Analyst Report Nissei Build Kogyo Co., Ltd

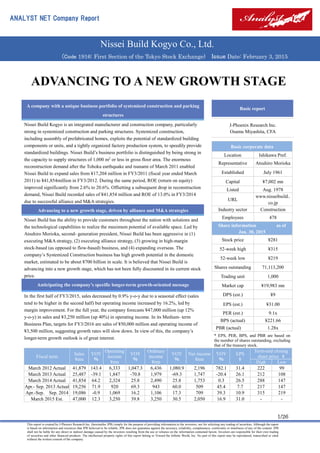

- 1. ANALYST NET Company Report Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 1/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. ADVANCING TO A NEW GROWTH STAGE A company with a unique business portfolio of systemized construction and parking structures Nissei Build Kogyo is an integrated manufacturer and construction company, particularly strong in systemized construction and parking structures. Systemized construction, including assembly of prefabricated homes, exploits the potential of standardized building components or units, and a tightly organized factory production system, to speedily provide standardized buildings. Nissei Build’s business portfolio is distinguished by being strong in the capacity to supply structures of 1,000 m2 or less in gross floor area. The enormous reconstruction demand after the Tohoku earthquake and tsunami of March 2011 enabled Nissei Build to expand sales from ¥17,204 million in FY3/2011 (fiscal year ended March 2011) to ¥41,854million in FY3/2012. During the same period, ROE (return on equity) improved significantly from 2.6% to 20.6%. Offsetting a subsequent drop in reconstruction demand, Nissei Build recorded sales of ¥41,854 million and ROE of 13.0% in FY3/2014 due to successful alliance and M&A strategies. Advancing to a new growth stage, driven by alliance and M&A strategies Nissei Build has the ability to provide customers throughout the nation with solutions and the technological capabilities to realize the maximum potential of available space. Led by Atsuhiro Morioka, second- generation president, Nissei Build has been aggressive in (1) executing M&A strategy, (2) executing alliance strategy, (3) growing in high-margin stock-based (as opposed to flow-based) business, and (4) expanding overseas. The company’s Systemized Construction business has high growth potential in the domestic market, estimated to be about ¥700 billion in scale. It is believed that Nissei Build is advancing into a new growth stage, which has not been fully discounted in its current stock price. Anticipating the company’s specific longer-term growth-oriented message In the first half of FY3/2015, sales decreased by 0.9% y-o-y due to a seasonal effect (sales tend to be higher in the second half) but operating income increased by 16.2%, led by margin improvement. For the full year, the company forecasts ¥47,000 million (up 12% y-o-y) in sales and ¥3,250 million (up 40%) in operating income. In its Medium- term Business Plan, targets for FY3/2016 are sales of ¥50,000 million and operating income of ¥3,500 million, suggesting growth rates will slow down. In view of this, the company’s longer-term growth outlook is of great interest. Basic report J-Phoenix Research Inc. Osamu Miyashita, CFA Basic corporate data Location Ishikawa Pref. Representative Atsuhiro Morioka Established July 1961 Capital ¥7,002 mn Listed Aug. 1978 URL www.nisseibuild.. co.jp Industry sector Construction Employees 478 Share information as of Jan. 30, 2015 Stock price ¥281 52-week high ¥315 52-week low ¥219 Shares outstanding 71,113,200 Trading unit 1,000 Market cap ¥19,983 mn DPS (est.) ¥9 EPS (est.) ¥31.00 PER (est.) 9.1x BPS (actual) ¥221.66 PBR (actual) 1.28x Fiscal term Sales ¥mn YOY % Operating income ¥mn YOY % Ordinary income ¥mn YOY % Net income ¥mn YOY % EPS ¥ Term-end closing share price ¥ High Low March 2012 Actual 41,879 143.4 6,333 1,047.3 6,436 1,080.9 2,196 782.1 31.4 222 99 March 2013 Actual 25,487 -39.1 1,847 -70.8 1,979 -69.3 1,747 -20.4 26.1 212 108 March 2014 Actual 41,854 64.2 2,324 25.8 2,490 25.8 1,753 0.3 26.5 288 147 Apr.- Sep. 2013 Actual 19,256 71.9 920 69.3 943 60.0 509 45.4 7.7 217 147 Apr.-Sep. Sep. 2014 19,086 -0.9 1,069 16.2 1,106 17.3 709 39.3 10.9 315 219 March 2015 Est. 47,000 12.3 3,250 39.8 3,250 30.5 2,050 16.9 31.0 - - * EPS, PER, BPS, and PBR are based on the number of shares outstanding, excluding that of the treasury stock.

- 2. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 2/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Nissei Build, founded in 1961, built a nationwide network and expanded businesses. Since 1996, Atushiro Morioka, second-generation president, has aggressively transformed the company into an integrated manufacturer. Examples of systemized construction structures Examples of parking structures ■ Leadership of second-generation president and growth Hiroshi Morioka founded Nissei Build as a garage manufacturing and sales company in 1961, with 17 employees. Over the following years the company has built a network of factories to provide ability to supply its products nationwide, and was listed in the Second Section of the Osaka Securities Exchange in 1978. Nissei Build then added more factories, expanded further, and was listed in the First Section of the Tokyo Stock Exchange in 1996. In 1998, Atsuhiro Morioka became the second president. Since then, Nissei Build has endeavored to realize organizational reform, enhance its marketing and sales force, strengthen its group power, and promote its M&A strategy. The company has been transformed into an integrated manufacturer with its core strength in systemized construction and parking structures, and additionally, productive engagement in general construction, development, and overseas businesses. 1961 The late Hiroshi Morioka founded Nissei Build as an assembly-type garage manufacturing and sales company in Kanaiwa, Kanazawa City. 1968 Built a factory in Saitama Prefecture. Established the House Department. 1971 Built a factory in Fukuoka Prefecture. 1973 Built a factory in Iwate Prefecture. 1974 Established the Housing Section. 1978 Listed in the Second Section of the Osaka Securities Exchange 1979 Built a factory in Hokkaido Prefecture. 1980 Established the Building Material Business Section. 1981 Built a factory in Ishikawa Prefecture. 1988 Established the Parking Structure Business Section. 1989 Built a factory in Ehime Prefecture. 1991 Listed in the First Section of the Osaka Securities Exchange 1993 Established the Building Lease Business Department 1996 Listed in the First Section of the Tokyo Stock Exchange. 1998 Atsuhiro Morioka became the second-generation president. 1999 Established the Sales Management Division to control sections, which were renamed from departments. 2000 Sections were integrated to the Housing Business Department and the Parking Structure Business Department. 2007 Delisted from the First Section of the Osaka Securities Exchange and became listed only in the First Section of the Tokyo Stock Exchange. 2008 Reformed the Organization with the aim of growing larger products and enhancing business in the Greater Tokyo area. 2009 Established the Maintenance Department. 2010 Renamed the Tokyo Sales Office to Tokyo Branch Office to enhance business in the Greater Tokyo area. (Source: Prepared by JPR, based on company materials) (Source: Prepared by JPR, based on company materials) Corporate name Nissei Build Kogyo Co., Ltd. Location 3-16-10 Kanaiwa-kita, Kanazawa City, Ishikawa Prefecture, Japan Representative Atsuhiro Morioka, President Established July 3, 1961 Capital 7,002 million yen Employees 478 (as of March 31, 2014) Fiscal term Ends March 31 Traded on Tokyo Stock Exchange (First Section) Sales FY ended March 2014 ¥44,854mn (Consol.): ¥25,903mn (Non-consol.) Business lines • Sales of systemized construction (prefabricated houses, and unit houses); rental of prefabricated houses • Sales, maintenance, and renewal of automated tower parking and multilevel parking • Sales of parking facilities with ramps • Construction and renovation construction of railways, civil engineering, and building works (by subsidiaries) • Parking management and operation (by a subsidiary) • Trading, brokerage, agency work, rental, and management of real estate (by a subsidiary) • Comprehensive management and maintenance of commercial facilities, etc. (by a subsidiary) • Planning, design, development, and management of software (by a subsidiary) Corporate Profile and Business Characteristics History and Corporate Profile

