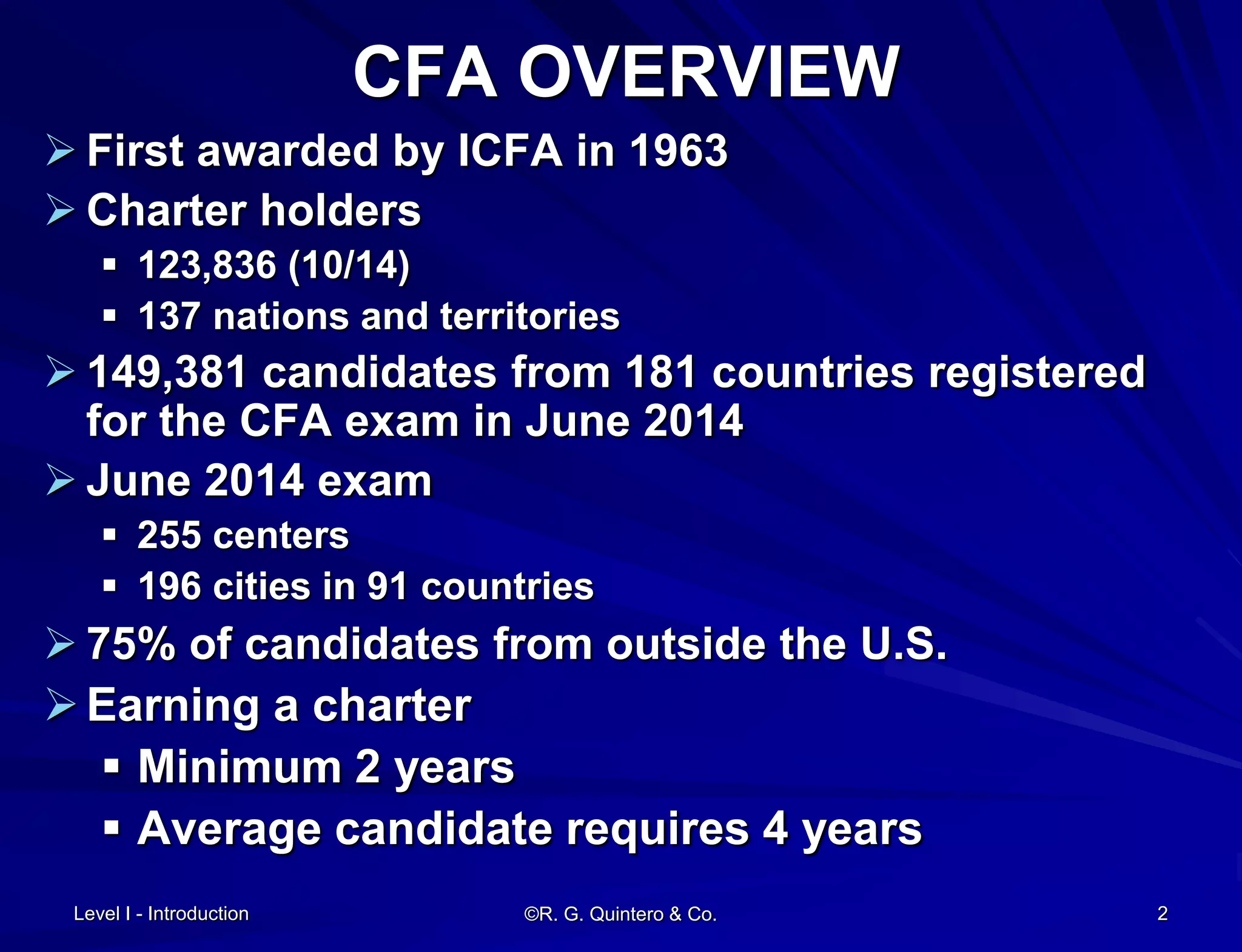

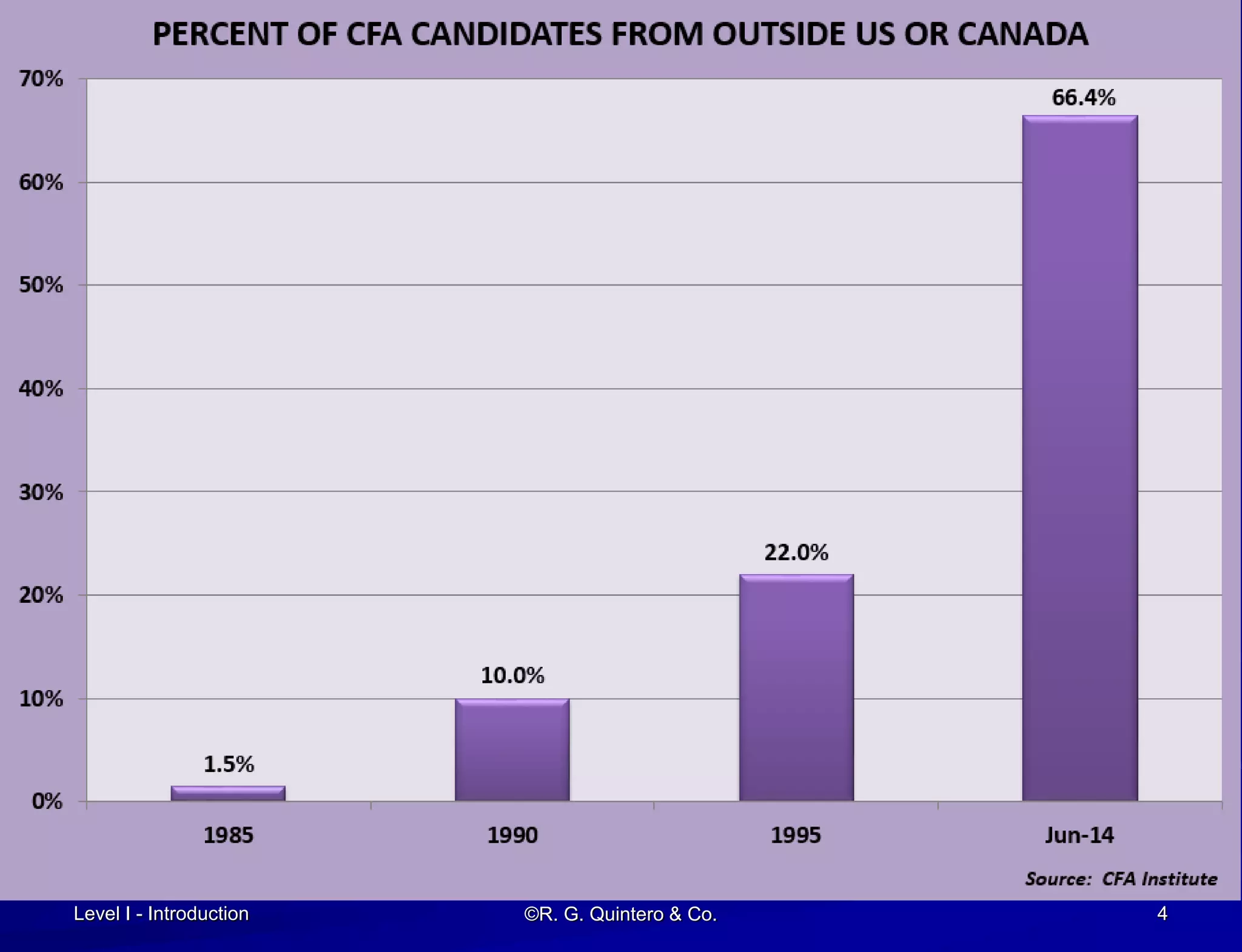

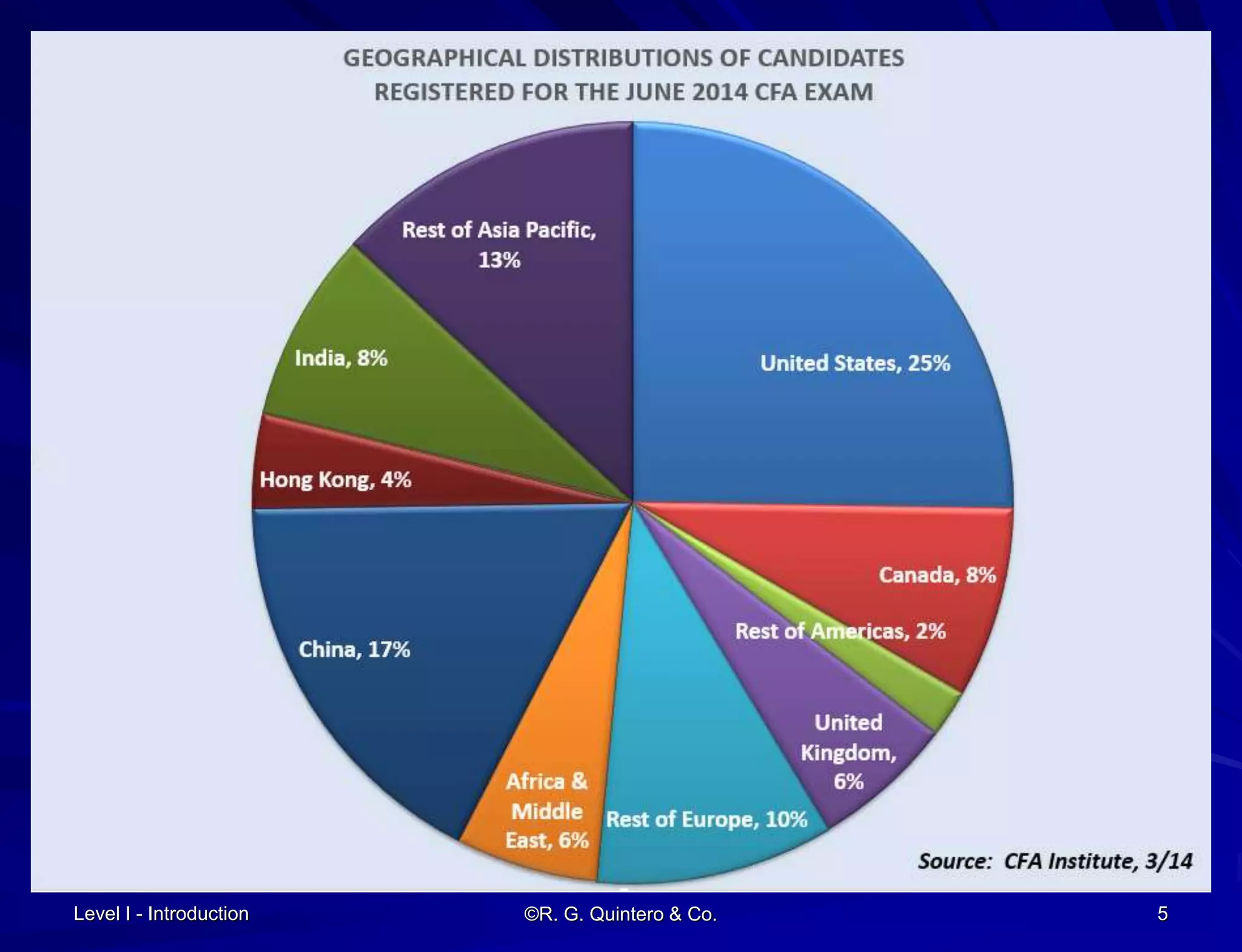

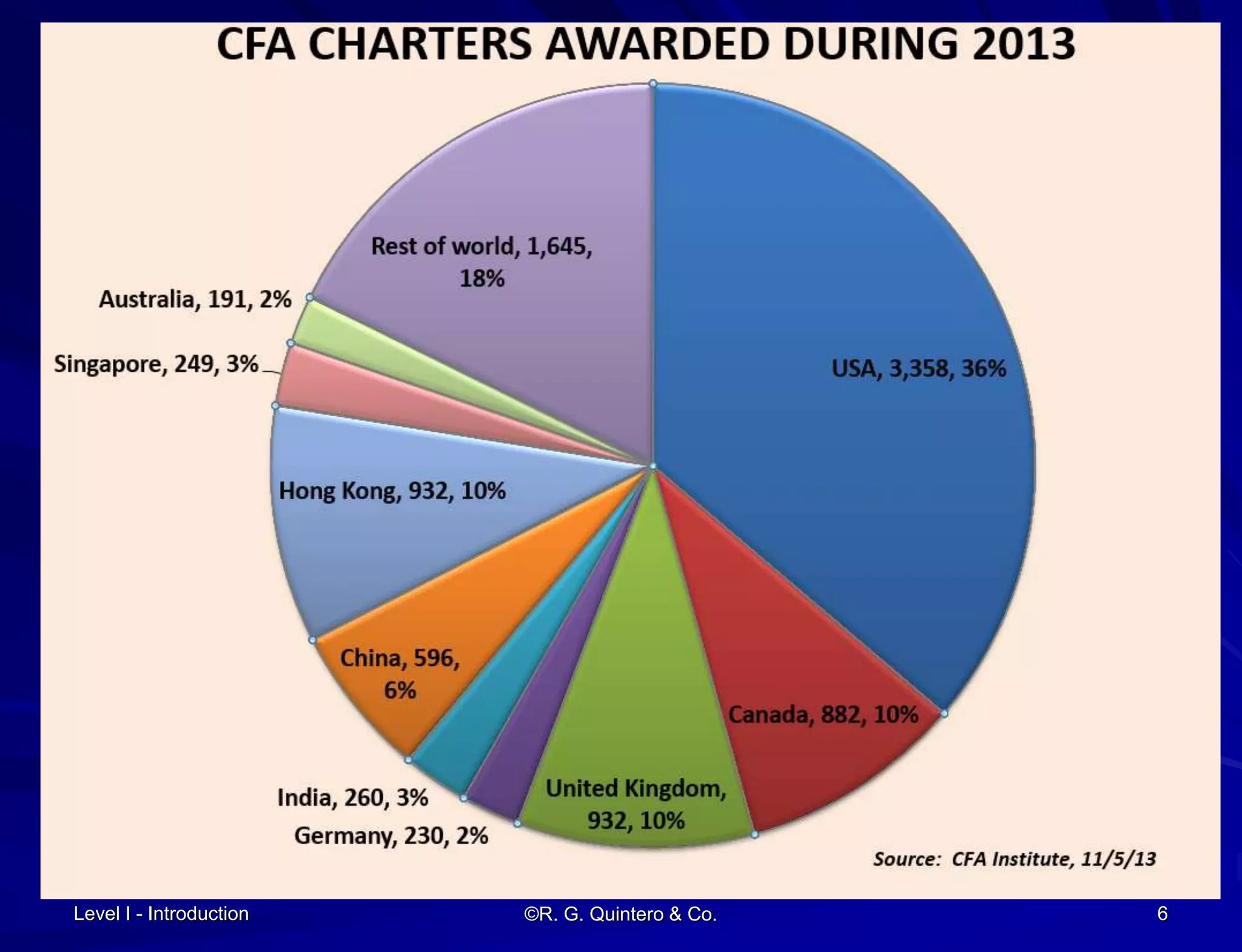

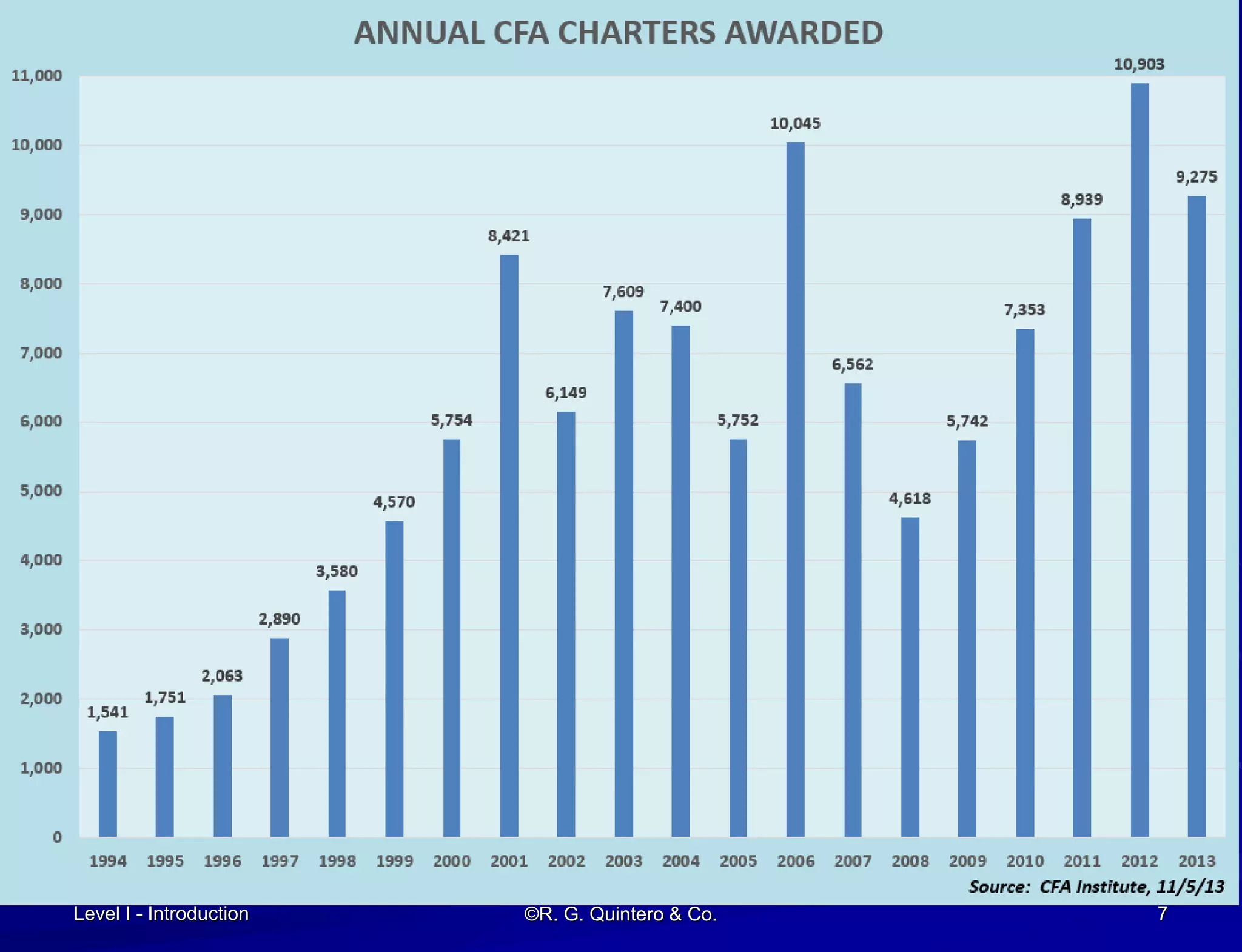

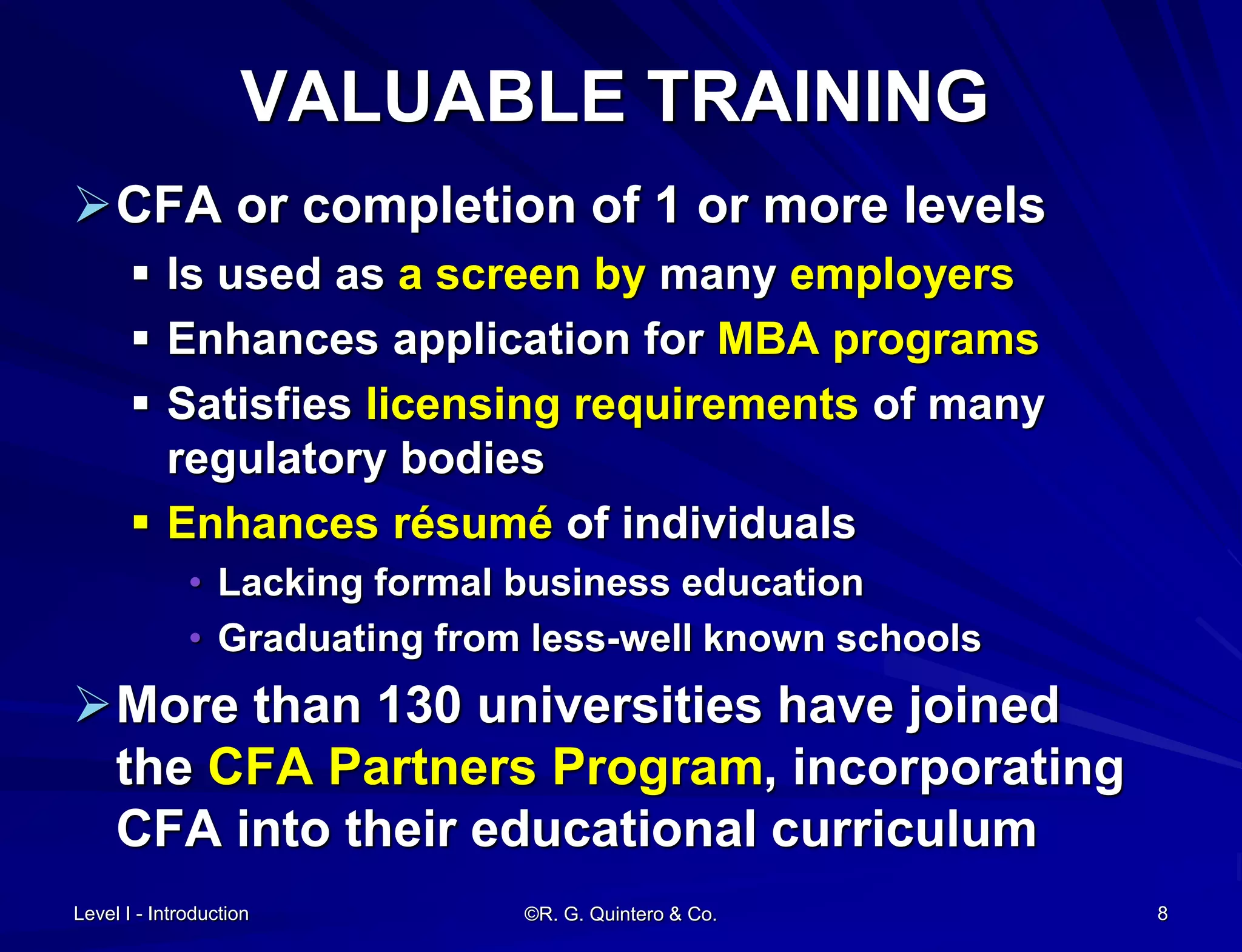

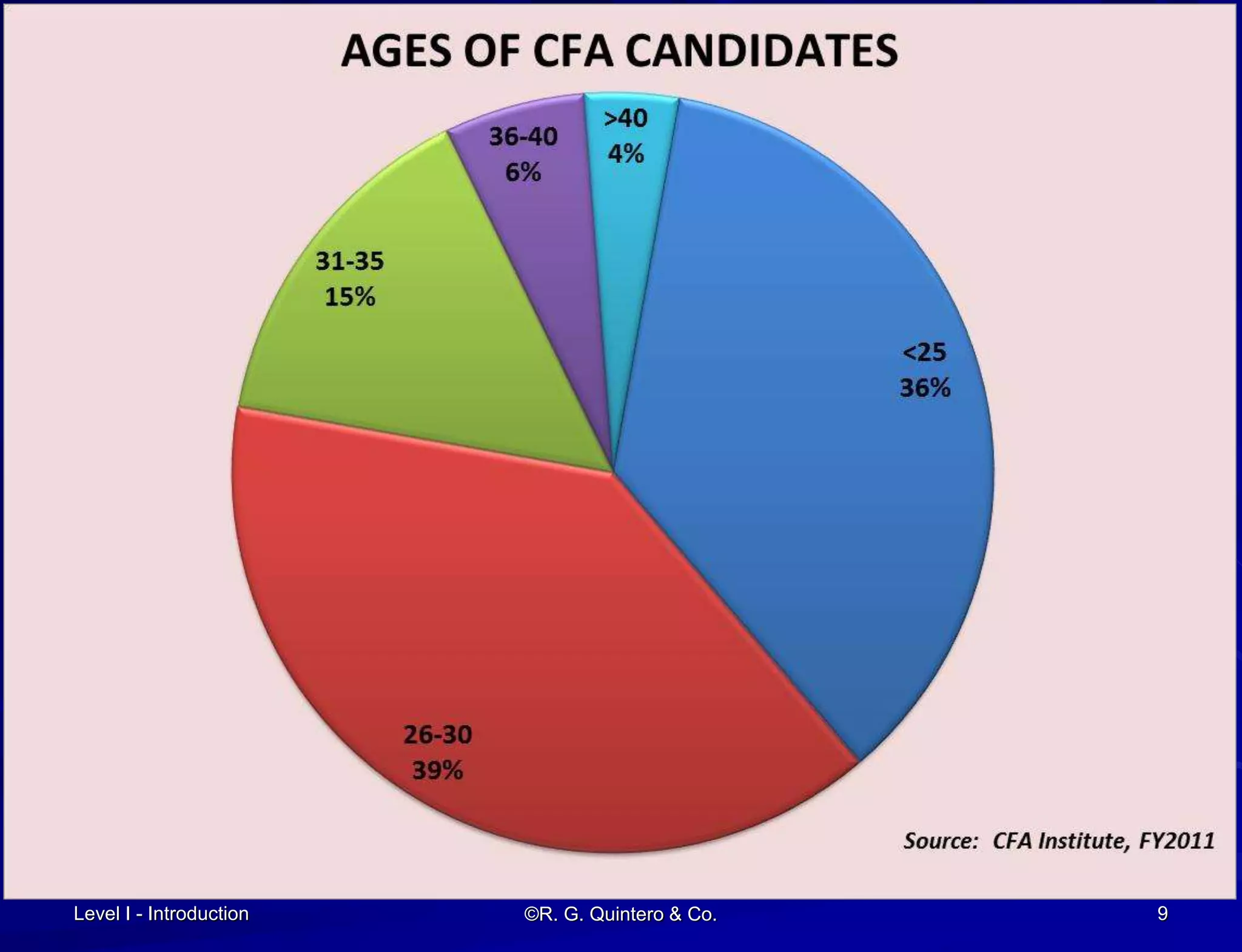

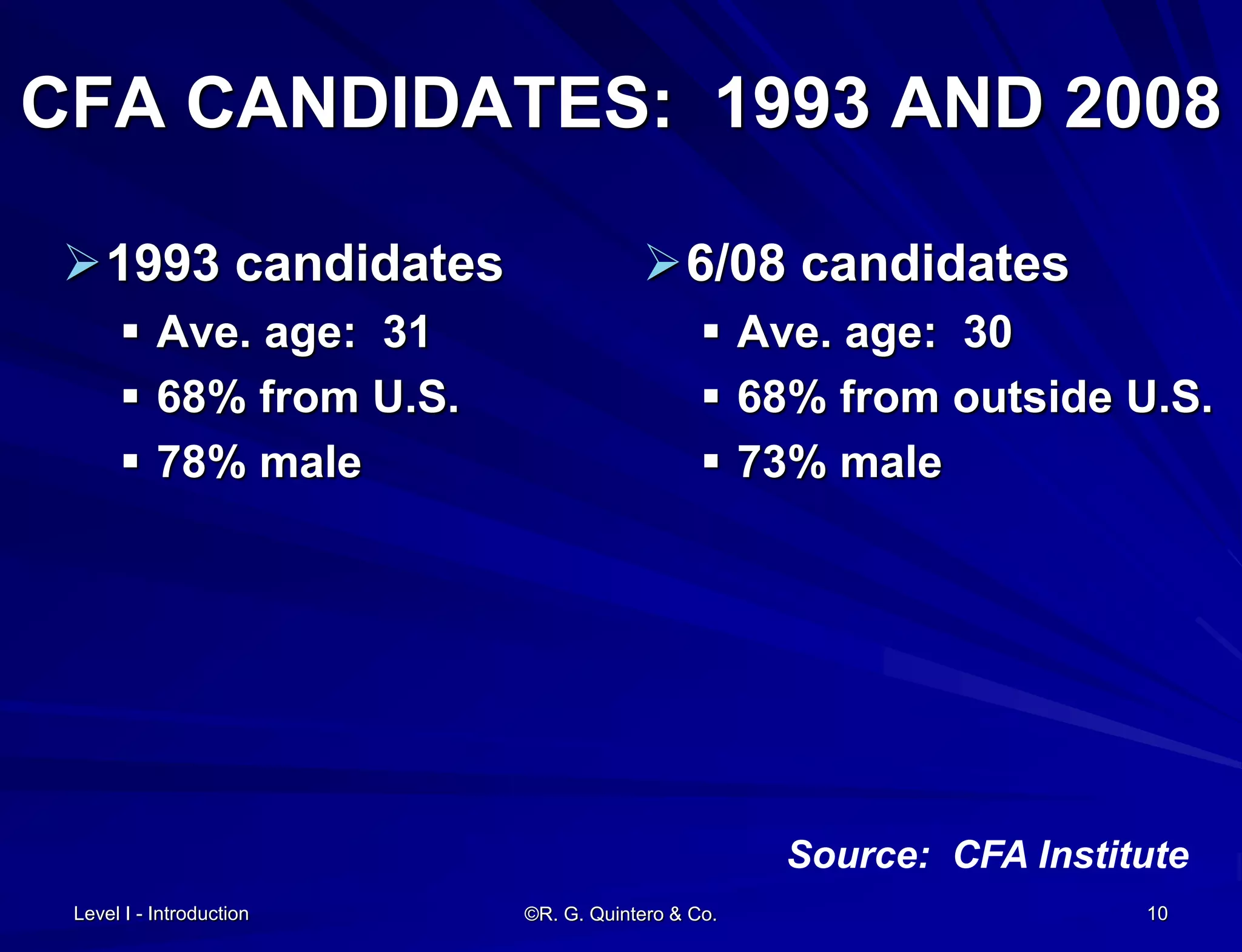

