BASIC TAX. LAW.docx

•Download as DOCX, PDF•

0 likes•24 views

This document contains the syllabus for a Taxation I course at the College of Law of Tomas Claudio Colleges. The syllabus outlines the course description, objectives, strategies, work plan, and requirements. The course aims to teach students the basic principles of taxation in the Philippines. It will cover topics like individual and corporate income tax, value-added tax, percentage taxes, and excise taxes. Assessment will include quizzes, class recitation, case digests, a midterm exam, and a final exam. The goal is to help students understand taxation and their role in nation-building.

Report

Share

Report

Share

Recommended

Taxation as sources of government revenue generation Impact of taxation on gov revenue generation in nigeria

Impact of taxation on gov revenue generation in nigeriaGodwin Emmanuel Oyedokun MBA MSc ACA ACIB FCTI FCFIP CFE

Recommended

Taxation as sources of government revenue generation Impact of taxation on gov revenue generation in nigeria

Impact of taxation on gov revenue generation in nigeriaGodwin Emmanuel Oyedokun MBA MSc ACA ACIB FCTI FCFIP CFE

The purpose of this study is to measure the tax knowledge and tax morale of government treasurers in colleges in complying with the taxation provisions. The study was conducted at four government colleges in West Java using a descriptive analytic method with a qualitative approach. The results show that treasurers have tax knowledge and tax morals that are good in complying with tax regulations so there are not many obstacles in fulfilling their tax obligations. The limitations of this research are that the research is still not wide enough so that there is still very limited data obtained.Tax knowledge, Tax Morale, and Tax Compliance : Taxpayers’ View

Tax knowledge, Tax Morale, and Tax Compliance : Taxpayers’ ViewThe International Journal of Business Management and Technology

Presentation by Azime A. Hassen at the second annual meeting of the Ethiopian Tax Research Network, which took place in Addis Ababa on 8th October 2018.An Assessment of ERCA's Taypayer Education Programs and How They Can Be Improved

An Assessment of ERCA's Taypayer Education Programs and How They Can Be ImprovedInternational Centre for Tax and Development - ICTD

More Related Content

Similar to BASIC TAX. LAW.docx

The purpose of this study is to measure the tax knowledge and tax morale of government treasurers in colleges in complying with the taxation provisions. The study was conducted at four government colleges in West Java using a descriptive analytic method with a qualitative approach. The results show that treasurers have tax knowledge and tax morals that are good in complying with tax regulations so there are not many obstacles in fulfilling their tax obligations. The limitations of this research are that the research is still not wide enough so that there is still very limited data obtained.Tax knowledge, Tax Morale, and Tax Compliance : Taxpayers’ View

Tax knowledge, Tax Morale, and Tax Compliance : Taxpayers’ ViewThe International Journal of Business Management and Technology

Presentation by Azime A. Hassen at the second annual meeting of the Ethiopian Tax Research Network, which took place in Addis Ababa on 8th October 2018.An Assessment of ERCA's Taypayer Education Programs and How They Can Be Improved

An Assessment of ERCA's Taypayer Education Programs and How They Can Be ImprovedInternational Centre for Tax and Development - ICTD

Similar to BASIC TAX. LAW.docx (20)

Tax system in nigeria – challenges and the way forward

Tax system in nigeria – challenges and the way forward

MEXICO’S 2014 TAX REFORM: A BRIEF REVIEW OF SOME OF ITS MOST RELEVANT ISSUES

MEXICO’S 2014 TAX REFORM: A BRIEF REVIEW OF SOME OF ITS MOST RELEVANT ISSUES

Tax knowledge, Tax Morale, and Tax Compliance : Taxpayers’ View

Tax knowledge, Tax Morale, and Tax Compliance : Taxpayers’ View

01. introduction to taxation ICAB, KL, Study Manual

01. introduction to taxation ICAB, KL, Study Manual

Analysis of tax morale and tax compliance in nigeria

Analysis of tax morale and tax compliance in nigeria

to investigate factors affecting category "A" tax payers in Samara logia city...

to investigate factors affecting category "A" tax payers in Samara logia city...

AN OVERVIEW OF THE LEGAL FRAMEWORK ON TAX INCENTIVES IN TANZANIA AN ANALYSIS...

AN OVERVIEW OF THE LEGAL FRAMEWORK ON TAX INCENTIVES IN TANZANIA AN ANALYSIS...

An Assessment of ERCA's Taypayer Education Programs and How They Can Be Improved

An Assessment of ERCA's Taypayer Education Programs and How They Can Be Improved

More from KathyrineBalacaoc

More from KathyrineBalacaoc (16)

523163593-Educ-204-Principle-of-Administration-and-Supervision (1).pptx

523163593-Educ-204-Principle-of-Administration-and-Supervision (1).pptx

523163593-Educ-204-Principle-of-Administration-and-Supervision.pptx

523163593-Educ-204-Principle-of-Administration-and-Supervision.pptx

idoc.pub_fundamental-principles-of-administration-and-supervision.pdf

idoc.pub_fundamental-principles-of-administration-and-supervision.pdf

Recently uploaded

https://app.box.com/s/x7vf0j7xaxl2hlczxm3ny497y4yto33i80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...Nguyen Thanh Tu Collection

Making communications land - Are they received and understood as intended? webinar

Thursday 2 May 2024

A joint webinar created by the APM Enabling Change and APM People Interest Networks, this is the third of our three part series on Making Communications Land.

presented by

Ian Cribbes, Director, IMC&T Ltd

@cribbesheet

The link to the write up page and resources of this webinar:

https://www.apm.org.uk/news/making-communications-land-are-they-received-and-understood-as-intended-webinar/

Content description:

How do we ensure that what we have communicated was received and understood as we intended and how do we course correct if it has not.Making communications land - Are they received and understood as intended? we...

