More Related Content

PPT

Chapter 5 Risk and Return from Fundamental of financial Management PPTX

Risk and RetEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEurn.pptx PDF

PPT

PPTX

PDF

PPT

Unit Two Risk and Return Accounting Finance.ppt PDF

Risk & Return Basic Framework Similar to BF Risk hhhhhhhhhhhhhhhhhhhhhhhhhhhhhand Return.pptx

PPT

risk and return student.ppt PPT

Financial Management Slides Ch 05 PPT

PPT

PDF

Investment_chapter-1-2020.pdf PPTX

1. introduction basics of investments.ppt PPT

PPTX

Week 5.pptxfgggggggggggggggggggggggggggggggggggggg PPT

PPTX

Risk and return analysis.pptx PPTX

Invt Chapter 2 ppt.pptx best presentation PPTX

Risk & Return of the stock and calculation of risk PPT

Risk and return. Chapter 8- Principles of Managerial Finance PPTX

PPT

Fin254-ch08_nnh-Risk-return.pptvweveverververv PPT

PPT

PPTX

Financial Management: Introduction, Scope, Functions PPTX

Brigham_EFM5_ch08_Risk and Rates of Return.pptx PPT

More from sairayamin2

PPTX

BF RisFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFk Return.pptx PPT

BF Cost of Capkkkkkkkkkkkkkkkkkkkkkkkkkital.ppt PPTX

Business and Cohhhhhhhhhhhhhhhhhhhhhmpany LAW.pptx PPTX

bcl 1uuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuu3.pptx PPTX

BCL 1eeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeee1 B.pptx PPT

BF 9 lkklkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkk2.ppt PPTX

NPpppppppppppppppppppppppppppppppppppppppppppV.pptx PPT

BCL 11 INDEppppppppppppppppppppppppppppMINITY.ppt PPT

BCL 10 A Contraoooooooooooooooooooct of SALE.ppt PPTX

BCL 5 A PERFORMGGGGGGGGGGGGGGGGGGGGGGGANCE OF CONTRACTS.pptx PPTX

Company cases i LLLLLLLLLLLLLLLLLLLLLLLn Pakistan.pptx PPT

Foreclorrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrsures.ppt PPTX

Mr. Aqib Abbasi Prettttttttttttttttttttttttsentation.pptx PPTX

uuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuWE (1) (1).pptx PPTX

uuuuuuuuuuuuuuuuuuuuuuuuuuuuQUIZ - Copy.pptx PPTX

BCL 8 PARNuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuI.P 2pptx PPTX

QUIeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeZ.pptx PPT

ttyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyT.ppt PPT

qqqqqwwwwwwwwwwwwwwwwwwwwwwwwwwwwwwwwwwwww.ppt PPT

ratiouuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuus.ppt Recently uploaded

PDF

How to Buy Old Gmail Accounts – Verified & Secure.pdf DOCX

_18 Buying USA LinkedIn Accounts Can Boost Your Social.docx PDF

RFI Responses for Govt Contracting Tips. PDF

_Top 7 Mistakes to Avoid When Buying Google Ads Accounts.pdf PDF

BendelPuertoRicoCubaGuyanaVenezuelaPetroleumRefineryPetrochemicalPetroAgroInd... DOCX

Podcast Promotion Schedule for Turntable News PDF

Nicky Oppenheimer World Economic Forum Jan 2000 PDF

_The Ultimate Guide to Buying Twitter Accounts Safely.pdf PDF

OIL CHECK 500 Portable - Air Quality Monitoring System DOCX

How to Buy Verified OnlyFans Accounts Work in 2026.docx PDF

The threat to financial insitutions of quantum computing breaking all encrypt... PDF

enterprise software is not dead and here is why PDF

How to Buy Twitter Accounts_ A Step-by-Step Guide (2).pdf DOCX

Best Top 7 sites to Buy Old Gmail Accounts (PVA & Aged).docx PPTX

Explore Hubspot’s Customer Agent for B2B PPTX

REVIEWER-3rd-quarter-exam-mathematics.pptx PDF

17 Guide to Buying Verified Binance Accounts in the US.pdf PDF

Camil Institutional Presentation_Jan26.pdf PDF

Equinox Gold - Corporate Presentation - Jan 2026 PDF

Kirill Klip GEM Royalty TNR Gold Lithium Presentation BF Risk hhhhhhhhhhhhhhhhhhhhhhhhhhhhhand Return.pptx

- 1.

Principles of Finance5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved. May

not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Chapter 5

Risks and

Rates of

Return

1

- 2.

Chapter 11 –Learning Objectives

Explain what it means to take risk when investing.

Compute the risk and return of an investment, and explain how the risk

and return of an investment are related.

Identify relevant and irrelevant risk, and explain how irrelevant risk can

be reduced.

