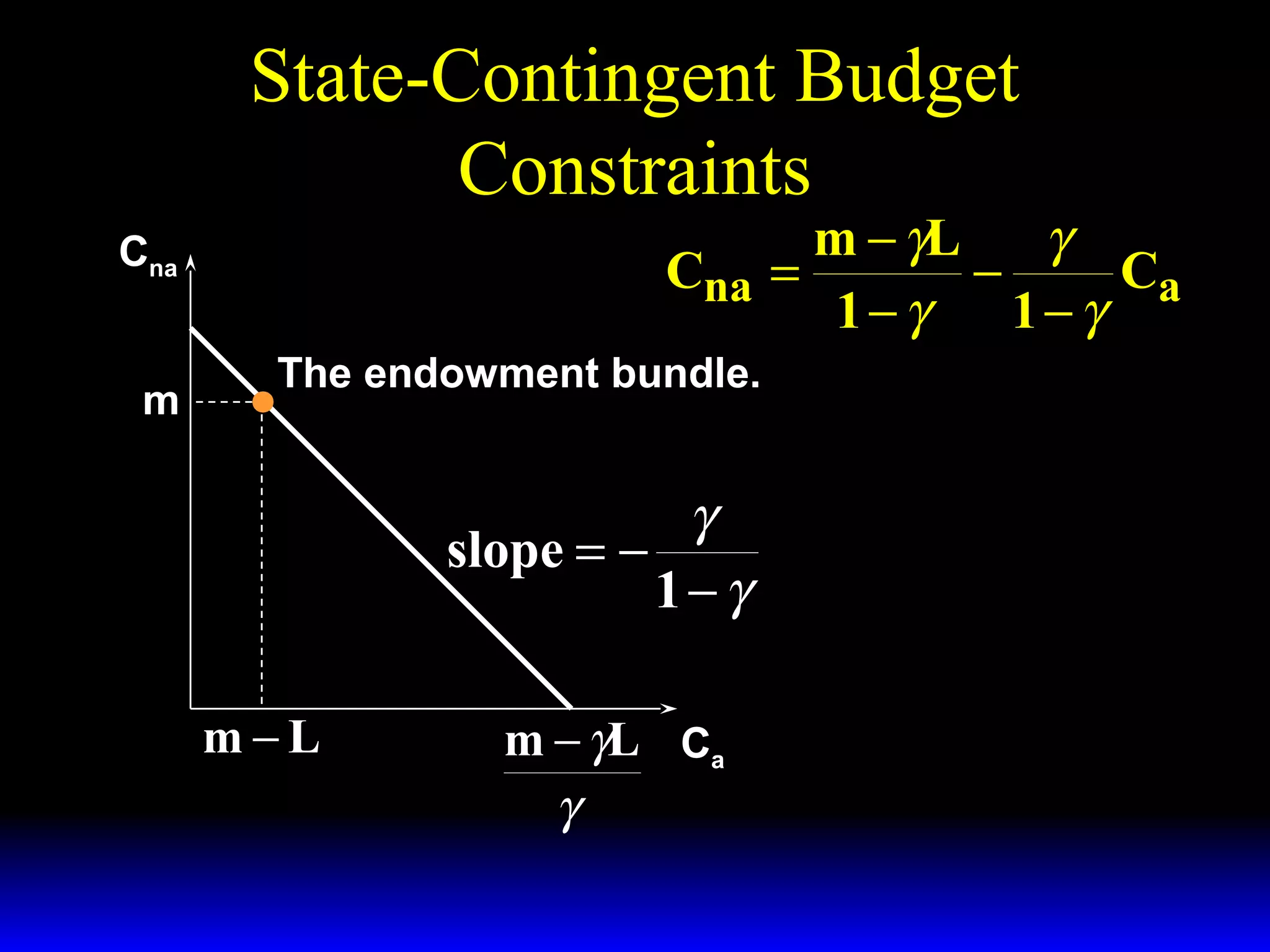

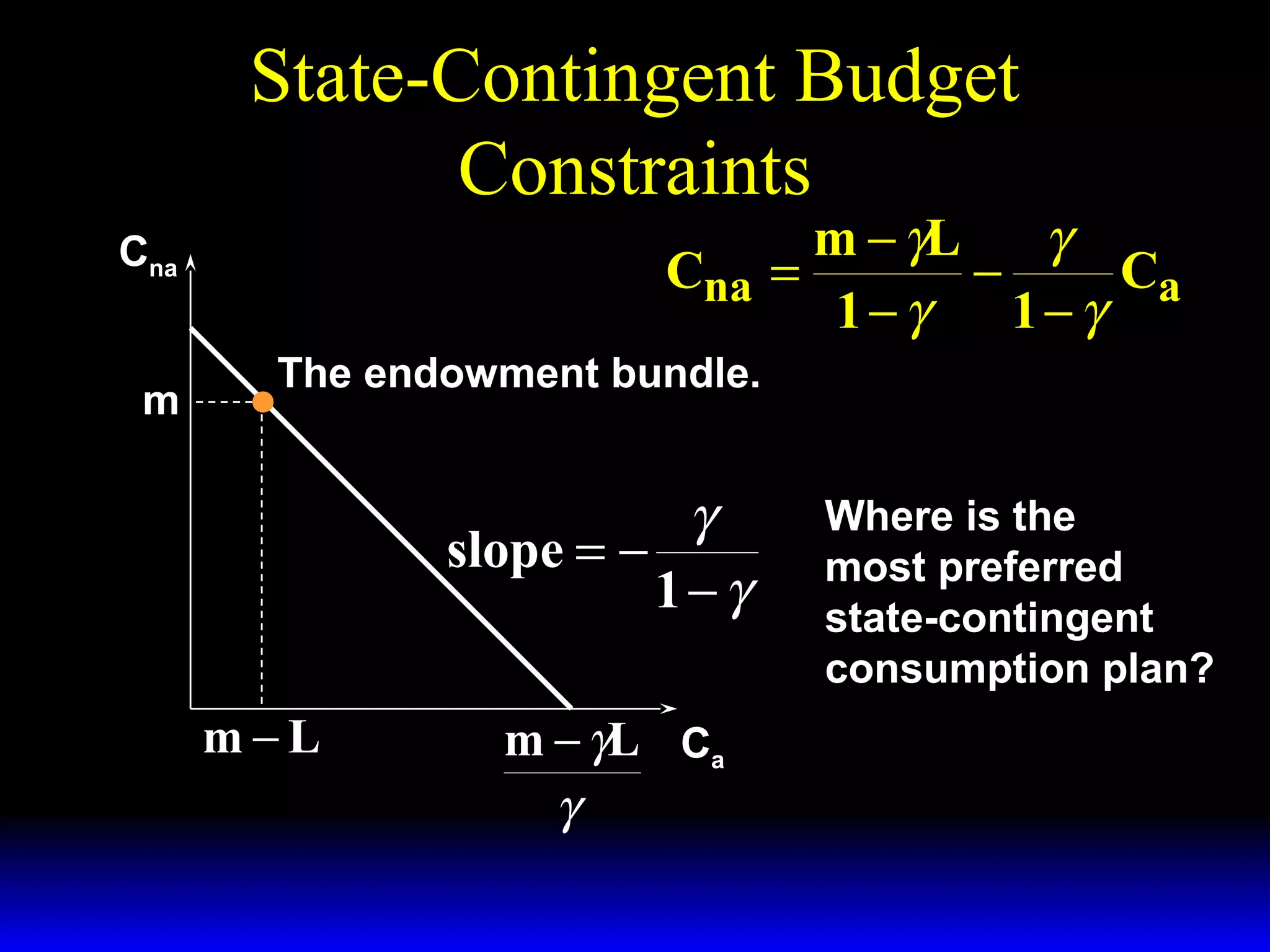

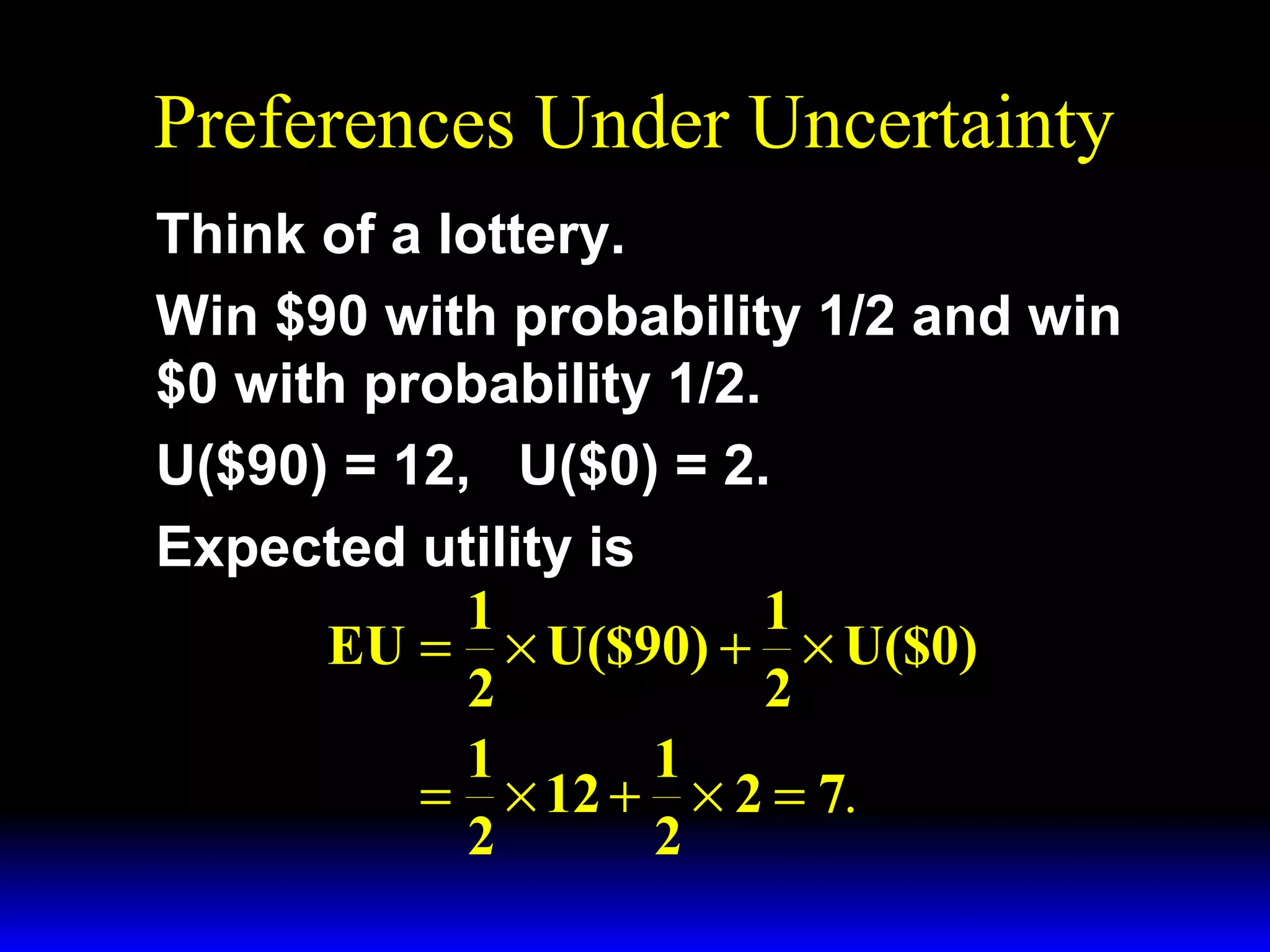

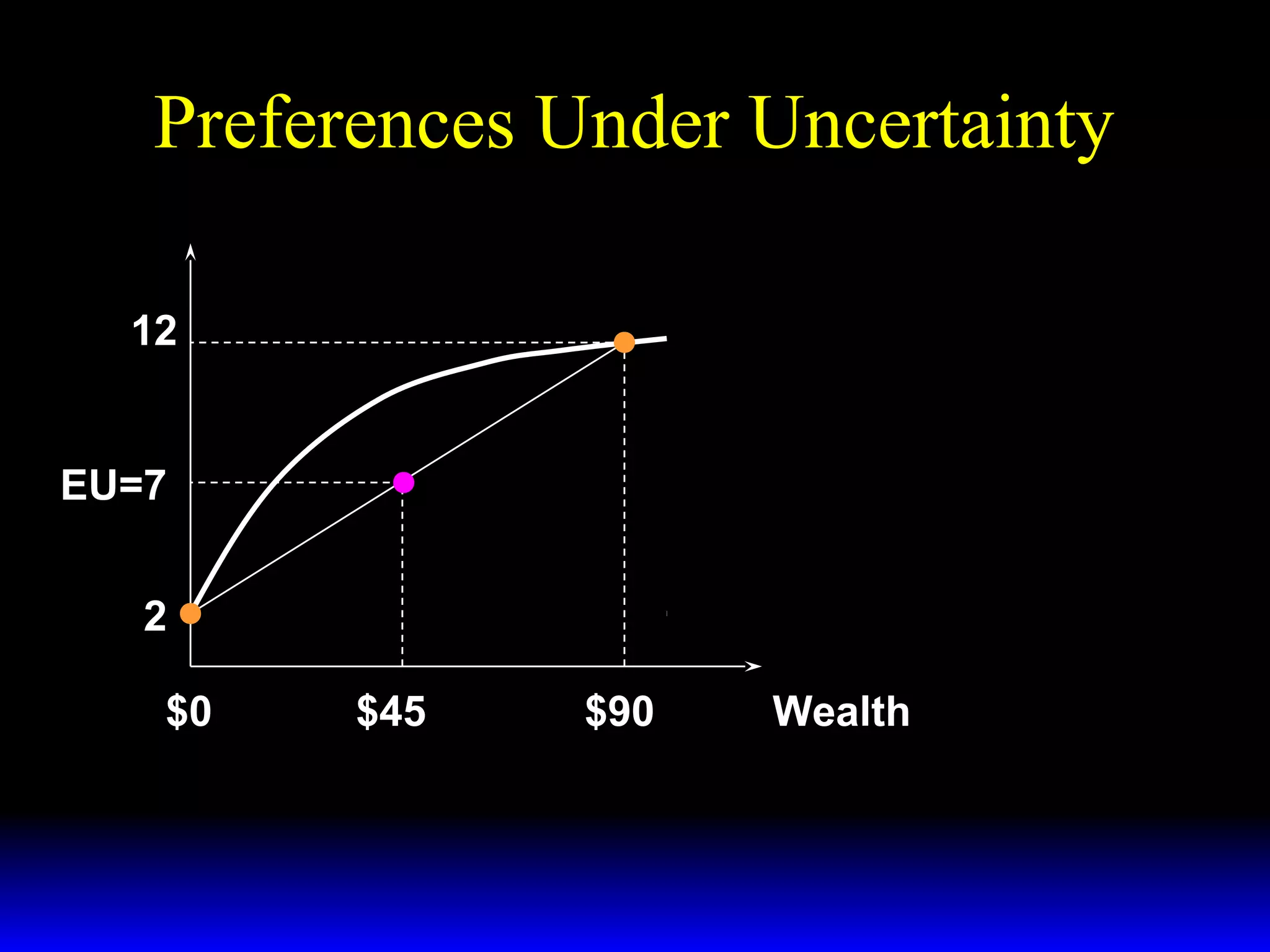

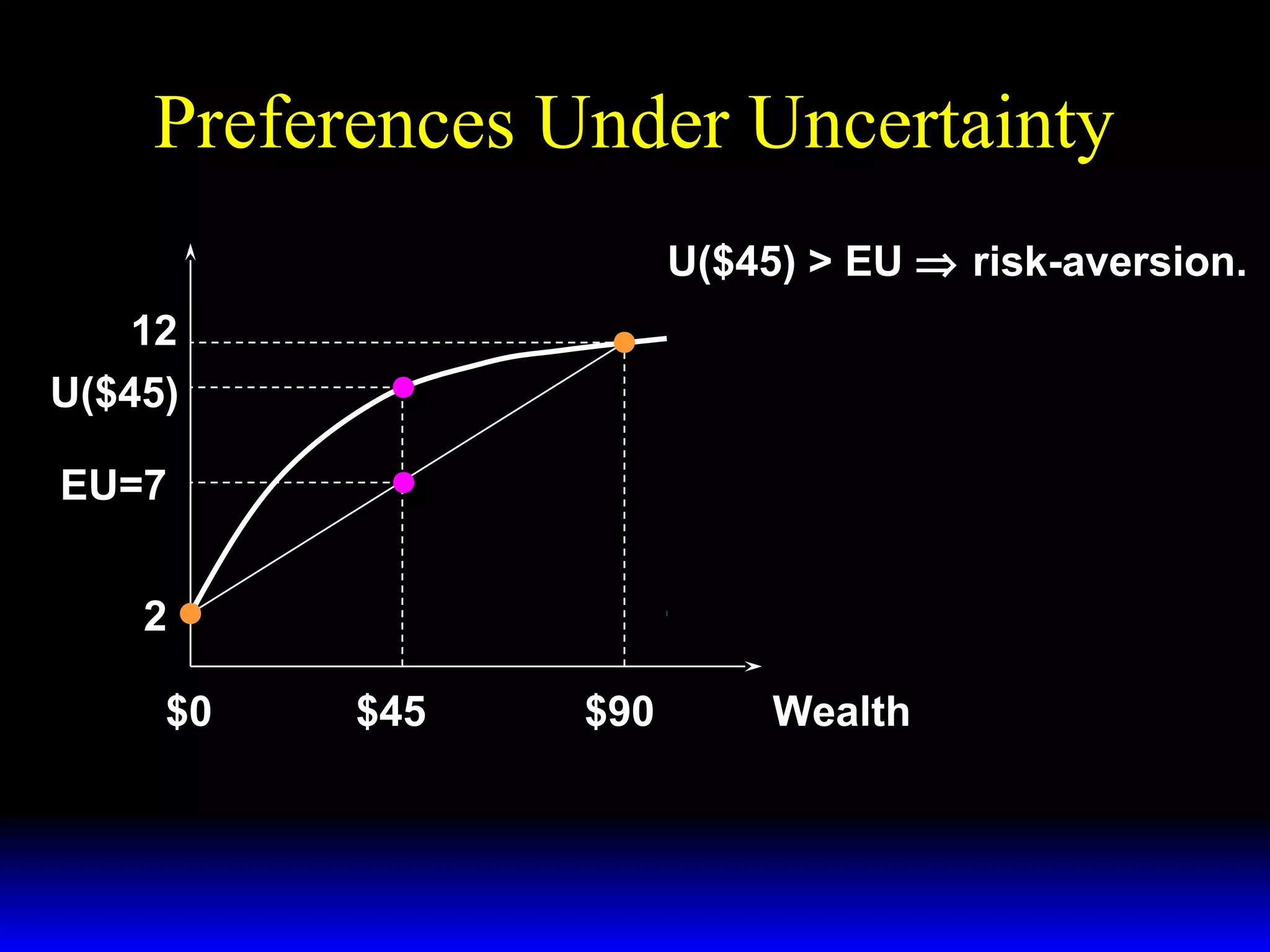

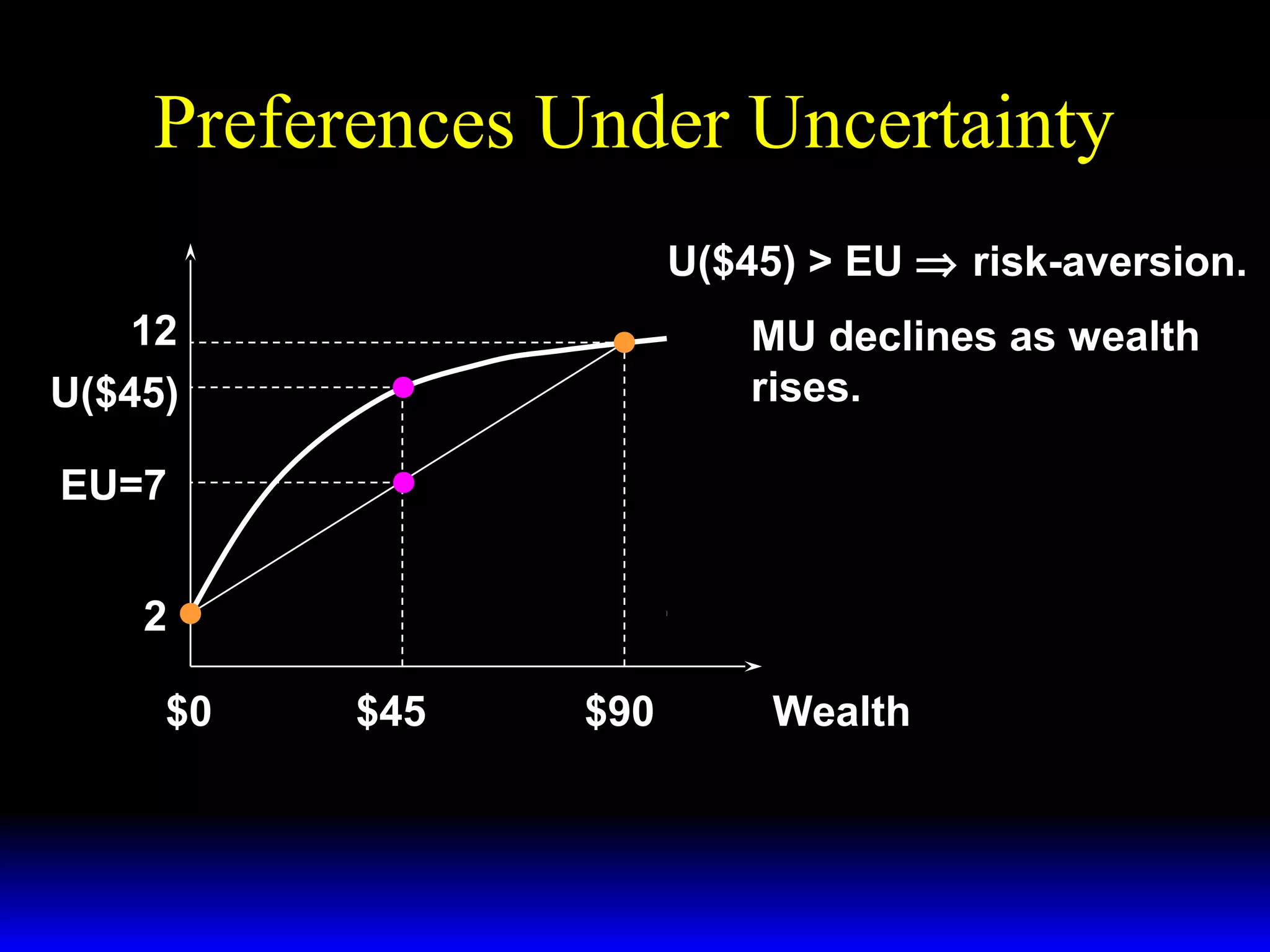

