This document provides an executive summary, background on NTPC Ltd and the Indian power sector, objectives of the project report, methodology used, and results.

The objectives were to provide an optimal financial model for NTPC's capital budget and structure to meet 12th Five Year Plan targets, and analyze power policies in India and China to enhance India's capacity.

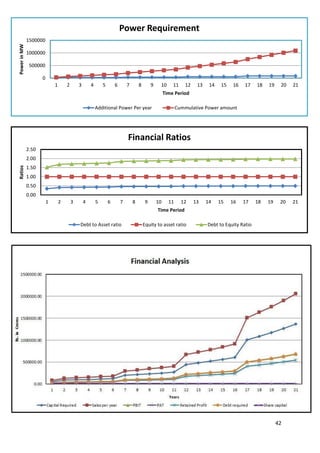

The methodology included primary and secondary data collection, exploratory and mathematical analysis using tools like capital budgeting and Excel, and recommending policies.

The results showed that India needs improvements in various areas like capacity addition, operations, funding, costs, regulations and distribution to meet targets sustainably while transitioning to alternative energy sources.

![EXECUTIVE SUMMARY

OBJECTIVES

To provide the optimum integrated financial model of Capital Budget & Capital

Structure for the additional power capacity required as per the 12th Five Year Plan and

Other Studies for the NTPC considering the public undertaking nature and various

regulatory provisions related to pricing, contracting of raw material, operations,

administration etc. by various regulatory authorities like CERC, Power Ministry and

Environment Ministry

To analyse the Power generation policies of developing and the developed countries,

particularly focusing on the India and China and recommending the changes for

Indian Power Sector to enhance the Capacity in most efficient manner.

METHODOLOGY

Methodology will include the intensive and extensive research, study and analysis to come to

the required solutions and suggestions incorporating the Power Industry norms. It will have

two sections: [see Exhibit 1]

DATA COLLECTION

Primary data

Data gathered from the NTPC staff, discussion and internal survey.

Secondary data

Data gathered using the external sources like study reports by various agencies like Asian

Development Bank, World Bank, UNO and other consultancy organisations who worked in

the same area like KPMG etc.

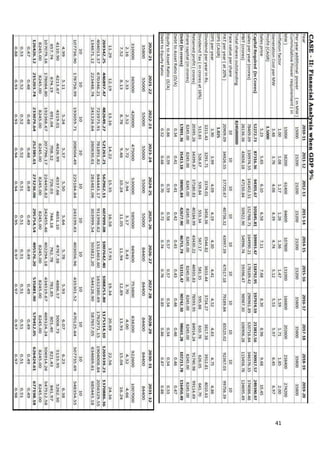

EXPLORATORY AND MATHEMATICAL STUDY

In Exploratory and Mathematical study various financial tools were used giving the inputs

from values available in primary data & secondary data section. Using these exploratory

results, future policies for Power Capacity addition and Operational, Fund Raising &

Technical Efficiencies will be recommended.

IT APPLICATION

Finally, using available software tools like MS Excel various charts and table drawn for the

visual representation of the study and analysis.

RESULTS

Indian Power sector greatly need to improve on various fronts to meet the 12th Five Year

target of the power capacity addition in terms of Operational, Functional, Funding, Cost

Reduction, Environment Challenges, Human Resource, Administration, Regulations, Tariffs,

and Distribution. Along it, India need to look for the alternative energy and sources also

considering the cost involving in Oil and Coal import and their limited availability with

focusing on the environmental effects and the large power requirement for sustaining the

economic and social growth.

