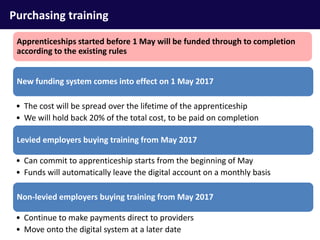

The document summarizes new apprenticeship funding rules in England beginning in May 2017, including:

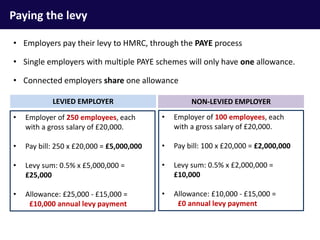

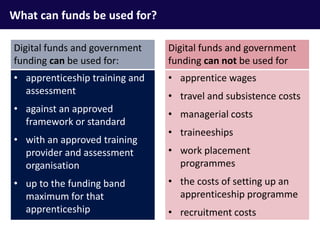

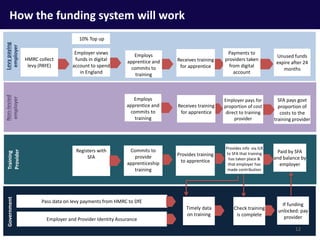

- The apprenticeship levy applied to large employers at a rate of 0.5% of payroll to fund apprenticeship training.

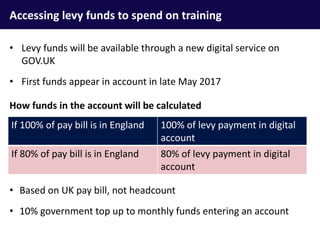

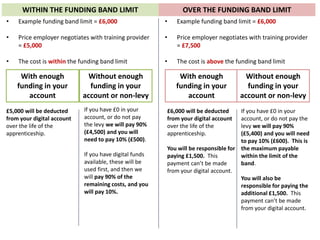

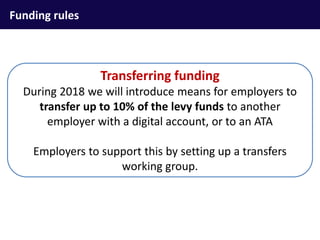

- Employers pay a levy to HMRC which is available in a digital account to spend on training. The government provides a 10% top-up.

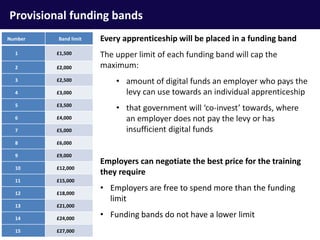

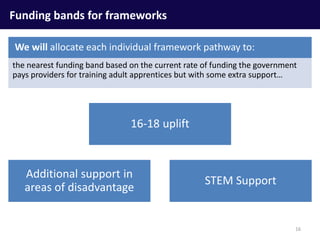

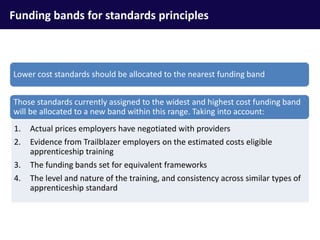

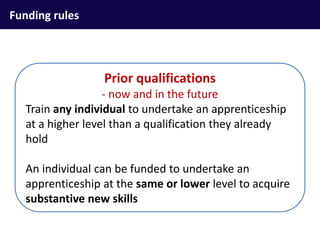

- Training costs are banded and the government funds 90% of costs for non-levy paying employers up to the band limit.

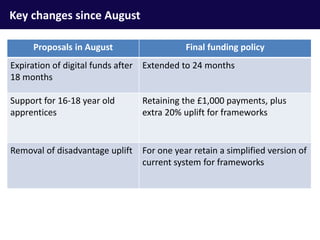

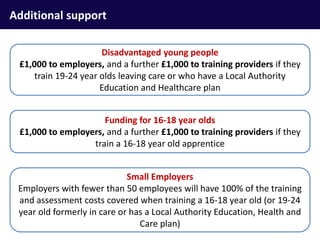

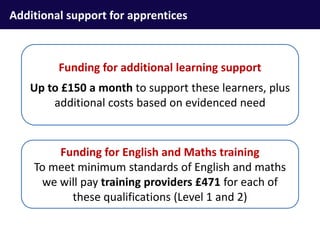

- Additional support is provided for 16-18 year olds, those from disadvantaged backgrounds, and small employers.

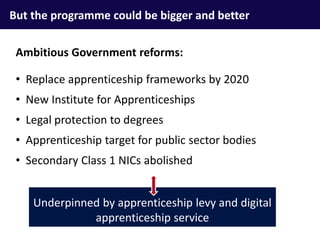

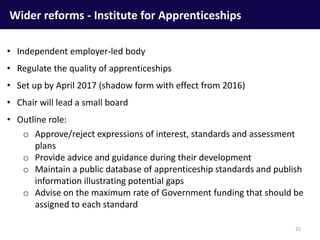

- Reforms establish an Institute for