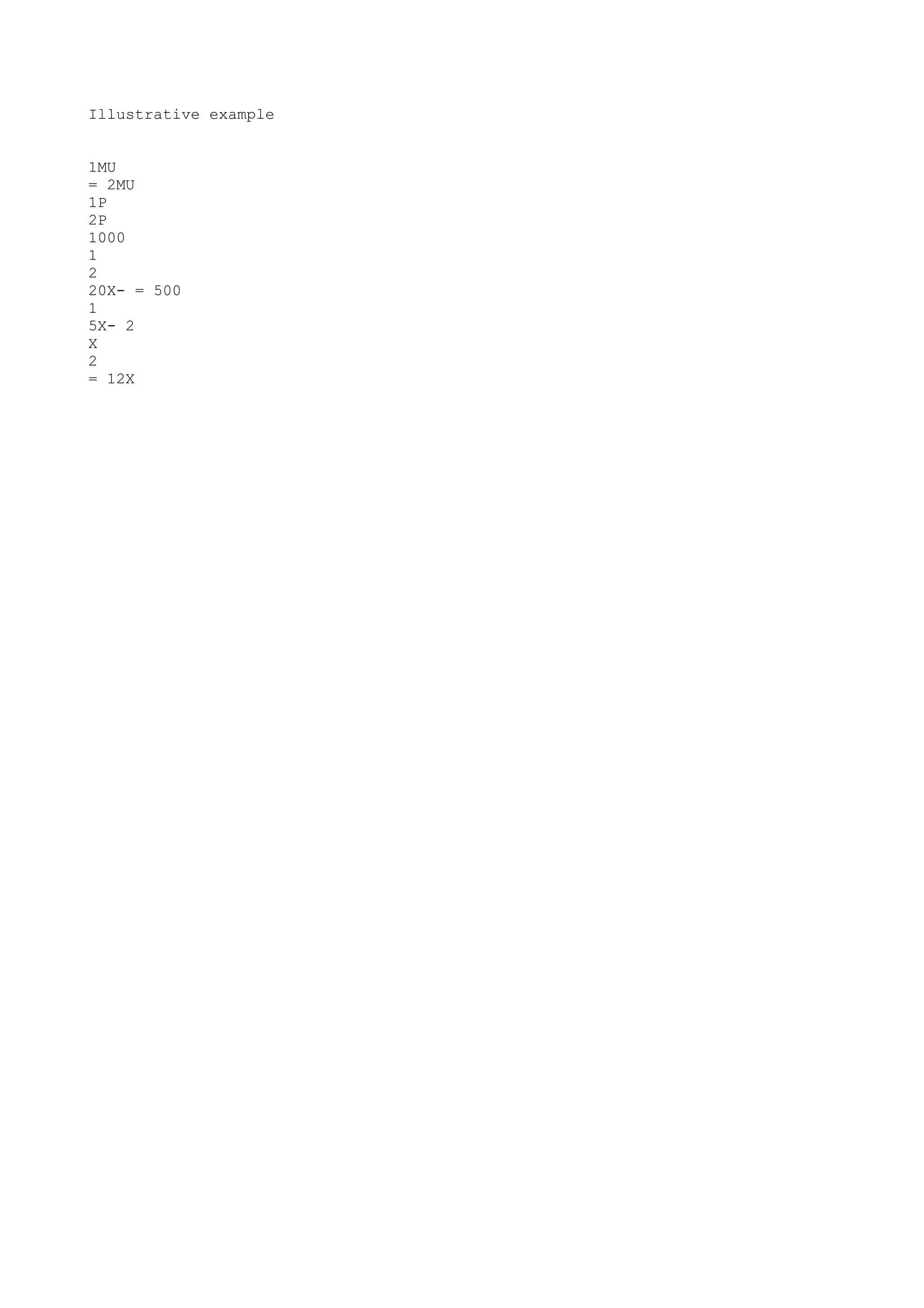

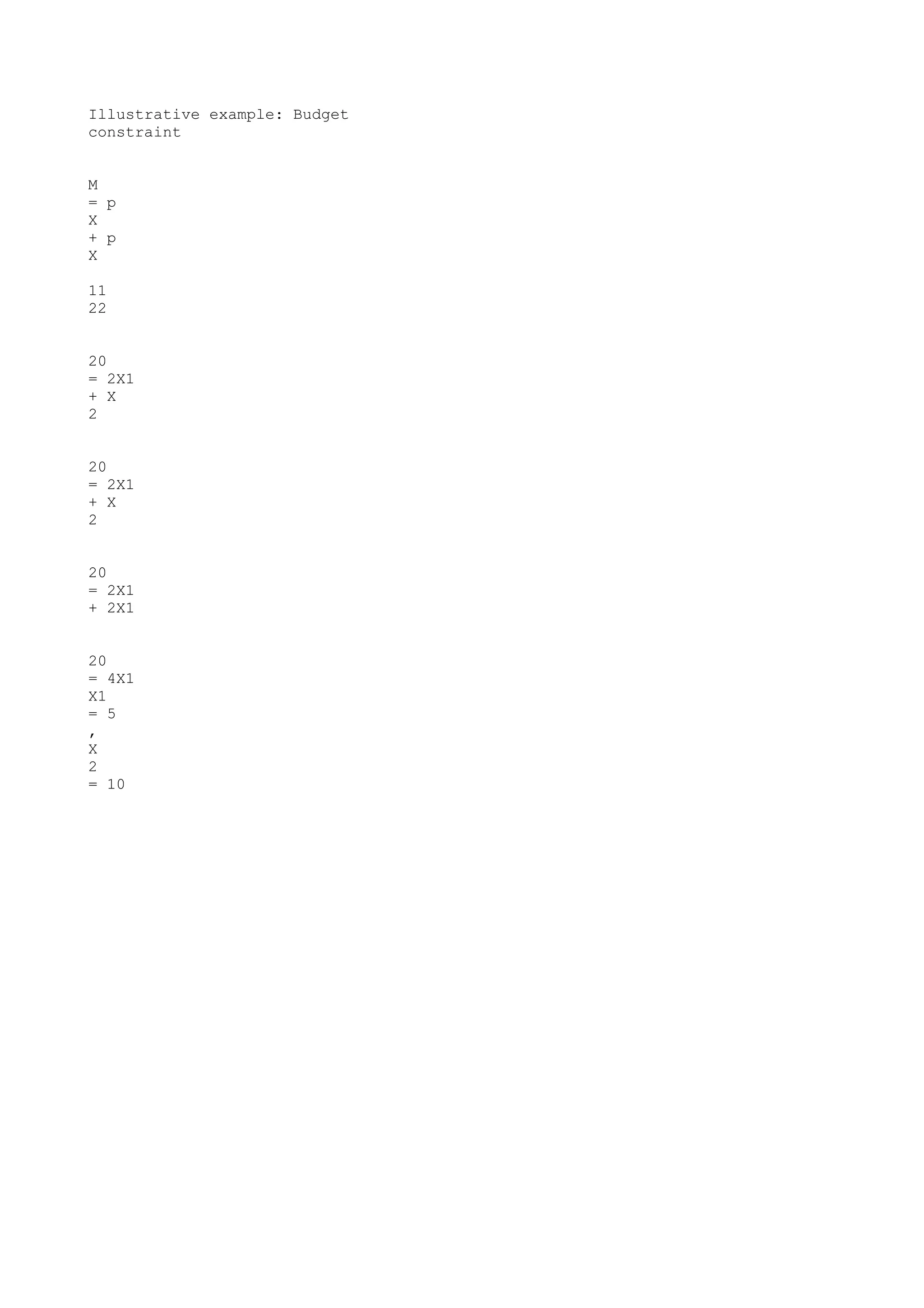

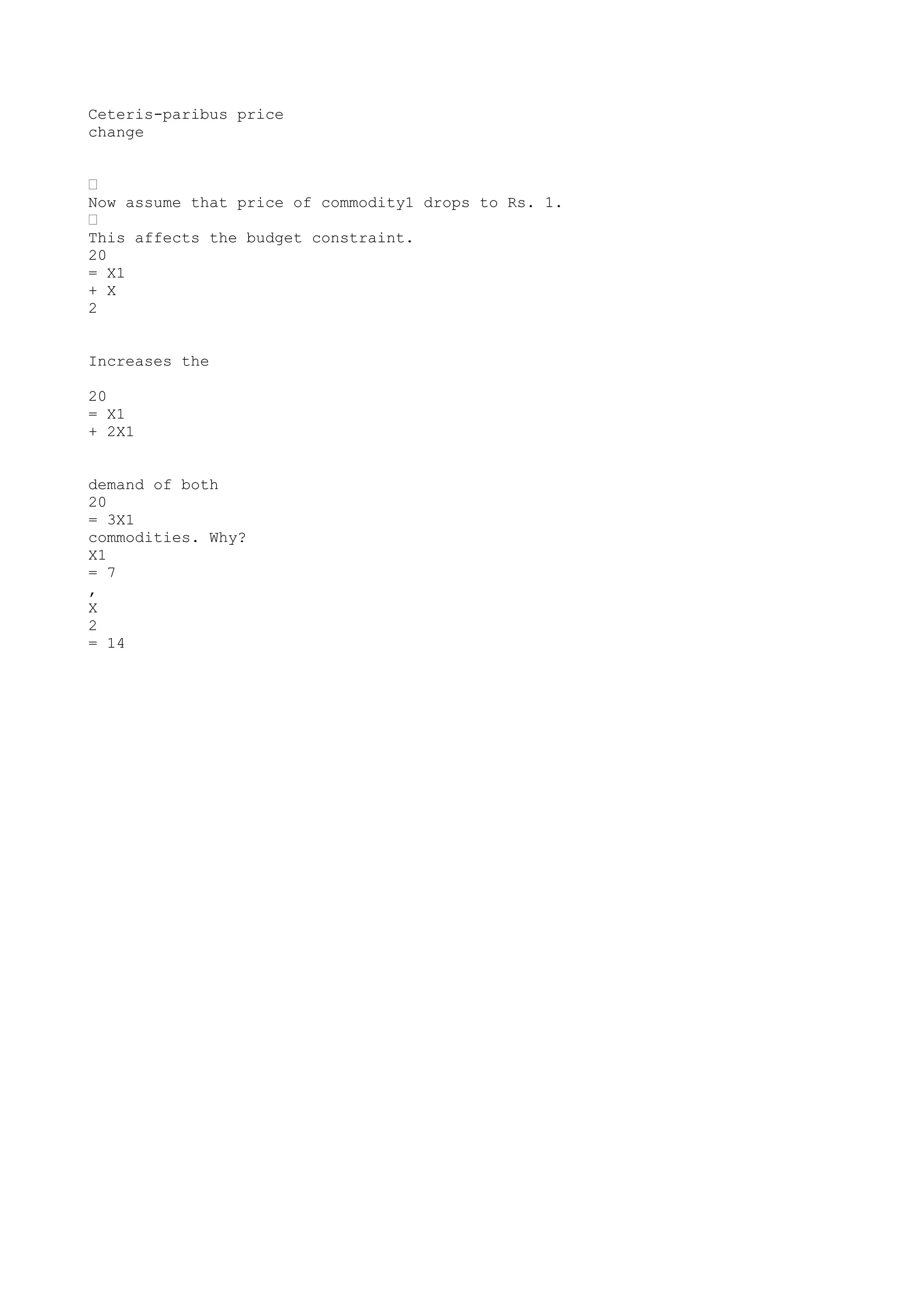

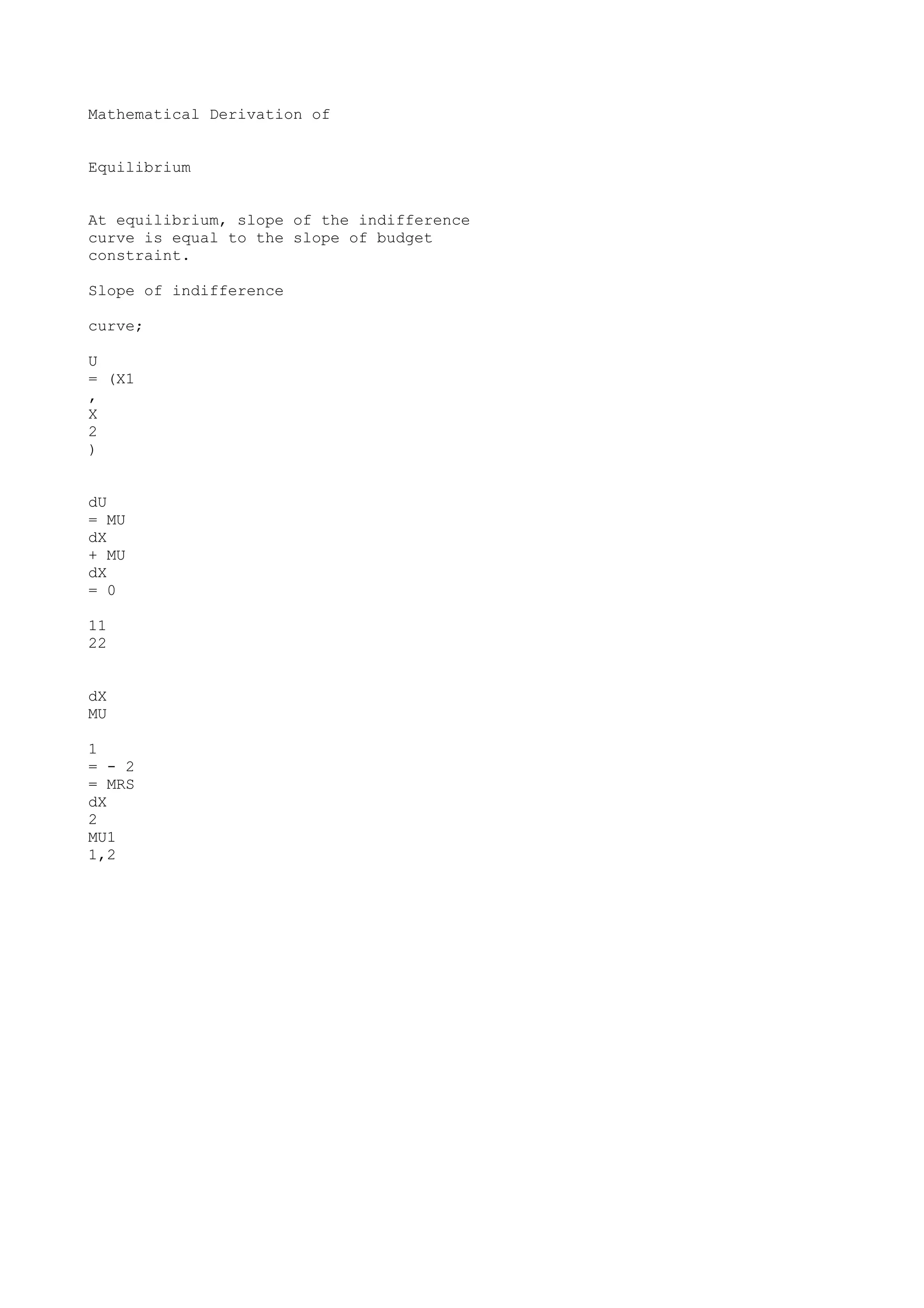

