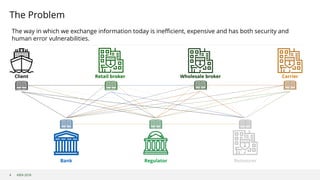

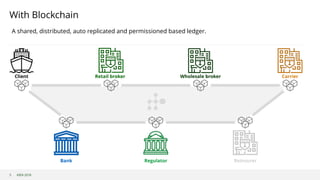

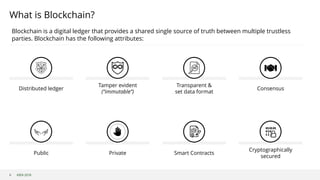

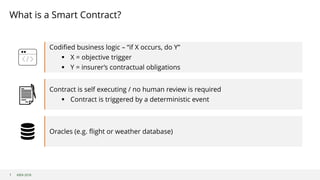

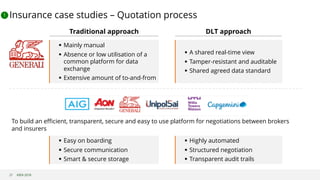

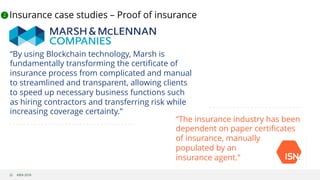

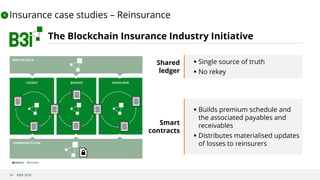

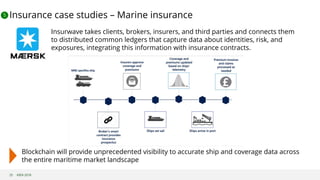

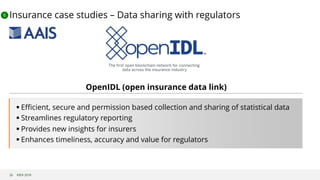

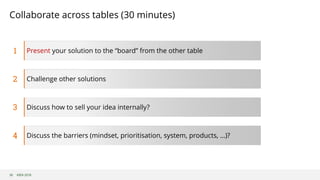

This document provides an overview of a business strategy masterclass on blockchain presented by B3i. The masterclass aims to create a common understanding of blockchain, provide tools and best practices for blockchain adoption, and allow collaboration between market participants. The document discusses challenges in the insurance industry that blockchain could help address, such as high costs, regulatory reporting, and lack of trust in data. It provides examples of how blockchain could reduce costs, improve data quality and transparency, and enable new types of smart contracts. The masterclass also covers key success factors and barriers to blockchain adoption in insurance. Attendees participate in group exercises to collaboratively design blockchain solutions to facilitate risk transfer and present their ideas to the other group.