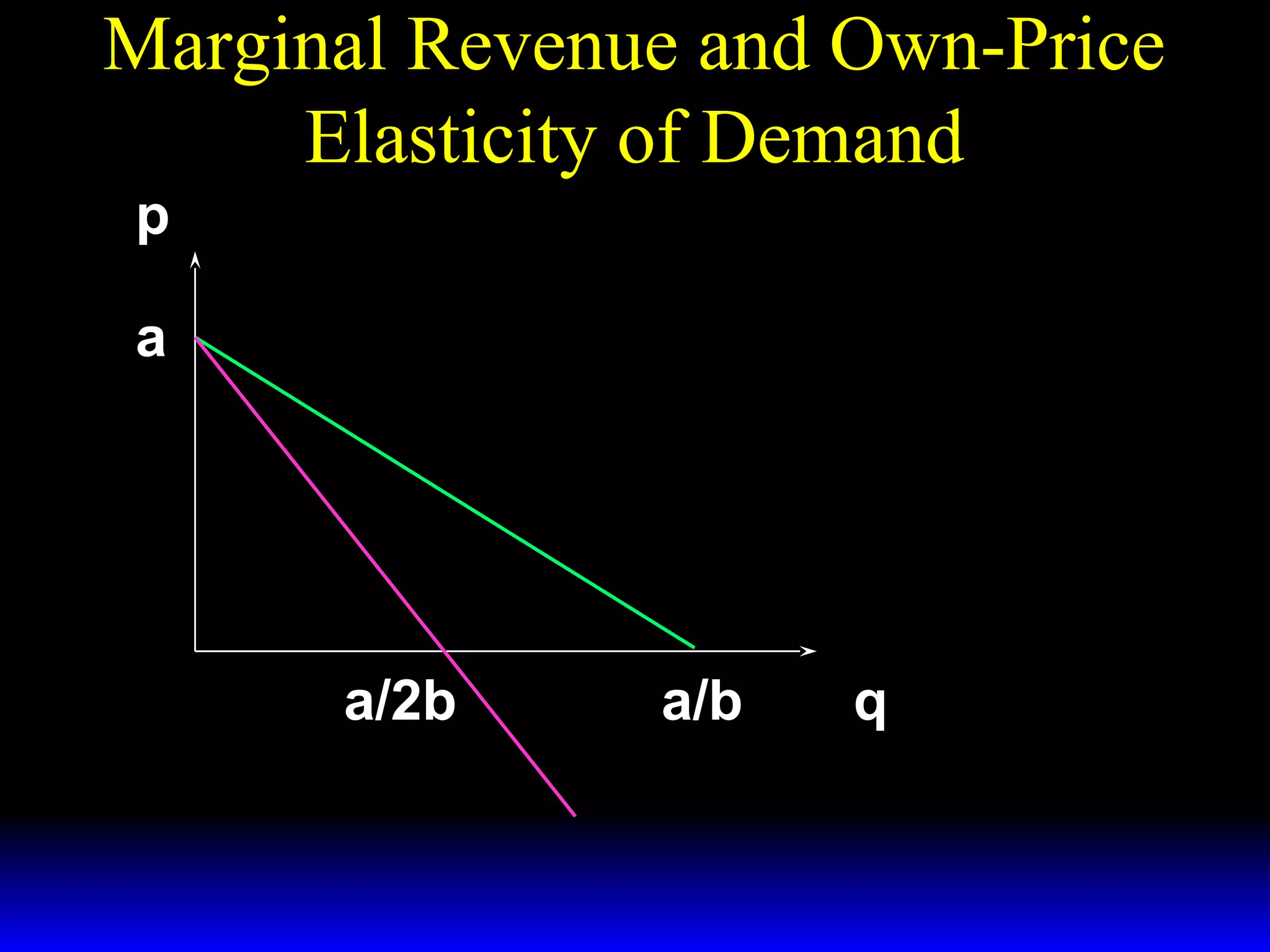

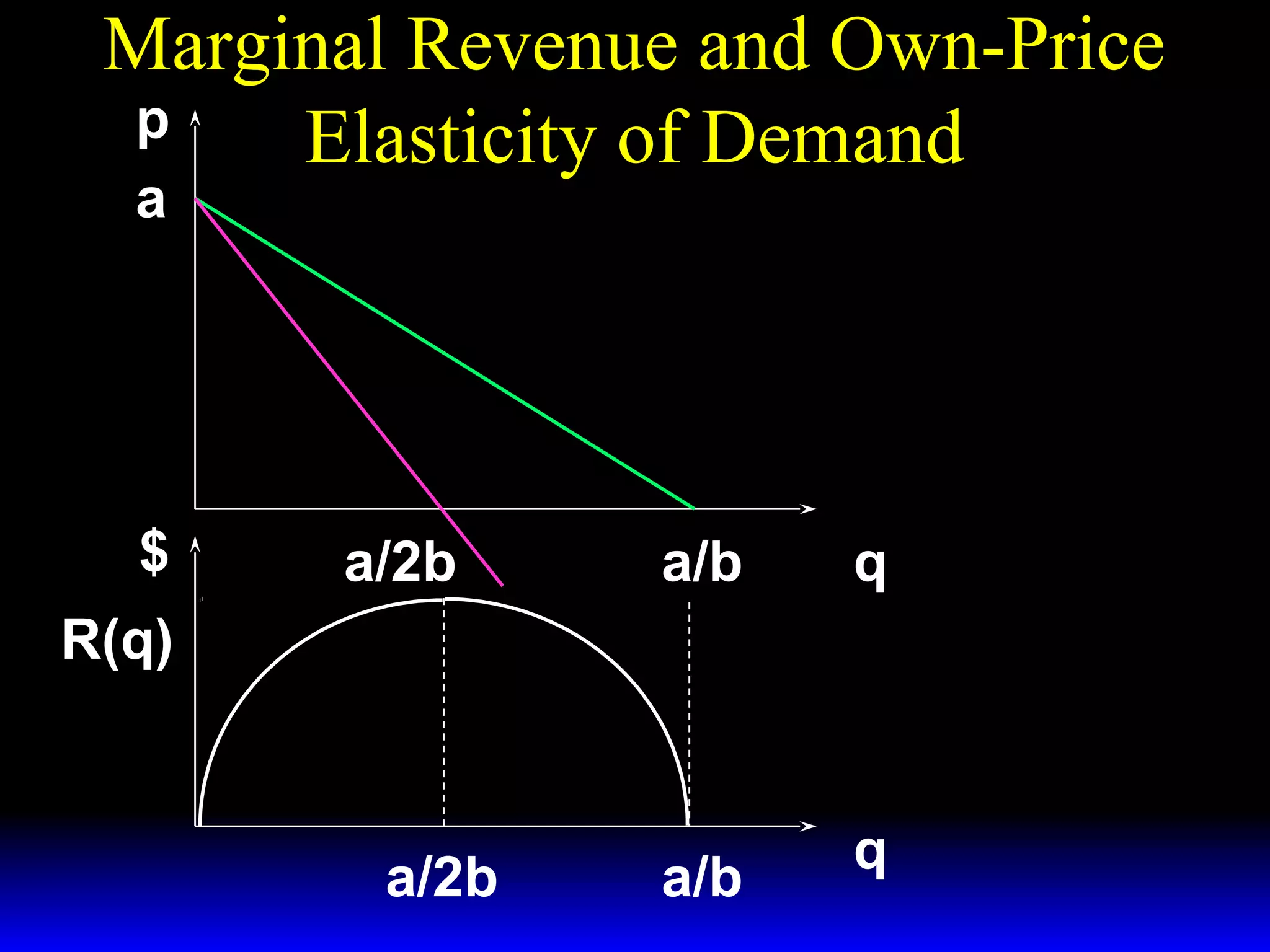

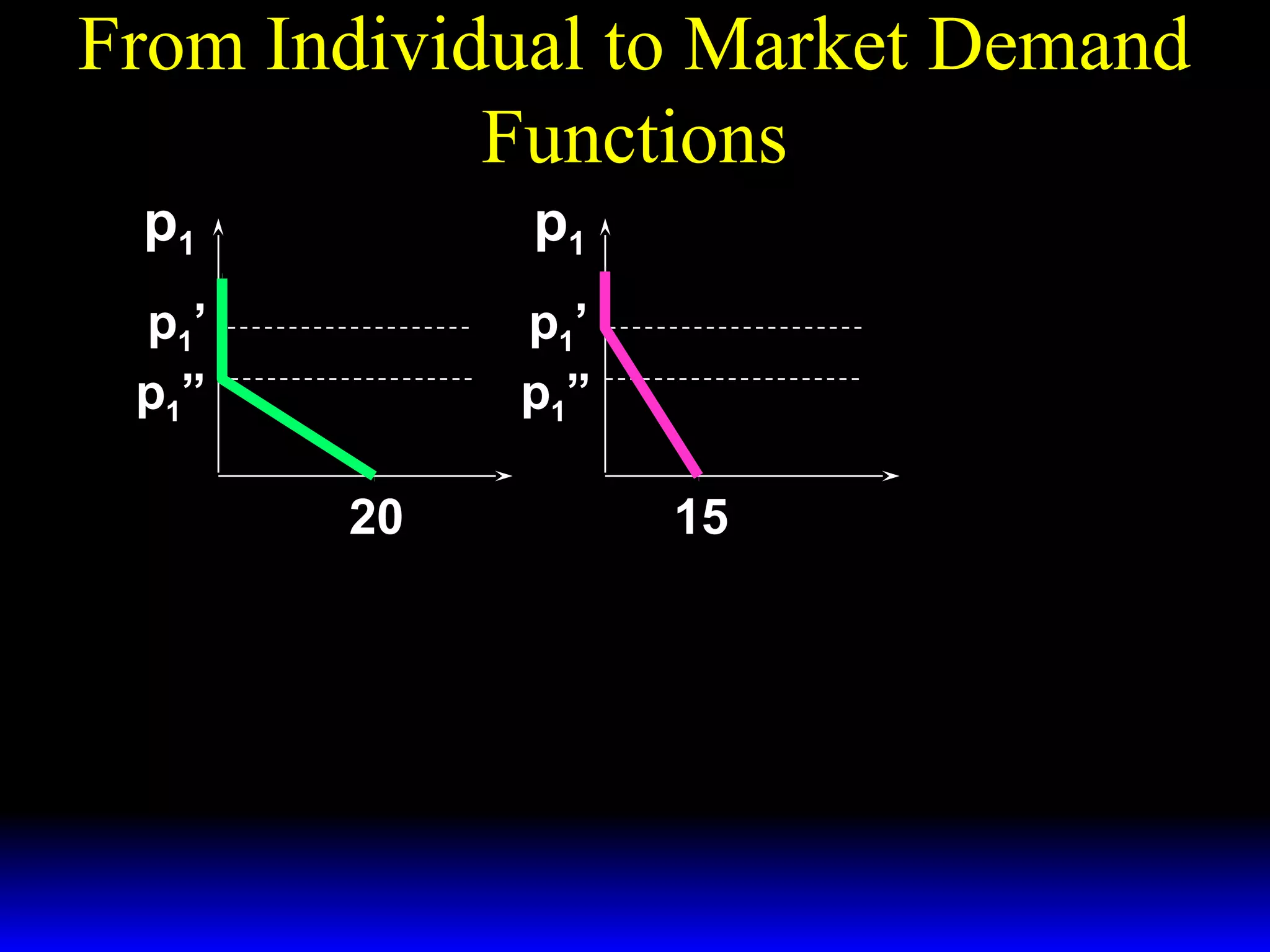

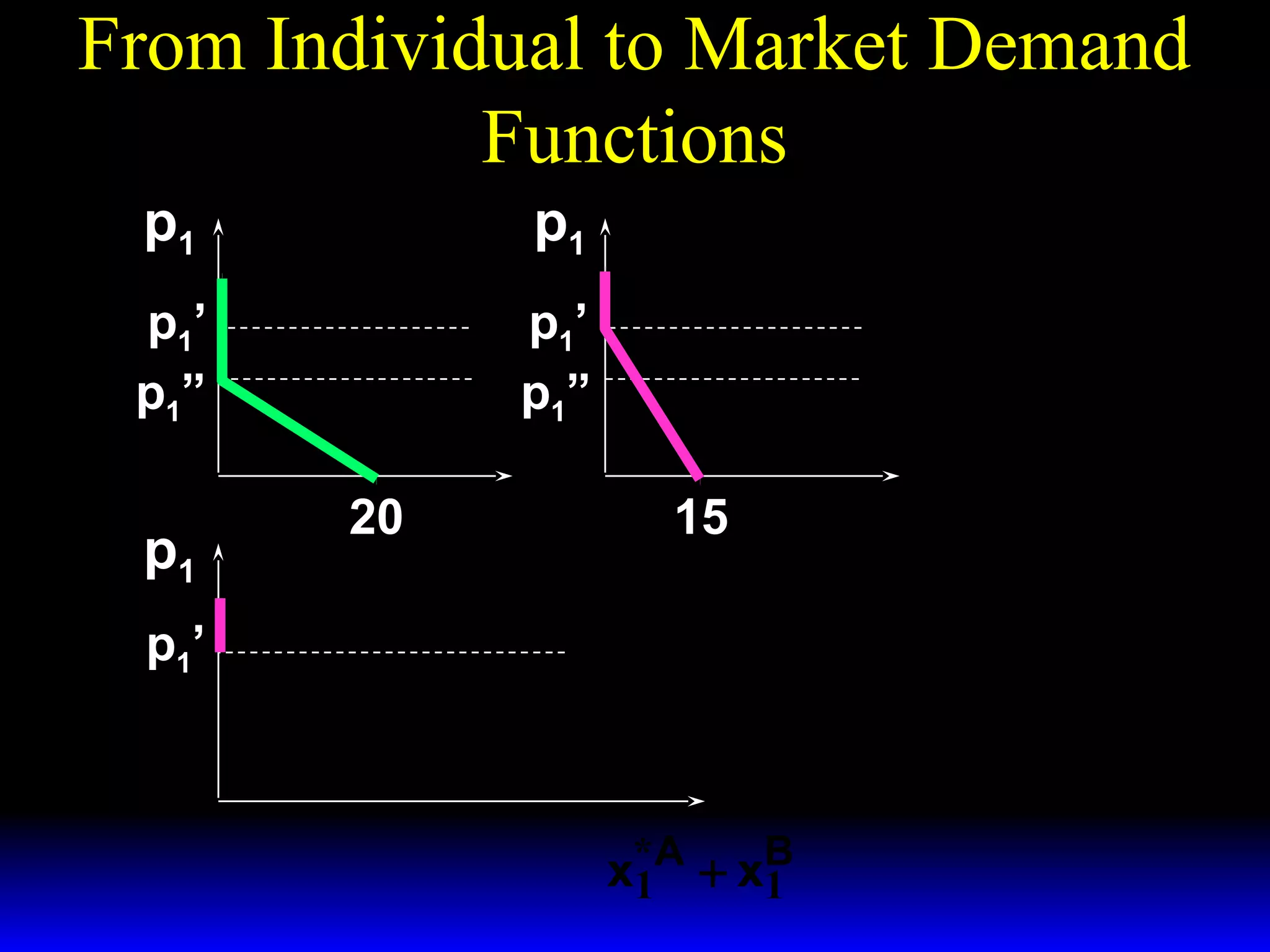

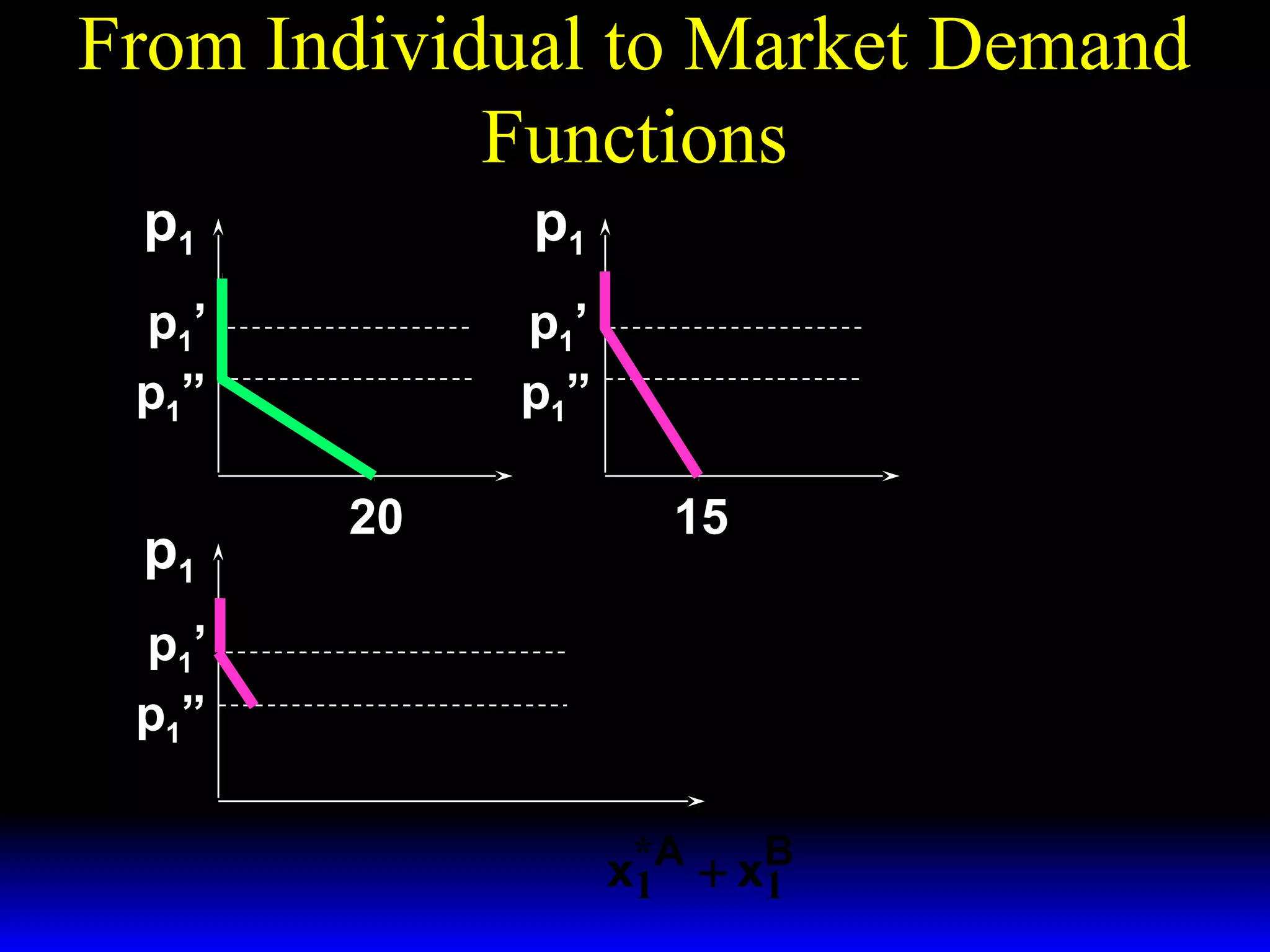

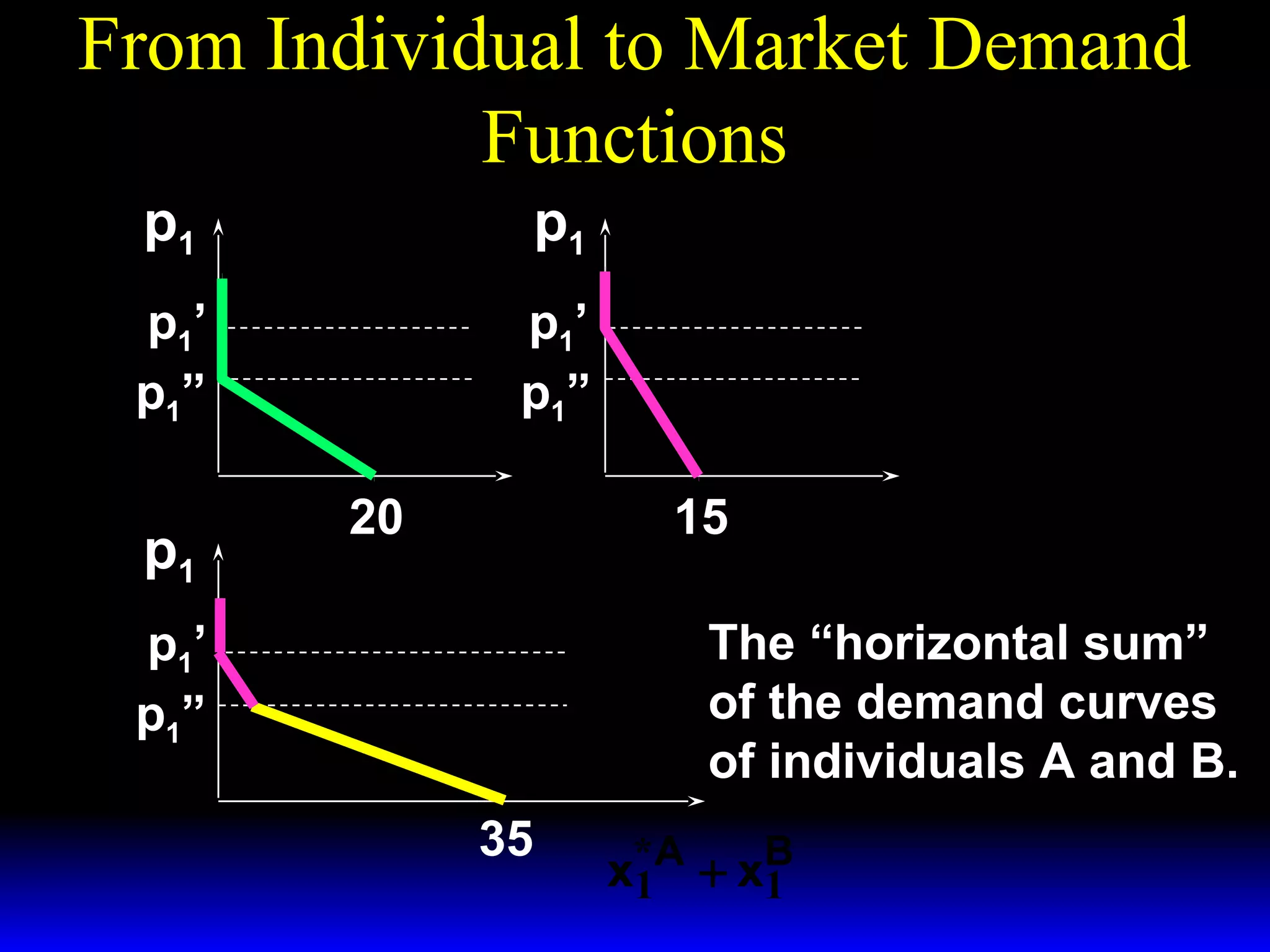

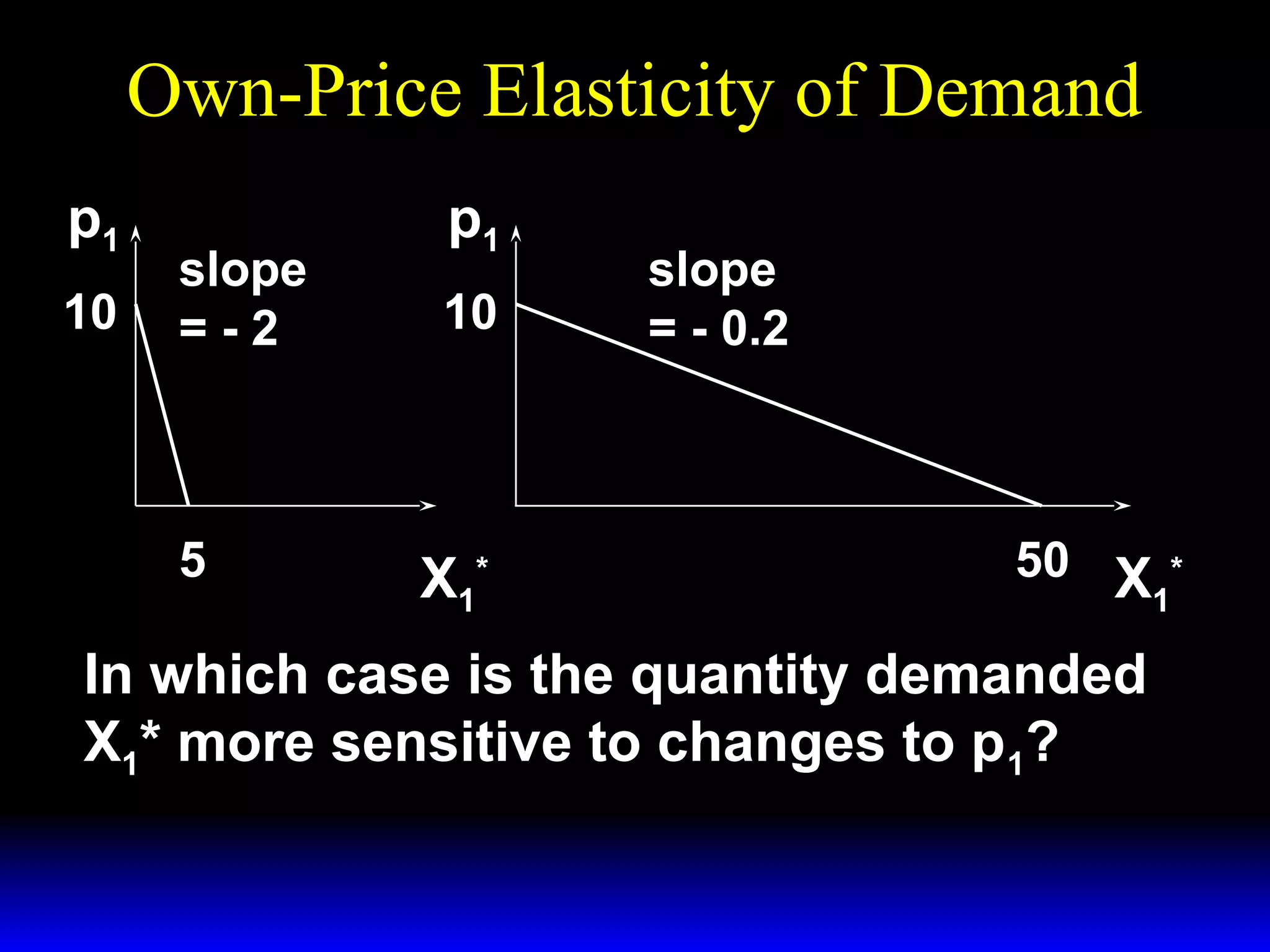

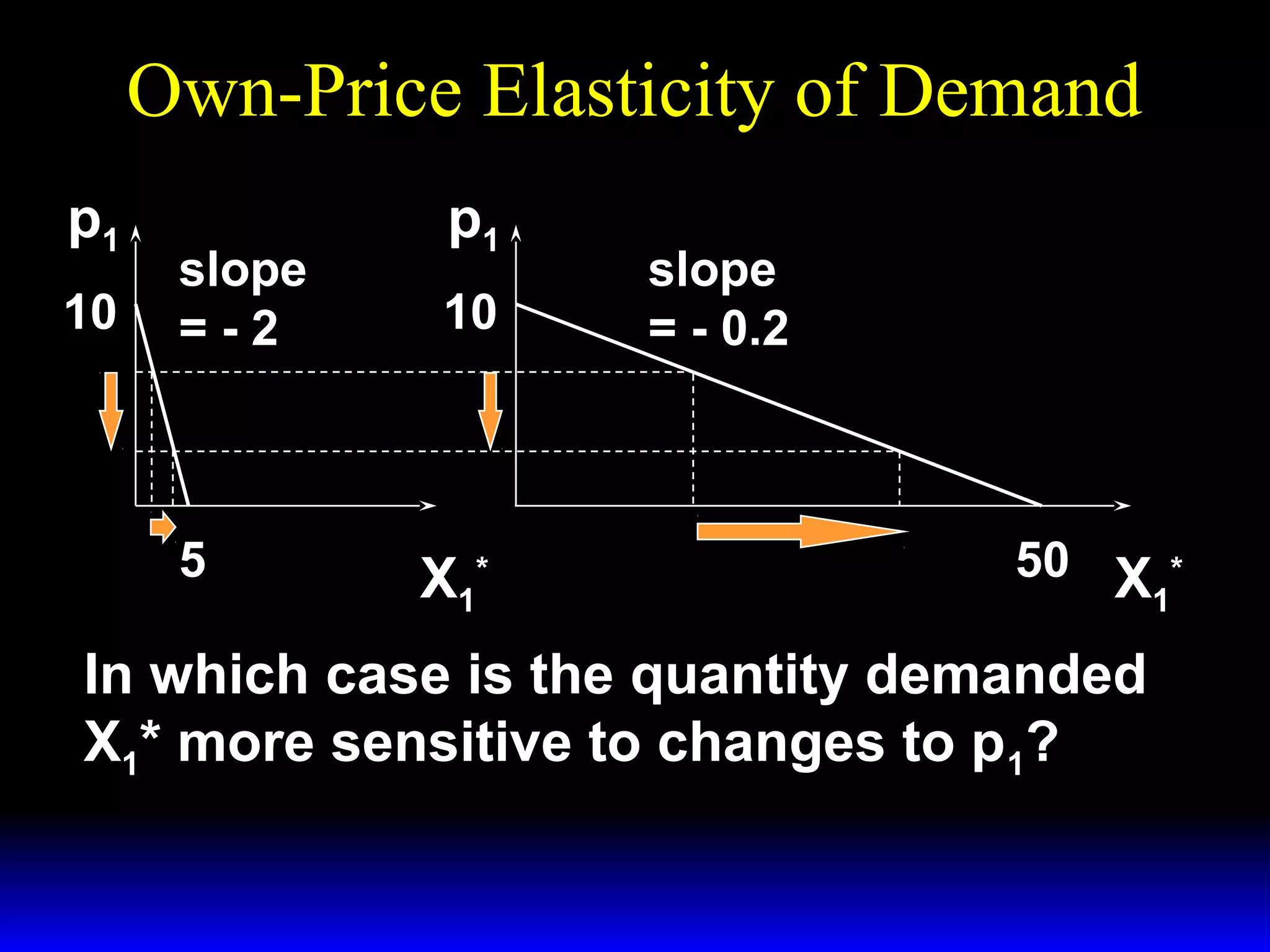

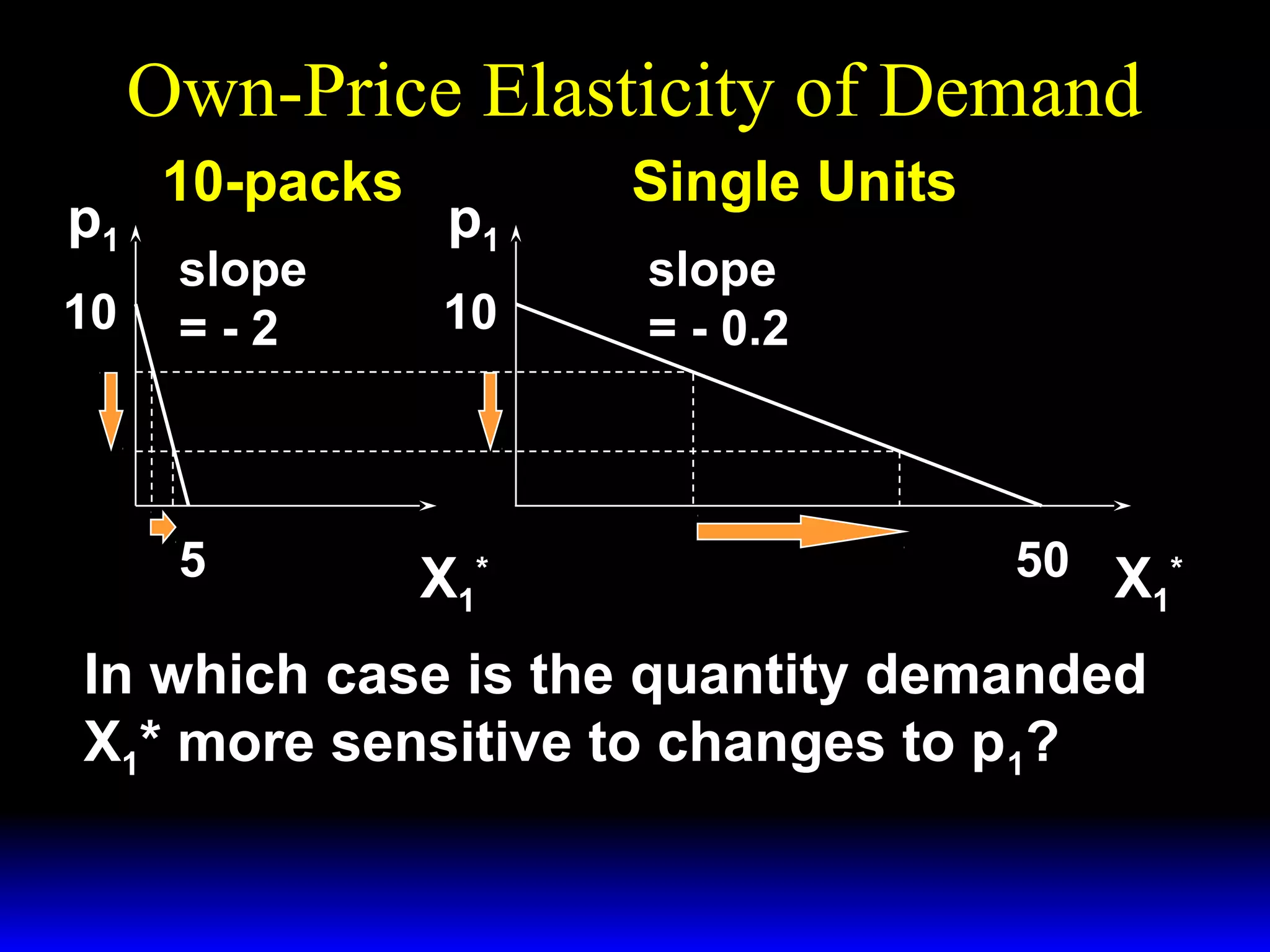

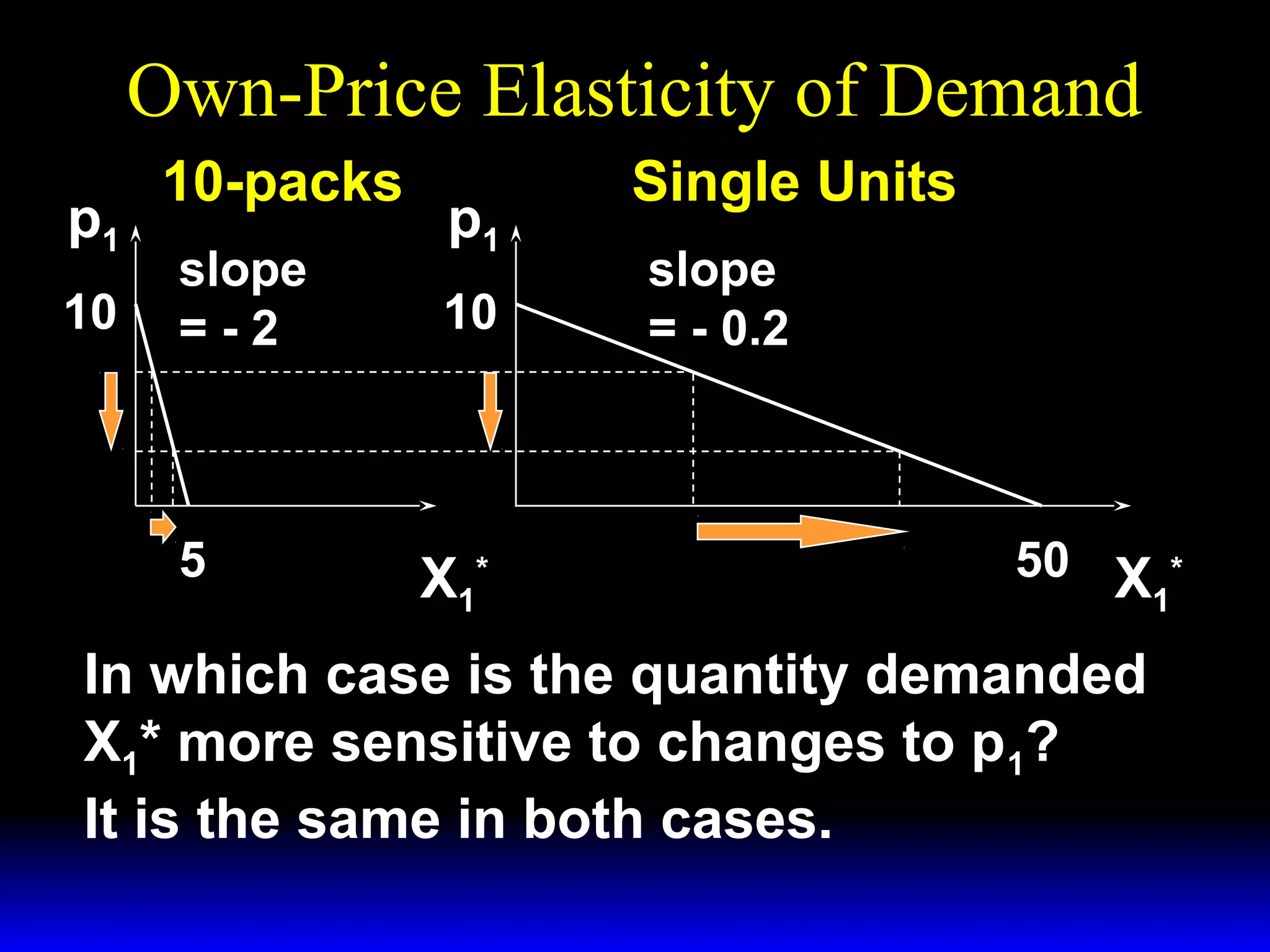