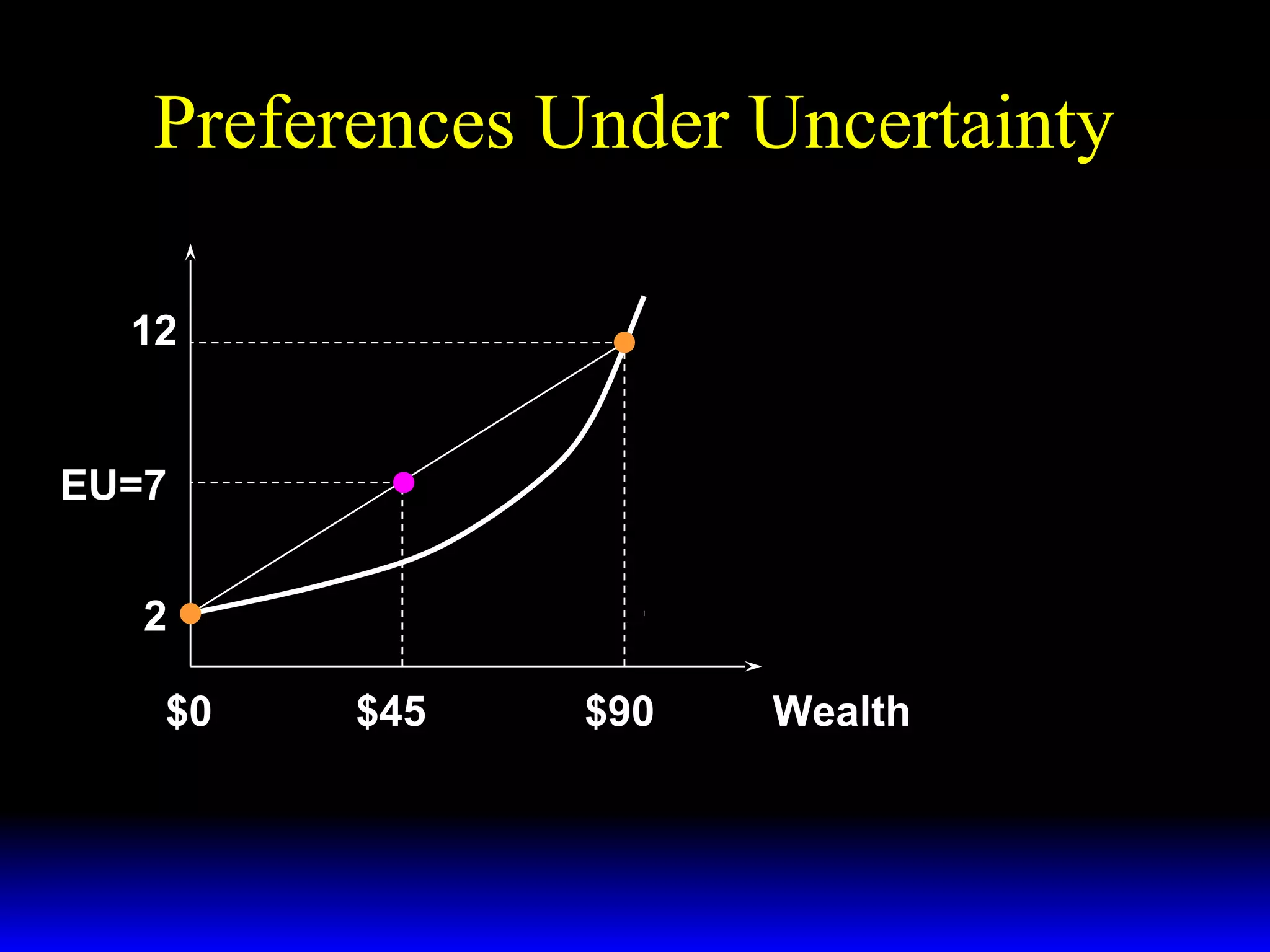

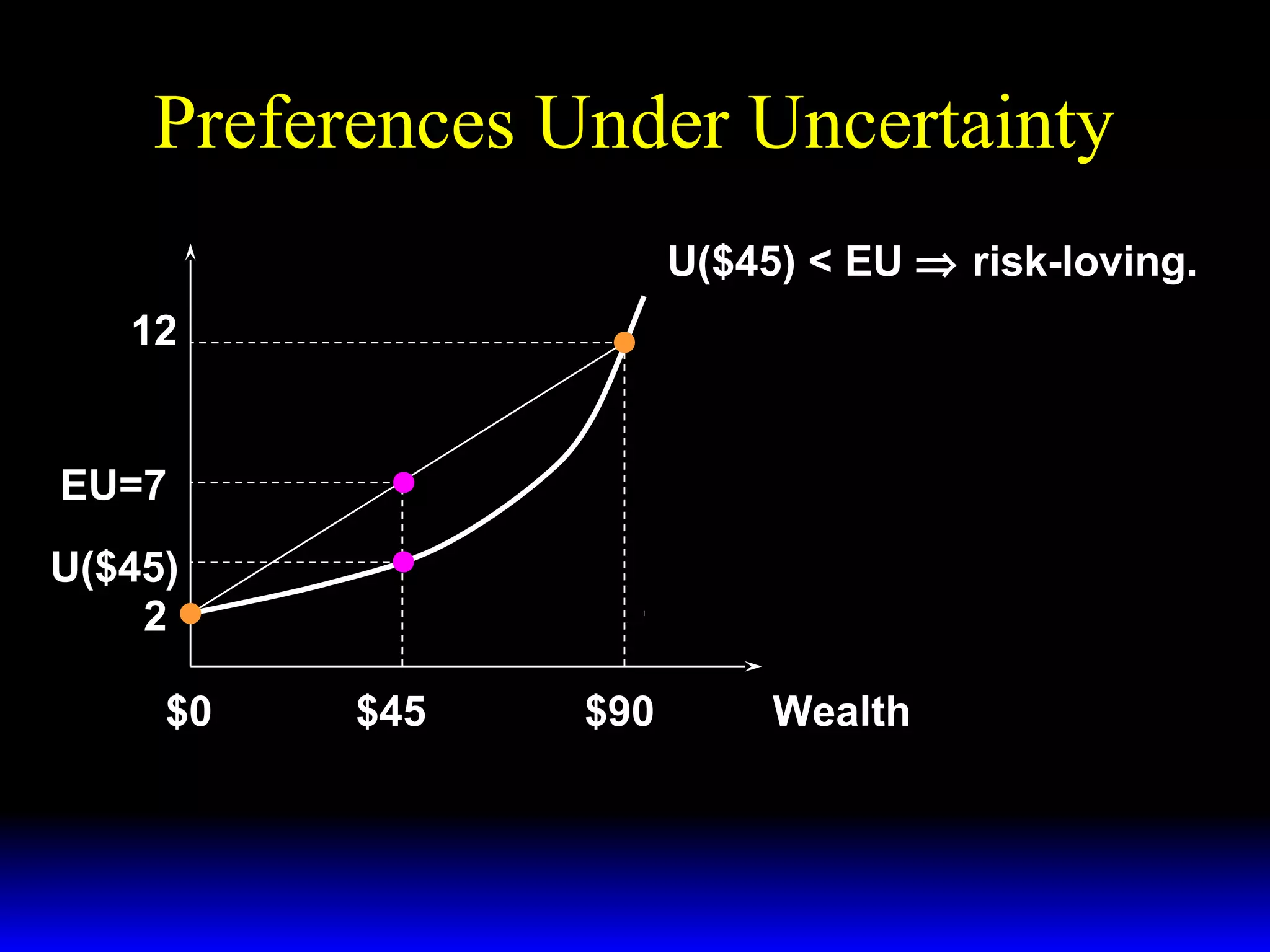

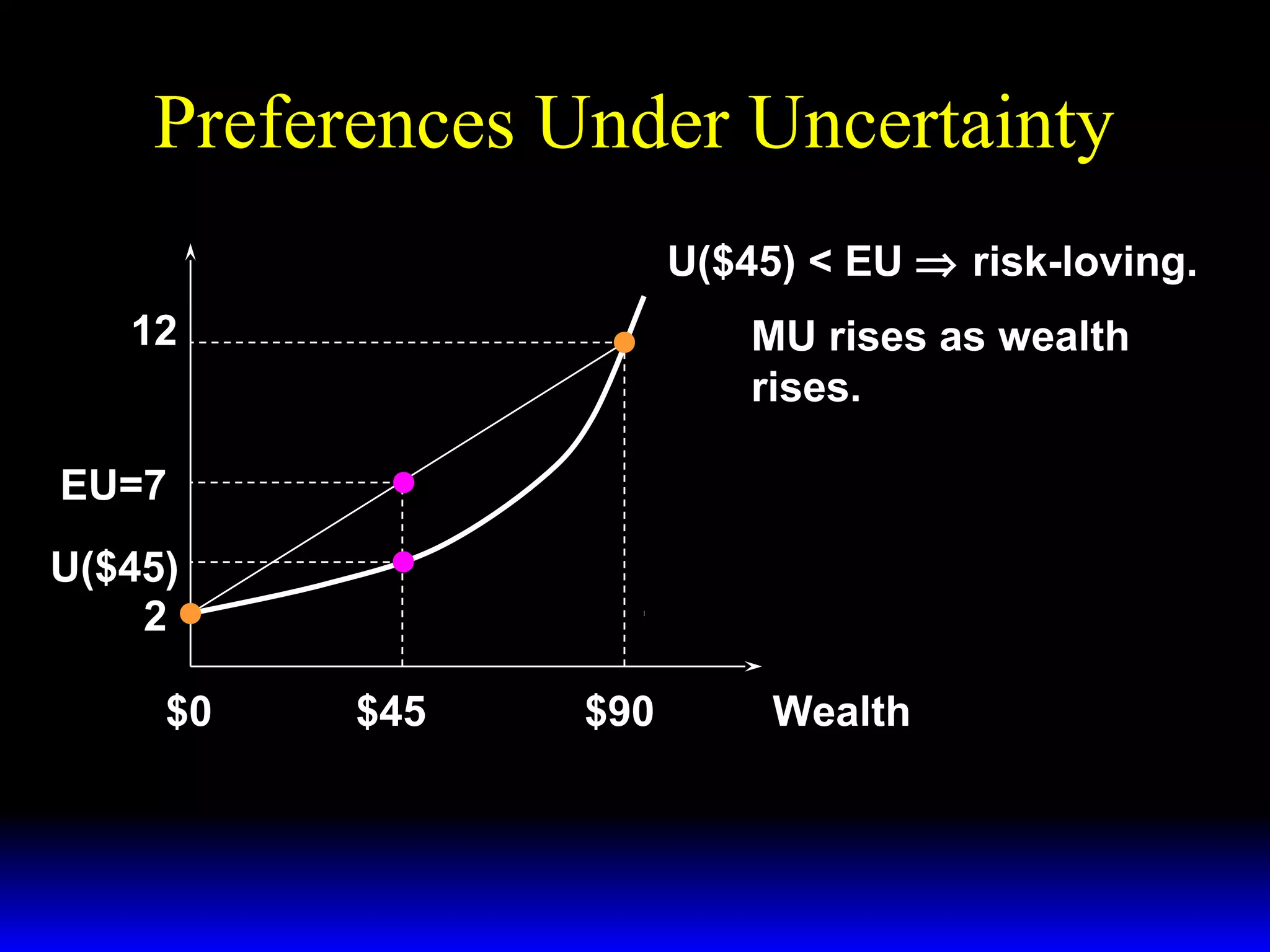

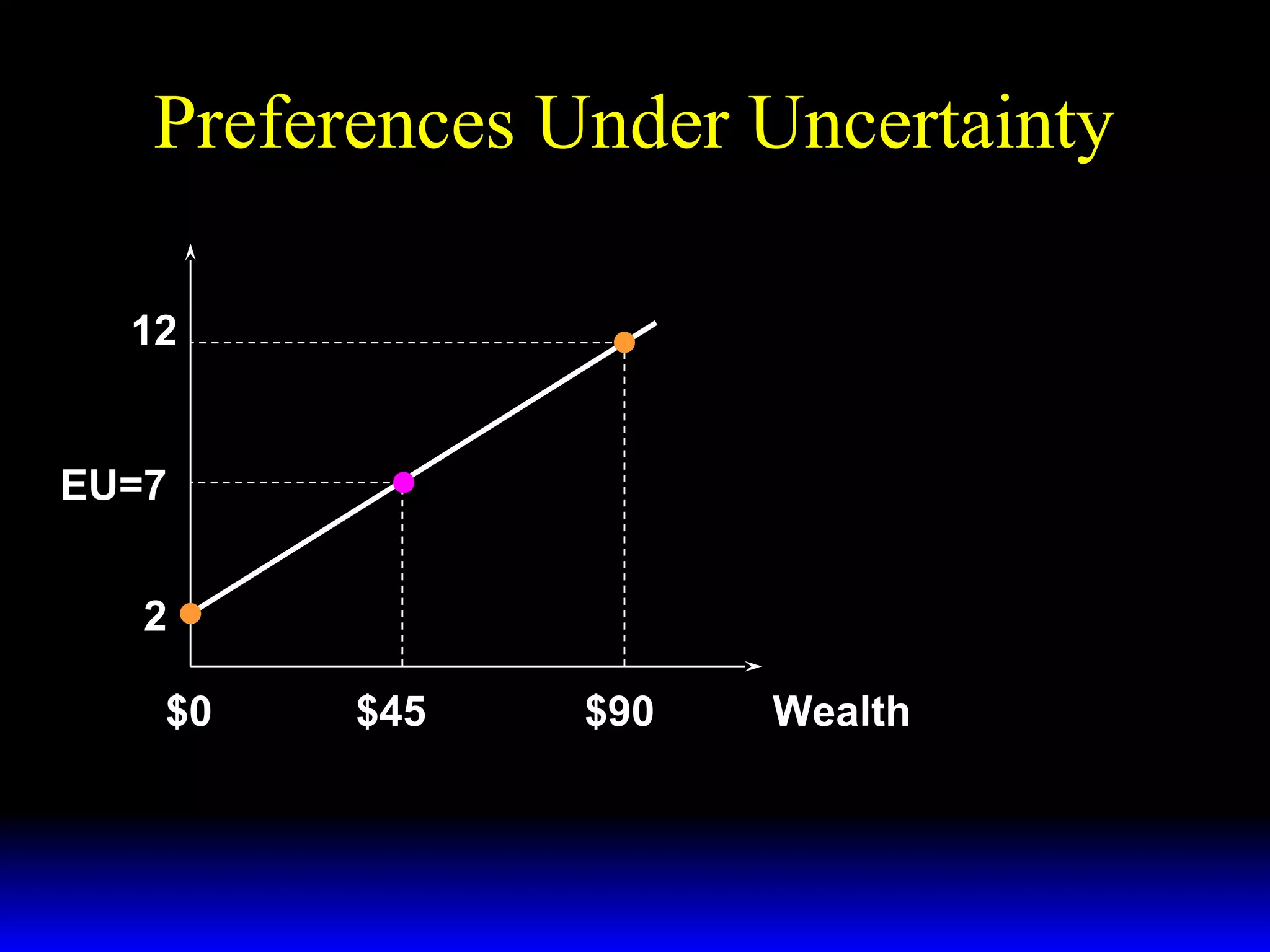

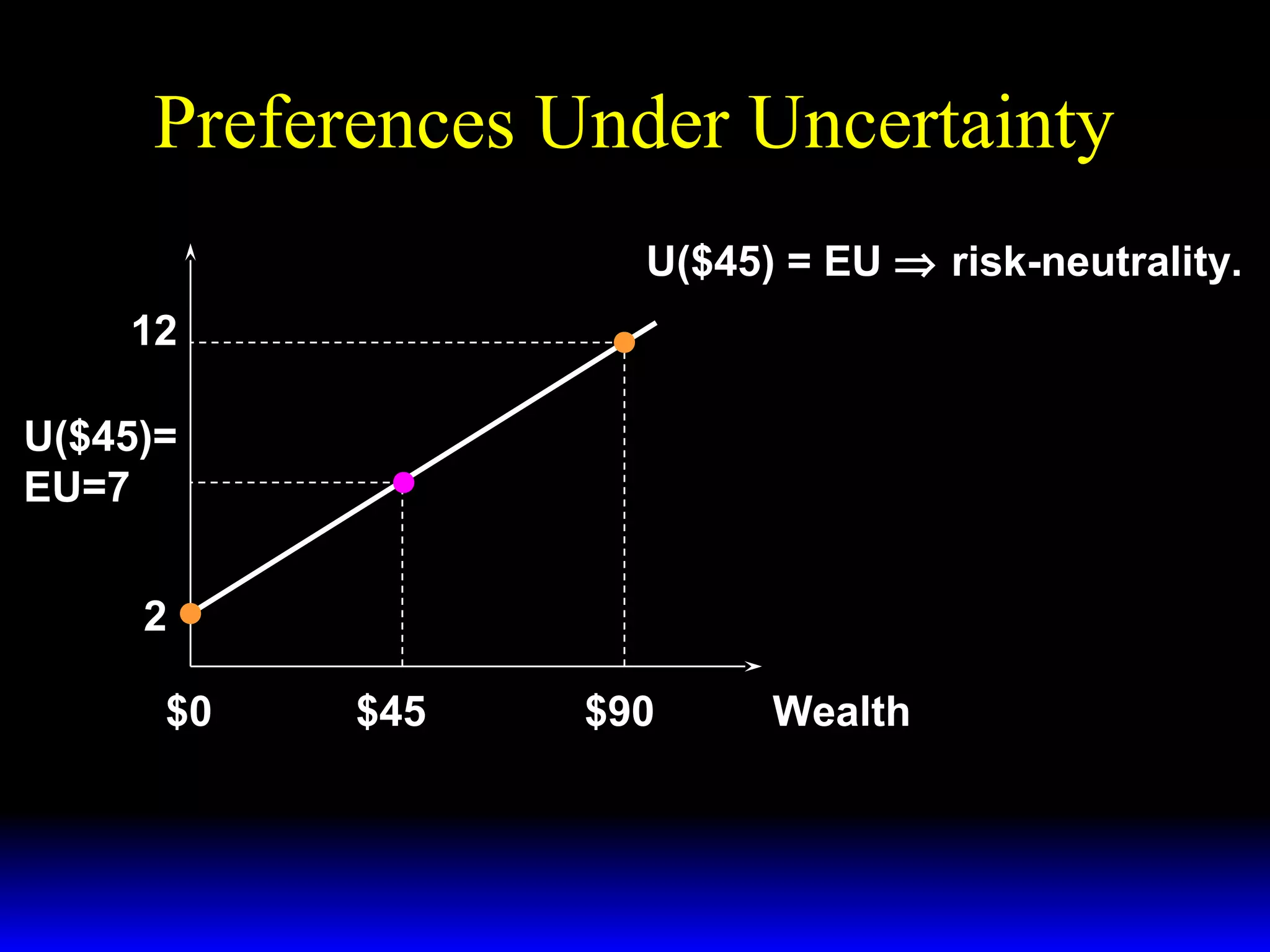

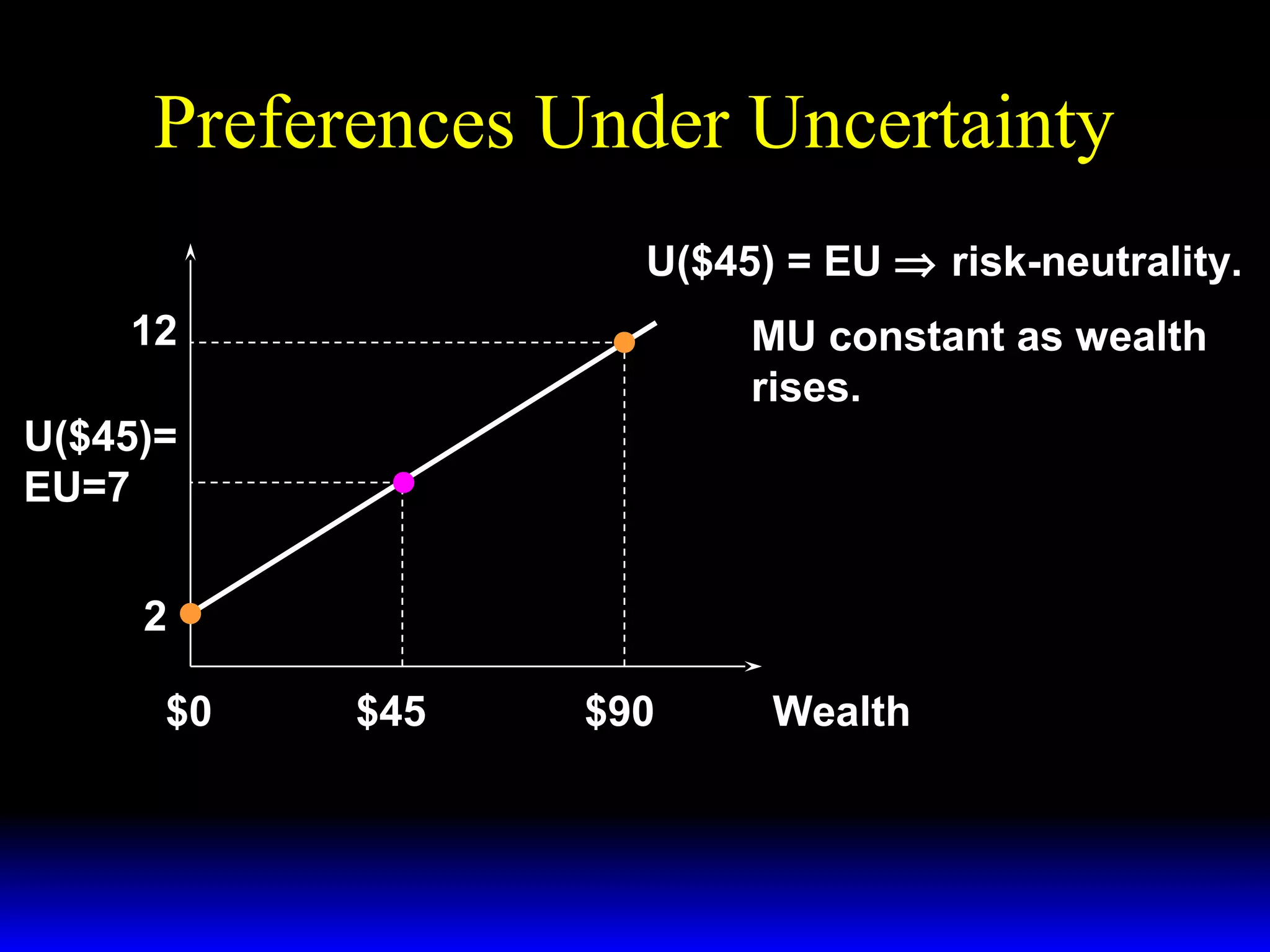

