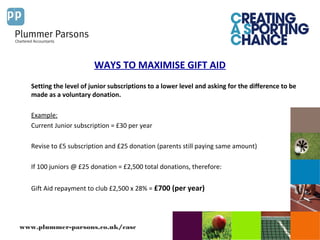

The document discusses the Community Amateur Sports Club (CASC) scheme in the UK, which provides tax benefits to registered sports clubs. It outlines how clubs can maximize income through Gift Aid donations and provides examples of how to structure donations, such as setting junior membership fees and expenses. Registering allows clubs to claim back 28% of donations from the government. The case study of Glynde & Beddingham Cricket Club shows how they earned over £3,000 in Gift Aid over two years for facility improvements. Plummer Parsons provides free advice and resources to help clubs utilize the CASC scheme.