1. Yes, this is a transaction that would be recorded. It represents an exchange of assets (cash) for services (wages). This transaction would:Increase assets (decrease cash)Increase expenses (increase wages expense) 2. No, this would not be recorded. It is an internal activity, not an exchange with an outside party.3. Yes, this is a transaction that would be recorded. It represents an exchange of assets (cash) for goods/inventory. This transaction would:Decrease assets (decrease cash)Increase assets (increase inventory)4. Yes, this is a transaction that would be recorded. It represents an exchange of assets (cash) for services

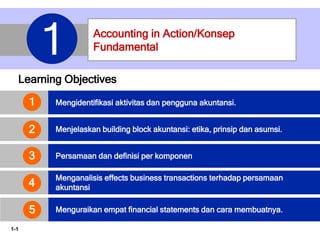

- 1. 1-1 Learning Objectives Mengidentifikasi aktivitas dan pengguna akuntansi. Menjelaskan building block akuntansi: etika, prinsip dan asumsi. Persamaan dan definisi per komponen 3 Menganalisis effects business transactions terhadap persamaan akuntansi 2 1 4 Menguraikan empat financial statements dan cara membuatnya. 5 Accounting in Action/Konsep Fundamental 1

- 2. 1-2 Cerita fitur Banyak mahasiswa mengambil mata kuliah ini tidak berencana untuk menjadi akuntan. Jika Anda masuk dalam kelompok (mahasiswa tersebut, Anda mungkin berpikir, "Jika saya tidak akan menjadi akuntan, mengapa saya harus mengetahui tentang akuntansi?" Menanggapi hal ini, perhatikan kutipan dari Harols Geneen, mantan Direktur Utama dari perusahaan internasional besar:

- 3. 1-3 Cerita fitur "Untuk menjadi yang terbaik dalam usaha Anda, Anda harus mengetahui angka-angka “ Keberhasilan dalam setiap usaha berpulang ke angka-angka. Anda akan bergantung pada angka-angka untuk mengambil keputusan, dan para manajer akan menggunakan angka-angka untuk mengevaluasi kinerja mereka. Hal tersebut adalah benar apa pun pekerjaan Anda apakah di bagian pemasaran, produksi, manajemen, dan system informasi

- 4. 1-4 Cerita fitur Dalam setiap usaha atau bisnis, akuntansi adalah untuk mengomunikasikan angka- angka. Jika Anda tidak mengetahui cara membaca laporan keuangan, Anda tidak benar-benar mengetahui bisnis Anda.

- 5. 1-5 Cerita fitur Banyak perusahaan menghabiskan sumber daya yang sangat besar untuk mengajarkan kepada para karyawan mereka tentang akuntansi dasar sehingga mereka dapat membaca laporan keuangan dan memahami bagaimana tindakan mereka memengaruhi kinerja keuangan perusahaan. Pemilik perusahaan perlu memiliki para manajer dalam semua bidang untuk "paham tentang keuangan"

- 6. 1-6 Cerita fitur Mengambil mata kualiah ini akan membutuhkan waktu yang lama untuk membuat Anda menjadi memahami keuangan. Dalam mata kuliah ini, Anda akan mempelajari bagaimana membaca dan Menyusun laporan keuangan, dan bagaimana menggunakan alat-alat dasar dalam mengevaluasi kinerja keuangan.

- 7. 1-7 Accounting mencakup tiga aktivitas utama: Mengidentifikasi, Mencatat, mengkomunikasikan Peristiwa ekonomi dalam organisasi bagi pihak yang membutuhkan. LEARNING OBJECTIVE Identify the activities and users associated with accounting. 1 LO 1

- 8. 1-8 Illustration 1-1 Aktivitas dalam proses akuntansi The accounting process includes the bookkeeping function. Three Activities LO 1

- 9. 1-9 INTERNAL USERS Illustration 1-2 Questions that internal users ask Siapa pengguna Data akuntansi LO 1

- 10. 1-10 LO 1

- 11. 1-11 LO 1 Illustration 1-3 Questions that external users ask Siapa Pengguna Accounting Data EXTERNAL USERS

- 12. 1-12 1 DO IT! 1 Solution: 1. 2. 3. 4. 5. Indicate whether the following statements are true or false. 1. The three steps in the accounting process are identification, recording, and communication. 2. Bookkeeping encompasses all steps in the accounting process. 3. Accountants prepare, but do not interpret, financial reports. 4. The two most common types of external users are investors and company officers. 5. Managerial accounting activities focus on reports for internal users. LO 1 True False False False True Basic Concepts