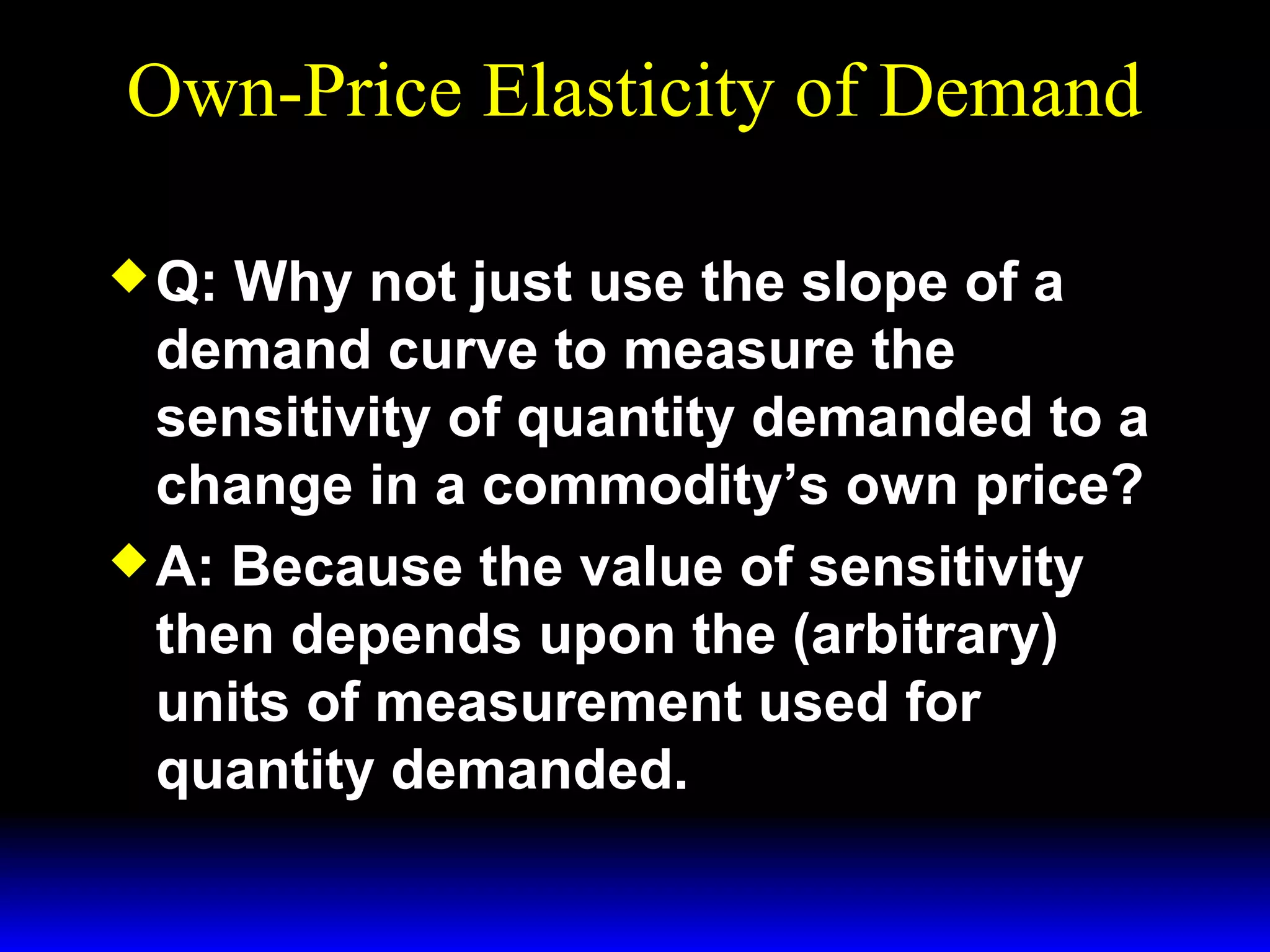

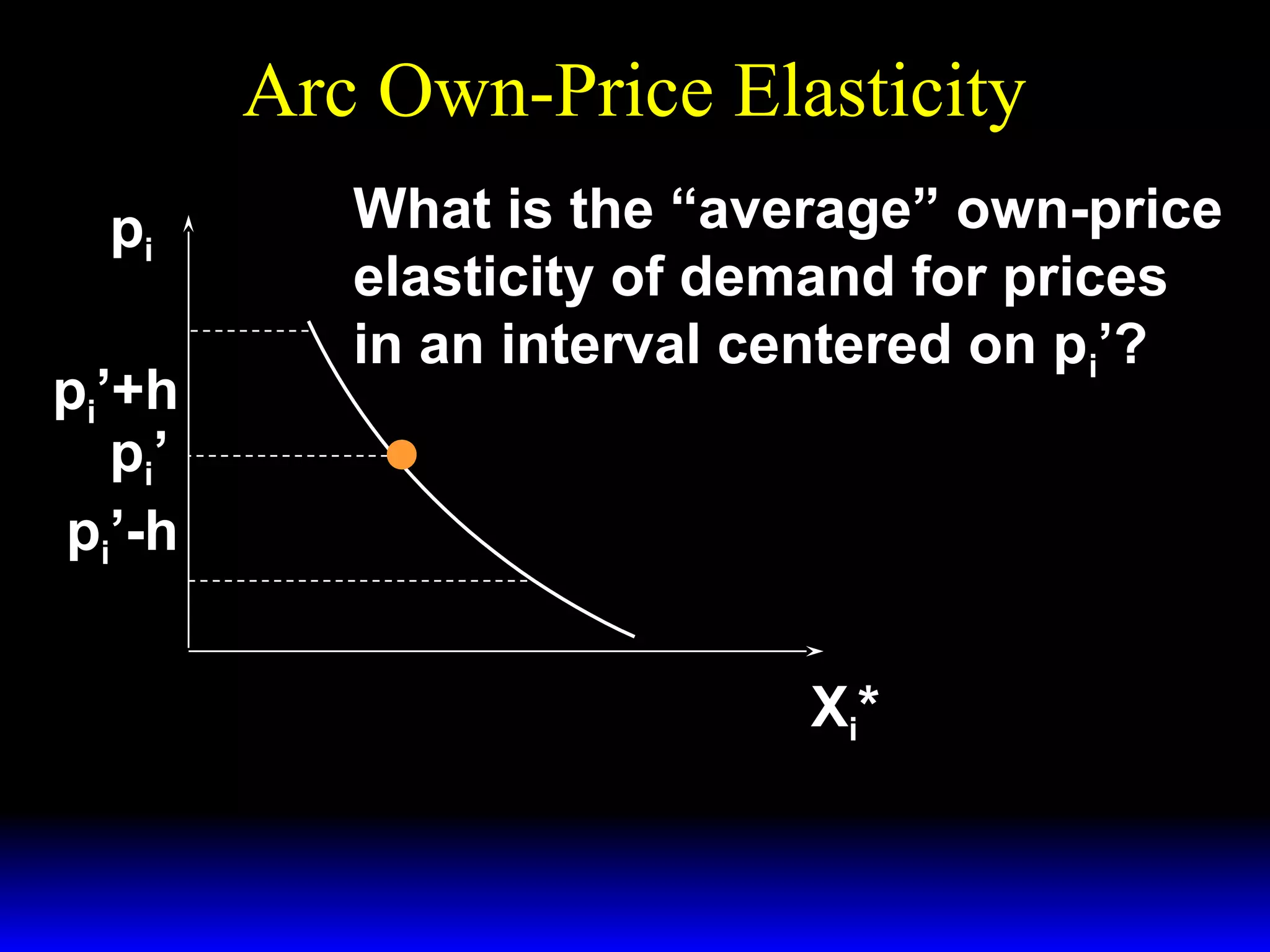

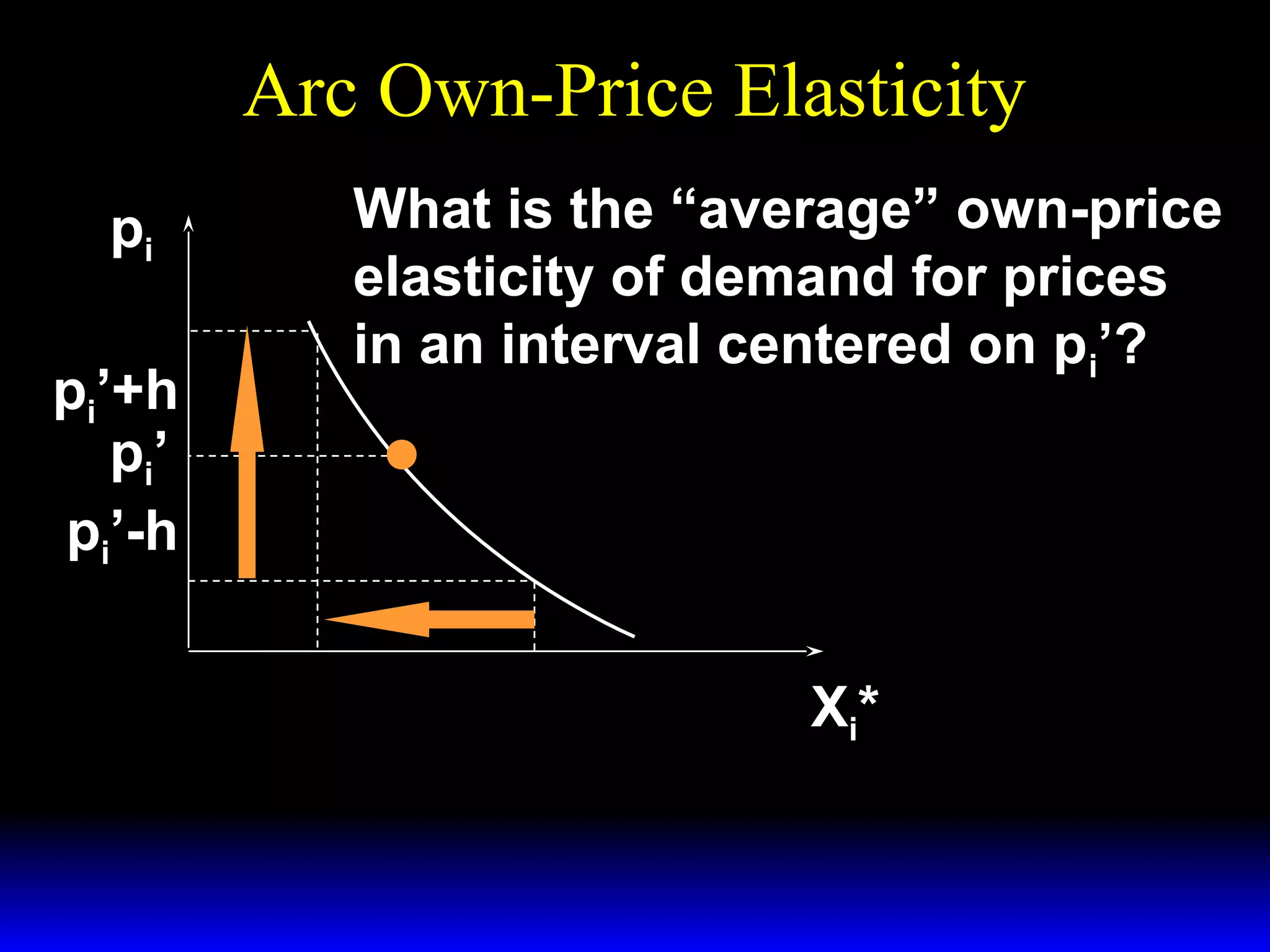

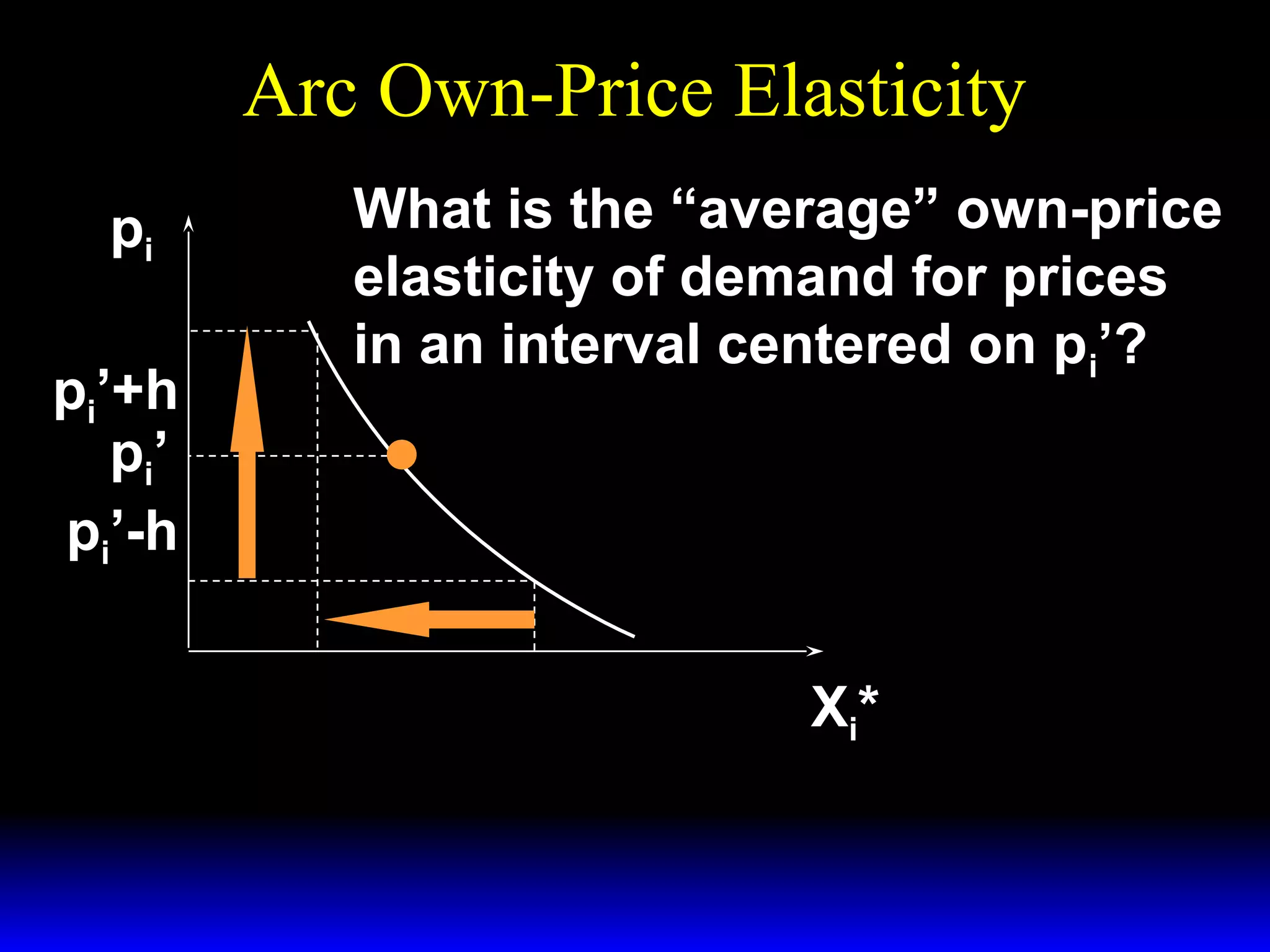

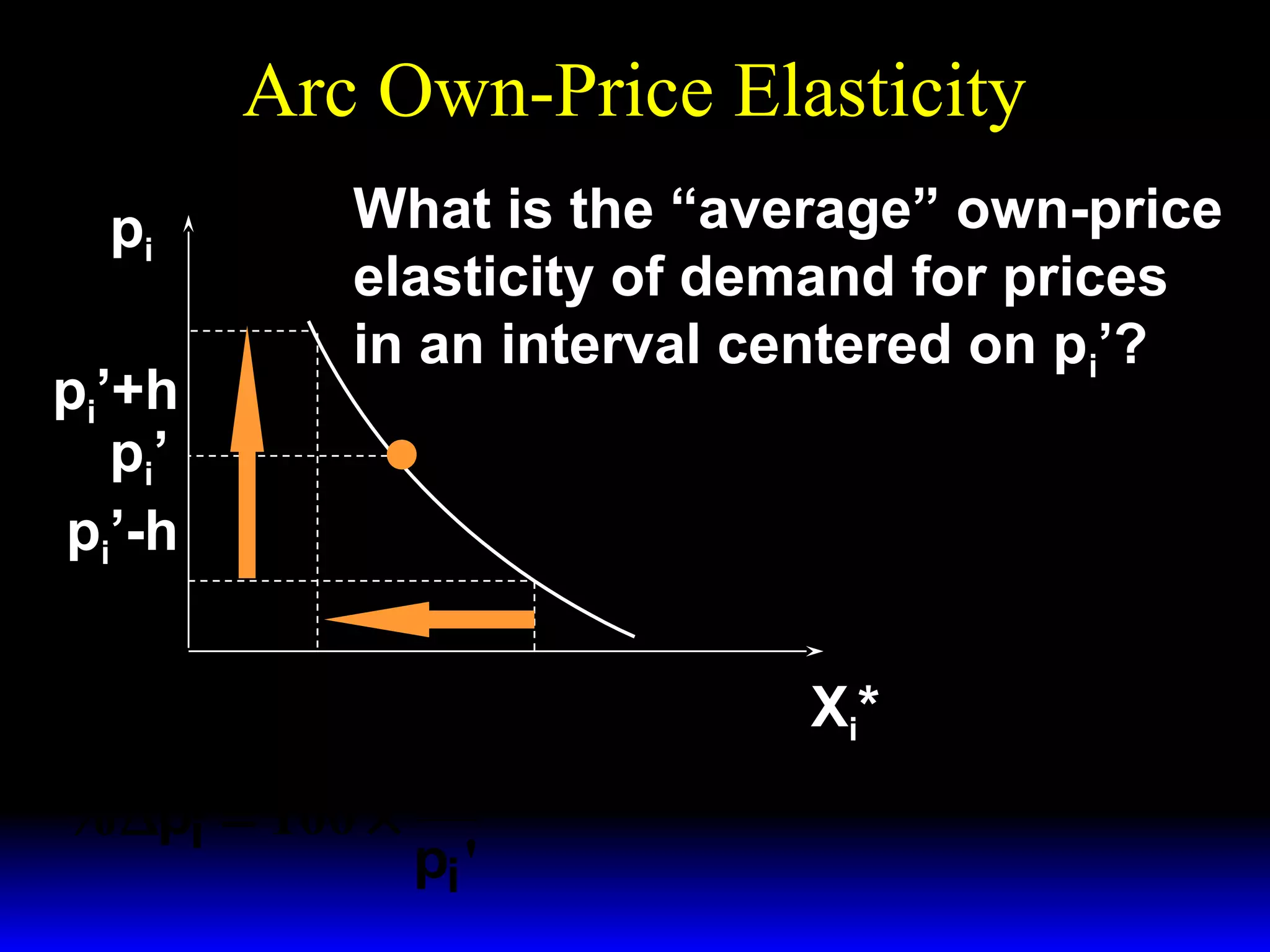

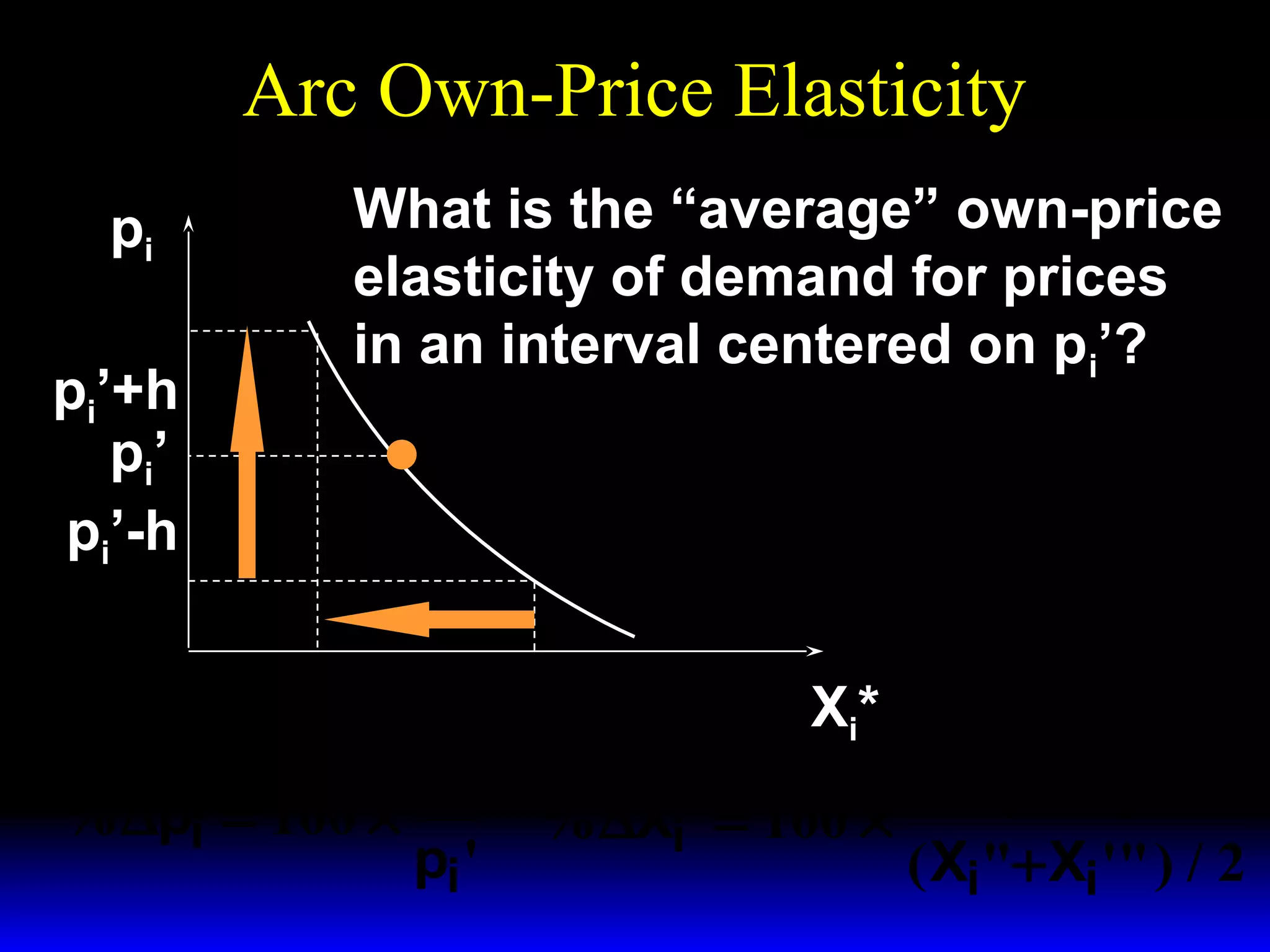

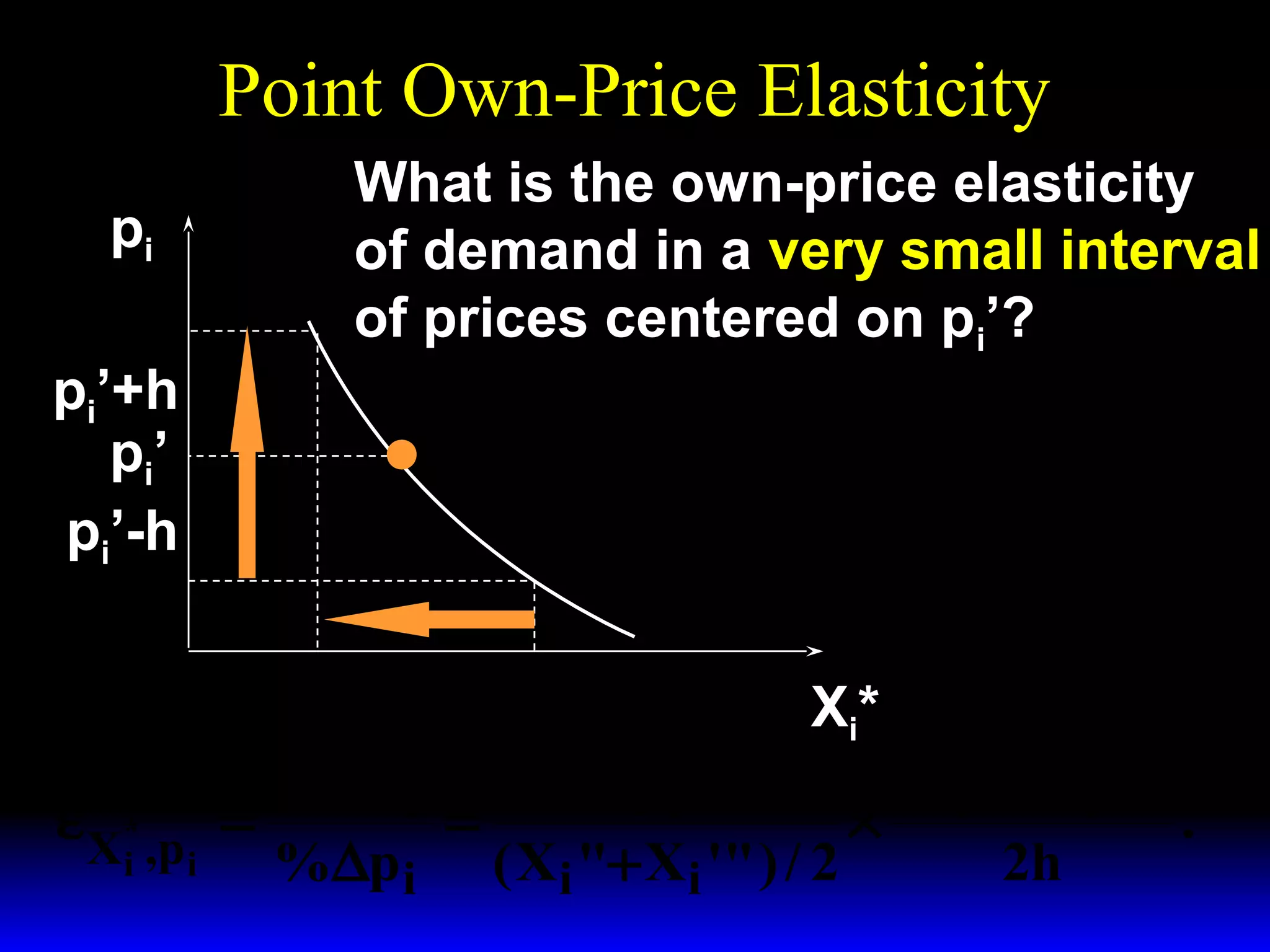

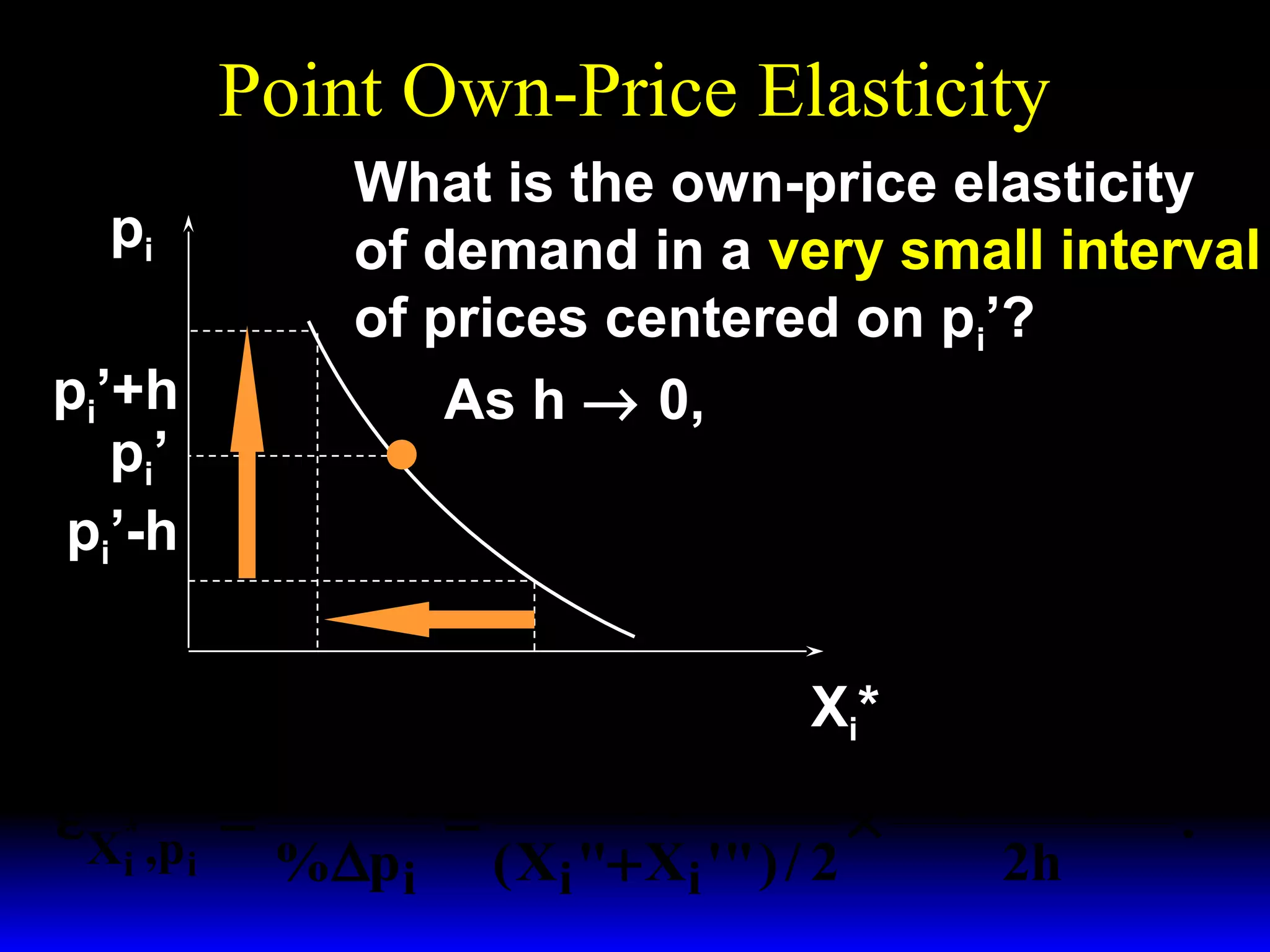

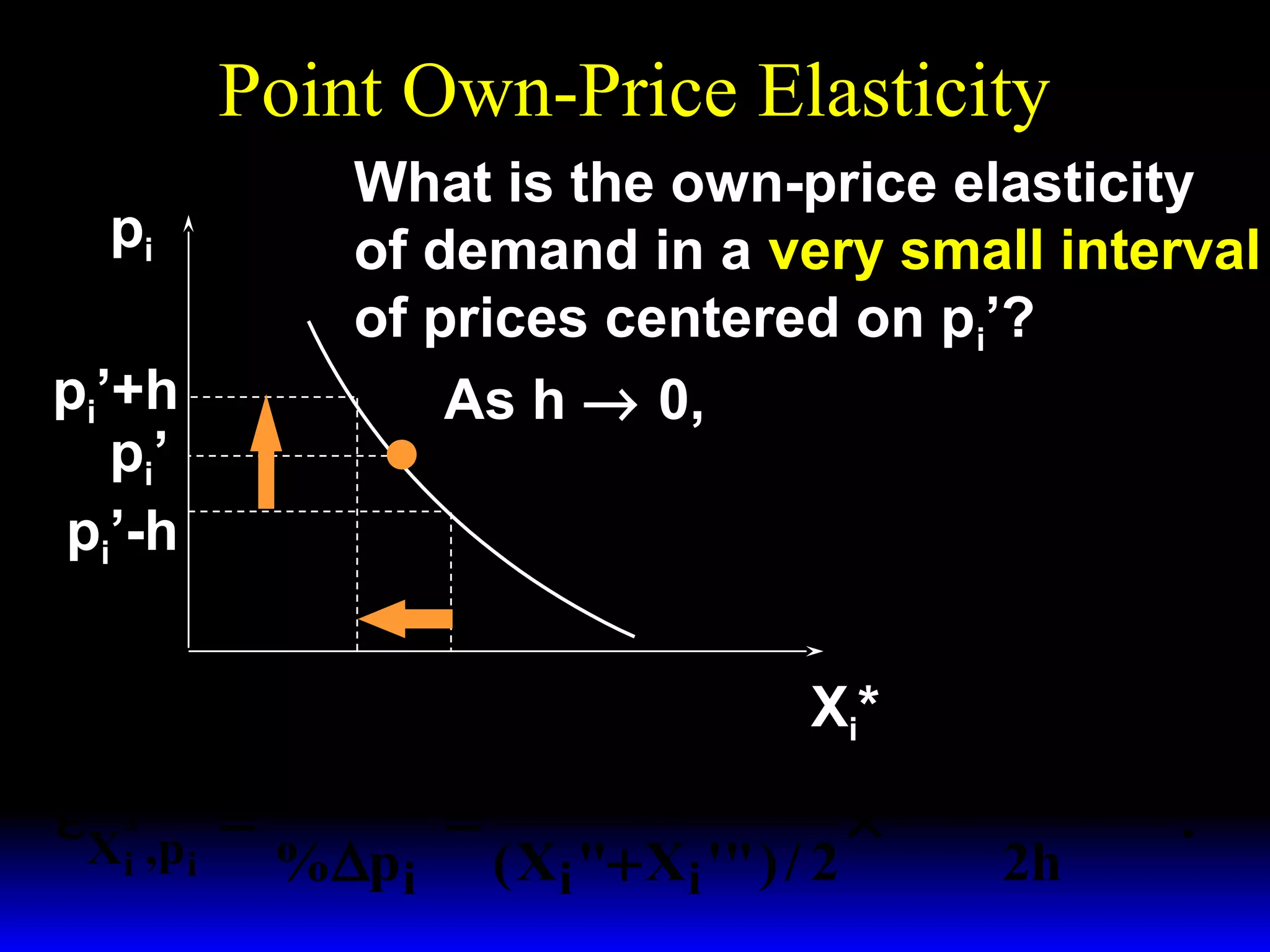

