1. Pfizer's drug Elelyso received FDA approval in 2012 for the treatment of type 1 Gaucher disease, joining two other enzyme replacement therapies on the market.

2. Elelyso was shown in clinical trials to effectively reduce spleen and liver volumes and improve blood counts in patients with type 1 Gaucher disease.

3. As an orphan drug for a rare disease, Elelyso faces competition from other treatments but aims to have advantages in lower production costs and reduced risk of viral transmission compared to therapies produced in mammalian cells.

![1

Pfizer Claims Success for Their New FDA Approved Drug, Elelyso for

Treatment of Type 1 Gaucher Disease Despite Market Competition for

an Orphan Indication

Shiva Bolourchi

December 2013

On May 1, 2012 Protalix and Pfizer’s orphan drug, Elelyso, received FDA approval

for the treatment of the most common lysosmal storage disorder (LSD), Gaucher Type I

disease.10

In this automosal recessive disease an enzyme called glucocerebrosidase is absent or

has low activity, causing the build up of a fatty acid molecule, glucocerebroside (a.k.a.

glucosylceramide), within macrophages (Gaucher cells) in the spleen, liver and bone

marrow. 9,3

The symptoms are enlarged spleen and liver, thrombocytopenia (low platelet

count), and anemia. The prevalence of Type I Gaucher disesase is 1:40,000 in the general

population and 1:500 among the Ashkenazi Jews (1 in 10 are carriers), accounting for

more than 90% of all cases of Gaucher disease. 9

In the United States only 6,000 patients

are reported to have Gaucher Type 1 diseaese.9

A minority of Gaucher types II and III

patients show neurological decline due to glucocerebrosidase accumulation in the central

nervous system (CNS). While the prevalence of Gaucher disease is not as high as other

diseases, untreated it could lead to life-threatening multi-organ dysfunction. 9, 3, 1

The low prevalence of Gaucher Disease defines treatment methods as orphan drugs.

FDA Office of Orphan Products Development (OOPD) provides orphan drug status to

compounds that are intended for treatment diagnosis or prevention of diseases that effect

less that 200,000 people in the US or effect more than 200,000 people but are not

expected to recover the cost of development and marketing.2

The incentives for orphan

drug development include higher clinical success rate and shorter clinical trials, premium

pricing, lower sales force, enhanced patent protection and marketing rights (10 years),

reduced taxes from federal government, clinical research financial subsidies, and

government run enterprises to do research and development. 2,4

Gaucher Diease Treatments –Competition in an Orphan Drug Space:

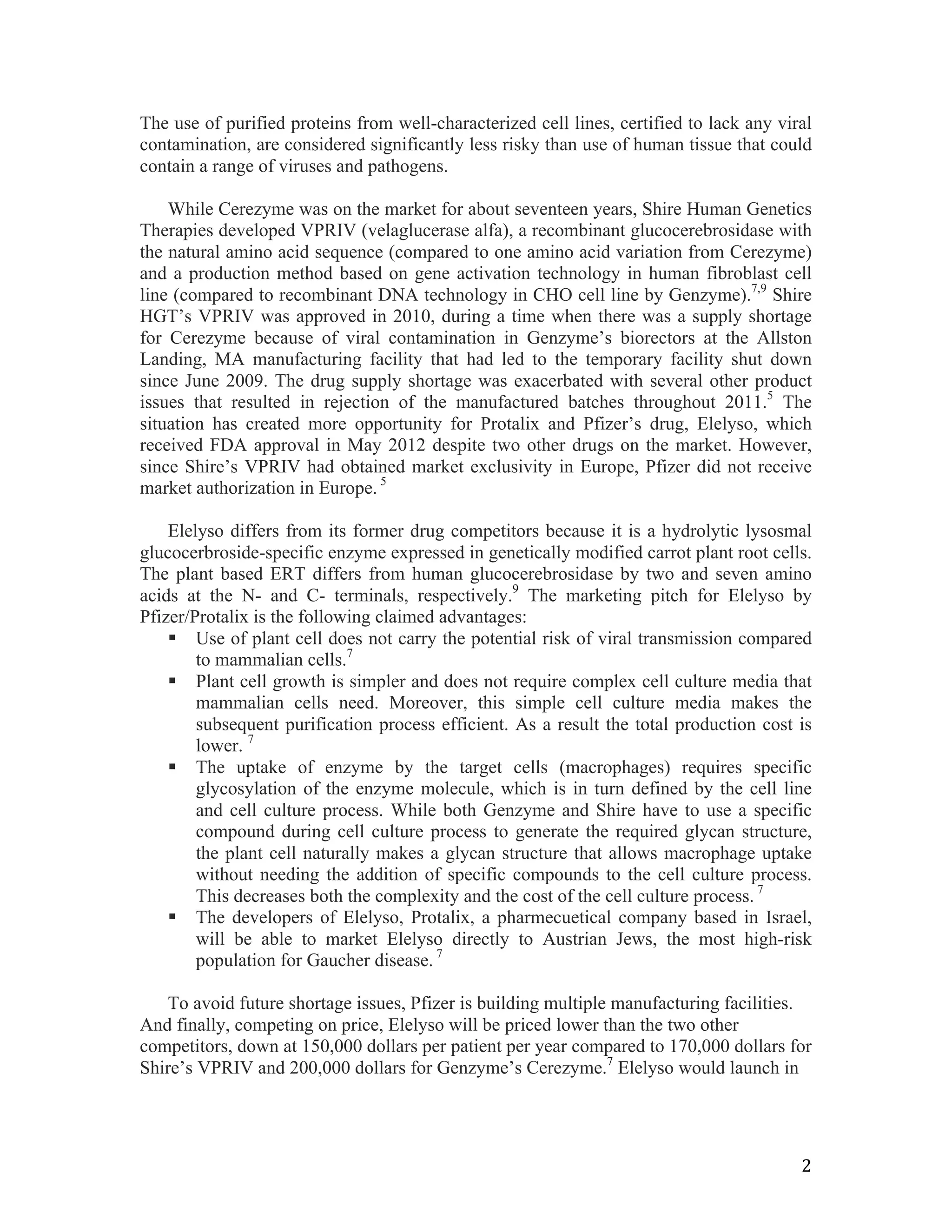

Gaucher Type I disease can be treated by enzyme replacement therapy (ERT) to

compensate for the underlying enzyme deficiency of glucocerebrosidase [Figure 1,

right].9

Despite the small number of patients globally, several ERTs are now on the

market. One of the key business drivers for companies to develop treatment for this

orphan indication is that Gaucher treatment is an approximately 1.1 billion dollar market,

so capturing even a portion of the market is attractive business.3,7,2

In 1991 the first approved ERT for Gaucher disease was Genzyme’s Ceredase

(alglucerase), glucocerebrosidase isolated from human placenta. As the 90’s saw the

advancements in recombinant DNA technology for generating protein therapeutics,

Genzyme replaced this product in 1994 with a recombinant glucocerebrosidase product

called Cerezyme (imiglucerase) generated in Chinese Hamster Ovary (CHO) cell line. 9,7](https://image.slidesharecdn.com/4d7a2fe6-c215-4046-b8b9-61dbf62ec144-150415101150-conversion-gate01/75/Bolourchi-Shiva_Elelyso-Drug-Review-1-2048.jpg)

![3

fiscal year 2013 with analyst projected US market share of 64 million dollars,

approximately 10% of the total market.7

Figure 1. Origin of Gaucher Disease and Associated Treatment Approaches. Gaucher disease is

caused by the lack of glucocerebrosidase, which the enzyme replacement therapies address. Alternatively,

the accumulation of glycocerebroside can be prevented by inhibiting glucosylceremaide synthase, which is

addressed by Eliglustat Tartarate.

Clinical Studies as the Basis for Approval of Elelyoso:

Typically clinical trials for new molecules include a Phase I dose escalation safety

study, a Phase II dose-response study, and a Phase III safety and efficacy study.

However, in orphan drugs where there are very low number of patients and the natural

history heterogeneous, Phase I and Phase II trials are combined to obtain safety and

initial dose response, with the use of extention studies to accumulate further bioactivity

and safety data. Then Phase III trial statistically confirms efficacy and adds more safety

data needed for product approval [Figure 2].2,8,6](https://image.slidesharecdn.com/4d7a2fe6-c215-4046-b8b9-61dbf62ec144-150415101150-conversion-gate01/75/Bolourchi-Shiva_Elelyso-Drug-Review-3-2048.jpg)