- 13. 1-13 Etika Laporan Keuangan Recent financial scandals include: Enron, WorldCom, HealthSouth, AIG, and other companies. Regulators and lawmakers concerned that economy would suffer if investors lost confidence in corporate accounting. In response, ► Congress passed Sarbanes-Oxley Act (SOX). Effective financial reporting depends on sound ethical behavior. LO 2 LEARNING OBJECTIVE Explain the building blocks of accounting: ethics, principles, and assumptions. 2

- 14. 1-14 Illustration 1-4 Steps in analyzing ethics cases and situations Ethics in Financial Reporting LO 2

- 15. 1-15 Ethics are the standards of conduct by which one's actions are judged as: a. right or wrong. b. honest or dishonest. c. fair or not fair. d. all of these options. Question Ethics in Financial Reporting LO 2

- 16. 1-16 LO 2

- 17. 1-17 Various users need financial information The accounting profession has developed standards that are generally accepted and universally practiced. Financial Statements Balance Sheet Income Statement Statement of Owner's Equity Statement of Cash Flows Note Disclosure Generally Accepted Accounting Principles (GAAP) Generally Accepted Accounting Principles LO 2

- 18. 1-18 Generally Accepted Accounting Principles (GAAP) – Standards that are generally accepted and universally practiced. These standards indicate how to report economic events. Standard-setting bodies: ► Financial Accounting Standards Board (FASB) ► Securities and Exchange Commission (SEC) ► International Accounting Standards Board (IASB) Generally Accepted Accounting Principles LO 2

- 19. 1-19 Prinsip Pengukuran HISTORICAL COST PRINCIPLE (or cost principle) dictates that companies record assets at their cost. FAIR VALUE PRINCIPLE states that assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability). Selection of which principle to follow generally relates to trade-offs between relevance and faithful representation. LO 2

- 20. 1-20 MONETARY UNIT ASSUMPTION requires that companies include in the accounting records only transaction data that can be expressed in terms of money. ECONOMIC ENTITY ASSUMPTION requires that activities of the entity be kept separate and distinct from the activities of its owner and all other economic entities. Proprietorship Partnership Corporation Forms of Business Ownership Assumptions LO 2

- 21. 1-21 Proprietorship Partnership Corporation Owned by two or more persons Often retail and service-type businesses Generally unlimited personal liability Partnership agreement Ownership divided into shares of stock Separate legal entity organized under state corporation law Limited liability Owned by one person Owner is often manager/operator Owner receives any profits, suffers any losses, and is personally liable for all debts Forms of Business Ownership LO 2

- 22. 1-22 Question Combining the activities of Kellogg and General Mills would violate the a. cost principle. b. economic entity assumption. c. monetary unit assumption. d. ethics principle. LO 2 Assumptions

- 23. 1-23 A business organized as a separate legal entity under state law having ownership divided into shares of stock is a a. proprietorship. b. partnership. c. corporation. d. sole proprietorship. Question LO 2 Assumptions

- 24. 1-24 Indicate whether each of the following statements presented below is true or false. 1. Congress passed the Sarbanes-Oxley Act to reduce unethical behavior and decrease the likelihood of future corporate scandals. 2. The primary accounting standard-setting body in the United States is the Financial Accounting Standards Board (FASB). 3. The historical cost principle dictates that companies record assets at their cost. In later periods, however, the fair value of the asset must be used if fair value is higher than its cost. True False True LO 2 DO IT! 2 Building Blocks of Accounting

- 25. 1-25 4. Relevance means that financial information matches what really happened; the information is factual. 5. A business owner’s personal expenses must be separated from expenses of the business to comply with accounting’s economic entity assumption. False True LO 2 Indicate whether each of the following statements presented below is true or false. DO IT! 2 Building Blocks of Accounting

- 26. 1-26 Assets Liabilities Owner's Equity = + LO 3 LEARNING OBJECTIVE State the accounting equation, and define its components. 3 Basic Accounting Equation Provides the underlying framework for recording and summarizing economic events. Assets are claimed by either creditors or owners. If a business is liquidated, claims of creditors must be paid before ownership claims.