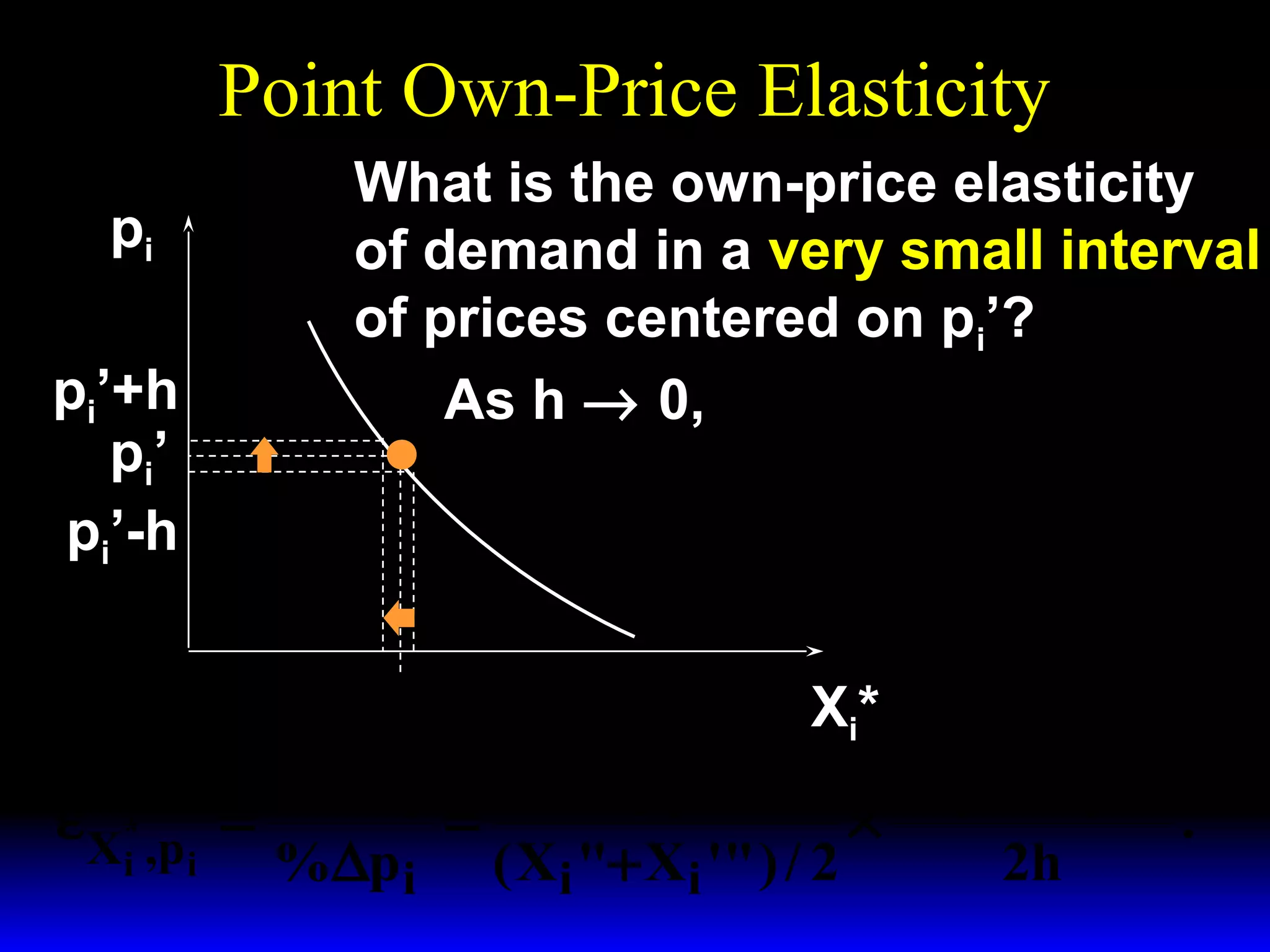

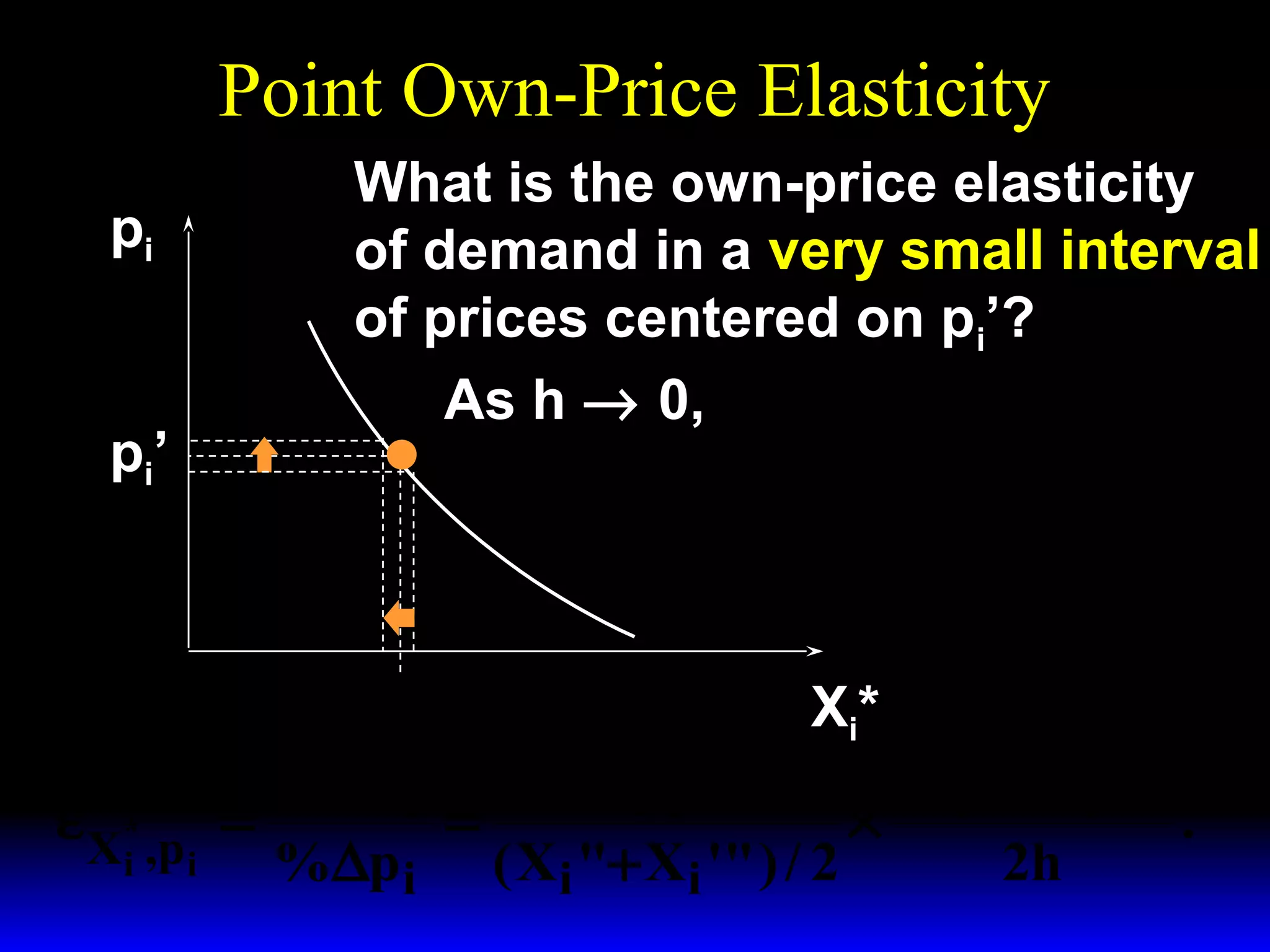

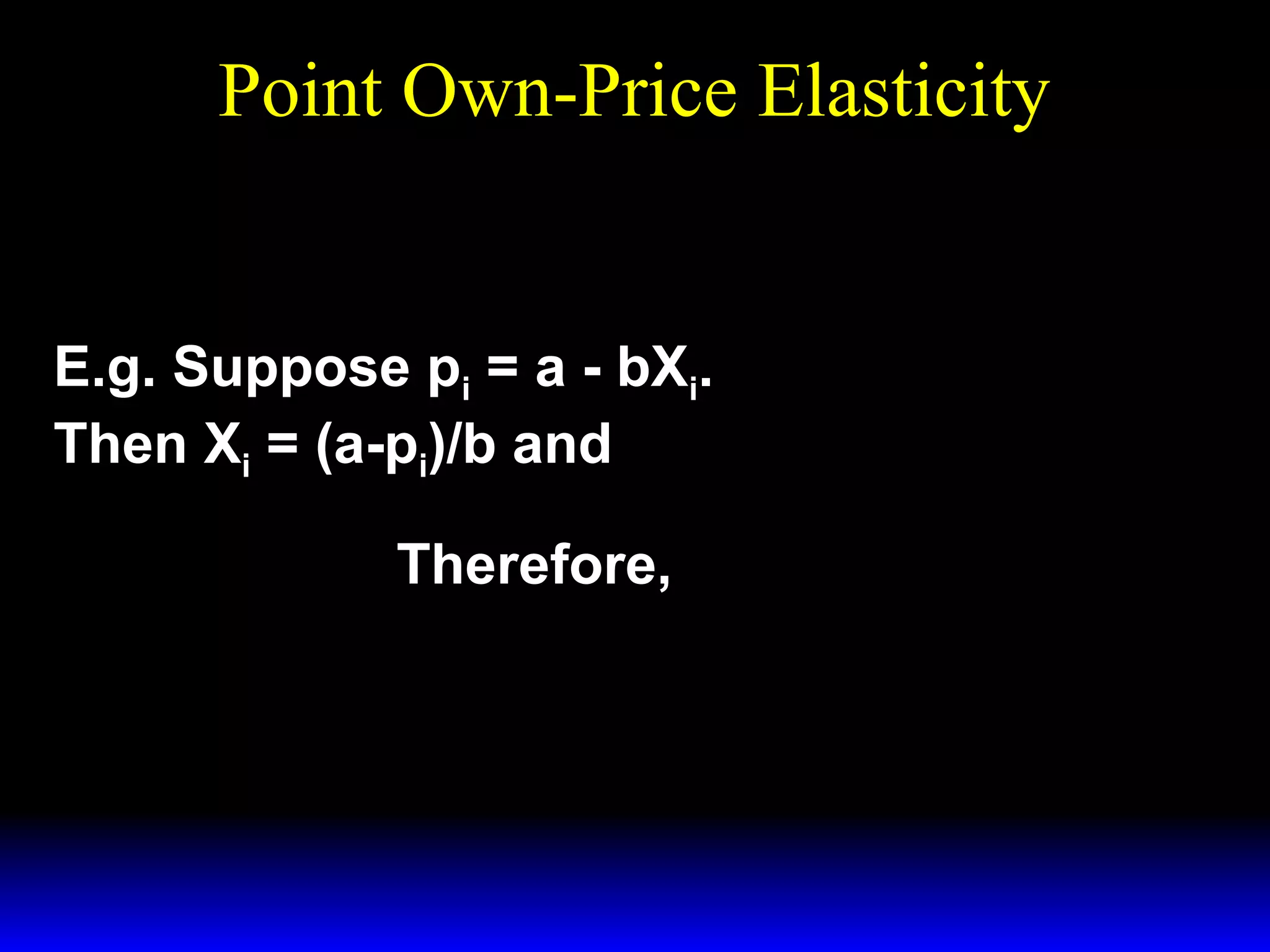

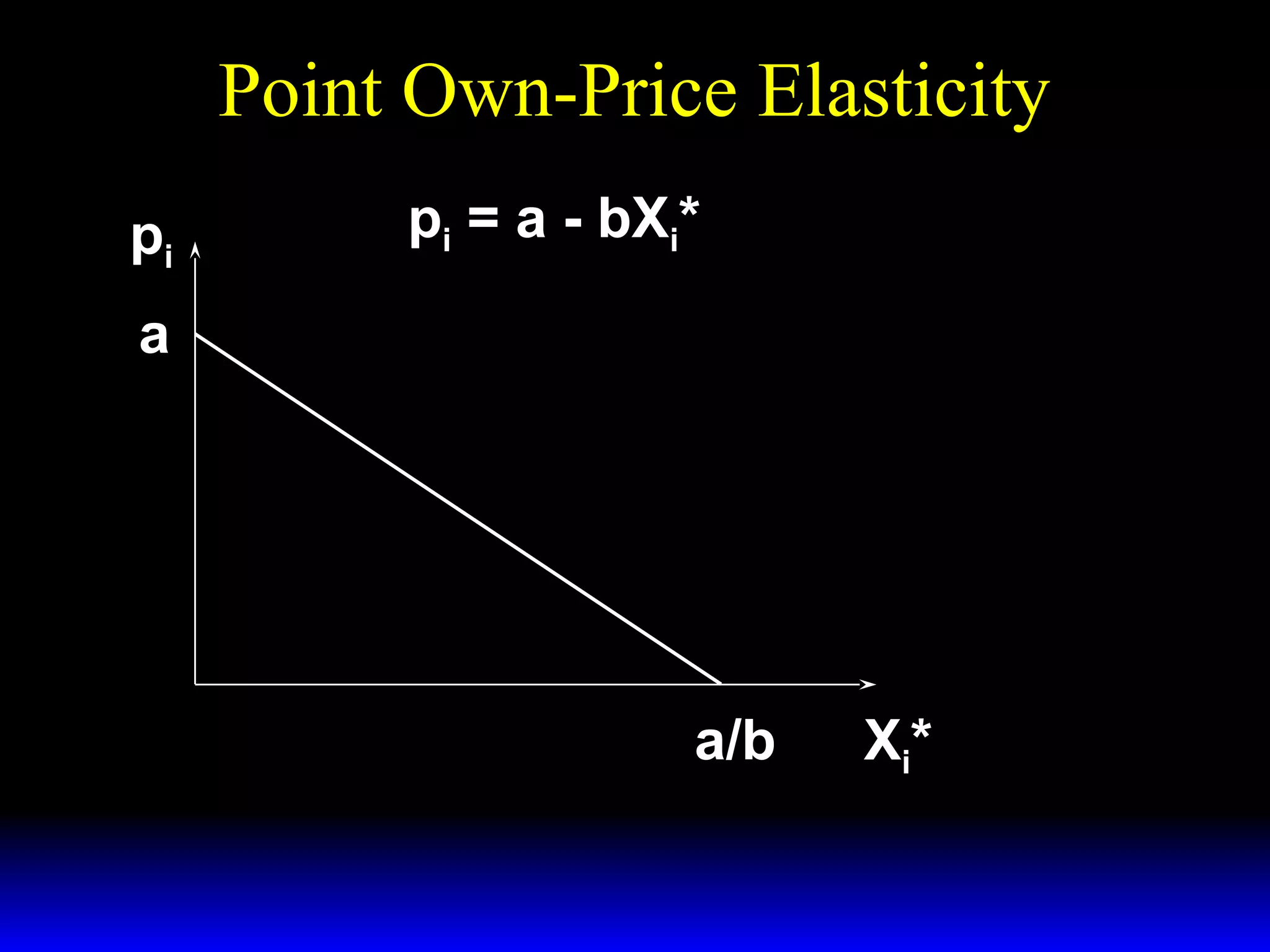

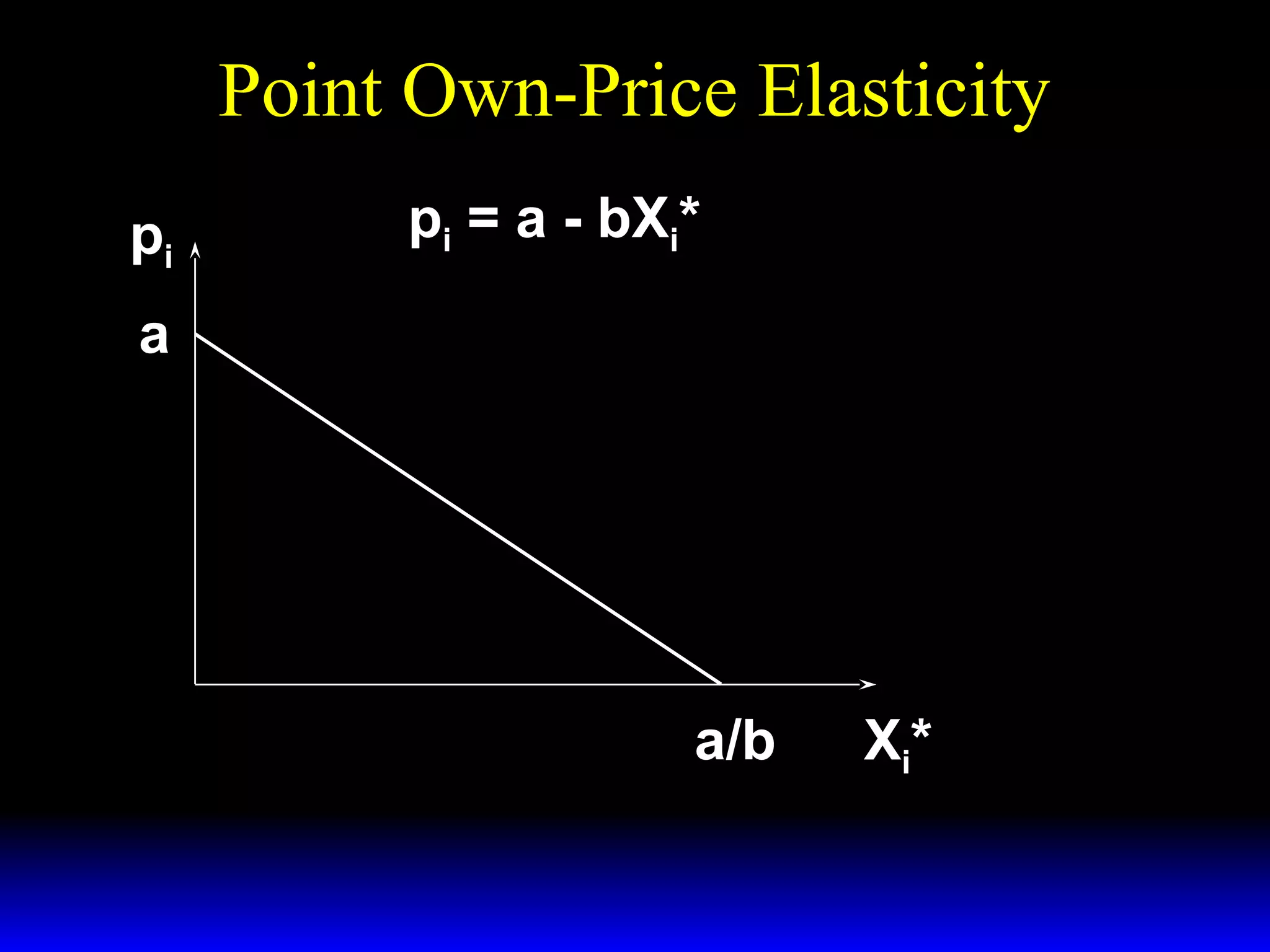

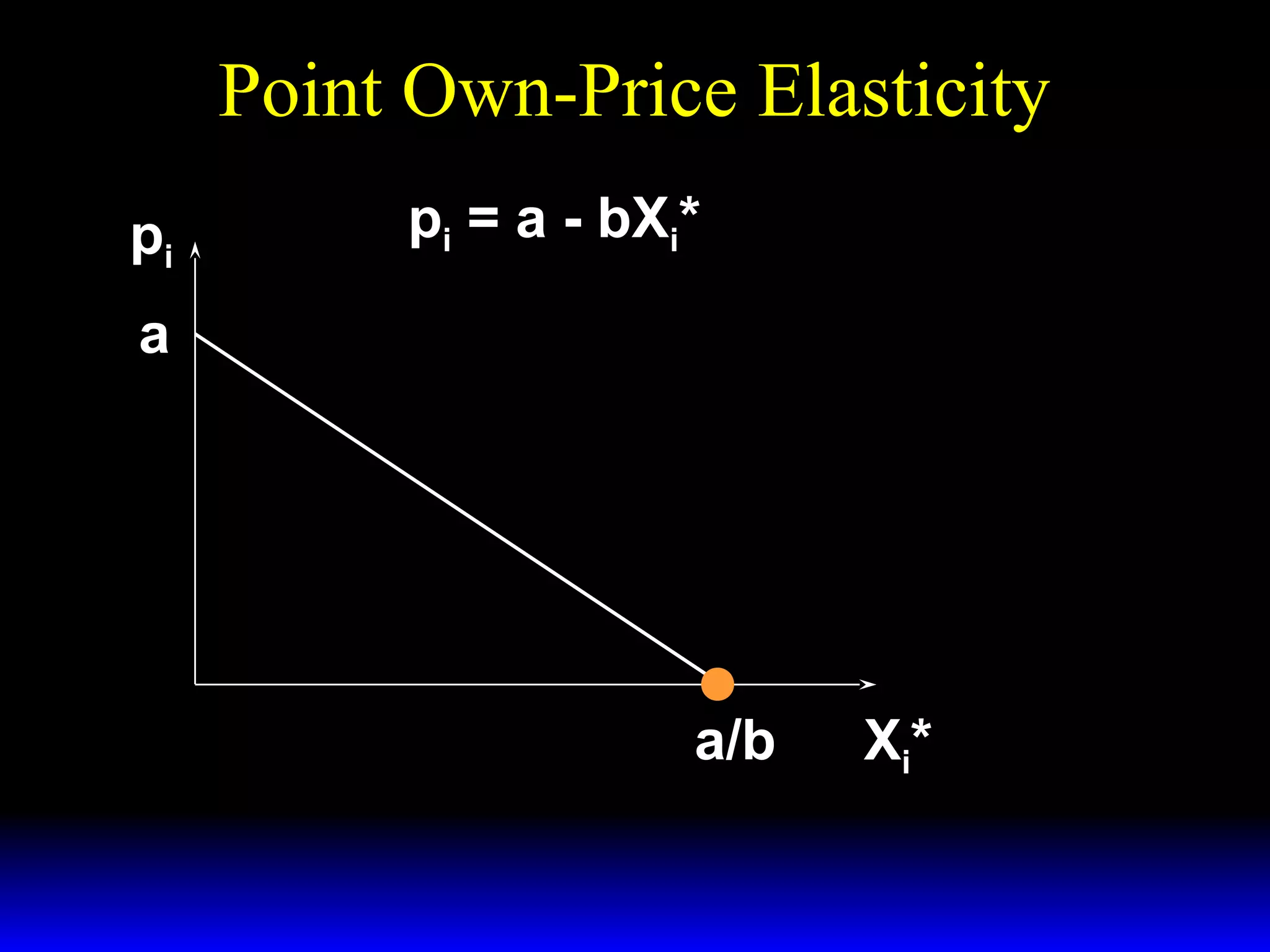

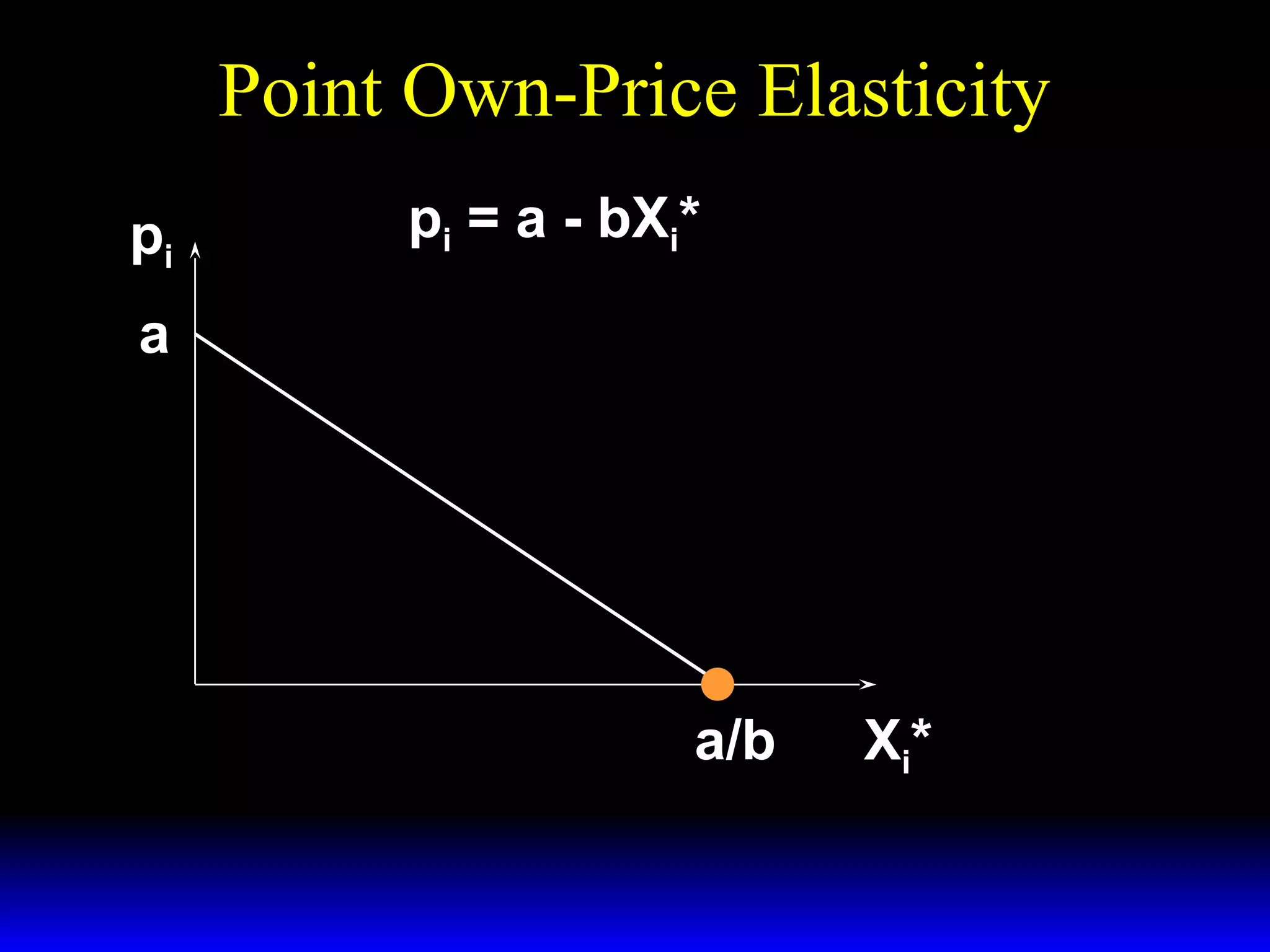

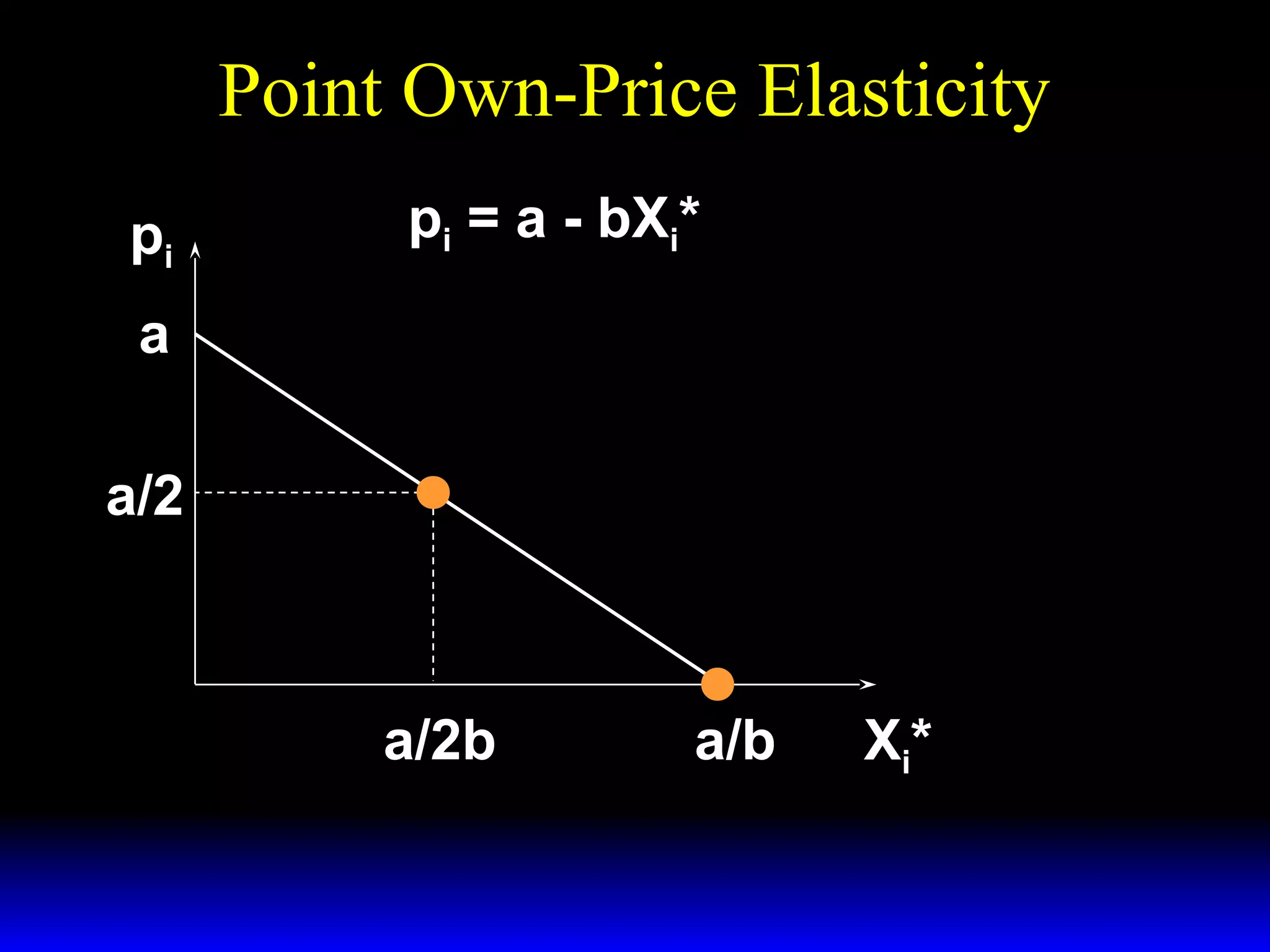

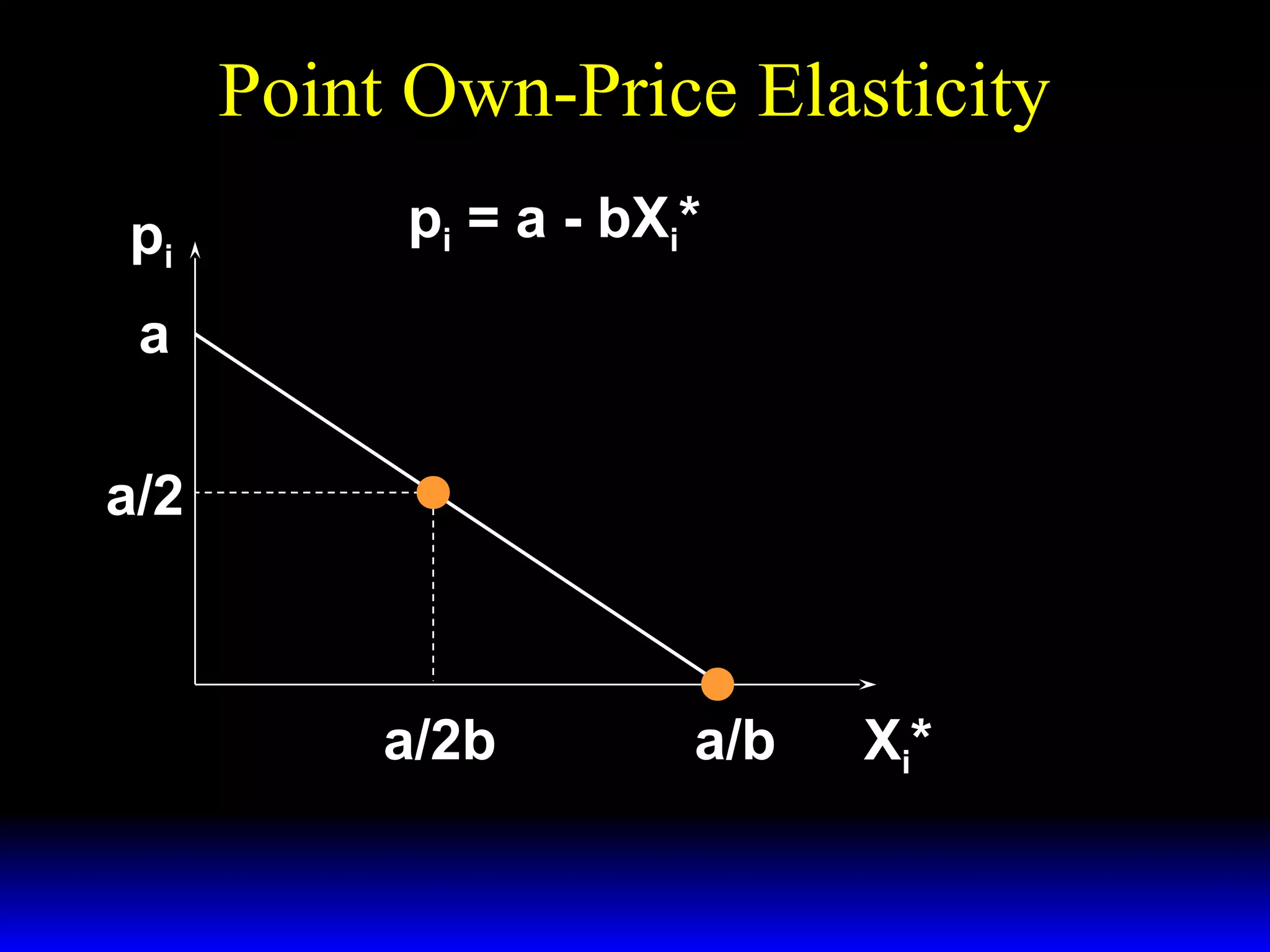

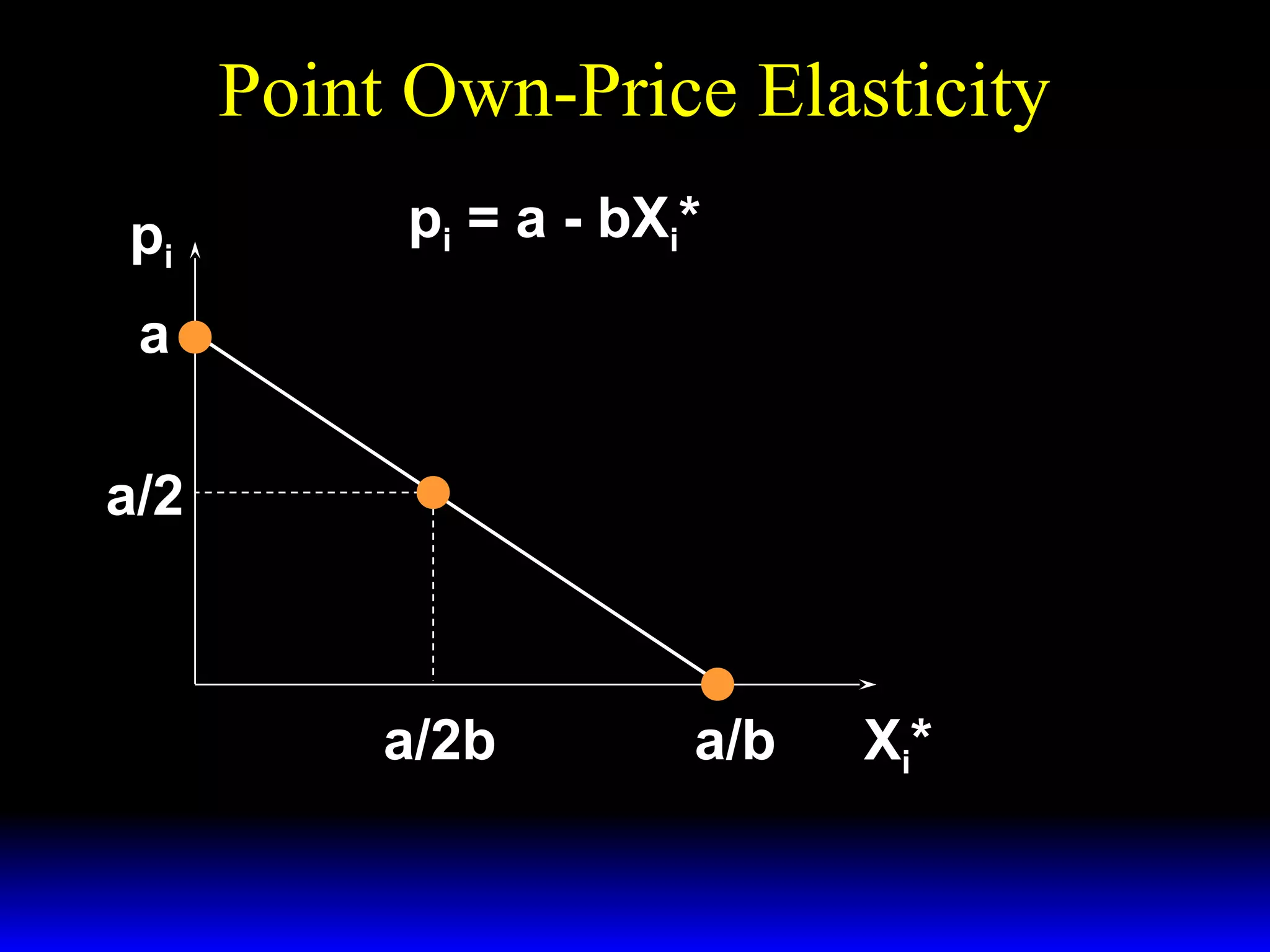