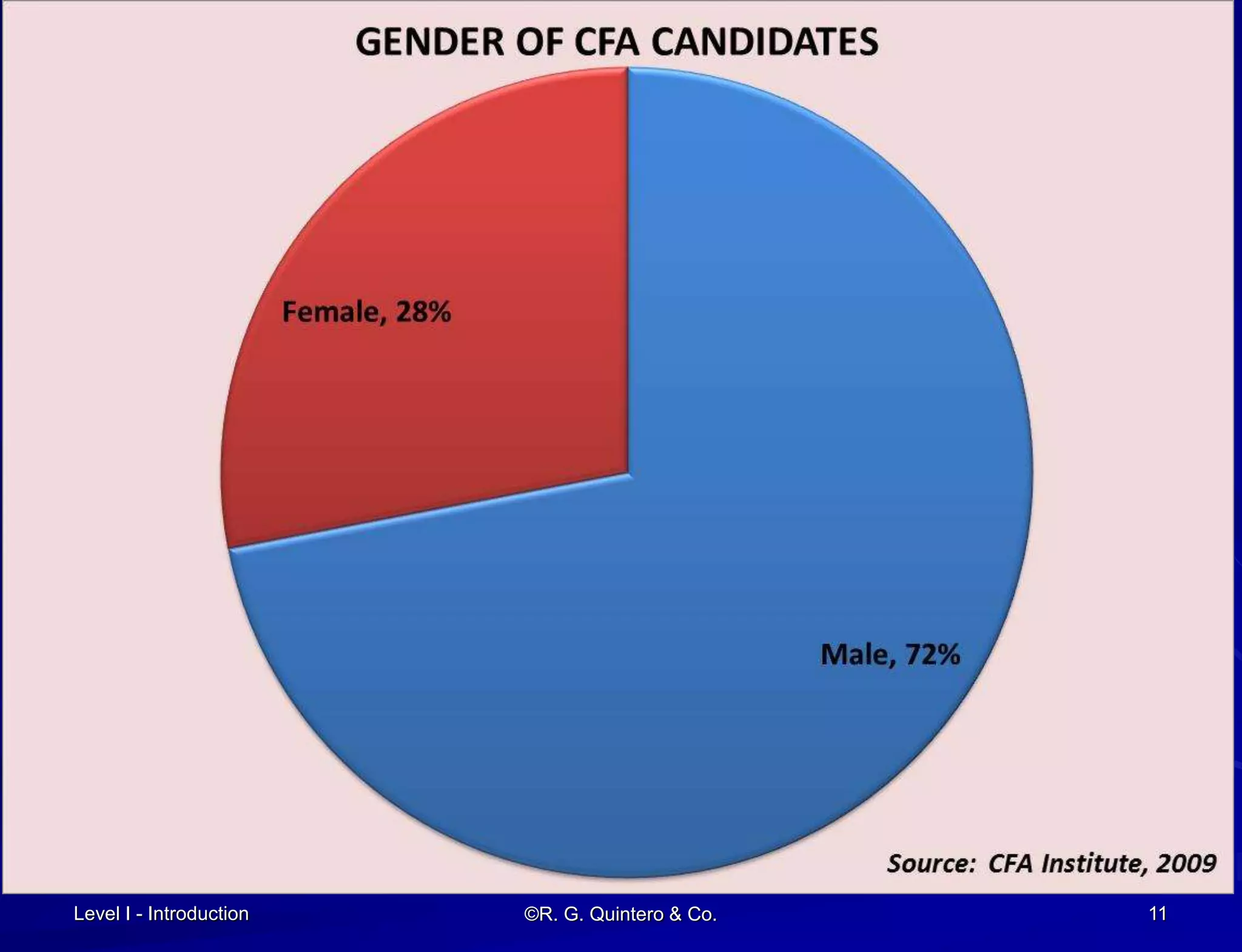

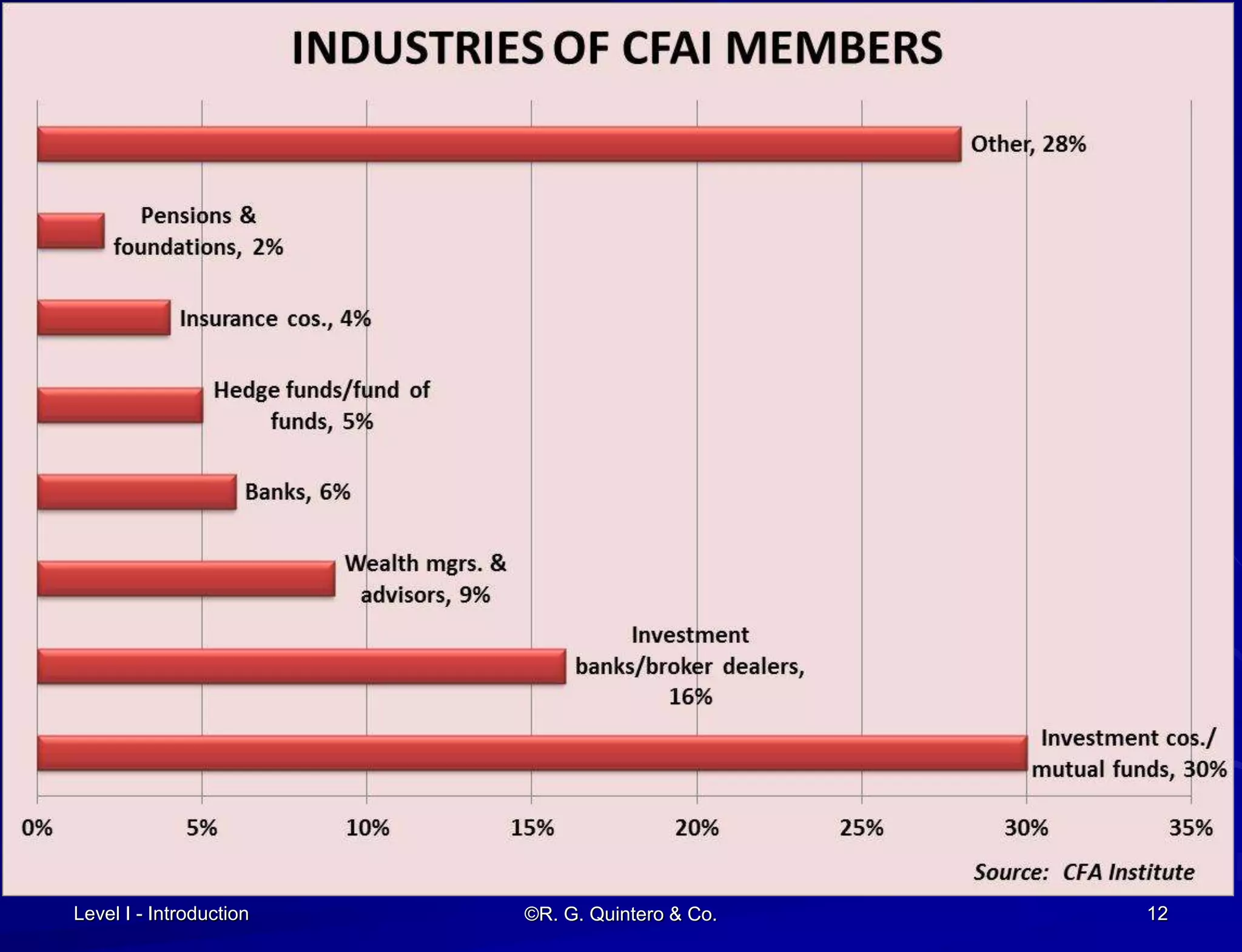

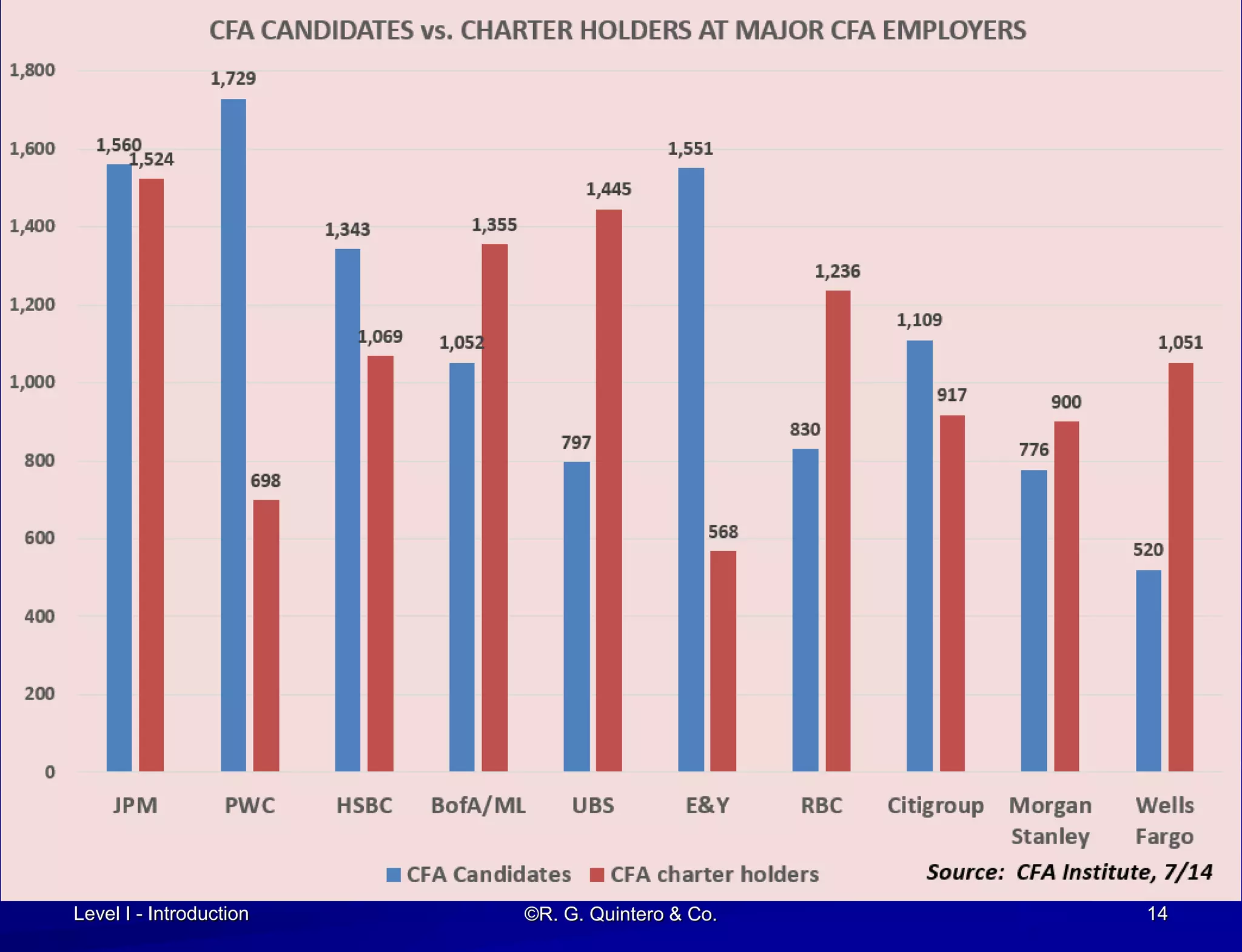

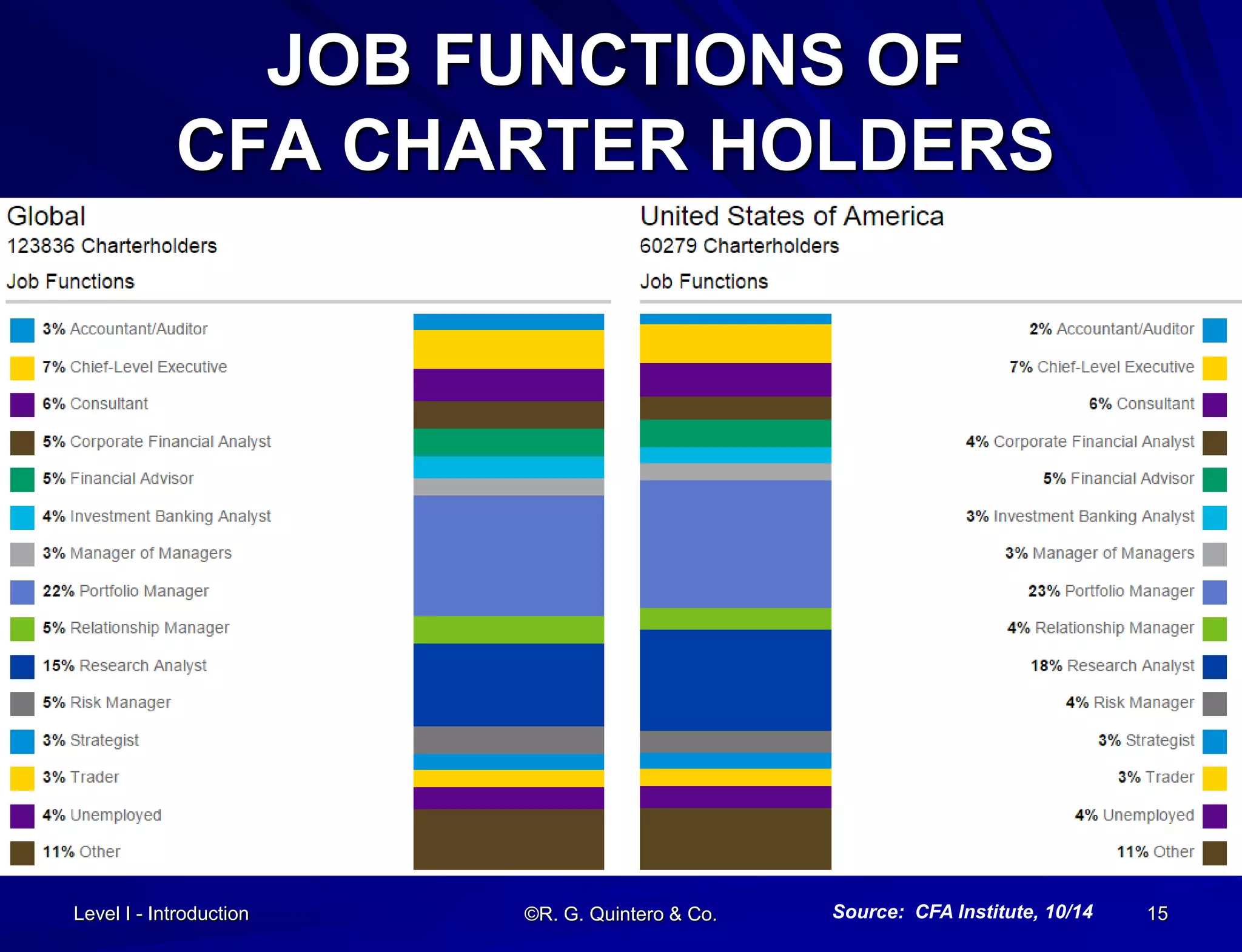

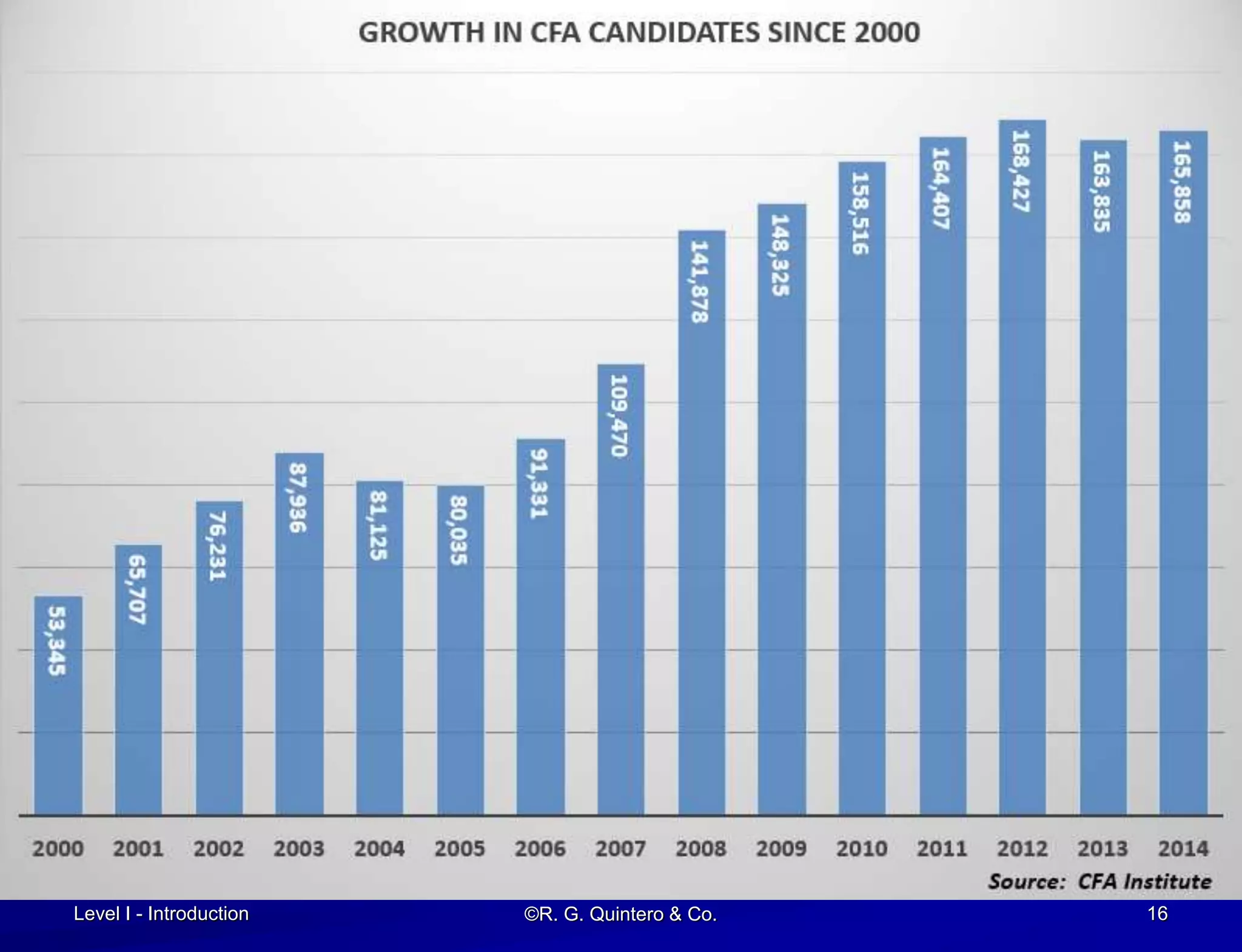

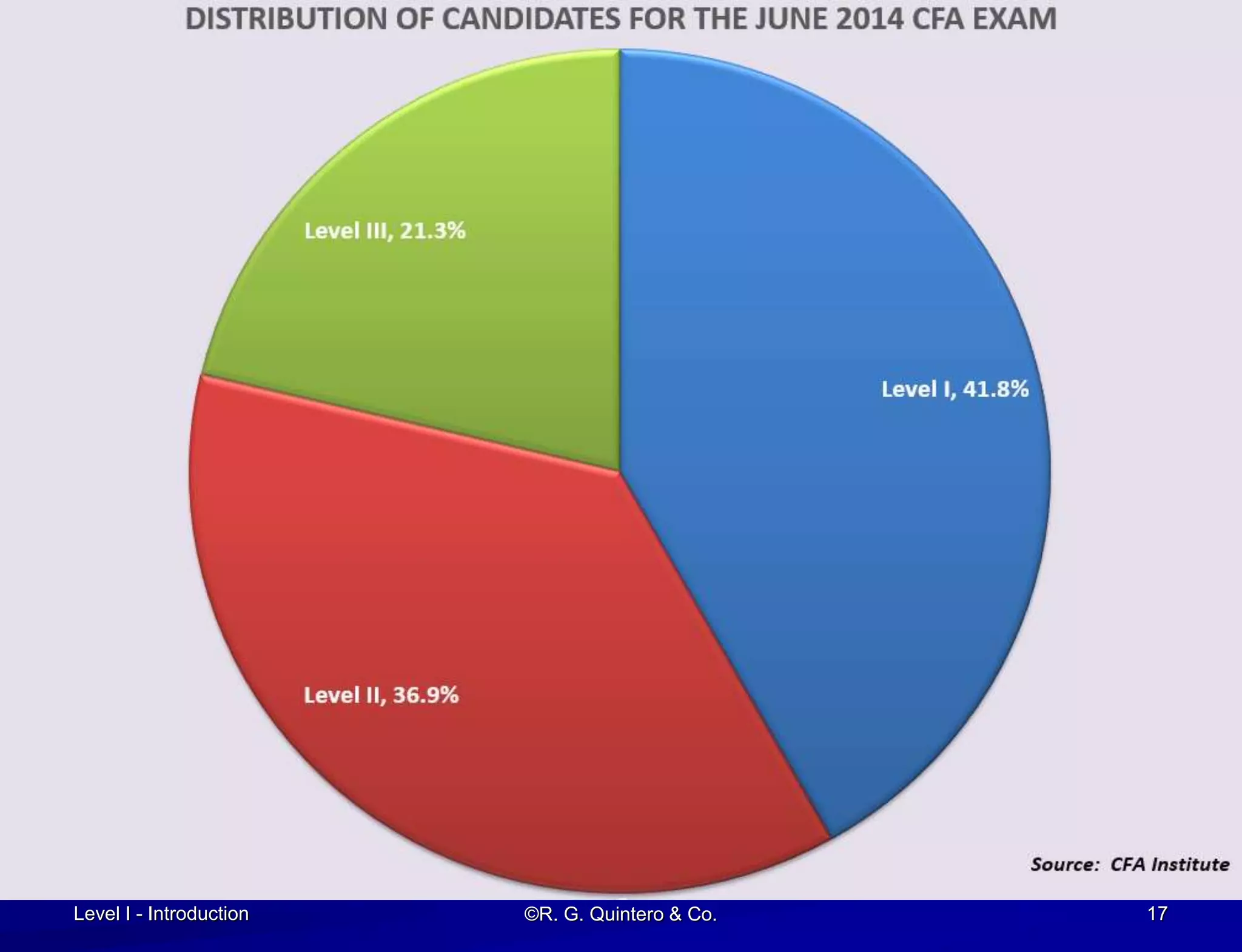

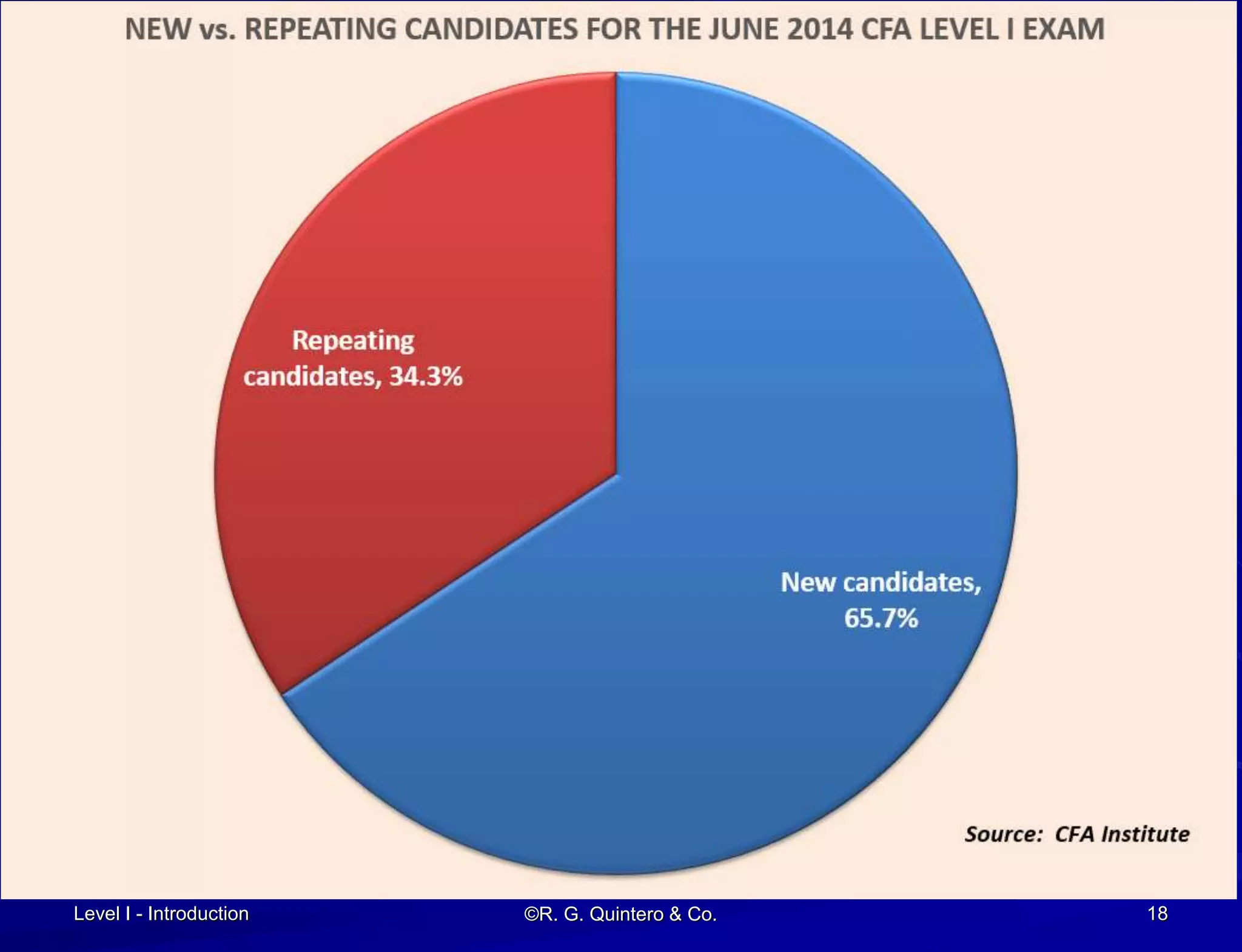

