This insurance policy provides commercial property owners with coverage for losses related to their investment property. Key coverage includes:

1) Property damage coverage for the owned building and contents.

2) Loss of income coverage if the property cannot be leased due to damage.

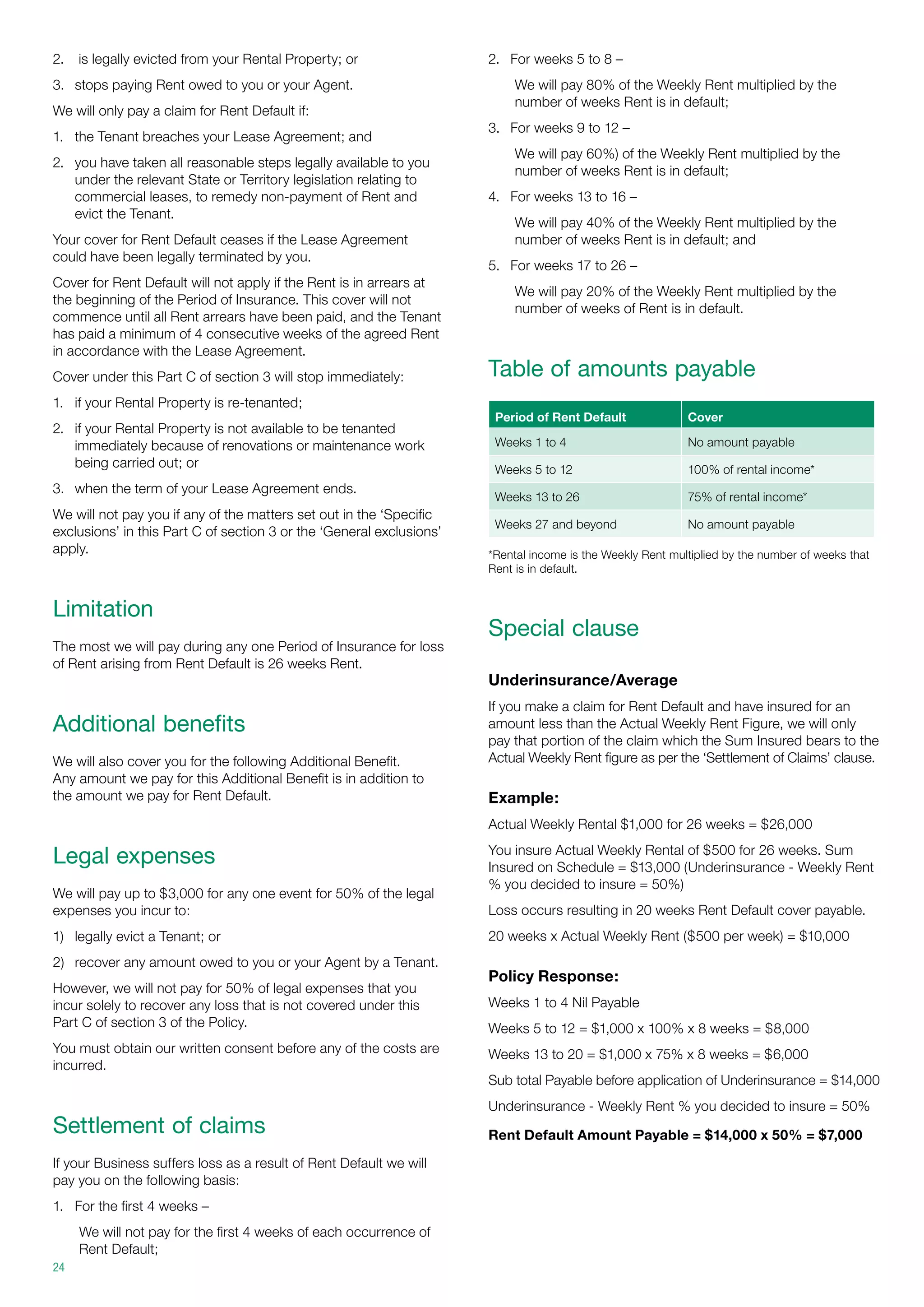

3) Theft and money coverage, as well as coverage for rent defaults by tenants.

4) Additional optional coverage available includes glass breakage, taxation audits, legal costs for health and safety issues, and machinery breakdown.

The policy is available through shareholders of an insurance brokerage and provides property owners with comprehensive protection for their commercial investment property.