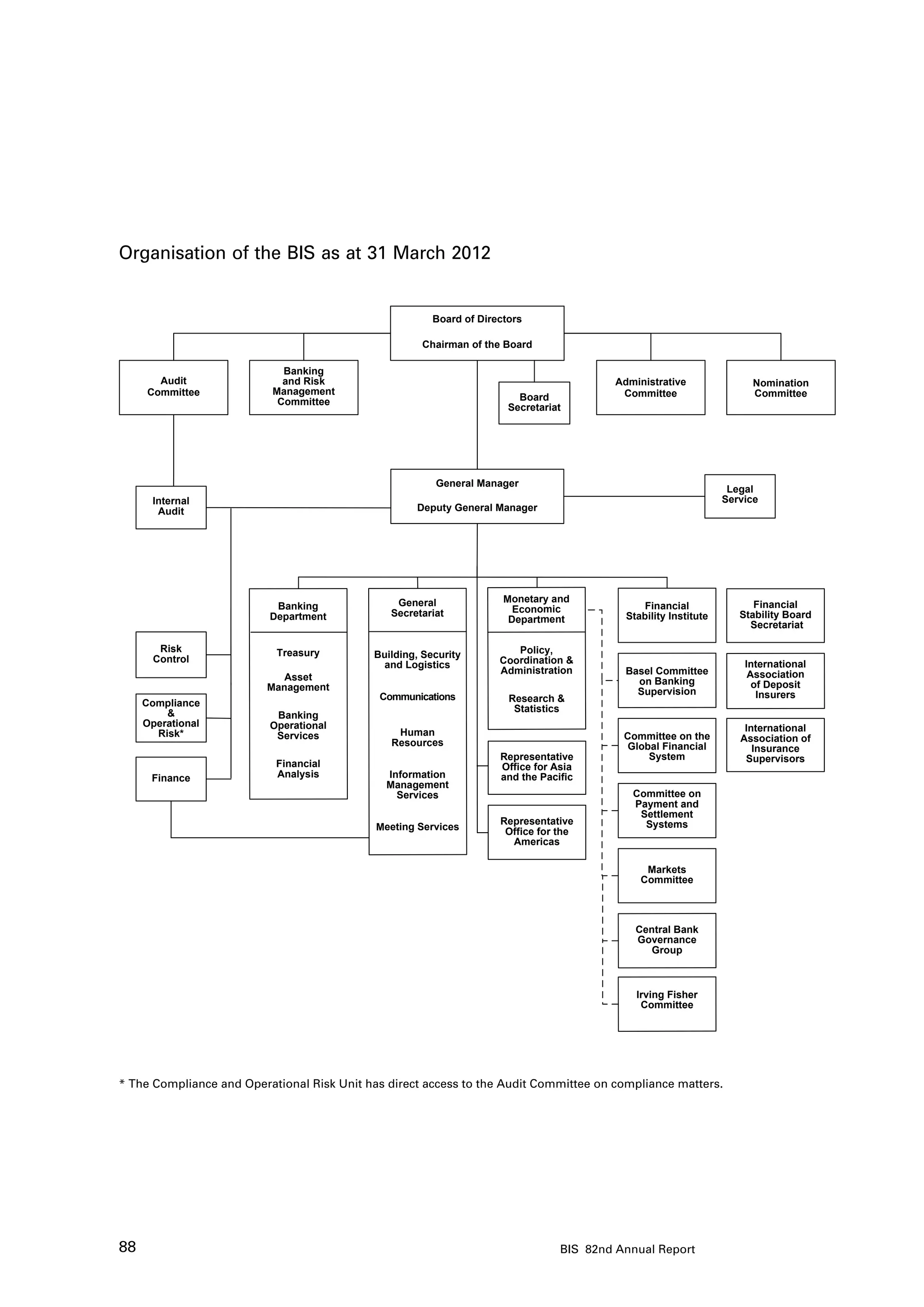

The document describes the organization of the Bank for International Settlements (BIS) as of March 31, 2012. It shows the BIS Board of Directors at the top, under which sit various committees that oversee areas like banking, risk management, and administration. Below this are the general manager and various departments that carry out the work of the organization like banking, research, and meetings. The compliance department has direct access to the audit committee.