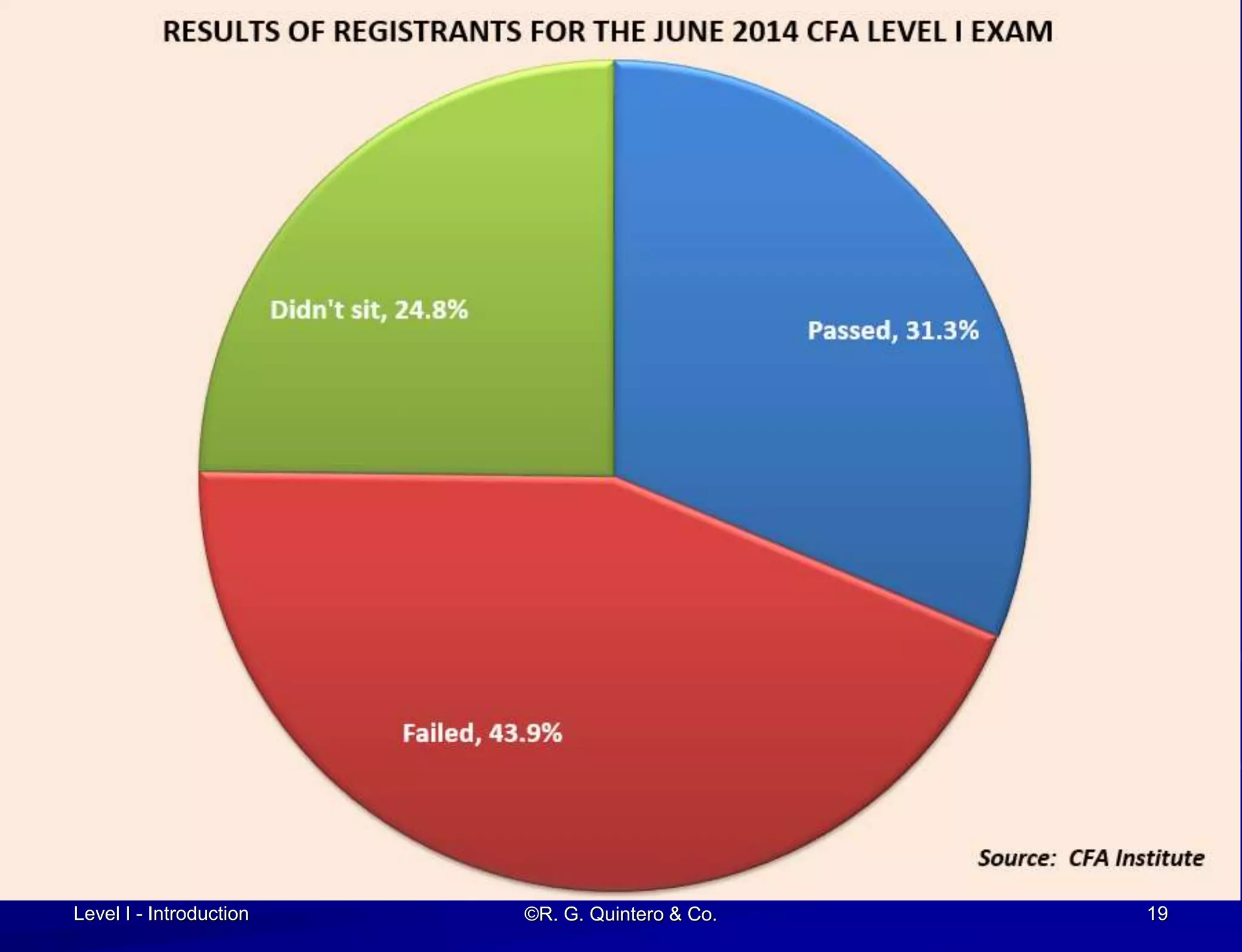

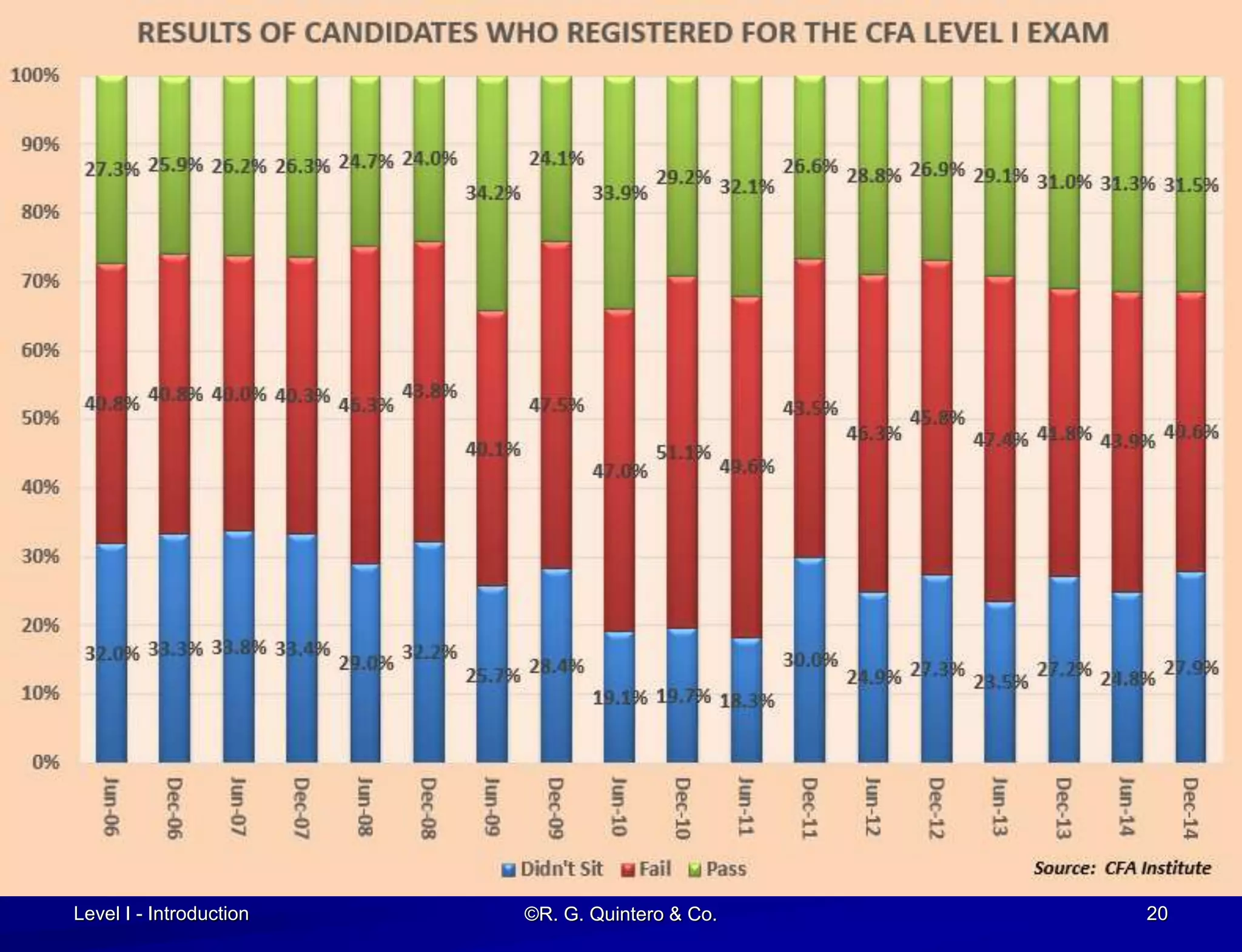

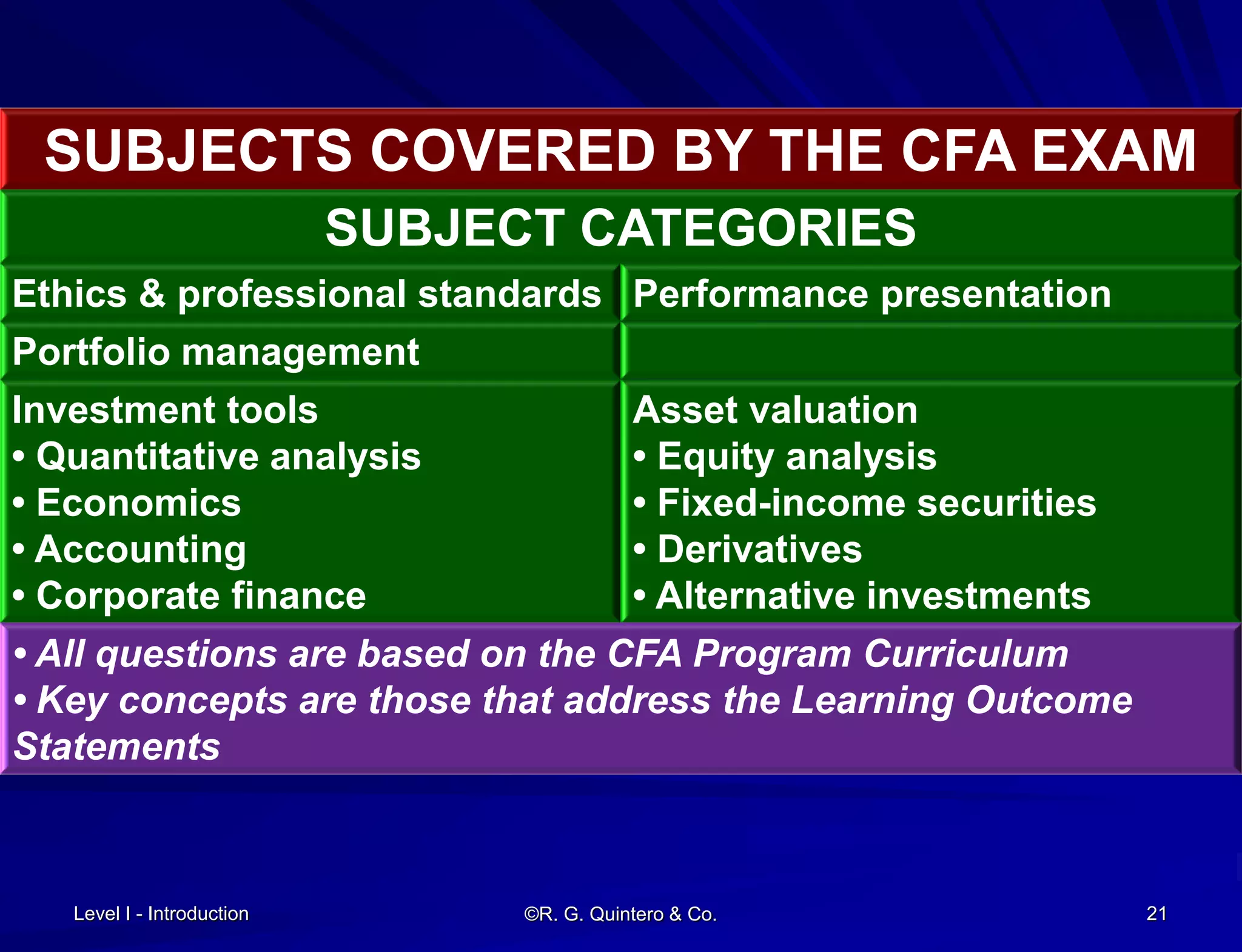

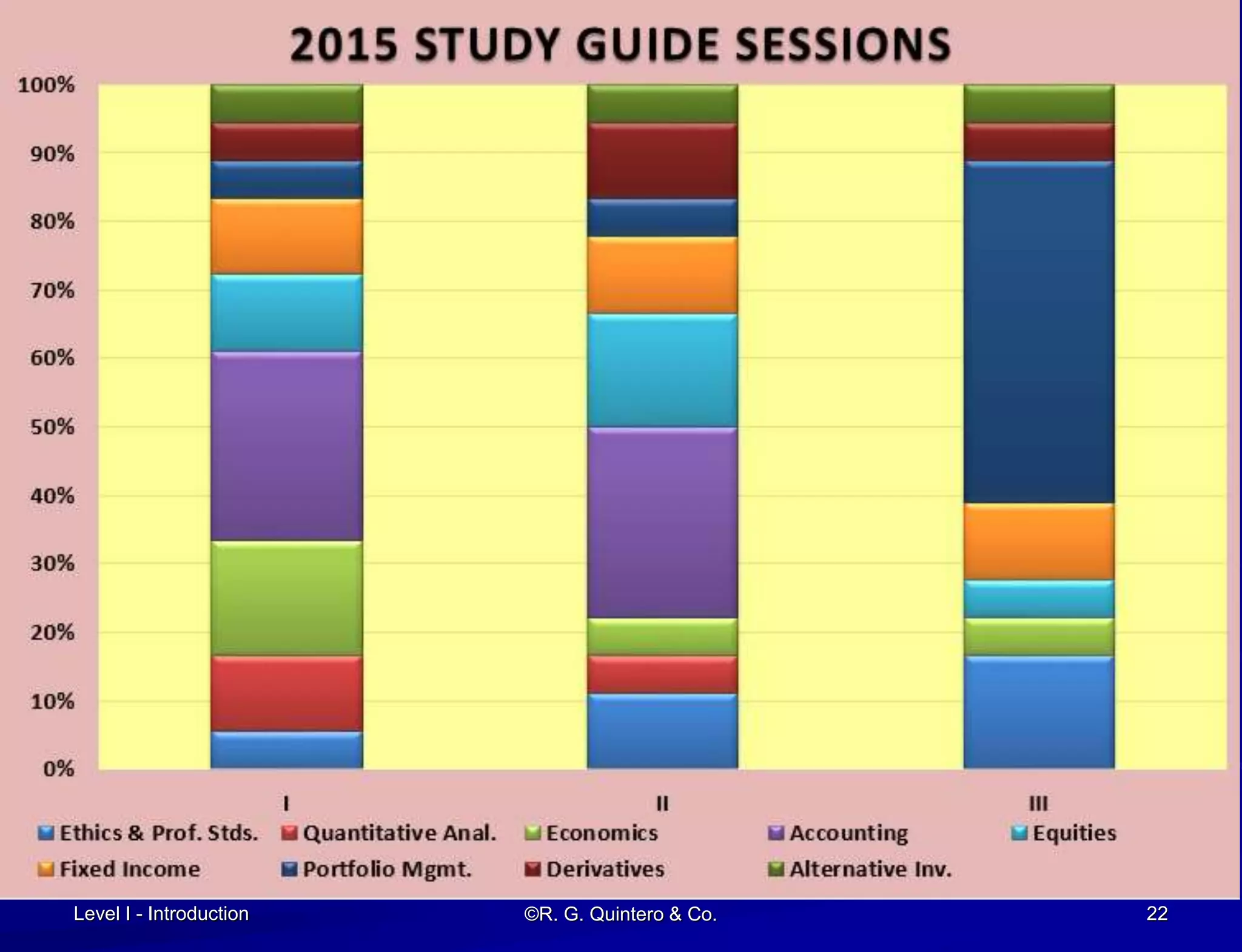

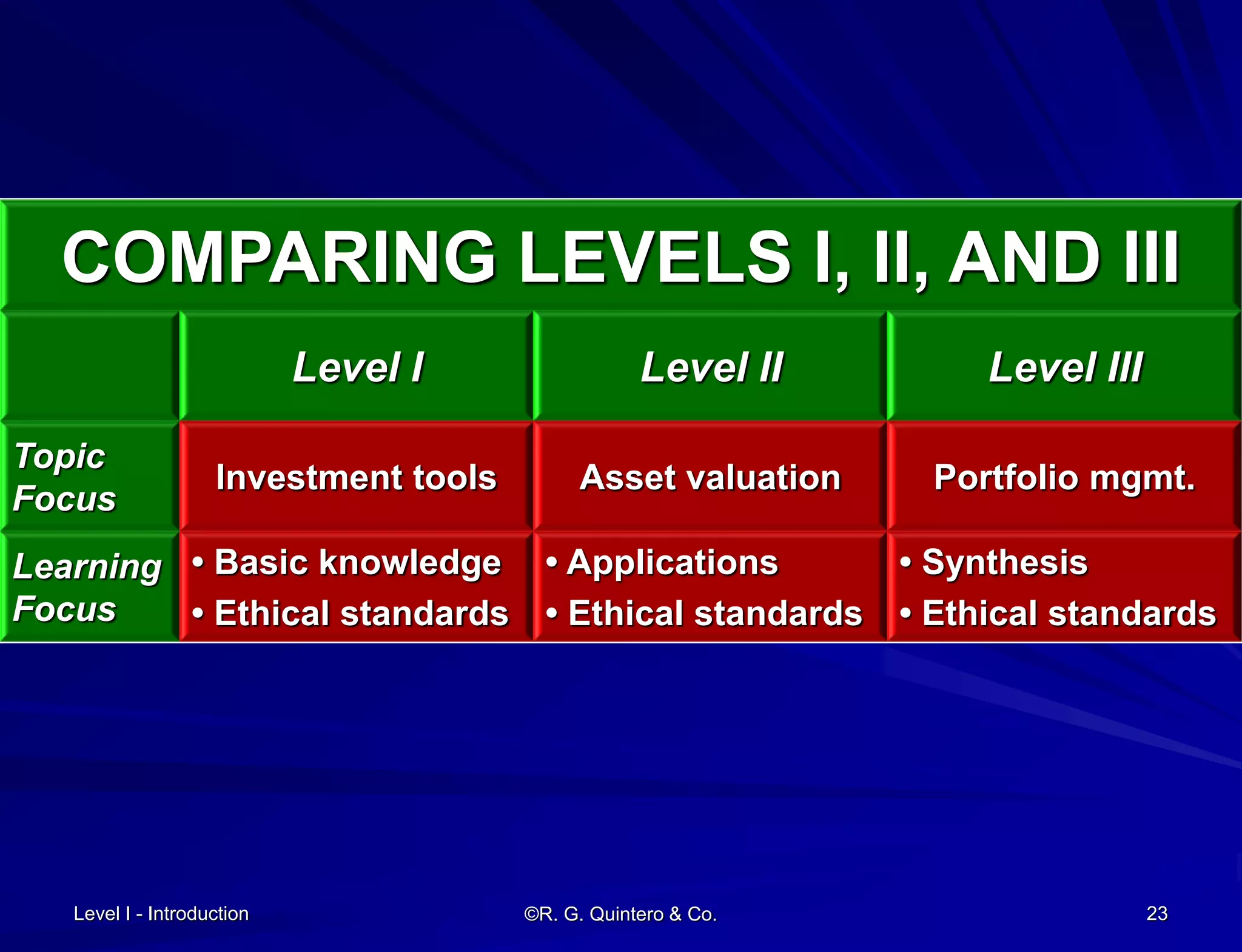

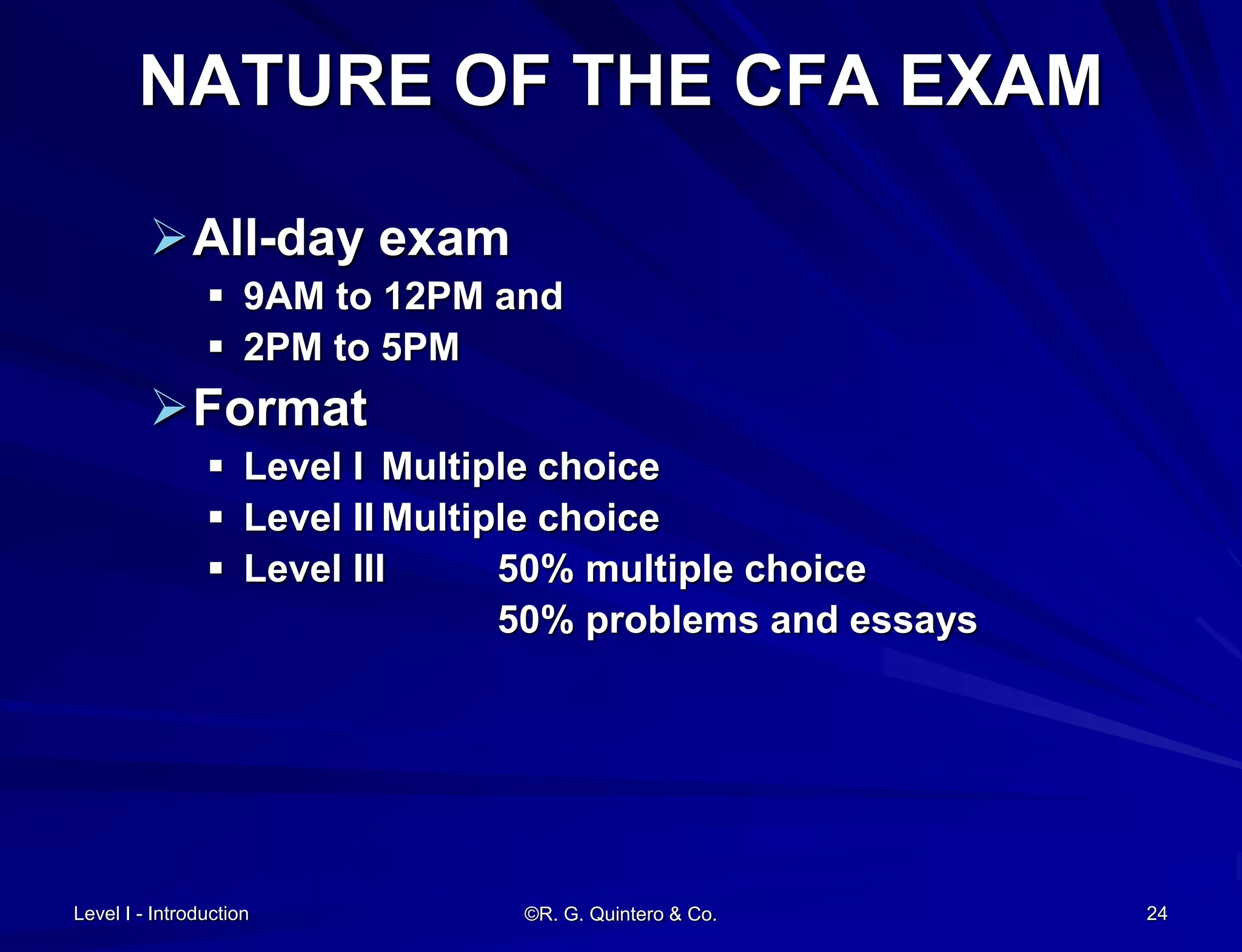

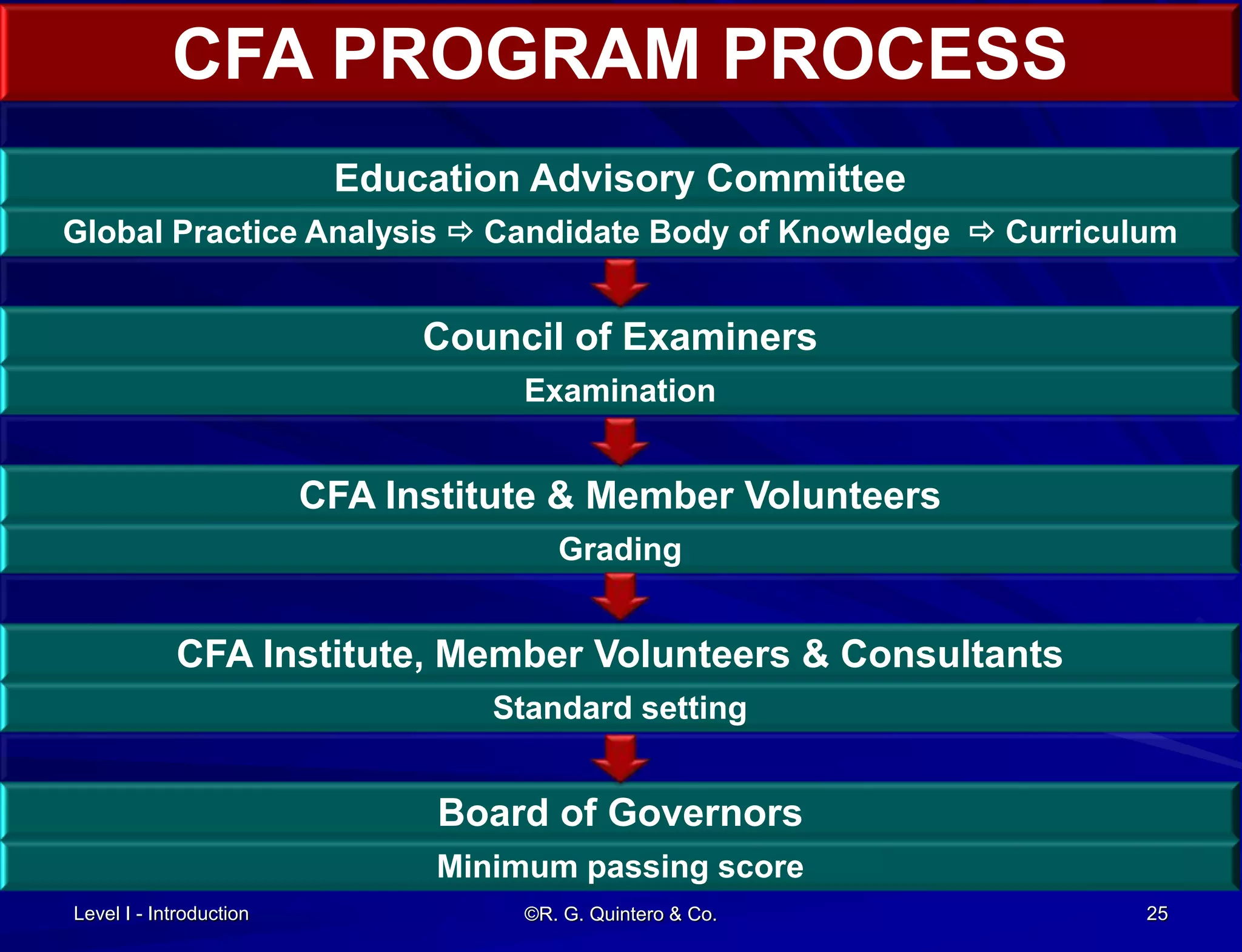

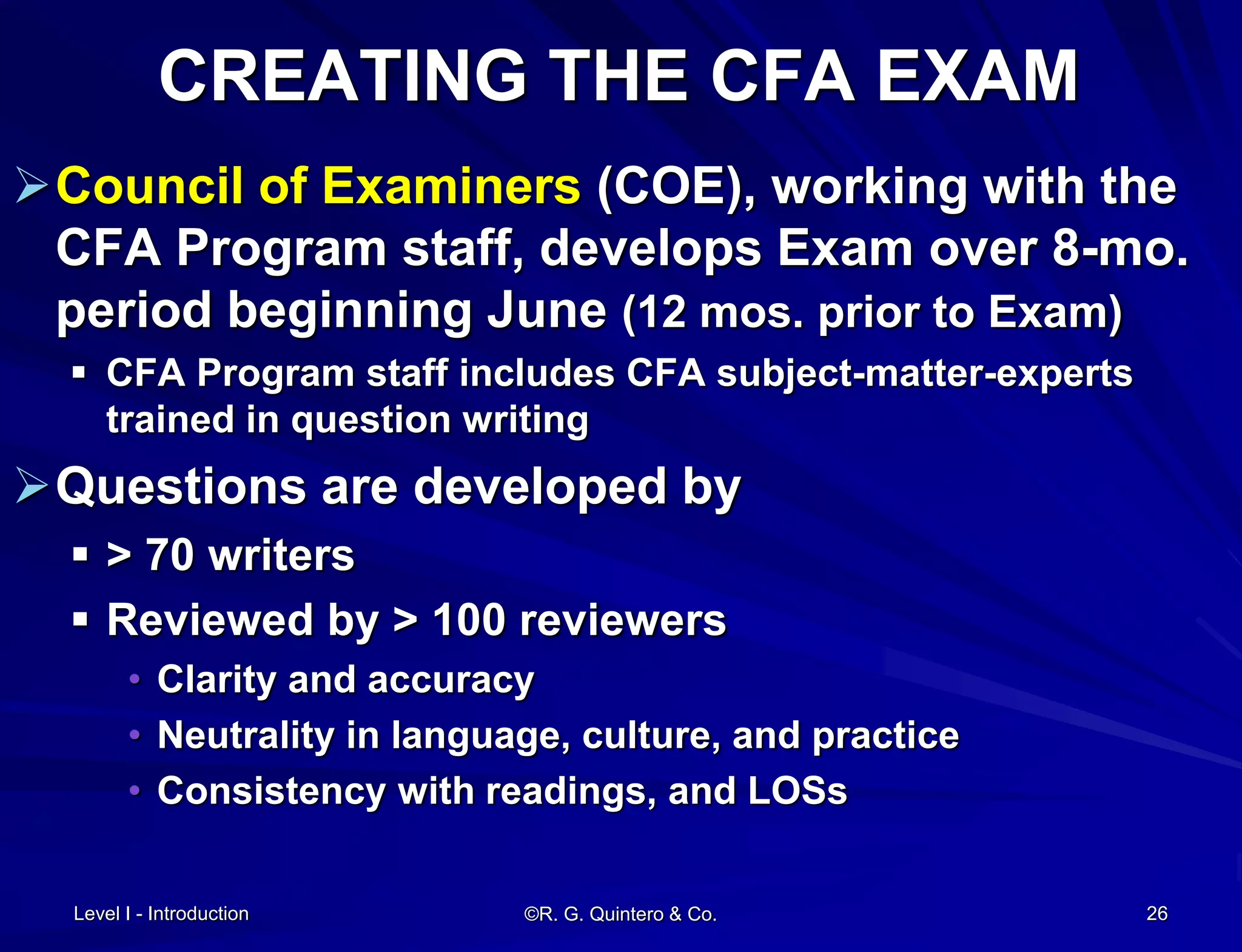