- 3. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 3/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. ■ Providing clients with full-range services, including construction, maintenance, and facilities management The Nissei Build Group (see chart below) provides full-range services, including construction, maintenance, and facilities management throughout Japan, in alliance with major six partner companies. Overseas, the company mainly operates parking structure businesses in Singapore, Thailand, and China. Plans have been made to set up a joint venture in Vietnam, with a local oil plant construction and sales company and others, to engage in construction, sales, and maintenance of parking structures. ■ Four major businesses Nissei Build has four major businesses: (1) Systemized Construction; (2) Parking Structures; (3) General Construction; and (4) Property Development. (Source: Company’s presentation materials) Nissei Build Asia Pte. Ltd. Capital: ¥490mn Owned: 100% Employees: 144 Business lines: Railway construction Building construction Civil engineering Renovation construction Nisse Build Kogyo NB Construction Ozawa Construction NB Parking NB Investment NB Facilities NB Networks Capital: ¥50mn Owned: 100% Employees: 18 Business lines: Building construction Civil engineering Capital: ¥30mn Owned: 100% Employees: 14 Business lines: Operation and management of car- parking and bicycle- parking facilities Capital: ¥30mn Owned: 100% Employees: 3 Business lines: Trade, brokerage, agency business, rental, and management of real estate Capital: ¥37mn Owned: 100% Employees: 5 Business lines: General management and maintenance of commercial facilities, etc. Capital: ¥30mn Owned: 100% Employees: 2 Business lines: Planning, design, development & management of software Country: Singapore Capital: SGD1.54mn Owned: 100% Employees: 1 Business lines: Sales of parking structures Operation and management of parking facilities Nissei Build Group Consolidated sales: ¥41,854mn (FY3/2014) Group employees: 678 (as of the end of September, 2014) Country: China Owned: 40% Capital: RMB17mn Employees: 4 Business lines: Operation, management, and maintenance of parking facilities Space Value (Thailand)Co., Ltd. Country: Thailand Capital: THB10mn Owned: 49% Employees: 9 Business lines: Sales of parking structures Operation and management of parking facilities Sales of systemized construction Asia Parking Investment Pte. Ltd. Country: Singapore Capital: SGD1.3mn Owned: 80% Employees: - Business lines: Development and investment of parking facilities Shanghai Tiandi Nissei Parking Management Co., Ltd. Overseas Group Companies Domestic Group Companies Capital: ¥7,002mn Employees: 478 Systemized construction business Parking structure business General construction business Property development business (FY3/2015) Systemized construction: Frontage of 10-40m; Use of H-type lightweight steel frame Building structures with standardized components and via systemized processes in a single process from design to factory fabrication to on-site construction. Nissei Build is the only Japanese company to perform systemized construction by using H-type lightweight steel frame. Prefabricated houses: Frontage of less than 10m; use of C-type steel frame. Quick construction, low cost, and flexible response to customer needs. Unit houses: Assemble units from factory-fabricated components. Automated tower parking: Maximum use of limited space by using an elevator. Multi-stacked parking; A product line-up of two- to six-storied structures. Parking with ramps: Safe, convenient, and cost-effective parking. Maintenance service. Coin-operated parking structures. Construction related to condominiums, large facilities, and railways. Anti-seismic reinforcement, large-scale repair of condominiums. Large-scale home centers, medical and welfare facilities, large-scale commercial buildings, etc. Development of condominiums and road-side buildings. Introduction to the Nissei Build Group Business Outline

- 4. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 4/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Representative products Interior of “Nissei V Span-S” H-type lightweight steel frames used in systemized construction by Nissei Build Sales of these business segments are well balanced (see charts below). The Property Development business segment is newly presented from this fiscal year. (Source: Company’s presentation materials) ■ Systemized construction, Prefabricated facilities, and Unit facilities This segment includes a wide variety of products, including systemized construction, Prefabricated facilities, and Unit facilities. The segment has driven the company’s significant growth in responding to post-disaster reconstruction demand. ■ Specialized in systemized construction by using H-type lightweight steel frames Nissei Build is the only Japanese company engaged in systemized construction business using H-type lightweight steel frames. By costing less than heavyweight frames they lower construction costs. Use of the H-type lightweight steel frames is suitable to structures with frontage of 10-40m, or gross floor space of 1,000m2 or less. Standardized frame systems, exterior systems, roof systems, and suitable components are selected by company engineers to construct structures according to specifications. Applications include factories, warehouses, stores, and public facilities. (Source: Company’s presentation materials) FY3/2014 Sales Systemized construction ¥18,946mn, 45% Parking structures ¥8,097mn, 19% Comprehensive construction ¥14,811mn, 36% FY3/2015(E) Sales Systemized construction ¥ 22,400mn, 48% Parking structures ¥9,500mn, 20% ¥44,854 million ¥47,000 million Comprehensive construction ¥13,700mn, 29% Development ¥1,400mn, 3% Sales up 12% Nissei V Span-SFrame system Exterior system Roof system Options Large space Short construction period Standardized Factories Warehouses Stores Public facilities Systemized Construction (Systemized Building)