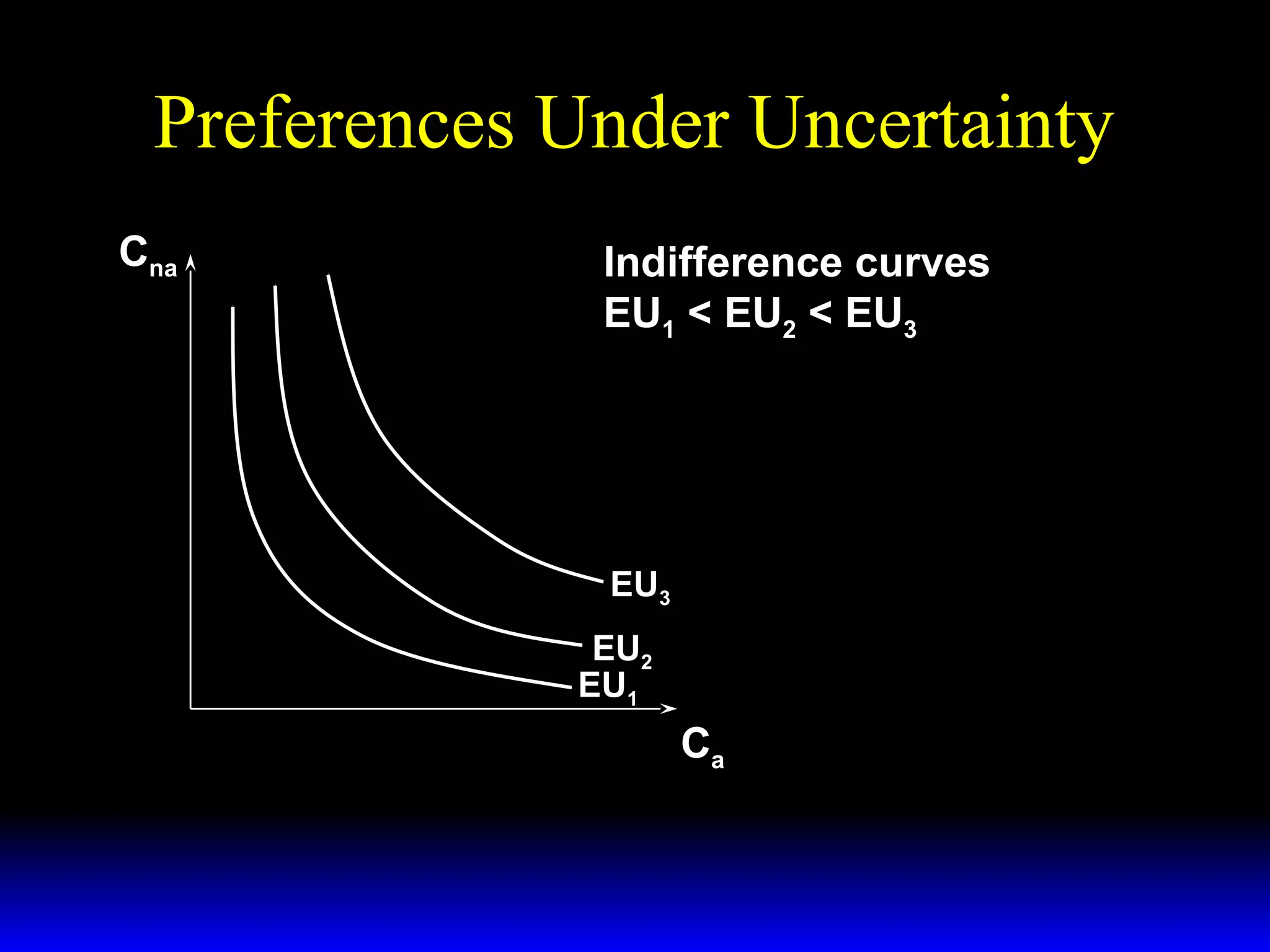

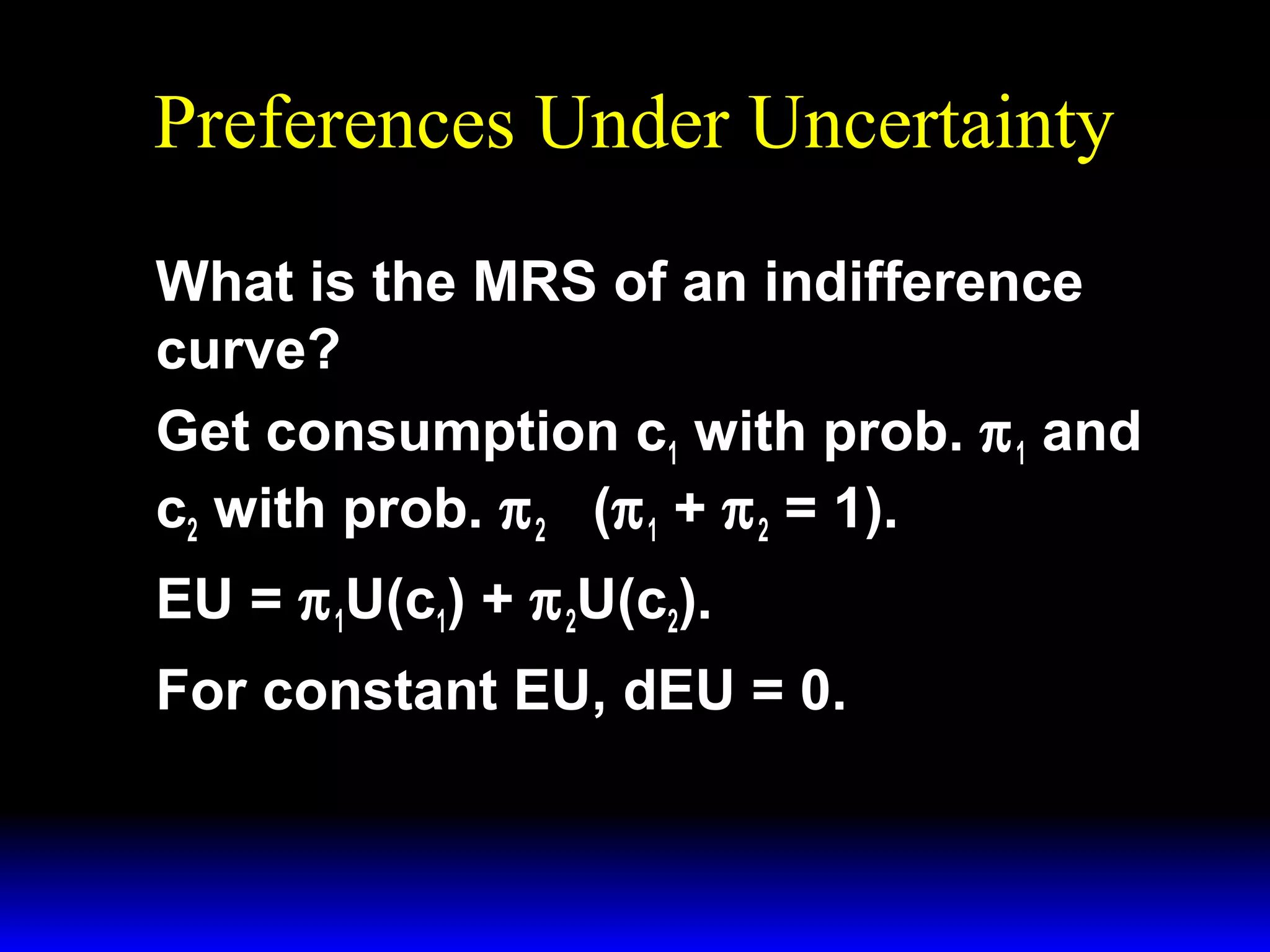

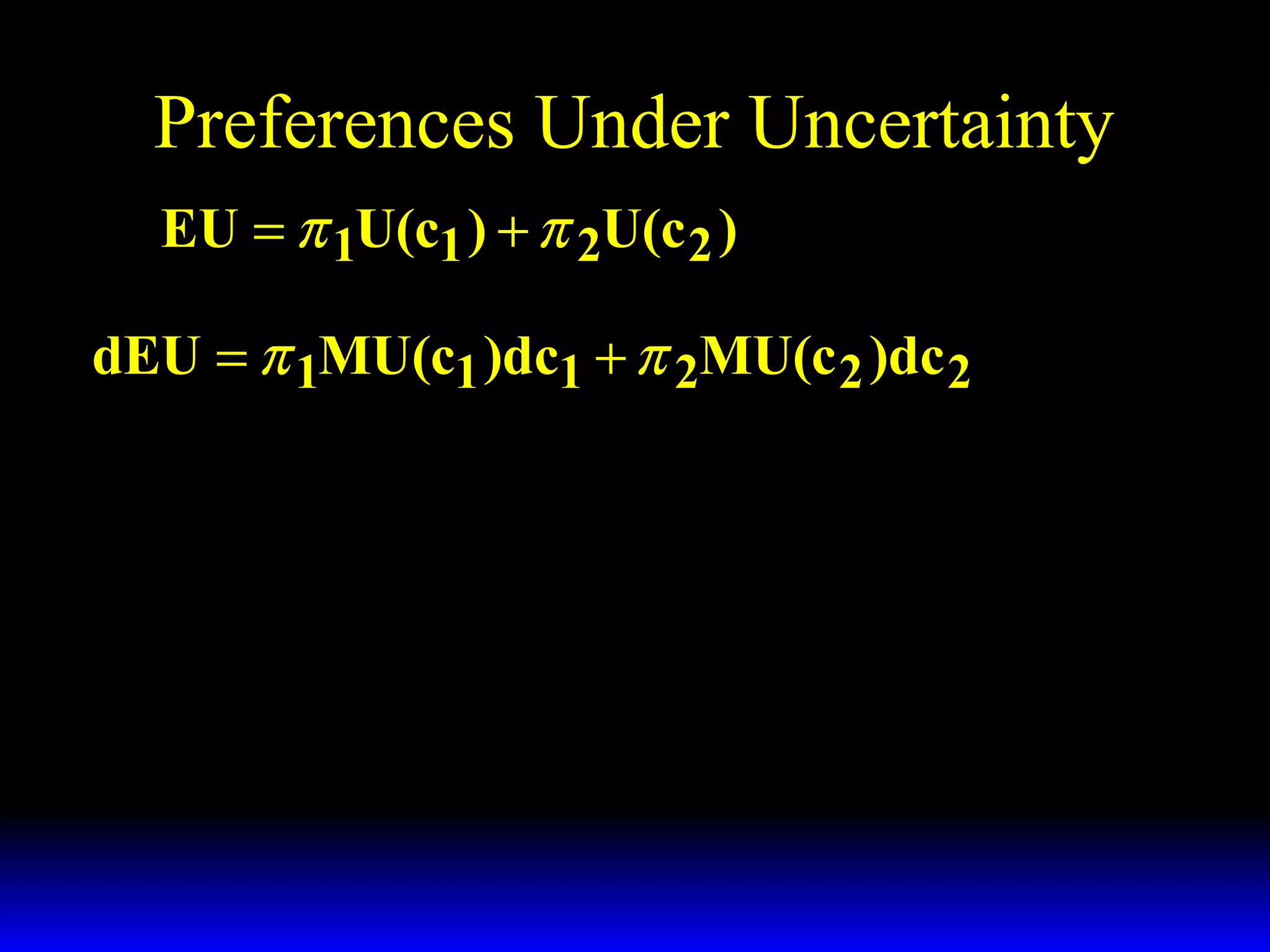

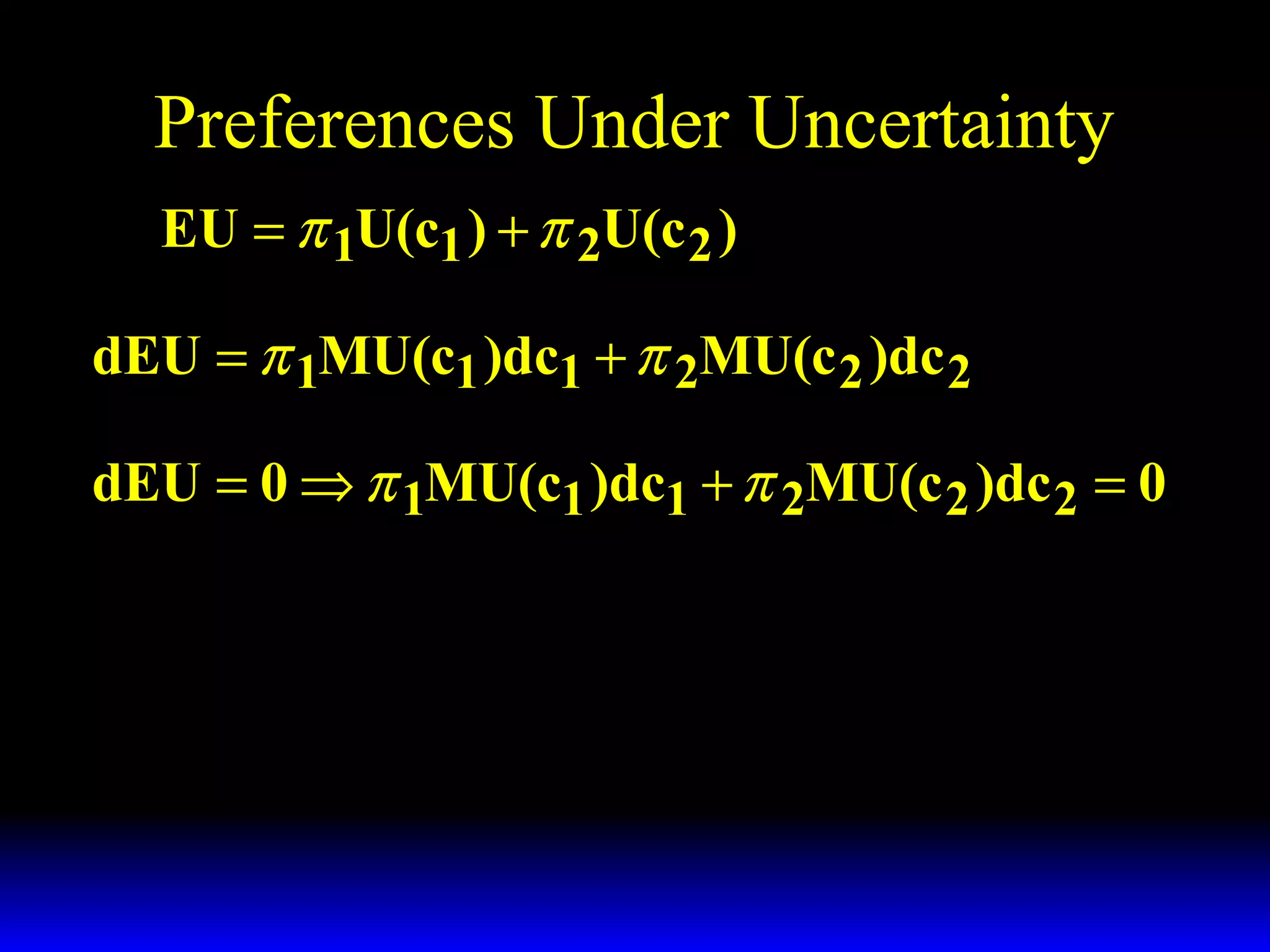

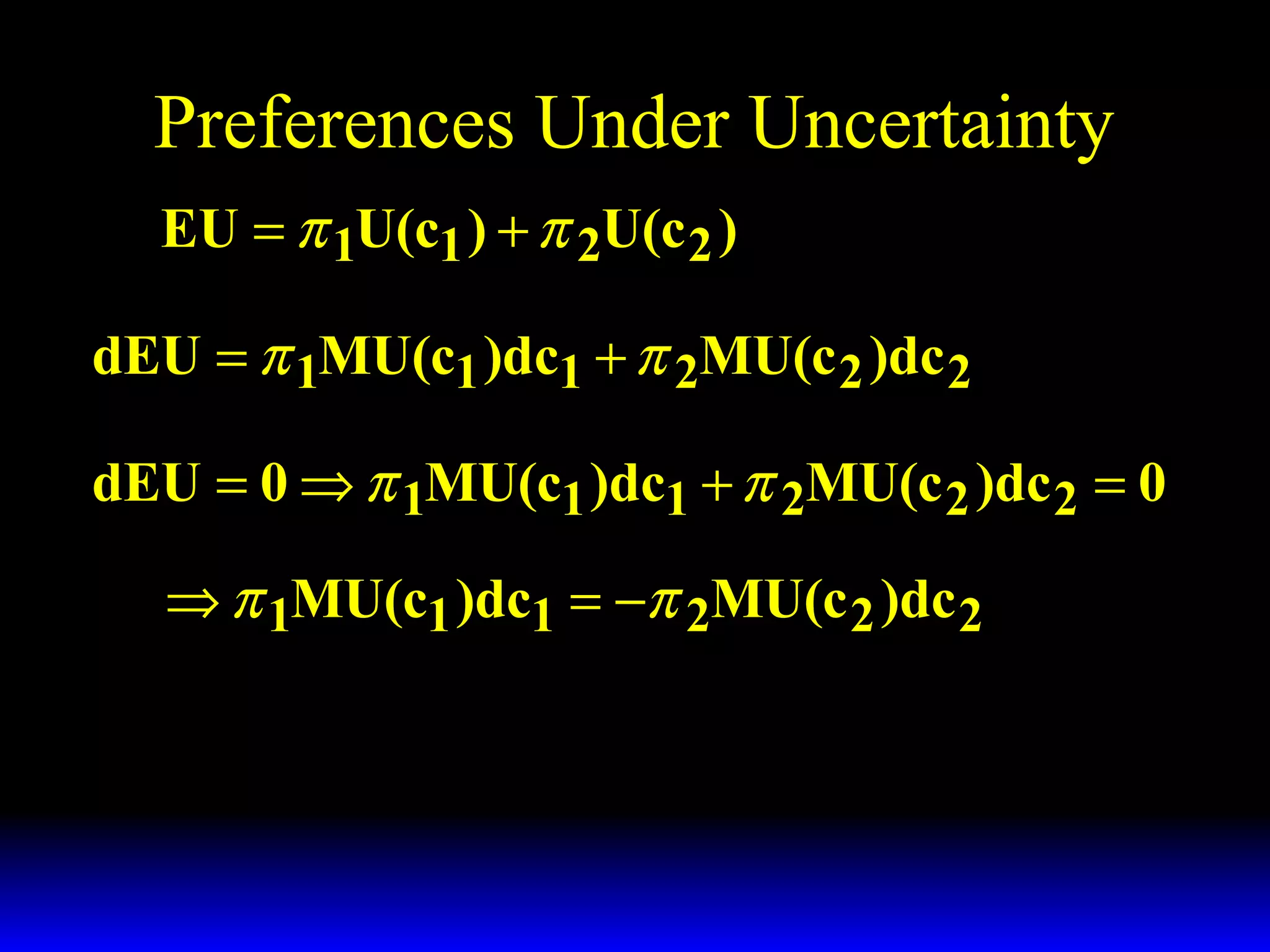

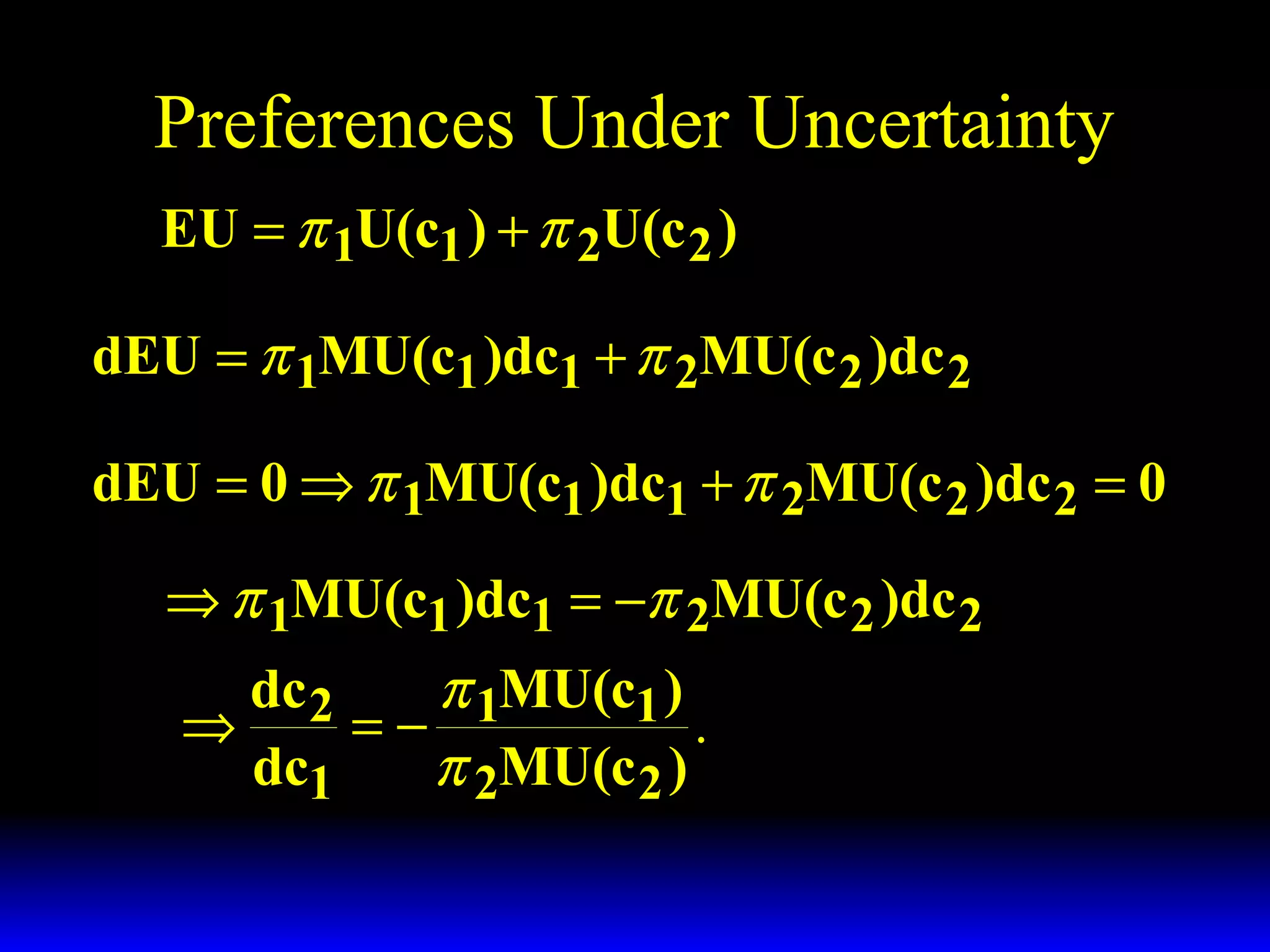

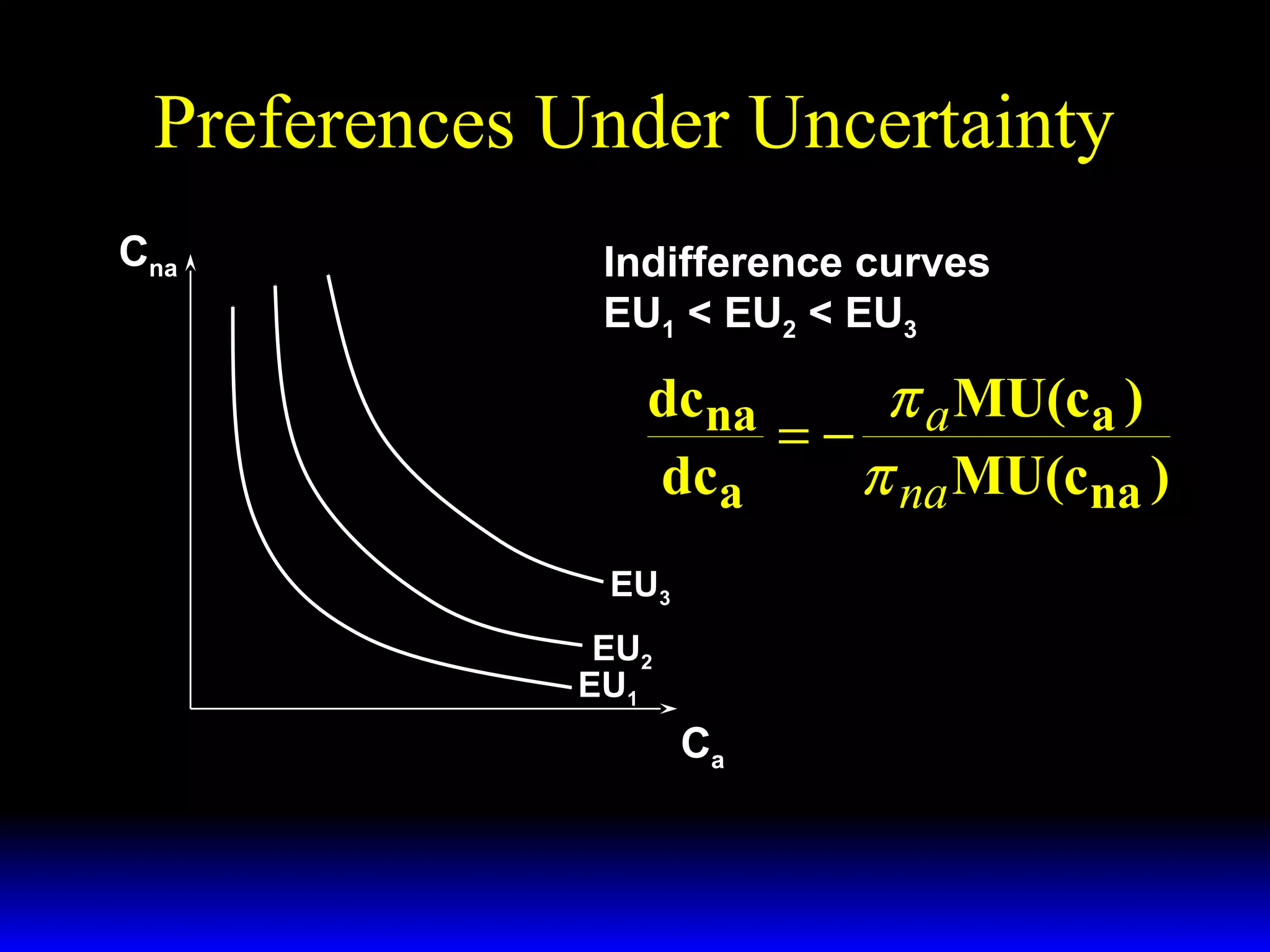

