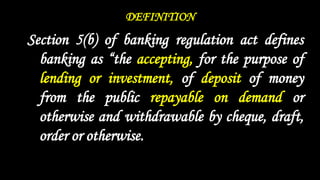

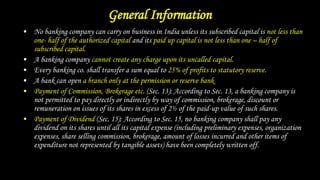

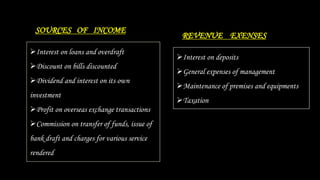

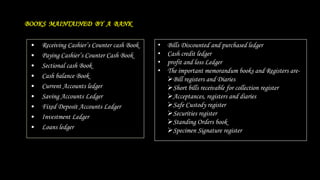

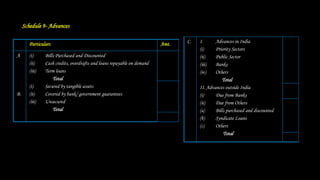

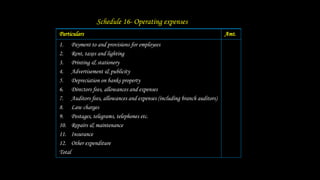

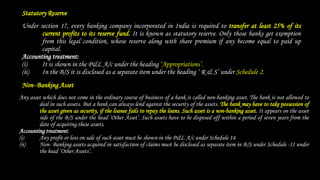

The document provides information on the final accounts of banking companies according to the Banking Regulation Act of 1949. It defines banking and outlines the key features of a banking company. It describes the general accounting system and books maintained by banks, including the counter cash book, cash balance book, and ledgers. It explains that banks prepare their final accounts in a vertical format consisting of a balance sheet and profit and loss account with 16 supporting schedules providing details of assets, liabilities, revenues and expenses.