This document provides an overview of the Pakistani banking sector in 2013. It contains several articles and interviews on topics related to economics, finance, and banking in Pakistan. The editor's note provides commentary on the State Bank of Pakistan's economic review and monetary policies. It questions whether sufficient monitoring of the financial market has occurred and why credit growth has failed to support SMEs and regional development. The banking sector has shown strong performance but economic growth has been sluggish since 2007. Overall, the document examines issues facing the banking industry and economy in Pakistan.

![Bankingisalwaysimportant

Editor’snote

04 / Banking Review 2013

The publication of Business Recorder’s

Banking Review 2013 has interestingly

coincided with the release of State Bank

of Pakistan’s latest quarterly review of the

country’s economy that covers the period

July-September 2013. A fresh central

bank outlook, therefore, has thrown up an

opportunity for us to make a brief

comment on the banking sector in a more

cogent and meaningful manner. While

defending its decision of a hike policy in

rate by 50 basis points to 9.5 percent in

September 2013, SBP has argued that

policy tightening had become imperative

although monetary growth was already

subdued as the growth in broad money

supply (M2) during Q1-FY14 was only 0.2

percent, compared to 0.7 percent in the

corresponding quarter last year. “[T]his

trend can primarily be traced to a rise in

the external deficit, which reduced the

NFA of the banking system by 64.4

percent during the period,” according to

SBP. The SBP report, through a footnote,

explains that in absolute terms, “the NFA

of the banking system declined by Rs

173.2 billion in Q1-FY14, compared to an

increase of Rs 11.8 billion in Q1-FY13”.

Explaining why NDA, on the other hand,

posted an increase of 2.3 percent during

the quarter, the central bank holds high

budgetary borrowing from the banking

system and lower net retirement of

private sector credit responsible for the

rise. Through another footnote or an

additional piece of information printed at

the bottom of the page, the bank argues

why its decisions on interest rates are not

based on the previous data, but on the

forecast of macroeconomic variables. The

SBP report, indeed, gives one a bigger

picture of the country’s financial domain.

Having said that, one however needs to

admit the fact that a lot of water has flown

under the bridges since September 2013

and the present shape of macroeconomic

indicators amply explain why central bank

policies are sometimes not truly forward-

looking or perhaps, do not genuinely

provide for the future.

That our active financial institutions

deliver significant and unique value to

the country’s economy and businesses,

investors, and savers is a fact that has

found its best expression in the perfor-

mance of our banking sector particularly

since 2000. However, there exists a

flawed, albeit widely popular, argument

that well developed financial markets are

correlated with economic development

and that a sound and sophisticated

financial system promotes the efficiency

of investment and economic growth in

an economy by reducing the costs of

intermediation and by improving the

allocation of risk. Unfortunately,

however, in our country well-developed

financial markets are conspicuous by

their absence; nor do we witness any

robust investment and economic growth

any more. This argument, therefore,

leads to a profound question whether or

not the key regulator, i.e., State Bank of

Pakistan, has been efficiently monitoring

the functioning of the domestic market

with a view to evaluating its impact on

the economy. A readily available answer

could be that the central bank has been

performing its regulatory job towards

money market, the forex market as well

as the domestic financial market in an

efficient way. But this does not appear to

be the most plausible answer because

what people generally confront is a

reality that shows that the banking

sector has been demonstrating an

impressive performance but the

country’s economy has been witnessing

a sluggish growth particularly since

2007. The other question that keeps

gnawing one’s mind is that why the

banking sector has failed to effect in

recent years a generous distribution of

credit to support SMEs and regions with

a view to contributing towards efforts

aimed at broadening and building a

sound economic base. These two

profound questions have been

discerned from the write-ups in this

Review. The articles and interviews in

this publication address a number of

questions and issues relating to econom-

ics and finance such as finance, growth

and national integration; the rise and fall

of banking spreads; mortgage finance;

and an unconventional view on banking.