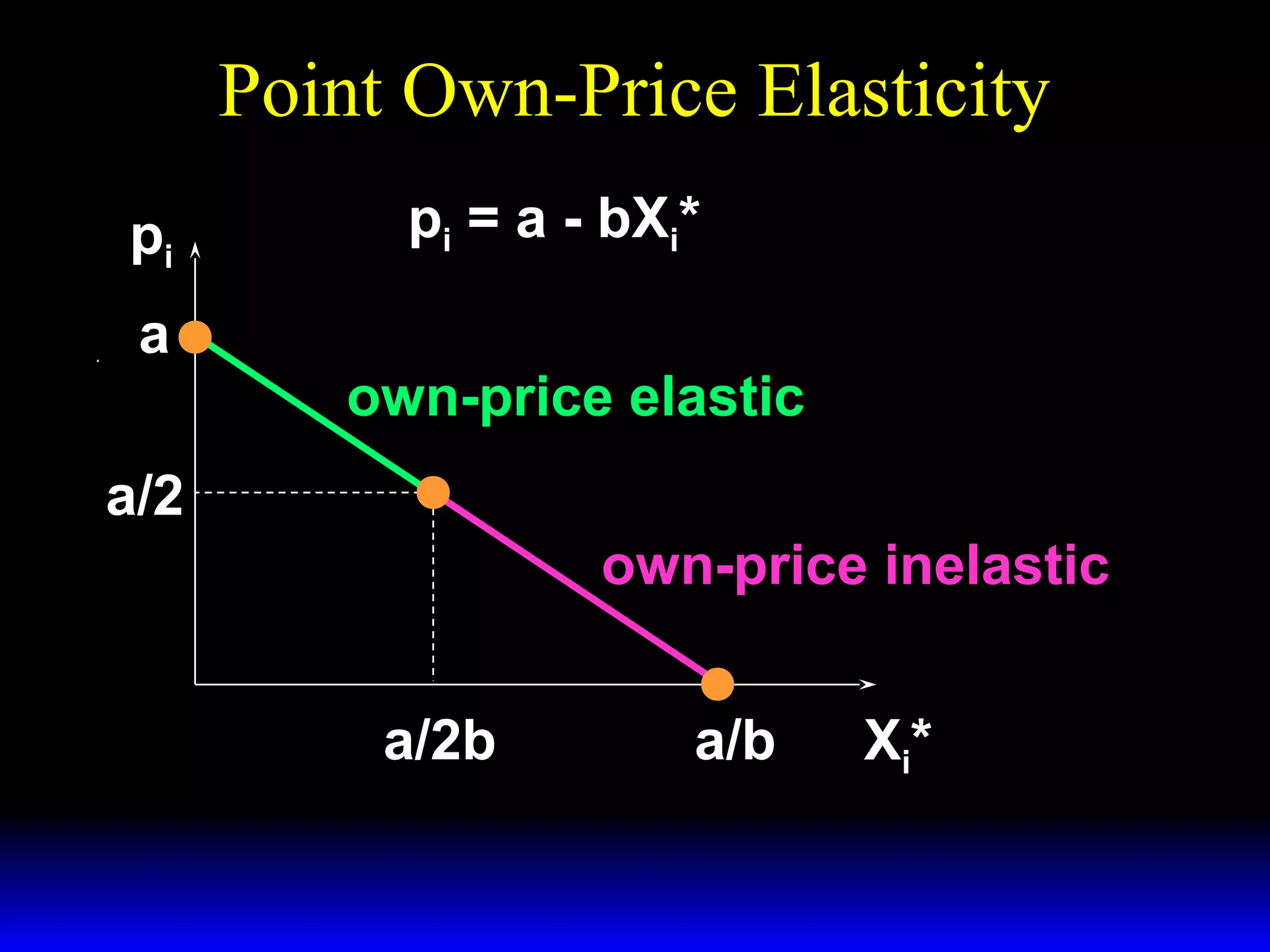

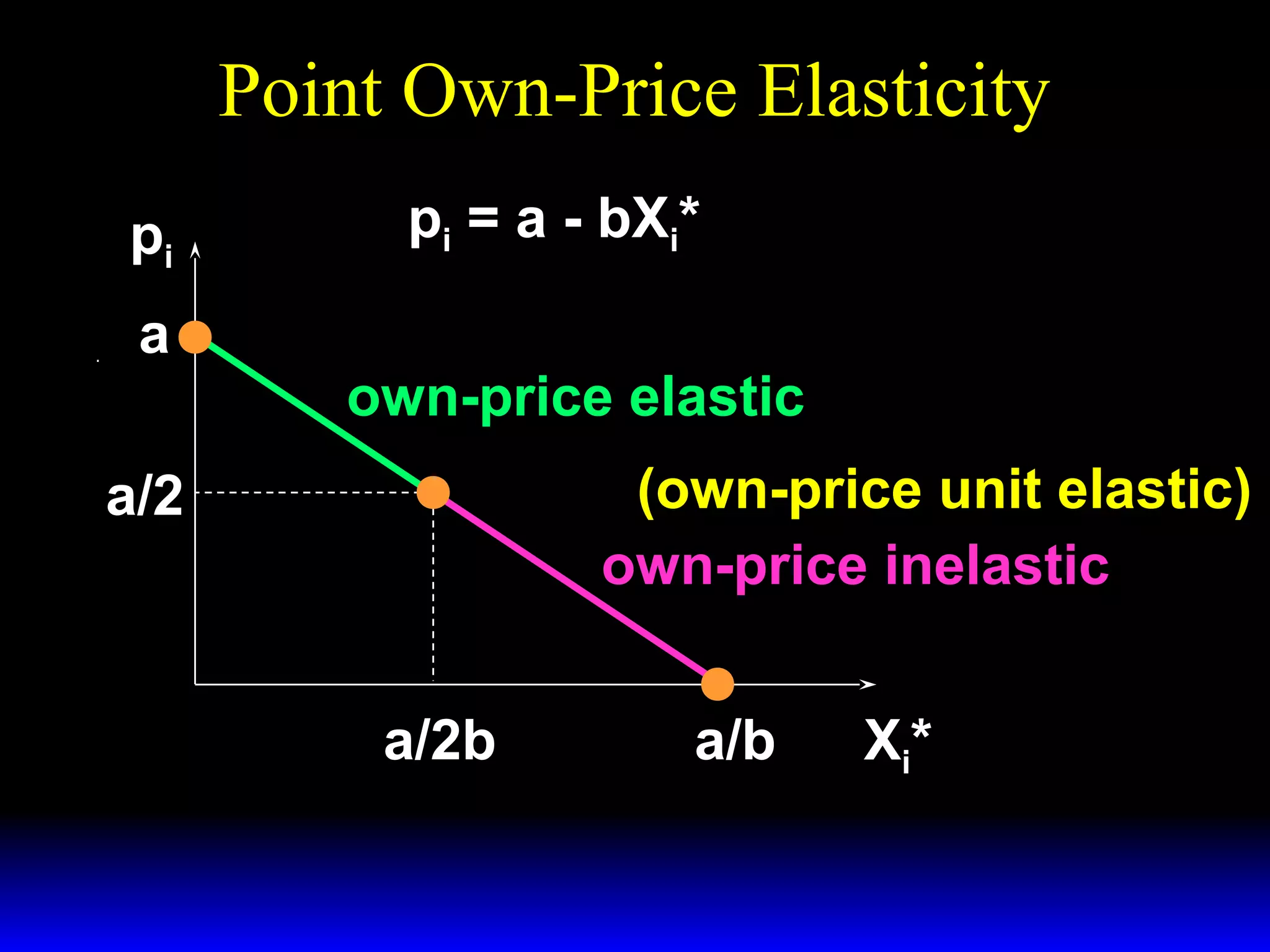

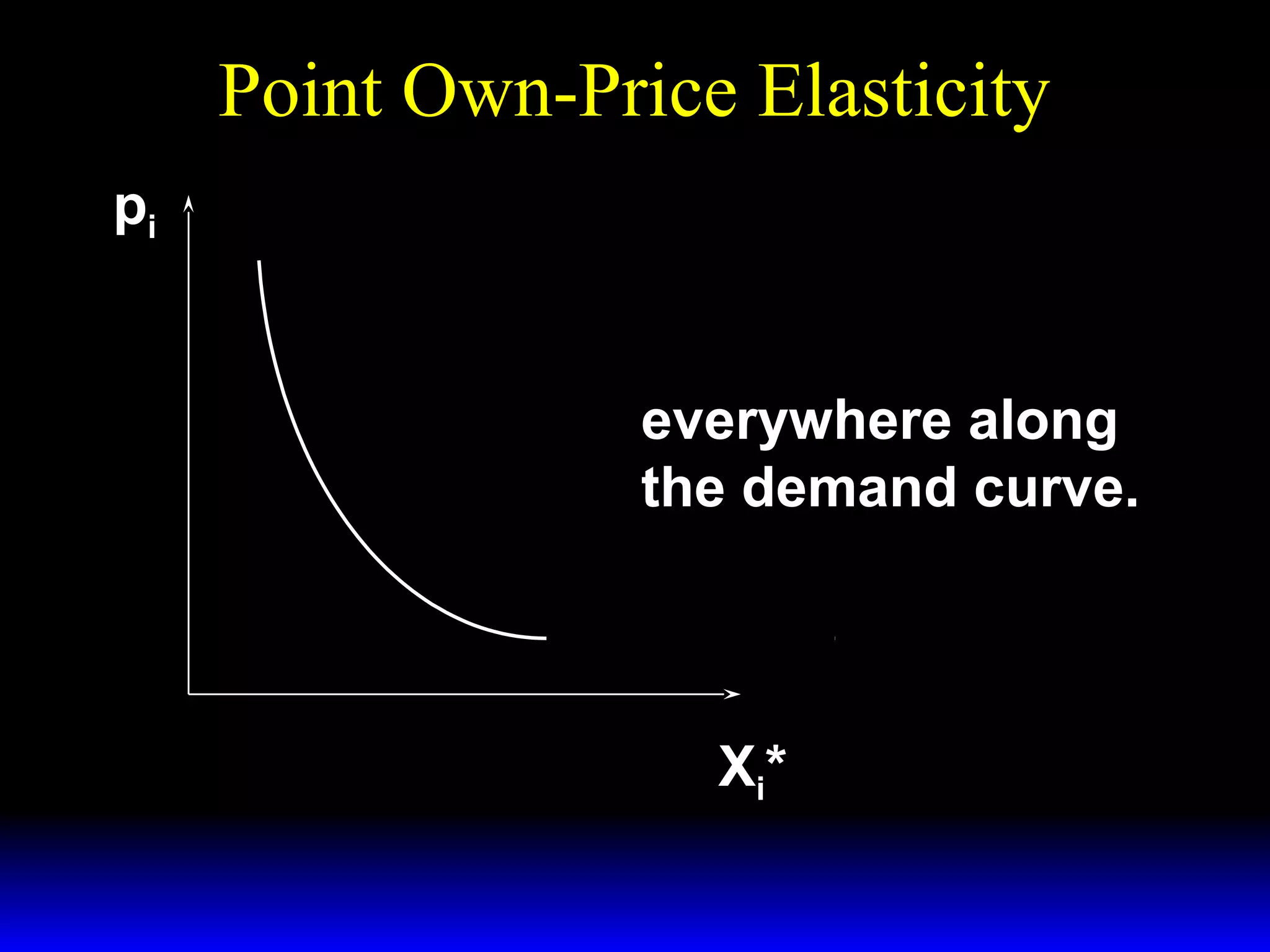

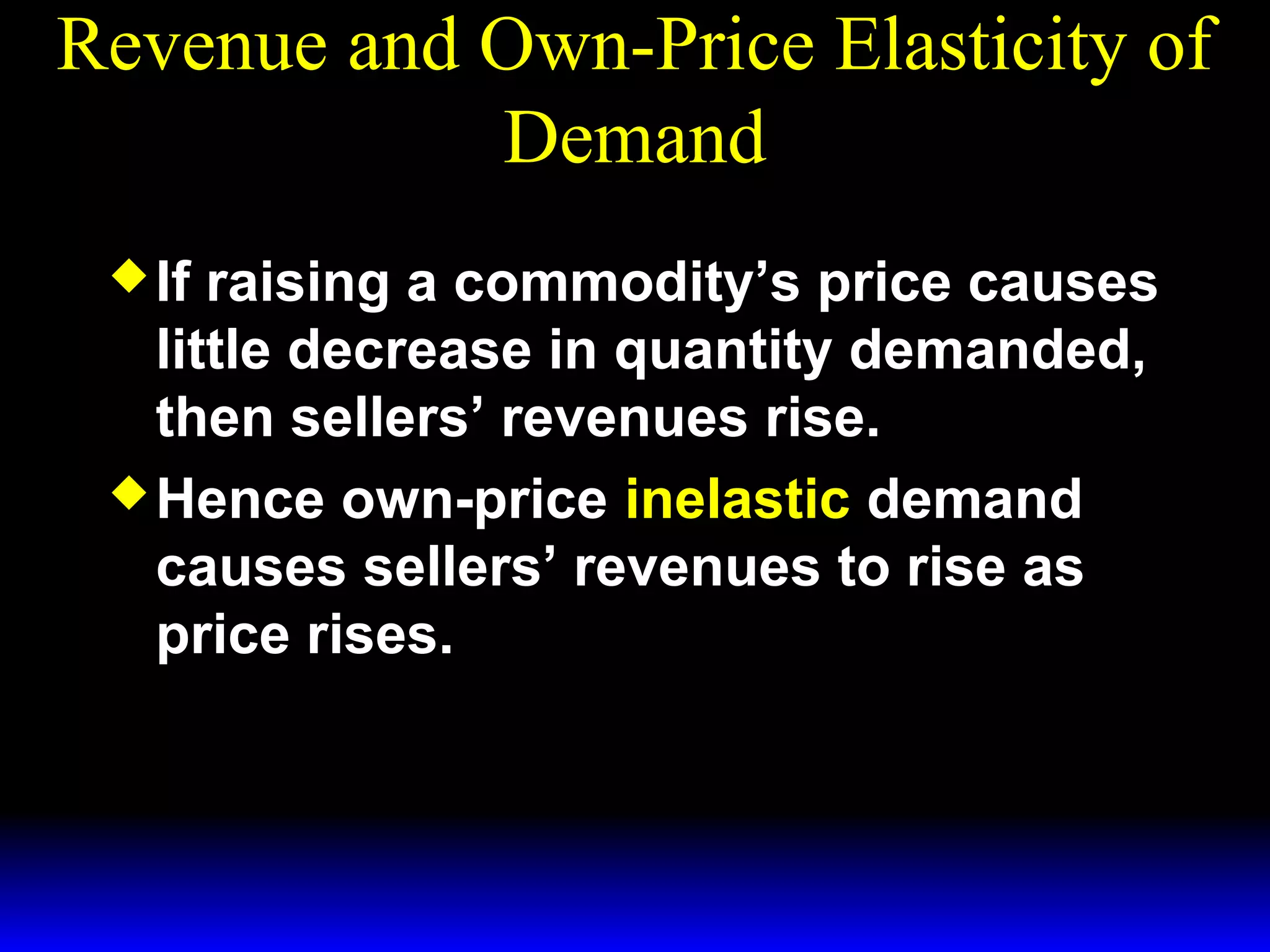

This document discusses the concept of market demand and how it relates to individual consumer demand. It explains that the market demand curve is the horizontal sum of individual demand curves. It then discusses the concept of