5](https://image.slidesharecdn.com/arvindsinghmahor-10bm60017-summerprojectreport-110731131256-phpapp01/85/Arvind-singh-mahor-summer-project-report-5-320.jpg)

![COMPANY BACKGROUND

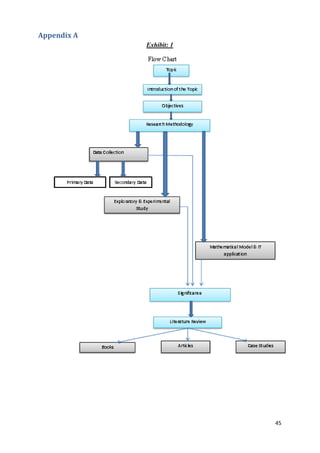

POWER INFRASTRUCTURE IN INDIA

India is the fifth largest producer of electricity in the world and according to the Planning

Commission, while the State Governments account for 51.5% of the total generation capacity,

the central sector and the private sector account for 33.1% and 15.4% of the generation

capacity respectively. The Power industry in India derives its funds and financing from the

government, some private players that have entered the market recently, World Bank, public

issues and other global funds. India‘s total installed capacity of 173,626.40 MW as on March

31, 2011, the installed capacity of central power sector utilities, state sector entities and

private sector companies accounted for approximately 31.3%, 47.5% and 21.2%,

respectively. The following table sets forth a summary of India's energy generation capacity

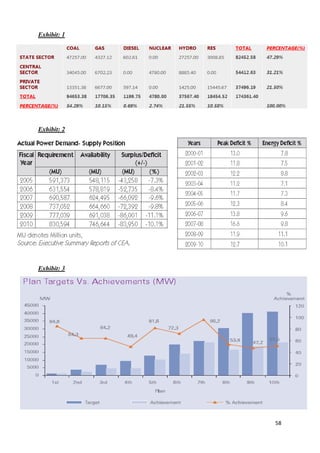

as of March 31, 2011 in terms of fuel source and ownership:

See the organisation of Indian Power Sector Organisation [see Exhibit 2]

Sector Thermal Nuclear Hydro Renewable energy Total

sources

Central 40,747.23 4,780.00 8,885.40 - 54,412.63

State 52186.73 - 27,257.00 3,008.85 82,452.58

Private 19890.52 - 1,425.00 15,445.67 36,761.19

Total 1,12,824.48 4,780.00 37,567.40 18,454.52 1,73,626.40

NTPC PROFILE

NTPC Limited (formerly known as National Thermal Power Generation Limited), India's

largest power company, was set up in 1975 with a vision “A world class integrated power

major, powering India‟s growth, with increasing global presence" to accelerate power

development in India. It has emerged as an „Integrated Power Major‟, with a significant

presence in the entire value chain of power generation business. NTPC is a Government-

owned entity with 89.5% of its paid-up capital contributed by the Government and the

balance of 10.5% being held with foreign institutional investors, financial institutions, banks,

and the general public. NTPC is primarily involved in constructing and operating power

stations. It is among the world‘s largest and most efficient power generation companies.

NTPC has installed capacity of 29,394 MW. It has

15 coal based power stations (23,395 MW),

7 gas based power stations (3,955 MW) and

4 power stations in Joint Ventures (1,794 MW).

The company has power generating facilities in all major regions of the country. It

plans to be a 75,000 MW company by 2017. NTPC is pursuing expansion of its business

activities into hydroelectric generation, coal mining, gas exploration, and participation in the

liquefied natural gas value chain, which supplements and supports its core power generation

activities.

NTPC Organisational Structure [see Exhibit 3]

Vision- A world class integrated power major, powering India's growth with increasing

global presence.

Mission- Develop and provide reliable power related products and services at competitive

prices, integrating multiple energy resources with innovative & Eco-friendly technologies and

contribution to the society

6](https://image.slidesharecdn.com/arvindsinghmahor-10bm60017-summerprojectreport-110731131256-phpapp01/85/Arvind-singh-mahor-summer-project-report-6-320.jpg)

![Core Values - BCOMIT

Business ethics

Customer Focus

Organizational & Professional Pride

Mutual Respect & Trust

Innovation & Speed

Total Quality for Excellence

Corporate Mission

―Develop and provide reliable power, related products and services at competitive prices,

integrating multiple energy sources with innovative and eco-friendly technologies and

contribute to society‖.