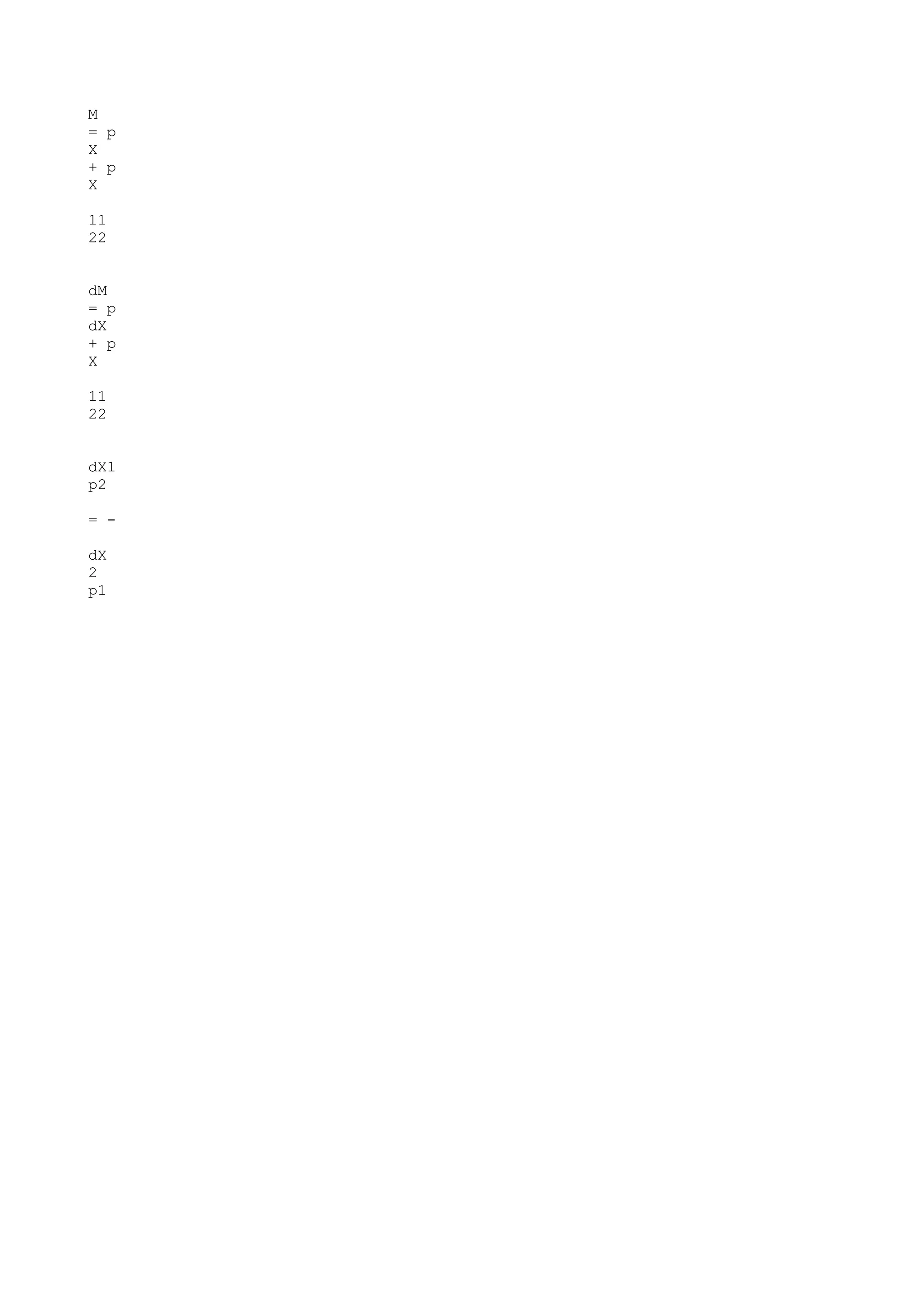

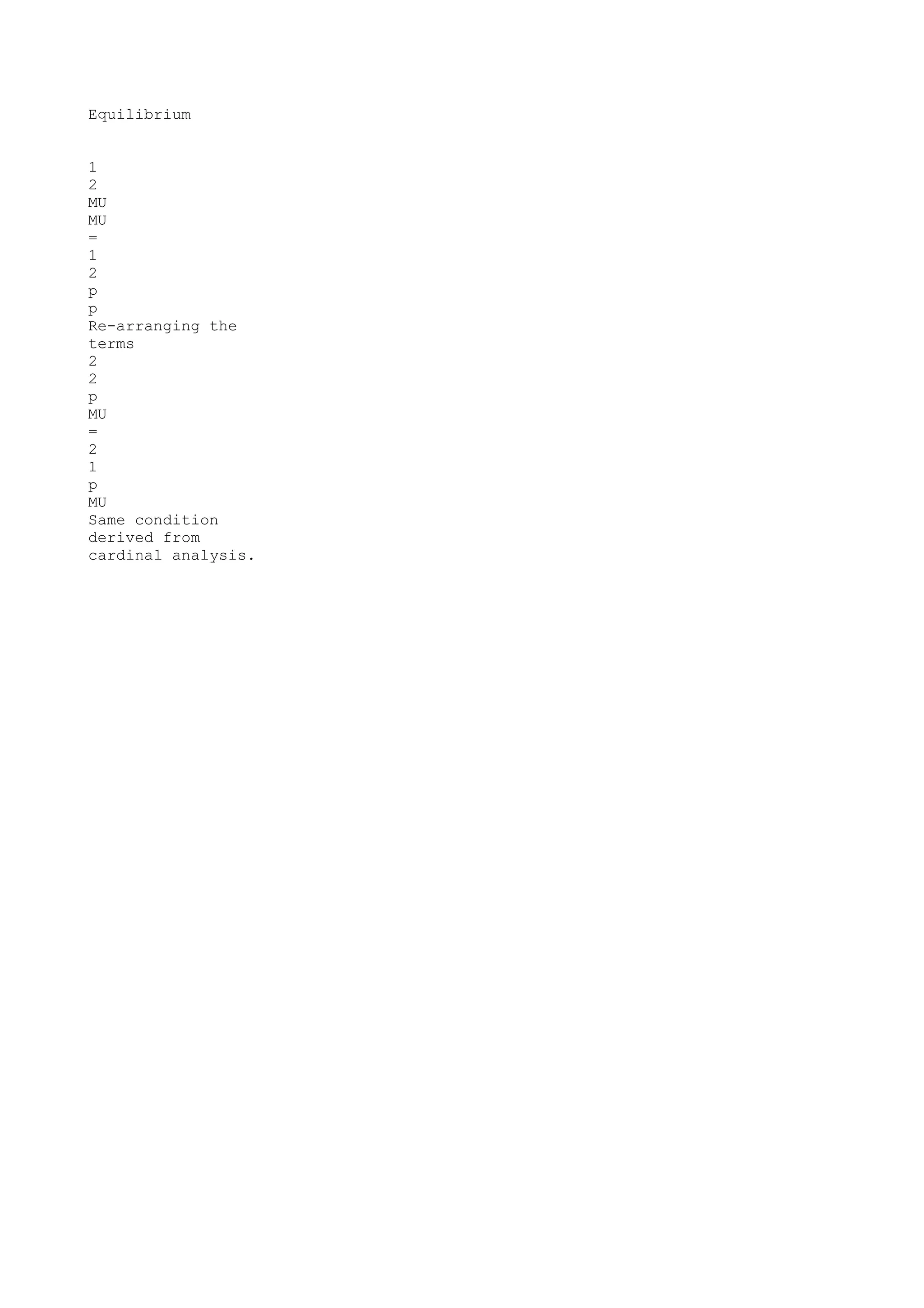

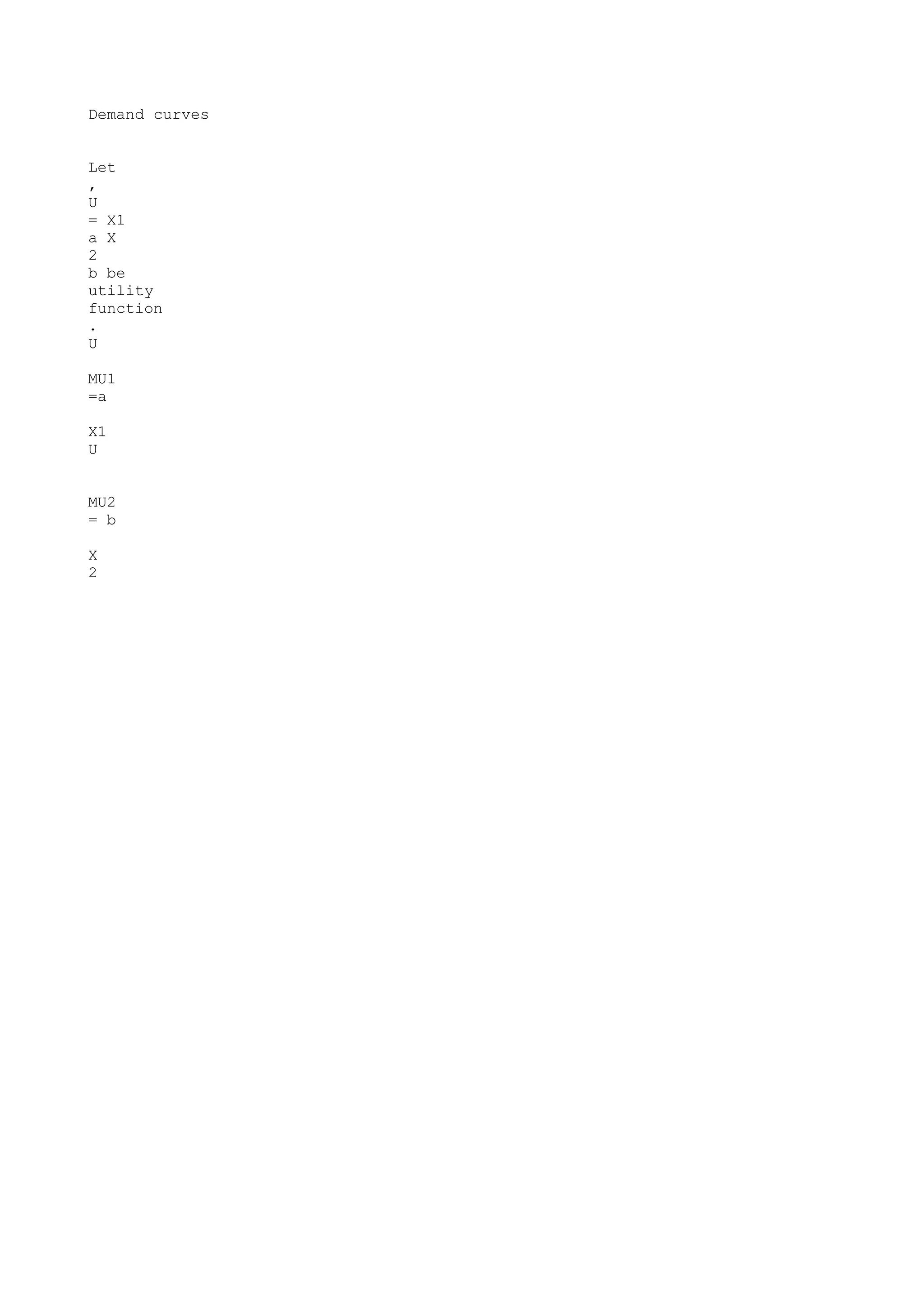