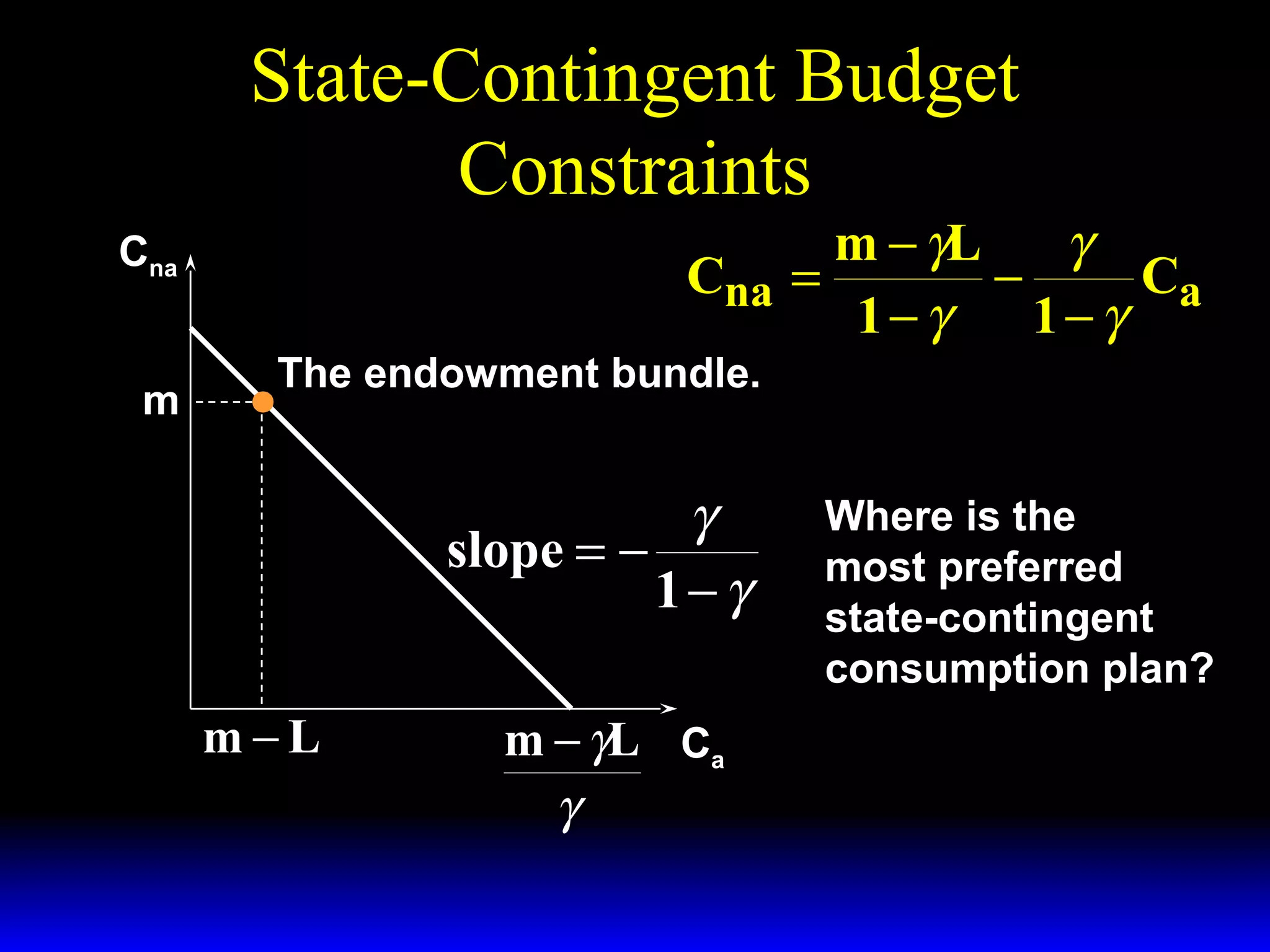

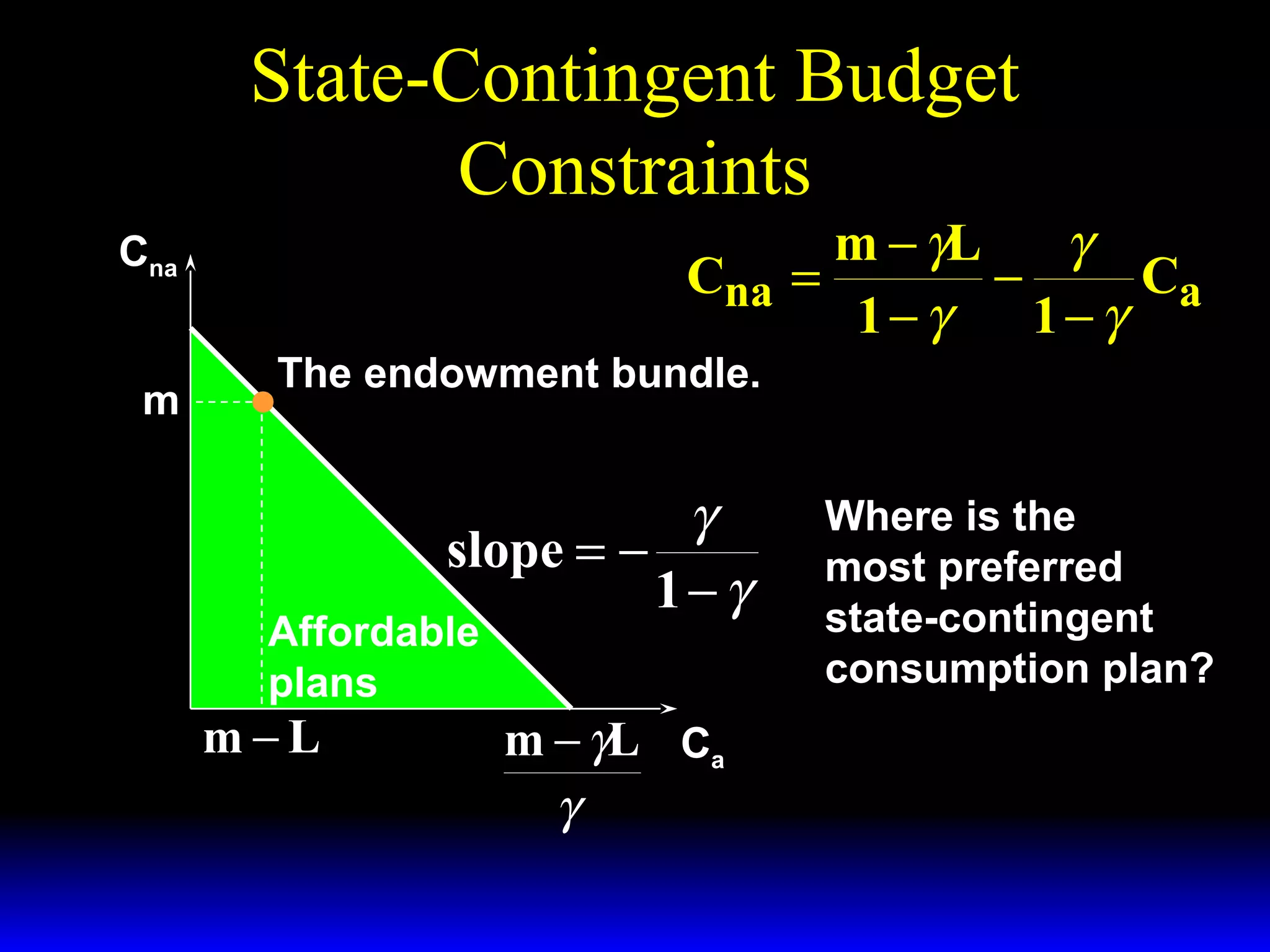

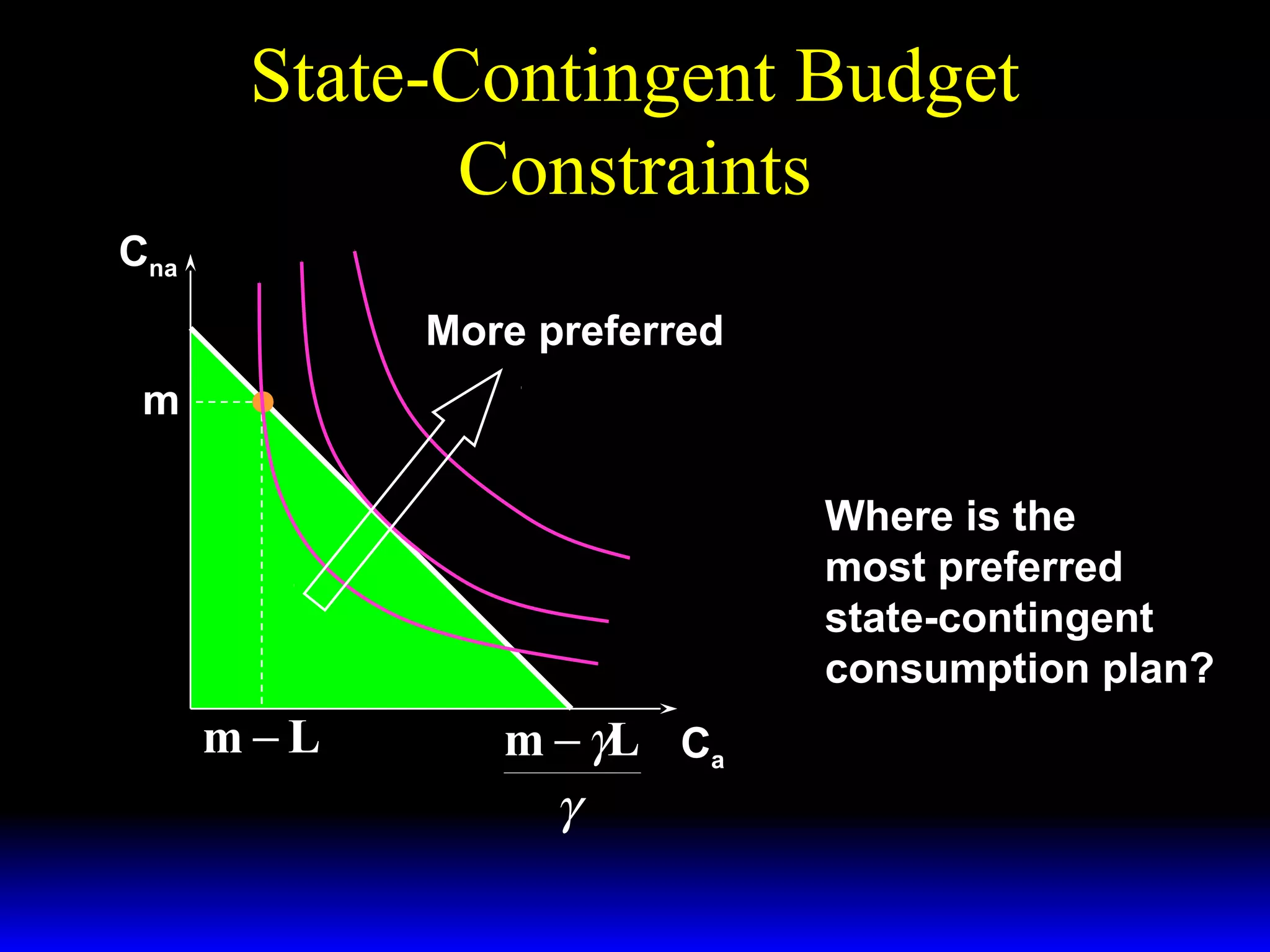

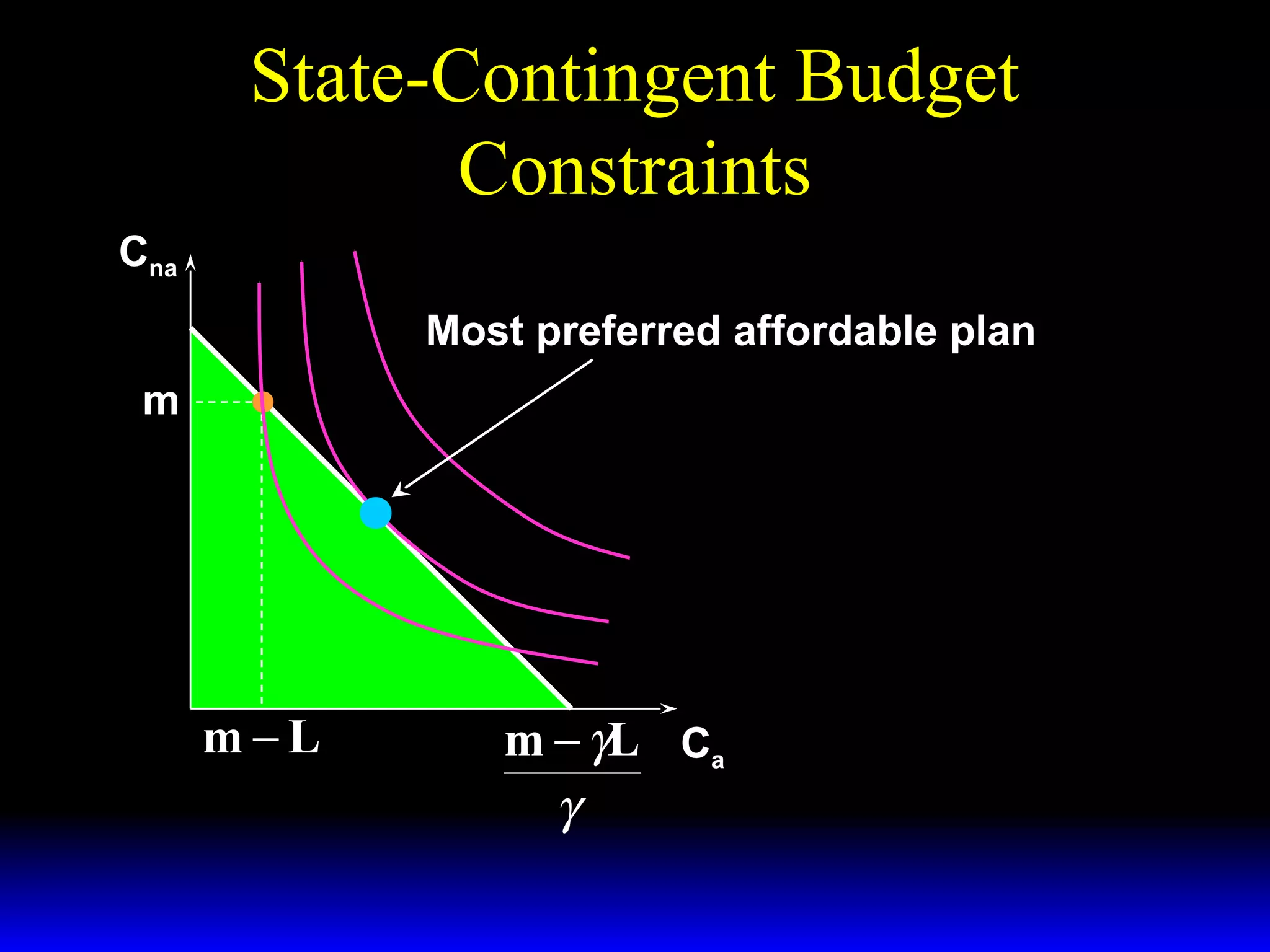

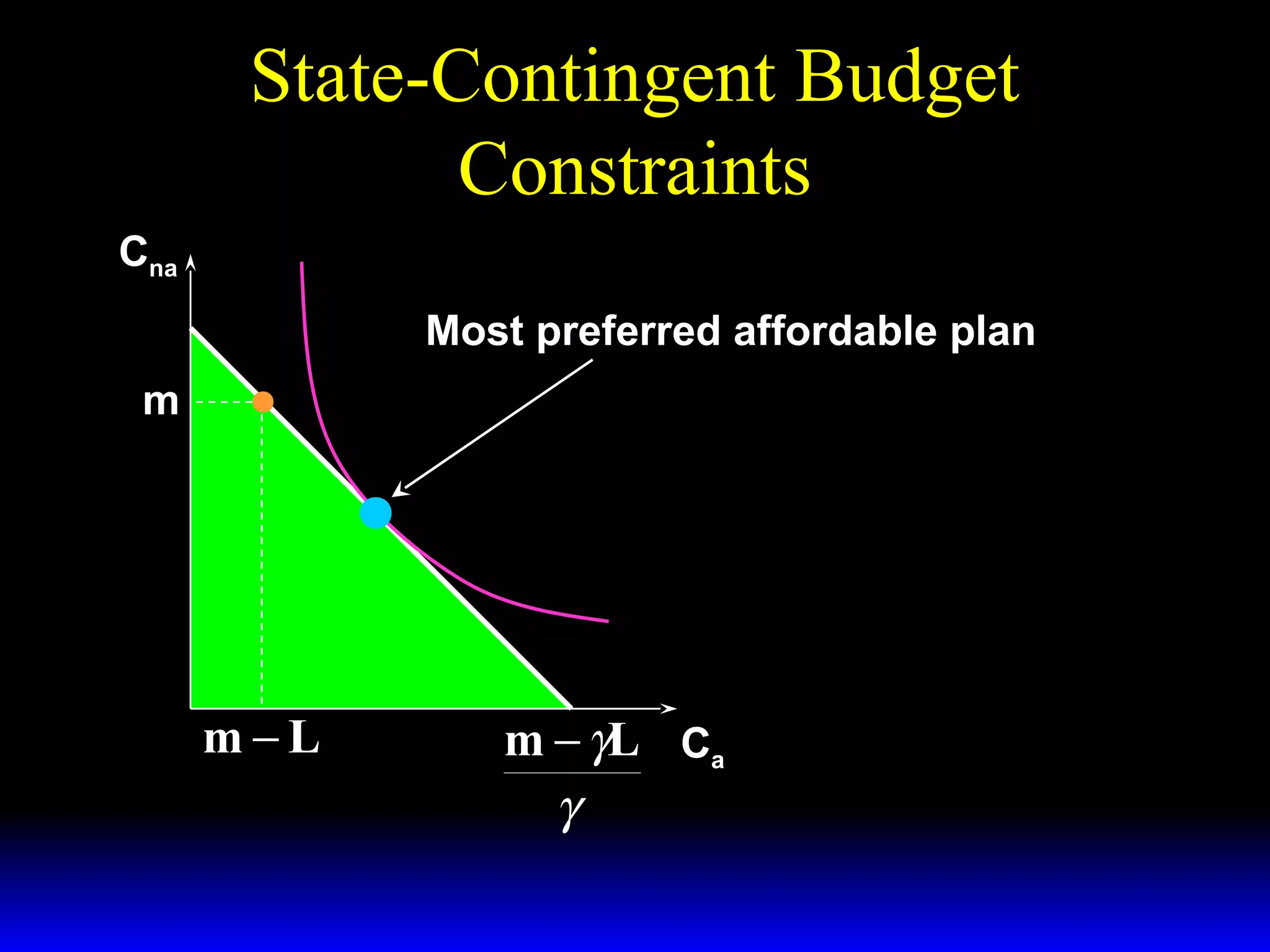

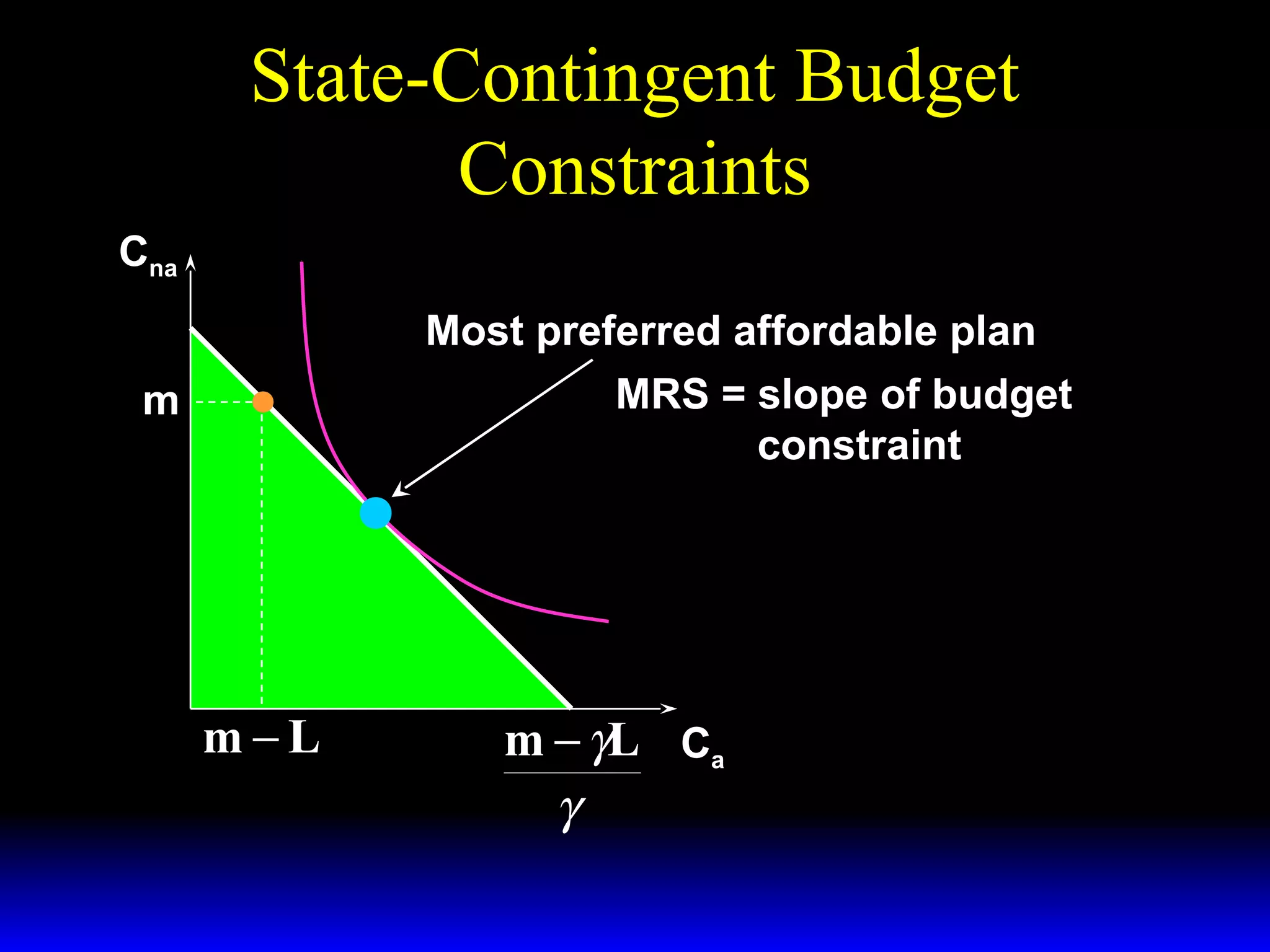

