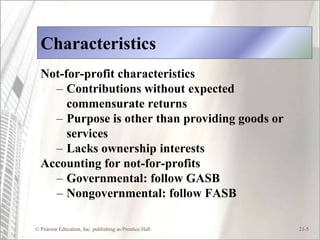

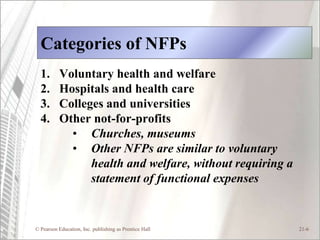

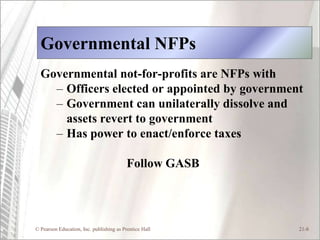

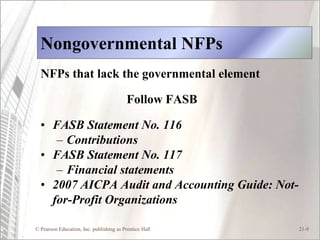

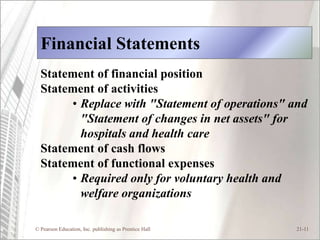

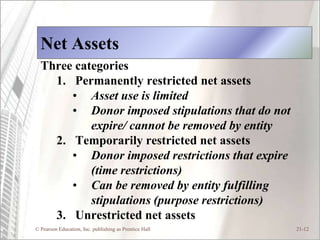

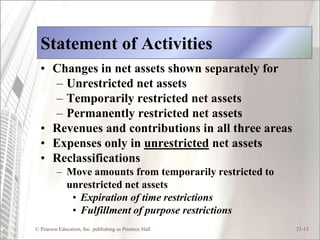

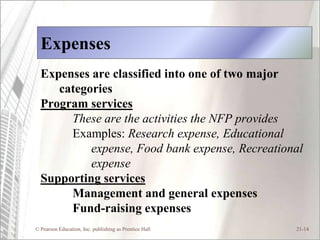

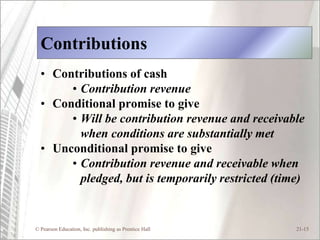

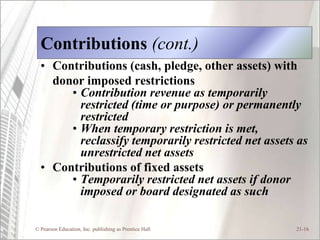

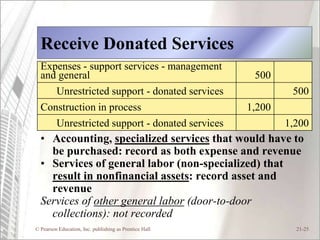

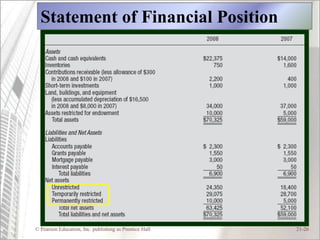

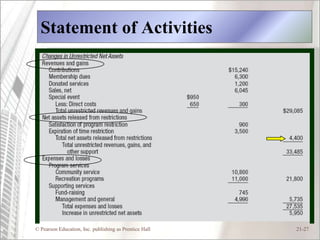

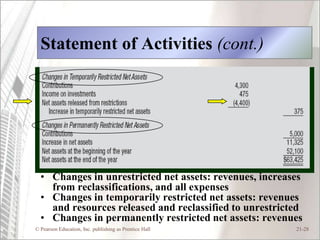

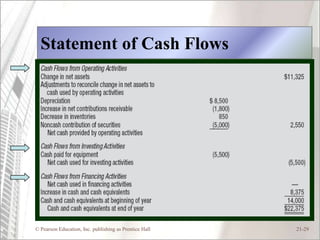

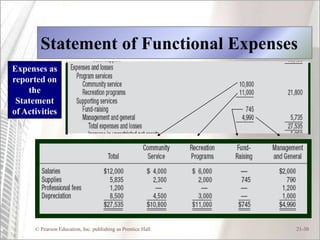

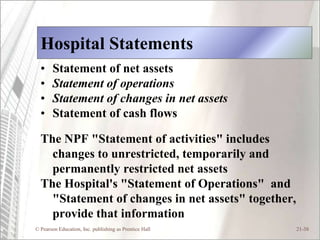

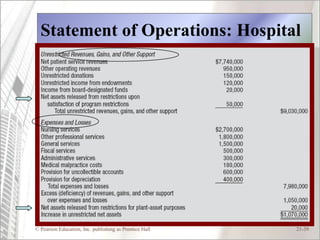

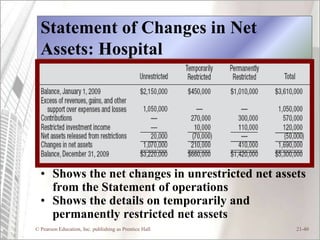

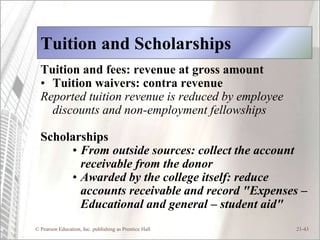

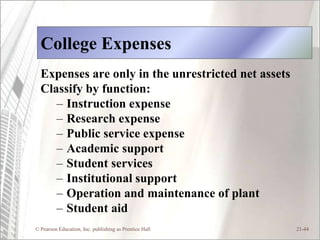

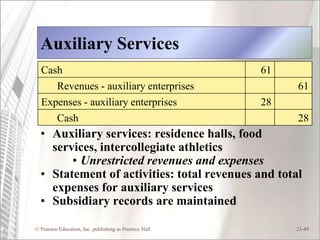

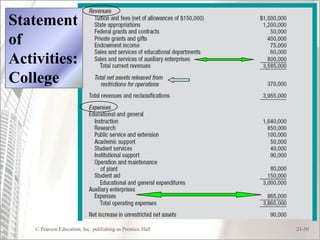

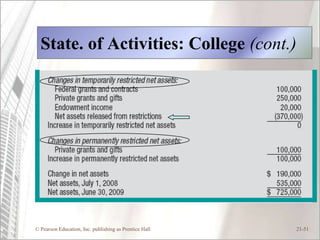

This document provides an overview of accounting principles for not-for-profit organizations. It discusses the four main categories of NFPs, the differences between governmental and non-governmental NFPs, key FASB standards for NFP accounting, and how to apply accounting principles to different types of NFPs including voluntary health and welfare organizations. The objectives are to learn the categories of NFPs, differentiate governmental from non-governmental, introduce FASB NFP standards, and apply principles to various organization types.