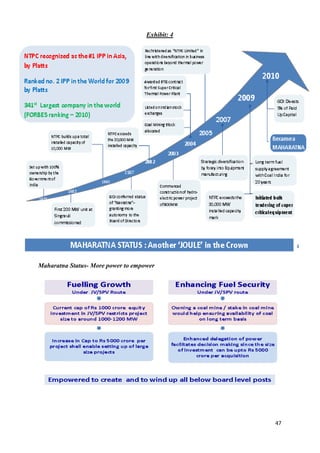

For the growth so far [see Exhibit: 4].

PRODUCTS AND SERVICES

Power generation- The Company has formulated a long term Corporate Plan for 15 years up

to 2017. The Corporate Plan seeks to integrate the Company's vision, mission and strategies

for growth with the national plans and to provide the company the cutting edge in the

emerging competitive environment. NTPC is targeting to become a 75,000 MW plus

Company by 2017.

Consultancy-The Consultancy Wing of NTPC, with an ISO 9001:2000 accreditation,

undertakes all the Consultancy and turnkey project contracts for Domestic and International

clients in the different phases of Power plants. NTPC is registered as a consultant with several

leading international development and financial institutions such as The World Bank, The

Asian Development Bank, The African Development Bank and UNDP.

Power Management Institute- NTPC has full-fledged facilities at the Power Management

Institute, NOIDA for providing training in all aspects of power Plant Management and

Systems. It also has Full Scope Replica Training Simulators both for Coal as well as Gas

based Stations for training personnel in Operation and Maintenance of power plants.

SUBSIDIARIES AND JOINT VENTURES

Business development through Acquisition and Joint Ventures serves both NTPC's own

commercial interest as well as the interest of the Indian economy taking over being a part of

the acquisition process, is also an opportunity for NTPC to add to its power generation

capacity through minimal investment and very low gestation period. Group NTPC has 5

Subsidiaries and 17 Joint Ventures [see Exhibit: 5] in the following area:

Power Generation

Services

Equipment Manufacturing

Coal Acquisition

Power Trading

7](https://image.slidesharecdn.com/arvindsinghmahor-10bm60017-summerprojectreport-110731131256-phpapp01/85/Arvind-singh-mahor-summer-project-report-7-320.jpg)

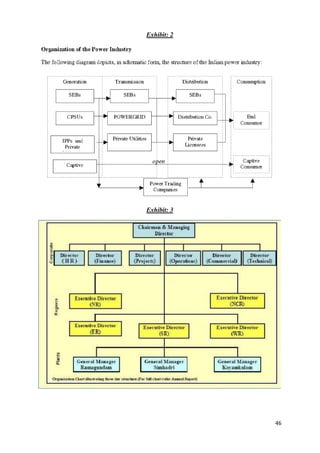

![PERFORMANCE HIGHLIGHTS

Coal based Stations performed at the highest ever Plan Load Factor (PLF) of 89.43 per cent

compared to 87.67 per cent last year. [see exhibit 6]. Seven coal based stations (Dadri,

Unchahar, Vindhyachal, Simhadri, Rihand, Tanda and Talcher-Kaniha) have achieved more

than 90 per cent PLF. Generated 188.74 Billion Units (BU) - an increase of 10.41 per cent

over the previous year. Contributed 28.50 per cent of the total electricity generated in the

country during 2006-07 with 20.18 per cent share of the total installed capacity of the nation.