- 5. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 5/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Differentiation reduces competitive pressure The potential market for Nissei Build’s systemized construction approximates ¥700 billion Coexistence with steelmakers ■ Competitive advantages in specialized structures with facades of 10-40m Being specialized in structures with facades of 10-40m is important for identifying Nissei Build’s competitive positioning, due to the following two points. 1. The H-type lightweight steel frames, having less volume than frames used in the past, are readily adopted for systemized construction, resulting in the reduction of costs. 2. Nissei Build does not compete with steelmakers and bridge makers which are engaged in systemized construction of a different segment, using heavyweight steel frames (i.e., Kawada Industries, Inc., JFE Civil Engineering & Construction Corp., Sumikin System Buildings Corp., .Yokogawa System Buildings Corp., and Nippon Steel & Sumikin Engineering Co., Ltd.) Thus, Nissei Build is differentiated in terms of segment and product. Regarding the point 2, Nissei Build often works in alliance with Kawada Industries, Inc. (a subsidiary of a holding company Kawada Technologies, Inc., TSE First Section, #3443).Through the alliance Nissei Build does small projects and Kawada, the bigger projects, whereby each company exploits its strengths, without competing with each other. As a result, Nissei Build can benefit from reduced competitive pressure in the middle-scale segment. In the small-scale market, Nissei Build has high growth potential based on its ability to propose solutions that maximize the value of client assets, and save on costs. According to Nissei Build estimates, the middle-scale and small-scale markets are estimated to be ¥500 billion and ¥200 billion respectively. Thus, Nissei Build’s main target is ¥700 billion in aggregate scale. (Source: Company’s presentation materials) Steelmakers supply H-type lightweight steel frames to Nissei Build and also engage in systemized construction by themselves. However, there is no conflict of interests as the steel companies specialize only in systemized construction using heavyweight steel frames, as shown below. Due to clear differentiation in market exposure and historical background, Nissei Build’s special positioning is expected to remain intact in the future. Total floor space Market size Main players Value chain Nissei Build’s strategy Nissei Build’s growth potential Large scale 1,000m2 or more Approx. ¥5 trillion Subsidiaries or a business department of major steel or bridge makers Most players have an integrated production system from materials to construction Use heavyweight steel frames Not applicable - Middle scale less than1,000m2 Approx. ¥500 billion Nissei Build; Subsidiaries or a business department of major steel or bridge makers Most players have an integrated production system from materials to construction Only Nissei Build uses H-type lightweight steel frames Main target High as major players cannot pursue scale merit and are not aggressive Small scale Approx. ¥200 billion Many small- scale companies Few companies have an integrated production system from materials to construction Main target High as Nissei Build’s one- stop solution is highly competitive Accelerate growth in the middle-scale market, in alliance with Kawada Industries Alliance with Kawada in the systemized construction business. Based on shared business information, Nissei Build does small projects (1,000m2 or less in floor space) and Kawada, the bigger projects.

- 6. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 6/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Prefab house (image) Nissei Build’s capabilities to shorter construction time, standardized formats, and lower costs are highly acknowledged by nationwide convenience stores and other retail franchisers (Source: Company’s presentation materials) ■ Nissei’s prefab houses have facades of 10m or less Prefabricated facilities (prefabs) are to manufacture pillars, beams, roofs, walls, and other components of a building at off-site factories in advance and then assemble them on-site to complete construction. Nissei Build specializes in prefab housing having facades of 10m or less. Many components are standardized, enabling high efficiency in both off-site factory production and on-site construction, and ensuring that high standards of quality are satisfied. The rationalized entire processes from design to production and construction helps lessen the overall work period and reduce construction costs. Among the Nissei Build customers who benefit from this method are convenience store and other retail business chains, including their franchisees, as chains require stores that are made according to a high degree of standardization, resulting in cost reduction, more flexible store development and reorganization. Nissei Build’s technological capabilities, ability to satisfy customers, and nationwide presence are highly evaluated by those familiar with the company. Steelmakers Lightweight steel frames Heavyweight steel frames Bridge-related systemized construction makers Steelmaking-related systemized construction makers Only Nissei Build is in systemized construction business, using lightweight steel frames Frontage of 10-40m Floor space of 1,000m2 or less Frontage of 40m or more Floor space of 1,000m2 or more Due to different background, Nissei Build is differentiated from other makers, and has established a value chain optimal to its business characteristics, that acts to deter entrants from other groupings. This has provided stability for the company. Groundwork Pillar installation Beam and bracing installation Exterior wall panel installation Completion Office buildings Stores Garages Public facilities Short construction period Standardized Coin-operated laundries Systemized Construction (Prefabs)

- 7. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 7/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Installation of factory-made finished products on site Strong ability to propose solutions and use technology for effective use of space ■ Construction by the unit method of installing factory-made finished products on site Nissei Build constructs structures by using the unit method of installing factory-made finished products on site. The method accommodates various needs and allows construction in a short work time. Flexibility of Unit facilities means more potential for modifying interior space to meet specific requirements, and facilitate relocation and expansion. ■ Strength in applying systemized construction know-how Parking structures are multilevel buildings and may be equipped with mechanical devices. By using standardized components and applying systemized construction know-how, Nissei Build constructs parking structures that satisfy a wide range of specific requirements and are completed and ready for use in a short time. The two main types are a mechanical type and a drive-in type. Mechanical parking can be either in the form of a tower or a multilevel facility. Nissei Build is leading the industry with its innovative product offerings and ability to ensure effective use of space. Nissei Build’s value-creating solutions and technological capabilities are well used in urban areas having a perpetual shortage of parking space. Nissei Build’s parking structures are also attractive as facilities that enable effective use of real estate and generate stable cash flow. Other attractive points for real estate owners and investors are the company’s ability to forecast parking income based on its long experience and integrated service including post-construction maintenance and operation. Short construction period Standardized Functional adaptability Sheds Shelters Studios Toilets Short construction period Standardized Flexible Automated tower parking タワー式 Parking with rampsMulti-stacked parking Hotels Offices Condos Corporate offices HospitalsCondos Corporate housing Systemized Construction (Unit facilities) Parking structure business

- 8. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 8/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Comprehensive support Operates mainly in the Greater Tokyo area ■ Parking-related full-services Nissei Build provides a range of parking-related services, including regular maintenance, management of coin-operated parking structures, replacement of old equipment, and renovation. ■ Business expansion driven by M&A: General construction mainly urban areas Most of Nissei Build’s general construction business has been in the Greater Tokyo area and by subsidiaries acquired since 2012. NB Construction is engaged in civil engineering, construction, and repair of railway and other facilities. Ozawa Construction mainly builds commercial facilities and condominiums. Addition of this business segment completes the range over which Nissei Build can respond to customer needs. The company expects to raise its solution-offering ability by as-needed joint efforts by the General Construction, Systemized Construction, and Parking Structures businesses. In addition, by having the general construction business, the company benefits by obtaining a wide range of real estate information in the Greater Tokyo area ■ Business alliances led to entry into development business Nissei Build tied up with ES-CON Japan, Ltd. (JASDAQ; #8892; Nissei Build owns 5%), a developer of condominiums and commercial facilities, in December 2012 and with Tosei Revival Investment Corporation, which is a subsidiary of Tosei Corp. (TSE First Section; #8923) engaged in alternative investment business. These alliances enabled Nissei Build to start the Property Development business segment in March 2014 for development, purchase and sale, and rental of properties, and obtain land for development. General Construction Renewal to a new model Property Development (from FY3/2015) Maintenance Coin-operated parking structure

