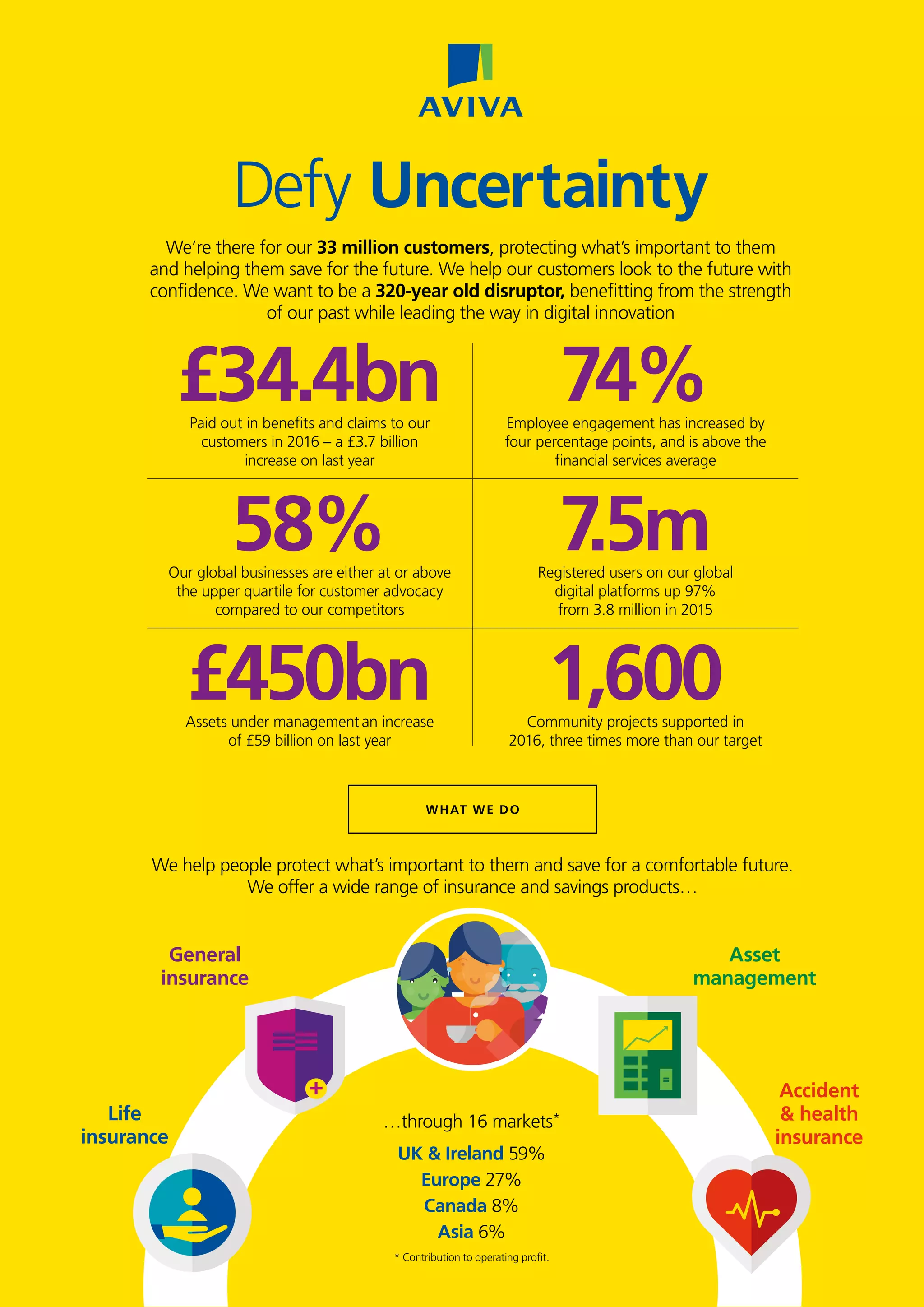

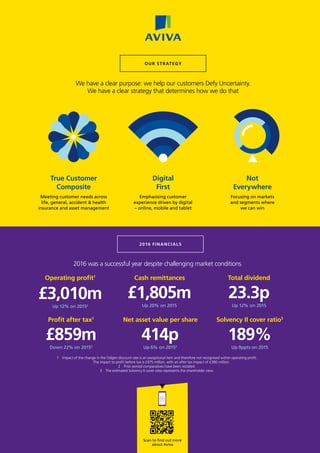

We help over 33 million customers around the world protect what's important to them through a wide range of insurance and savings products. We offer life, general, accident & health insurance, and asset management services to both individual and business customers. In 2016 we paid out £34.4 billion in benefits and claims to customers while growing our assets under management to £450 billion.