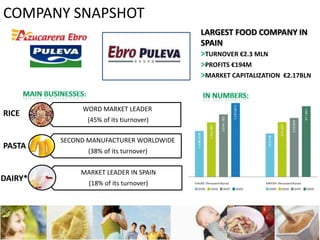

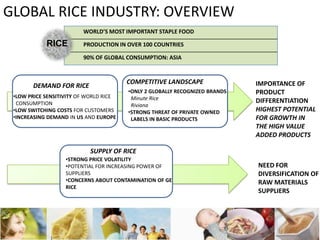

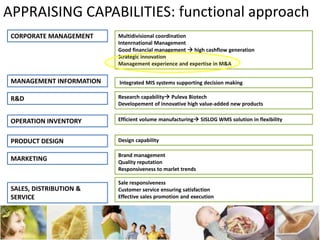

This document provides an overview of a large Spanish food company. It discusses the company's business segments including rice, pasta and dairy. The company has a turnover of €2.3 billion and profits of €194 million. It has international presence in over 26 countries across Europe, Asia, Africa and Americas. The document performs external and internal analysis of the global food industry and the company. It discusses key success factors, resources, capabilities and provides a SWOT analysis. The business strategy focuses on leveraging competitive advantages in research and product innovation, especially in rice and pasta segments.