PAF of both the coal and gas-based stations remained at healthy levels, which enabled the

company to earn efficiency incentives. The company‘s Plant Availability Factor (PAF) for

FY2011 as a whole stood at 91.67%, up 46bp Y-O-Y. During 4QFY2011, PAF of coal-based

plants stood at 96.4%, while PAF of gas-based plants stood at 96.87%. [Exhibit: 6]

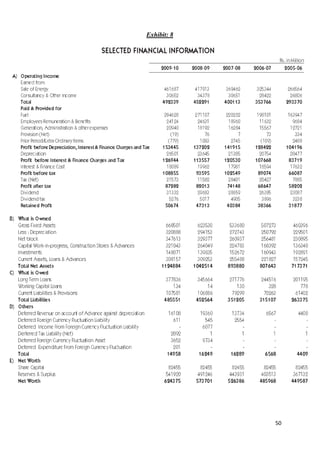

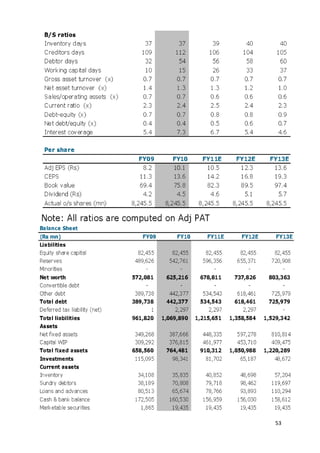

FINANCIAL RESULTS

NTPC Ltd has declared its provisional unaudited revenues and profit for quarter and year-

ended March 31, 2011. The audited results are expected by May 20, 2011 post which we will

release a detailed results analysis. The provisional numbers indicate that the performance is

likely to be in line with CRISIL Equities‘ estimates. CRISIL continue to believe that NTPC is

better placed due to strong growth prospects, higher fuel security and a stable return model.

NTPC maintains fundamental grade of 5/5, indicating that the fundamentals of the company

are excellent relative to other listed securities in India. [Exhibit: 7] & [Exhibit: 8]

100% realization of the billing for the eighth consecutive year.

Provisional and un-audited Net Sales of Rs. 53,721 crore during 2010-11 as against

Rs. 46,169 crore (audited) during 2009-10, registering an increase of 16.36%. The

provisional and un-audited Gross Revenue is Rs.56,331 crore during 2010-11 as

against Rs.49,247 crore (audited) for the year 2009-10, an increase of 14.38%.

Provisional and un-audited Profit after tax for the year 2010-11 is Rs.8,826.16 crore s

compared to Rs.8,728.2 crore (audited) during the year 2009-10, an increase of

1.12%.

Capital Expenditure of Rs.12,817.61 crore during 2010-11, an increase of 22.46%

over the last year‘s figure of Rs.10,467.13 crore. NTPC Group‘s capital expenditure

was Rs. 16,326.58 crore as against Rs.14,334.54 crore over the last year, an increase

of 14%

Contributed Rs.6,243.99 crore to exchequer on account of Corporate tax, Dividend

and tax thereon and wealth tax, an increase of 92% over the previous year.

Approved outlay for 2011-12 for NTPC‘s capital schemes is Rs.26,400 crore; for

NTPC Group, the outlay is Rs.30,843.72 crore.

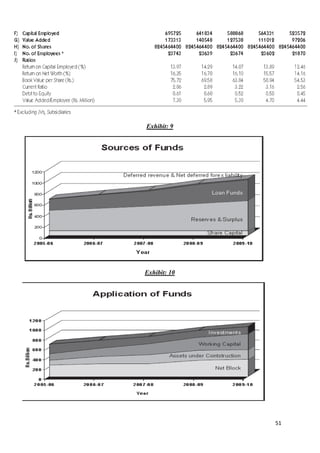

For Financial Results [Exhibit: 11]

8](https://image.slidesharecdn.com/arvindsinghmahor-10bm60017-summerprojectreport-110731131256-phpapp01/85/Arvind-singh-mahor-summer-project-report-8-320.jpg)