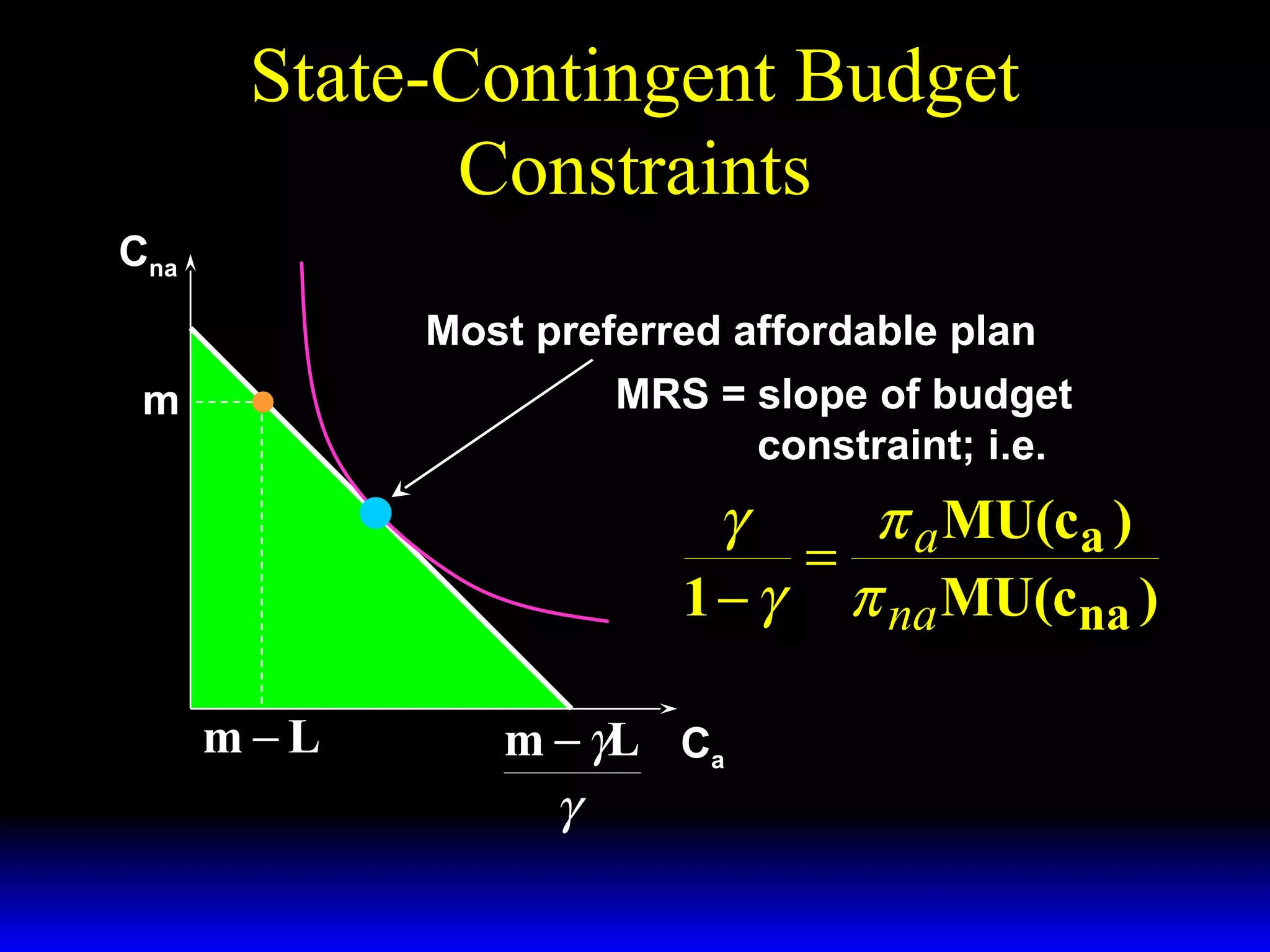

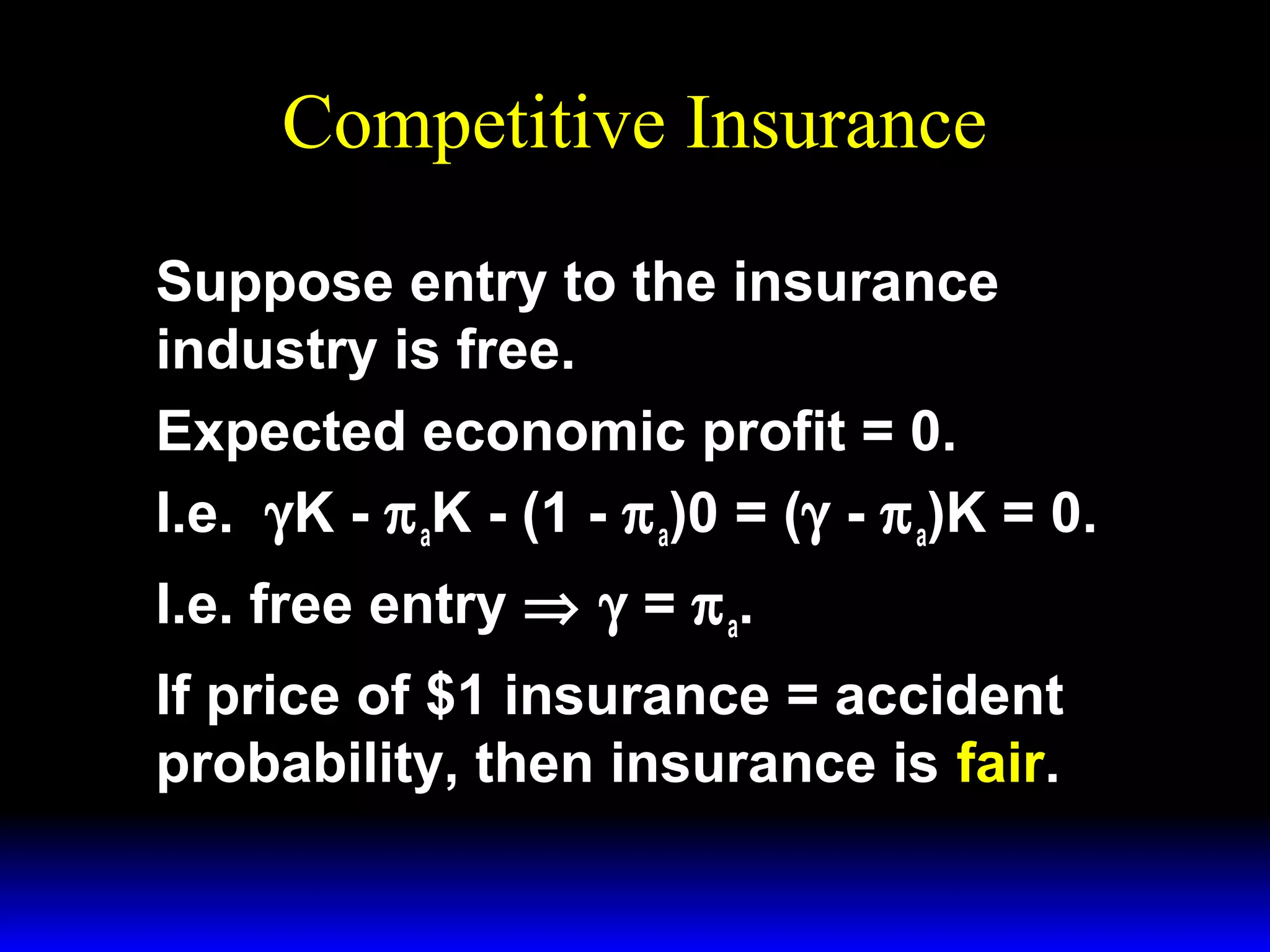

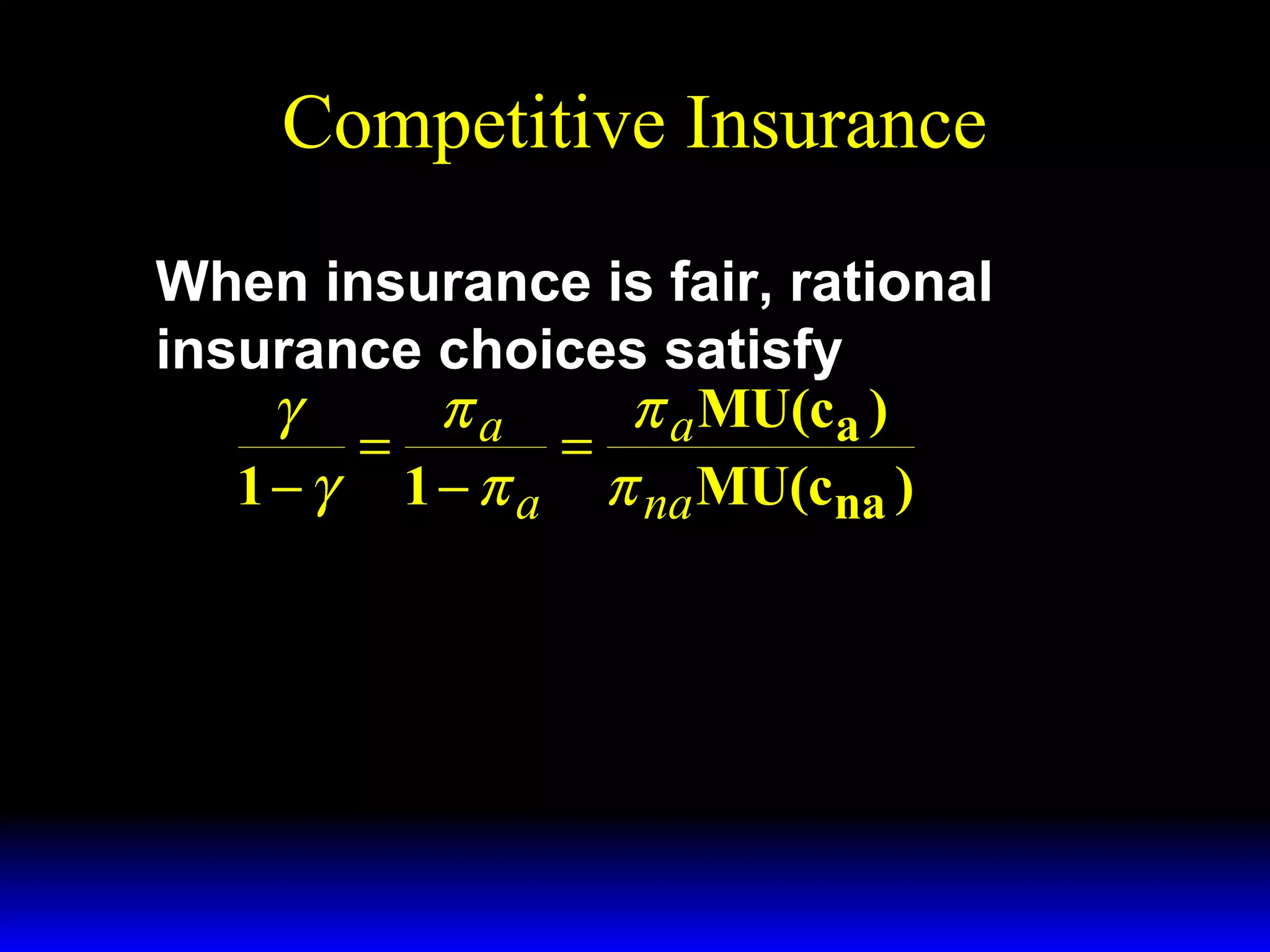

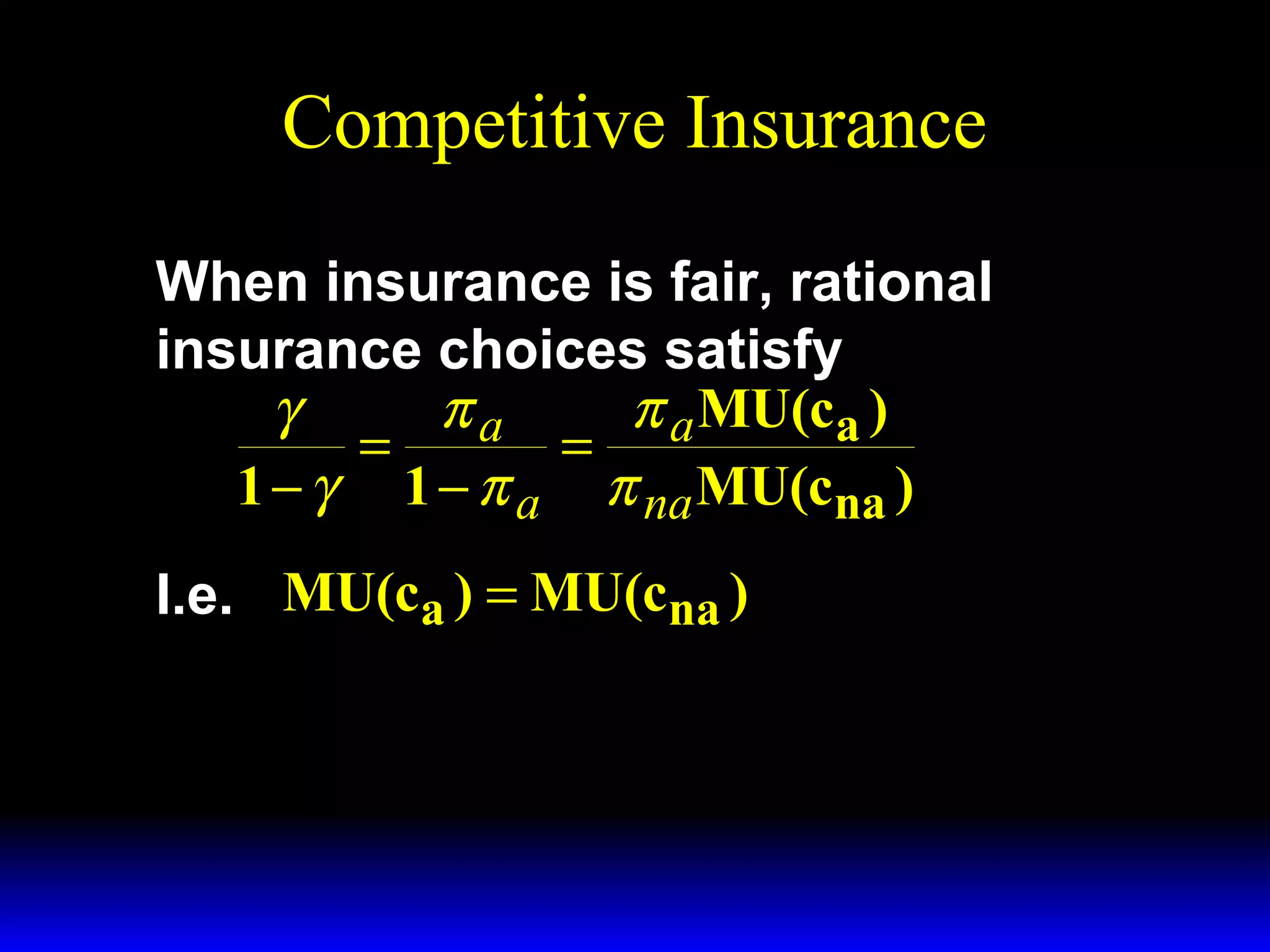

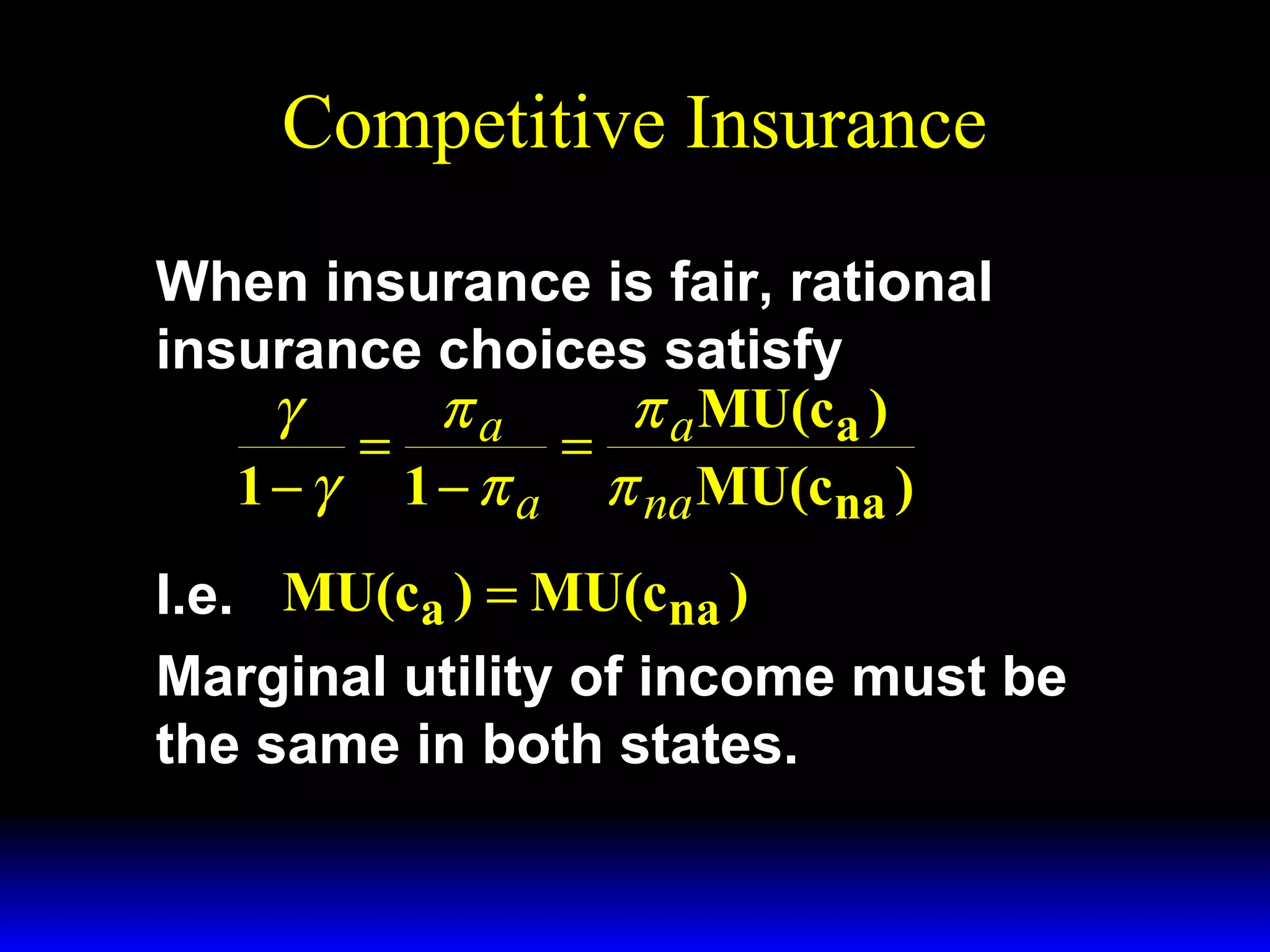

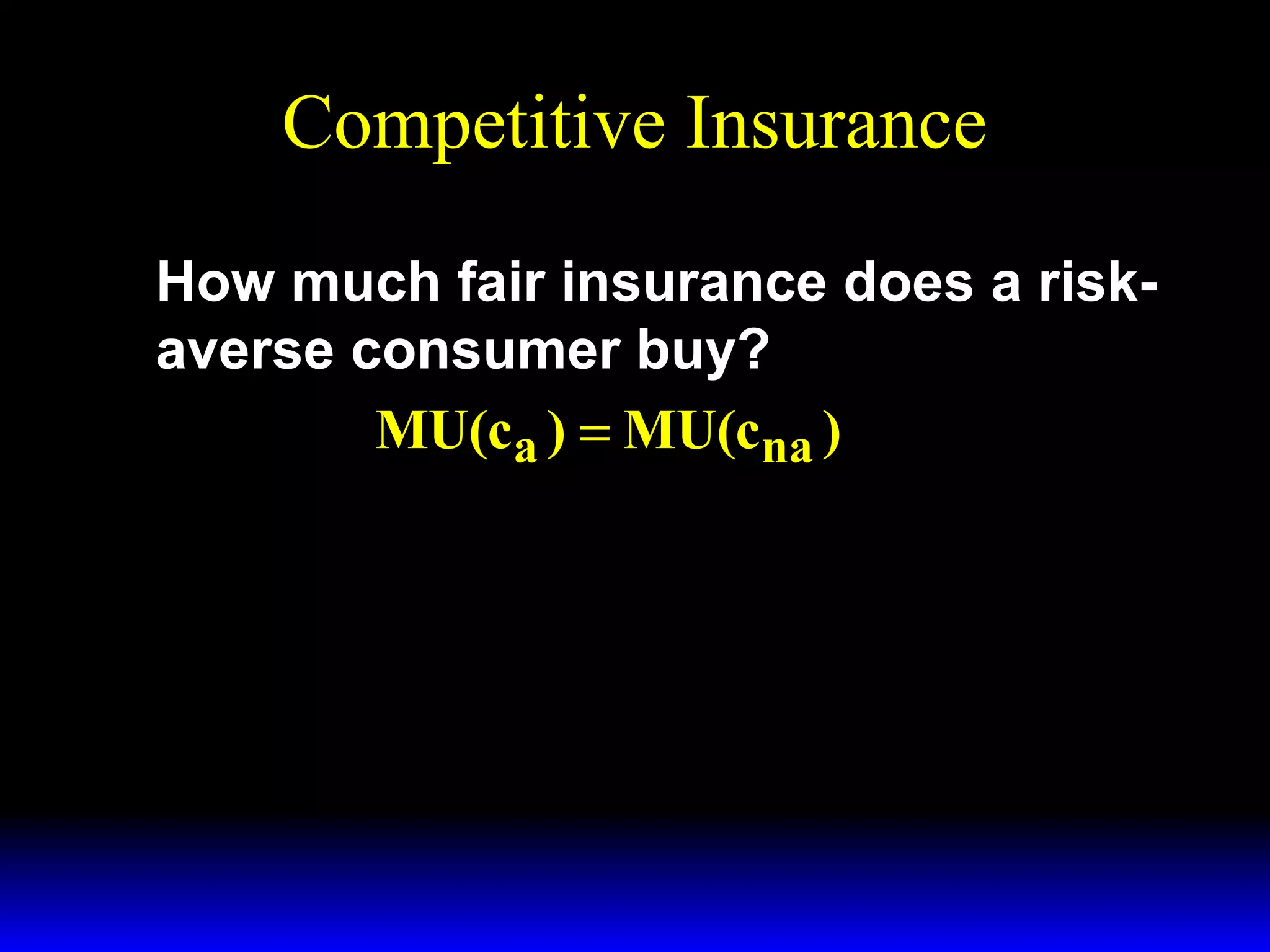