- 27. 1-27 Assets Liabilities Owner's Equity = + Resources a business owns. Provide future services or benefits. Cash, Supplies, Equipment, etc. Assets LO 3 Basic Accounting Equation

- 28. 1-28 Assets Liabilities Owner's Equity = + Basic Accounting Equation Claims against assets (debts and obligations). Creditors (party to whom money is owed). Accounts Payable, Notes Payable, Salaries and Wages Payable, etc. Liabilities LO 3

- 29. 1-29 Owner's Equity Assets Liabilities Owner's Equity = + Basic Accounting Equation LO 3 Ownership claim on total assets. Referred to as residual equity. Investment by owners and revenues (+) Drawings and expenses (-).

- 30. 1-30 Investments by owner are the assets the owner puts into the business. Revenues result from business activities entered into for the purpose of earning income. ► Common sources of revenue are: sales, fees, services, commissions, interest, dividends, royalties, and rent. Owner’s Equity Increases in Owner’s Equity Illustration 1-6 Expanded accounting equation LO 3

- 31. 1-31 Drawings An owner may withdraw cash or other assets for personal use. Expenses are the cost of assets consumed or services used in the process of earning revenue. ► Common expenses are: salaries expense, rent expense, utilities expense, tax expense, etc. Owner’s Equity Decreases in Owner’s Equity Illustration 1-6 Expanded accounting equation LO 3

- 32. 1-32 Expense Decrease Expense Decrease Revenue Increase Drawings Decrease Classification Classify the following items as investment by owner, owner’s drawings, revenue, or expenses. Then indicate whether each item increases or decreases owner’s equity. 1. Rent Expense 2. Service Revenue 3. Drawings 4. Salaries and Wages Expense Effect on Equity LO 3 DO IT! 3 Owner's Equity Effects

- 33. 1-33 Transactions are a business’s economic events recorded by accountants. May be external or internal. Not all activities represent transactions. Each transaction has a dual effect on the accounting equation. LO 4 LEARNING OBJECTIVE Analyze the effects of business transactions on the accounting equation. 4

- 34. 1-34 Illustration: Are the following events recorded in the accounting records? Event Purchase computer Criterion Is the financial position (assets, liabilities, or owner’s equity) of the company changed? Discuss product design with potential customer Pay rent Record/ Don’t Record Transaction Analysis LO 4 Illustration 1-7

- 35. 1-35 Transaction Analysis TRANSACTION 1. INVESTMENT BY OWNER Ray Neal decides to start a smartphone app development company which he names Softbyte. On September 1, 2017, he invests $15,000 cash in the business. This transaction results in an equal increase in assets and owner’s equity. Trans- action Cash Accounts Receivable Supplies Equipment Accounts Payable Owner's Capital 1. +15,000 +15,000 Assets = Liabilities + Owner's Equity + + + + + = LO 4 Owner's Drawings Rev. Exp. + - Illustration 1-8 Tabular summary of Softbyte transactions

- 36. 1-36 8. -250 -250 9. +600 -600 10. -1,300 -1,300 5. +250 -250 4. +1,200 +1,200 7. -1,700 -600 -900 -200 Trans- action Cash Accounts Receivable Supplies Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + + + = 1. +15,000 +15,000 2. -7,000 +7,000 3. +1,600 +1,600 6. +1,500 +2,000 +3,500 $8,050 $1,400 $1,600 $7,000 $1,600 $15,000 $4,700 $1,950 $1,300 + + + + + = - - TRANSACTION 2. PURCHASE OF EQUIPMENT FOR CASH Softbyte Inc. purchases computer equipment for $7,000 cash. Illustration 1-8 LO 4 Owner's Capital Owner's Drawings Rev. Exp. + -

- 37. 1-37 8. -250 -250 9. +600 -600 10. -1,300 -1,300 5. +250 -250 4. +1,200 +1,200 7. -1,700 -600 -900 -200 Trans- action Cash Accounts Receivable Supplies Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + + + = 1. +15,000 +15,000 2. -7,000 +7,000 3. +1,600 +1,600 6. +1,500 +2,000 +3,500 $8,050 $1,400 $1,600 $7,000 $1,600 $15,000 $4,700 $1,950 $1,300 + + + + + = - - TRANSACTION 3. PURCHASE OF SUPPLIES ON CREDIT Softbyte Inc. purchases for $1,600 headsets and other accessories expected to last several months. The supplier allows Softbyte to pay this bill in October. Illustration 1-8 LO 4 Owner's Capital Owner's Drawings Rev. Exp. + -

