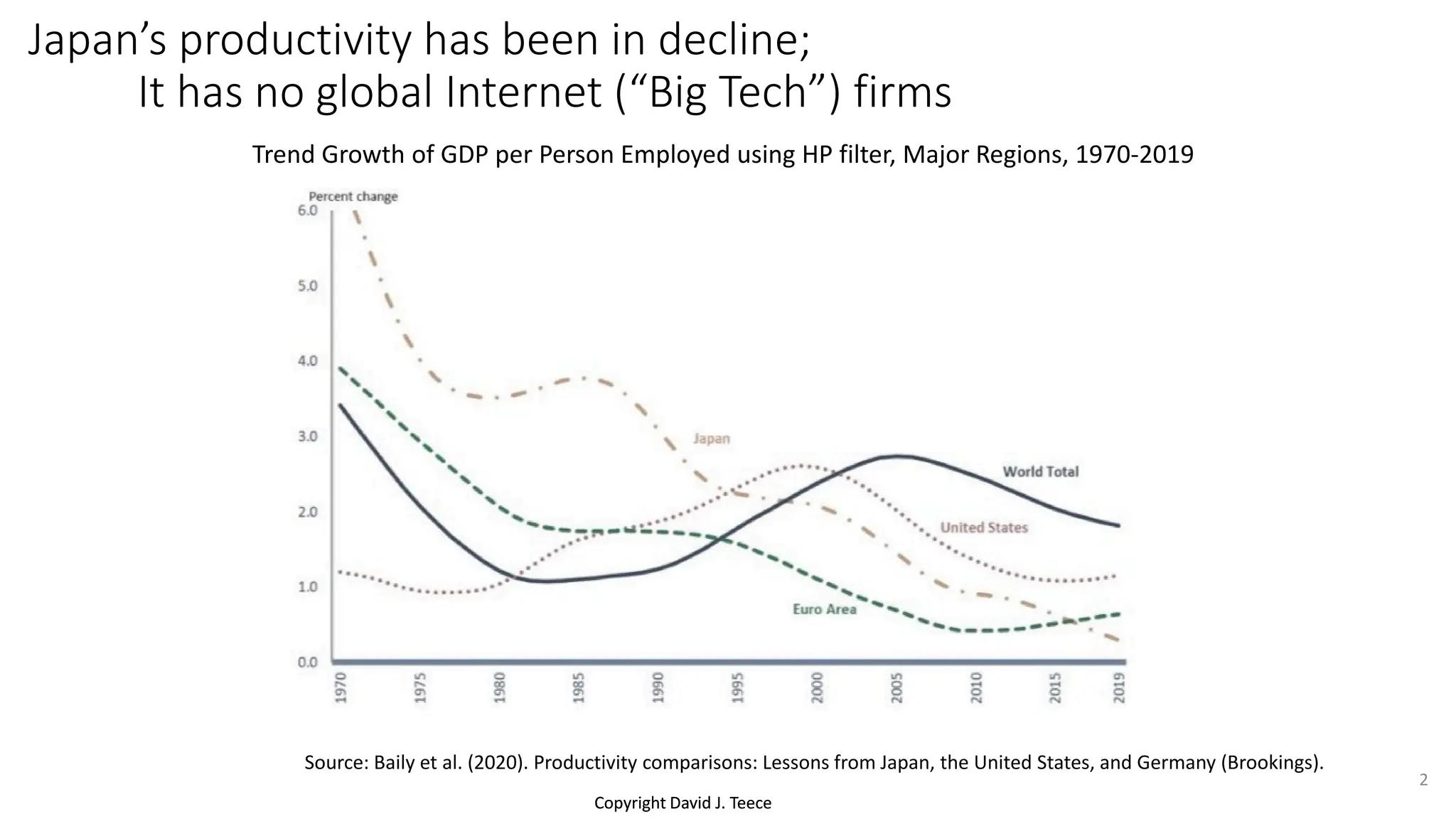

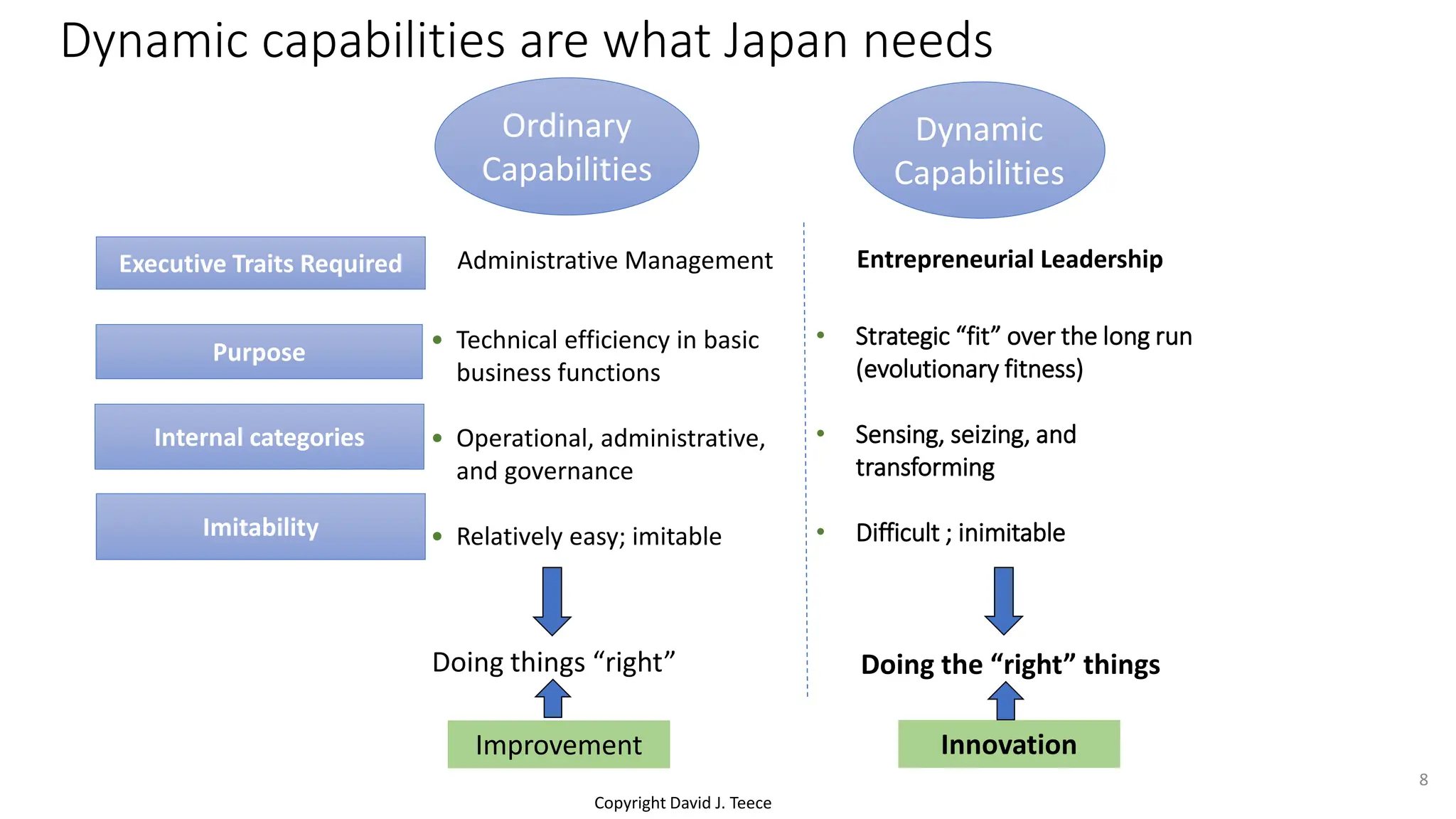

Japan’s productivity has been in decline; It has no global Internet (“Big Tech”) firms.