- 9. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 9/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Maximizing value by means of combining three elements, satisfying owners’ needs, and sensitivity to features of the site and its location “Space is Value” is a corporate slogan ■ Solution-providing ability and technological capabilities: two strengths to maximize usage of space Nissei Build’s strength lies in solution-providing ability and technological capability, that enable maximal usage of space, and customers throughout the nation can avail themselves of these advantages. (Source: Prepared by JPR, based on company interview) ■ Three elements of solution-providing ability: ability to combine businesses, understand customer needs, and provide full-range support. First, ability to combine. Nissei Build combines its business of Systemized Construction, General Construction, and Parking Structures and proposes a one-stop solution to maximize usage of space. The Systemized Construction business facilitates shorter work time, greater space, standardized products, lower price, and receptiveness to scrap-and-build situations. The General Construction business responds to lasting individual customer needs. The Parking Structure business can realize effective use of spare space and improve convenience. By combining these businesses for specific projects, Nissei can better achieve maximizing customer value, based on needs of landowners and business operators, characteristics of properties, and location conditions. (Source: Prepared by JPR, based on company interview) The second element is to understanding customers’ needs. Based on information provided by alliance partners, Nissei Build strives to properly understand needs of prospective customers who are interested in its solutions, and to make actionable proposals. Typical customers are convenience store chains, hospitals, and public facilities. Solution Providing Ability Technological Capability Solution Providing Abilities and Technological Capabilities which pursue the maximization of the value of the space of the real-estate for the landlords and the business operators are available nation-wide 1) Ability of combining various solutions 2) Ability of understanding needs of clients 3) Providing one stop supporting services 1) Own designing and manufacturing Capability 2) Capability of realizing combination of various solutions 3) Nation-wide capability to provide the same quality of service and facilities Space Needs & Feature of Real-estate & Conditions of Location Value Realization through Systemized Construction structures Value Realization through General Construction Value Realization through Parking Structures “Space is Value” Business Model Characteristics Two strengths enabling maximization of space usage Three elements of solution-providing ability

- 10. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 10/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Slashing the requirement for skilled workers means Nissei Build is less affected by the labor shortage problem than constructors using conventional methods The third element is provision of full-range support. Nissei Build is committed to provide a one-stop, most-appropriate support for the constructed building. (Source: Prepared by JPR, based on company interview) ■ Three elements of technological capability: provision of own design and production service, ability to form combinations, and offering of the same level of capabilities nationwide The first element is the company’s own design and production capabilities. In an integrated manner, Nissei Build designs and manufactures steel frames, walls, roofs, and other building components and devises control programs for tower parking facilities. Standardized mass production helps lower costs and the construction technology reduce the need for veteran construction workers, which enables restraint of overall costs and shortening of construction periods. The second element is ability to flexibly realize combinations. Depending on customer needs and characteristics of sites and building requirements, Nissei Build can come up with a wide variety of proposals by combining the specialties of Systemized Construction (i.e., “Nissei V Span-S,” prefab houses and Unit facilities for sale or lease), General Construction, and Parking Structures (mechanical, drive-in, coin-operated parking, or their combination) segments and by developing proposals using its technological capabilities. The third element is provision of identical-quality technical services of design, manufacturing, and construction by Nissei Build’s own factories, partner building contractors, and sales offices across Japan. The company is less affected by the labor shortage problem, compared to constructors using conventional methods, as it does not require skilled workers. Moreover, it can fully respond to market needs throughout the nation. Design Construction Completion Operationand management Maintenance Renewal Operationand management Dismantlement Three elements of technological capabilities

- 11. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 11/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Sustainable long-term value-creating chain realized by providing one-stop solutions Enhanced ability to collect information, through alliances ■Value-creating chain to maximize usage of space With the aim of strengthening its strengths in making proposals and technological capabilities, Nissei Build focuses on realizing a sustainable long-term value-creating chain by offering one-stop solutions to customers. The sequence of this chain processes is as follows: collect information construct manage enhance functional and asset value anticipate future needs provide new ways to utilize space. (Source: Company presentation materials) To collect information is the first step of the value-creating chain. Nissei Build has enhanced this step by making the following alliances since 2012. (Source: Company presentation materials) The Nissei Build Group has also established arrangements to realize all steps of the value-creating chain, and does this by means of the above-mentioned M&A strategy. By having pursued this since 2012, the entire structure has now been completed and is ready to be activated. Nissei Build’s one-stop solution forms a long-term sustainable value-creating chain Through alliance partners, collect nation-wide information on land with development potential in connection with business activity Provide realistic, convincing construction proposals, combined with comprehensive construction expertise Manage Enhance functional and asset value Construct Operate and manage the constructed property in optimal condition Enhance the value of property through good facility management and maintenance Anticipate future needs Perform large-scale repair or renovation work in keeping with changing needs Collect information Providewaystoutilizespace GE Capital Japan ORIX Corporation ES-CON Japan Ltd Luckland Co., Ltd. Tosei Revival Investment Corporation Business alliance for introduction of lease clients Business alliance for introduction of lease clients Business and capital alliance for development of condominiums and commercial facilities Nissei Build owns a 5% stake Business and capital alliance on development of new products and clients Cross-shareholding of ¥50 million with Nissei Build Business alliance on real estate development, renewal, and property management Kawada Industries, Inc. Business alliance for systemized construction; Nissei Build does small projects (1,000m2 or les s in floor space), Kawada does bigger projects Clients of all sectors; financing Store openings; planning and design of commercial facilities Need for building renewals Need for systemized construction Type of information Alliance partners Details Start time Sep. 2012 Aug. 2012 Nov. 2012 Nov. 2012 Apr. 2013 Sep. 2013 How to create corporate value