- 38. 1-38 8. -250 -250 9. +600 -600 10. -1,300 -1,300 5. +250 -250 7. -1,700 -600 -900 -200 Trans- action Cash Accounts Receivable Supplies Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + + + = 1. +15,000 +15,000 2. -7,000 +7,000 3. +1,600 +1,600 6. +1,500 +2,000 +3,500 $8,050 $1,400 $1,600 $7,000 $1,600 $15,000 $4,700 $1,950 $1,300 + + + + + = - - TRANSACTION 4. SERVICES PERFORMED FOR CASH Softbyte Inc. receives $1,200 cash from customers for app development services it has performed. Illustration 1-8 LO 4 4. +1,200 +1,200 Owner's Capital Owner's Drawings Rev. Exp. + -

- 39. 1-39 8. -250 -250 9. +600 -600 10. -1,300 -1,300 7. -1,700 -600 -900 -200 Trans- action Cash Accounts Receivable Supplies Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + + + = 1. +15,000 +15,000 2. -7,000 +7,000 3. +1,600 +1,600 6. +1,500 +2,000 +3,500 $8,050 $1,400 $1,600 $7,000 $1,600 $15,000 $4,700 $1,950 $1,300 + + + + + = - - TRANSACTION 5. PURCHASE OF ADVERTISING ON CREDIT Softbyte Inc. receives a bill for $250 from the Daily News for advertising on its online website but postpones payment until a later date. Illustration 1-8 LO 4 Owner's Capital Owner's Drawings Rev. Exp. + - 4. +1,200 +1,200 5. +250 -250

- 40. 1-40 8. -250 -250 9. +600 -600 10. -1,300 -1,300 7. -1,700 -600 -900 -200 Trans- action Cash Accounts Receivable Supplies Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + + + = 1. +15,000 +15,000 2. -7,000 +7,000 3. +1,600 +1,600 $8,050 $1,400 $1,600 $7,000 $1,600 $15,000 $4,700 $1,950 $1,300 + + + + + = - - TRANSACTION 6. SERVICES PERFORMED FOR CASH AND CREDIT. Softbyte performs $3,500 of services. The company receives cash of $1,500 from customers, and it bills the balance of $2,000 on account. Illustration 1-8 LO 4 Owner's Capital Owner's Drawings Rev. Exp. + - 4. +1,200 +1,200 6. +1,500 +2,000 +3,500 5. +250 -250

- 41. 1-41 8. -250 -250 9. +600 -600 10. -1,300 -1,300 Trans- action Cash Accounts Receivable Supplies Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + + + = 1. +15,000 +15,000 2. -7,000 +7,000 3. +1,600 +1,600 $8,050 $1,400 $1,600 $7,000 $1,600 $15,000 $4,700 $1,950 $1,300 + + + + + = - - TRANSACTION 7. PAYMENT OF EXPENSES Softbyte Inc. pays the following expenses in cash for September: office rent $600, salaries and wages of employees $900, and utilities $200. Illustration 1-8 LO 4 Owner's Capital Owner's Drawings Rev. Exp. + - 4. +1,200 +1,200 7. -1,700 -600 -900 -200 6. +1,500 +2,000 +3,500 5. +250 -250

- 42. 1-42 8. -250 -250 9. +600 -600 10. -1,300 -1,300 Trans- action Cash Accounts Receivable Supplies Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + + + = 1. +15,000 +15,000 2. -7,000 +7,000 3. +1,600 +1,600 $8,050 $1,400 $1,600 $7,000 $1,600 $15,000 $4,700 $1,950 $1,300 + + + + + = - - TRANSACTION 8. PAYMENT OF ACCOUNTS PAYABLE Softbyte Inc. pays its $250 Daily News bill in cash. The company previously (in Transaction 5) recorded the bill as an increase in Accounts Payable. Illustration 1-8 LO 4 Owner's Capital Owner's Drawings Rev. Exp. + - 4. +1,200 +1,200 7. -1,700 -600 -900 -200 6. +1,500 +2,000 +3,500 5. +250 -250

- 43. 1-43 8. -250 -250 9. +600 -600 10. -1,300 -1,300 Trans- action Cash Accounts Receivable Supplies Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + + + = 1. +15,000 +15,000 2. -7,000 +7,000 3. +1,600 +1,600 $8,050 $1,400 $1,600 $7,000 $1,600 $15,000 $4,700 $1,950 $1,300 + + + + + = - - TRANSACTION 9. RECEIPT OF CASH ON ACCOUNT Softbyte Inc. receives $600 in cash from customers who had been billed for services (in Transaction 6). Illustration 1-8 LO 4 Owner's Capital Owner's Drawings Rev. Exp. + - 4. +1,200 +1,200 7. -1,700 -600 -900 -200 6. +1,500 +2,000 +3,500 5. +250 -250