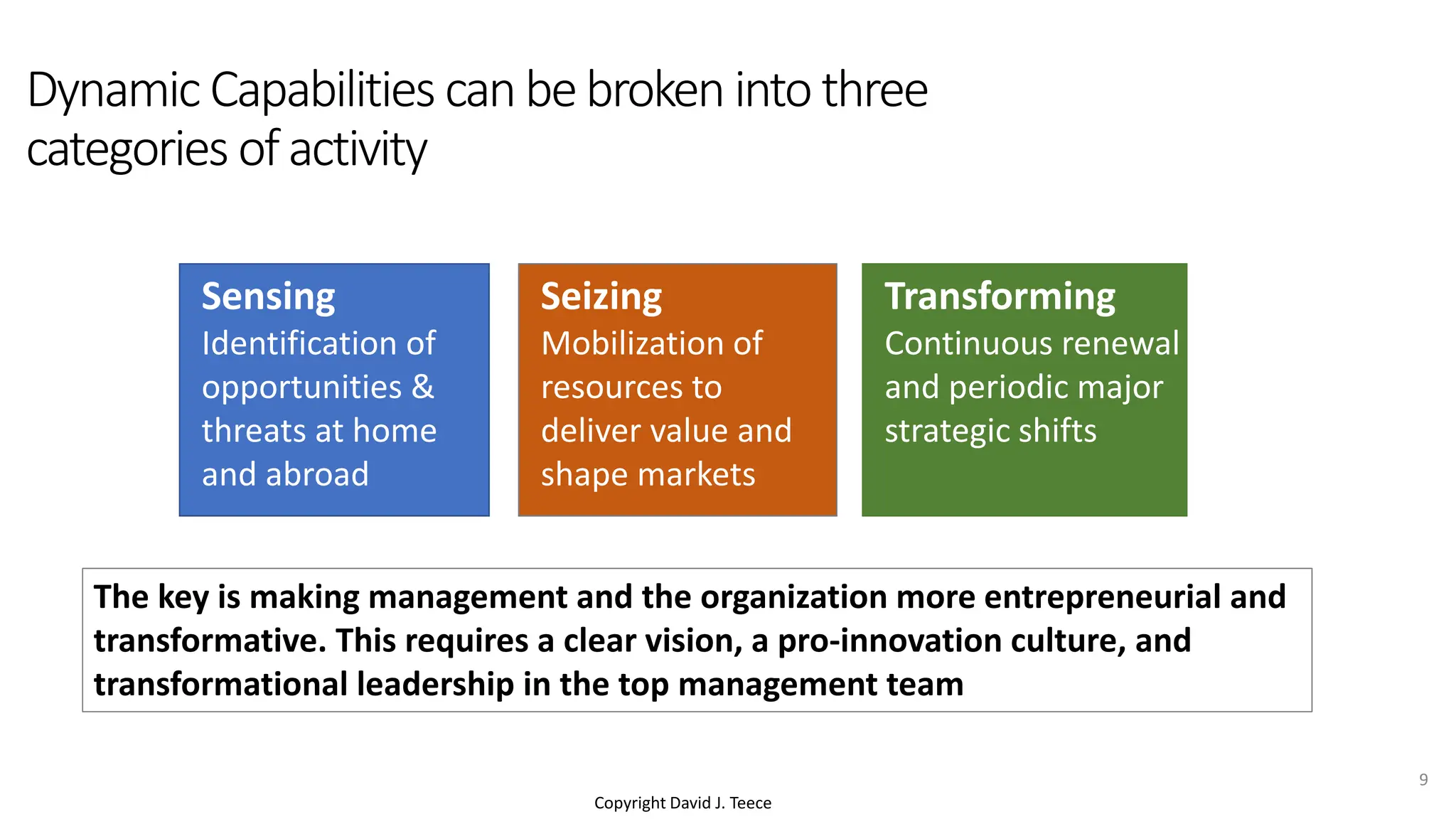

Dynamic Capabilities Help Sustain Industry-Leading Profitability.

