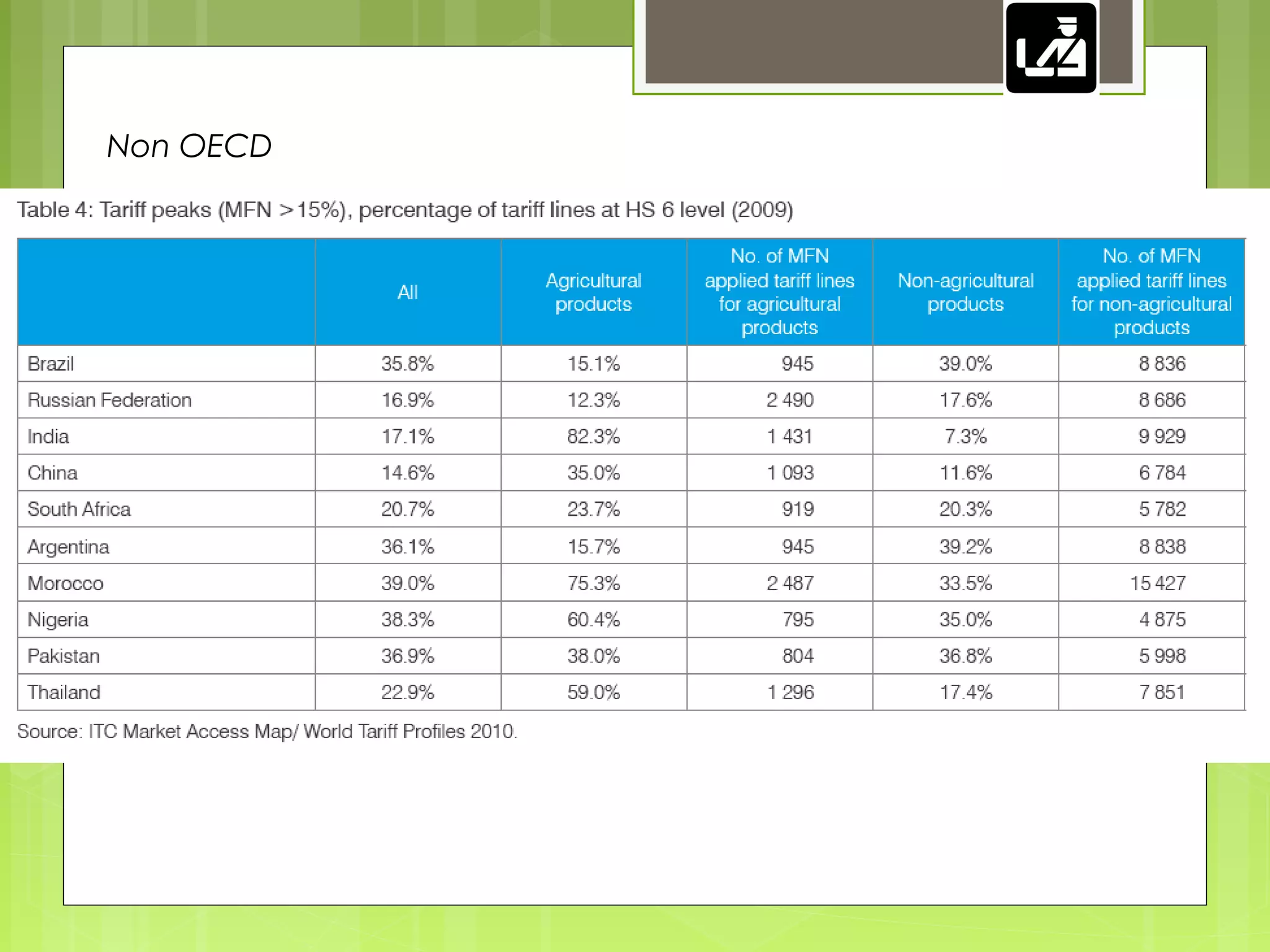

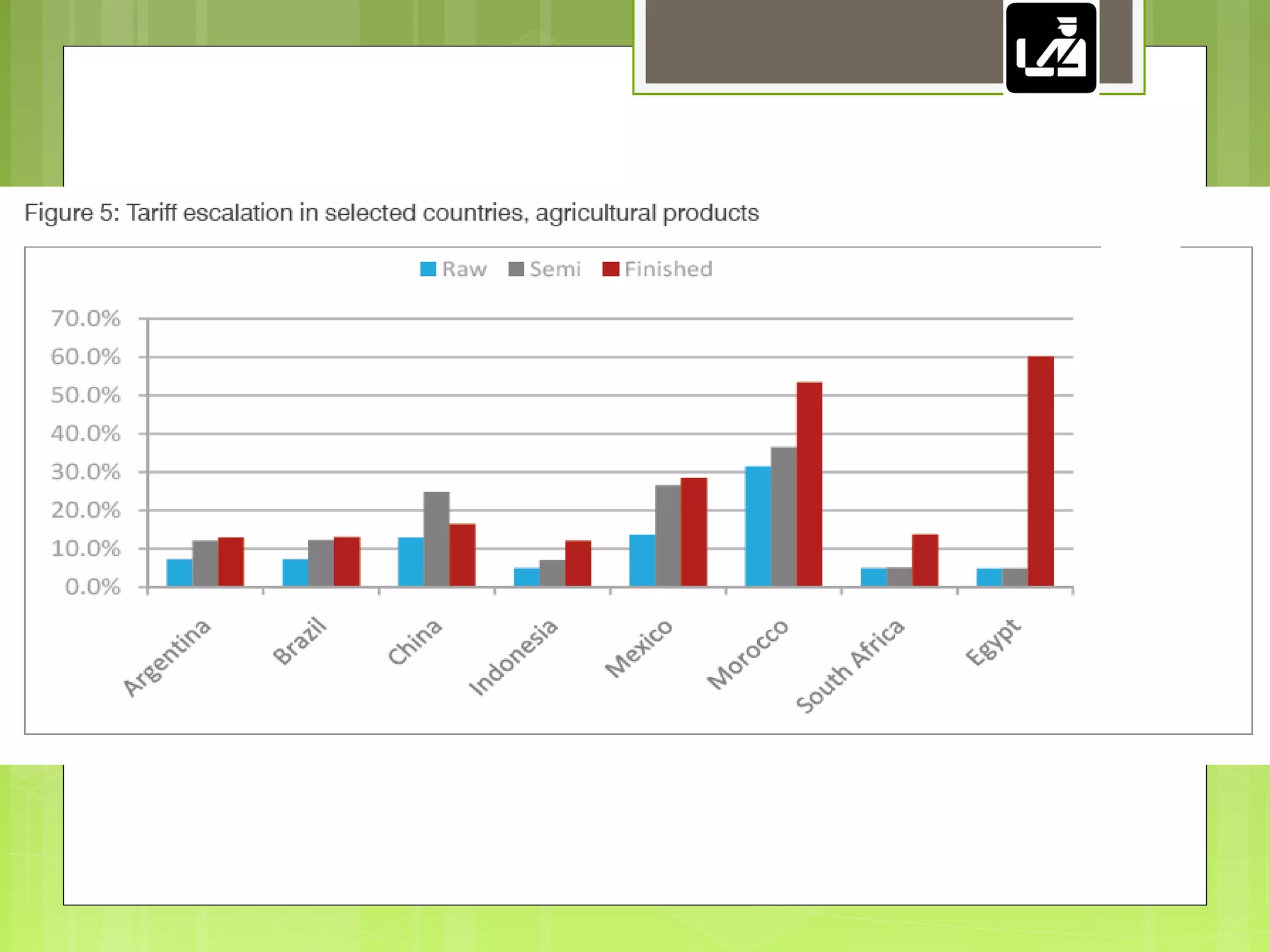

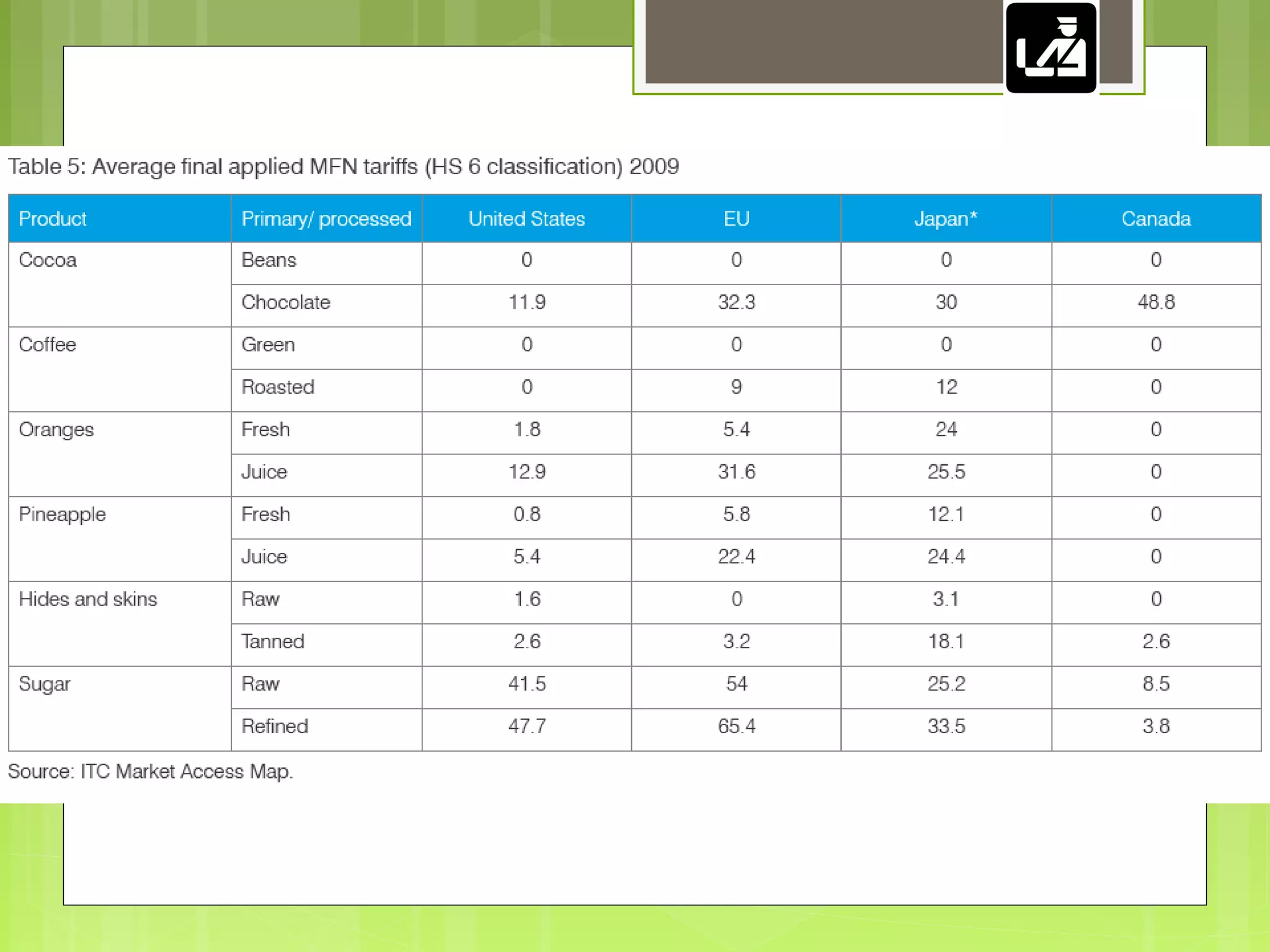

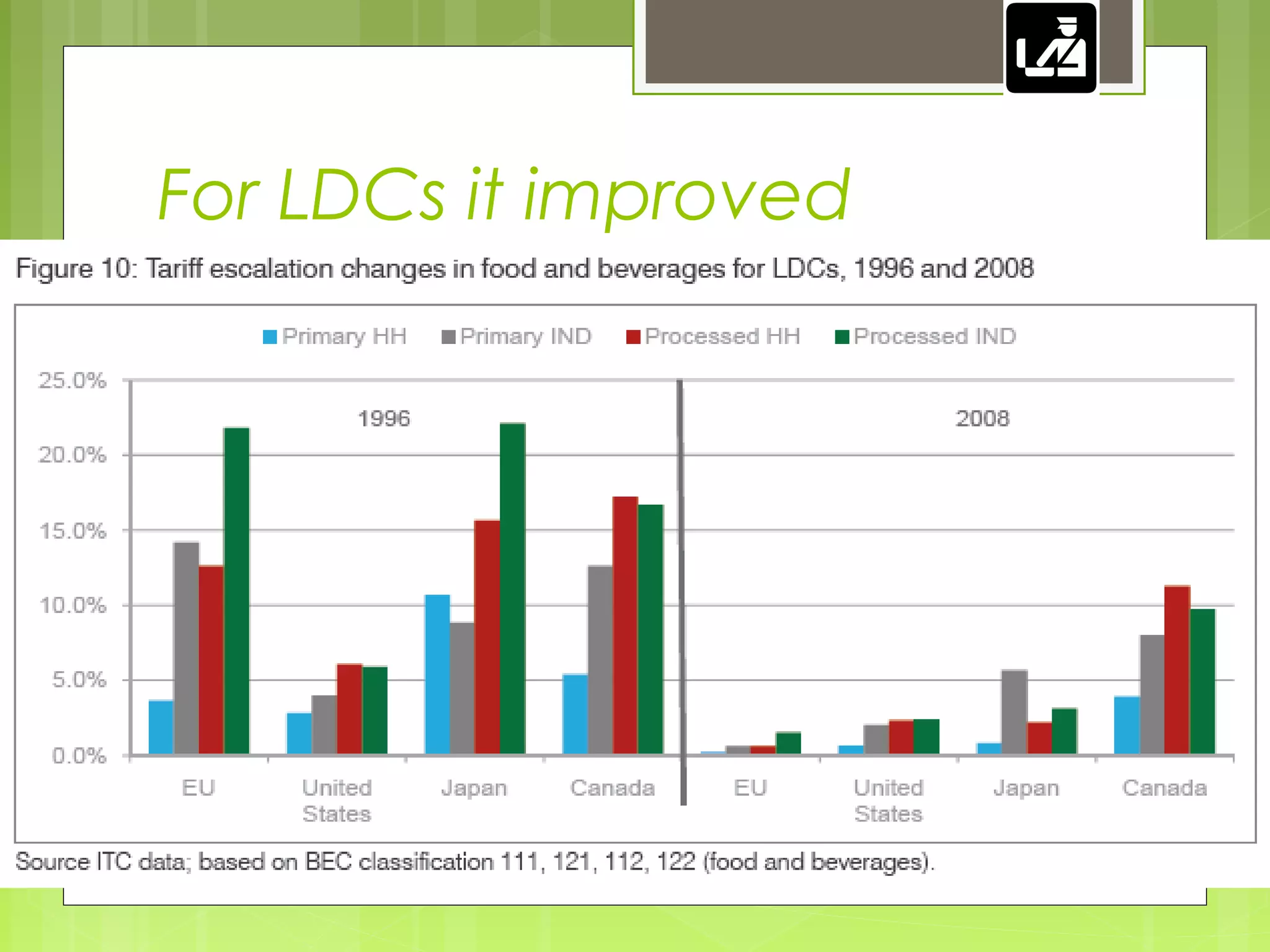

The document discusses issues related to international trade, including the theory of comparative advantage, limitations of trade models, barriers to trade such as tariffs and non-tariff barriers, and the impact of trade policies on developing countries. It notes that while free trade can expand global output, it also risks trapping countries in low-value production and limits opportunities for industrialization. Trade liberalization in agriculture has slowed due to policies in rich nations that affect world prices and new non-tariff barriers introduced.