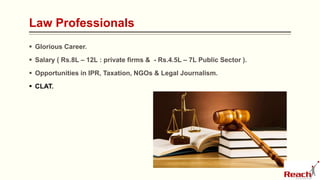

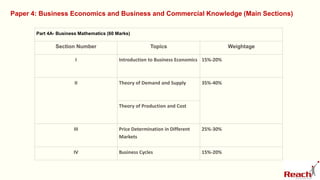

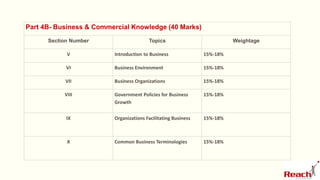

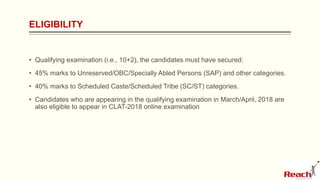

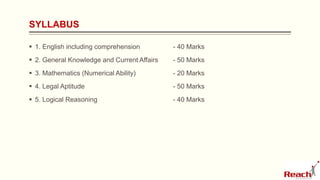

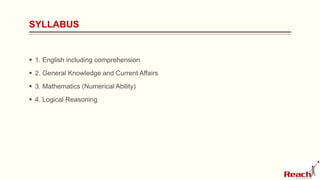

The document provides information on lucrative professions and the education required to enter them. It discusses law professionals, chartered accountants, management professionals, and chartered accountancy. It outlines the salary ranges, opportunities, and entrance exams for each field. Specifically, it focuses on the Chartered Accountancy Foundation exam, describing the exam pattern, topics covered, and classes available to prepare students. It also provides details about the Common Law Admission Test for law school and commerce entrance exams for top business colleges.