- 44. 1-44 8. -250 -250 9. +600 -600 10. -1,300 -1,300 Trans- action Cash Accounts Receivable Supplies Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + + + = 1. +15,000 +15,000 2. -7,000 +7,000 3. +1,600 +1,600 $8,050 $1,400 $1,600 $7,000 $1,600 $15,000 $1,300 $4,700 $1,950 + + + + + = - - TRANSACTION 10. WITHDRAWAL OF CASH BY OWNER Ray Neal withdraws $1,300 in cash in cash from the business for his personal use. $18,050 $18,050 Illustration 1-8 LO 4 7. -1,700 -600 -900 -200 6. +1,500 +2,000 +3,500 5. +250 -250 Owner's Capital Owner's Drawings Rev. Exp. + - 4. +1,200 +1,200

- 45. 1-45 1. Each transaction is analyzed in terms of its effect on: a. The three components of the basic accounting equation. b. Specific of items within each component. 2. The two sides of the equation must always be equal. Summary of Transactions LO 4

- 46. 1-46 Transactions made by Virmari & Co., a public accounting firm, for the month of August are shown below. Prepare a tabular analysis which shows the effects of these transactions on the expanded accounting equation, similar to that shown in Illustration 1-8. 1. The owner invested $25,000 cash in the business. 2. The company purchased $7,000 of office equipment on credit. 3. The company received $8,000 cash in exchange for services performed. 4. The company paid $850 for this month’s rent. 5. The owner withdrew $1,000 cash for personal use. LO 4 DO IT! 4 Tabular Analysis

- 47. 1-47 1. +25,000 +25,000 Trans- action Cash Equipment Accounts Payable Owner's Capital Assets = Liabilities + Owner's Equity + + + = 1. The owner invested $25,000 cash in the business. 2. +7,000 +7,000 3. +8,000 +8,000 4. -850 -850 5. -1,000 -1,000 $31,150 $7,000 $7,000 $25,000 $8,000 $850 $1,000 + + + = - - $18,050 $18,050 LO 4 Owner's Drawings Rev. Exp. + - DO IT! 4 Tabular Analysis

- 48. 1-48 1. +25,000 +25,000 Trans- action Cash Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + = 2. The company purchased $7,000 of office equipment on credit. 2. +7,000 +7,000 3. +8,000 +8,000 4. -850 -850 5. -1,000 -1,000 $31,150 $7,000 $7,000 $25,000 $8,000 $850 $1,000 + + + = - - $18,050 $18,050 LO 4 Owner's Drawings Rev. Exp. + - Owner's Capital DO IT! 4 Tabular Analysis

- 49. 1-49 1. +25,000 +25,000 Trans- action Cash Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + = 3. The company received $8,000 cash in exchange for services performed. 2. +7,000 +7,000 3. +8,000 +8,000 4. -850 -850 5. -1,000 -1,000 $31,150 $7,000 $7,000 $25,000 $8,000 $850 $1,000 + + + = - - $18,050 $18,050 LO 4 Owner's Drawings Rev. Exp. + - Owner's Capital DO IT! 4 Tabular Analysis

- 50. 1-50 1. +25,000 +25,000 Trans- action Cash Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + = 4. The company paid $850 for this month’s rent. 2. +7,000 +7,000 3. +8,000 +8,000 4. -850 -850 5. -1,000 -1,000 $31,150 $7,000 $7,000 $25,000 $8,000 $850 $1,000 + + + = - - $18,050 $18,050 LO 4 Owner's Drawings Rev. Exp. + - Owner's Capital DO IT! 4 Tabular Analysis

- 51. 1-51 1. +25,000 +25,000 Trans- action Cash Equipment Accounts Payable Assets = Liabilities + Owner's Equity + + + = 5. The owner withdrew $1,000 cash for personal use. 2. +7,000 +7,000 3. +8,000 +8,000 4. -850 -850 5. -1,000 -1,000 $31,150 $7,000 $7,000 $25,000 $1,000 $8,000 $850 + + + = + $38,150 $38,150 LO 4 Owner's Drawings Rev. Exp. + - Owner's Capital DO IT! 4 Tabular Analysis -

- 52. 1-52 Companies prepare four financial statements : Balance Sheet Income Statement Statement of Cash Flows Owner’s Equity Statement LEARNING OBJECTIVE Describe the four financial statements and how they are prepared. 5 LO 5

