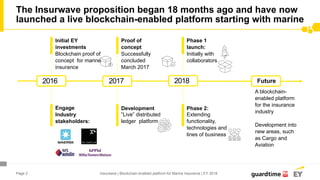

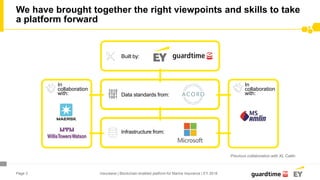

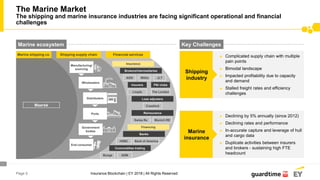

The Insurwave platform, developed over 18 months, is a blockchain-enabled solution aimed at enhancing the marine insurance industry by addressing operational challenges such as data duplication and lack of transparency. The platform facilitates real-time data sharing among various stakeholders, improves automation, and aims to streamline processes while ensuring regulatory compliance. Insurwave focuses on improving visibility of assets and exposures, enhancing claims responses, and developing new models for insurance buying.