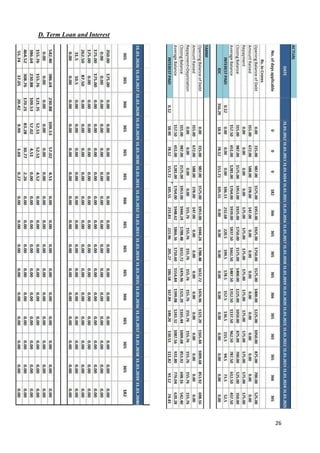

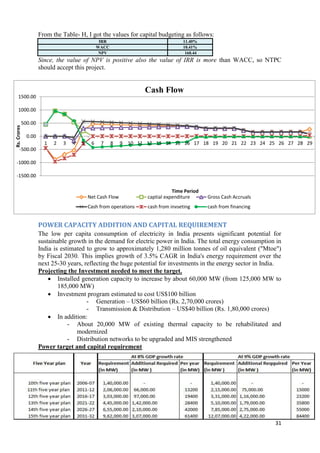

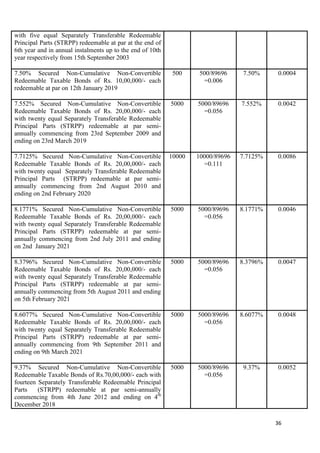

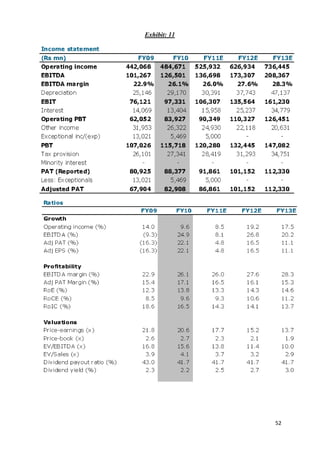

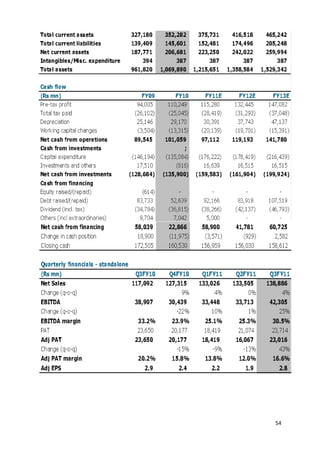

![FINANCIAL STRATEGIES AND FUND RAISING BY NTPC

Fund Mobilisation

Leveraging strong ratios to raise debt at optimal rates:

A. Capital Structure

New projects to be financed with Debt equity ratio of 70:30.

Internal accruals sufficient to finance equity portion of the scheduled investment in

NTPC

Deployment of equity in Subsidiaries/JVs selectively – preferably with control

retention.

B. Debt Funding

NTPC has the ―Most Favoured Borrower‖ status due to:

- Low gearing and healthy coverage ratios

- Debt servicing ability to remain strong due to certainty of revenue based on the

cost plus regime.

Long term debt (term loans/bonds) preferred to match project cash flows-to be

realised from domestic/international markets.

Projects executed by subsidiaries and JVs to be financed under projects finance route.

C. 2010-2011

Total outlay Rs. 22350 crore, Rs. 12818 crore required as debt.

For Sources of fund [Exhibit: 9] and Application of fund [Exhibit: 10]

32](https://image.slidesharecdn.com/arvindsinghmahor-10bm60017-summerprojectreport-110731131256-phpapp01/85/Arvind-singh-mahor-summer-project-report-32-320.jpg)

![Appendix B

CASE LET - NTPC: CURRENT STATUS, FUTURE DEMANDS AND INVESTMENT NEEDED

On May 5th, 2011, a hot day, as it usually it happens in Delhi or other North Indian

Places during summer season, Power Management Institute (PMI), management training

wing of National Thermal Power Corporation (NTPC) at Noida (Uttar Pradesh, India) had

got new interns for their MBA training at NPTC from IIT Kharagpur were coming to have

their first glimpse of NTPC and future corporate life. All people were informed to report to

Prof. Dash, a senior and very renowned faculty at PMI Noida.

