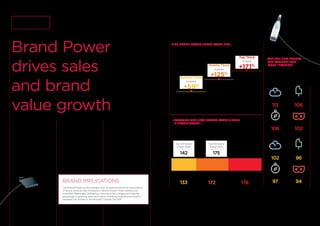

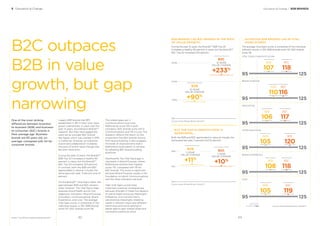

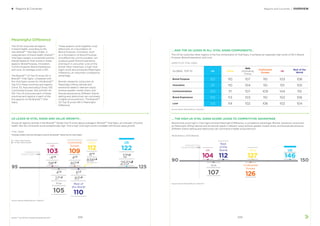

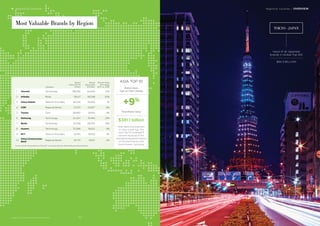

The value of the top 100 global brands increased 8% in 2017 to $3.6 trillion despite a turbulent geopolitical year, with surprises like Brexit and the US election. Seven categories rose moderately while two, retail and technology, increased by double digits. The fastest growing brand was Adidas, up 58%, while retail was the fastest growing category at 14%. Some brands addressed social issues in response to consumer expectations around brand purpose.