- 53. 1-53 Financial Statements Net income will result during a time period when: a. assets exceed liabilities. b. assets exceed revenues. c. expenses exceed revenues. d. revenues exceed expenses. Question LO 5

- 54. 1-54 Net income is needed to determine the ending balance in owner’s equity. Financial Statements LO 5 Illustration 1-9 Financial statements and their interrelationships SOFTBYTE Income Statement For the Month Ended September 30, 2017 SOFTBYTE Owner’s Equity Statement For the Month Ended September 30, 2017

- 55. 1-55 The ending balance in owner’s equity is needed in preparing the balance sheet. Illustration 1-9 Illustration 1-9 Financial statements and their interrelationships SOFTBYTE Owner’s Equity Statement For the Month Ended September 30, 2017 SOFTBYTE Balance Sheet September 30, 2017

- 56. 1-56 Balance sheet and income statement are needed to prepare statement of cash flows. SOFTBYTE Balance Sheet September 30, 2017 SOFTBYTE Statement of Cash Flows For the Month Ended September 30, 2017 Illustration 1-9 Financial statements and their interrelationships Financial Statements

- 57. 1-57 Reports the revenues and expenses for a specific period of time. Lists revenues first, followed by expenses. Shows net income (or net loss). Income Statement LO 5 Does not include investment and withdrawal transactions between the owner and the business in measuring net income.

- 58. 1-58 Reports the changes in owner’s equity for a specific period of time. The time period is the same as that covered by the income statement. Owner’s Equity Statement LO 5

- 59. 1-59 Reports the assets, liabilities, and owner's equity at a specific date. Lists assets at the top, followed by liabilities and owner’s equity. Total assets must equal total liabilities and owner's equity. Is a snapshot of the company’s financial condition at a specific moment in time (usually the month-end or year- end). Balance Sheet LO 5

- 60. 1-60 Information on the cash receipts and payments for a specific period of time. Answers the following: ► Where did cash come from? ► What was cash used for? ► What was the change in the cash balance? Statement of Cash Flows LO 5

- 61. 1-61 Which of the following financial statements is prepared as of a specific date? a. Balance sheet. b. Income statement. c. Owner's equity statement. d. Statement of cash flows. Financial Statements Question LO 5

- 62. 1-62 LO 5

- 63. 1-63 LO 5 DO IT! 5 Financial Statement Items Presented below is selected information related to Flanagan Company at December 31, 2017. Flanagan reports financial information monthly. Equipment $10,000 Utilities Expense $ 4,000 Cash 8,000 Accounts Receivable 9,000 Service Revenue 36,000 Salaries and Wages Expense 7,000 Rent Expense 11,000 Notes Payable 16,500 Accounts Payable 2,000 Owner’s Drawings 5,000 (a) Determine the total assets of at December 31, 2017. (b) Determine the net income reported for December 2017. (c) Determine the owner’s equity at December 31, 2017.

- 64. 1-64 LO 5 DO IT! 5 Financial Statement Items Presented below is selected information related to Flanagan Company at December 31, 2017. Flanagan reports financial information monthly. Equipment $10,000 Utilities Expense $ 4,000 Cash 8,000 Accounts Receivable 9,000 Service Revenue 36,000 Salaries and Wages Expense 7,000 Rent Expense 11,000 Notes Payable 16,500 Accounts Payable 2,000 Owner’s Drawings 5,000 (a) Determine the total assets of at December 31, 2017. The total assets are $27,000, comprised of • Cash $8,000, • Accounts Receivable $9,000, and • Equipment $10,000.

- 65. 1-65 LO 5 DO IT! 5 Financial Statement Items Presented below is selected information related to Flanagan Company at December 31, 2017. Flanagan reports financial information monthly. Equipment $10,000 Utilities Expense $ 4,000 Cash 8,000 Accounts Receivable 9,000 Service Revenue 36,000 Salaries and Wages Expense 7,000 Rent Expense 11,000 Notes Payable 16,500 Accounts Payable 2,000 Owner’s Drawings 5,000 (b) Determine the net income reported for December 2017.

- 66. 1-66 LO 5 DO IT! 5 Financial Statement Items Presented below is selected information related to Flanagan Company at December 31, 2017. Flanagan reports financial information monthly. Equipment $10,000 Utilities Expense $ 4,000 Cash 8,000 Accounts Receivable 9,000 Service Revenue 36,000 Salaries and Wages Expense 7,000 Rent Expense 11,000 Notes Payable 16,500 Accounts Payable 2,000 Owner’s Drawings 5,000 (c) Determine the owner’s equity at December 31, 2017.