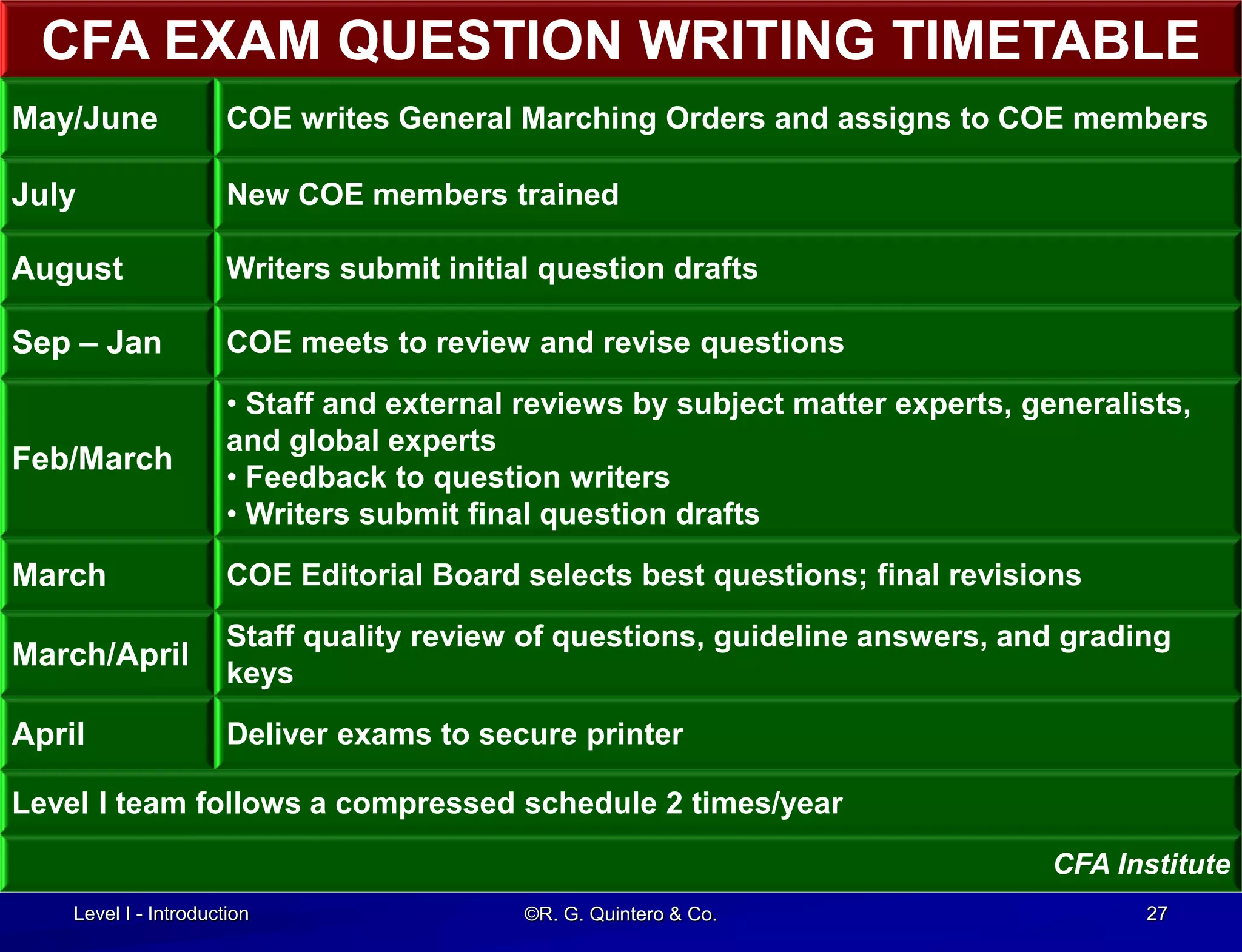

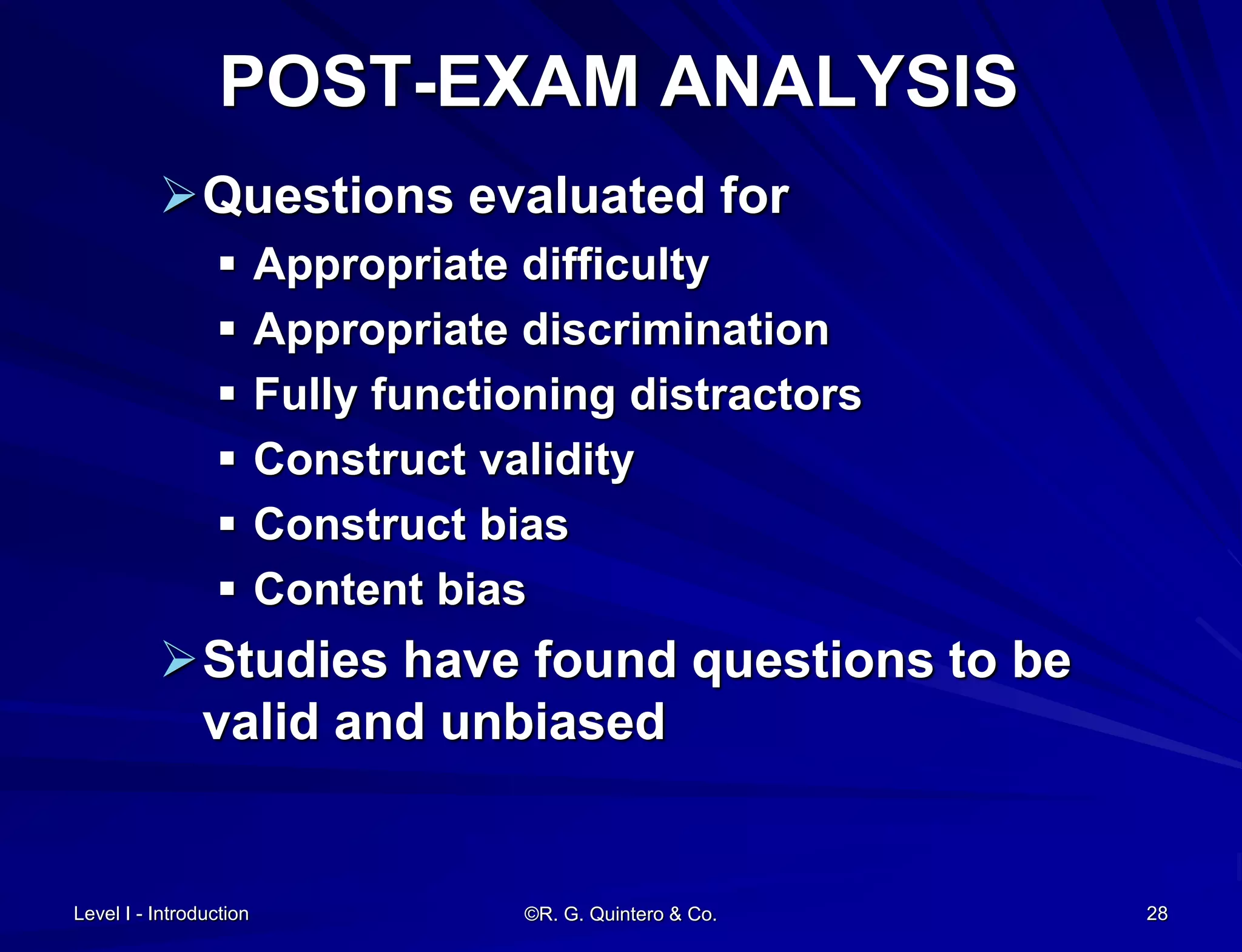

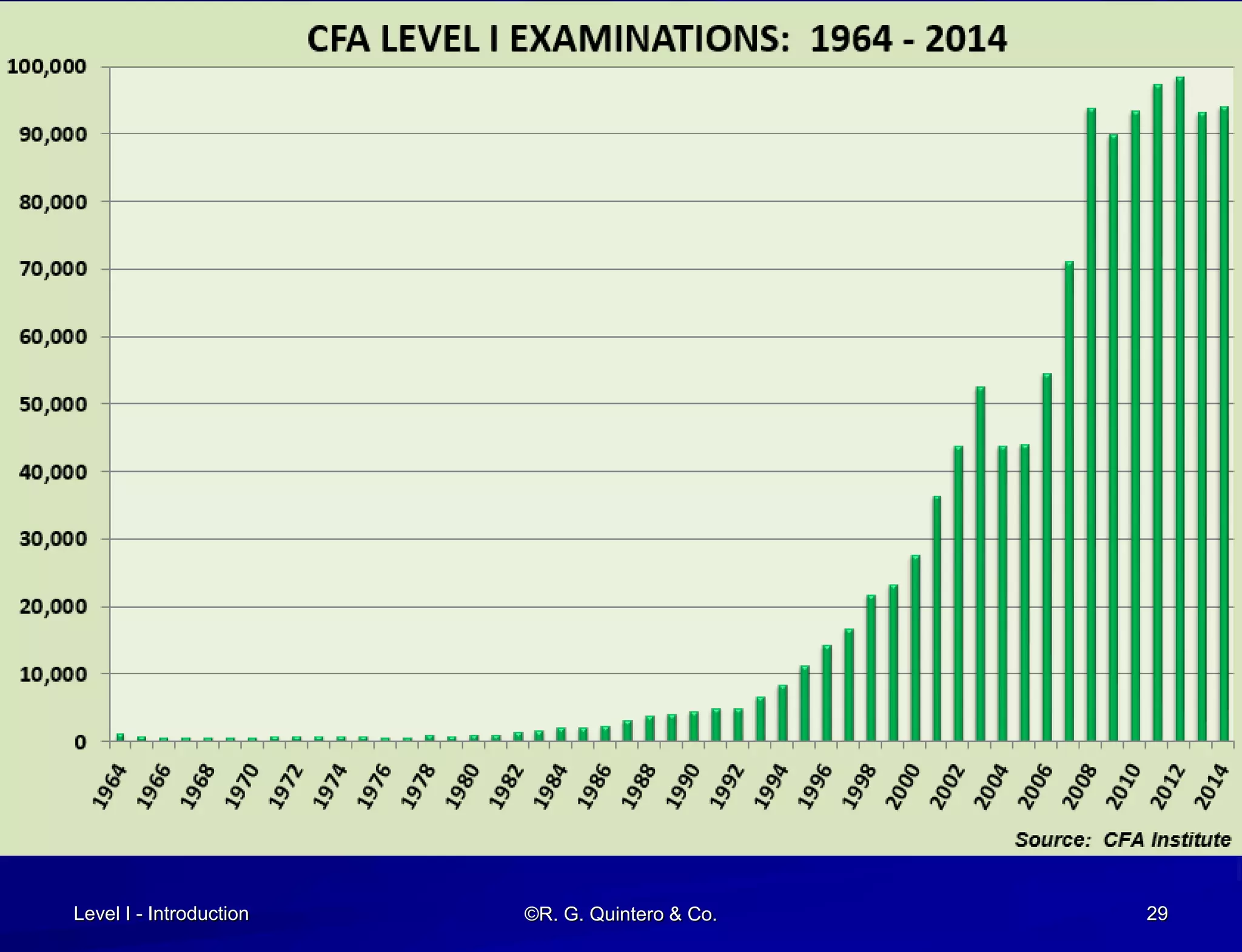

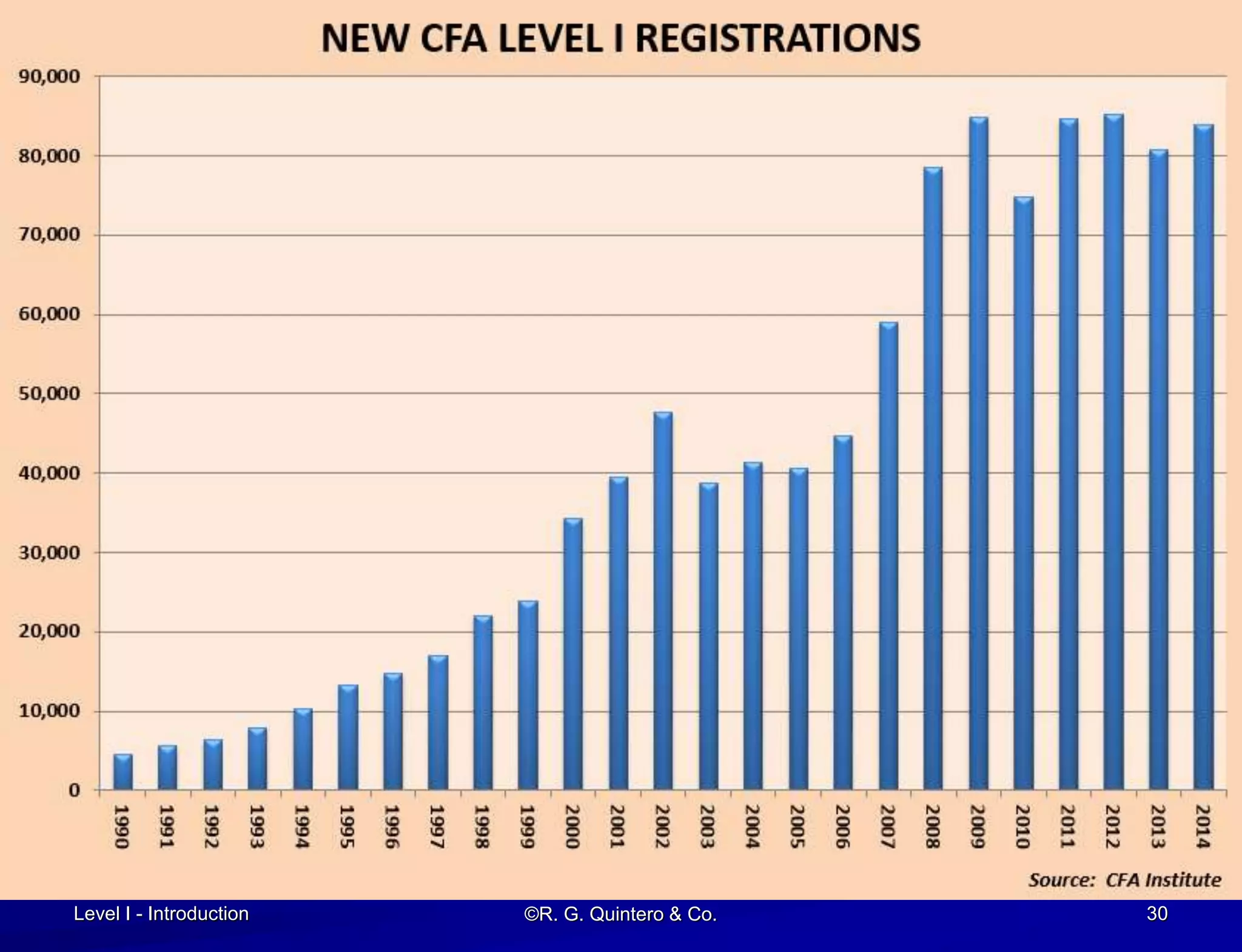

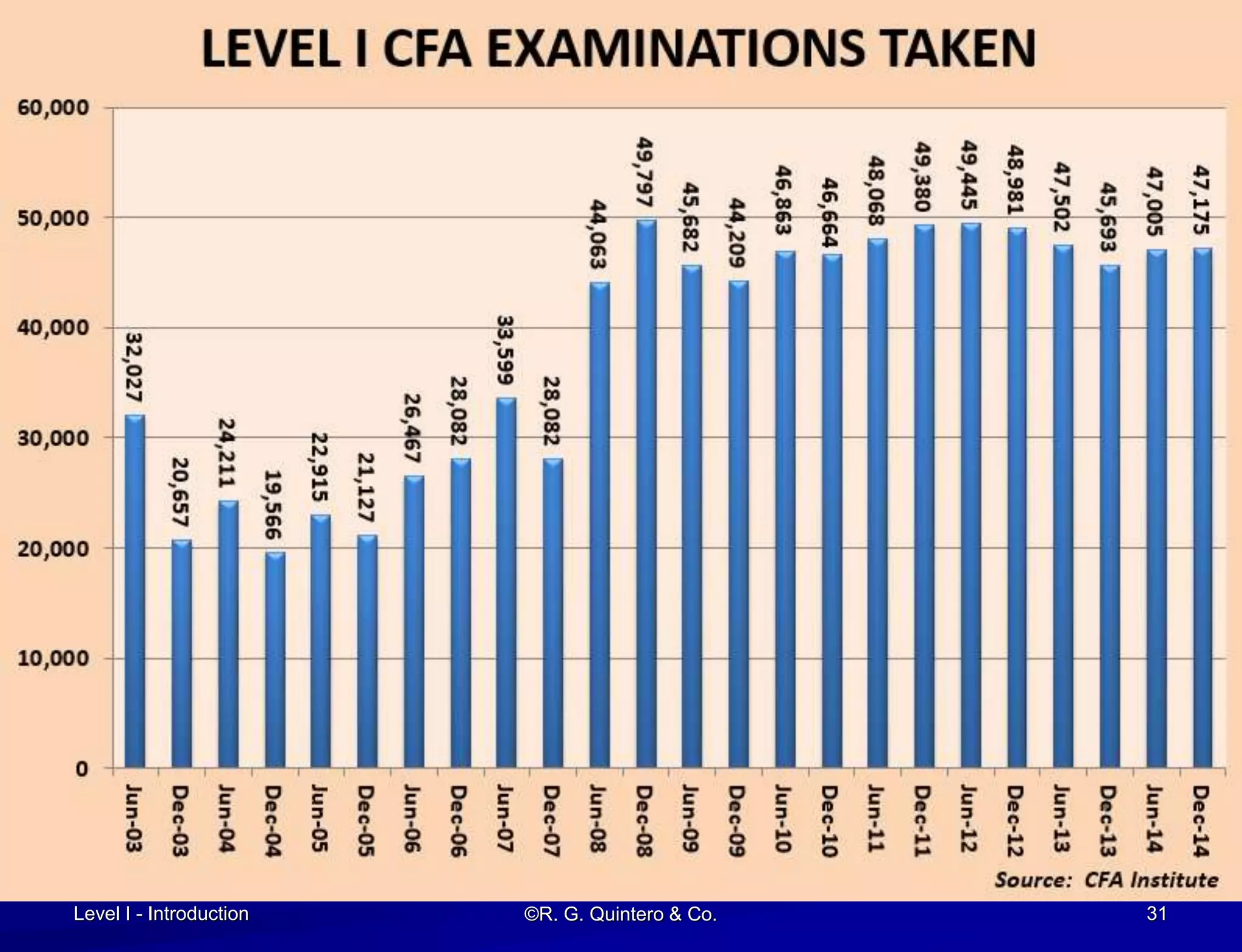

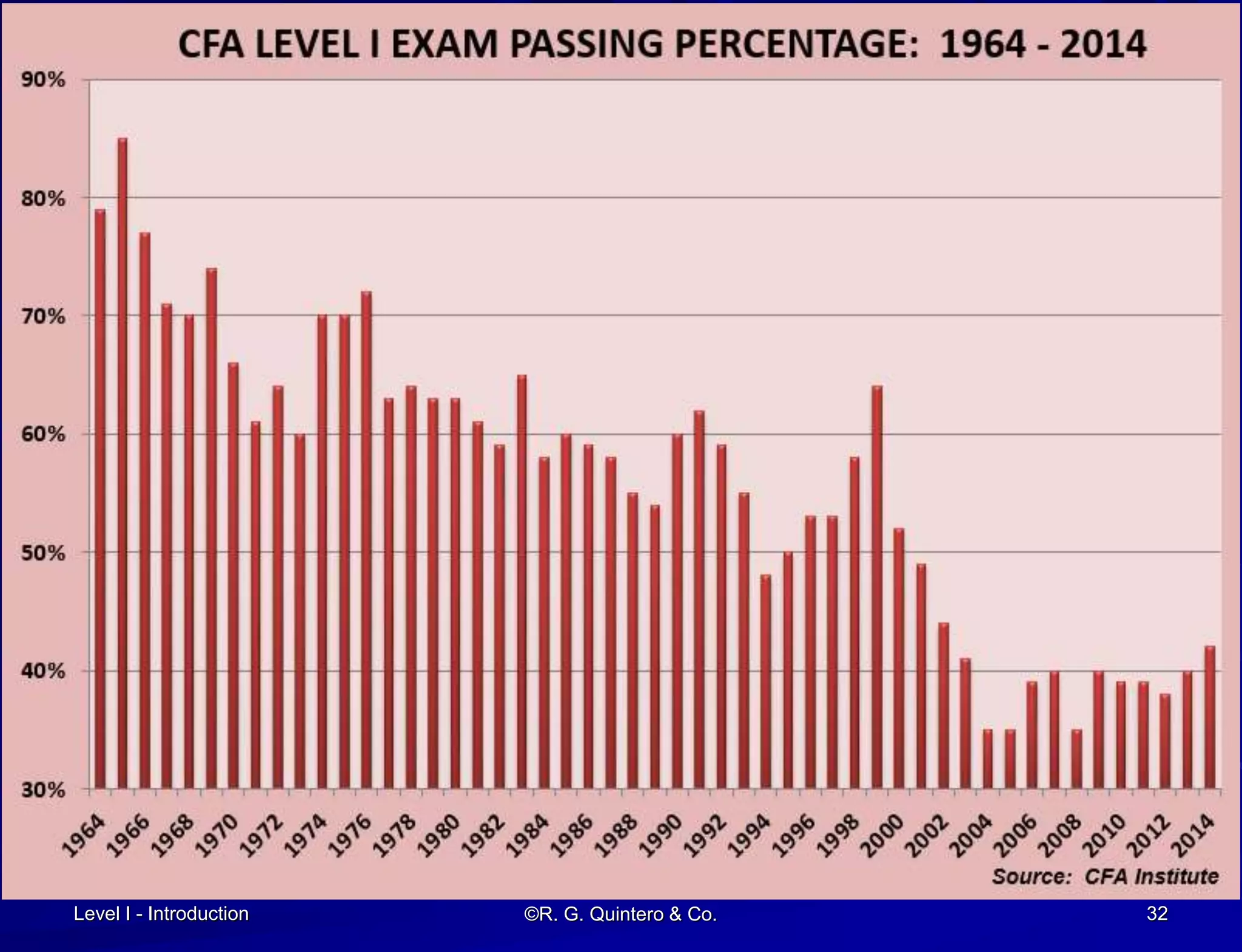

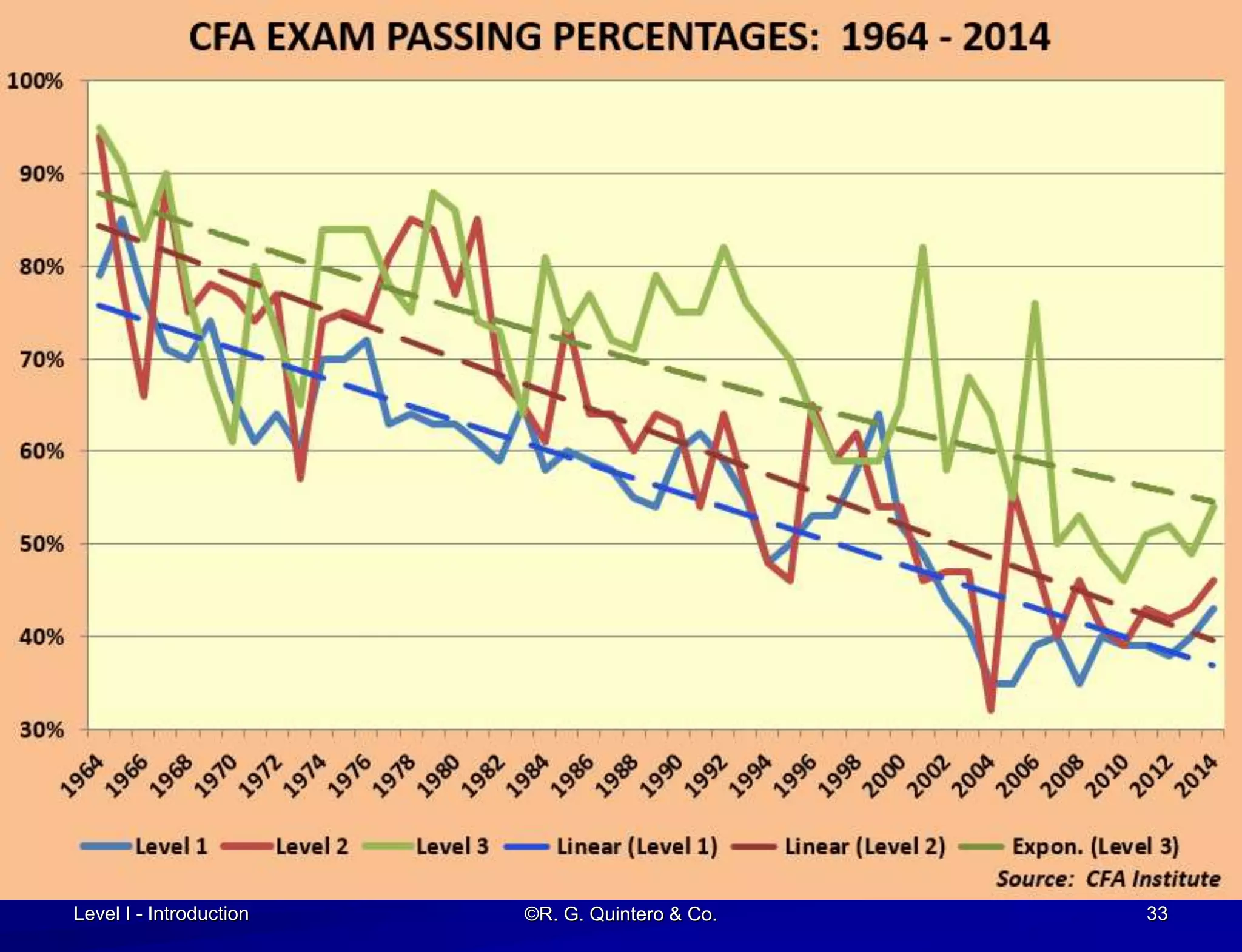

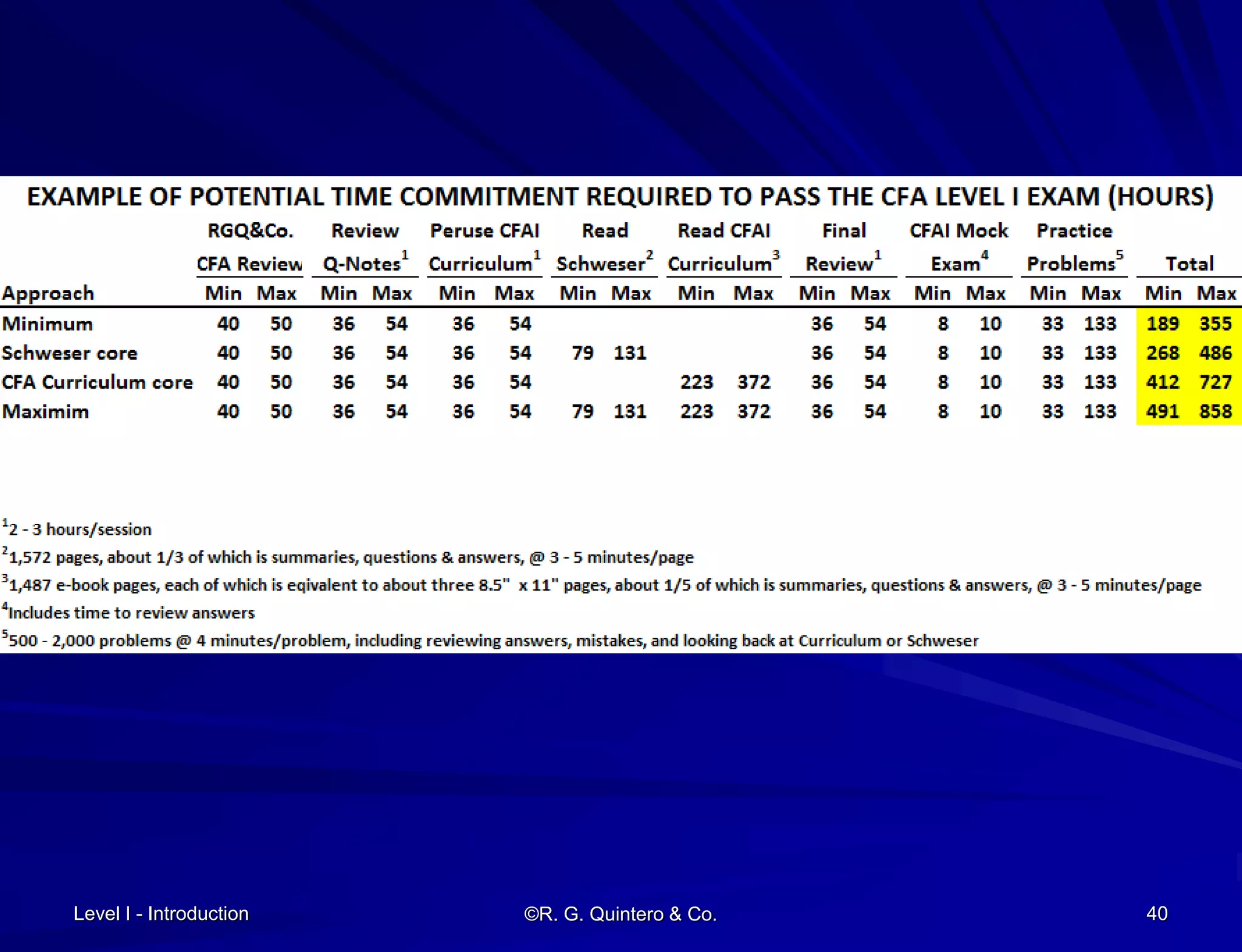