- 12. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 12/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Completing the building of a value-creating chain by executing M&A strategy (Source: Company presentation materials) ■ New business development: stock business in Japan and overseas expansion Nissei Build is promoting expansion of stock (as opposed to flow) business in Japan, and parking structure business overseas. The stock business includes maintenance of parking structures, operation and management of car and/or bicycle parking, management of business facilities, and management and maintenance of commercial facilities. Stock business sales are projected to increase by 1.8 times from ¥2,951 million in FY3/2014 to ¥5,400 million in FY3/2015. The company further aims to grow sales to ¥10,000 million by FY3/2017. Outside Japan, Nissei Build operates businesses in China, Thailand, and Singapore. As the company has recently entered into those markets, sales are not yet significant but growth can be anticipated in the future judging from the potential of the company’s accumulated know-how in parking structures in urban areas which suffer from a perpetual shortage of parking space. (Source: Company presentation materials) Enhance functional and asset value Anticipate future needs Manage Construct Collect information Nissei Build Kogyo NB Construction *2 Ozawa Construction *3 NB Parking *4 NB Facilities *5 NB Investment *1Land development Support of store openings Systemized construction Parking structure construction Comprehensive construction Civil and infrastructure works Operation and management of parking facilities for cars or bicycles Management of facilities for business Maintenance of parking structures Maintenance and general management of commercial facilities, etc. Railway track improvement Renovation of parking structures Large-scale repair works Nissei Build Kogyo Nissei Build Kogyo NB Investment NB Construction NB Construction Ozawa Construction Proposeawaytoutilizespace *1: Established in Dec. 2013; *2 Established in Feb. 2013; *3 Became subsidiary in Sep. 2012; *4 Became subsidiary in March 2013; *5 Established in Sep. 2013 Expansion of stock business in Japan NB Facilities Maintenance of parking structures Maintenance and general management of commercial facilities, etc. Nissei Build Kogyo NB Parking Operation and management of parking facilities for cars or bicycles (Millions of yen) FY3/2014 FY3/2015(E) Maintenance of parking structures 1,951 2,100 Operation & management of parking 1,000 1,900 Development business - 1,400 Total 2,951 5,400 Management of facilities for business development NB Investment Expansion Overseas Shanghai Tiandi Nissei Parking Management Co., Ltd. Space Value (Thailand) Co., Ltd. China Thailand Singapore Nissei Build Asia Pte. Ltd. Asia Parking Investment Pte. Ltd. Focus on parking operation and management Operation and management of parking facilities of theme parks and hospitals 16,000 parking lots managed by the maintenance subsidiary Develop systemized structure and parking structure construction business Parking projects for local firms Multilevel parking at limited-space industrial complexes Services for Japanese companies’ plants and warehouses Promote development of the Myanmar market Develop parking structure construction business Capture the projects by Singapore’s Housing & Development Board Promote development of the Malaysian market New business development

- 13. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 13/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. ■ Higher fixed-cost coverage ratio enhances value creation The stock business has high growth potential. Target sales are ¥10,000 million in FY3/2017. This business has a higher gross margin, 30-40%, than other businesses. Expansion of the stock business will make the company’s profit structure more resilient and will better cover fixed costs. (Source: Company’s presentation materials) ■ Business segments and segmentation Business segments and segmentation, including non-consolidated subsidiaries, are summarized below. Note, however, that NB Facilities, which is engaged in facility management, and overseas subsidiaries are not consolidated. (Source: Company presentation materials) FY3/2015 ¥5.4bn (E) in sales Aim over ¥10bn in sales in around FY3/2017 • Accelerate sales by acquiring maintenance management companies, as wide-range synergies in use of space can be expected Maintenance and general management of commercial facilities, etc. • Accelerate sales by acquiring parking facility management companies, as wide-range synergies in use of space can be expected Operation and management of parking facilities for cars or bicycles Management of business facilities (Development business) • Promotion of increase in management assets to include visible cash-flow parking facilities adjacent to convenience stores, and hospitals • Focus on less economic sensitive projects with ensured exit strategy FY3/2015 Sales Plan by Segment Systemized construction business ¥22,400mn, 48% 販売事業 12,414 30% Parking structure business ¥9,500mn, 20% ¥47,000 million Development business ¥1,400mn, 3% Comprehensive construction business ¥13,700mn, 29% Systemized construction Parking structures Comprehensive construction Development Nissei Build Kogyo (Parent) NB Construction Ozawa Construction NB Parking NB Investment Nissei Build Kogyo (Parent) Nissei Build Kogyo (Parent) Non-consolidated subsidiaries Equity income affiliate NB Facilities Space Value (Thailand) Co., Ltd. Nissei Build Asia Pte. Ltd. Asia Parking Investment Pte. Ltd. Shanghai Tiandi Nissei Parking Management Co., Ltd. Business Segmentation Financial implication of stock business expansion Business segments and segmentation

- 14. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 14/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. ■ Nine directors and three auditors Nissei Build has one outside director and two outside auditors. President and Representative Director Atsuhiro Morioka Senior Managing Director Naoki Morioka Managing Director Yoshiaki Motoyoshi Managing Director, General Manager of the Production Division Keiji Fujiwara Director, General Manager of the Sales Division Masao Nawamaki Director, General Manager of the Engineering Division Nobu Tanida Director, Manager of the Greater Tokyo Business Section and of the Kanto Block, the Sales Division Hideki Ueda Director, General Manager of the Maintenance Division Koji Kotani Director Junya Kikuchi (Outside Director) Full-time Auditor Akihiro Matsumoto Auditor Shouji Arakawa (Outside Auditor) Auditor Mitsuhiro Tokuno (Outside Auditor) (Source: Securities Filing; as of March 31, 2014) ■ Well-diversified shareholder structure The ten largest shareholders are well diversified with financial institutions such as banks and securities companies ranking at the top. The founder’s family, owning less than 10%, does not have controlling interest. The composition of the board of directors and of the body of shareholders indicates that corporate governance is functioning well with no great cause for concern. Major shareholders Shares owned (Thousands) Voting rights (%) 1 The Master Trust Bank of Japan, Ltd. (Trust Account) 6,307 8.87 2 Japan Trustee Services Bank, Ltd. (Trust Account) 5,594 7.87 3 Morioka International Ltd. 4,551 6.40 4 Hokuriku Bank, Ltd. 2,684 3.77 5 Hokkoku Bank, Ltd. 2,607 3.67 6 The Nomura Trust and Banking Co., Ltd. (Investment Trust Account) 2,235 3.14 7 Nippon Life Insurance Company 2,055 2.89 8 BNP-Paribas Securities Services 1,660 2.33 9 Atsuhiro Morioka 1,423 2.00 10 Goldman Sachs International 1,367 1.92 (Source: Securities Filing; as of March 31, 2014) ■ Standard dividend policy According to securities filings, Nissei Build’s basic dividend policy is to maintain stable dividend payments and take into account a comprehensive range of factors, including financial conditions and plans for future business development. The company also intends to secure internal reserves for efficient investment for business growth and for future returning of profit. The company’s payout ratio is not low at 30.4% in FY3/2014 and is expected to be about 30% in the near future years. Corporate Governance Board of Directors Major shareholders Policy to return profits to shareholders