- 67. 1-67 Forensic Accounting Uses accounting, auditing, and investigative skills to conduct investigations into theft and fraud. Governmental Accounting Careers with the IRS, the FBI, the SEC, public colleges and universities, and in state and local governments. Private Accounting Careers in industry working in cost accounting, budgeting, accounting information systems, and taxation. Public Accounting Careers in auditing, taxation, and management consulting serving the general public. LEARNING OBJECTIVE APPENDIX 1A: Explain the career opportunities in accounting. 6 LO 6

- 68. 1-68 Salary estimates for jobs in public and corporate accounting Illustration 1A-1 Upper-level management salaries in corporate accounting Illustration 1A-2 LO 6 “Show Me the Money”

- 69. 1-69 Key Points Following are the key similarities and differences between GAAP and IFRS as related to accounting fundamentals. Similarities The basic techniques for recording business transactions are the same for U.S. and international companies. Both international and U.S. accounting standards emphasize transparency in financial reporting. Both sets of standards are primarily driven by meeting the needs of investors and creditors. LO 7 LEARNING OBJECTIVE Describe the impact of international accounting standards on U.S. financial reporting. 7

- 70. 1-70 Key Points Similarities The three most common forms of business organizations, proprietorships, partnerships, and corporations, are also found in countries that use international accounting standards. Differences International standards are referred to as International Financial Reporting Standards (IFRS), developed by the International Accounting Standards Board. Accounting standards in the United States are referred to as generally accepted accounting principles (GAAP) and are developed by the Financial Accounting Standards Board. LO 7

- 71. 1-71 Key Points Differences IFRS tends to be simpler in its accounting and disclosure requirements; some people say it is more “principles-based.” GAAP is more detailed; some people say it is more “rules-based.” The internal control standards applicable to Sarbanes-Oxley (SOX) apply only to large public companies listed on U.S. exchanges. There is continuing debate as to whether non-U.S. companies should have to comply with this extra layer of regulation. LO 7

- 72. 1-72 Looking to the Future Both the IASB and the FASB are hard at work developing standards that will lead to the elimination of major differences in the way certain transactions are accounted for and reported. LO 7

- 73. 1-73 Which of the following is not a reason why a single set of high-quality international accounting standards would be beneficial? a) Mergers and acquisition activity. b) Financial markets. c) Multinational corporations. d) GAAP is widely considered to be a superior reporting system. A Look at IFRS IFRS Self-Test Questions LO 7

- 74. 1-74 The Sarbanes-Oxley Act determines: a) international tax regulations. b) internal control standards as enforced by the IASB. c) internal control standards of U.S. publicly traded companies. d) U.S. tax regulations. A Look at IFRS IFRS Self-Test Questions LO 7

- 75. 1-75 IFRS is considered to be more: a) principles-based and less rules-based than GAAP. b) rules-based and less principles-based than GAAP. c) detailed than GAAP. d) None of the above. A Look at IFRS IFRS Self-Test Questions LO 7

- 76. 1-76 Self-Test Question 1. Manakah dari berikut ini yang bukan merupakan langkah dalam proses akuntansi? A. Identifikasi. B. Verifikasi. C. Pencatatan. D. Komunikasi.

- 77. 1-77 Self-Test Question 2. Manakah dari pernyataan-pernyataan berikut tentang para pengguna informasi akuntansi yang salah? A. Manajemen adalah pengguna internal. B. Otoritas perpajakan adalah pengguna eksternal. C. Kreditur yang ada adalah pengguna eksternal. D. Badan regulator adalah pengguna internal.

- 78. 1-78 Self-Test Question 3. Prinsip biaya historis menyatakan bahwa: A. aset pada awalnya harus dicatat pada harga perolehannya dan disesuaikan saat nilai wajarnya berubah. B. aktivitas sebuah entitas harus dipisahkan dan dibedakan dari para pemiliknya. C. aset harus dicatat sebesar biaya perolehannya. D. hanya datatransaksi yang dapat dinyatakan dalam uang yang dimasukkan dalam catatan akuntansi.