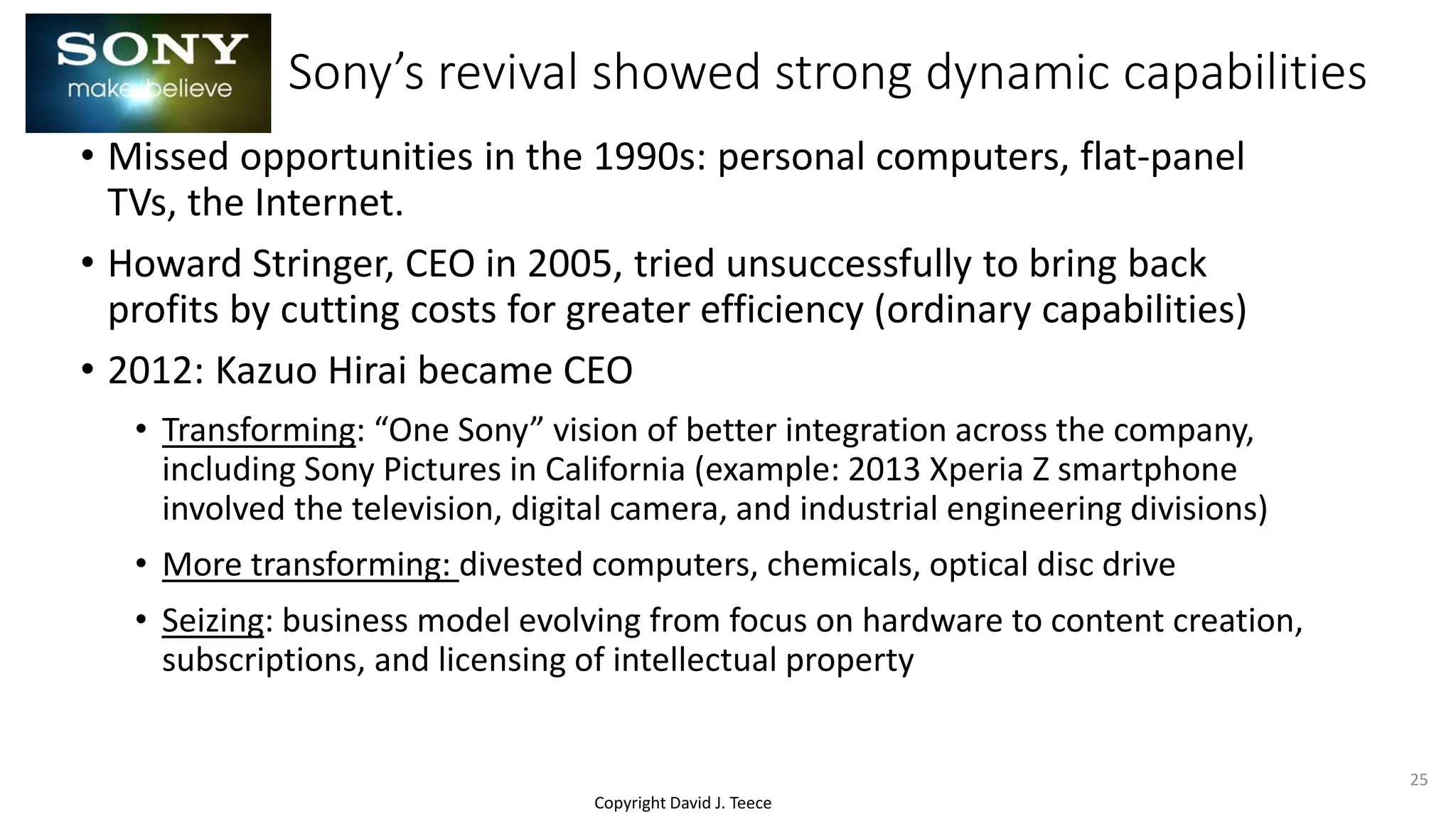

Strong dynamic capabilities requires leadership and entrepreneurial management.

There is often too little attention given to big (strategic) decisions because operational concerns tend to crowd out strategic priorities.

Perfectionism can be the enemy of innovation.

Learn these concepts and more, in this 2021 presentation from Professor David J. Teece, the founder of the dynamic capabilities framework and the world's most cited scholar in business and management.