elasticity, including own-price elasticity of demand and how elasticity measures the sensitivity of one variable to changes in another. It provides examples of how own-price elasticity can be calculated using demand curves and formulas. It also discusses how the elasticity measurement relates to whether raising price will increase or decrease seller revenue.

![Revenue and Own-Price Elasticity of

Demand

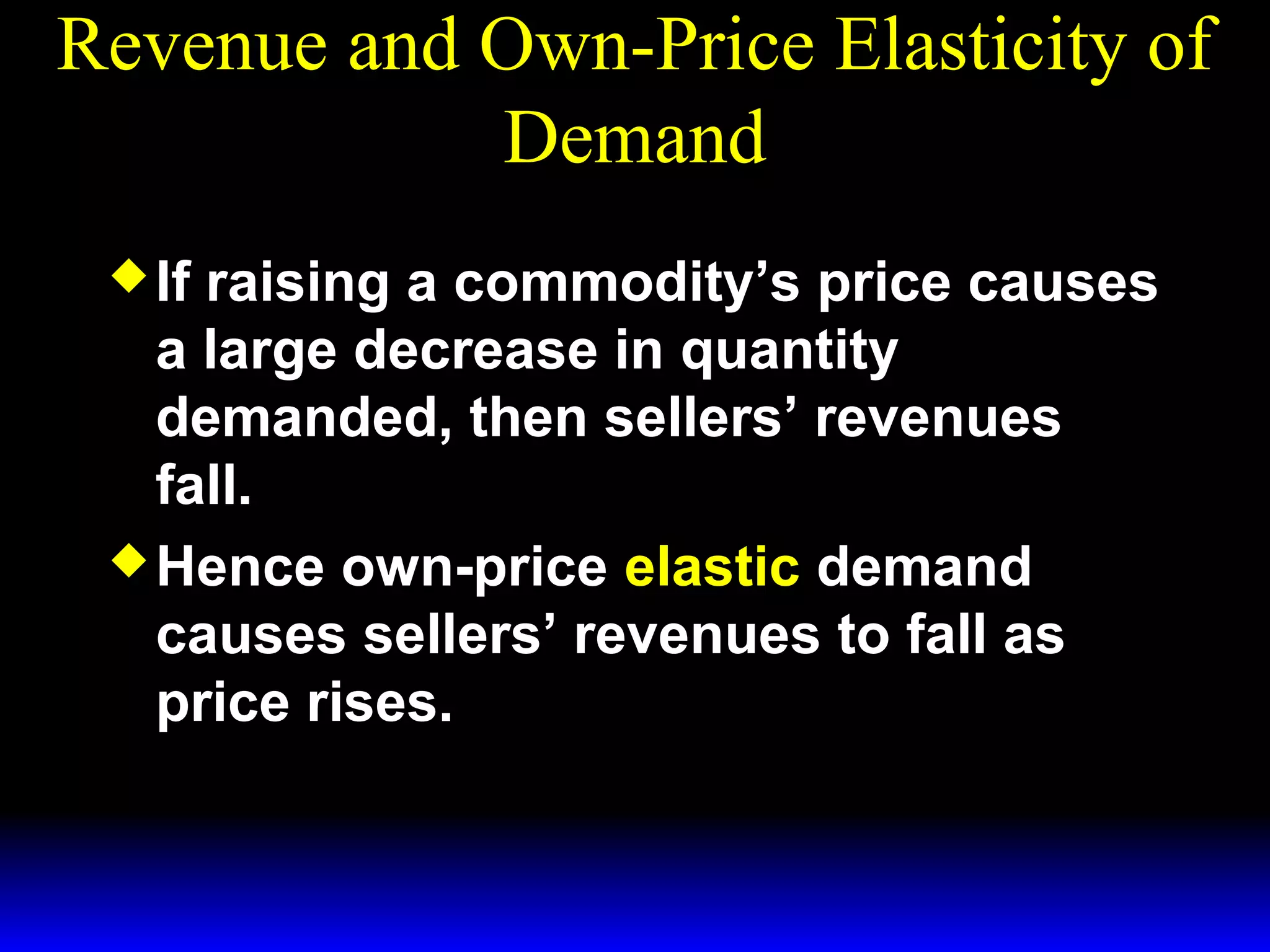

R( p ) = p × X* (p ).

Sellers’ revenue is

dR

dX*

So

= X* (p ) + p

dp

dp

*

p dX

*

= X (p )1 +

*

X (p ) dp

= X* (p )[ 1 + ε ] .](https://image.slidesharecdn.com/ch15-140131134447-phpapp01/75/Ch15-52-2048.jpg)

![Revenue and Own-Price Elasticity of

Demand

dR

= X* (p )[ 1 + ε ]

dp](https://image.slidesharecdn.com/ch15-140131134447-phpapp01/75/Ch15-53-2048.jpg)

