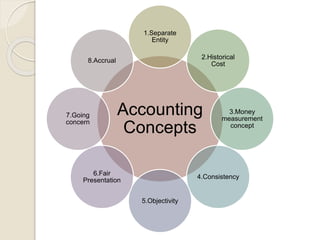

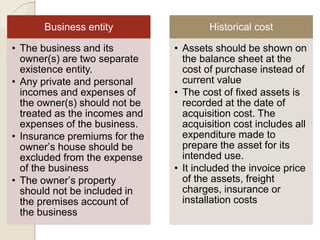

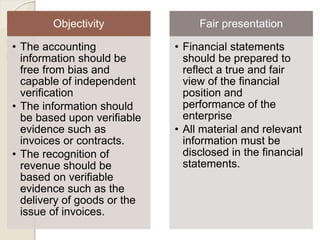

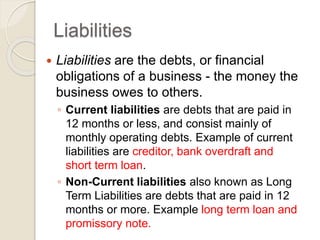

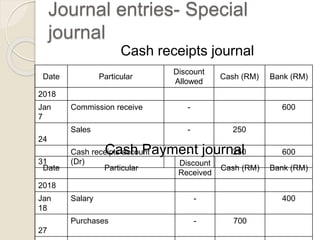

This document provides an introduction to financial accounting concepts. It defines accounting and bookkeeping, outlines their differences, and describes key accounting concepts like the accounting equation. Accounting tracks and reports business transactions, while bookkeeping records daily financial activities. Concepts covered include separate entity, historical cost, money measurement, consistency, and accruals. The document also discusses the components of accounting - assets, liabilities, owner's equity, revenue and expenses. It defines each component and provides examples. The accounting equation is introduced as a way to balance the relationship between assets, liabilities and owner's equity.