Describe how to determine the appropriate reward—that is, risk

premium—that investors should earn for purchasing a risky

investment.

Describe actions that investors take when the return they require to

purchase an investment is different from the return they expect the

investment to produce.

Identify different types of risk and classify each as relevant or

irrelevant with respect to determining an investment’s required rate of

return.

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 2

- 3.

Defining and MeasuringRisk

Risk is the chance that an outcome other

than expected will occur

Probability distribution is a listing of all

possible outcomes with a probability

assigned to each

Probabilities must sum to 1.0 (100%)

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 3

- 4.

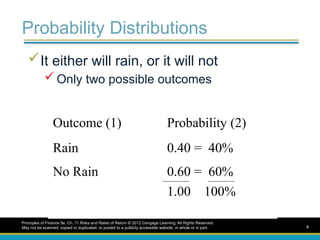

Probability Distributions

It eitherwill rain, or it will not

Only two possible outcomes

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 4

Outcome (1) Probability (2)

Rain 0.40 = 40%

No Rain 0.60 = 60%

1.00 100%

- 5.

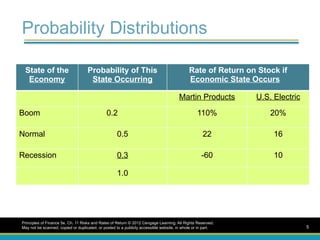

Probability Distributions

Principles ofFinance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 5

State of the

Economy

Probability of This

State Occurring

Rate of Return on Stock if

Economic State Occurs

Martin Products U.S. Electric

Boom 0.2 110% 20%

Normal 0.5 22 16

Recession 0.3 -60 10

1.0

- 6.

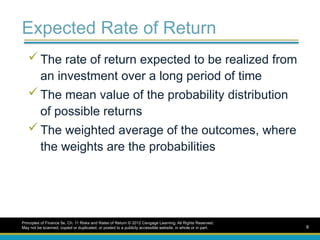

Expected Rate ofReturn

The rate of return expected to be realized from

an investment over a long period of time

The mean value of the probability distribution

of possible returns

The weighted average of the outcomes, where

the weights are the probabilities

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 6

- 7.

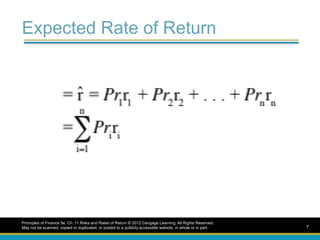

Expected Rate ofReturn

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 7

- 8.

Measuring Risk: TheStandard Deviation

A measure of the tightness, or variability,

of a set of outcomes

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 8

- 9.

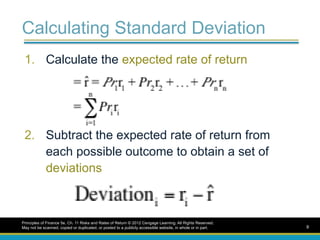

Calculating Standard Deviation

1.Calculate the expected rate of return

2. Subtract the expected rate of return from

each possible outcome to obtain a set of

deviations

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 9

- 10.

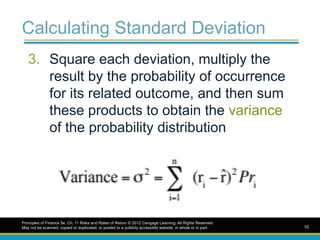

Calculating Standard Deviation

3.Square each deviation, multiply the

result by the probability of occurrence

for its related outcome, and then sum

these products to obtain the variance

of the probability distribution

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 10

- 11.

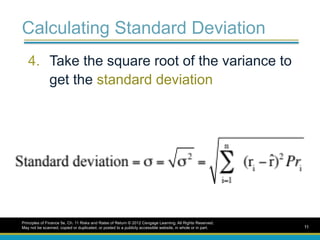

Calculating Standard Deviation

4.Take the square root of the variance to

get the standard deviation

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 11

- 12.

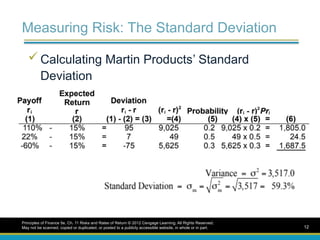

Measuring Risk: TheStandard Deviation

Calculating Martin Products’ Standard

Deviation

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 12

- 13.

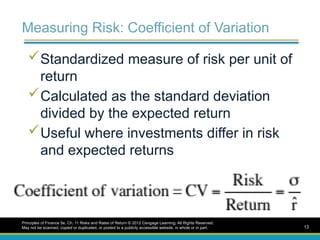

Measuring Risk: Coefficientof Variation

Standardized measure of risk per unit of

return

Calculated as the standard deviation

divided by the expected return

Useful where investments differ in risk

and expected returns

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 13

- 14.