Making communications land - Are they received and understood as intended? we...Association for Project Management

Recently uploaded (20)

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

Making communications land - Are they received and understood as intended? we...

Making communications land - Are they received and understood as intended? we...

On National Teacher Day, meet the 2024-25 Kenan Fellows

On National Teacher Day, meet the 2024-25 Kenan Fellows

Python Notes for mca i year students osmania university.docx

Python Notes for mca i year students osmania university.docx

Sensory_Experience_and_Emotional_Resonance_in_Gabriel_Okaras_The_Piano_and_Th...

Sensory_Experience_and_Emotional_Resonance_in_Gabriel_Okaras_The_Piano_and_Th...

UGC NET Paper 1 Mathematical Reasoning & Aptitude.pdf

UGC NET Paper 1 Mathematical Reasoning & Aptitude.pdf

Interdisciplinary_Insights_Data_Collection_Methods.pptx

Interdisciplinary_Insights_Data_Collection_Methods.pptx

Unit-V; Pricing (Pharma Marketing Management).pptx

Unit-V; Pricing (Pharma Marketing Management).pptx

Jual Obat Aborsi Hongkong ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan...

Jual Obat Aborsi Hongkong ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan...

Fostering Friendships - Enhancing Social Bonds in the Classroom

Fostering Friendships - Enhancing Social Bonds in the Classroom

BASIC TAX. LAW.docx

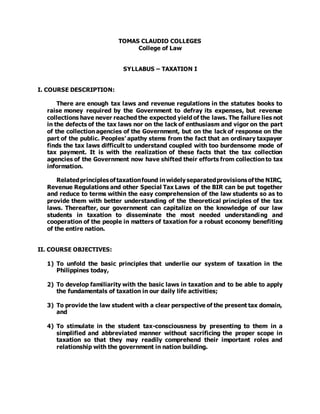

- 1. TOMAS CLAUDIO COLLEGES College of Law SYLLABUS – TAXATION I I. COURSE DESCRIPTION: There are enough tax laws and revenue regulations in the statutes books to raise money required by the Government to defray its expenses, but revenue collections have never reached the expected yield of the laws. The failure lies not in the defects of the tax laws nor on the lack of enthusiasm and vigor on the part of the collection agencies of the Government, but on the lack of response on the part of the public. Peoples’ apathy stems from the fact that an ordinary taxpayer finds the tax laws difficult to understand coupled with too burdensome mode of tax payment. It is with the realization of these facts that the tax collection agencies of the Government now have shifted their efforts from collection to tax information. Relatedprinciplesoftaxationfound in widely separatedprovisionsofthe NIRC, Revenue Regulations and other Special Tax Laws of the BIR can be put together and reduce to terms within the easy comprehension of the law students so as to provide them with better understanding of the theoretical principles of the tax laws. Thereafter, our government can capitalize on the knowledge of our law students in taxation to disseminate the most needed understanding and cooperation of the people in matters of taxation for a robust economy benefiting of the entire nation. II. COURSE OBJECTIVES: 1) To unfold the basic principles that underlie our system of taxation in the Philippines today, 2) To develop familiarity with the basic laws in taxation and to be able to apply the fundamentals of taxation in our daily life activities; 3) To provide the law student with a clear perspective of the present tax domain, and 4) To stimulate in the student tax-consciousness by presenting to them in a simplified and abbreviated manner without sacrificing the proper scope in taxation so that they may readily comprehend their important roles and relationship with the government in nation building.

- 2. III. COURSE STRATEGIES AND METHODS: 1. Lecture and discussion 2. Class recitation and participation 3. Case studies and group discussion IV. WORK PLAN AND LESSON DISTRIBUTION: 1. Introduction, concepts and general principles in taxation inclusive of the latest tax law amendments 2. The NIRC (RA 8424), the TRAIN LAW (RA 10963) and CREATE Act (RA 11534) on: Individual and Corporate Income Taxation - a) Definition of tax terms, theories and doctrines, b) Classification of income taxpayers; c) Source of income and situs of taxation; d) Income from services, business and professions, farming, interest, rent and whatever source; e) Income from sale of properties; f) Taxable income, exclusions g) Allowable deductions; h) Exemption from income tax as applied to the different kinds of taxpayers; i) Capital gains tax, different kinds of withholding taxes; j) Determination of taxable income and computation of income tax due the government, and k) Filing of tax returns, payment of the tax and penalties. 3. Business taxes a) The Value –Added tax b) Percentage taxes c) Excise tax on certain goods d) Documentary Stamp tax V. COURSE REQUIRMENTS: 1) Quizzes after each major topic 2) Graded class recitation 3) Cases digest 4) Mid-term examination 5) Final examination VI. REFERENCES: 1) The National Internal Revenue Code 2) RA 10963 and RA 11534

- 3. 3) Latest tax amendments in the Tax Code 4) Revenue Regulations and BIR issuances 5) Supreme Court’s decisions in taxation and jurisprudence 6) Tested classroom materials and problems. Prepared by: Dr. Virginia Jeannie P. Lim Professor