- 79. 1-79 Self-Test Question 4. Manakah dari pernyataan berikut tentang asumsi dasar yang benar?: A. Asumsi-asumsi dasar sama dengan prinsip- prinsip akuntansi. B. Asumsi entitas ekonomi menyatakan bahwa harus ada unit akuntabilitas tertentu. C. Asumsi unit moneter membuat akuntansi dapat mengukur moral karyawan. D. Persekutuan bukan merupakan entitas ekonomi

- 80. 1-80 Self-Test Question 5. Tiga jenis entitas bisnis adalah: A. perusahaan perorangan, perusahaan kecil, dan persekutuan. B. perusahaan perorangan, persekutuan, dan perseroan terbatas. C. perusahaan perorangan, persekutuan, dan perusahaan besar. D. perusahaan jasa keuangan, manufaktur, dan jasa

- 81. 1-81 Self-Test Question 6. Laba neto akan dihasilkan selama suatu periode waktu saat: A. aset melebihi liabilitas. B. aset melebihi pendapatan. C. beban melebihi pendapatan. D. pendapatan melebihi beban

- 82. 1-82 Self-Test Question 7. Melaksanakan pekerjaan dan belum dibayarkan akan memiliki pengaruh berikut pada komponen-komponen persamaan akuntansi dasar: A. meningkatkan aset dan mengurangi ekuitas. B. meningkatkan aset dan meningkatkan ekuitas. C. meningkatkan aset dan liabilitas. D. meningkatkan liabilitas dan ekuitas

- 83. 1-83 Self-Test Question 8. Pada 31 Desember 2014, Stoneland Company Aset aset $3.500 dan ekuitas $2.000. Berapakah liabilitas Stoneland Company per 3l Desember 2014? A. $1.500 B. $1.000. C. $2.500. D. $2.500.

- 84. 1-84 Self-Test Question 9. Manakah dari peristiwa berikut yang tidak dicatat dalam catatan akuntansi? A. Peralatan dibeli secara kredit. B. Karyawan dipecat. C. Investasi secara tunai ditanamkan di perusahaan. D. Perusahaan membayarkan dividen kas.

- 85. 1-85 Self-Test Question 10. Selama tahun 2014, aset Gibson Company turun sebesar $50.000 dan liabilitasnya turun sebesar $90.000. Oleh karena itu, ekuitas Gibson Company? A. naik sebesar $40.000. B. turun sebesar $140.000. C. turun sebesar $40.000. D. naik sebesar $140.000

- 86. 1-86 Self-Test Question 11. Pembayaran utang usaha memengaruhi komponen persamaan akuntansi dalam cara berikut? A. menurunkan ekuitas dan menurunkan liabilitas. B. meningkatkan aset dan menurunkan liabilitas. C. menurunkan aset dan meningkatkan ekuitas. D. menurunkan aset dan menurunkan liabilitas

- 87. 1-87 Self-Test Question 12. Manakah dari pernyataan-pernyataan berikut ini vang salah? A. Laporan arus kas mengikhtisarkan informasi tentang arus kas masuk (penerimaan) dan arus kas keluar (pembayaran) untuk periode waktu tertentu. B. Laporan posisi keuangan melaporkan aset, liabilitas, dan ekuitas pada tanggal tertentu. C. Laporan laba rugi menyajikan pendapatan, beban, perubahan dalam ekuitas, dan menghasilkan laba neto atau rugi neto untuk periode waktu tertentu. D. Laporan saldo laba mengikhtisarkan perubahan dalam saldo laba untuk periode waktu tertentu.

- 88. 1-88 Self-Test Question 13. Pada hari terakhir dari suatu periode, Jim Otto Company membeli mesin seharga $900 secara kredit. Transaksi ini akan memengaruhi: A. hanya laporan laba rugi. B. hanya laporan posisi keuangan. C. laporan laba rugi dan laporan saldo laba. D. laporan laba rugi, laporan saldo laba, dan laporan posisi keuangan.

- 89. 1-89 Self-Test Question 14. Laporan keuangan yang melaporkan aset, Iiabilitas, dan ekuitas adalah: A. laporan laba rugi. B. laporan saldo laba. C. laporan posisi keuangan. D. laporan arus kas.

- 90. 1-90 Self-Test Question 15. Jasa-jasa yang diberikan oleh akuntan publik terdiri dari: A. Pengauditan, perpajakan, dan konsultasi manajemen. B. Pengauditan, penganggaran, dan konsultasi manajemen. C. Pengauditan, penganggaran, dan akuntansi biaya. D. Audit internal, penganggaran, dan konsultasi manajemen.

- 91. 1-91 Jawaban Self-Test Question 1. B 2. D 3. C 4. B 5. B 6. D 7. B 8. A 9. B 10. A 11. D 12. C 13. B 14. C 15. A