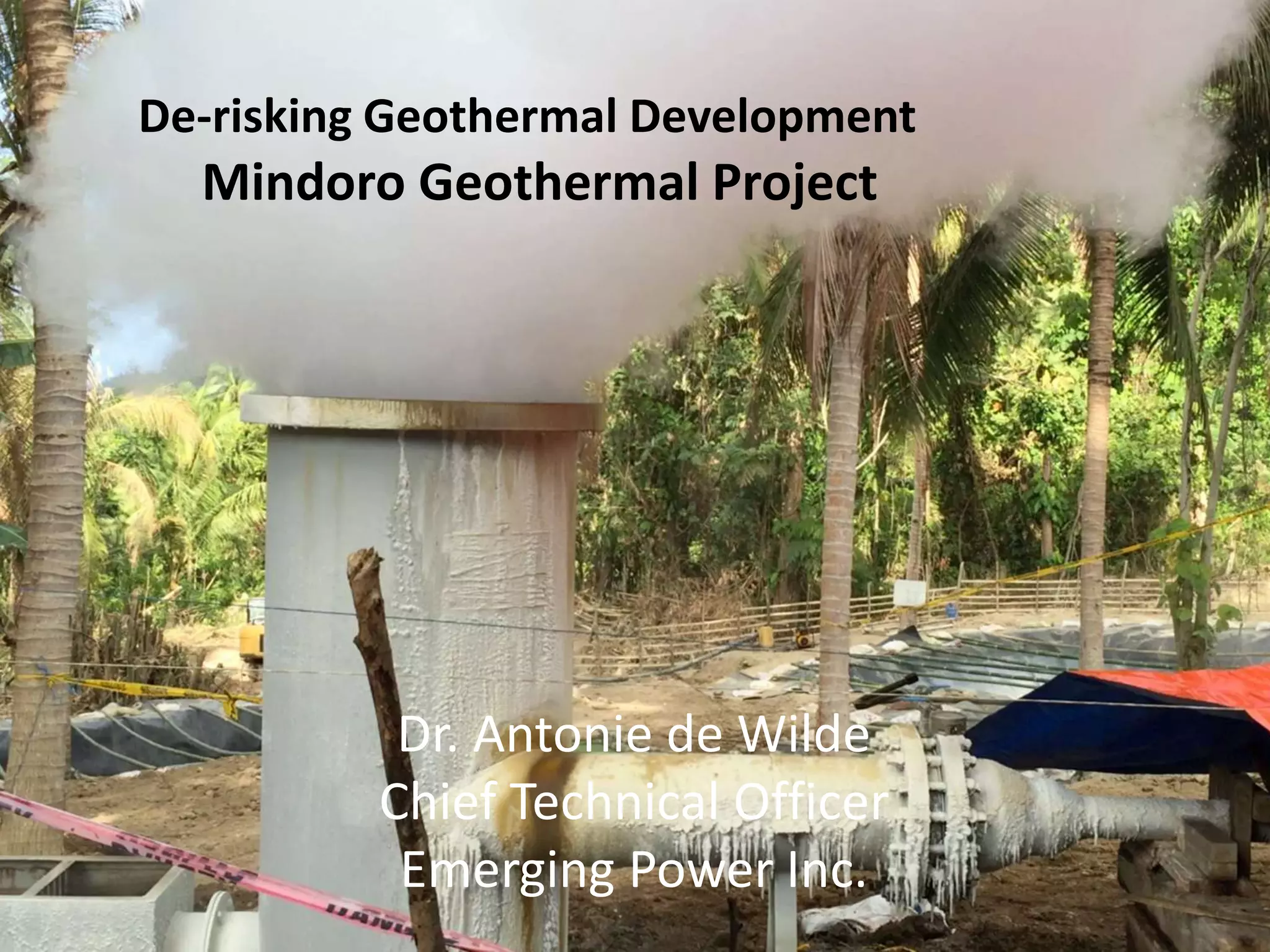

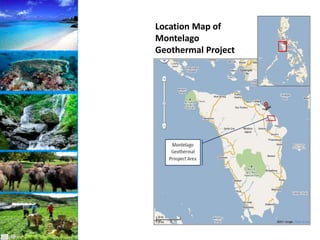

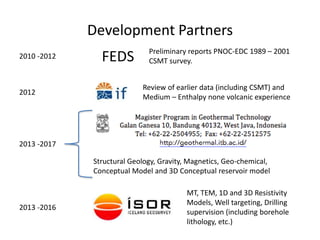

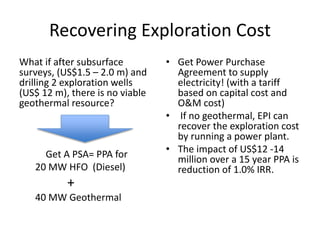

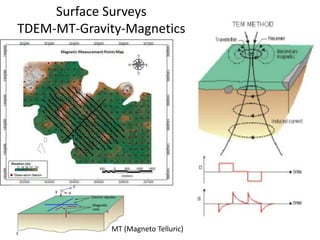

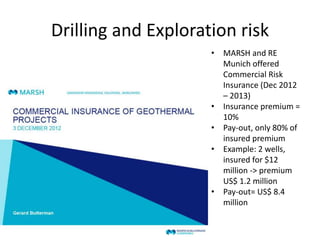

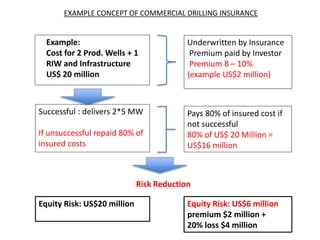

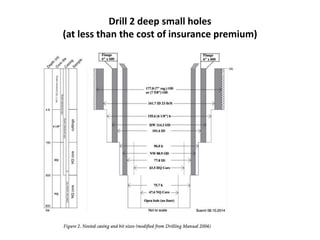

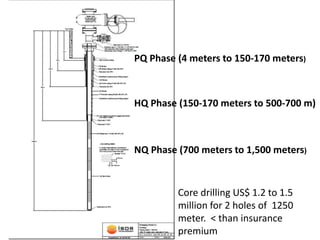

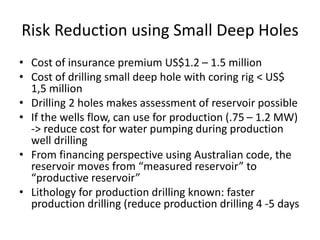

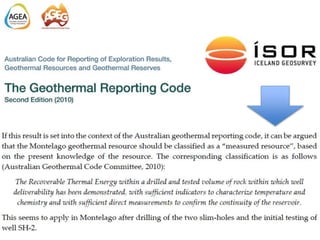

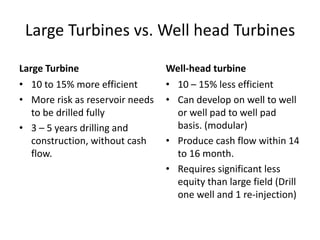

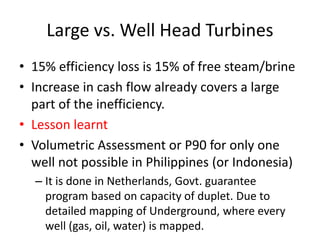

The document discusses the risks and strategies used in the development of the privately funded Mindoro Geothermal Project in the Philippines. Key strategies to de-risk the project included obtaining a power purchase agreement, improving subsurface surveys using techniques like MT and TEM, obtaining commercial drilling insurance, and drilling deep slim holes to better understand the resource prior to production wells. These strategies helped confirm a measured resource of 40MW and secure $50 million in equity funding to develop the field using modular well-head turbines.