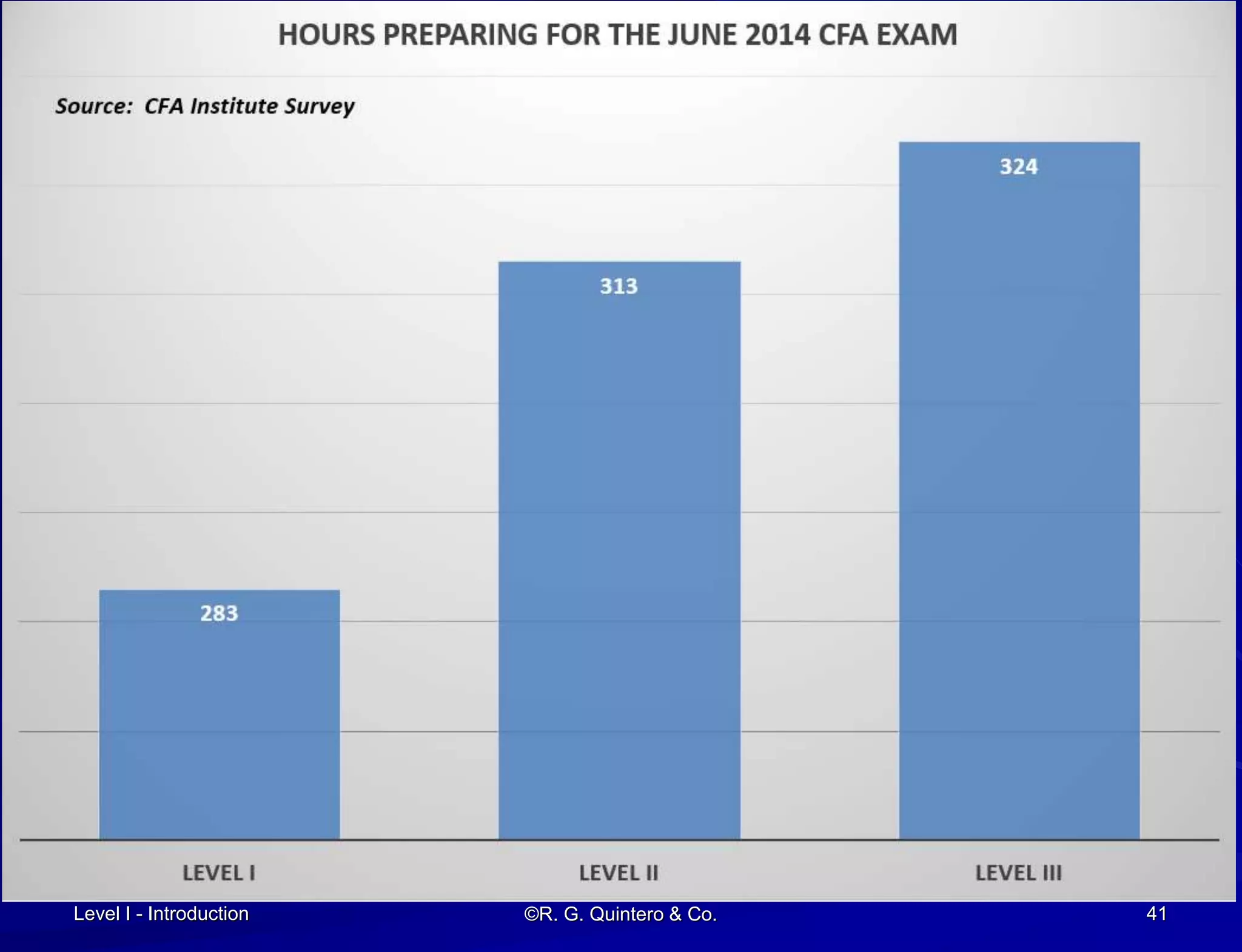

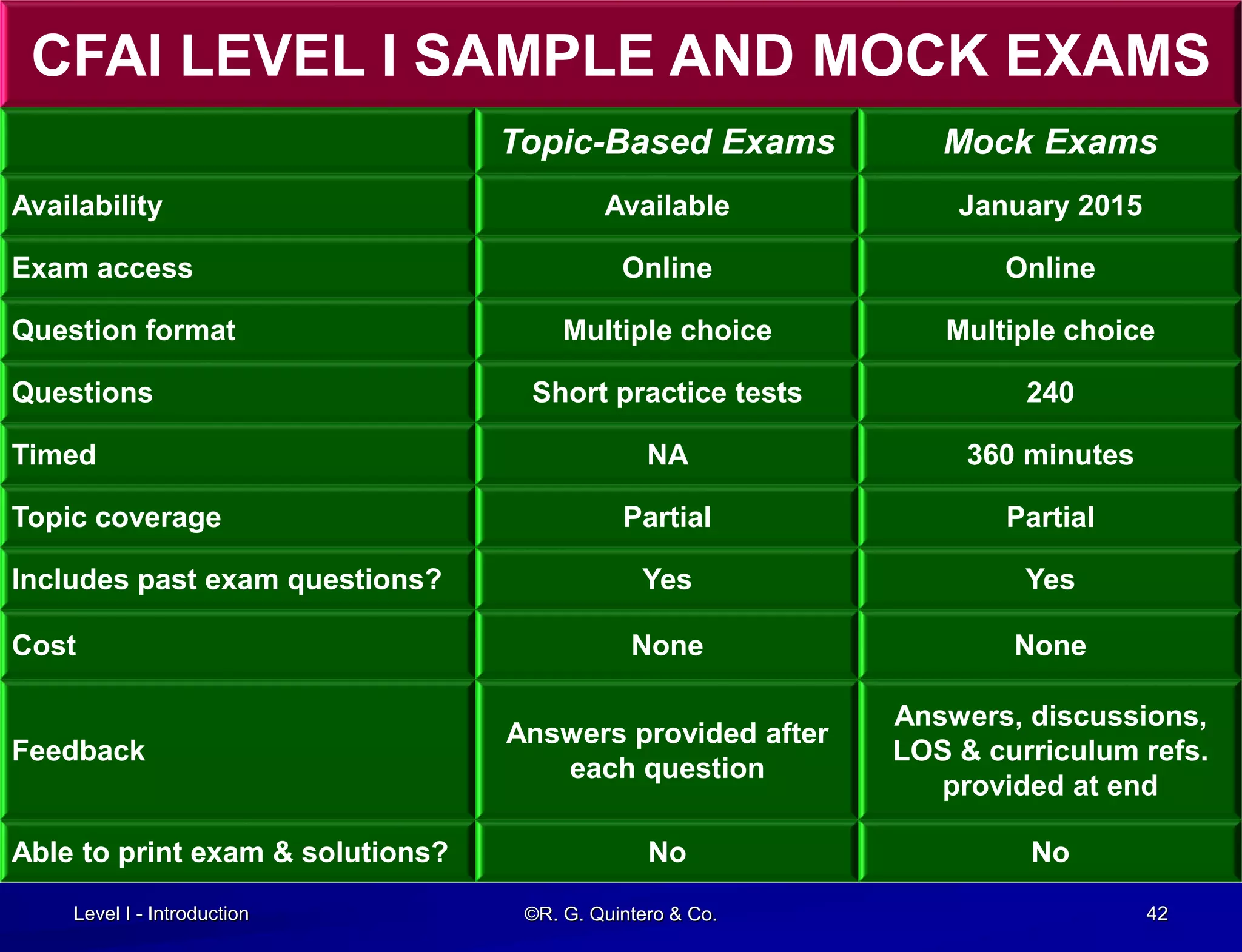

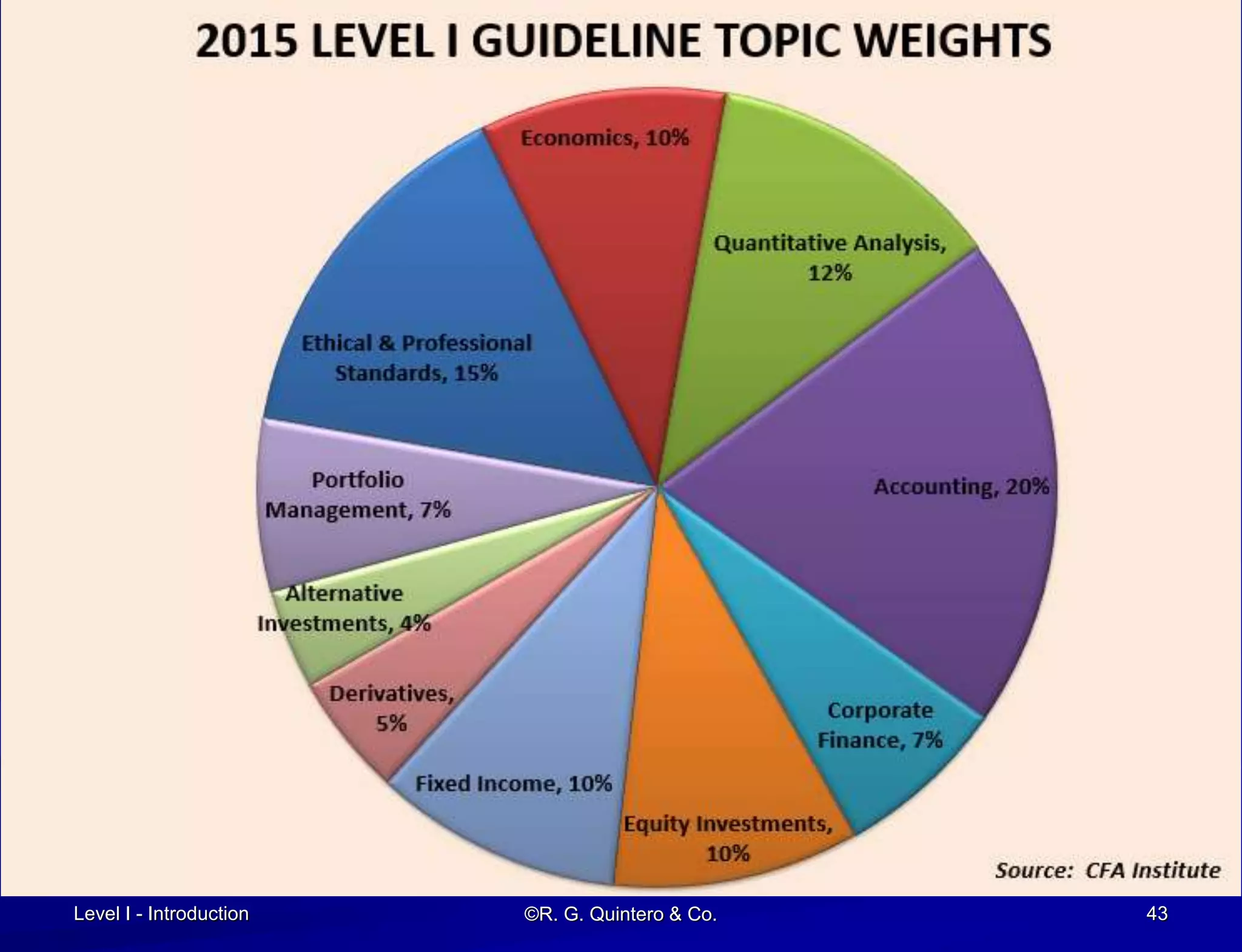

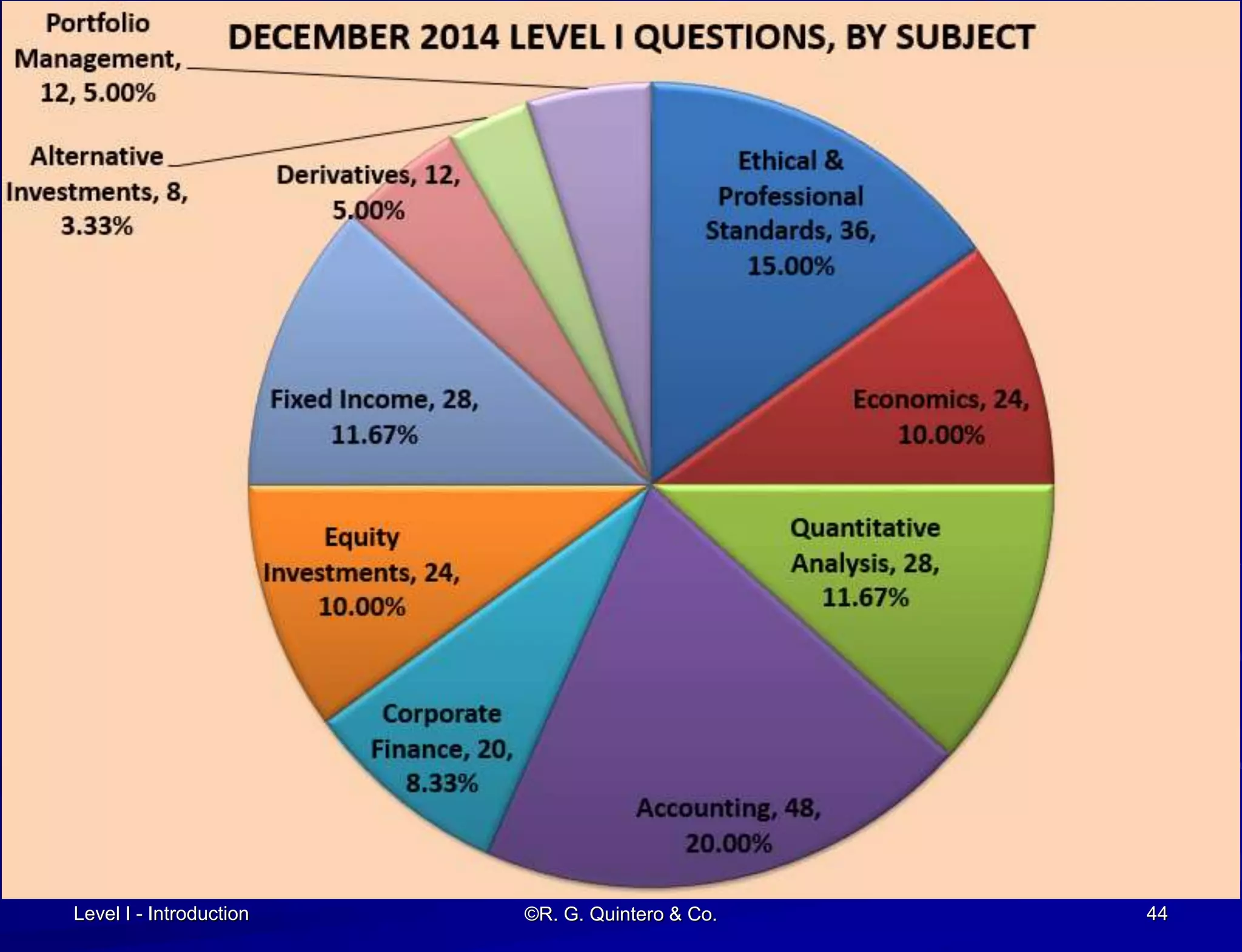

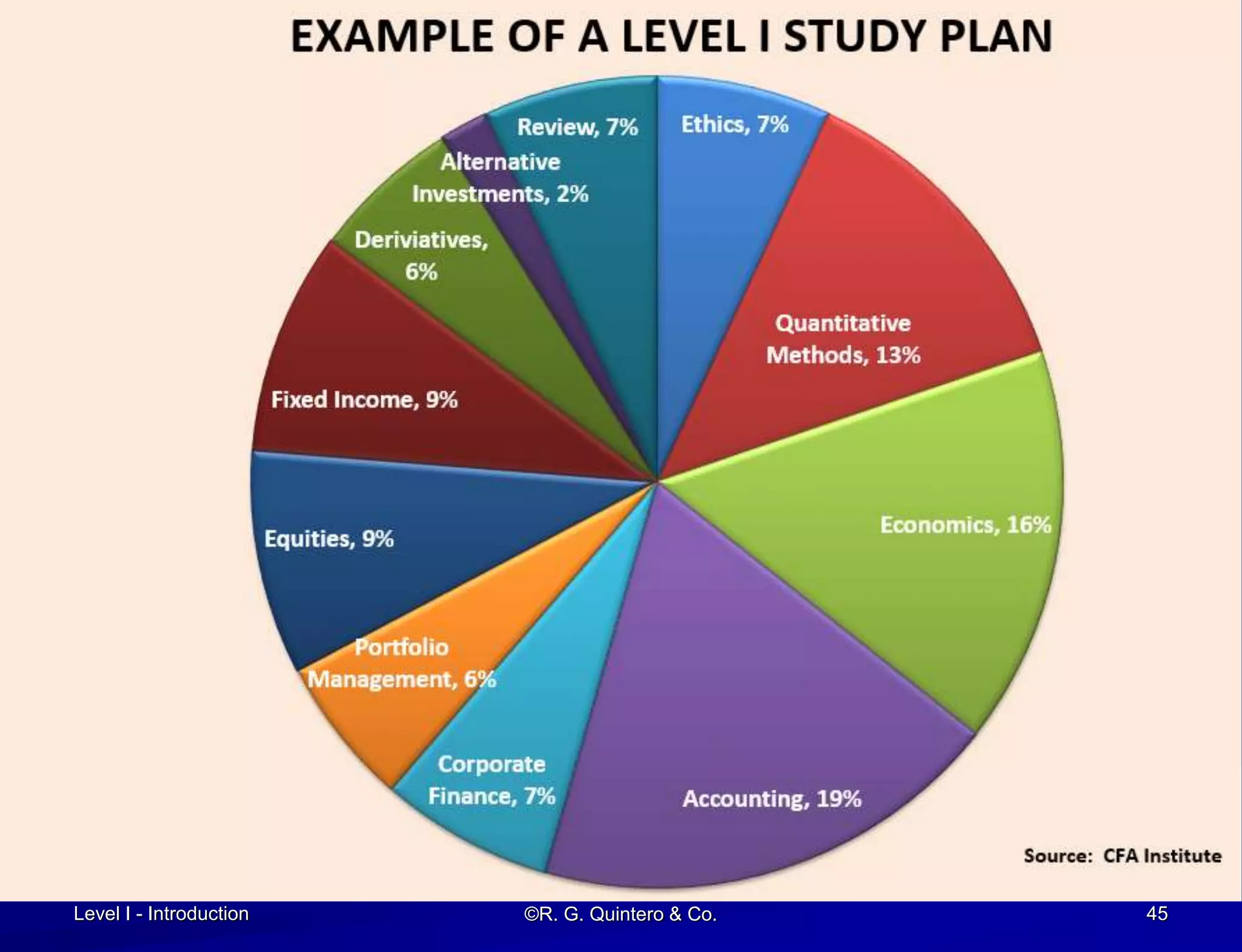

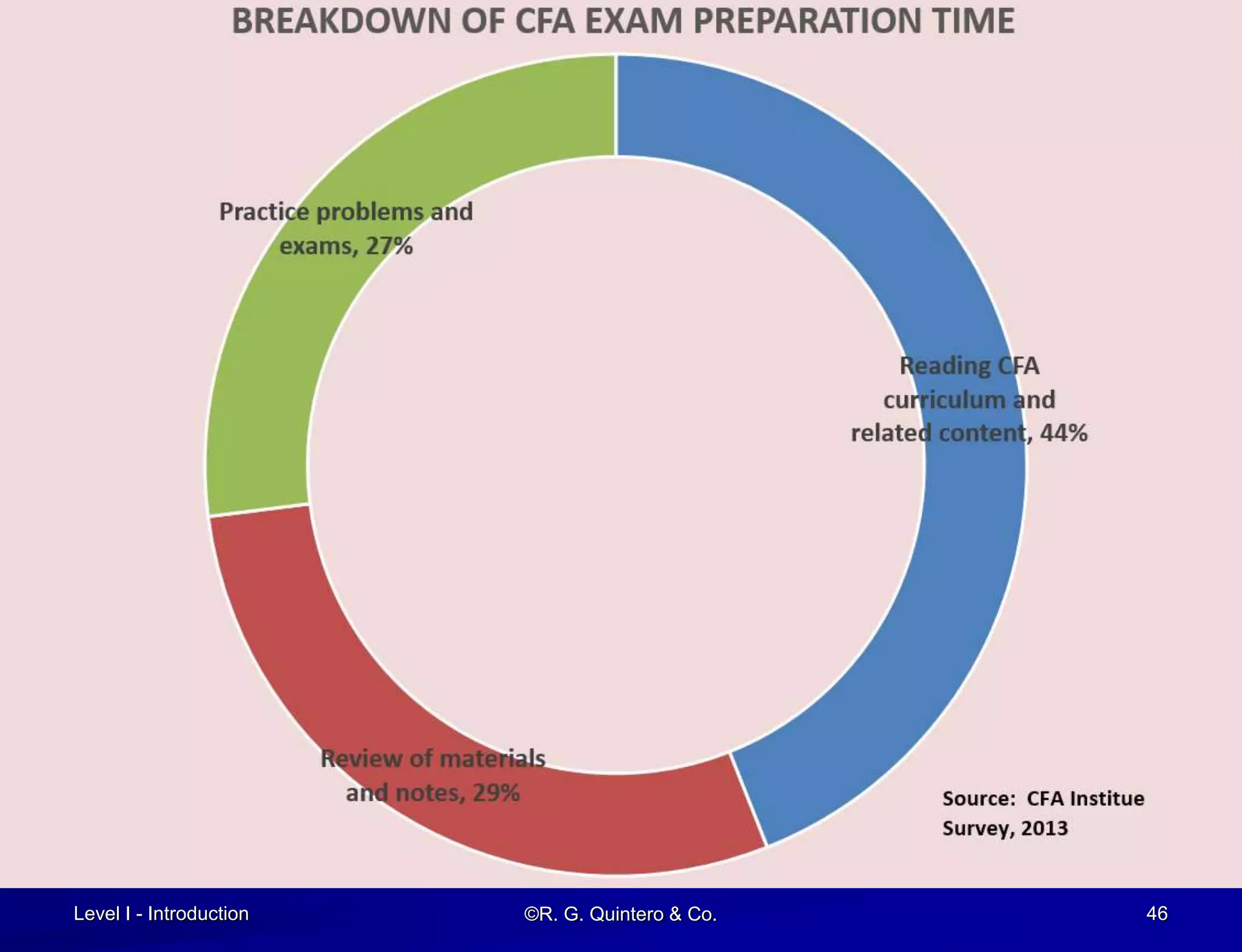

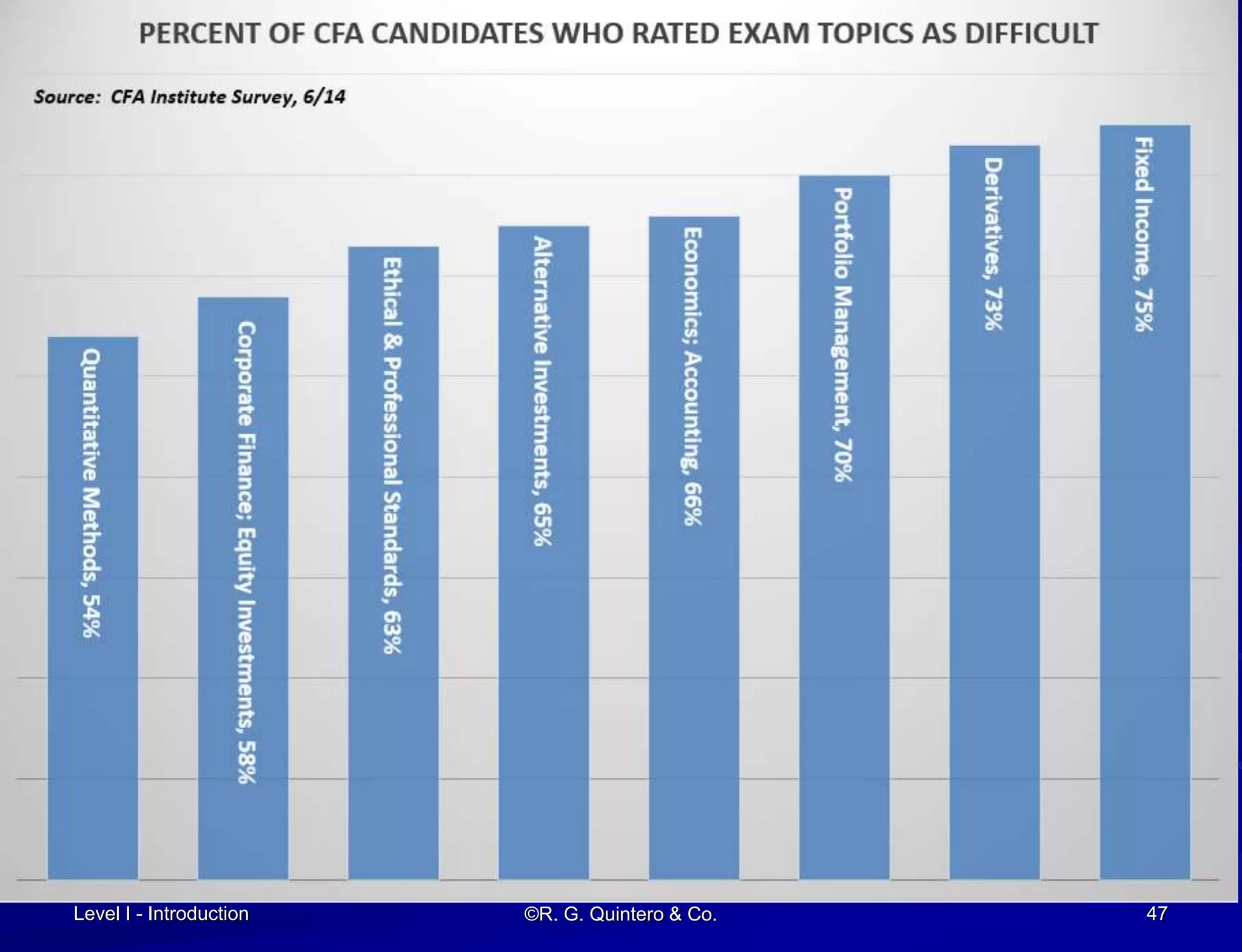