- 15. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 15/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. ■ Political, economic, and social environment based evaluation Negative factors for Nissei Build include sustained high building material prices and concerns over the rise in labor cost, caused by a labor shortage. In contrast, positive factors are the expected rise of real estate prices mainly in the Great Tokyo area, ahead of the 2020 Tokyo Olympics, rising benefits from land management induced by lower interest rates, and greater needs for property management in anticipation of the January 2015 rise in the inheritance tax. As real estate tends to be evaluated lower than cash in assessing value for inheritance tax, there is a growing need to convert cash into real estate, as a way to reduce inheritance tax obligations. ■ Five force analysis: Strong and solid market positioning As shown in the chart below, Nissei Build has established a strong positioning in all five forces. (Source: Company’s presentation materials) ■ Assessment of management resources by VRIO analysis Nissei Build is highly valued as it has established competent management resources in all four factors: value, rareness, imitability, and organization. (Source: Company’s presentation materials) Competitive rivalryThreat of new entrants Threat of substitutes Relationship with partners Strong and solid relations with clients Few companies offer one- stop solutions in Nissei Build’s targeted middle- and small-scale markets. Limited competition It is not easy to provide a comprehensive service with a nationwide production network such as that of Nissei Build. Low risk Nissei Build’s products replace conventional methods. Low substitution risk Clients such as convenience store chains highly regard Nissei Build’s capability to provide solutions based on understanding of the client’s business. Clients are highly satisfied with Nissei Build’s systemized construction (for 1,000m2 or less) and parking structures. Nissei Build has established strong relationships of trust with intermediate companies or agencies, who in turn are trusted by clients. The life cycle maintenance enables to last long-term relationship. Information providing partners: Alliances with Nissei Build invigorates their business Building contractors in partnership: Profit from handling Nissei Build’s differentiated products Steelmakers: Nissei Build established a strong relationships of trust as a large client to purchase lightweight steel frames Strong and solid relations Value Nissei Build’s total solutions to maximize space value and satisfy client needs, which are available nationwide, have proven highly valuable to operators of chain stores. Rarity Nissei Build is the only company in Japan to do systemized construction by using H-type lightweight steel frame for structures of 10-40 m in frontage and 1,000m2 or less in gross floor space in Japan. Very few companies provide one-stop solution for small-scale structures, from component fabrication to construction and maintenance. Imitability It is difficult to imitate systemized construction starting with component fabrication. Nissei Build’s human resources who market total solutions and respond to client needs are difficult to replicate. Organization Nissei Build is organized to provide one-stop solutions from component fabrication to construction and maintenance for systemized construction of 1,000m2 or less. Nissei Build is capable of proposing use of space of the target businesses and do actual construction as one-stop. Business Model Evaluation Evaluation concerning external environments Five force analysis VRIO analysis

- 16. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 16/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Growth, driven first by reconstruction demand, and then M&A and alliance strategies Growth was accelerated by aggressive alliance strategy in and after 2012 ■ Assessment in growth Nissei Build’s sales surged in FY3/2012, due to strong post-earthquake reconstruction demand, after which sales increased due to the M&A and alliance strategies. Based on the company’s forecasts up to FY3/2016, the expected compound annual growth rates in sales, operating income, and net income from FY3/2010 to FY3/2016 are 17.0%, 42.1%, and 42.8% respectively. (Source: Company’s presentation materials) By business segment, the Parking Structure business recorded double-digit sales growth of 26.9% y-o-y in FY3/2013, 39.0% in FY3/2014, and is estimated to grow 17.3% in FY3/2015. This includes a strong contribution from the alliance strategy. The Systemized Construction segment is projected to increase sales by 18.2% y-o-y for FY3/2015, with almost no negative impact from the disappearance of reconstruction demand. Since 2012, growth has appeared boosted by business expansion driven by aggressively making alliances. (Source: Prepared by JPR, based on Securities Filing) Indicators (millions of yen) FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 FY3/2015 (Plan) FY3/2016 (Plan) Net sales 18,367 17,204 41,879 25,487 41,854 47,000 50,000 Gross profit 3,305 3,148 9,591 5,271 6,356 7,650 8,300 SG&A expenses 2,911 2,596 3,258 3,423 4,031 4,400 4,800 Operating income 394 552 6,333 1,847 2,324 3,250 3,500 Ordinary income 477 545 6,436 1,979 2,490 3,250 3,500 Net income 242 249 2,196 1,747 1,753 2,050 2,250 0 10,000 20,000 30,000 40,000 50,000 60,000 Net Sales 0 500 1,000 1,500 2,000 2,500 Operating Income 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 Net Income (Millions of yen) (Millions of yen) (Millions of yen) Indicators (millions of yen) FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 FY3/2015 (Plan) Net sales 18,367 17,204 41,879 25,487 41,854 47,000 Systemized construction business 11,367 11,327 37,288 18,236 18,945 22,400 Parking structure business 6,998 5,877 4,590 5,824 8,097 9,500 General construction business 0 0 0 1,426 14,811 13,700 Property development business 0 0 0 0 0 1,400 Sales Growth Ratio -25.0% -6.3% 143.4% -39.1% 3.9% 18.2% Systemized construction business -0.4% 229.2% -51.1% 3.9% 18.2% Parking structure business -16.0% -21.9% 26.9% 39.0% 17.3% General construction business -7.5% Financial analysis

- 17. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 17/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Operating margin is improving from 5.6% in FY3/2014 to 7.0% in FY3/2016 General Construction business improves margin by selective order-taking ■ Evaluation of margins, EPS, and payout ratio After a spike in FY3/2012, margins have dropped with the fading away of reconstruction demand. Operating margin is expected to gradually improve from 5.6% in FY3/2014 to 6.9% estimated for FY3/2015 and 7.0% estimated for FY3/2016. (Source: Company’s presentation materials) Segment information reveals that General Construction, driven by M&A activities and added in FY3/2013, has a lower margin compared to the Systemized Construction segment and the Parking Structure segment. The General Construction segment became more selective in receiving orders and the improved margin enabled a swing back to profits in FY3/2014. (Source: Prepared by JPR, based on securities filing) Ratios (millions of yen) FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 FY3/2015 (Plan) FY3/2016 (Plan) Gross margin 18.0% 18.3% 22.9% 20.7% 15.2% 16.3% 16.6% SG&A expenses to sales 15.8% 15.1% 7.8% 13.4% 9.6% 9.4% 9.6% Operating margin 2.1% 3.2% 15.1% 7.3% 5.6% 6.9% 7.0% Ordinary margin 2.6% 3.2% 15.4% 7.8% 5.9% 6.9% 7.0% Net margin 1.3% 1.4% 5.2% 6.9% 4.2% 4.4% 4.5% 0% 5% 10% 15% 20% 25% Gross Margin 0% 1% 2% 3% 4% 5% 6% 7% 8% Net Margin 0% 2% 4% 6% 8% 10% 12% 14% 16% Operating Margin Ratios (millions of yen) FY3/2013 FY3/2014 Sales Systemized construction business 18,239 18,945 Parking structure business 5,824 8,097 General construction business 1,426 14,811 Consolidated 25,487 41,854 Segment Profits Systemized construction business 3,228 2,820 Parking structure business 397 287 General construction business -161 677 Adjustments -1,617 1,460 1,847 2,324 Profit Margin Systemized construction business 17.7 14.9 Parking structure business 6.8 8.4 General construction business -11.3 1.9 Adjustments - - Consolidated 7.2 5.6

