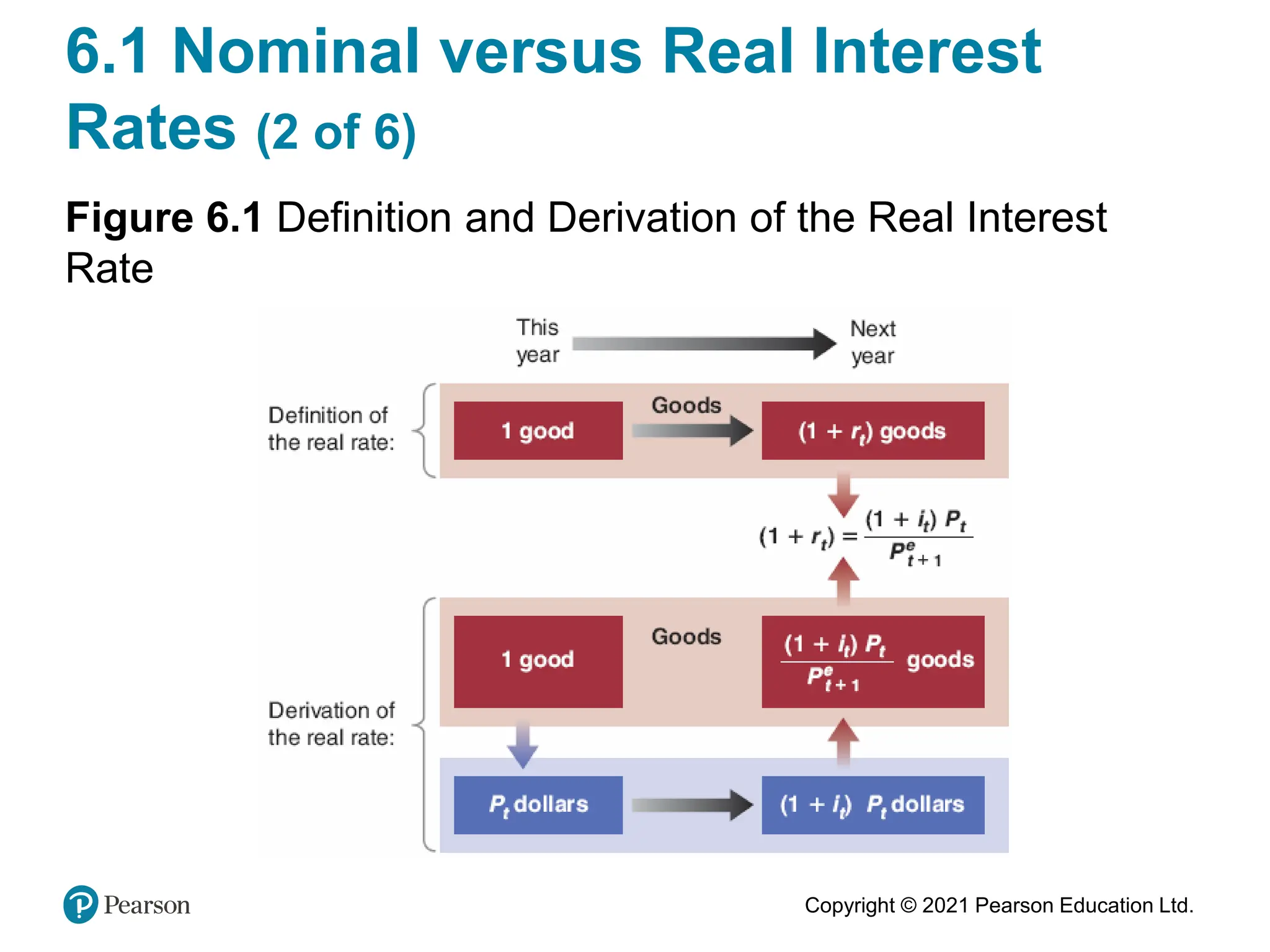

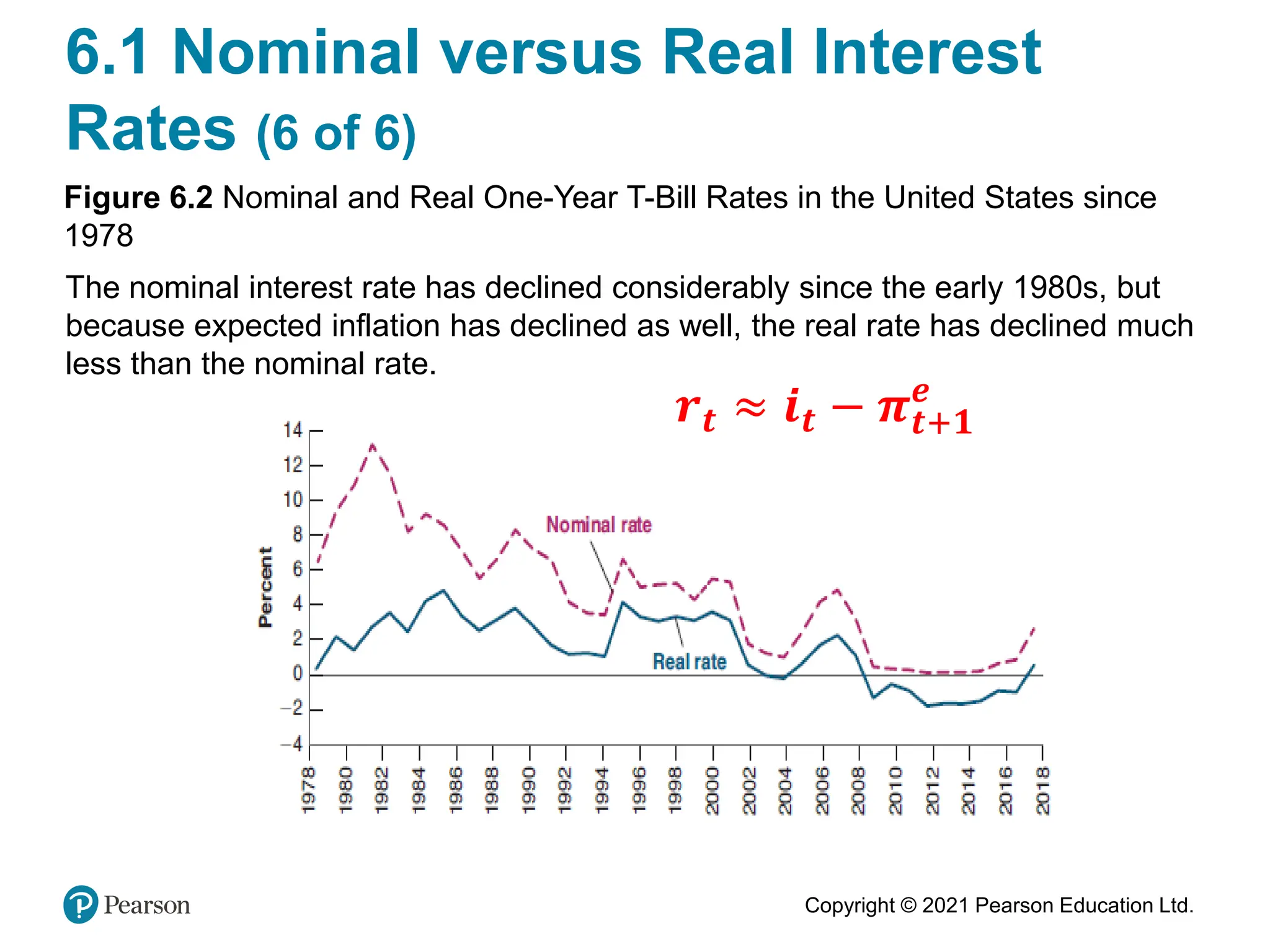

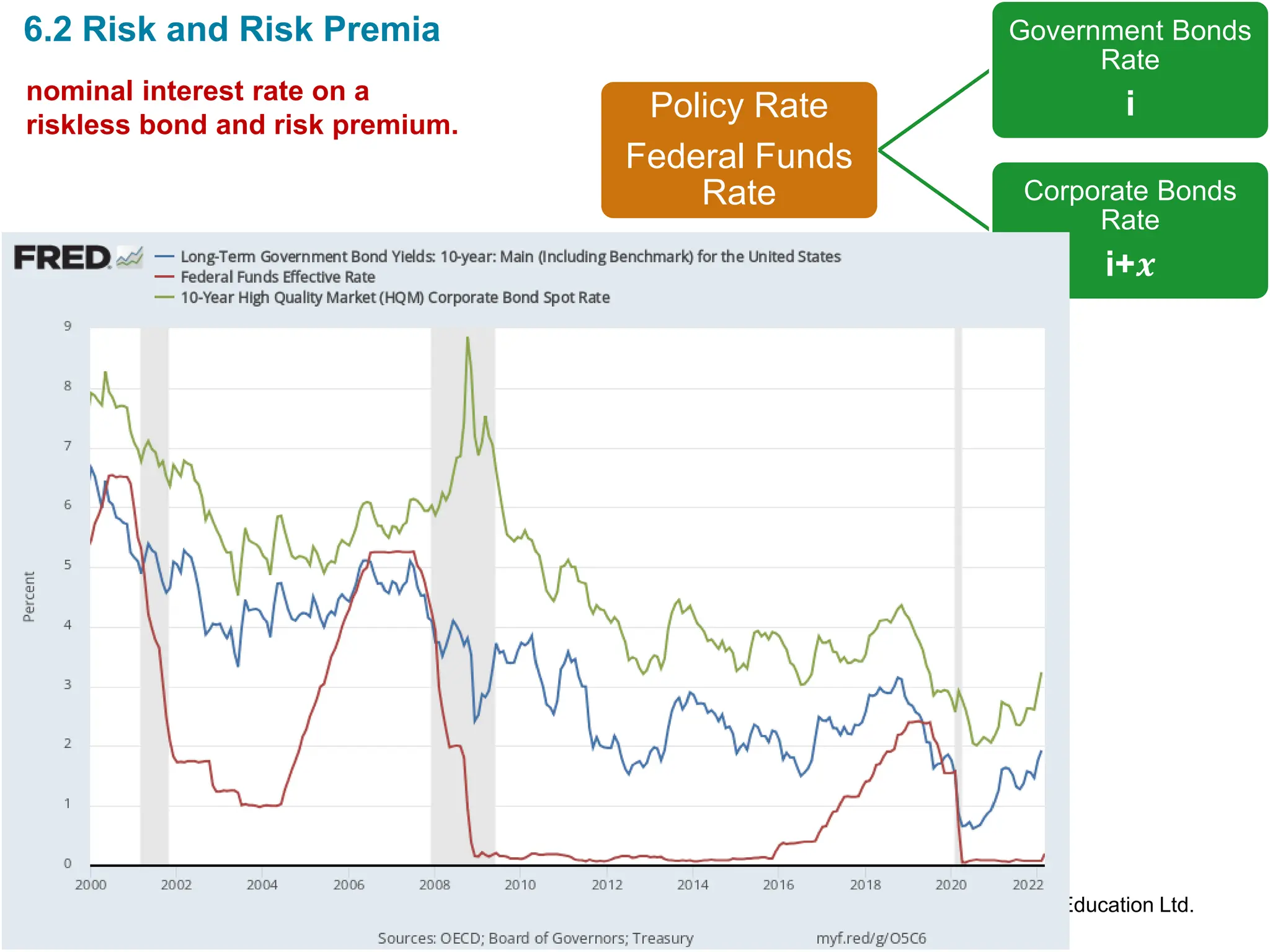