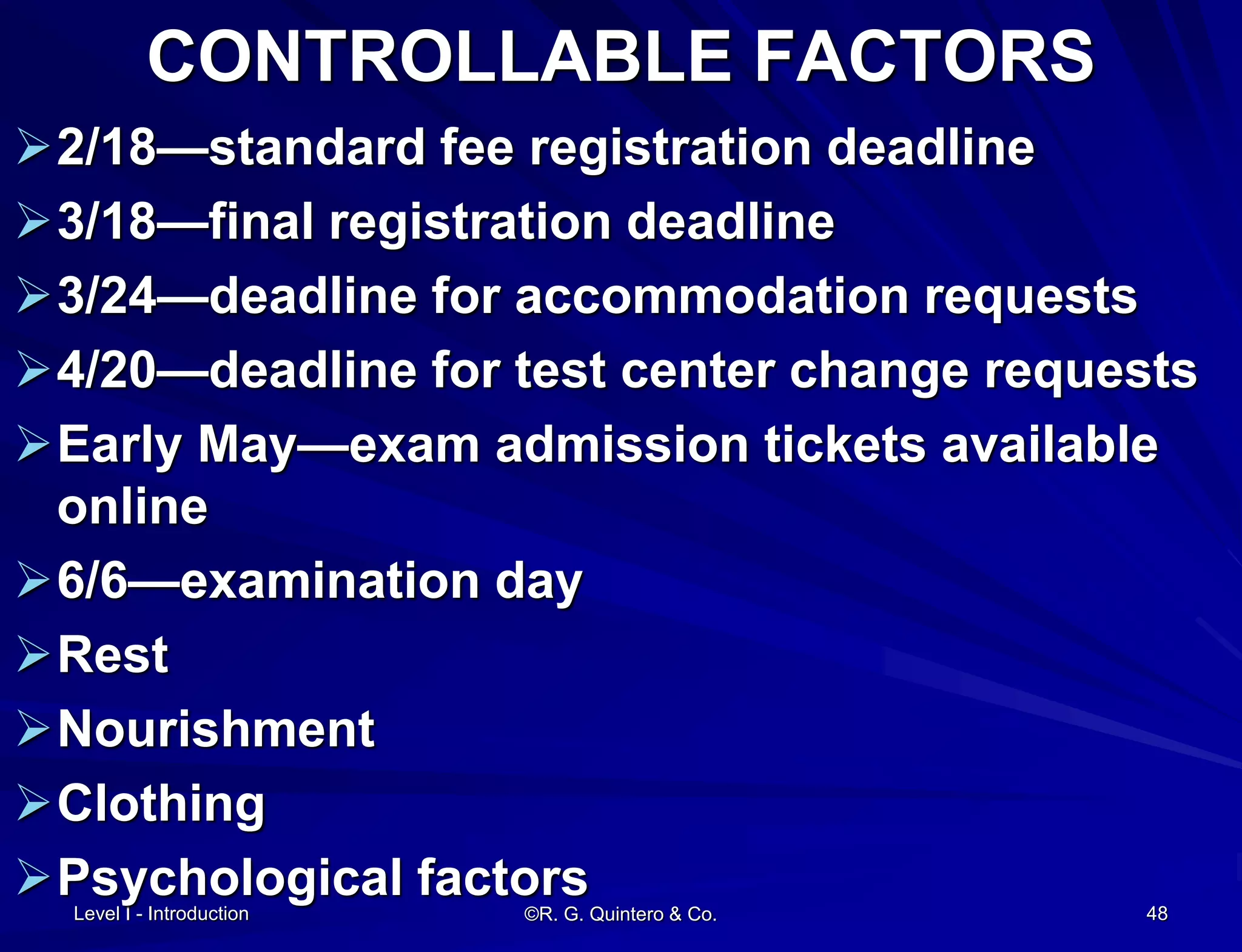

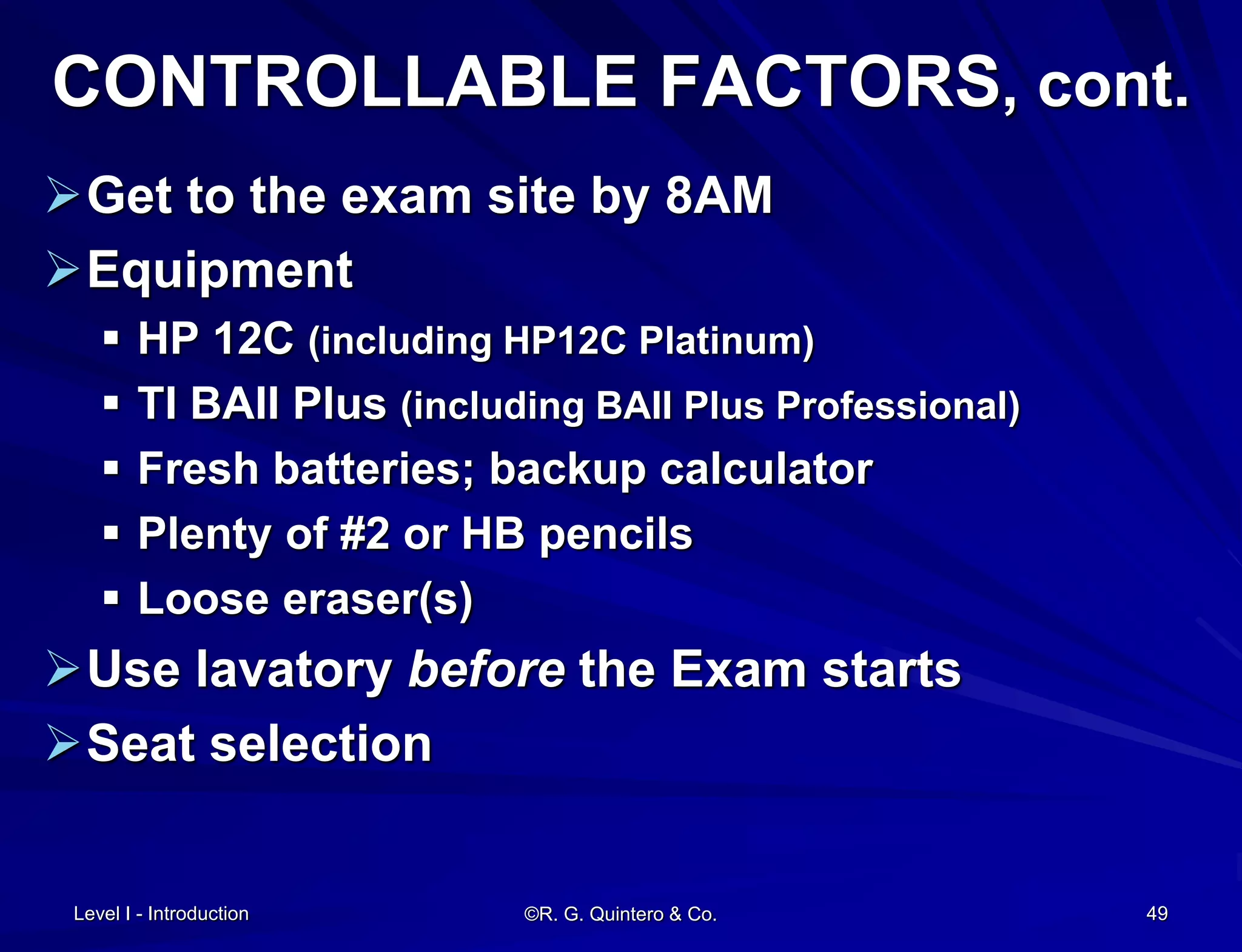

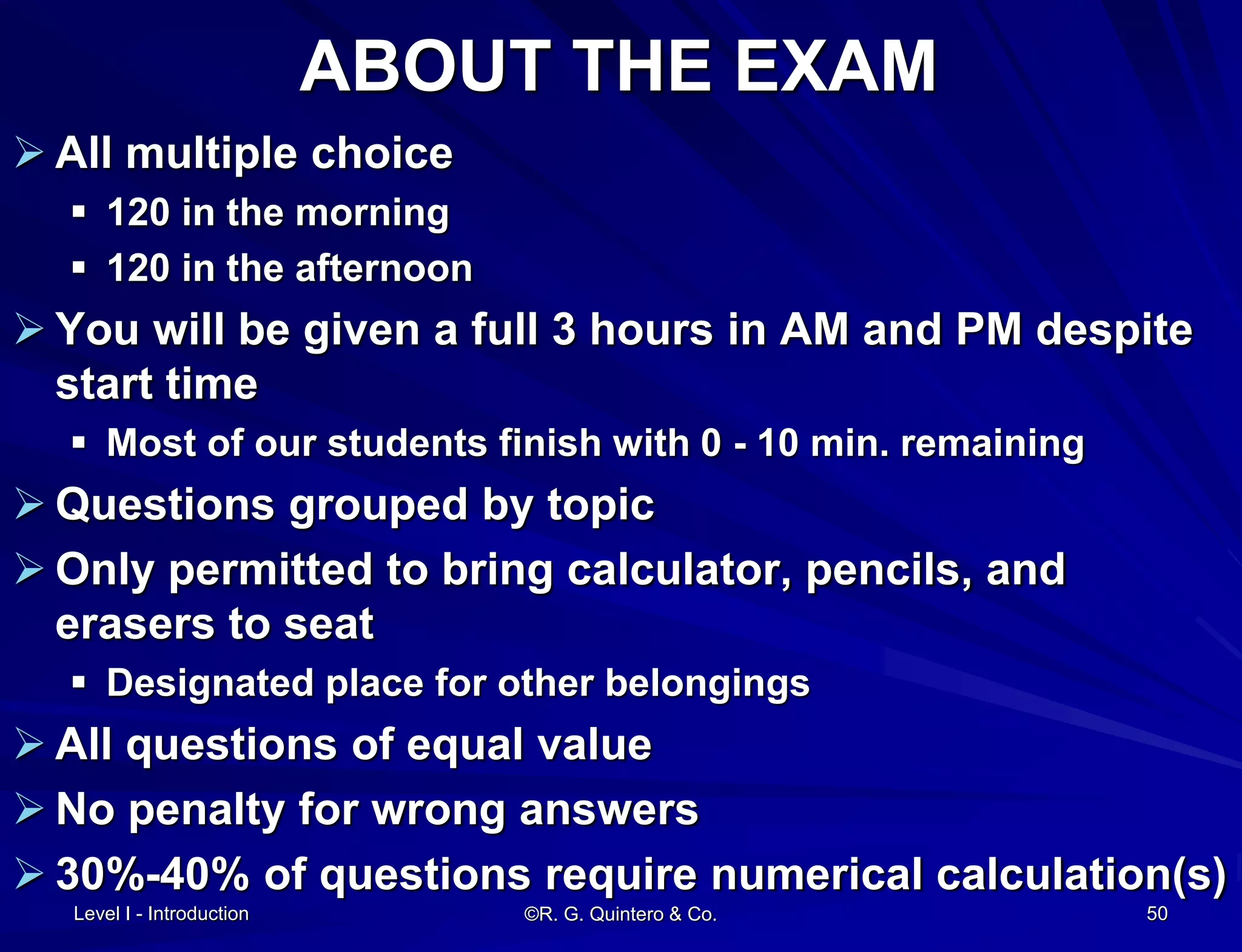

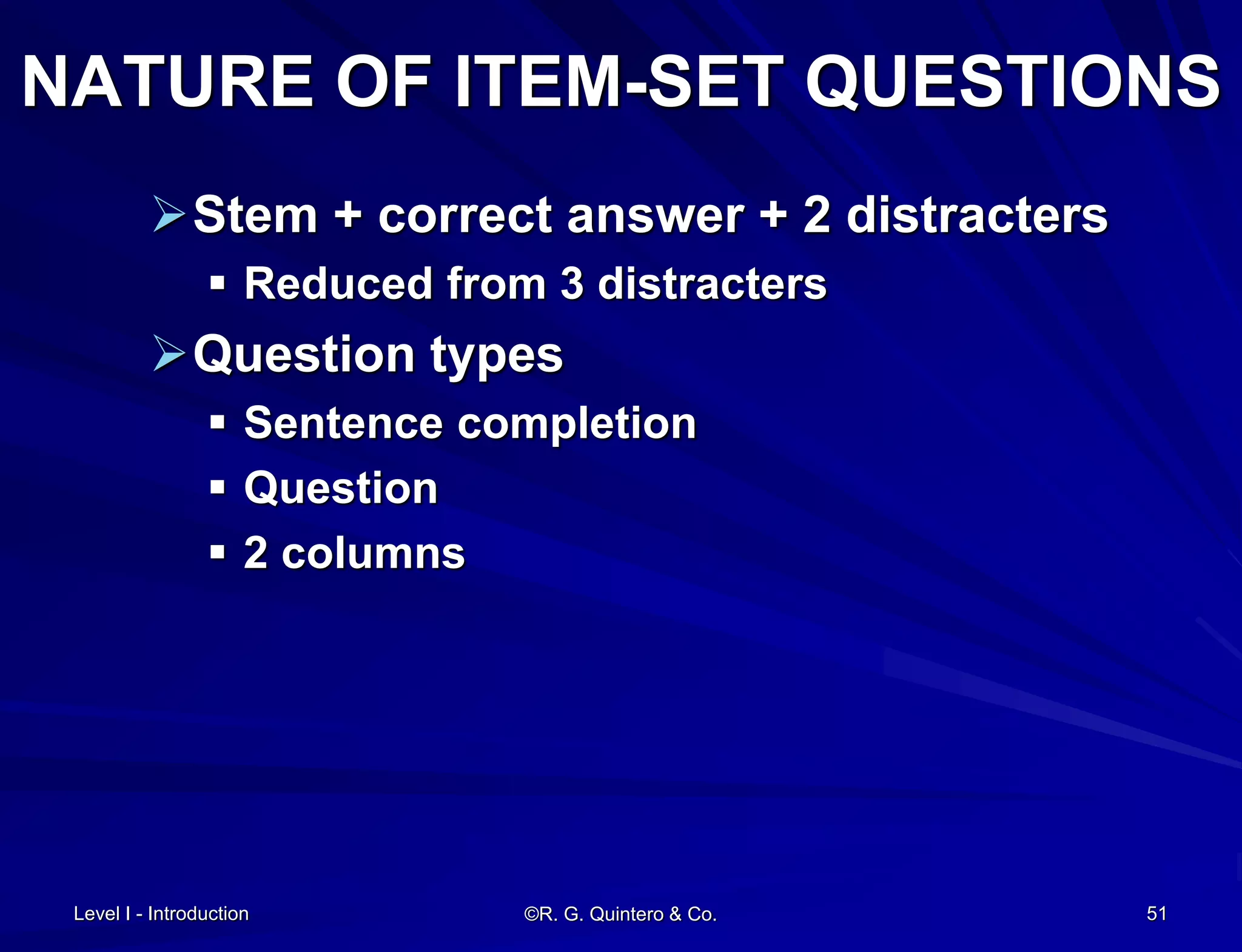

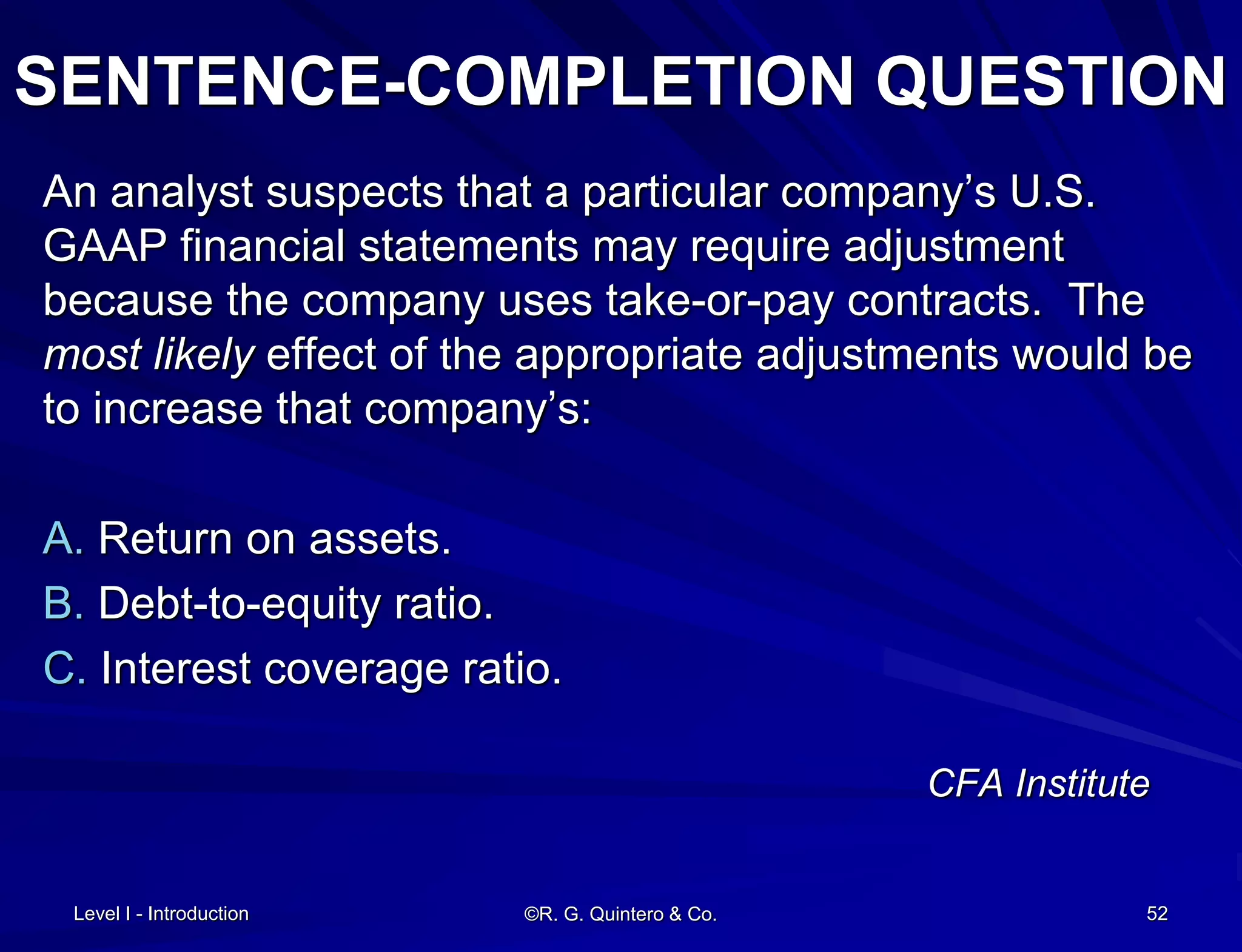

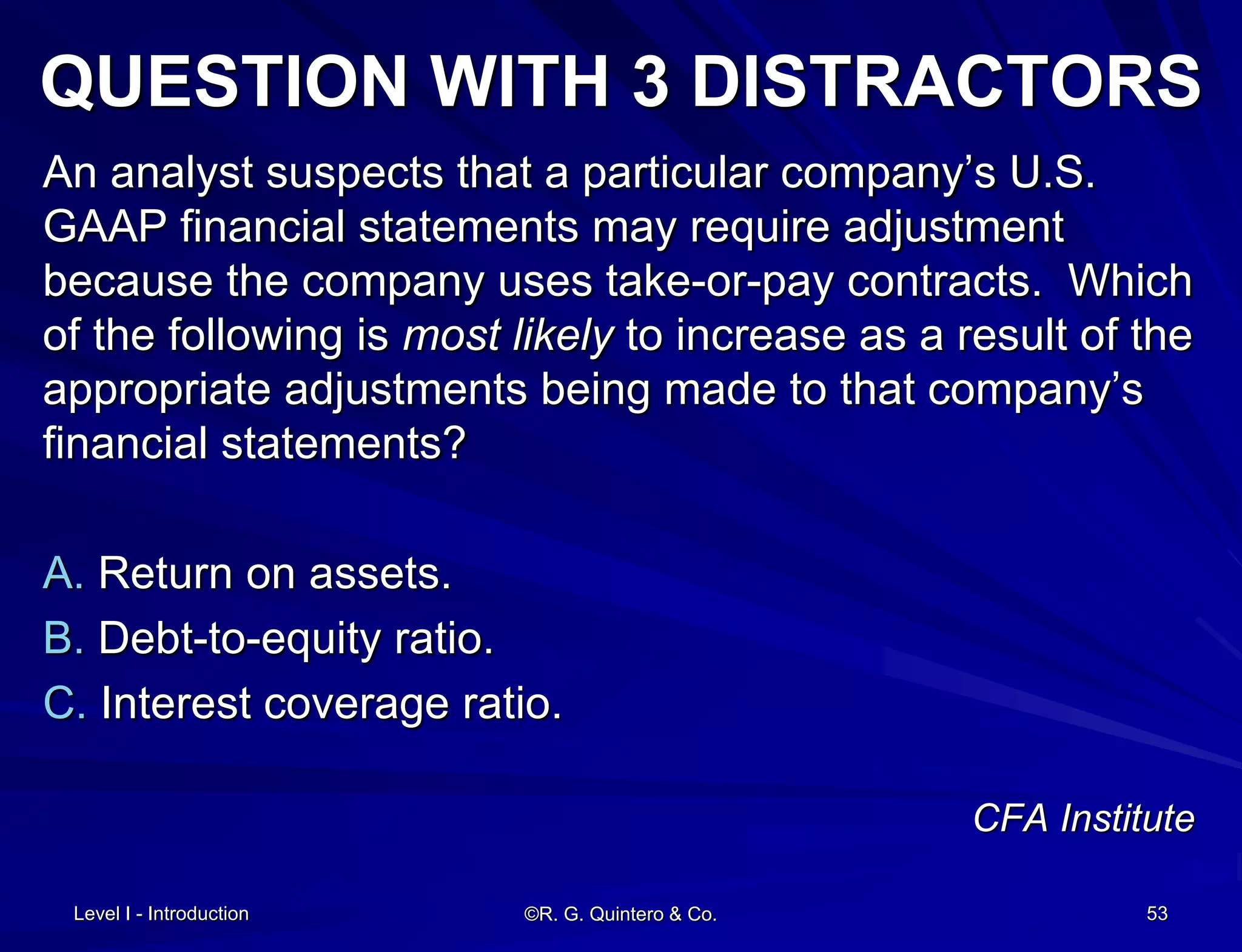

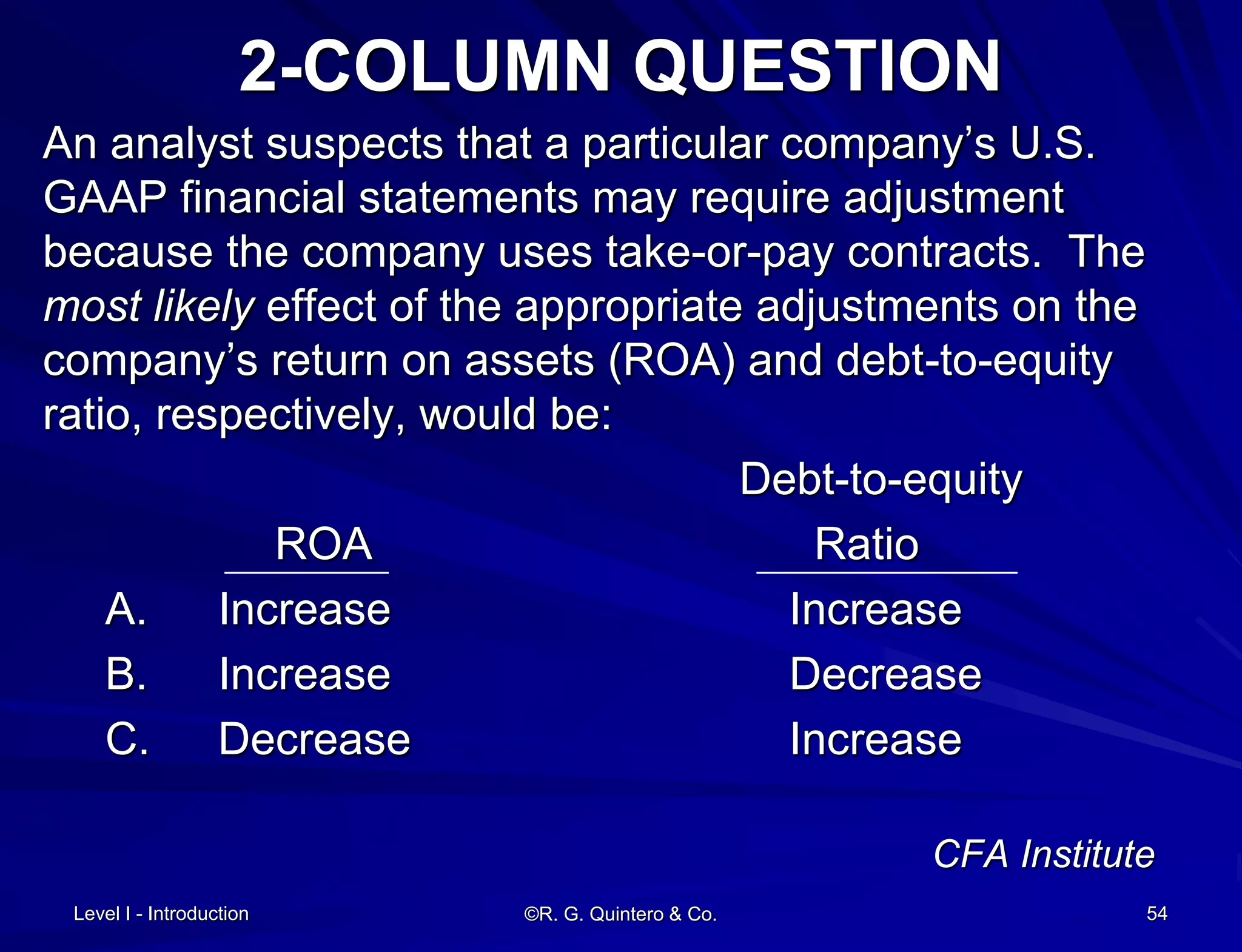

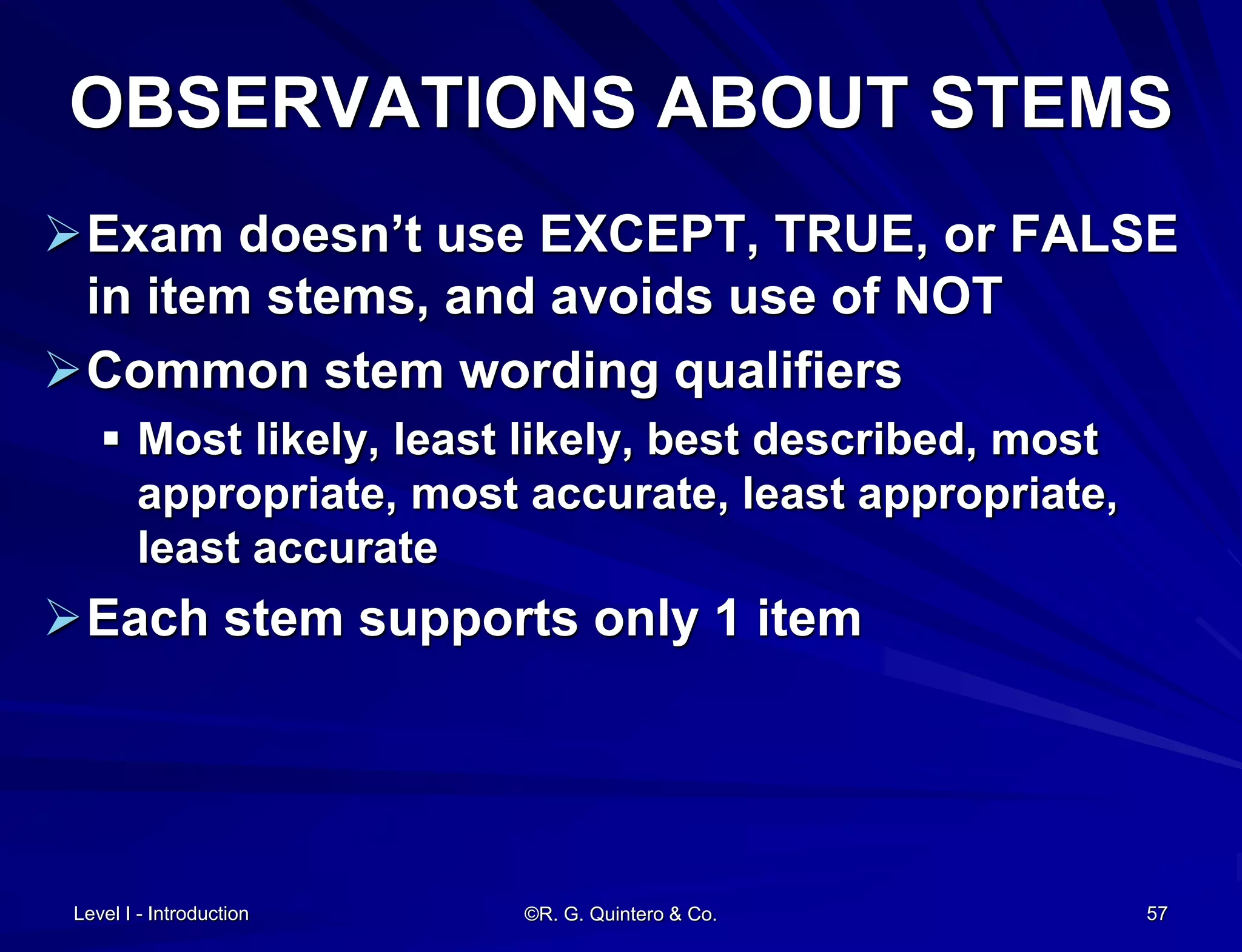

