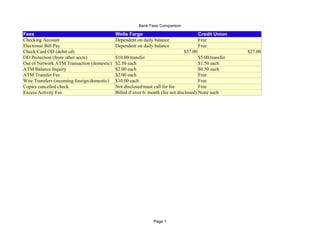

This document compares fees for checking accounts, electronic bill pay, overdraft protection, ATM transactions, and wire transfers between Wells Fargo and credit unions. Wells Fargo charges fees for most typical banking services like bill pay, overdraft protection transfers, out-of-network ATM uses, while a credit union offers many of these services for free, including bill pay, overdraft protection transfers, ATM balance inquiries, and wire transfers. Credit unions also have lower fees than Wells Fargo for services like check card overdrafts, out-of-network ATM transactions, and do not charge excess activity fees.