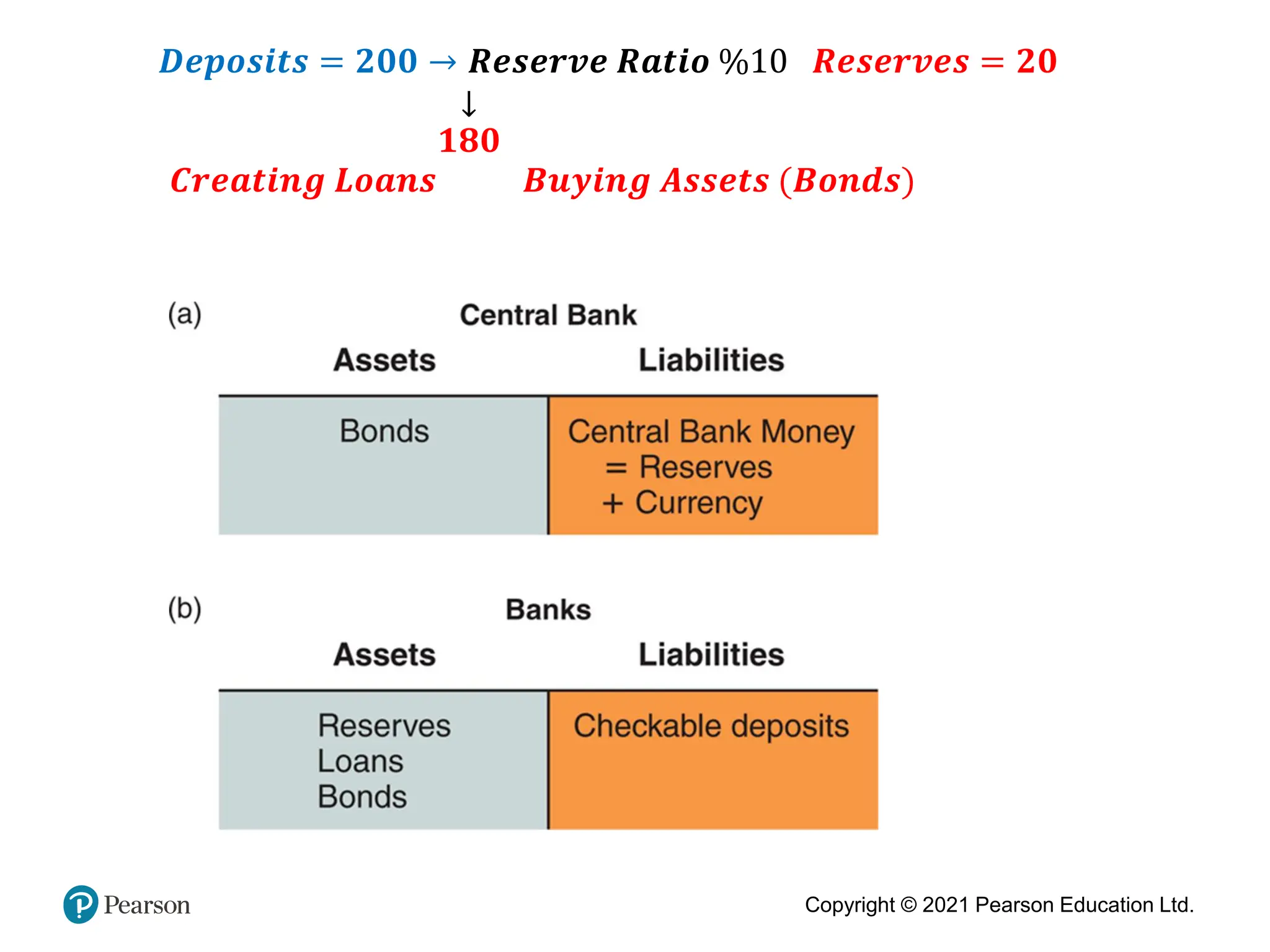

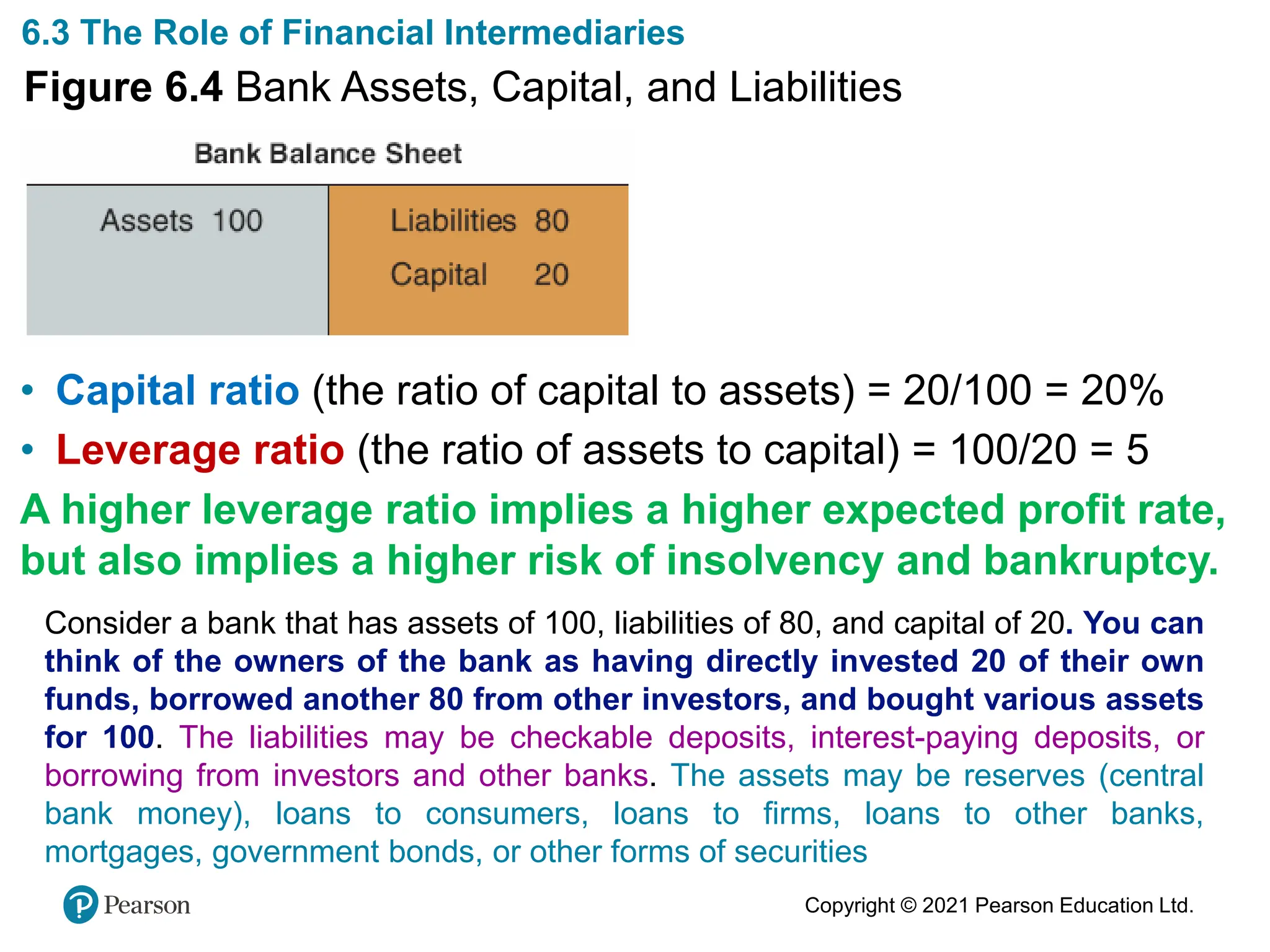

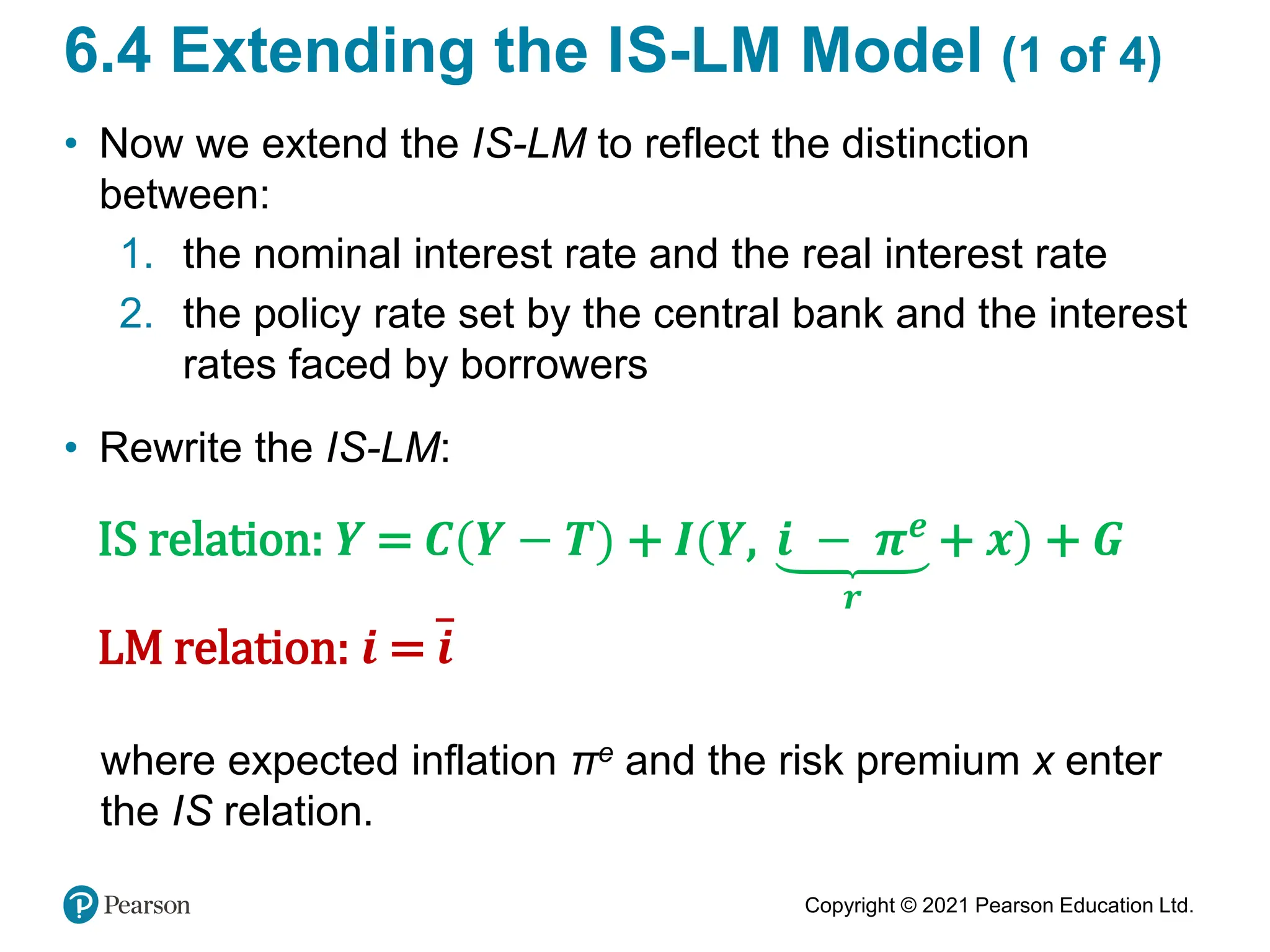