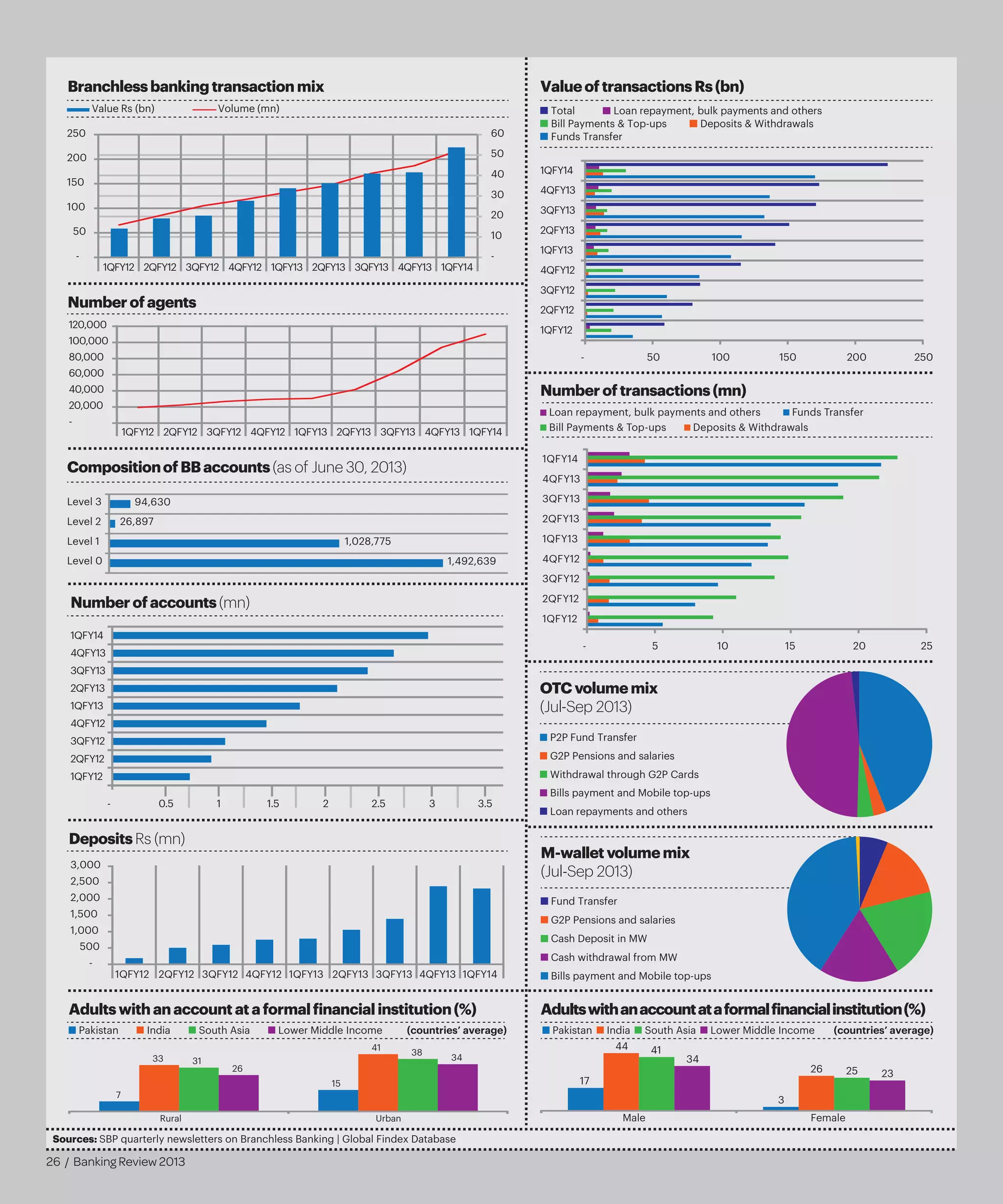

Last but not least, branchless banking

and Islamic banking seem to be the

buzzwords in the world of finance in

Pakistan. According to many, these may

be more of a solution than buzzwords.