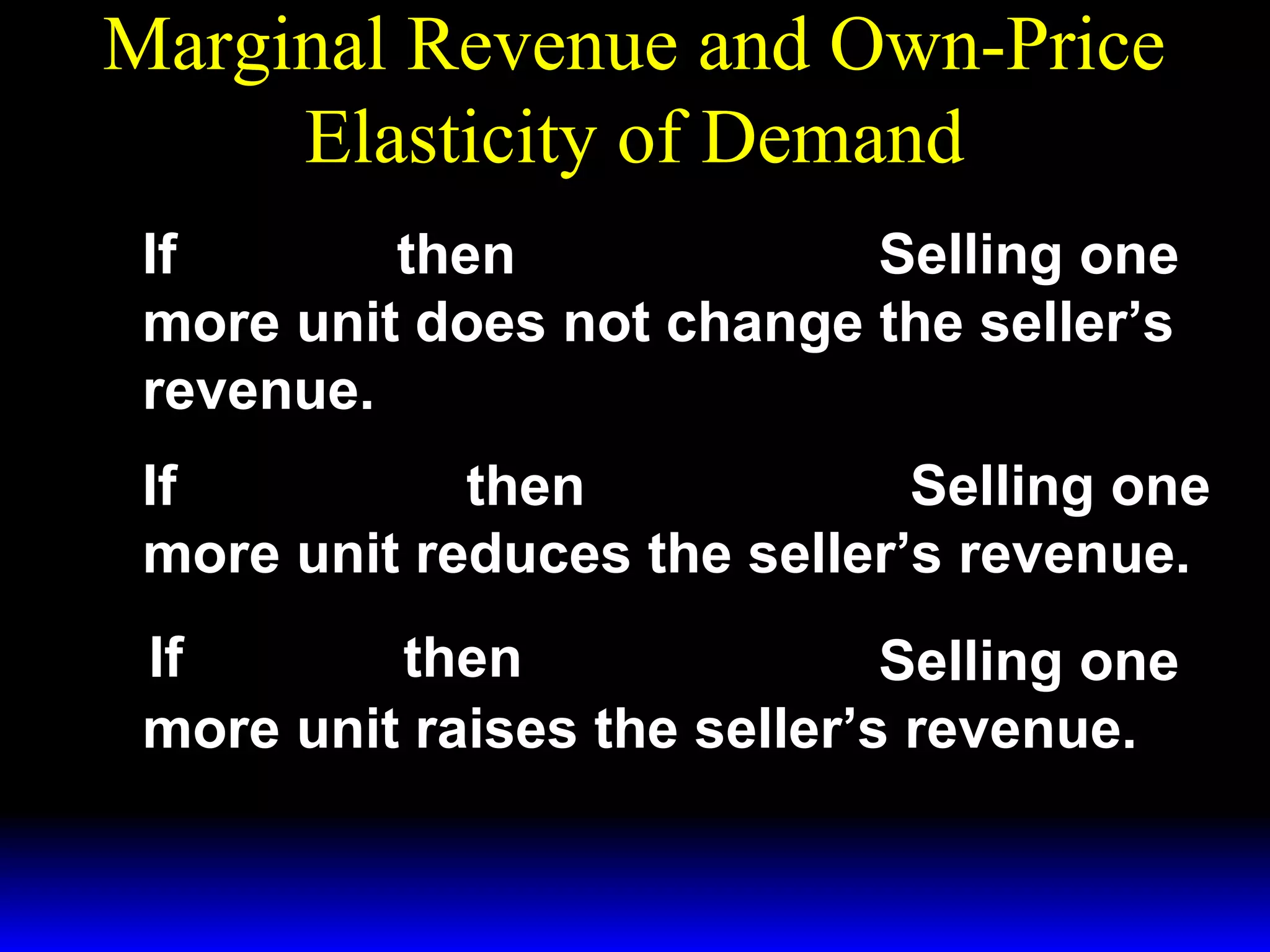

![Revenue and Own-Price Elasticity of

Demand

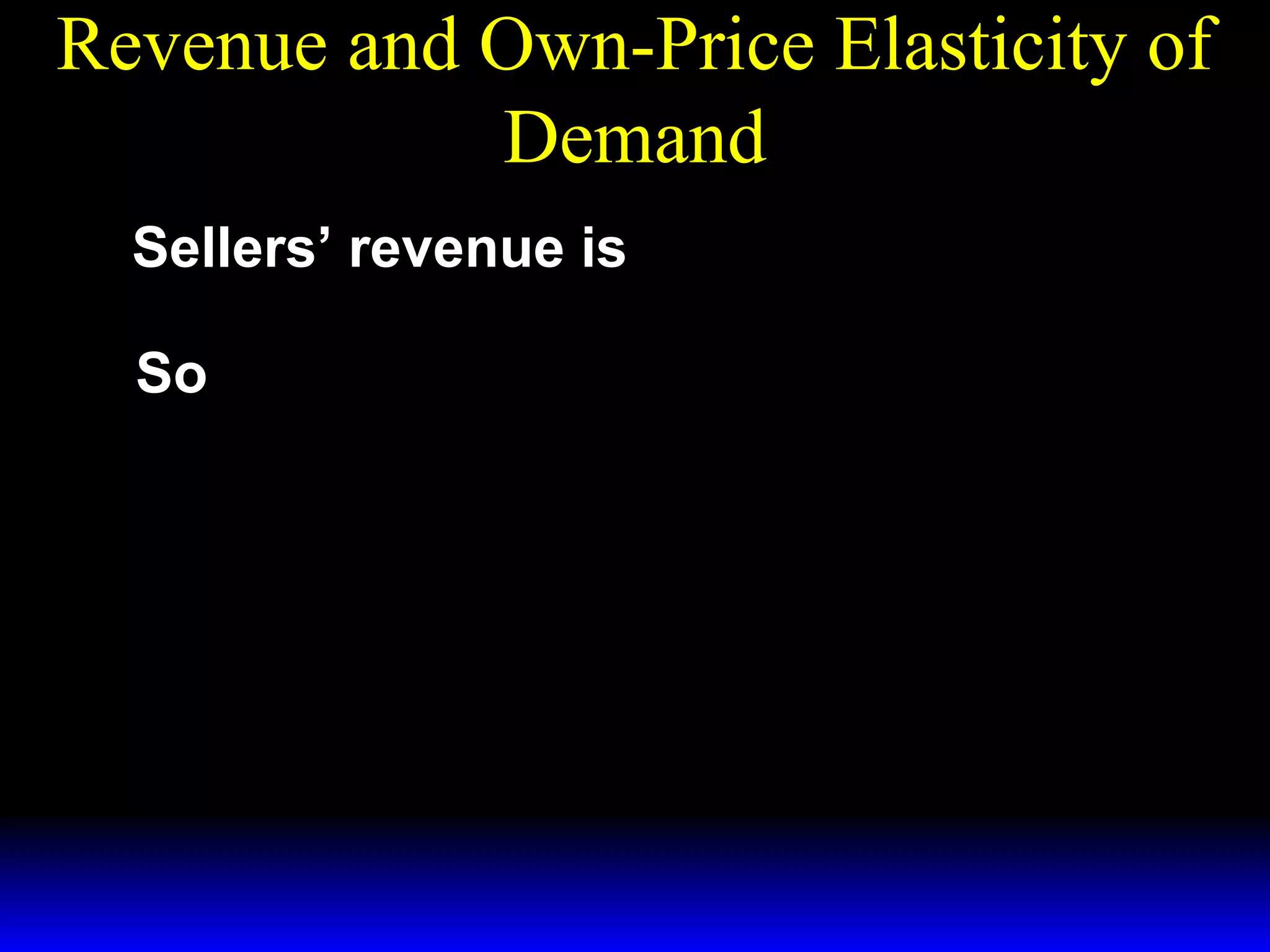

dR

= X* (p )[ 1 + ε ]

dp

so if ε = −1

then

dR

=0

dp

and a change to price does not alter

sellers’ revenue.](https://image.slidesharecdn.com/ch15-140131134447-phpapp01/75/Ch15-54-2048.jpg)

![Revenue and Own-Price Elasticity of

Demand

dR

= X* (p )[ 1 + ε ]

dp

dR

>0

but if − 1 < ε ≤ 0 then

dp

and a price increase raises sellers’

revenue.](https://image.slidesharecdn.com/ch15-140131134447-phpapp01/75/Ch15-55-2048.jpg)

![Revenue and Own-Price Elasticity of

Demand

dR

= X* (p )[ 1 + ε ]

dp

And if

ε < −1

dR

<0

then

dp

and a price increase reduces sellers’

revenue.](https://image.slidesharecdn.com/ch15-140131134447-phpapp01/75/Ch15-56-2048.jpg)