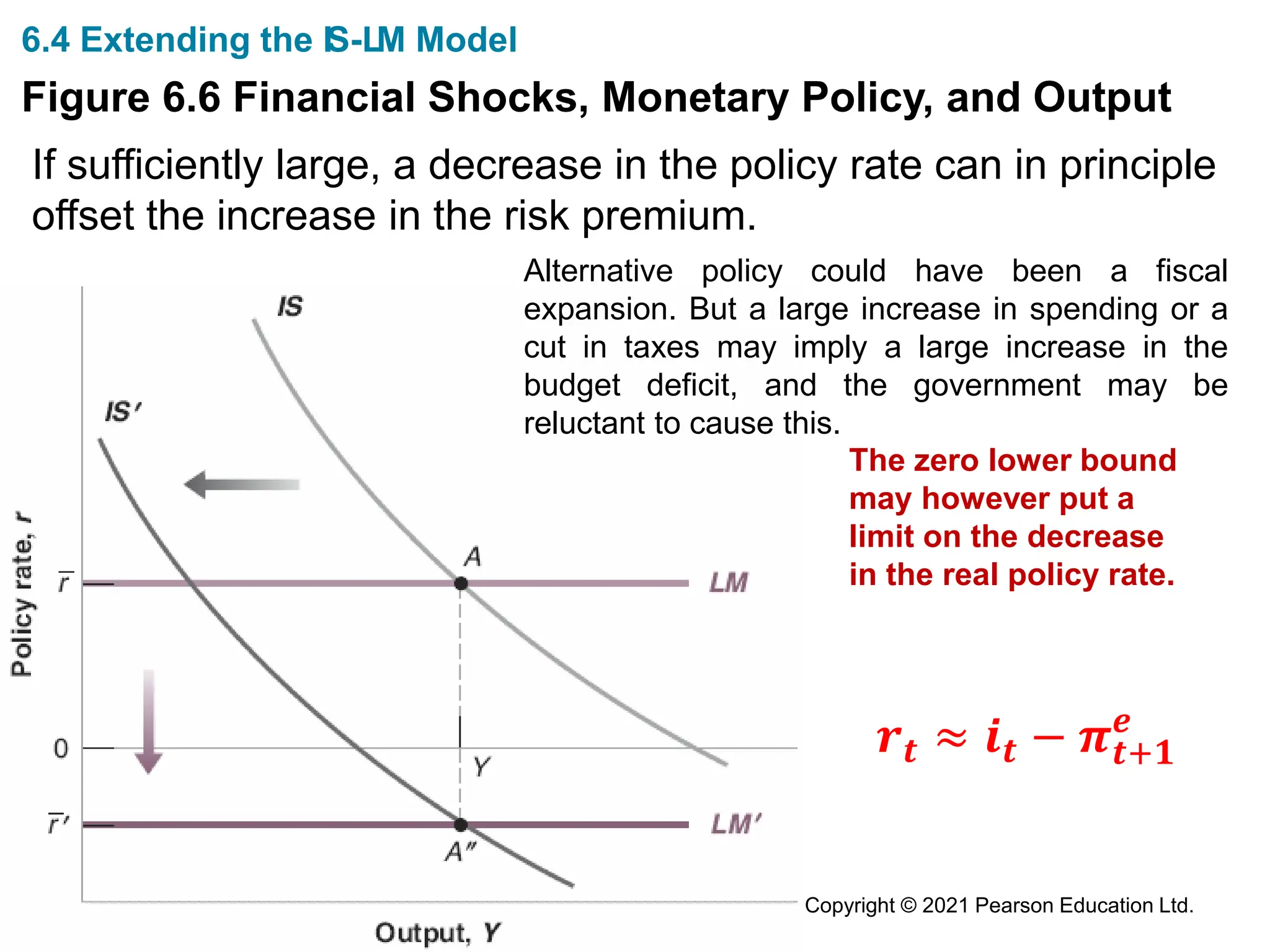

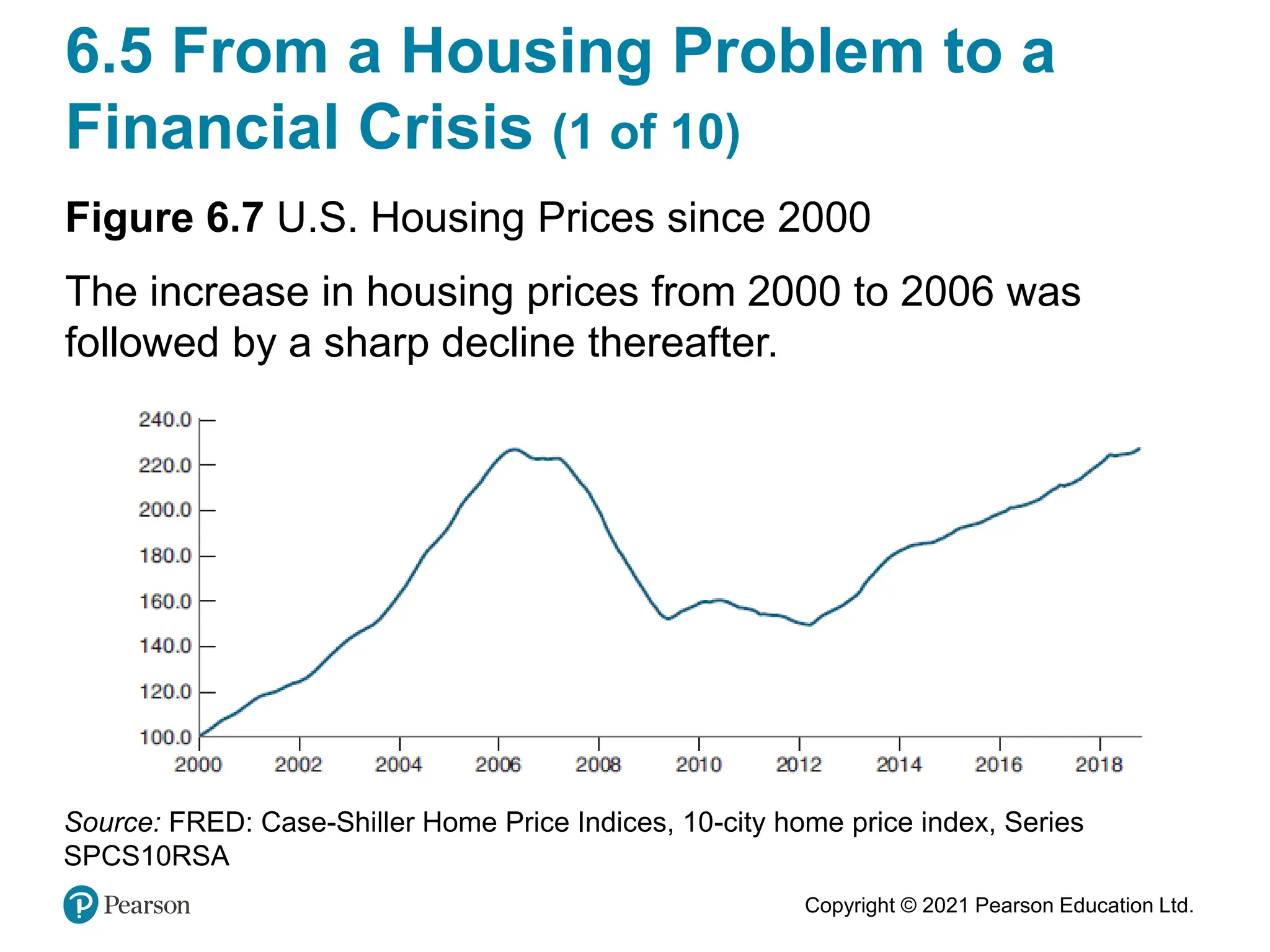

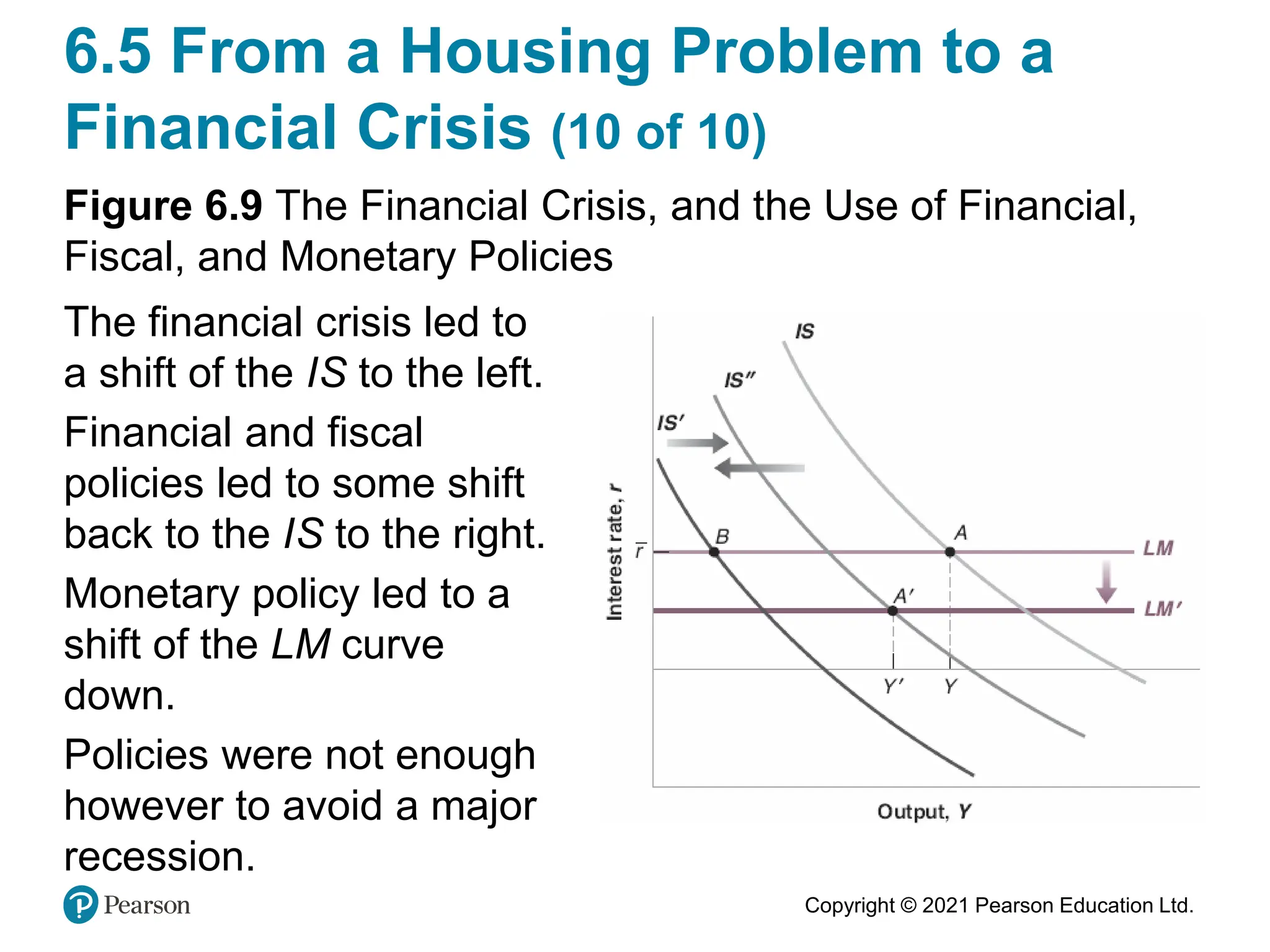

Chapter 6 of the macroeconomics textbook discusses the extended IS-LM model and the role of financial markets, focusing on nominal versus real interest rates, risk premia, and financial intermediaries. It highlights the impact of financial crises, particularly the 2008 financial collapse and more recent events like the Silicon Valley Bank failure, emphasizing the importance of understanding real interest rates and the interconnectedness of financial systems. The chapter concludes by extending the IS-LM framework to incorporate factors such as expected inflation and risk premiums affecting the economy.