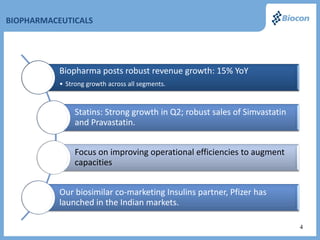

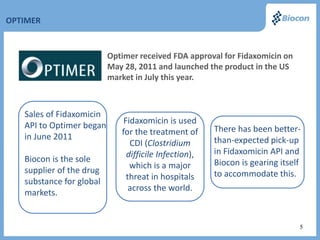

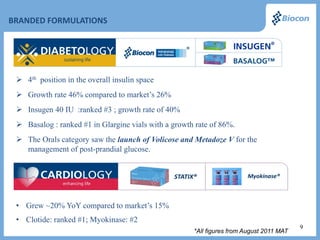

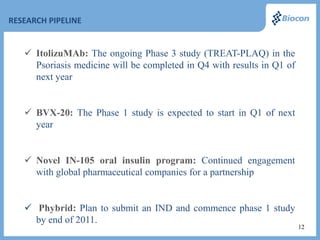

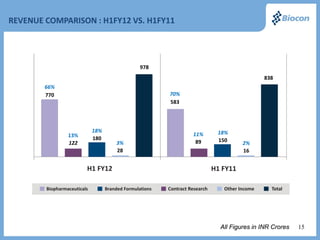

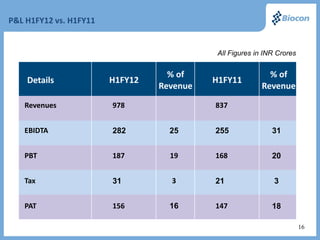

The FY 2012 results presentation highlights Biocon's robust revenue growth in its biopharmaceuticals sector with a 15% increase year-over-year and successful product launches, including the FDA-approved fidaxomicin. Significant expansion efforts are underway, including the establishment of a biopharmaceutical facility in Malaysia and the introduction of a first-in-class reusable insulin delivery device. Financially, the company reports a strong performance with improved revenues and a notable presence in the insulin and renal transplant markets.