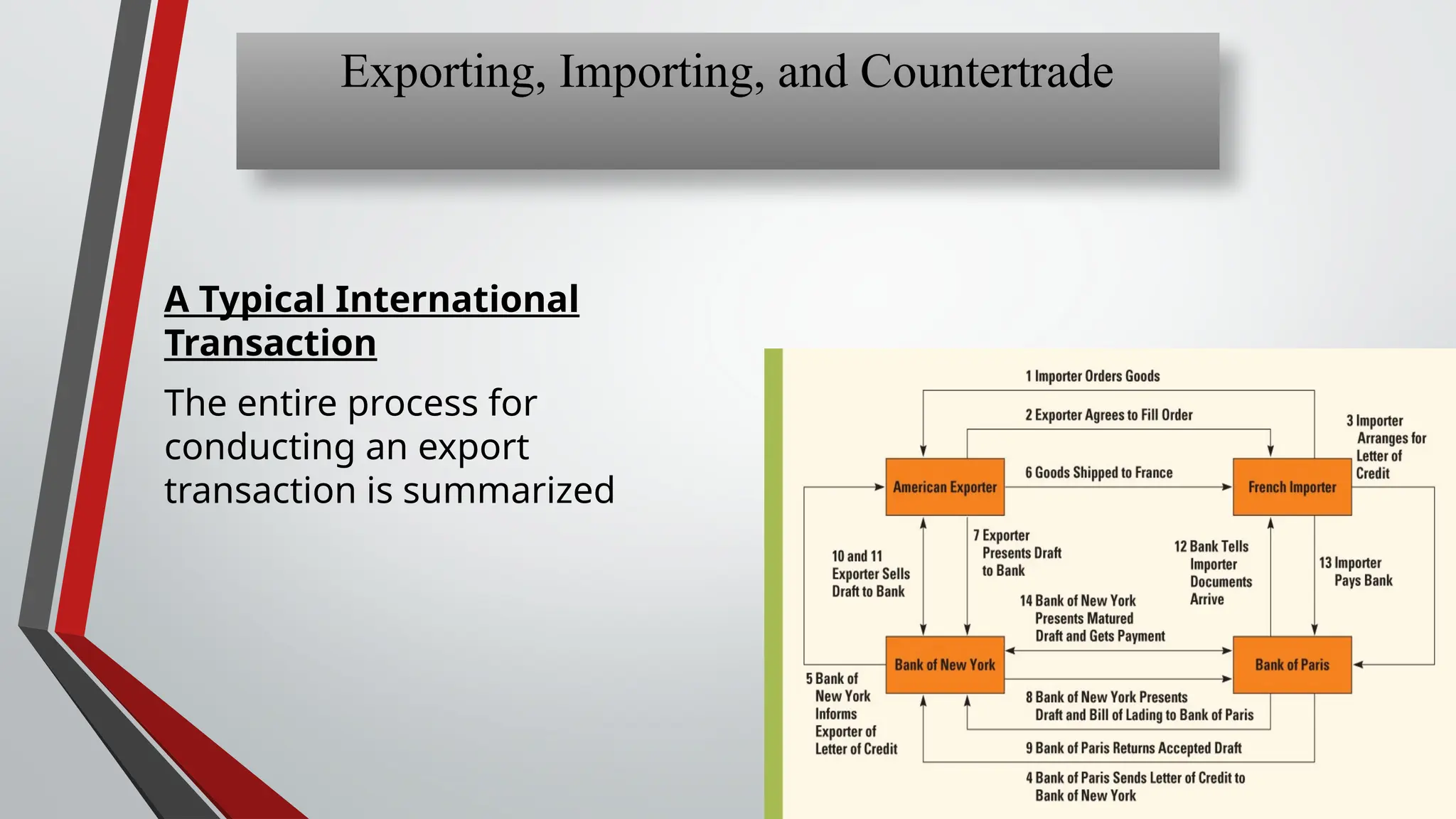

The document discusses the concepts of exporting, importing, and countertrade, emphasizing the benefits and challenges faced by firms engaging in international trade. It highlights the importance of understanding market conditions, navigating paperwork, and utilizing export management companies to facilitate operations. Additionally, it outlines countertrade as an alternative payment method, detailing its types and the advantages and disadvantages associated with it.