After sometime, Prof. Dash called everybody and gave short introduction of self,

the PMI (NPTC) and the various projects in Indian Power Sector being carried out. Later, he

asked everybody to give their details about profile and background knowledge before asking

about the choice of projects. Arvind Mahor, an intern among them, told of his profile as

finance and expressed his desire to work in Capital Budgeting and Capital Structuring at

Power Projects. Prof. Dash asked him some questions in the area of Corporate Finance and

discussed with him about the demand and supply of power scenario in India and focused on

the 12th Five Year Plan and its target by 2017 in energy sector. He told him to carry out with

the project in “Capital Budgeting, Capital Planning and Comparative study of Power Sector

focusing on China and India and proposing the ways for the improvements”.

INDIAN POWER SECTOR STATUS

The power sector in India is mainly governed by the Ministry of Power. As far as generation

is concerned it is mainly divided into three sectors these are Central Sector, State Sector, and

Private Sector. Due to India‘s economic rise, the demand for energy has grown at an average

of 3.6% per annum over the past 30 years. At the end of April 2011, the installed power

generation capacity of India stood at 174361.40MW. The total thermal capacity, including

gas stations and diesel generation accounts for about 64.27% of installed capacity of the

country followed by hydro capacity at 23.13%. Nuclear stations account for 2.86% and the

balance 9.74% is contributed by Renewable Energy Sources [Exhibit: 1]. Still, Power Sector

Units (PSUs) are the measure players, NTPC is one of them.

PROFILE OF NTPC

NTPC Limited (formerly known as National Thermal Power Generation Limited), India's

largest power company, was set up in 1975. It has emerged as an „Integrated Power Major‟,

with a significant presence in the entire value chain of power generation business. NTPC is a

Government-owned entity with 89.5% of its paid-up capital contributed by the Government

and the balance of 10.5% being held with foreign institutional investors, financial institutions,

banks, and the general public. It plans to be a 75,000 MW company by 2017. NTPC is

primarily involved in constructing and operating power stations. It is among the world‘s

largest and most efficient power generation companies. NTPC has installed capacity of

29,394 MW. It has

15 coal based power stations (23,395 MW),

7 gas based power stations (3,955 MW) and

4 power stations in Joint Ventures (1,794 MW).

55](https://image.slidesharecdn.com/arvindsinghmahor-10bm60017-summerprojectreport-110731131256-phpapp01/85/Arvind-singh-mahor-summer-project-report-55-320.jpg)

![NTPC is pursuing expansion of its business activities into hydroelectric generation, coal

mining, gas exploration, and participation in the liquefied natural gas value chain, which

supplements and supports its core power generation activities.

PROJECT DETAILS

This project had three parts. In first part, some assumptions were given for the input values

like project life, fuel cost, land cost, financial parameters, efficiency etc. for a dummy project

that NTPC is planning to implement. In this part he was to calculating Capital Budgeting

parameters like NPV and IRR considering the risk factors to determine the financial

implications of the project.

Second part was about to analyse the global Power sector Practices both in

developed and developing countries particularly focusing on China‘s Power Sector growth

trend, in hence proposing the various ways for operational and functional efficiency

improvement, financing pattern like FDI, Private participation etc. and other reforms

considering the regulatory norms, environmental effects etc. for the Indian Power Sector.

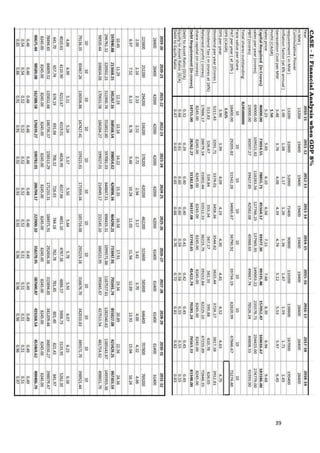

Finally, to project the Power demand and capital requirement year-on-year basis as

per the Five Year Plans, past track record and study reports from the various organisations

like World Bank, private consulting firms, planning commission etc. and prepare the financial

model using Excel tool depicting the visual representation in the forms of graphs and tables.

