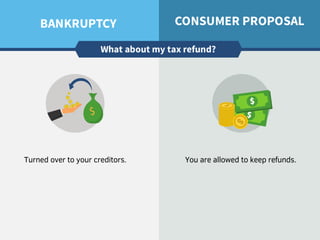

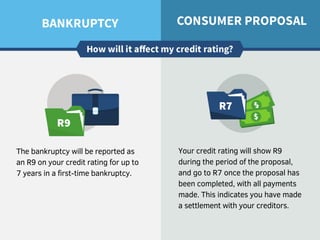

This document provides information about bankruptcy and consumer proposals in Canada. It explains that bankruptcy is for those with over $1,000 in debt and under $250,000 in unsecured debt, and must be filed by a licensed trustee. A consumer proposal allows payments based on income over a period of 9 months to 5 years, after which contact from creditors must cease. The bankruptcy will be reported on a credit rating for 7 years, while a completed proposal is reported for a shorter period.