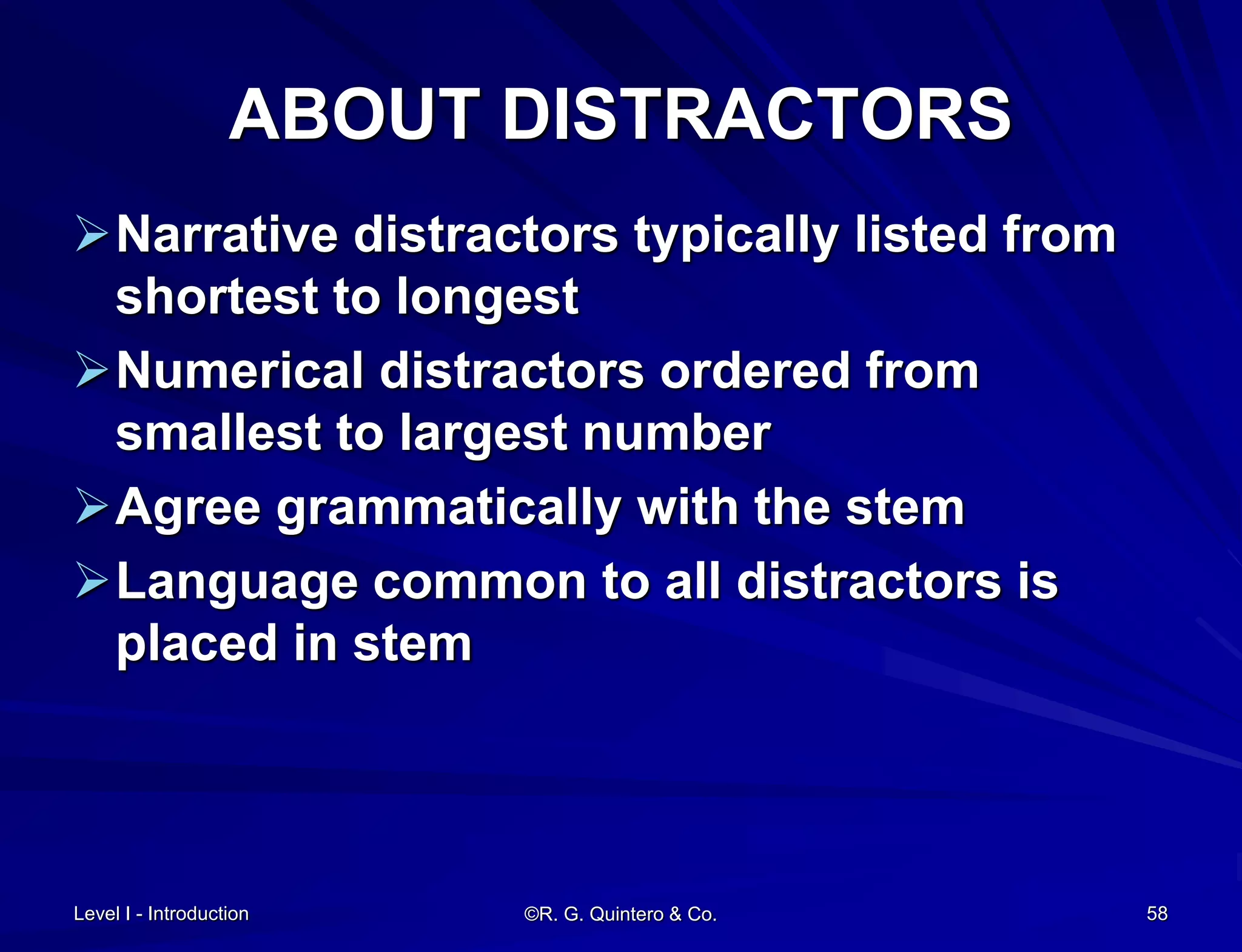

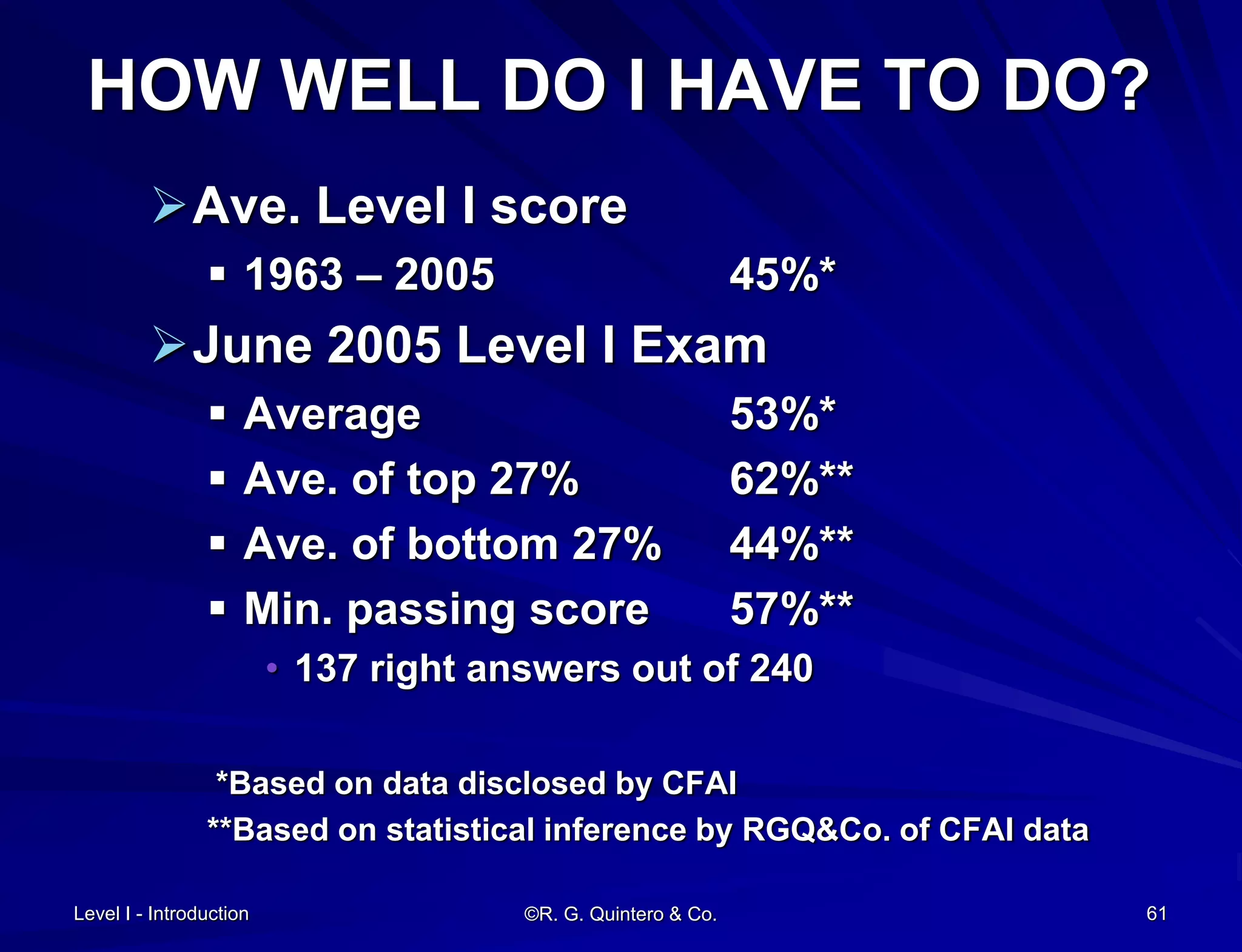

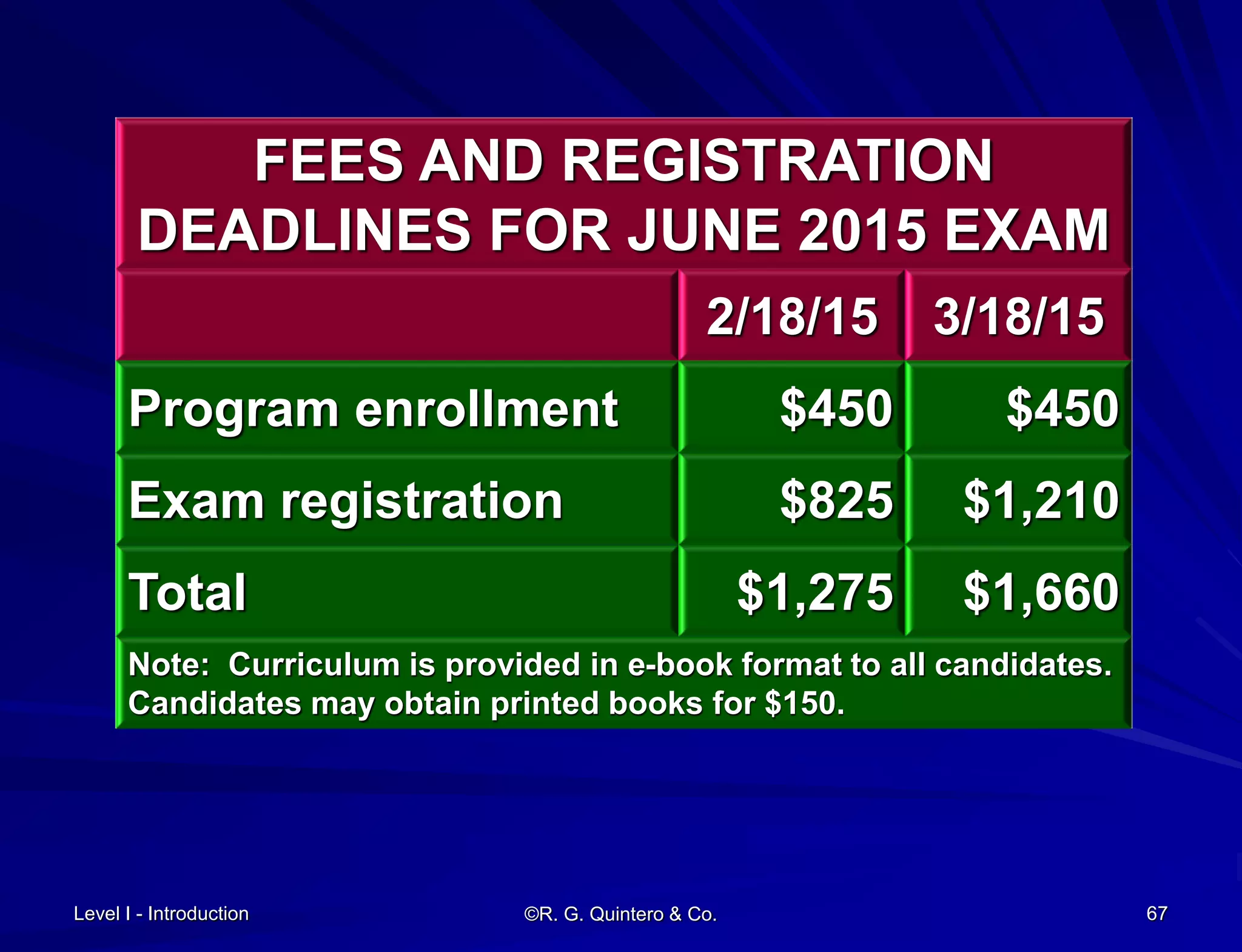

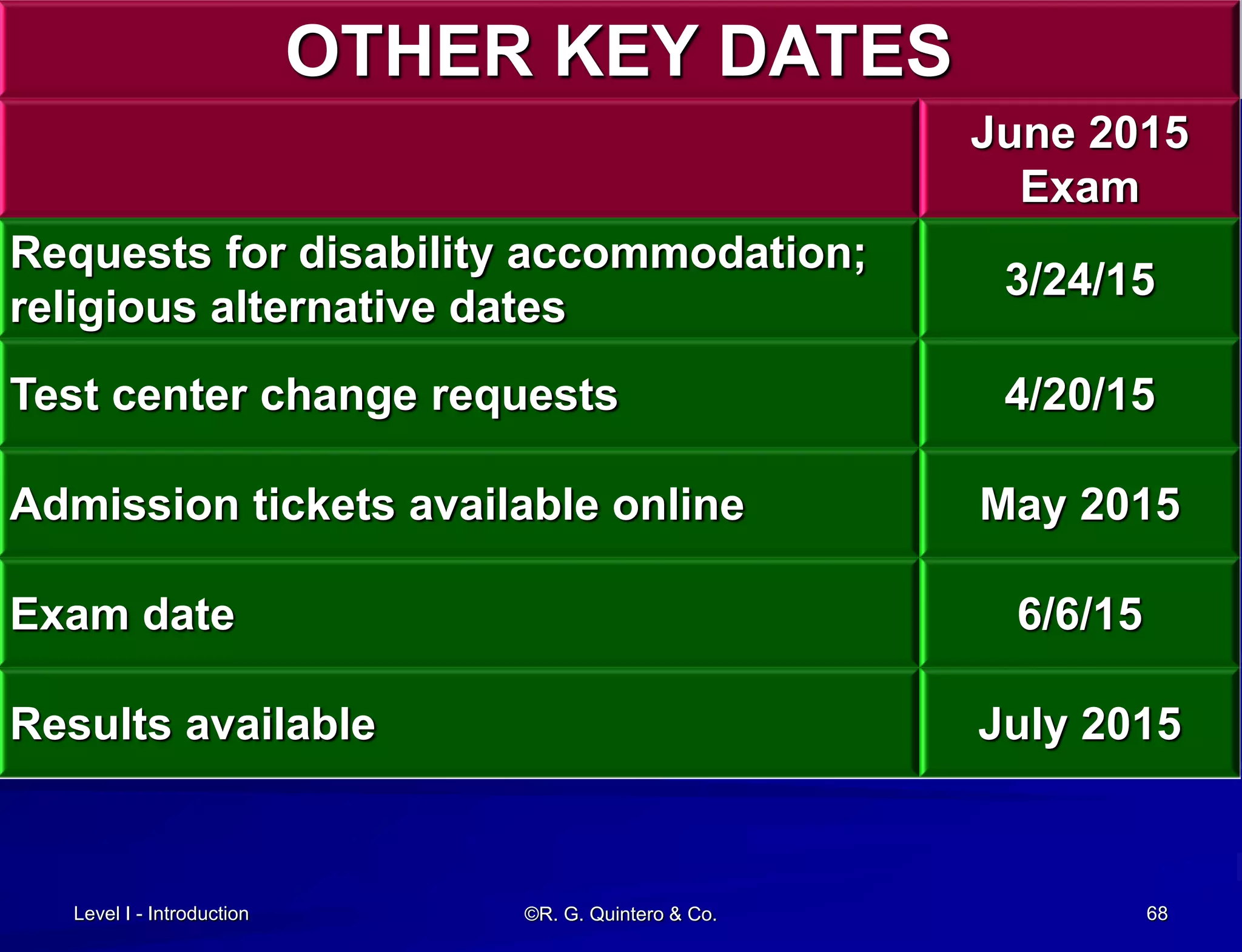

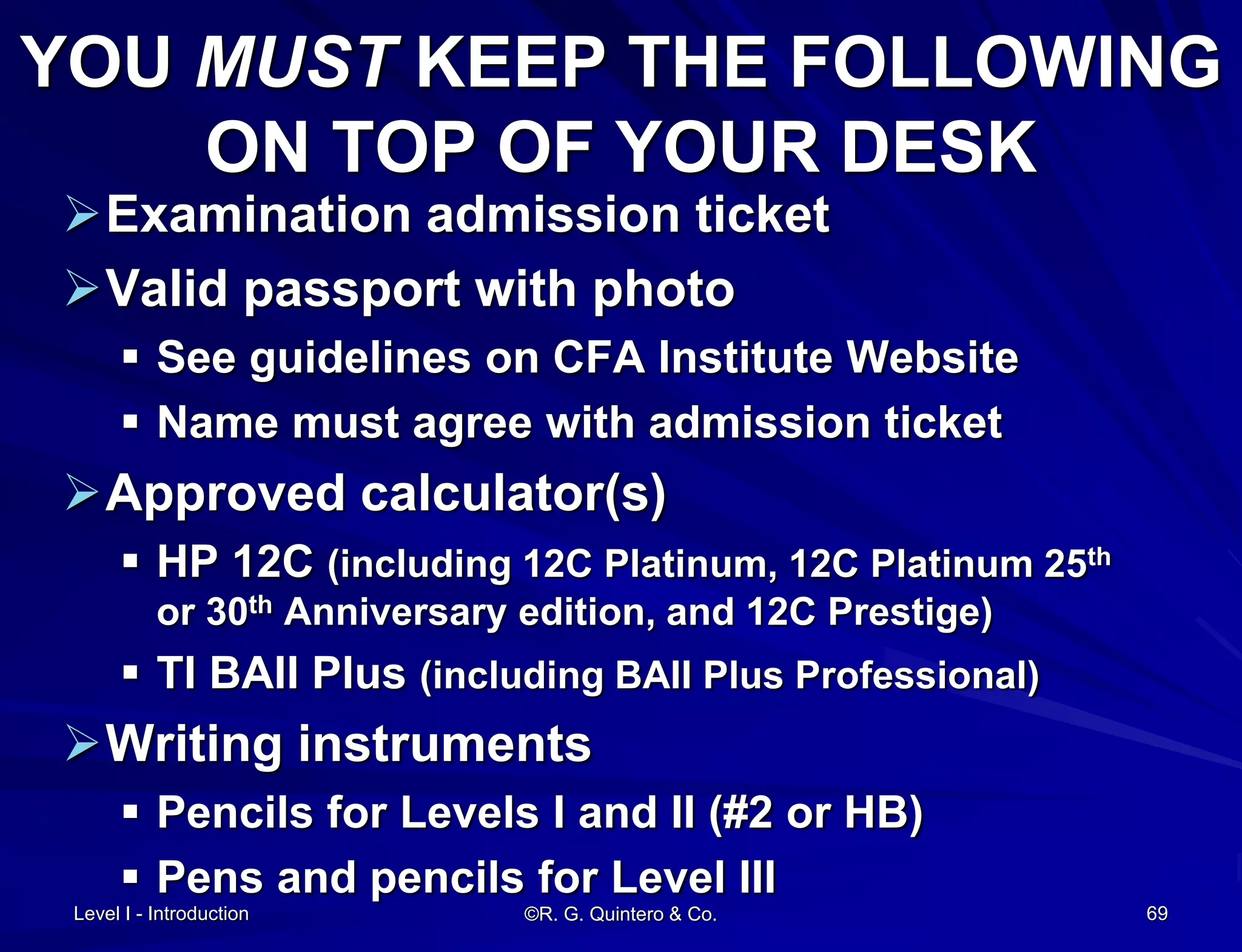

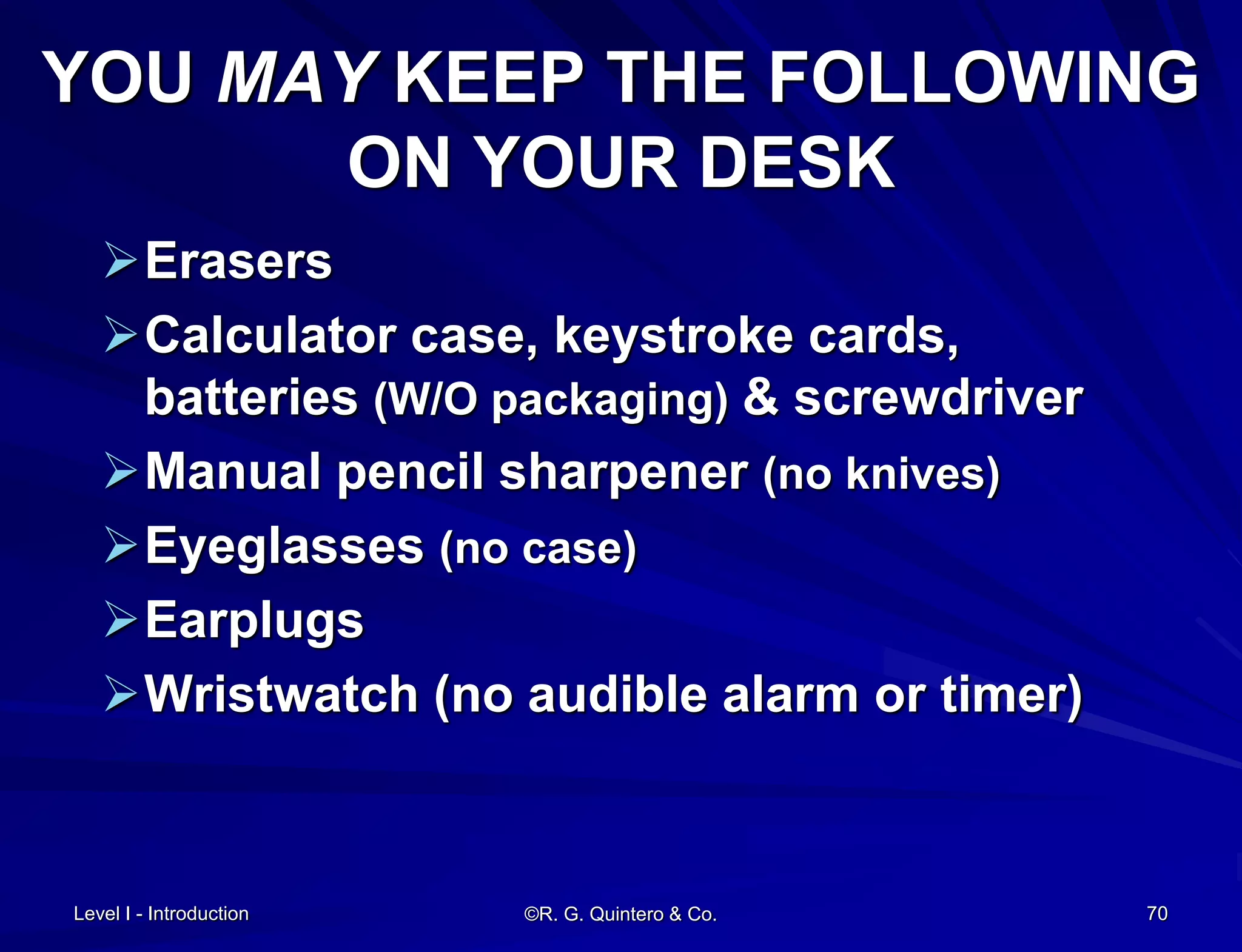

The document provides an overview of the CFA (Chartered Financial Analyst) program, highlighting its significance, structure, and examination process. It details the statistics on candidates and the international recognition of the CFA as a gold standard in financial education. Additionally, it offers insights into exam preparation strategies, topics covered, and challenges faced by candidates.