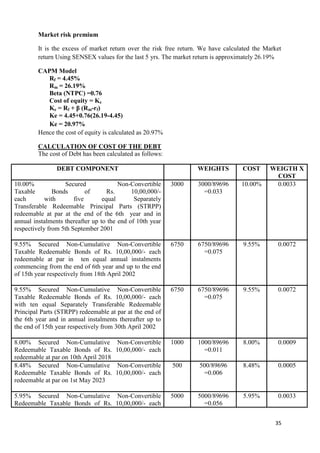

GLOBAL POWER SECTOR TRENDS

World electricity generation rose at an average annual rate of 3.7%, greater than the 2.1%

growth in total primary energy supply. The share of fossil fuels in the overall fuel mix for

electricity generation is in general more than 50–60%. From the fossil fuels, coal is most

frequently used [Exhibit: 5]. De-regulation in areas of the global energy markets has led to

fierce competition. The enormous challenges are recognised in providing electricity as

efficiently as possible and strive to develop technology to meet your needs. Collectively,

developing countries use 30% of the world's energy, but with projected population and

economic growth in those markets, energy demands are expected to rise 95 %. Overall global

consumption is expected to rise 50 % from 2005 to 2030. Many non-OECD countries facing

high electricity demand growth favour privatizing their electric power sectors and opening

their markets to foreign firms.

FUNDING PATTERN OF THE POWER PROJECTS

In many parts of the world, financial capital may be a greater resource constraint than primary

energy supplies. It has been estimated that over the period 1993 to 2010 investment to sustain

the power generation infrastructure will require from 0.1 to 0.2 per cent of GDP in the

industrialized countries, 0.6 to 1.1 per cent in China, and as much as 1.0 to 1.6 per cent in

India [Exhibit: 4]. Nearly two-thirds of all the capital raised for new private power projects

was provided under Project finance structures, in which project cash flows and assets, rather

than sponsors balance sheets, provide security to lenders. Structurally power project finance

has involved largely build-own-operate (BOO) project structures and long-term contract.

Merchant power plants are rare. The vast majority of debt has involved direct finance or

credit enhancement from export credit agencies and multilateral development banks. The

private sector uses a variety of mechanisms for managing risks but main is relying on central

government.

56](https://image.slidesharecdn.com/arvindsinghmahor-10bm60017-summerprojectreport-110731131256-phpapp01/85/Arvind-singh-mahor-summer-project-report-56-320.jpg)

![LESSON FOR INDIA

Financing of power projects: Prices for the electricity produced from all new power plants

are now set by contract to cover financing and operating costs, on a plant-by-plant basis, and

rolled into the average power tariff. Encourage the FDI like China by Joint ventures (JVs),

Initial public offerings (IPOs) on stock exchanges, Build-Operate-Transfer (BOT)

agreements, simultaneously, implement "rolling exploitation mechanism".

Restructuring of Power Sector Decision: India should divest the amount of decision

making closer to the state or province level, structure the power monolith and create the

power markets. Along it, should investment in energy-efficient measures, energy

conservation for both economic and environmental terms, R&D and clean energy.

