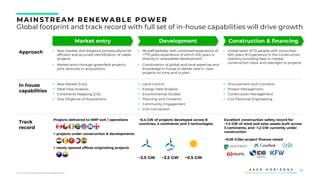

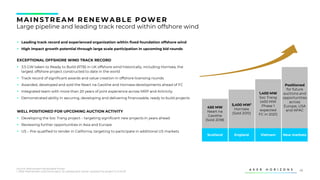

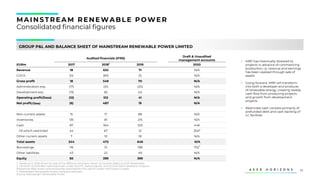

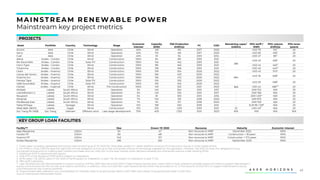

Mainstream Renewable Power has a global portfolio of over 11 GW of renewable energy projects with a diverse mix of solar, onshore wind, and offshore wind technologies. The portfolio includes over 1.4 GW under construction or operation and nearly 11 GW in development across Latin America, Africa, Asia Pacific, and offshore regions. Mainstream has established itself as a leading independent developer by bringing over 6.4 GW of projects to financial close since inception.