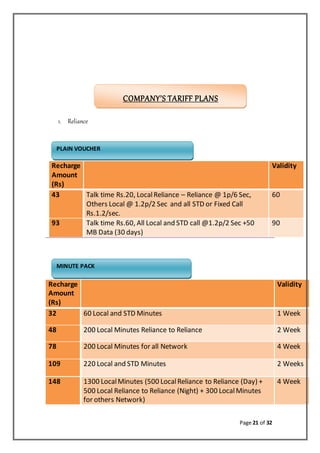

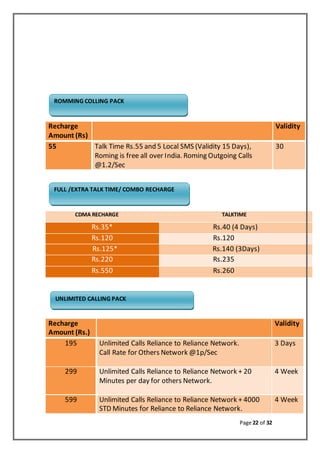

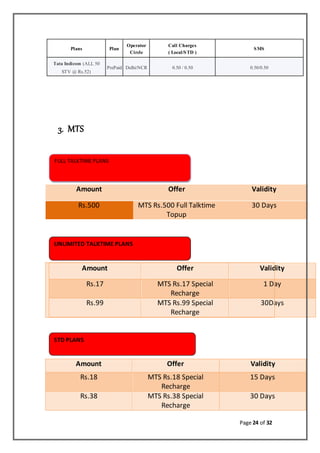

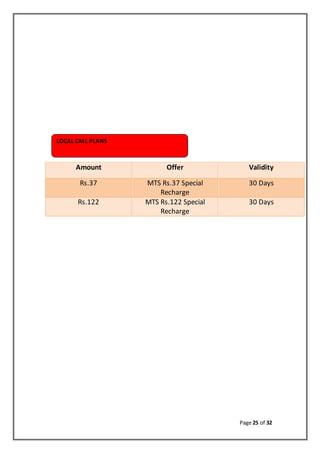

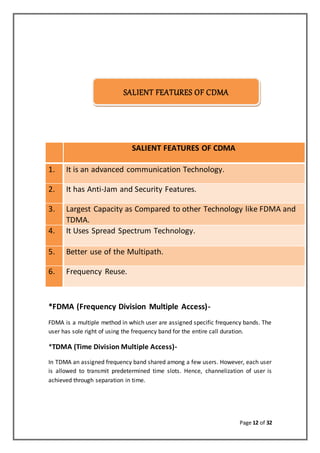

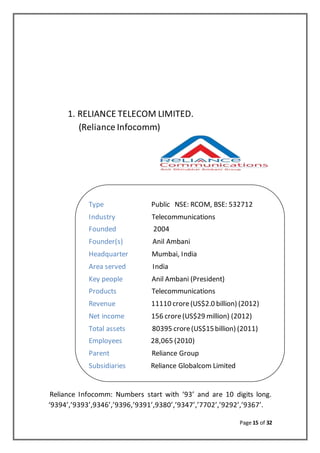

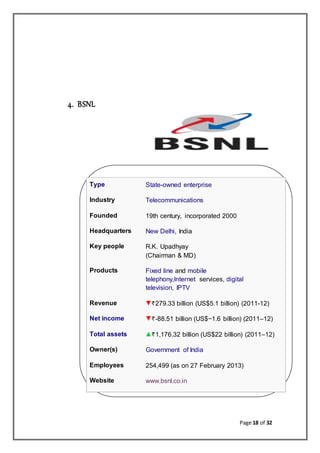

This document is a 32-page project report submitted as part of an MBA program. It includes an executive summary that discusses growth in the global telecommunications industry. The objectives and scope of the project are to study consumer needs and behavior regarding CDMA SIM cards. The report also provides profiles of six major CDMA service providers in India - Reliance Communications, Tata Communications, MTS, BSNL, MTNL, and HFCL - and details their network coverage, products, revenues, and tariff plans.

