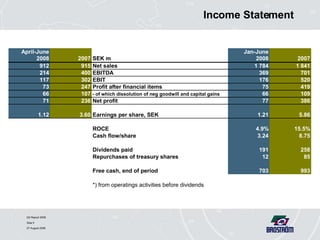

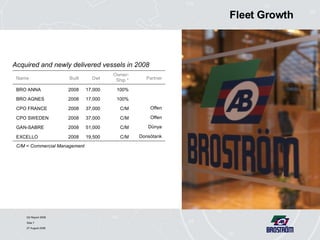

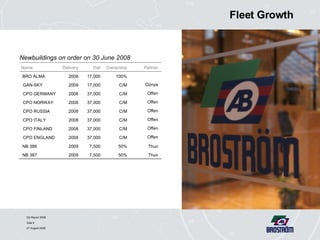

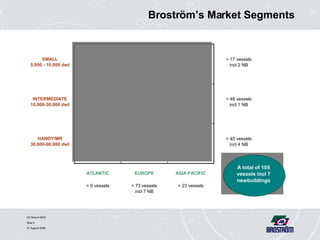

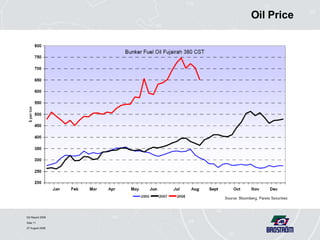

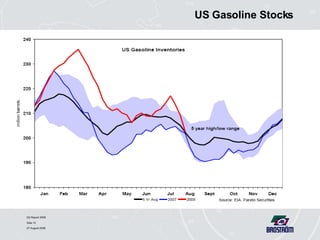

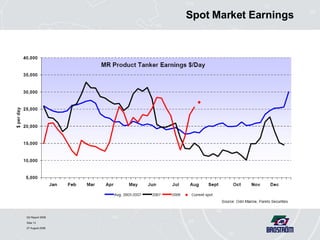

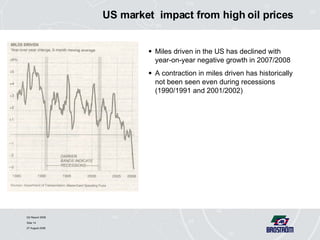

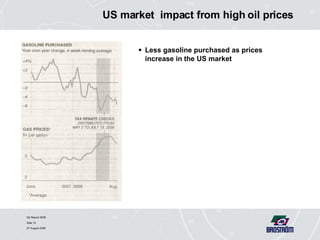

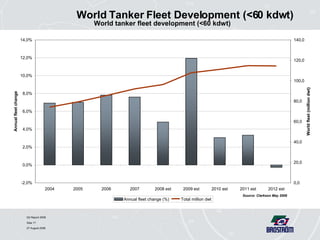

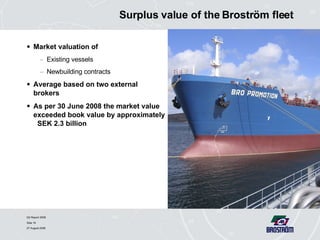

This document summarizes Broström's Q2 2008 presentation. It discusses the volatile freight market in Q2 2008, with weakness in European, Atlantic, and Asian markets for large tonnage. It provides figures on Broström's fleet growth and development. It also outlines trends in the oil market like high prices and declining US gasoline consumption and miles driven. The outlook notes continued market improvement in Q3 2008 but uncertainty due to new tonnage and efforts to reduce oil dependence.