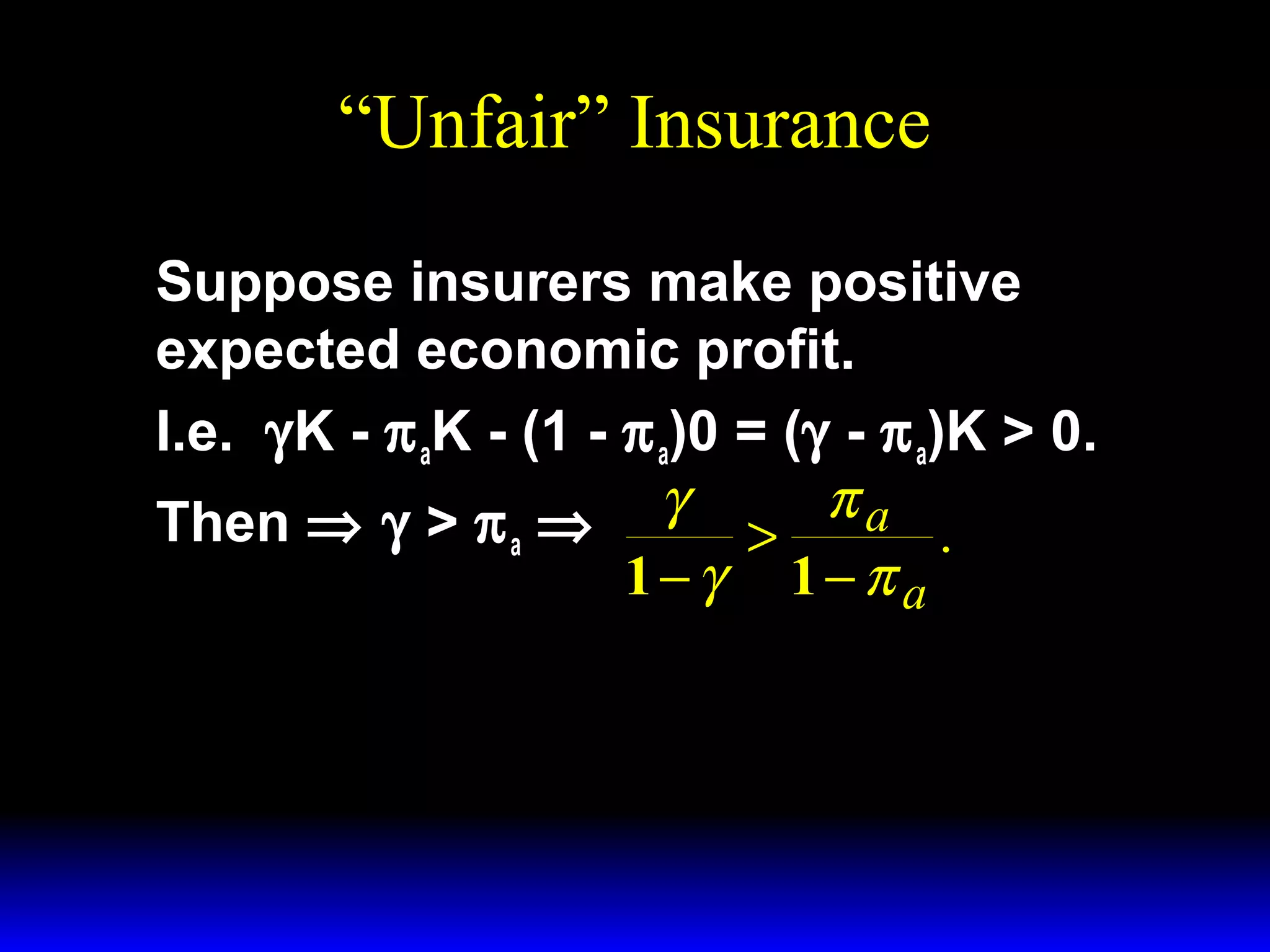

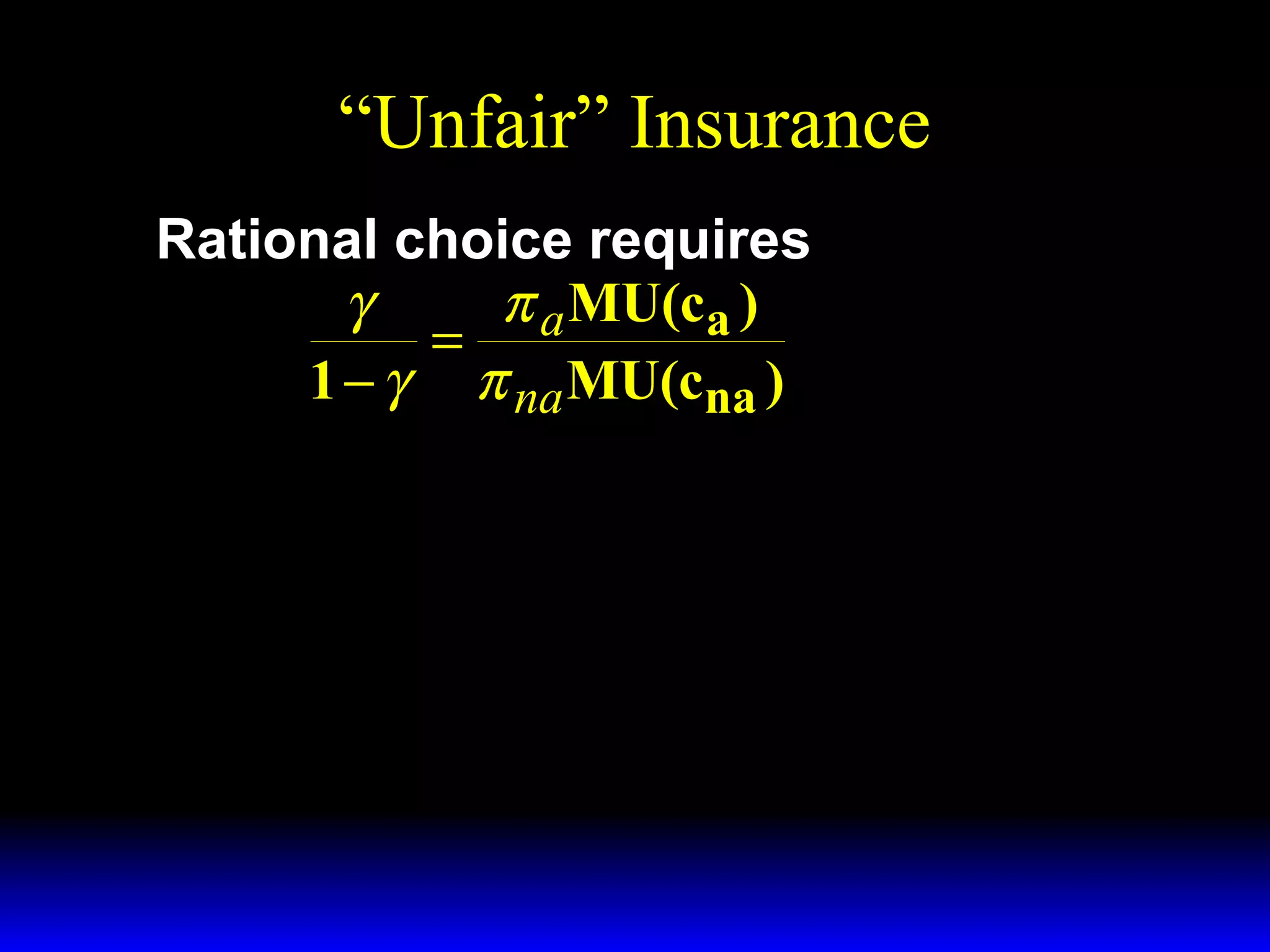

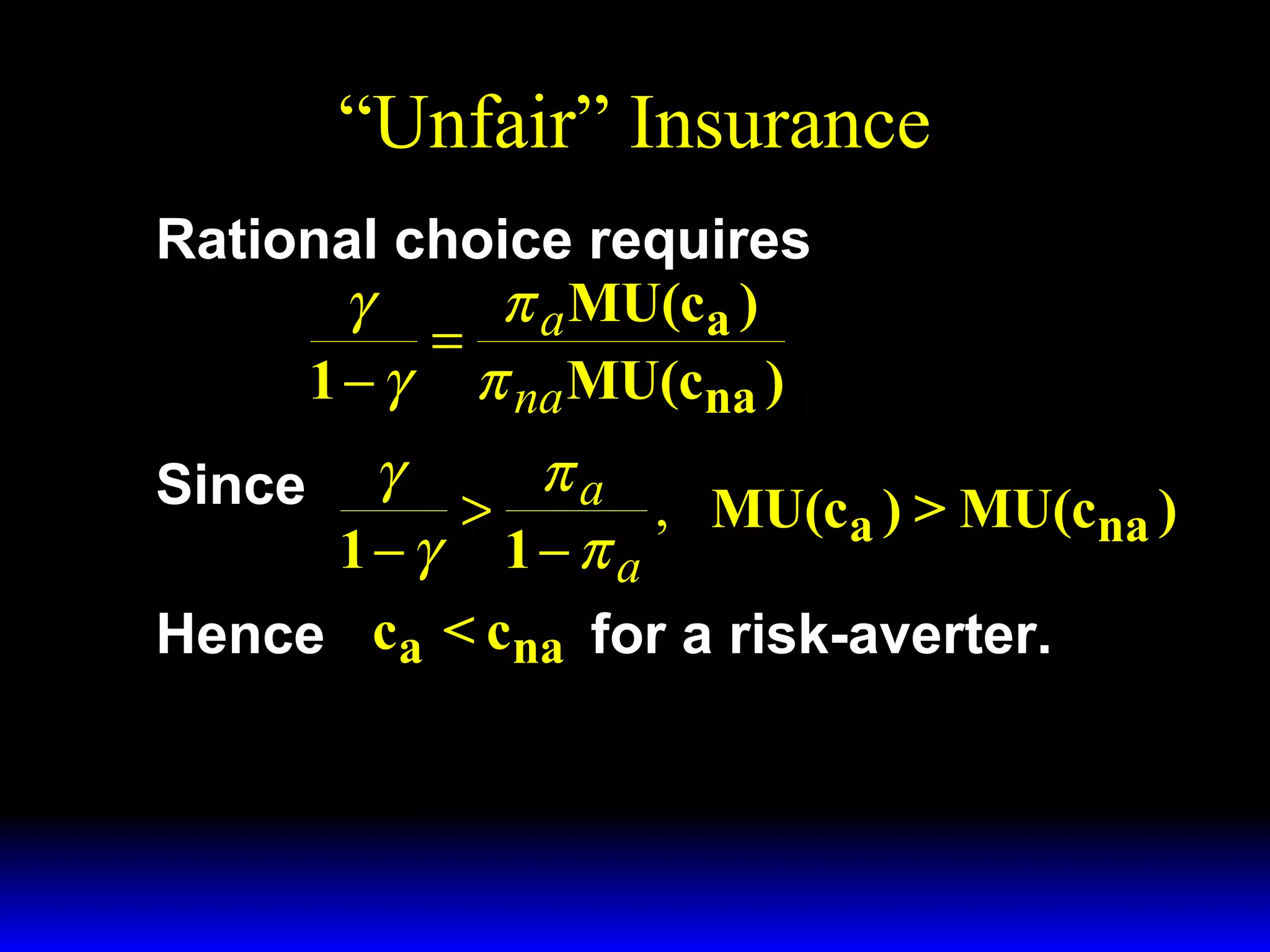

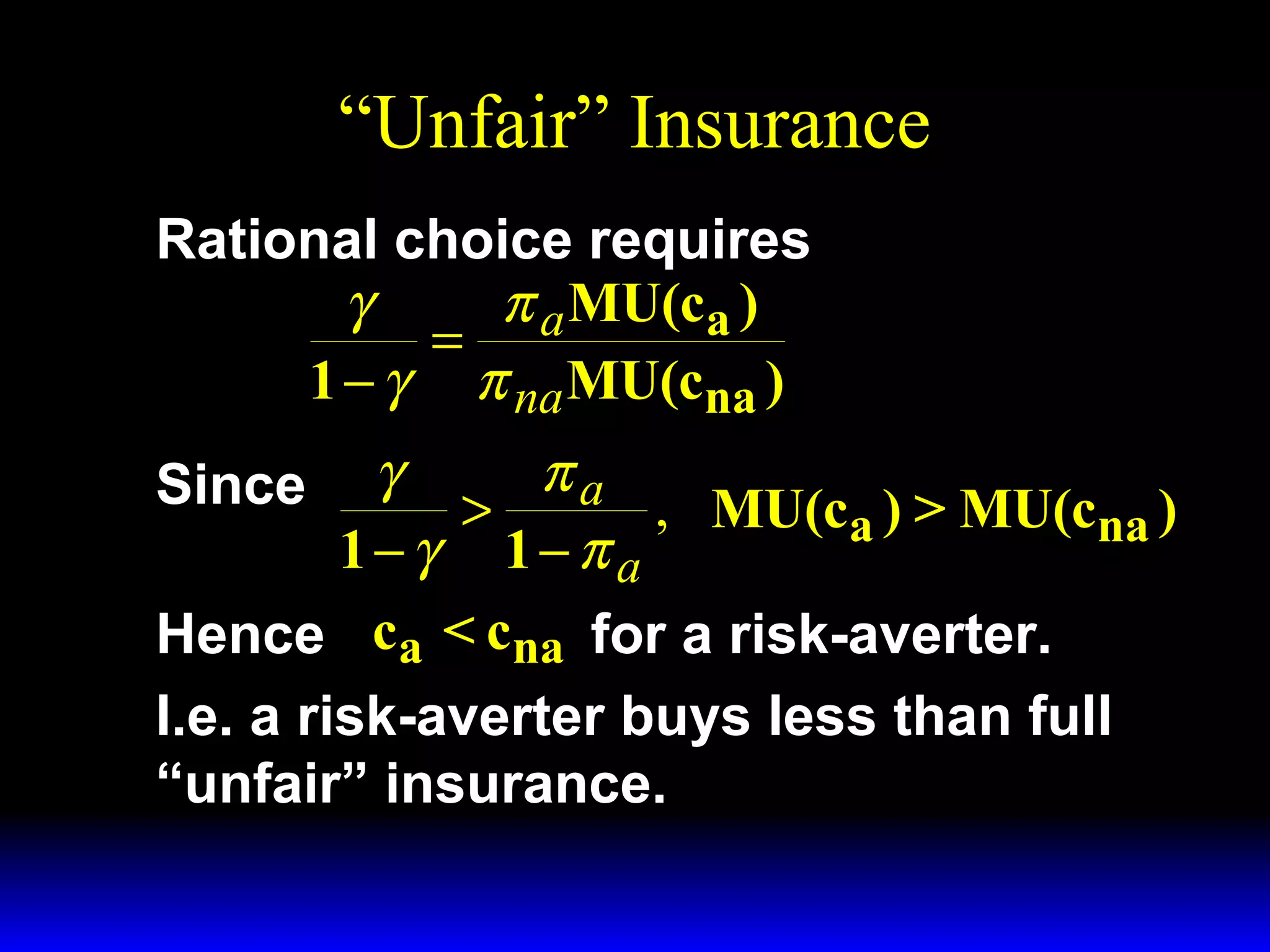

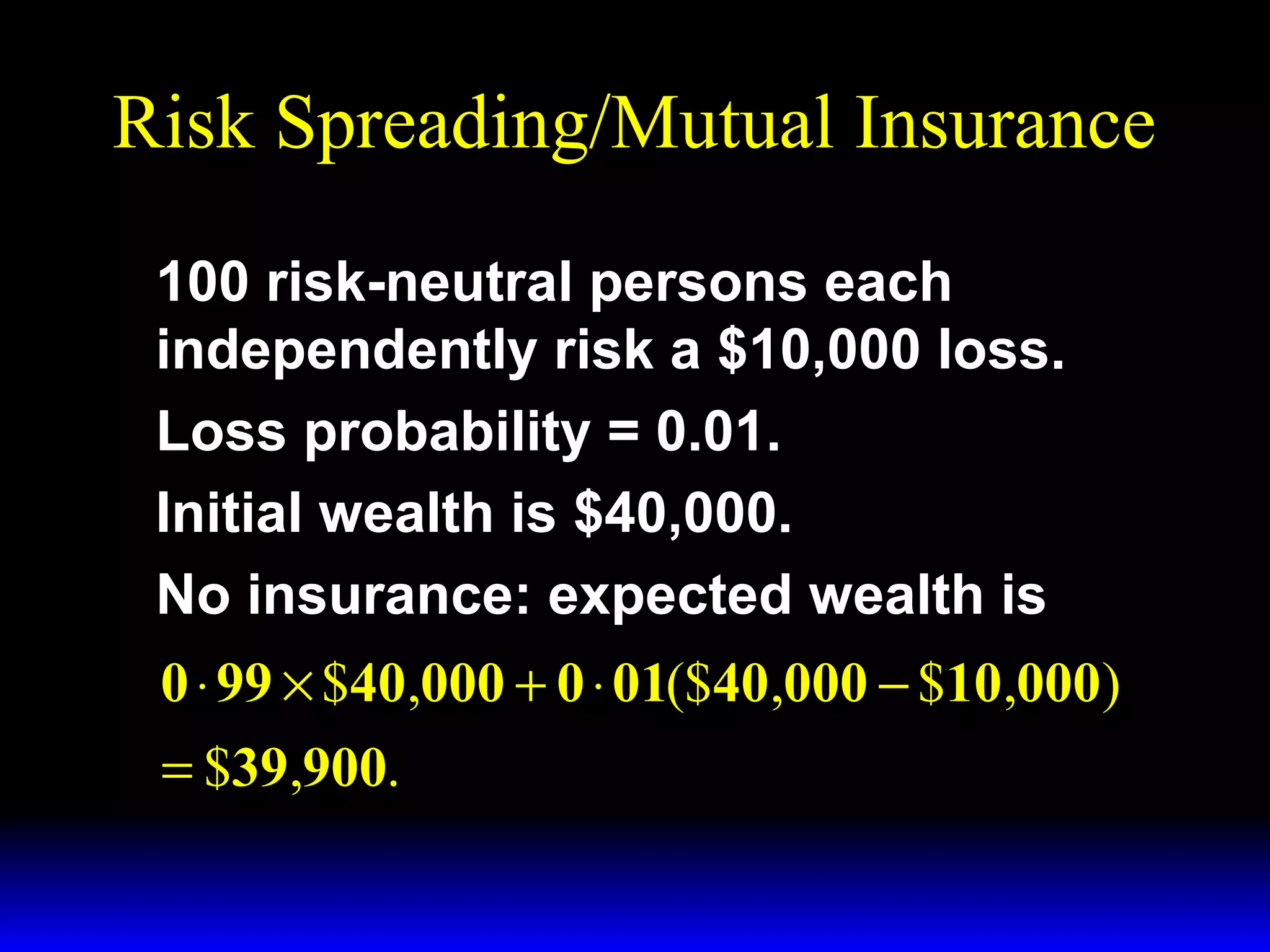

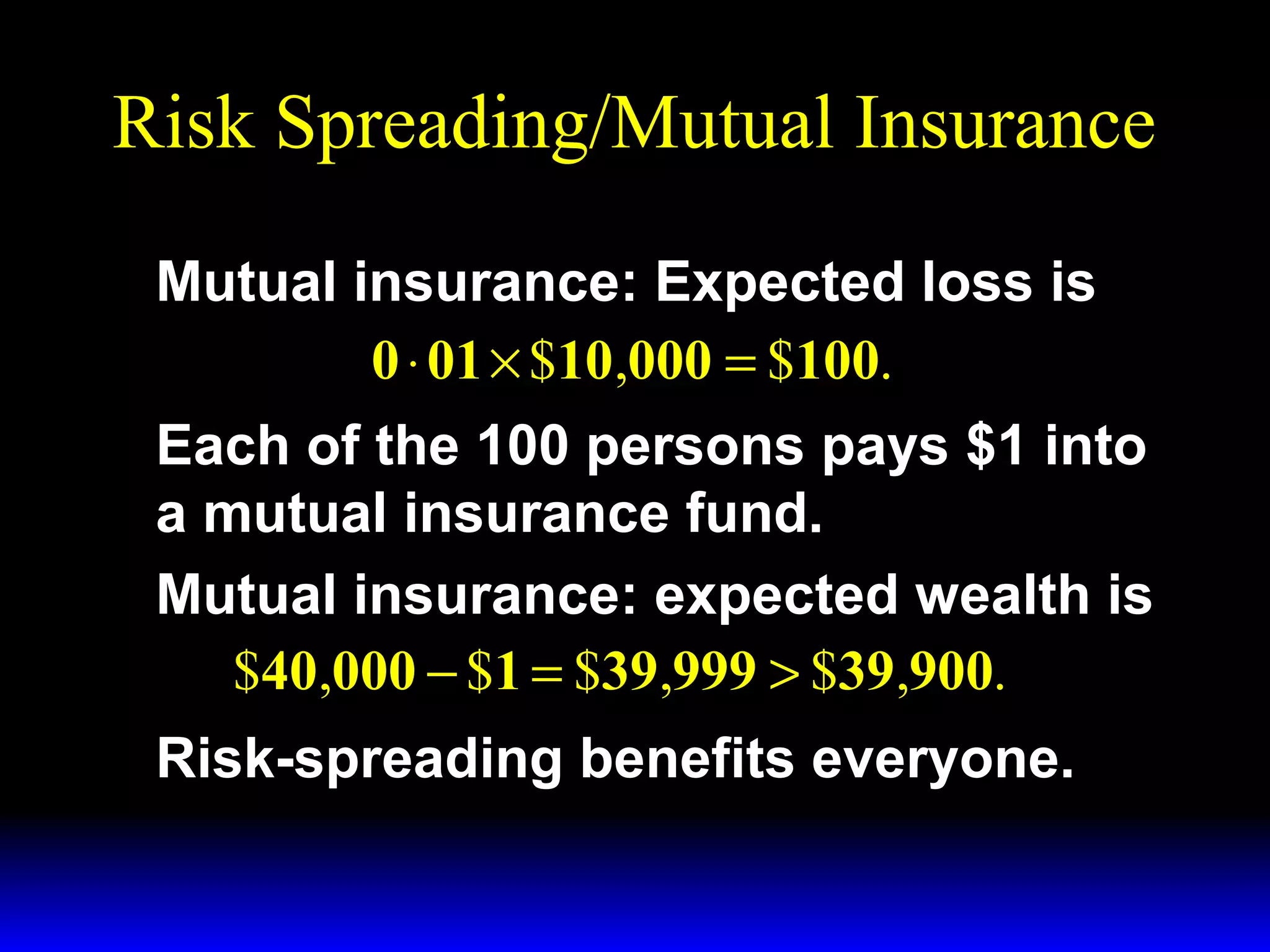

This chapter discusses uncertainty and rational responses to it. It introduces key concepts like states of nature, contingent contracts and consumption plans, and state-contingent budget constraints. Rational agents will choose the most preferred affordable consumption plan from their budget set. Insurance is a common response to reduce the costs of uncertainty. Competitive insurance leads to "fair" prices where risk-averse agents buy full insurance. Diversification and mutual insurance are other ways to manage risk.