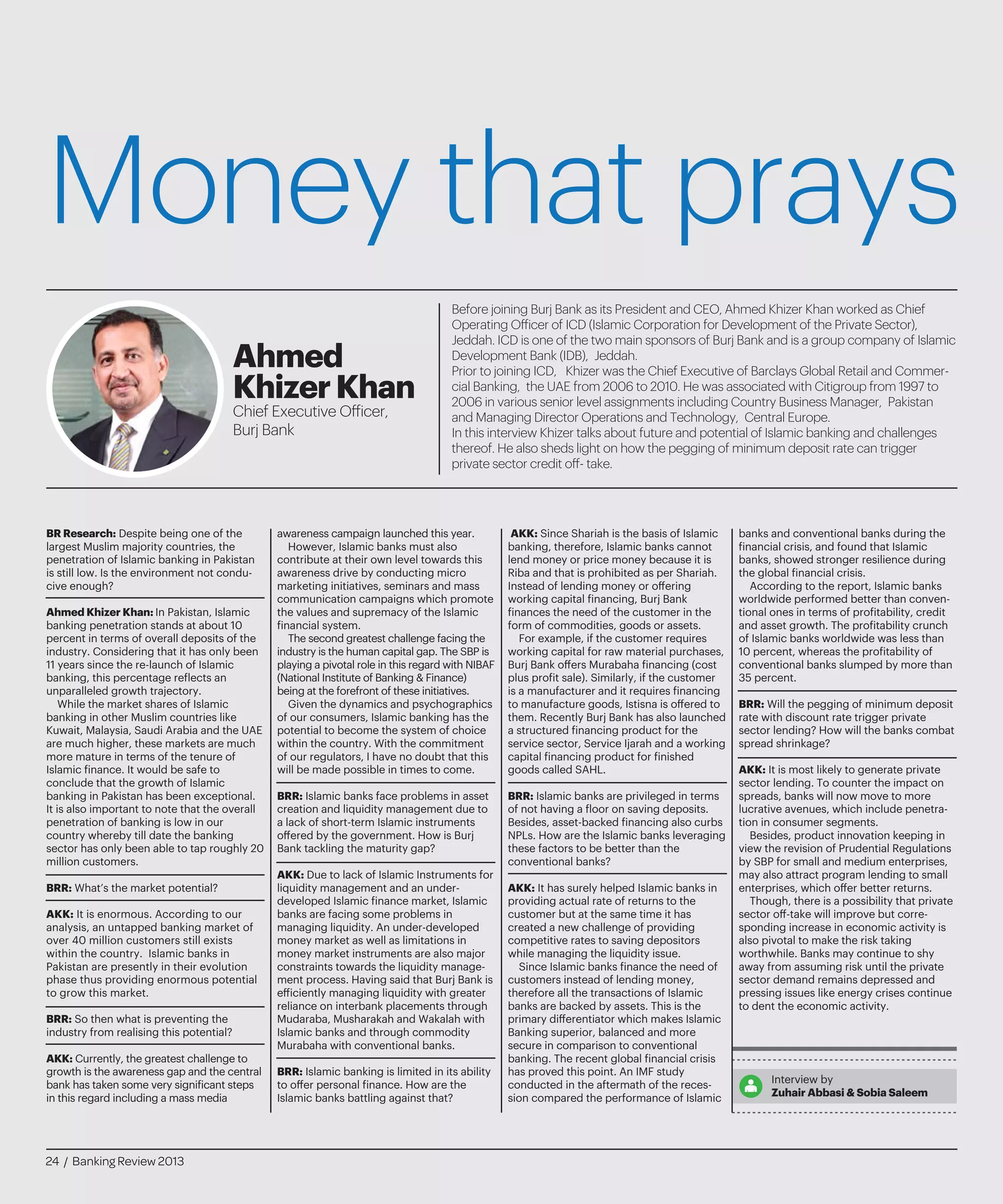

Insofar as Islamic banking is concerned,

that has shown an impressive 10 percent

growth in a decade, this mode of

banking has become an important

segment of the global financial markets.

In Pakistan, we are witnessing the

operations of Islamic banking alongside

the conventional banking system.

Islamic banks have been anticipating a

bigger share of the pie and space in

coming months and years. They mainly

derive their confidence from Shariah-

compliant products that they offer to a

largely conservative Muslim society. The

other major reason behind their growing

optimism is the fact that already Islamic

financial institutions, in one form or

another, are operating in over 70

countries. Its huge success in Malaysia,

for example, is a strong case in point.

But what the proponents of Islamic

finance often overlook is the fact that

Islamic economics, as argued, for

example, by Muhammad Akram Khan in

his book What is Wrong with Islamic

Economics? Analyzing the Present State

and Future Agenda, has failed in part

because of its disproportionate focus on

issues of finance—both in terms of

providing Islamic financial products and

institutions to circumvent the perceived

prohibition of riba, and in terms of zakah

as a tool of public finance. Those who

strongly advocate Islamic banking as a

substitute for conventional banking are

required to make unstinted efforts

towards making Islamic finance a

coherent discipline and chart a way

forward for that discipline in the

country’s economic policymaking. In the

end, this newspaper wishes proponents

of both conventional banking and

Islamic banking a bright present and a

brighter future. Business Recorder will

always encourage a healthy competition

between these two modes of banking in

the larger interest of Pakistan, although

one must refrain from making a direct

comparison between Islamic banking

and conventional banking.](https://image.slidesharecdn.com/e57755e4-e2de-4cfb-9e12-82adbe4e1893-150422221140-conversion-gate01/75/Banking-Review-2013-Final-print-edition-4-2048.jpg)

![Citibank N.A. cautiously

optimistic about Pakistan

Meet Nadeem Lodhi, who rejoined Citibank N.A Pakistan as its Country Manager and

Managing Director in 2012. Prior to that, Nadeem was associated with Abraaj Capital where

he was heading the business for sub-Saharan Africa. During his earlier tenure at Citi,

Nadeem held various roles in Pakistan and Africa including the CEO for Uganda.