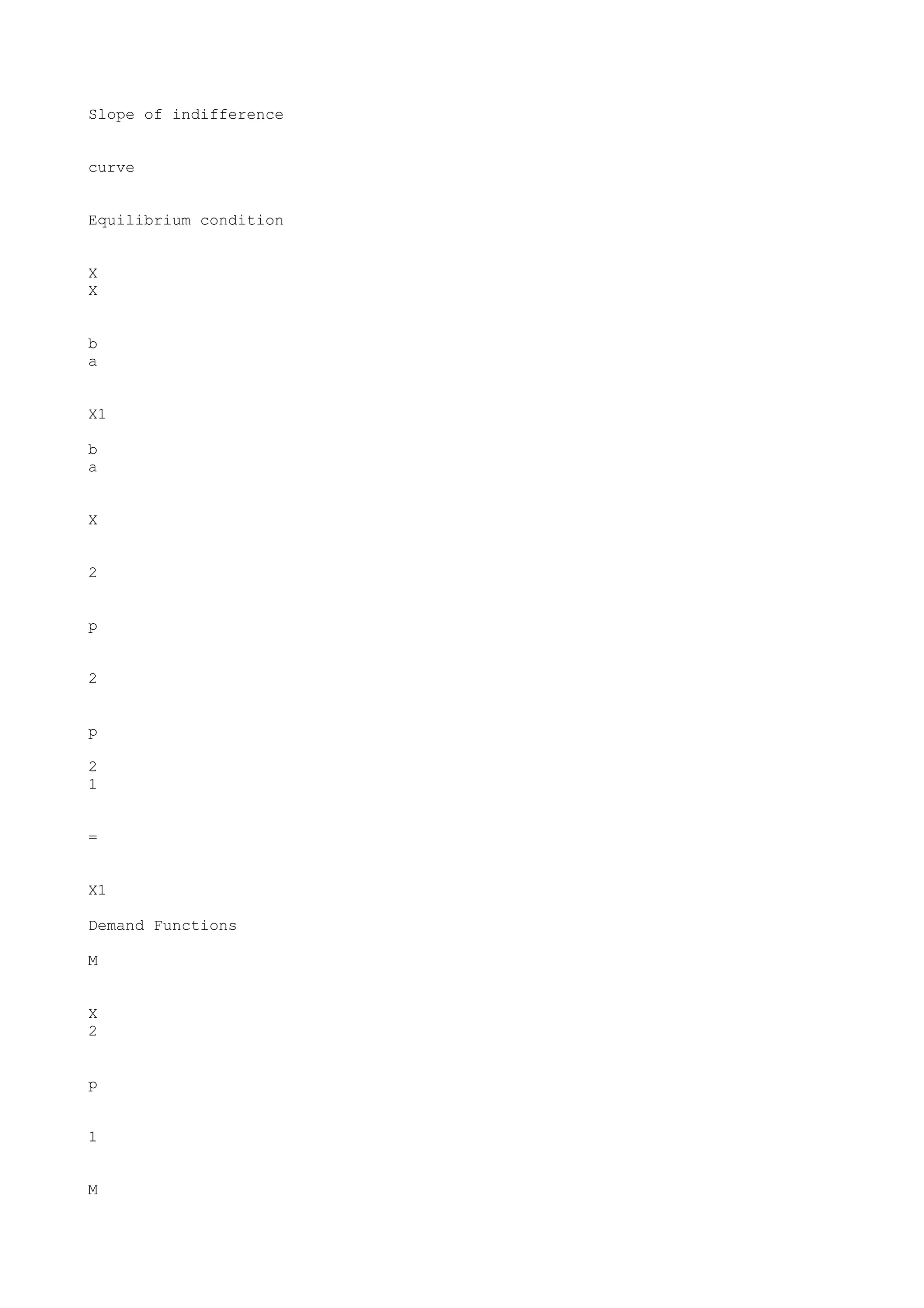

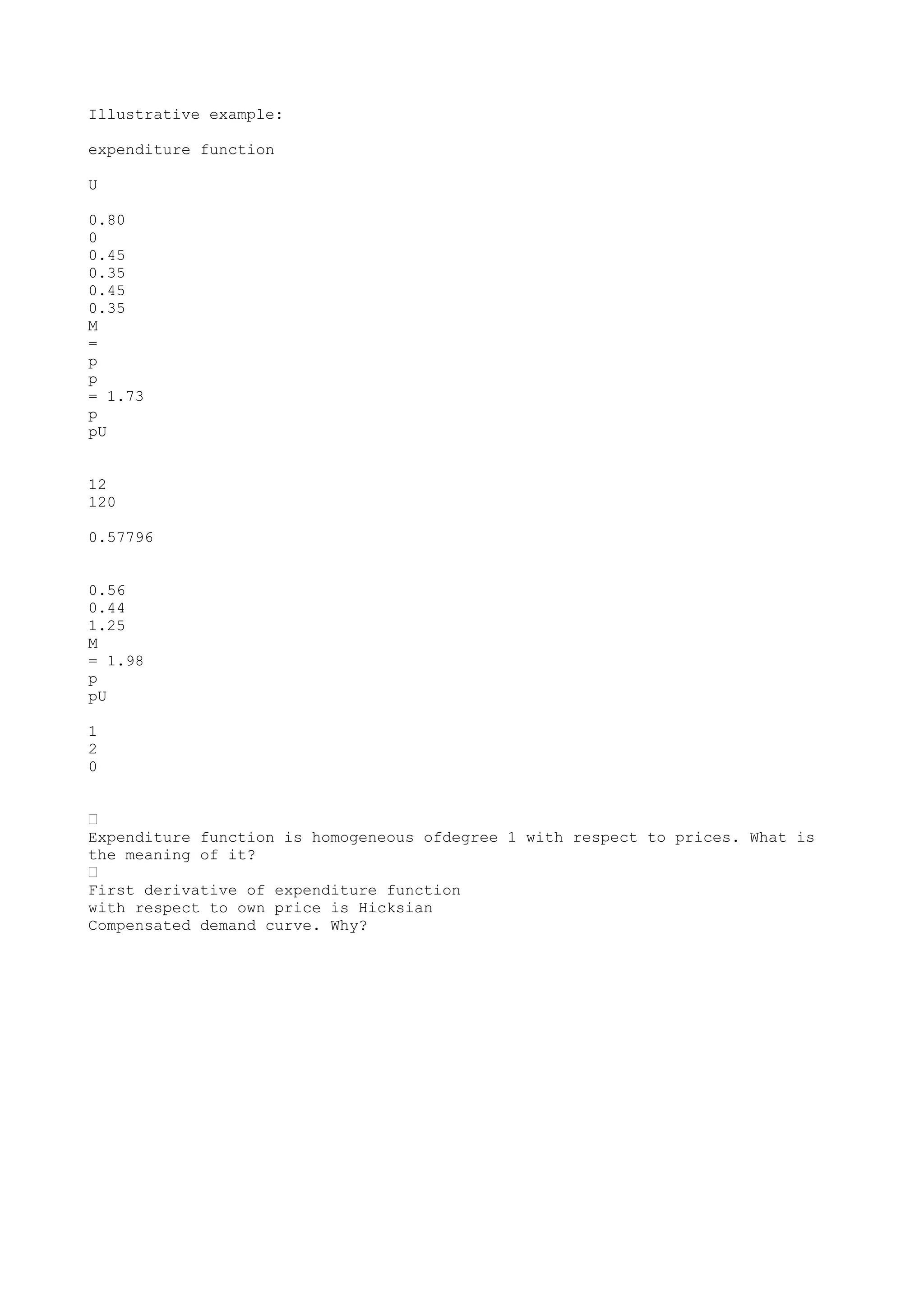

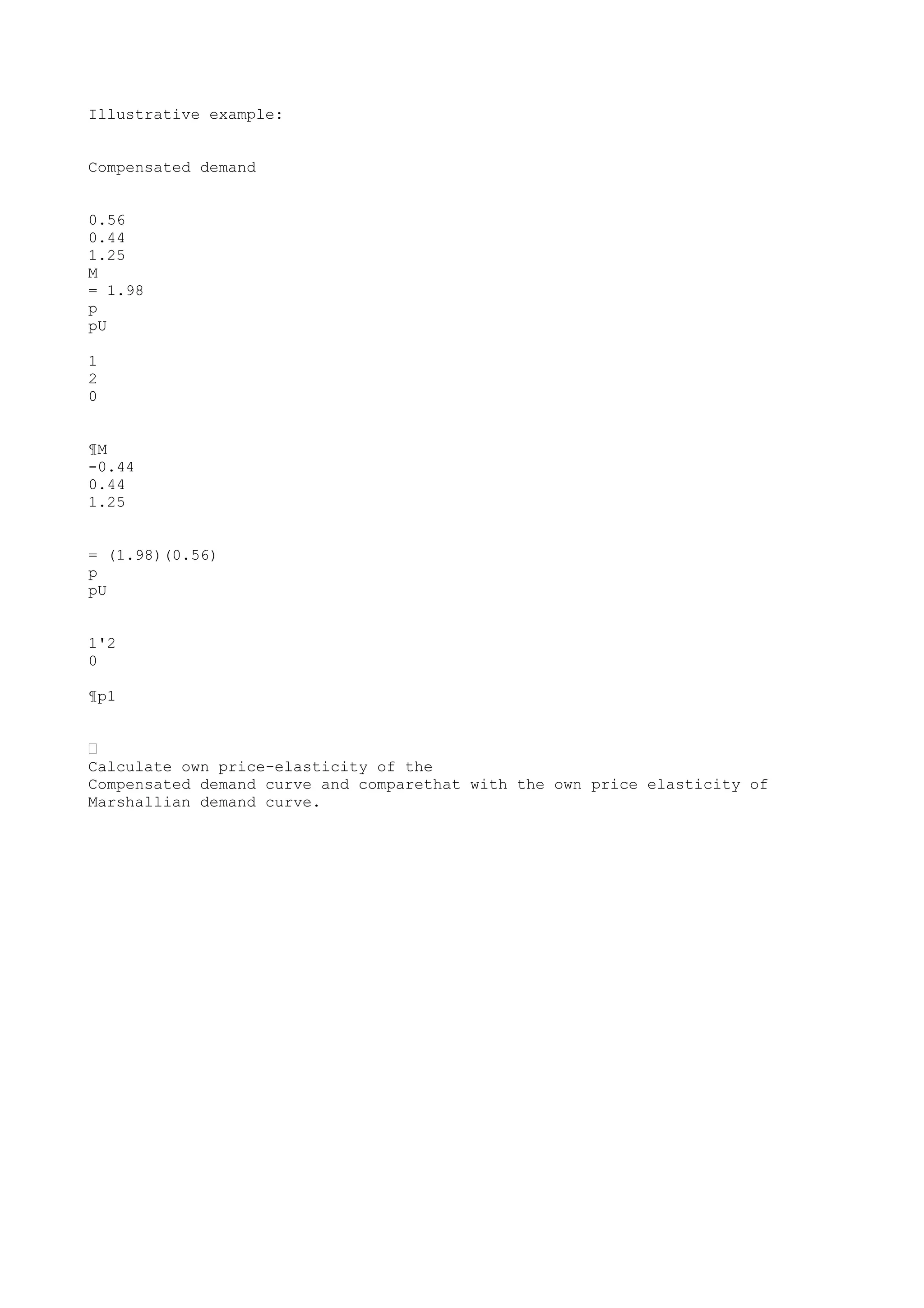

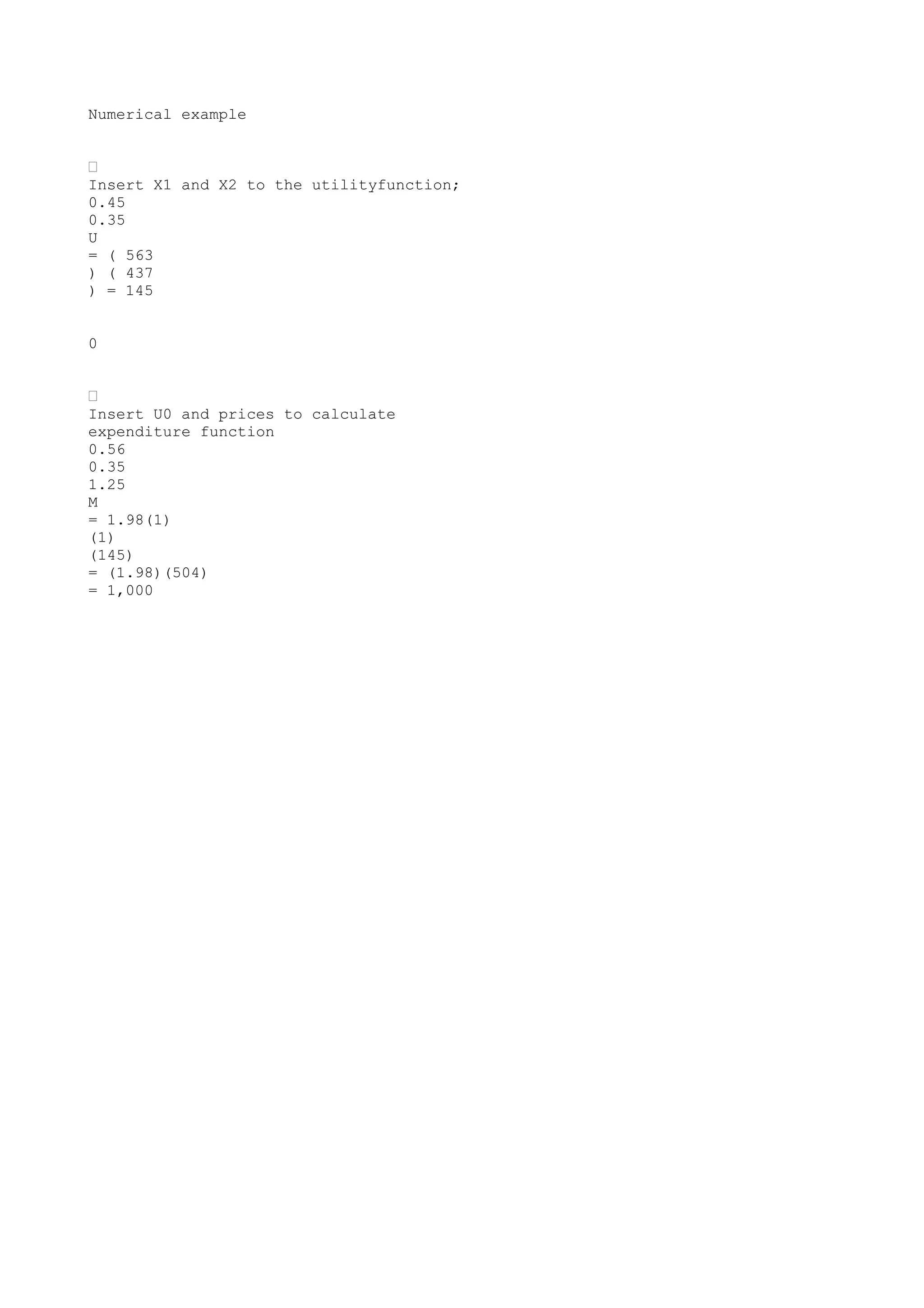