![Page 16 of 32

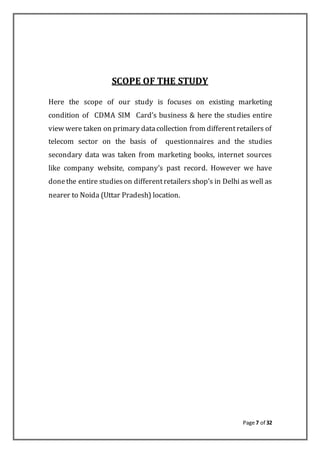

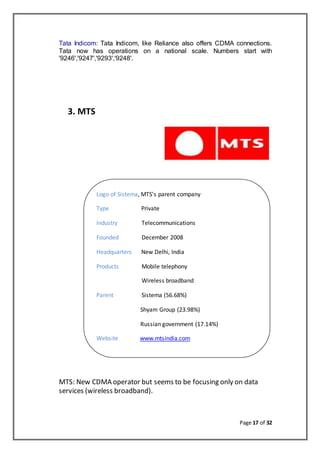

2. TATA TELESERVICESLIMITED.

Type Privately held company

Industry Conglomerate

Founded 1868

Founder(s) Jamsetji Tata

Headquarters Mumbai, Maharashtra, India

Area served Worldwide

Key people Cyrus Pallonji Mistry

(Chairman)[1]

Products Airline, automotive, steel, it, electricity generation,

chemicals, beverages, telecom, hospitality, retail,

consumer goods, engineering, construction,

financial services

Revenue US$ 100 billion (2011–12)

Profit US$6.23 billion (2011–12)

Total assets US$77.7 billion (2011–12)

Owner(s) Tata Sons (Promoter)

Website www.tata.com](https://image.slidesharecdn.com/71a5aafb-b694-4c83-9dc2-6014b9ffee23-161108094834/85/CDMA-Project-16-320.jpg)

![Page 19 of 32

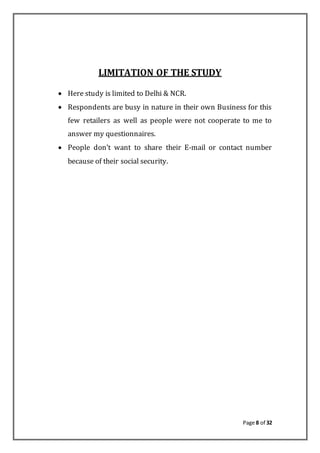

5. MTNL

Type Publicly listed state-owned enterprise

Traded as NSE: MTNL

BSE: 500108

NYSE: MTE

Industry Telecommunications

Founded (April 1, 1986)

Headquarters New Delhi, India

Key people A.K.Garg

(Chairman & MD)

Products Fixed-line, mobile telephony, wired and

wireless broadband,Fibre-to-the-home, dial-

upinternet, IPTV, digital television

Revenue $788.7 million (2010)[1]

Net income $-567.5 million (2010)[1]

Total assets $6.988 billion (2010)[1]

Total equity $1.351 billion (2010)[1]

Owner(s) Governmentof India (56.25%)](https://image.slidesharecdn.com/71a5aafb-b694-4c83-9dc2-6014b9ffee23-161108094834/85/CDMA-Project-19-320.jpg)

![Page 20 of 32

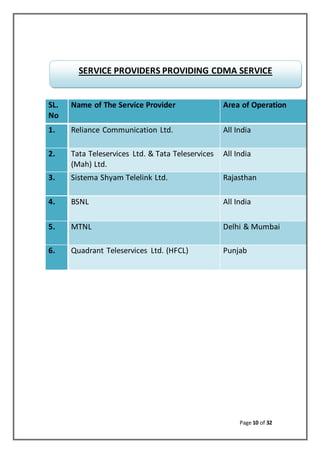

Employees 45,000 (2010)[1]

Subsidiaries Mahanagar Telephone Mauritius Limited (MTML)

Website www.mtnldelhi.inwww.mtnlmumbai.in

6. QUADRANTTELEVENTURES LIMITED (HFCL)

Quadrant Tele ventures Limited (formerly HFCL Infotel Limited)

Ownership type: Publicly listed

Private equity

investors:

Yes

Stock market: Bombay Stock

Exchange (India)

Reuters Code: QUAD.BO

Bloomberg Code: QDTV:IN

Last full year

revenues:

INR 2,828.000 millions

Year end: March 2012

No. of employees: 524

Key activities:

Internet service provision

Telecom equipment &

infrastructure

Telecom Services

Summary description

Quadrant Televentures Limited (formerly HFCL Infotel Limited) is a telecoms services

provider based in India. Established in 1946, the company provides wireline voice

(Landline) services, DSL (Internet) services, leased line services, CDMA wireless

services and GSM mobile services in the Punjab telecom circle. It has 1.6 million

wireless, of which 27, 768 CDMA and 1.3 million GSM subscribers and 0.2 million

wireline subscriptions (July 2012) and 0.1 million broadband subscriptions (March 2012).

In March 2010, it had launched its GSM wireless services in Punjab Telecom circle.

In the year ended March 2012, Quadrant Televentures Limited generated INR 2.8 billion

in revenue with an annual growth of 21.7% and net profit of 1.7 billion, with an annual

decline of 22.7%.](https://image.slidesharecdn.com/71a5aafb-b694-4c83-9dc2-6014b9ffee23-161108094834/85/CDMA-Project-20-320.jpg)