Principles of Finance5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved

. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 14

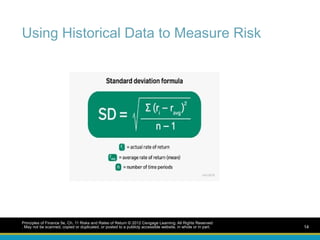

Using Historical Data to Measure Risk

- 15.

Risk Aversion

Risk-averse investorsrequire higher

rates of return to invest in higher-risk

securities

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 15

- 16.

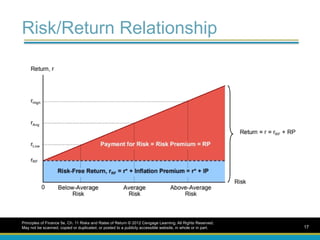

Risk Aversion andRequired Returns

Risk premium (RP)

The portion of the expected return that can

be attributed to the additional risk of an

investment

The difference between the expected rate

of return on a given risky asset and that on

a less risky asset

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 16

- 17.

Risk/Return Relationship

Principles ofFinance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 17

- 18.

Risk and Returnin a Portfolio

Context

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights

Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in

whole or in part.

18

- 19.

Risk and Returnin a Portfolio Context

Portfolio

A collection of investment securities

A combination of two or more securities or

assets.

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 19

- 20.

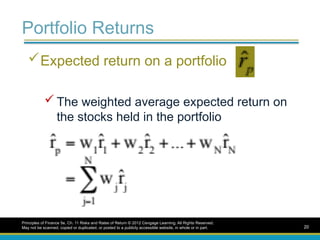

Portfolio Returns

Expected returnon a portfolio

The weighted average expected return on

the stocks held in the portfolio

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 20

- 21.

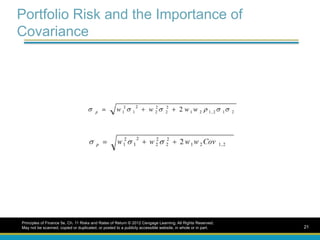

Portfolio Risk andthe Importance of

Covariance

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 21

- 22.

Portfolio Risk

Correlation coefficient

A measure of the degree of relationship

between two variables

Positively correlated stocks have rates of

return that move in the same direction

Negatively correlated stocks have rates of

return that move in opposite directions

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 22

- 23.

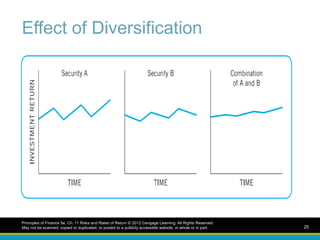

Portfolio Risk

Risk reductionthrough diversification

The concept of diversification makes

such common sense that our language

even contains everyday expressions that

exhort us to diversify (“Don’t put all your

eggs in one basket”). The idea is to

spread your risk across a number of

assets or investments.

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 23

- 24.

Risk reduction throughdiversification

Combining stocks that are not perfectly

positively correlated will reduce the portfolio

risk through diversification

The riskiness of a portfolio is reduced as

the number of stocks in the portfolio

increases

The smaller the positive correlation, the

greater the reduction of risk from adding

another investment

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 24

- 25.

Effect of Diversification

Principlesof Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 25

- 26.

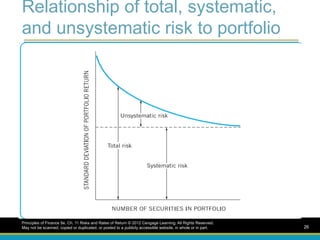

Relationship of total,systematic,

and unsystematic risk to portfolio

size

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 26

- 27.

Systematic risk

Systematic riskThe variability of return

on stocks or portfolios associated with

changes in return on the market as a

whole such as changes in the nation’s

economy, tax reform by Congress, or a

change in the world energy situation.

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 27

- 28.

Different Types ofRisk

Systematic Risks

Interest rate risk

Inflation risk

Maturity risk

Liquidity risk

Exchange rate risk

Political risk

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 28

- 29.

Un Systematic Risk

Thevariability of return on stocks or

portfolios not explained by general

market movements. It is avoidable

through diversification such as a new

competitor may begin to produce

essentially the same product; or a

technological breakthrough may make

an existing product obsolete.

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 29

- 30.

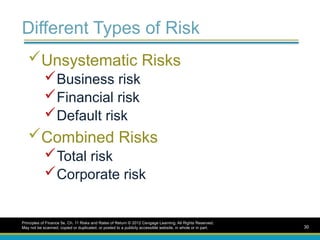

Different Types ofRisk

Unsystematic Risks

Business risk

Financial risk

Default risk

Combined Risks

Total risk

Corporate risk

Principles of Finance 5e, Ch. 11 Risks and Rates of Return © 2012 Cengage Learning. All Rights Reserved.

May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 30