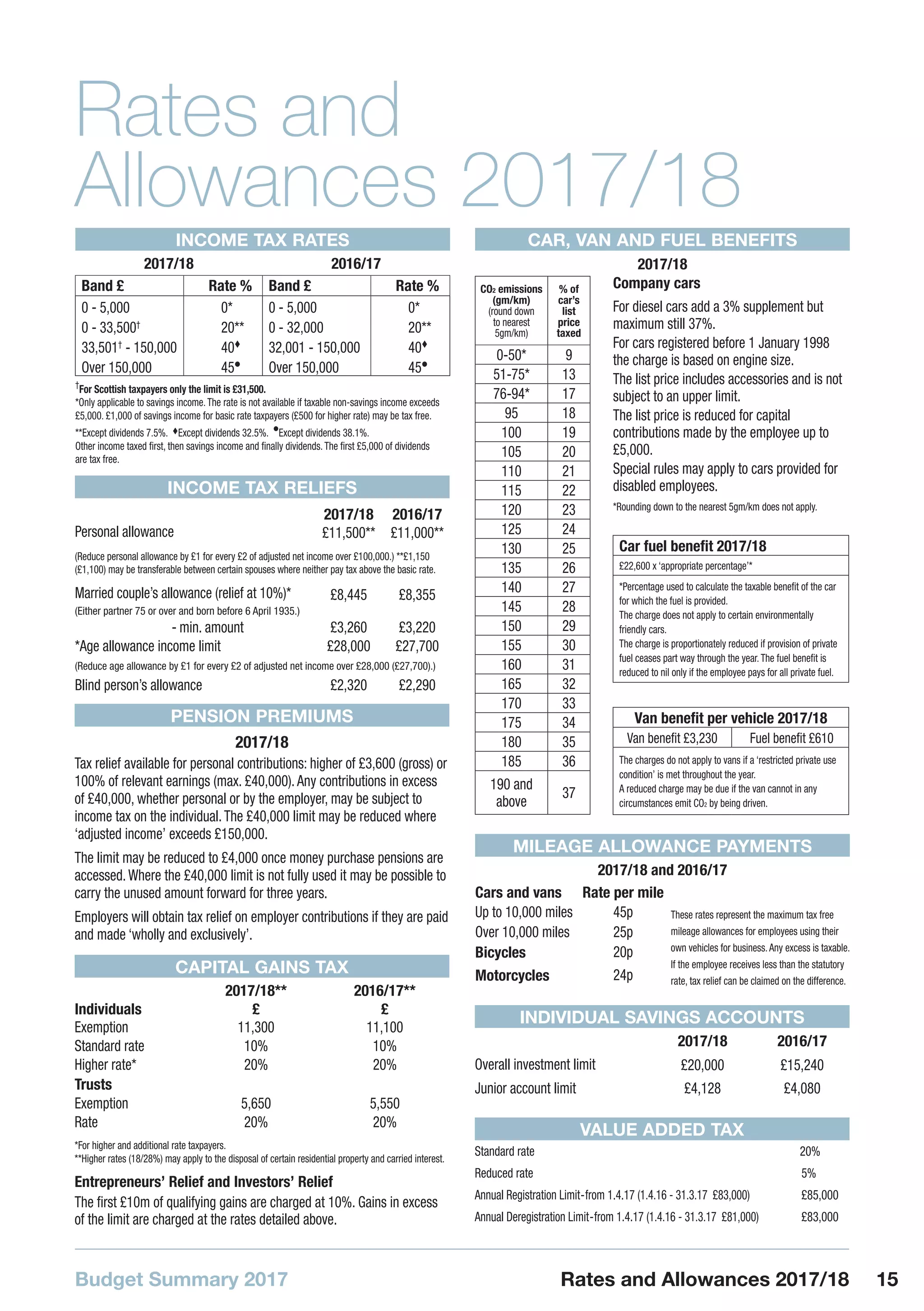

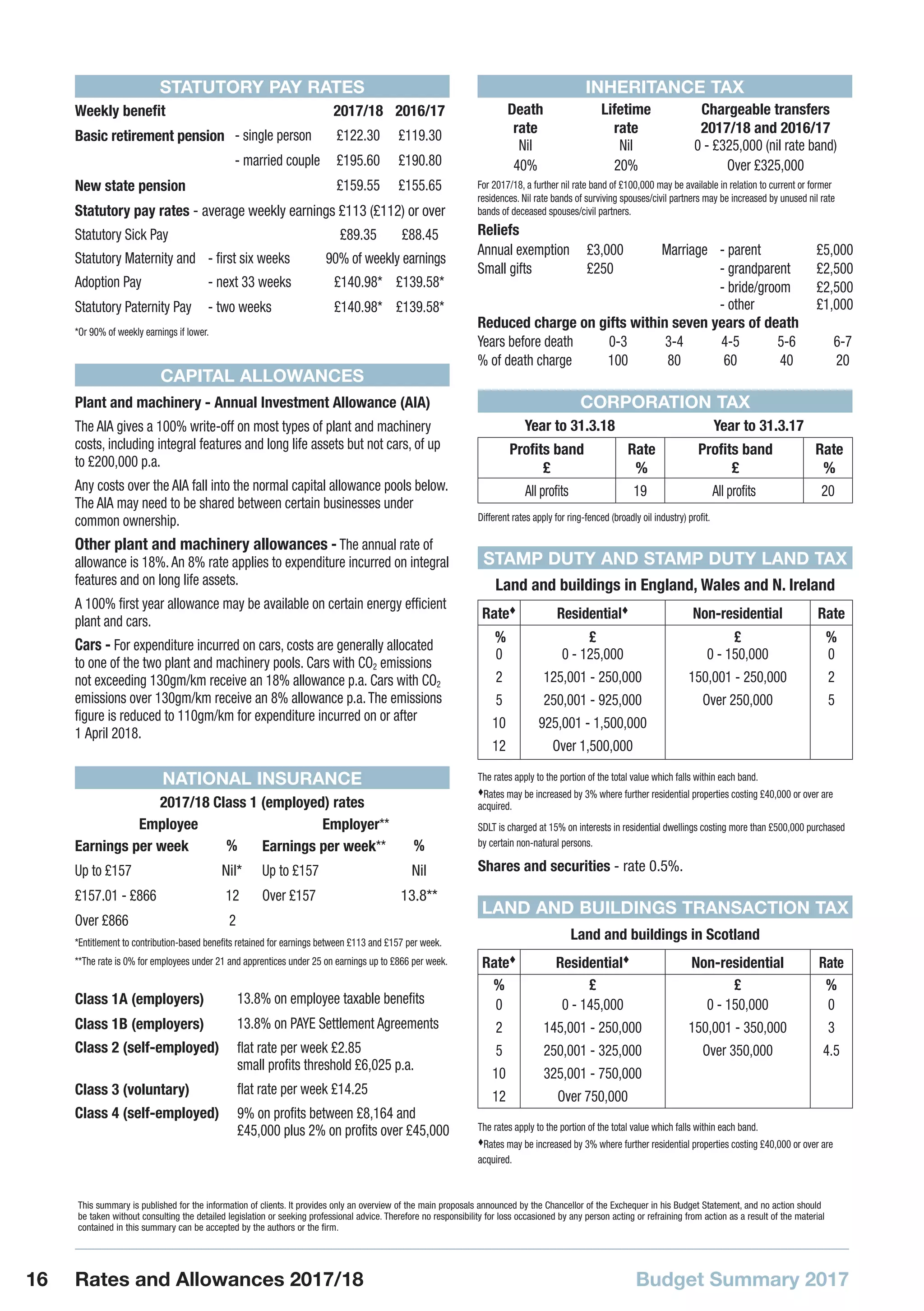

The Spring Budget 2017, presented by Chancellor Philip Hammond, aimed to ensure fairness in the tax system, particularly between employed and self-employed individuals. Key proposals include increases to Class 4 National Insurance rates, a reduction in the dividend allowance from £5,000 to £2,000, and changes to the timing of Making Tax Digital for small businesses, among other personal and business tax updates. The budget also proposes a one-year deferral for mandating digital reporting for unincorporated businesses and introduces new allowances for property and trading income, effective from April 2017.