- 18. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 18/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. ROE exceeds 10% Payout ratio is 30% Stable and efficient balance sheet Net D/E ratio of 0.13 times After exceeding 20% in FY3/2012, return on equity (ROE) has been maintained at over 10%. EPS was below ¥10 up to FY3/2012, spiked to ¥31 in FY3/2012 when reconstruction demand was strong, and then dropped to ¥26. Recent gradual improvement is expected to push FY3/2016 EPS to over ¥34. The payout ratio is expected to exceed 30%. Margin improvement has steadily raised ROE and EPS. Together with a rise in the payment ratio, Nissei Build has been returning more profits to shareholders. (Source: Company’s presentation materials) ■ Evaluation of balance sheet Nissei Build had total assets of ¥37,954 million at the end of March 2014. The total asset turnover ratio, on a year-end basis, was 1.1 times (sales of ¥41, 854 million divided by total assets of ¥37,954 million). The ratio of current assets, ¥25,064 million, is high, representing over 60% of total assets. The company is financially stable with a net debt/equity ratio [(long-term borrowings and corporate debts + short-term borrowings - cash and deposits) divided by total assets] of 0.13 times. The balance sheet in general is stable and efficient. Specifically, a significant increase in inventories in FY3/2014 is mainly attributable to an increase in real estate for sale by acquisition of construction sites by ES-Con Japan for a collaborative project to develop condominiums. (Source: Company’s presentation materials) 0% 5% 10% 15% 20% 25% 30% 35% 40% Ratios FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 FY3/2015 (Plan) FY3/2016 (Plan) ROE 2.6% 2.6% 20.6% 14.2% 13.0% 14.0% 14.0% EPS (yen) 2 4 31 26 27 31 34 Payout ratio 46.6% 28.1% 22.3% 19.2% 26.4% 29.0% 35.0% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% ROE 0 5 10 15 20 25 30 35 EPS Payout Ratio(Yen) Items (millions of yen) FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 Current assets 11,657 10,581 21,685 23,308 25,064 Cash and deposits 3,421 2,458 11,387 6,678 4,879 Notes and accounts receivable 6,610 6,191 7,629 13,012 11,737 Inventories 1,466 1,687 2,619 2,578 7,731 Deferred tax assets - - - 195 318 Fixed assets 12,603 12,365 8,649 11,843 12,889 Tangible fixed assets 9,962 10,307 7,249 8,399 9,205 Depreciable assets 4,389 4,694 3,035 3,547 4,718 Land 5,569 5,610 4,213 4,246 4,486 Intangible fixed assets 93 72 80 189 254 Goodwill - - - 47 35 Investment and other assets 2,546 1,985 1,320 3,254 3,429 Investment securities 1,526 976 122 2,025 2,323 Total assets 24,260 22,946 30,335 35,152 37,954

- 19. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 19/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. An increase in inventories is the greatest cash-out item (Source: Company’s presentation materials) (Source: Prepared by JPR, based on Company’s disclosed materials. Figures based on term-end differ from the aforementioned ones) ■ Cash flow An increase in inventories is the greatest cash-out item in FY3/2014. (Source: Company’s presentation materials) Items (millions of yen) FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 Current liabilities 11,621 10,115 14,800 18,628 19,815 Notes and accounts payable 3,984 3,992 7,742 11,410 10,354 Short-term borrowings, bonds, etc. 4,999 3,717 1,666 2,359 4,394 Deferred tax liabilities - - - - - Non-current liabilities 3,161 3,341 3,715 3,648 3,988 Long-term borrowings, bonds, etc. 2,251 2,247 2,705 2,091 2,298 Deferred tax liabilities - 7 2 144 77 Total liabilities 14,782 13,456 18,515 22,276 23,803 Net assets 9,478 9,490 11,819 12,875 14,151 Common stock 7,002 7,002 7,002 7,002 7,002 Capital surplus 1,913 1,913 1,913 1,913 1,913 Retained earnings 715 894 3,020 4,279 5,701 Treasury stock -123 -123 -126 -624 -625 Total shareholders’ equity 9,507 9,686 11,810 12,570 13,992 Net unrealized valuation gain, etc. -29 -196 - 289 120 Subscription rights to shares - - 8 16 37 Minority interests - - - - - Total liabilities and net assets 24,260 22,946 30,335 35,152 37,954 Own capital 9,478 9,490 11,810 12,859 14,113 Interest-bearing debt 7,250 5,964 4,371 4,450 6,692 Items FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 ROE(on the basis of the year- end data, not compatible with the previous pages) 2.5% 2.6% 18.6% 13.9% 12.5% ROA(on the basis of the year- end data, not compatible with the previous pages) 1.6% 2.4% 20.9% 5.3% 6.1% Net D/E Ratio (Times) 0.40 0.36 -0.59 -0.18 0.13 Total Assets Turnover (Times) 0.76 0.75 1.38 0.73 1.10 Items (millions of yen) FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 Operating cash flow 1,364 1,061 10,368 -50 -1,633 Pre-tax income 294 306 3,211 1,885 1,764 Depreciation 720 700 553 347 504 Amortization of goodwill - - - 76 18 Increase in accounts payable 1,248 419 -1,437 767 1,278 Decrease in inventories 1,500 -221 -932 155 -5,141 Decrease in accounts receivable -1,574 7 3,749 -1,084 -1,064 Subtotal 1,645 1,212 10,678 1,549 -1,658 Interest and dividends received 36 26 27 7 27 Interest expenses paid -163 -140 -96 -77 -75 Income taxes paid -153 -37 -50 -1,529 73 Investing cash flow -94 -646 235 -2,266 -2,248 Increase in tangible and intangible fixed assets -71 -1,035 -296 -841 -1,397 Increase in investment securities -63 5 740 -1,258 -972 Financing cash flow -564 -1,367 -1,678 -2,364 1,744 Increase in borrowings and corporate bonds -553 -1,283 -1,593 -1,346 2,117 Increase in treasury stock -1 0 -2 -498 -1 Dividends paid 0 -70 -68 -483 -329 Cash and cash equivalents 3,387 2,434 11,359 6,678 4,679

