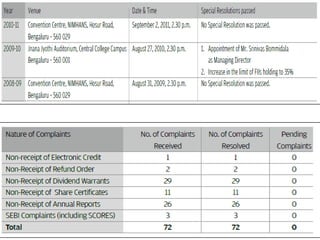

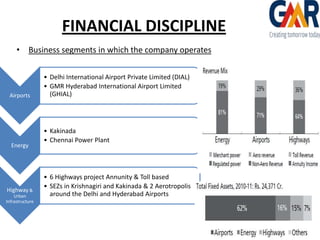

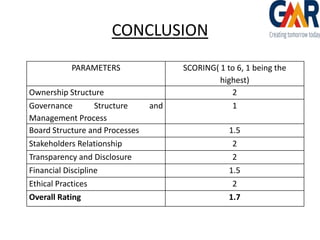

The document provides a summary of ICRA's corporate governance ratings for GMR Ltd. ICRA evaluates companies on various parameters like ownership structure, governance processes, board structure, stakeholder relationships, transparency, financial discipline, and ethical practices. For GMR, ICRA assigned high ratings between 1-2 for most parameters, including an overall rating of 1.7 out of 6, indicating strong corporate governance practices. The summary highlights GMR's diverse business segments, governance policies, disclosure practices, and CSR initiatives.