Belowistheeditedtranscriptofarecentsit-downwithBRResearch.

NadeemLodhi

Country Manager and Managing Director, Citibank N.A.

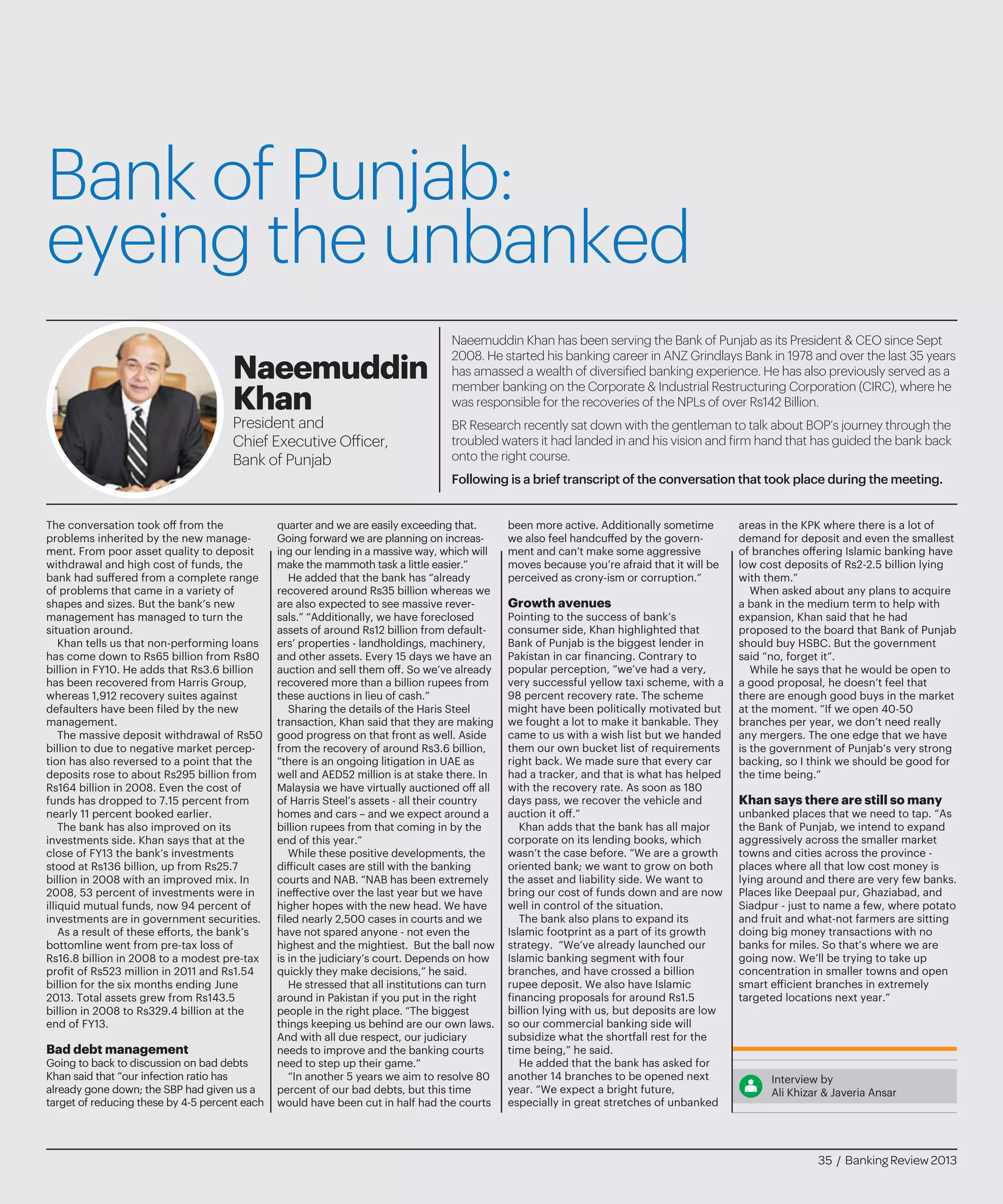

Nadeem kicks off the discussion by

explaining the business strategy of the

bank. “Globally, Citibank N.A. classifies

its banking business into two major

domains: consumer banking and institu-

tional banking. The institutional business

of the bank primarily comprises treasury

& trade services, advisory & investment

banking and corporate banking, which

forms the core essence of Citi’s opera-

tions worldwide.”