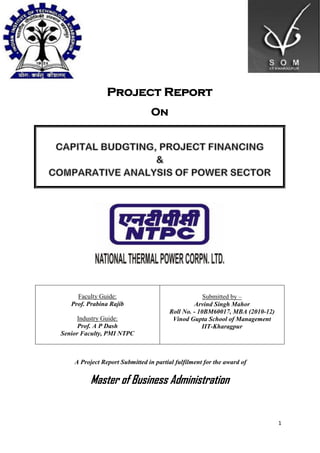

DEMAND AND SUPPLY STATUS

Rapid growth of the economy places a heavy demand on electric power. The demand for

electricity has consistently exceeded the supply, and the demand-supply gap has been

widening. The per capita power consumption in India is 733.54KWh/yr, which is very

minimal as compared to global average of 2340KWh/yr. In fiscal 2010, peak energy deficit

was 12.7% and total energy deficit was 10.1%. The total demand for electricity in India is

expected to cross 950,000 MW by 2030. Peak load demand, however, increased by 8.52%

whereas peak supply grew by 7.6 % resulting in raising peak load deficit to 12.7% in 2009-10

from 11.9 % in the previous year [Exhibit: 2]. Central Electricity Authority in its 17th Electric

Power Survey (EPS) has projected that in order to completely wipe off the energy deficit, the

energy requirement at the power station bus bar would be of the order of 968.659 Billion

Units in 2011-12 The Indian government has set an ambitious target to add approximately

78,000 MW of installed generation capacity by 2012.

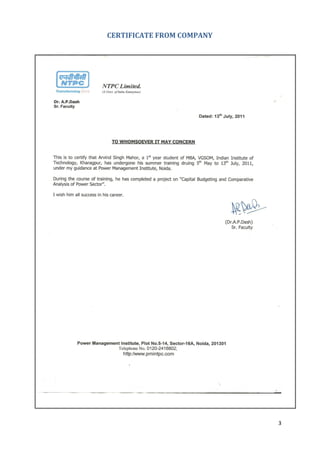

POWER GENERATION EFFICIENCY

After comparing these statistics to International Energy Agency (IEA) statistics it is noticed

that Indian Power generation among the lease efficient. The biggest indicator of a poor track

record is the inability to meet targets on the power generation capacity additions [Exhibit: 3].

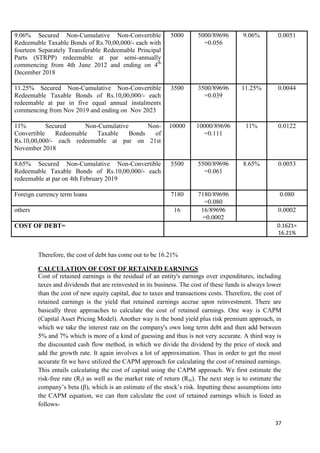

PROJECTION OF THE DEMAND AND INVESTMENT

[Exhibit: 6]

FINANCIAL STRATEGIES AND FUND RAISING BY NTPC

NTPC is leveraging strong ratios to raise debt at optimal rates. New projects to be financed

with Debt equity ratio of 70:30. NTPC is maintaining sufficient internal accruals to finance

equity portion of the scheduled investment and deploying equity in Subsidiaries/JVs

selectively – preferably with control retention. Long term debt (term loans/bonds) is preferred

to match project cash flows-to be realised from domestic/international markets. Projects

executed by subsidiaries and JVs to be financed under projects finance route.

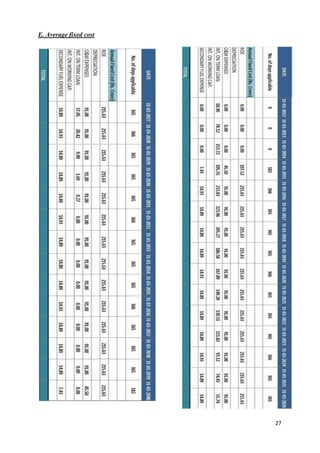

RESULTS

The results for the capital budgeting of dummy project came out as:

WACC = 10.41% IRR = 11.40% NPV = 160.44 Rs.

And capital investment in term of equity and debt was calculated at GDP rate of 8% and 9%.

57](https://image.slidesharecdn.com/arvindsinghmahor-10bm60017-summerprojectreport-110731131256-phpapp01/85/Arvind-singh-mahor-summer-project-report-57-320.jpg)