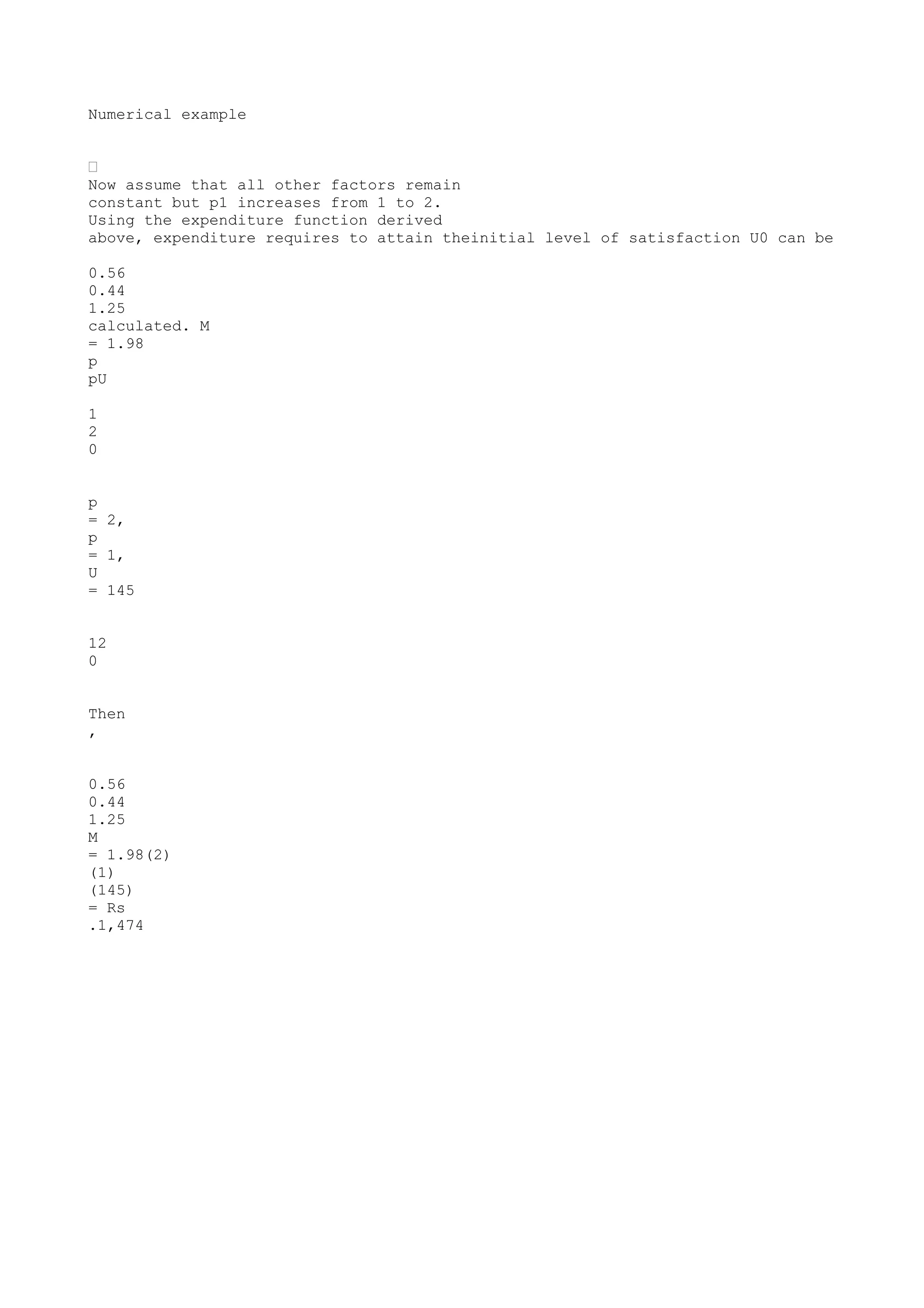

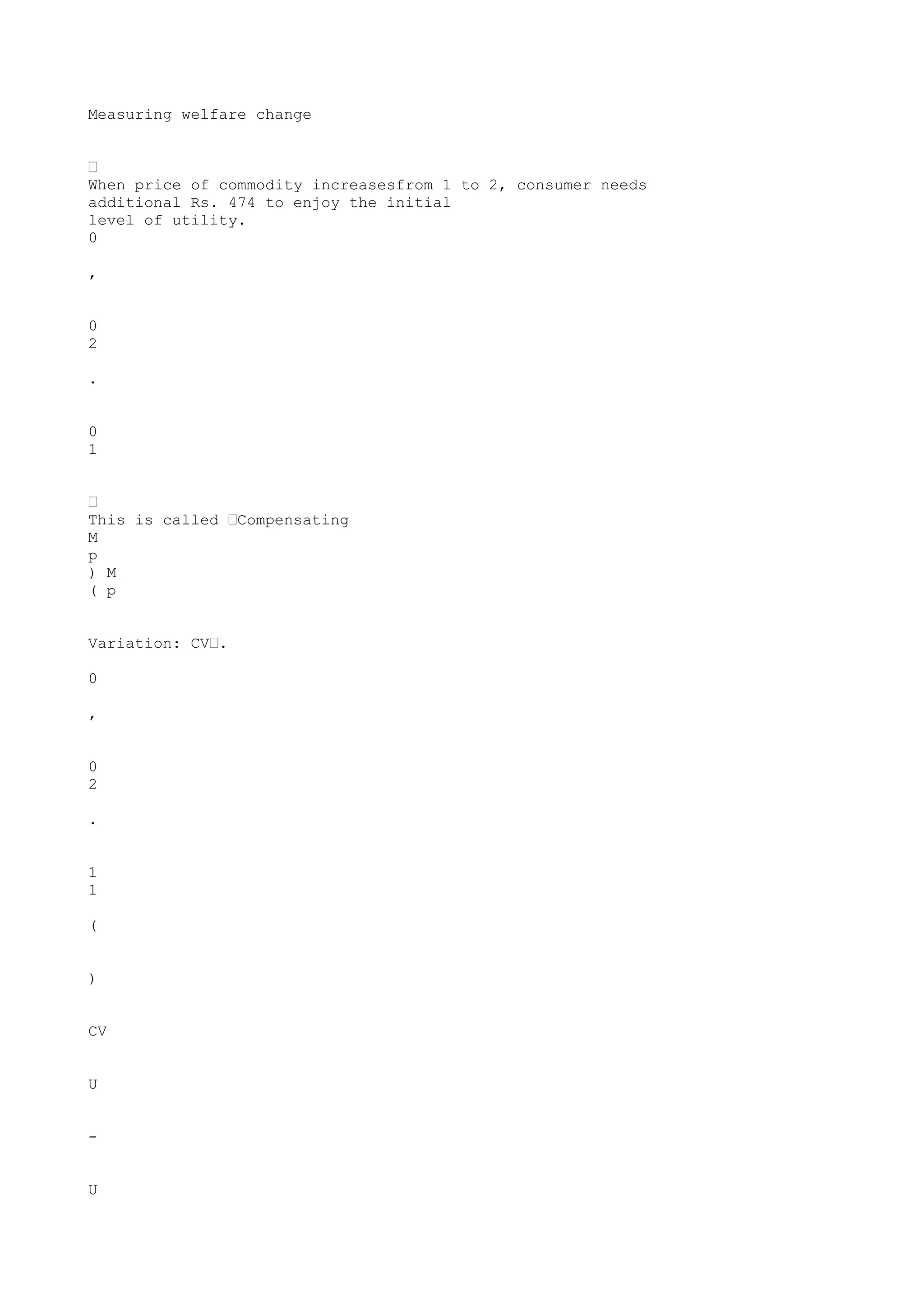

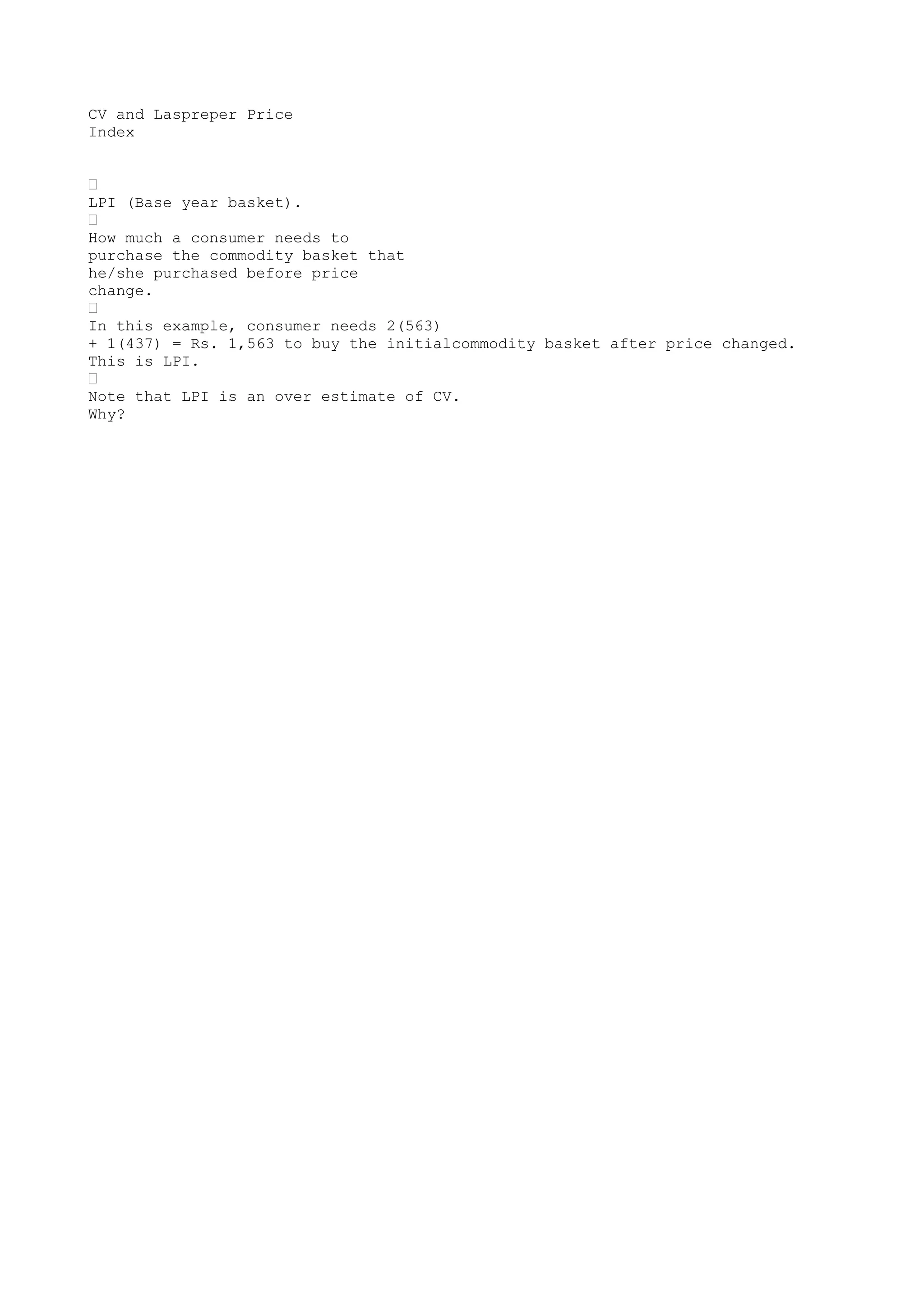

This document discusses three approaches to consumer behavior analysis: cardinal, ordinal, and revealed preference. It provides an illustrative example using the cardinal approach to demonstrate how a consumer allocates income between two goods to maximize total utility, given prices and budget constraints. It also shows how demand would change if price or income changed. Next, it covers the ordinal and indifference curve analysis, defining key concepts. Finally, it provides a numerical example to illustrate demand curves, welfare measurement, and relationships between compensating variation and price indices.