- 20. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 20/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. Full-year forecasts: sales of ¥47,000 million (up 12% y-o-y) and operating income of ¥3,250 million (up 40%) Anticipating the company’s specific longer-term growth message ■ Higher income and a little less sales in the first half of FY3/2015, due to higher weight in the second half In the first half of FY3/2015, Nissei Build’s sales decreased by 0.9% y-o-y due to a seasonal effect (more sales in the second half) but operating income increased by 16.2%. For the full year, the company forecasts ¥47,000 million (up 12% y-o-y) in sales and ¥3,250 million (up 40%) in operating income. In its Medium-term Business Plan, the company targets for FY3/2016 are sales of ¥50,000 million and operating income of ¥3,500 million, suggesting slower growth rates of 6% and 8% respectively. Given the company’s achievement in executing growth strategies and improving margins, these forecasts are conservative and hence it is important to look forward to the company’s disclosure of its longer-term growth outlook. (Source: Company’s presentation materials) FY3/2014 1H FY3/2015 1H Increase Amount % to sales Amount % to sales Amount Y-O-Y(%) Net sales 19,256 100.0 19,086 100.0 △170 △0.9 Gross income 2,892 15.0 3,060 16.0 168 5.8 SG&A expenses 1,971 10.2 1,991 10.4 19 1.0 Operating income 920 4.8 1,069 5.6 148 16.2 Ordinary income 943 4.9 1,106 5.8 163 17.3 Net income 509 2.6 709 3.7 199 39.3 (Millions of yen) (Millions of yen) FY3/2014 1H FY3/2015 1H Increase Amount % to sales Amount % to sales Amount Y-O-Y(%) Sales 5,496 28.5 7,164 37.5 1,668 30.4 Rental 2,827 14.7 3,310 17.4 483 17.1 Systemized construction business 8,323 43.2 10,474 54.9 2,151 25.8 Sales 2,859 14.9 1,958 10.3 △901 △31.5 Maintenance 865 4.5 779 4.1 △86 △9.9 Parking operation & management 278 1.4 602 3.1 324 116.7 Parking structure business 4,003 20.8 3,341 17.5 △662 △16.5 Comprehensive construction business 6,929 36.0 5,260 27.5 △1,668 △24.1 Development business - - 9 0.1 9 - Total 19,256 100.0 19,086 100.0 △170 △0.9 Indicator (millions of yen) FY3/2014 (Actual) FY3/2015 (Plan) FY3/2016 (Plan) Net sales 41,854 47,000 50,000 Operating income 2,324 3,250 3,500 Ordinary income 2,490 3,250 3,500 Net income 1,753 2,050 2,250 Earnings per share (yen) 26.5 31.0 34.0 Operating margin 6% 7% 7% ROE 13% 14% 14% Payout ratio 26% 29% 35% FY3/2015 First-Half Results and Full-Term Forecasts First half of FY3/2015 のレビュー

- 21. Nissei Build Kogyo Co., Ltd. (Code 1916: First Section of the Tokyo Stock Exchange) Issue Date: February 3, 2015 21/26 This report is created by J-Phoenix Research Inc. (hereinafter JPR) simply for the purpose of providing information to the investors, not for soliciting any trading of securities. Although the report is based on information and resources that JPR believed to be reliable, JPR does not guarantee against the accuracy, reliability, completeness, conformity or timeliness of any of the content. JPR shall not be liable for any direct or indirect damage caused by the investors resulting from the use or reliance on the information contained herein. Investors are responsible for their own trading of securities and other financial products. The intellectual property rights of this report belong to Toward the Infinite World, Inc. No part of this report may be reproduced, transcribed or cited without the written consent of the company. 15.5% dilution due to stock acquisition rights Close to ¥4 billion in capital procurement when fully exercised Successful capital procurement will strengthen net assets, currently ¥14 billion, and accelerate investment Focus on creation of a virtuous cycle of “margin improvement” “higher stock price” “financing by exercise of stock acquisition rights” “more profit growth led by more investment” ■ Issuance of 10 million stock acquisition rights at exercise prices of ¥300, ¥350, and ¥500 On November 26, 2014, Nissei Build issued 10 million stock acquisition rights, allotted to Deutsche Bank AG, London Branch. Given use of treasury stock when exercised, the dilution rate should be 15.5%. The exercise prices are set at ¥300, ¥350, and ¥500, with respective issuance of 3 million, 3 million, and 4 million shares. The exercise prices are above the current stock price. Unless the stock price rises to those levels, dilution will not occur, proving that consideration has been given to existing shareholders in the choice of financing method. This financing arrangement will result in procurement of ¥900 million, ¥1,050 million, and ¥2,000 million (¥3,950 million in total) with a three-year exercise period. The company’s approval is required for Deutsche Bank to request exercise. It is expected that Nissei Build will give full consideration to the impact on its stock price and the market’s sales trend after third-party allotment. There is an option for Nissei Build to revise the exercise price from May 26, 2015. The proceeds will be used as capital for lease building assets, land and stores of convenience stores, the coin-operated parking business, and M&A in the facility management business. Nissei Build’s advantage when attempting to make acquisition in the facility management business is to be able to strategically offer an acquisition price by considering benefits from synergies with its other businesses. (Source: Company’s disclosed materials) As mentioned above, Nissei Build has the ability to propose solutions and the technological capabilities to make optimum use of space, and do so on behalf of clients anywhere in the nation. The company has been aggressive in (1) executing M&A strategy, (2) executing alliance strategy, (3) achieving growth in high-margin stock-based business, and (4) expanding overseas. Those measures, since 2012, are likely to show results in terms of upcoming operating performance. Under the strong leadership of Atsuhiro Morioka, Nissei Build is advancing to a new growth stage in terms of the growth process and profitability, which is thought to not be reflected in the current stock price level. It is important to focus on whether the recent issuance of stock acquisition rights will create a virtuous cycle of “margin improvement in the growth stage” “higher stock price” “financing by exercise of stock acquisition rights” “more profit growth led by more investment.” Stock acquisition rights Total number of stock acquisiton rights 3,000,000 rights 3,000,000 rights 4,000,000 rights Aggregate amount to be paid in 1,140,000 yen 840,000 yen 1,000,000 yen Per share amount to be paid in 0.38 yen 0.28 yen 0.25 yen Per share exercise price 300 yen 350 yen 500 yen Item concerning revision to exercise price Exercise period Conditions for the exercise of stock acquisition rights Yes Yes Yes First series Second series Third series Yes Yes Yes Three years Three years Three years Margin Improvement Higher Stock Price More profit growth led by more investment Financing by exercising stock acquisition rights Equity Financing Issuance of stock acquisition rights by third party allotment