He explains that the bank remains at the

forefront of taking clients in Pakistan to

international capital markets and introduc-

ing new products from other geographies

by adapting them to local needs.

Recalling Citi’s feats, Nadeem says that

“fundamentally, Citi Pakistan is now a

wholesale bank serving its corporate and

institutional clients – all their other

offerings are designed to facilitate the

delivery of services to such clients. Some

of our most significant transactions include

Government of Pakistan’s first foreign

currency Sukuk, first local currency Sukuk,

first oil hedge in Pakistan and so on. We

have also been involved with the govern-

ment as Joint Arranger on three Eurobond

issues in 2005, 2006 and 2007 and the

OGDCL GDR issue in 2005.”

He emphasizes on how Citi’s business

model is different from other banks

operating in Pakistan and also explains the

rationale behind the bank’s limited market

presence - having just three corporate

branches in the country.

“Citi’s primary focus is to serve top tier

Pakistani corporates and public sector

entities as well as MNC clients present in

various locations across the globe with

heavy presence in the country. In Pakistan

we are uniquely positioned with a

well-entrenched franchise and continue to

successfully deliver value-added solutions

to this niche client base from areas of

structured financing, M&A advisory,

electronic payment solutions, export credit

agency supported financing, working

capital management and risk management.

Just to give you an example, we handle

over 50 percent of the total MNC trade

volume in the country,” he said.

Some of the most recent and significant

achievements of Citi include, jointly

arranging $130 million syndicated foreign

currency Islamic facility for Pakistan

International Airline (PIA) in October 2013

which was the second biggest transaction

in the last 2 years. The bank also arranged

$70 million FMO & OPIC supported

financing for Pakistan Mobile Communica-

tion Limited (Mobilink) in 2012.

On the investment banking front, the

bank holds a leading position in the

market. “We’ve recently advised Unilever

on share buy-back of Unilever Pakistan and

delisting from the Pakistani exchanges

which contributed to be the single largest

FDI in the recent history of Pakistan. The

bank also advised on AkzoNobel's sale of

its controlling stake in ICI Pakistan, and

acquisition of 35 percent stake of Pakistan

International Container Terminal by ICTSI.”

Among all the categories of institutional

banking, Lodhi terms trade and cash

business to be the anchor of the bank’s

business and the single most important

area that pours in flow into the bank, while

on the treasury front, Citi also provides

hedging and derivative to its clients

besides FX sales.

As part of its commitment to the

country, Citibank N.A. has been conduct-

ing road shows since last year to show-

case the potential of the Pakistani market.

In collaboration with the US State Depart-

ment, the bank also hosted an investment

conference in Dubai in June last year,

providing an opportunity to Pakistani

companies to highlight the multiple

opportunities available in the country to

US investors.

The bank is already Basel-III compliant

while other banks are likely to achieve the

same level in 2018, as per the plan

chalked out by the regulator. Further-

more, Citi is pioneering efforts to imple-

ment state-of-the-art technological

systems in line with a regulatory push to

automate banks’ operations.

Commenting on the ‘banking float’,

which is the duplicate money present in

the banking system between the time

when a deposit is made and when the

funds become available in an account,

Nadeem says that the State Bank of

Pakistan wants to reduce the banking float,

which “could be achieved through a

technology engine called Real-Time Gross

Settlement (RTGS). Citibank N.A. is

expected to be the first bank automated on

RTGS with the SBP in the first quarter of

CY14.”

When asked about the economic

backdrop, Lodhi said the bank remains

bullish about the Pakistani market in the

CY14. “Our niche clientele, mainly MNCs,

consider Pakistan to be in their top ten

growth markets. If they do well, it reflects

positively on our performance,”

comments Lodhi.

He believes that the energy sector is the

key area that will turn around economic

growth in the coming years and bring a

revival in the fiscal system. “The decision

to tackle the three Es [energy, economy

and extremism] is the correct formula

employed by the government and will

bear fruits soon.”

Interview by

Zuhair Abbasi & Sobia Saleem

“We’ve recently advised

Unilever on share

buy-back of Unilever

Pakistan and delisting

from the Pakistani

exchanges which

contributed to be the

single largest FDI in the

recent history of

Pakistan.”

31 / Banking Review 2013](https://image.slidesharecdn.com/e57755e4-e2de-4cfb-9e12-82adbe4e1893-150422221140-conversion-gate01/75/Banking-Review-2013-Final-print-edition-31-2048.jpg)